Laura Shin Review

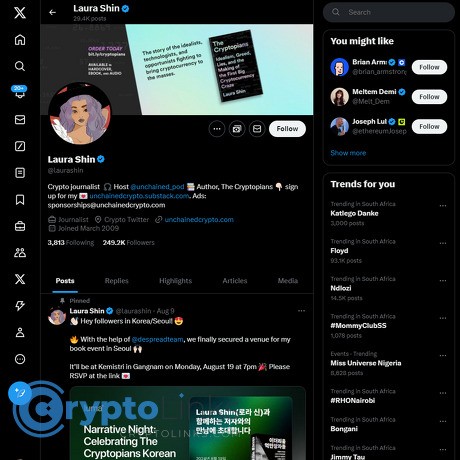

Laura Shin

x.com

Laura Shin on X (Twitter): my no‑BS review guide + FAQ for crypto readers

Want a crypto voice on X you can actually trust—and use—without scrolling for hours?

If you’re tired of guessing who’s legit, here’s the straight talk on Laura Shin’s feed, why it’s worth your attention, and how to plug it into your daily workflow. I’ll show you what you really get by following her, how to separate signal from noise, smart tracking tactics, and a quick FAQ (including how to reach her) so you don’t waste time.

Crypto X has a noise problem

Let’s be honest: X is loud. Between shills, hype threads, and anonymous “experts,” it’s easy to miss real news—or worse, act on something sketchy. Impersonators pop up, breaking stories get distorted, and long threads often bury the key facts.

- High noise, low signal: Hype moves faster than reporting.

- Impersonators: Look‑alikes can spin scams or fake “insider” tips.

- Time traps: Ten tweets later, you still don’t know what actually happened.

Pew Research has repeatedly noted that many people now get news via social platforms—but trust in what they see there is low. That mismatch is exactly why a vetted source matters.

The simple fix I’m offering

Here’s a clear, practical review of @laurashin: who she is, what she posts, why her feed matters, how to set it up in your workflow, and a quick FAQ (including contact info). You’ll walk away knowing how to get value fast—without living on your timeline.

Who Laura Shin is (in 30 seconds)

She’s a veteran crypto and tech journalist, host of the long‑running Unchained podcast, and an author known for careful sourcing and sharp interviews. She explains complex stories in plain English and links back to primary material so you can verify.

- Reporter first: Context over hot takes.

- Real access: Founders, developers, regulators—on record.

- Receipts: Links to docs, transcripts, and sources when it counts.

Example: when a major enforcement action hits or a protocol exploit trends, she’ll point to the primary filings or credible incident reports and, often, follow up with an on‑record discussion on Unchained. That’s what you want in a fast market: a quick frame, plus a path to the evidence.

What you’ll get from this guide

- What Laura posts and how often—so you know what to expect

- How I use her feed for reliable updates without doomscrolling

- Easy ways to avoid impostors and stay safe

- FAQ: how to contact her, common confusions, and what to expect

What this is not

This isn’t investment advice or a fan piece. It’s a no‑BS, practical review so you can decide if following @laurashin helps your day‑to‑day research and saves you time.

Up next: Want the 60‑second snapshot on why her perspective stands out—and who gets the most value from following her? Let’s look at that right now.

Who Laura Shin is and why her X feed matters

Short bio and creds

When I want facts without theatrics, I check Laura Shin. She’s a long-time crypto reporter, host of Unchained (one of the most established crypto podcasts, running since 2016), and the author of The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze. Her work is built on sourcing and follow-through, not hype.

- Podcast credibility: Unchained has interviewed a who’s-who of founders, core contributors, security sleuths, prosecutors, and policy voices. If there’s a major move in crypto—technical, legal, or market structure—there’s usually an episode or transcript you can reference.

- Book and investigations: Her reporting around Ethereum’s early years and the DAO era is widely cited. Expect timelines, receipts, and careful attributions—not rumor-chasing.

- Editorial style: Source-driven, even-handed, and built for clarity. She asks pointed questions and keeps the spotlight on facts.

Why her perspective is useful

Crypto lives at the intersection of code, economics, and policy. Laura sits right at that junction. On X, she doesn’t just pass along headlines—she adds context and links you to deeper material (episodes, transcripts, court docs, or trustworthy articles) so you can confirm details fast.

That matters because speed and accuracy don’t always travel together on Crypto X. A well-known study from MIT (Science, 2018) found that false news spreads significantly faster than truth on Twitter/X—especially for big, emotional stories. If you value signal over sensational threads, a journalist who consistently links sources is a relief.

