DonAlt Review

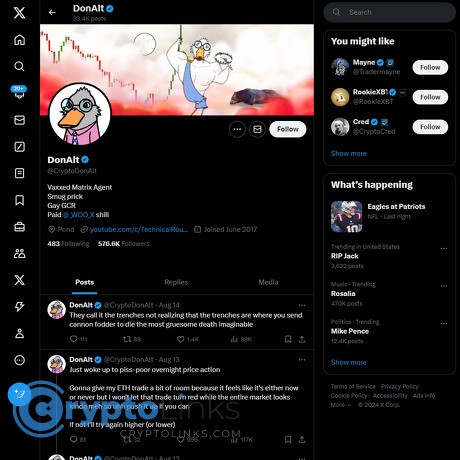

DonAlt

x.com

DonAlt (@CryptoDonAlt) review guide: everything you need to know, with FAQ

Question: can following @CryptoDonAlt on X actually make you a better crypto trader—or just more anxious and reactive?

I’ve seen both outcomes. In this guide, I’m going to show you how I review influencers like DonAlt so you get clarity, not confusion. You’ll see what he posts, how to read his calls, what to expect (and not expect), and how to use his feed without risking your stack. Short, practical, honest.

Why so many traders get burned by “good” tweets

Here’s the messy reality: most people don’t lose because a commentator was “wrong.” They lose because they misread timeframe, enter late, and ignore risk. A few common traps I see all the time:

- Chasing the move: You see a HTF-bullish comment while price is already extended. You FOMO long, it wicks down, you stop out… then it goes your original way without you.

- Timeframe mismatch: An influencer talks weekly levels; you trade 15-minute candles. A normal pullback on weekly looks catastrophic on your screen.

- Invisible risk: The post shows bias and levels, not your position size, stop, or invalidation. You copy the idea but skip the risk rules.

- Hindsight bias: We tend to remember the bangers and forget the misses. If you only recall winners, you’ll oversize the next one.

- Style mismatch: A swing trader’s “I’m patient here” gets read as “ape now.” Different goals, different outcomes.

These aren’t just anecdotes. Behavior research backs this up:

- Barber & Odean (2000) showed that frequent trading often hurts returns—overconfidence + reacting to noise is expensive.

- Dalbar’s QAIB studies consistently find that timing mistakes (buying high, selling low) cause investors to underperform the very assets they hold.

- Research on retail flows and attention suggests that social attention spikes can lead to momentum chasing and whipsaw behavior.

Sample scenario (hypothetical): DonAlt posts a weekly chart noting “above 60k is constructive; weekly close below = risk.” You buy after a fast push to 61.2k, no stop, barf on a 3% wick, then watch price close the week back above 60k. The call wasn’t the problem—your timing and risk were.

What I’m going to do for you here

I’m going to map out who DonAlt is, what he tends to do well, how I evaluate credibility, and a simple way to turn his insights into your own rules—so you stop guessing and start filtering.

- Context first: Understand his timeframe and bias before you touch the buy/sell button.

- Actionable filters: Convert posts into “if-then” rules that fit your plan, not his.

- Credibility checklist: A simple way to judge consistency without fanboying or fighting.

- Risk guardrails: Keep your downside small while you learn to use the feed well.

How to read posts without FOMO (the simple mental model)

- Identify the timeframe: Is he talking weekly or daily? If weekly, treat intraday noise as noise.

- Extract the levels: Note the areas of interest and invalidation language (“if below X, I’m wrong”).

- Translate to your plan: If your system already has a setup at his level, great. If not, pass.

- Normalize patience: If the post implies waiting for a close or retest, actually wait. No early entries “just because.”

Red flags I always watch for (any influencer, any market)

- Hindsight posting: Victory laps with no prior context or timestamped bias.

- Deleted misses: A suspiciously “perfect” timeline usually isn’t.

- Signal selling pressure: Hard sells for “guaranteed” calls or opaque paywalls.

- Emotional bait: Rage posts and tribal dunks spike engagement, not performance.

Alerts and filters so you only see what matters

- Follow with purpose: Turn on notifications for @CryptoDonAlt, but consider muting replies and non-chart threads.

- Bookmark reference posts: Save key HTF charts and re-check them on weekly closes.

- Use platform alerts: Set price alerts at the levels mentioned so you’re not glued to the feed.

- Build a watchlist: Keep 3–5 pairs max that match the commentary; cut the rest to reduce noise.

Ready to make this actually useful? Next, I’ll show you who DonAlt is, where he posts, and exactly what you can expect to see on his feed—so you know when to listen and when to scroll past. Want the quick profile?

Who is DonAlt and what does he actually do?

When I think “clean, higher‑timeframe market context on X,” I think DonAlt. He’s a crypto market commentator who keeps it simple: bigger charts, clearer bias, fewer distractions. No hype machine, no 20‑tweet manifestos every day—just levels, context, and straight talk. If you want swing‑friendly perspective without being dragged into every intraday wiggle, his feed fits.

Where he posts and what you’ll find

Most of his public presence runs through X, and it’s easy to spot a pattern in what he shares. Here’s what I consistently see in my feed:

- HTF charts first: Weekly and daily BTC/ETH views are the backbone. He’ll highlight key zones (prior highs/lows, range midpoints, weekly closes) and mark “areas of interest” rather than screaming entries.

- Clear bias with room for change: Posts often read like “I’m bullish while price is above X level” or “Below this, I’m out.” It’s stance + invalidation, not vague hindsight.

- Occasional trade thoughts: You’ll see comments like “I like bids in this area if we reclaim X,” paired with a chart. It’s context for a plan, not a signal to market‑buy instantly.

- Less is more: He doesn’t flood your feed. When he posts, it tends to matter. That scarcity is useful if you’re trying to avoid noise and FOMO.

- Not financial advice tone: He’s not your broker. You’ll feel that in the language—opinionated, but not prescriptive. That’s healthy.

- BTC‑first, majors next, alts when warranted:Bitcoin leads, ETH gets coverage, and alts show up when the setup is notable, not just trending.

In plain terms: if you’re looking for someone to call tops and bottoms every hour, that’s not what you’ll find. If you want a steady HTF compass and a few well‑marked landmarks, you’re in the right place.

The voice and value

What keeps me following is the tone—direct, a little dry, and focused on what actually moves the needle. No victory laps on tiny timeframes, no hand‑wringing every time BTC wobbles 0.8%. That restraint is a feature, not a bug.

- Value for me: bias clarity, simple charts, and consistency over time. You can scroll back weeks and still understand the story he’s been telling.

- Value for you: If you struggle with noise, this style cuts it down. A couple of key levels and a bias can save you from 10 bad trades you take out of boredom.

“In a market that screams 24/7, the rare edge is silence plus a plan.”

There’s a useful side effect here. Research on social sentiment and crypto performance keeps pointing to the same thing: attention can nudge short‑term moves, but the signal decays fast. Accounts that filter rather than amplify noise help you avoid chasing blips. That’s the lane DonAlt tends to stay in—HTF structure first, chatter second.

What he isn’t

It’s easy to project your expectations onto any popular account. Don’t.

- Not your signal provider: You won’t get “buy now, sell now” or perfect entries. He’s offering context, not scripts.

- Not a day‑trade hotline: He isn’t updating every 15 minutes. If you scalp, you’ll need your own triggers and process.

- Not guaranteed accuracy: No one is. The value is in the framework—bias, levels, invalidation—not in a 100% hit rate.

- Not your risk manager: He can’t size your position, set your stop, or fix your discipline. That part is on you.

If you treat his charts like a map and your system like the vehicle, you’ll know exactly what to do when price reaches a marked area: slow down, check conditions, and decide using your rules—not his tweets.

So here’s the real question: how do you read his higher‑timeframe charts and turn them into entries, exits, and risk boundaries you can actually trade? In the next section, I’ll break down how he thinks about timeframes, setups, and context—so you know what to do when his chart shows a big red box and your finger hovers over the buy button.

How DonAlt thinks about the market (timeframes, setups, context)

DonAlt looks at the crypto market like a map-maker, not a siren. The maps are the higher timeframes, the landmarks are clean levels, and the job is to decide where you’re likely to find “acceptance” versus “rejection.” If you read his posts with that lens, you’ll stop expecting instant fireworks and start seeing useful context.

“Clarity beats adrenaline.” A good bias today can be worth more than ten rushed entries this week.

Timeframes and bias

His bias usually comes from weekly and daily charts. That matters. Weekly and daily candles carry less noise, which means fewer whipsaws and more meaningful signals. If you’re used to five-minute charts, it can feel glacial. That’s the point.