“Extraordinary claims require extraordinary evidence.”

—Carl Sagan

Her feed often pairs a short, plain-English note with authoritative material—think official filings, a fresh interview with the person in the middle of the story, or a well-structured thread summarizing what’s proven versus what’s speculation. It keeps you calm when everyone else is yelling.

Who gets the most value

- Builders and researchers: You get quick links to primary sources and technical discussions without the influencer theater.

- Analysts and long-term investors: Clean, verified updates on regulatory actions, legal cases, and security incidents that actually change risk.

- Anyone allergic to hype: If you prefer vetted information over hot takes, this feed fits your workflow.

Real example from my workflow: when a major exchange pauses withdrawals, I scan Laura’s post for the “why,” jump into the linked primary doc or interview, and decide in under two minutes whether this is an operational hiccup or a structural problem. No guessing. No chasing unverified screenshots.

What to keep in mind

- She’s a journalist, not your trading signal. Expect reporting and context—not price calls, memes, or “apes only” content.

- Verification takes time. If she’s quiet while rumors fly, it’s usually because she’s checking sources. That patience pays you back in fewer mistakes.

- Clarity over clicks. Posts are measured and cite guests or documents; perfect if you want to reduce noise, less ideal if you’re chasing adrenaline.

If that sounds like the kind of feed you’ve been missing, you’ll probably love what actually shows up on her timeline. Curious about the exact mix—breaking-news pointers, interview links, smart retweets—and how often they appear? I’ll show you what you’ll see and how to read it in under a minute next.

Inside @laurashin on X: what you’ll actually see

When crypto is chaos—ETF rumors, court rulings, exploit alerts—I reach for feeds that stay calm and checkable. Laura’s X timeline does exactly that: fewer posts, tighter facts, and quick links that help me move from “what happened?” to “what should I read next?” without losing an hour.

“Extraordinary claims require extraordinary evidence.” — Carl Sagan

That’s the energy you’ll feel as you scroll @laurashin: facts first, receipts attached, hype left at the door.

Content mix

Expect a clear pattern. Her posts usually fall into a few high-value buckets that make research faster:

- Episode and article links: Pointers to new Unchained interviews, investigations, and explainers. You’ll often get a crisp line or two on why the piece matters and who’s speaking, so you can decide in seconds whether it’s relevant to your work. Pair it with show notes and transcripts when you need details.

- Regulatory and policy context: Short posts around SEC filings, court decisions, or hearings—usually with a link to primary sources or her longer-form coverage. When the rules move, she flags what actually changed versus what people are guessing.

- Security and incident updates: References to major exploits, protocol incidents, or exchange outages, with direction to reliable reporting. Think: bridge hacks, multisig failures, or governance attacks—summarized without the drama.

- Signal-boosts from credible voices: Retweets and quotes from researchers, founders, and officials that extend the story. It’s a curated “who to read next” that keeps you inside verified conversations, not rumor loops.

Example of what this looks like in practice: an SEC action hits, and you’ll see a one-liner framing the decision, a link to the filing or transcript, and a pointer to a relevant interview—so you can go straight from headline to primary source to expert commentary.

Posting rhythm

Her cadence is event-driven. Expect activity around news cycles, episode drops, and big hearings; quieter stretches in between. It’s a “quality over quantity” stream that respects your attention, which matters a lot on X.

Why that matters: research shows low-quality or sensational posts tend to travel faster on social platforms than verified reporting, which can distort perception during fast-moving stories. A well-known MIT study found false news spread “farther, faster, deeper, and more broadly” than true news on Twitter (now X). Source: Science, 2018. Fewer, sourced updates help counter that effect—especially when markets are jumpy.

And if you’ve ever felt overwhelmed by the news firehose, you’re not alone. Many people now get headlines via social feeds while expressing skepticism about what they see. Source: Pew Research, 2023. A focused posting rhythm is a feature, not a bug.

Tone and standards

- Clear and measured: The caption tells you what changed, not how to feel about it.

- Sourced and checkable: Links to filings, court docs, or interviews are common. You can verify fast.

- No theatrics: You won’t get wild predictions or meme-bait—just clean context that stands up a week later.

- Attribution on point: Guests, experts, and outlets are named, so you can judge the credibility at a glance.

In short, it’s the opposite of “engagement farming.” The posts read like notes from a reporter who assumes you value accuracy more than adrenaline.