- HTF bias ≠ intraday scalp. A weekly bullish bias doesn’t die because of a 30-minute red candle.

- Patience is built in. HTF views can take days or weeks to confirm. Entries are often planned around weekly closes and daily retests.

- Wider invalidation. Bigger timeframes = bigger levels = wider stops. Position sizing matters more than usual.

Why this approach tends to work better for many traders:

- Less noise: Microstructure “noise” dominates very short timeframes. Research shows higher sampling reduces false signals (see Bandi & Russell, 2006).

- Momentum exists over months: Time-series momentum has been observed across assets on 1–12 month horizons (Moskowitz, Ooi & Pedersen, 2012). That’s the zone HTF bias tries to tap.

- Lower churn, fewer mistakes: Overtrading kills returns (Barber & Odean, 2000). HTF keeps you from FOMO-clicking every wiggle.

Translation: when DonAlt marks his bias, he’s telling you where the tide points, not which wave to surf in the next 15 minutes.

How to read his charts and levels

His posts on X often include a handful of clearly defined levels with short notes. Think of them as “if-then” checkpoints, not market orders.

- Levels = areas of interest. Boxes/lines around prior highs/lows, range mid, or weekly opens are places he’s watching for acceptance or rejection.

- Invalidation is implied. When he highlights a level, losing or reclaiming that area usually marks the bias flip.

- Scenarios, not certainties. His tone is typically conditional: “If price accepts above X, I like Y. Lose X, I’m cautious.”

Example patterns you’ll often see implied by his charts:

- SR flip: Old resistance turns support (or vice versa). Acceptance above a prior ceiling often becomes his bullish tilt.

- Range mid respect: Midpoint of a well-defined range acts as a quick “risk-on/off” toggle.

- Deviation/SFP: A wick through a level that closes back inside the range—often treated as a fake-out and potential reversal cue.

Sample read of a typical post (hypothetical numbers to show the logic):

- “BTC weekly: 62k–63k is the line.” — That’s your decision zone. Weekly close above = bullish continuation context.

- “Lose 59k and I hate it.” — That’s invalidation. Below there, bias likely flips or he stands aside.

- “Chop between 59k–63k.” — That’s no-man’s-land. He’s not rushing mid-chop; he’s waiting for the break and acceptance.

What to extract from each post (and what to leave behind)

- Take this:

- Trend bias: Bullish, bearish, or neutral on weekly/daily.

- Key levels: A short list you can put alerts on.

- Risk cue: The invalidation area that kills the idea.

- Condition: What needs to happen (“acceptance,” “reclaim,” “lose”).

- Timeframe stamp: Note if he wrote “weekly” or “daily.” That sets your expectations.

- Leave this:

- Blind copy-trades without knowing your stop and size.

- Oversized bets because a level “looks clean.”

- Panic when intraday zigzags don’t match a weekly idea.

Pattern toolbox you’ll notice in his charts

- Acceptance vs. tap: He cares more about closes and retests than one wick poke. A weekly close above a level “sticks” better than a fleeting spike.

- “Deviations” matter: If price wicks above resistance and closes back below, it often becomes a short-term bearish tell until reclaimed.

- Clean levels over indicators: You’ll see more horizontal lines than oscillators. Simplicity is the feature, not a bug.

A quick read-flow I use when he posts

- 1) Tag the timeframe: Weekly? Daily? That sets patience and stop width.

- 2) Note the bias: Bullish/neutral/bearish—write it down.

- 3) Mark the invalidation: The level where the idea is wrong for him.

- 4) Define the condition: “Acceptance above,” “lose,” “reclaim.” No condition met = no action.

- 5) Fit to your playbook: If your system is intraday scalps, use his HTF bias only as background wind, not a trigger.

Common misreads to avoid

- Confusing bias with entry: “Bullish weekly” does not mean “ape now.”

- Ignoring invalidation: If he says “below X I’m out,” that’s the heart of the idea.

- Forgetting regime shifts: If macro/liquidity changes, HTF context can reframe quickly—check the latest timestamp.

In short, DonAlt’s posts give you a reliable compass: trend bias, key levels, and clear risk cues on higher timeframes. The compass won’t walk the trail for you—but it can stop you from wandering in circles.

Curious how I tell whether a compass like this is actually trustworthy—and not cherry-picked after the fact? Up next, I’ll show you the exact checklist I use to judge credibility, point by point. Would your favorite account pass it?

Is DonAlt legit? My credibility checklist

Trust is earned in public, not claimed in bios. I don’t guess with influencers. I test what’s visible, track it forward, and filter out the noise. Here’s exactly how I look at DonAlt on X through a simple, repeatable lens you can use on anyone.

“Confidence is noisy. Consistency is quiet.”

What I can—and can’t—verify

I only judge what I can see and timestamp. Screenshots and anecdotes don’t count; repeatable patterns do.

- Verifiable:

- Timestamps and levels: When he posts a chart/level, you can confirm the date and whether price respected/invalidated it later. Use X’s Advanced Search: x.com/search-advanced with filters like from:CryptoDonAlt, keywords, and date ranges.

- Bias consistency: Does he stay HTF-focused across weeks, or flip with every 1-hour candle? Forward-track new posts to see if the stated bias holds.

- Follow-ups: Are there public updates when conditions change, or silence until after the move?

- Not verifiable:

- Exact entries/exits, size, leverage, PnL: Execution details are private unless proven with brokerage statements (rare). I treat all PnL talk as unverified.

- Deleted misses: If a miss is deleted, you’ll only catch it if others quoted it. You can’t reliably audit what’s gone.

Reality check: even pros are wrong. Research on trader behavior shows overconfidence and excessive trading reduce returns (Barber & Odean, 2000: “Trading Is Hazardous to Your Wealth” — SSRN). I focus on process, not hit rate bragging.

The checklist I use

Every time I read a market post, I score it against this list. It keeps me out of emotional traps.

- Clear bias: Is the view plainly stated? Bullish, bearish, neutral, or “waiting.” If I can’t tell, it’s noise.

- Stated invalidation: Is there a level or condition that proves the idea wrong? No invalidation = no credibility.

- Forward, not hindsight: Is the idea posted before the move with a plan, or just victory laps after?

- Willingness to be wrong: Are there public “I was wrong; here’s why” updates? Egos don’t manage risk; people do.

- No hard-sell signals: Is the account pushing paid “perfect” calls or secret groups? That’s a marketing funnel, not market analysis.

- Timeframe alignment: If the post is higher timeframe, do the updates match that cadence? I don’t penalize intraday noise on a weekly view.

- Actionable structure: Key levels, context, and what changes the bias. Vague takes don’t help.

How I test a single post in 3 minutes:

- Run an Advanced Search for the post date to confirm it’s genuinely before the move.

- Note the level(s) mentioned and mark them on your chart.

- Check for later replies or a follow-up thread acknowledging validation or invalidation.

- Log the outcome. One post means nothing; patterns across months mean everything.

Bonus tip: build a quick spreadsheet. Columns: Date, Bias, Level(s), Invalidation, Follow-up link, Outcome (Y/N), Notes. You’ll spot consistency faster than your memory ever will.

Green flags I look for with DonAlt

- Consistent HTF commentary: Bias framed on daily/weekly, not chasing every 5-minute candle.

- Levels over hype: Posts that say “above X = strength, below Y = weakness” help you think in if-then.

- Context-first tone: I want “here’s the scenario” more than “ape now.” That’s a hallmark of analysis, not signals.

- Public updates: If conditions change, the feed reflects it. Silence during invalidation is a red flag; updates are a green light.

Why this matters: we’re all vulnerable to hindsight bias (Fischhoff, 1975 — we remember outcomes as more predictable than they were). A clean audit trail fights that bias and keeps you honest.

Red flags I watch for anywhere (not specific to him)

- Deleted misses + loud victory laps: That’s curation, not trading.

- Secret “premium” signals with guarantees: Markets don’t offer guarantees. Sales pages do.

- Emotional bait: Posts designed to trigger FOMO or fear. Good traders manage emotion; bad marketers amplify it.

- Timeframe whiplash: HTF bullish in the morning, HTF bearish by afternoon, with no stated trigger. If the timeframe changes, I expect the reason why.

Quick tools to keep it honest

- X Advanced Search: filter by date/keywords to verify a post was truly ahead of the move: x.com/search-advanced

- Quote tracking: search “to:CryptoDonAlt” or “url:status” to find replies and quotes for follow-ups.

- Web Archive: save links/threads for later proof: web.archive.org

I’m not looking for perfection; I’m looking for process. If the feed shows clear bias, invalidation, and honest updates over time, I give it weight. If it leans on hype, deletes misses, or sells certainty, I tune it out.

So how do you turn that credibility check into trades you won’t regret? In the next section, I’ll show you the simple if‑then plan and alert setup I use to translate a single tweet into a controlled position—without FOMO. Ready to make this practical?

Turn his feed into something you can actually use

You don’t need more tweets. You need a way to turn one good post into a controlled, testable decision. Here’s how I turn DonAlt’s higher‑timeframe bias and levels into trades I can live with—win or lose.

“Plans are worthless, but planning is everything.” — Dwight D. Eisenhower

Set up a simple “if‑then” plan

I keep this dead simple. If a post aligns with my setup, I have rules. If it doesn’t, I scroll on.

- Template I use: “If DonAlt’s HTF bias matches mine and price is at my pre‑marked level, then I take a starter position at size = risk/stop distance, with a written invalidation. No alignment = no trade.”

- Example (BTC): Let’s say DonAlt is constructive above 64k, watching 66.5k–67k as a key area. I already have 66.7k marked from my own chart.

- If BTC reclaims 66.7k on a 4H close and HTF bias is up, then I go long with stop below 65.5k. Target 69.8k first, 72k second.

- If BTC closes back below 66.7k, then I step aside. No chop trades.

- Position size math (quick and clean): Account $10,000, max risk 1% = $100. Entry 66,700. Stop 65,500. Stop distance = $1,200. Size = 100 / 1,200 ≈ 0.083 BTC. Done. No guessing.

- Write your invalidation: “This trade is wrong below 65,500 on a 4H close.” I put this in my journal before I click anything.

Why this works: research shows structured checklists reduce errors in complex environments (see the WHO surgical checklist results in NEJM, 2009). Trading isn’t surgery, but the chaos is real—and structure keeps you from reacting to every spike.

NEJM checklist study

Alerts, filters, and timing

Your information diet matters as much as your edge. I set the feed to work for me, not against me.

- Follow with intent: Turn on post notifications for DonAlt’s main posts, not replies. Create an X List called “HTF context” with 3–5 accounts max to avoid noise.

- Price alerts where it counts: If he flags 66.5k–67k, I set TradingView alerts just above/below those levels plus my own confluence (MA, weekly level, or prior high). No alert = no attention.

- Timing rules I live by:

- Act on the timeframe he’s anchoring. If the read is daily/weekly, I wait for a 4H or daily close—not a 5‑minute wick.

- Use a 15‑minute cool‑off after a big tweet or a sharp move. Fast fingers are expensive fingers.

- Require two signals: his bias + my setup. One without the other is entertainment, not a trade.

- Mute bait: I mute keywords that trigger impulse (e.g., “instant,” “guaranteed,” “moonshot”). Less noise, fewer mistakes.

Risk rules that actually save accounts

I love levels and context, but my account survives because of these rules, not because of any tweet:

- Fixed max risk per trade: 0.25%–1% of equity depending on market conditions. Lower if volatility spikes.

- Pre‑set invalidation: Always a line in the sand. If the reason for the trade is gone, I’m gone.

- No revenge trades: After a stop, 20‑minute lockout. If I feel a “must win it back” itch, I’m done for the session.

- Three‑strike rule: Three trades max per day (or two losses and I’m out). Overtrading kills. Evidence backs it up—high‑frequency traders underperform on average (Barber & Odean).

- Scale and trail with logic: Take 30% off at 1R, move stop to breakeven at 1.2R, let the rest run to target or HTF resistance.

Build a “DonAlt dashboard” in 10 minutes

This keeps me consistent and removes second‑guessing mid‑trade.

- One‑page tracker (Notion/Sheets):

- Date / Asset

- His bias (Bull/Bear/Neutral)

- Key level he mentioned

- My confluence (HTF level, trend, indicator)

- If‑Then plan and invalidation

- Result (R multiple) and notes

- Color code: Green = aligned, Yellow = partial, Red = ignore. If it’s not green, I don’t force it.

- Weekly snapshot: How many aligned signals did I take? What would have happened doing nothing? Sometimes the best trade was the restraint.

A quick routine that keeps me sane

- Sunday: Mark HTF levels, write two if‑then plans with invalidation for the week.

- Mid‑week: Check what he’s updated and whether price is near my levels. No level, no action.

- Friday: Journal the trades I took and the trades I skipped. Skipped winners hurt, but they also prove I followed the plan.

Most mistakes come from hurry and hope. This routine replaces both with structure and patience.

Copy‑this protocol (ready to use)

- Save a DonAlt post that shows HTF bias + a clear level.

- Set price alerts ±0.2% around that level and at your invalidation.

- Write one if‑then line and one sentence of invalidation.

- Size the trade by risk/stop distance. Enter only on your chosen close (e.g., 4H).

- Log the outcome in R, note what you felt, and one thing you’d repeat or fix.

If you’ve ever stared at a tweet and felt your pulse spike, you’re not alone. That rush is why people blow up accounts. Turn it into a checklist, and the rush turns into a plan.

Still wondering how accurate he really is, whether there’s a paid group, or how to check old calls without falling into hindsight traps? I’ve got quick answers lined up next—curious which one will change how you read his feed tomorrow morning?

DonAlt FAQ (the questions people actually ask)

Who is DonAlt?

He’s a well-known crypto trader and market commentator who posts clear, higher‑timeframe views on X. If you want a taste of his style, check his feed here: @CryptoDonAlt. Expect charts with key levels, context for bias, and the occasional trade thought—without hand-holding signals.

Is DonAlt accurate?

He’s human. No one nails every call. What I value is that his big‑picture reads set a useful anchor. I treat those reads as inputs, then run them through my own rules before touching the buy/sell button.

Two real-world notes that keep me grounded:

- Time matters. A weekly-level idea can be “right” over weeks but look wrong intraday. I often see people bail on day two, then watch price tag his level on day ten.

- Overtrading kills. Research by Barber and Odean found that frequent traders tend to underperform because they chase and churn. That’s exactly what happens when you react to every tweet instead of sticking to a plan.

What strategy or timeframe does he use?

Mostly higher timeframes (daily/weekly), with swing‑style context. That means:

- Patience is required. His setups aren’t 15‑minute scalp alerts.

- Clear invalidations. Levels are “areas of interest,” not market‑order sirens. If price reclaims/loses a key area, bias adjusts.

Sample you’ll often see on his feed: a weekly chart with range high/low marked, and a simple message like, “Above here I’m constructive; below here I’m cautious.” That’s your cue to plan—not to FOMO.

Does he sell signals or run a paid group?

I treat his account as free commentary unless he clearly says otherwise. As a rule, be skeptical of anyone promising “guaranteed” signals or perfect win rates. The market doesn’t do guarantees—only probabilities.

Can I just copy‑trade him?

I don’t, and here’s why:

- Different accounts, different outcomes. Your size, execution, fees, and risk tolerance aren’t his.

- Copy trading isn’t a cheat code. Studies on social trading show that blindly mirroring “top traders” rarely produces consistent outperformance—especially when leverage creeps in.

- Process > personality. Use his bias as context. Trade your plan.

“If his bias aligns with my setup and price is at my level, I’ll consider a starter with a defined stop. If not, I do nothing.”

How do I check old calls?

Quick ways I use to avoid hindsight bias:

- Use X search: In the search bar, type from:CryptoDonAlt BTC (or your asset). Add date filters with “since:” and “until:” to see what was said before a move.

- Follow forward, not backward: When he posts a fresh level, bookmark it. Revisit in a week. Did price respect/reject the area?

- Track cleanly: Make a simple sheet with date, asset, level, bias, and what happened. It takes 5 minutes and kills selective memory.

- Look for follow‑ups: He’ll often update if the higher‑timeframe picture changes. That continuity matters more than cherry‑picked wins.

What if I’m new?

Start slow. Here’s the minimal setup that keeps you safe while you learn:

- Risk per trade: cap at a fixed small percent. Small enough that a loss is boring.

- Invalidation first: decide your stop before you enter. If price tags it, you’re out—no debates.

- Timeframe match: if you act on a weekly idea, don’t stare at a 5‑minute chart.

- Case‑study mindset: treat his posts as lessons. Ask: What’s the trend? Where’s the invalidation? What would “prove this wrong”?

How often does he post?

It varies. Some weeks are chatty; some are quiet. That’s normal for higher‑timeframe traders—they talk when price is at interesting spots and shut up when it’s noise. Use notifications if you want to catch the key ones, but don’t turn it into a reflex game.

Does he talk alts or just Bitcoin?

Mostly Bitcoin and broader market context, with alt takes when relevant. For alts, the same rules apply: treat levels as areas to prepare, not chase.

What’s a healthy way to act on one of his posts?

Example I actually use:

- See: He posts a weekly BTC level he’s watching for a reclaim.

- Plan: I set an alert slightly above the level and prep my entry/stop before price gets there.

- Act: If alert triggers and my system confirms, I take a small starter. If price fakes out and hits my stop, I’m out—no “one more try.”

- Review: I snapshot the chart and note “why this trade,” then check it next week.

Can I learn anything from the way he updates his views?

Yes—watch how he flips bias when invalidated. That willingness to be wrong is a skill. In my experience, traders who update quickly and cleanly tend to last longer than those who “marry” a position. Behavioral finance backs this up: stubborn conviction after a clear invalidation is a common pitfall that compounds losses.

Any red flags I should watch anywhere on crypto X?

- Hindsight victory laps without timestamps or charts from before the move.

- Deleted misses and only “curated wins.”

- Hard‑sell paywalls promising certainty or “95% win rates.”

- Emotional bait: shame for sitting out, hype for max leverage, or tribal “this can only go up.”

Want the straight answer to the real question—should you follow @CryptoDonAlt or not? I’ve got a simple, no‑fluff verdict and the best way to start without risking your stack. Ready for it?

My verdict: should you follow @CryptoDonAlt?

Yes—with a condition. If you want higher‑timeframe context and clean levels, and you’re willing to think for yourself, he’s worth your attention. If you’re hunting for 24/7 signals, instant entries, or hand‑holding, that’s not what he does—and that’s not how you should use him.

Yes—if you want higher‑timeframe context and you’re willing to think for yourself

His posts help me set bias and focus on key areas without getting sucked into minute‑by‑minute noise. That matters. Research shows that attention-driven trading often leads to worse outcomes for retail traders who chase headlines and “hot” moves (Barber & Odean, 2008). A higher‑timeframe lens forces patience and cuts the churn.

Here’s how that looks in practice for me:

- Sample BTC plan (fictional but typical): If he highlights a weekly resistance around, say, $64k with a note that a weekly close above turns the structure constructive, I set alerts at $63.8k and $64.2k. No knee‑jerk trades. If the weekly closes above and my system also flips bullish, I’ll take a starter with 0.5% risk, stop below the breakout invalidation. If it stuffs back below, I’m out. Simple, mechanical.

- Sample ETH/BTC plan: If he marks a higher‑timeframe demand on ETH/BTC and I see confluence on my own chart (200‑week MA or prior weekly close), I’ll plan a test‑then‑confirm entry only after a higher‑low forms. No “catching knives,” no guessing.

Why this works: using if‑then rules (implementation intentions) improves follow‑through and reduces impulsive decisions—something behavioral research has backed for decades (Gollwitzer, 1999). Pair that with reduced overtrading—another known performance drag for retail (Barber & Odean, 2000)—and the HTF focus becomes a feature, not a bug.

Quick reminder: his levels are context. Your entries, stops, and size are your job.

Best way to start (and actually benefit)

- Follow for two weeks with alerts on for posts that include charts or levels.

- Save posts that map to your markets. Build a small library of examples you understand at a glance.

- Write a simple if‑then rule for each setup you’re considering. Example: “If weekly closes above X and my system confirms on the daily, then enter with ≤0.5% risk and stop at invalidation.”

- Set price alerts at the levels mentioned. Let the market ping you—don’t babysit charts.

- Filter the noise: mute replies/keywords that trigger FOMO. Attention is a resource; protect it (attention-driven trading research exists for a reason).

- Journal briefly post-trade: Did you follow the rule? Did the level matter? A 60‑second note improves next trade quality (checklists and brief debriefs consistently reduce error rates across fields).

Two quick examples of what this avoids:

- Chasing breakouts intraday on a weekly idea. If the thesis is weekly, wait for the weekly close or your system’s trigger. No FOMO entries.

- Oversizing because the post “feels” confident. Keep a fixed max risk per trade. Confidence isn’t a stop‑loss.

Bottom line

Follow for perspective, trade your plan, protect your downside. That’s how I use accounts like @CryptoDonAlt. Let his higher‑timeframe bias narrow your focus, then let your rules do the heavy lifting. If it aligns, take the shot with small, controlled risk. If it doesn’t, pass without regret. Staying in the game is the edge most people overlook.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.