Typical high-signal topics

- Exchange and protocol news: Launches, restructures, outages, and roadmap shifts—flagged with context to separate PR from substance.

- Security exploits: Bridges, oracle mishaps, governance takeovers, and wallet supply chain issues. Expect short descriptions and directions to trustworthy threads or interviews.

- Legal cases and enforcement: Lawsuits, settlements, and bankruptcy milestones, often paired with links to documents or expert breakdowns.

- Policy updates: Regulatory guidance, agency actions, and comments from lawmakers and officials in the U.S. and abroad.

- Founder and builder stories: Interviews that surface trade-offs, token design choices, and technical constraints—useful if you work in the space and need signal that isn’t price-centric.

If you’re tired of playing “guess the truth” on X, this feed gives you a reliable spine for your daily scan: hit the post, skim the source, decide whether to go deeper. Want my system for turning that into a low-noise radar—Lists, alerts, and smart search that save hours?

Pro tips to get the most from her feed

“In crypto, attention is your scarcest asset. Guard it like your seed phrase.”

Make a “Signal” List

I keep a private X List that I open when the market is moving or when a big policy headline hits. It’s designed to cut noise, not entertain. Put @laurashin at the top, then add a handful of credible, non-hype sources so you see breaking context—fast.

- How to build it: On X, create a private List named “Signal.” Add a tight set of accounts (think 10–20) so one screen tells you the story.

- Sample adds: @coincenter (policy), @jchervinsky (legal), @zachxbt (investigations), @Chainalysis (on-chain), @FinCEN (official notices).

- Why it works: Research shows false news spreads faster than truth on social platforms, especially during breaking events. Less noise = fewer traps. Source: MIT/Science (2018) study.

Pro move: Split Lists: “Signal-Core” (10–20 must-reads) and “Signal-Extended” (30–50). During volatility, open Core first so you don’t chase rumors.

Use notifications strategically

Alerts are a scalpel, not a firehose. I only turn them on for @laurashin during major hearings, enforcement waves, or high-impact exploits—then switch them off.

- Set it right: Tap the bell on her profile → choose All Posts during big events, then back to Highlights (or off) once the dust settles.

- Protect your focus: Phone pings drain cognition—even when you don’t open them. That’s not folklore; it’s measured. See Stothart et al. (2015) on the attentional cost of notifications and Ward et al. (2017) on “brain drain” from smartphones.

- Bundle the noise: Use iOS Focus or Android Do Not Disturb to allow alerts from your “Signal” app list only. Everything else waits.

Search smarter

When I need fast context on a topic, I don’t scroll—I search. X has powerful operators that turn @laurashin’s feed into a mini research database.

- Quick recipes:

- Topic + facts:

from:laurashin SEC since:2024-01-01 -is:retweet - Find source links only:

from:laurashin filter:links keyword - Timeboxing big events:

from:laurashin ETF since:2024-07-01 until:2024-08-01 - High-engagement posts:

from:laurashin min_faves:200 keyword

- Topic + facts:

- Save it: After you run a search, tap the three dots → Save search. Now it’s one tap away when news breaks.

- Deeper research: Pair X results with Unchained transcripts so you can quote precisely. Use Google:

site:unchainedcrypto.com transcript keyword.

Verify before you act

“Trust, but verify” isn’t optional in crypto. Before I do anything with a post—even from trusted accounts—I run a quick check.

- The 3-source rule: Look for confirmation from an official page, a primary document, and one credible outlet. Two of three is the minimum; three is best.

- Official first: Regulators, courts, or company blogs beat screenshots. For example, SEC orders live at sec.gov, not image albums.

- Link hygiene: Watch for typosquats. unchainedcrypto.com is not the same as unchained-crypto.com or unchainedcrypto.info. If unsure, paste the URL into urlscan.io or VirusTotal.

- Impersonator check: The handle must be exactly x.com/laurashin. Also check follower graph (do reputable accounts follow?), account age, and linked domains. A blue badge alone means nothing.

Stay safe

If a post or DM pressures you to move fast, it’s almost always a trap. Slow is smooth; smooth is safe.

- Never share keys or seed phrases. No journalist, exchange, or “helper” needs them—ever.

- Assume DMs asking for funds are scams, even if the profile photo and name match. Verify the handle and cross-check via a known public email before responding.

- Lock down DMs: In X → Settings → Privacy and safety → Direct messages → Turn off “Message requests from everyone.”

- Use a hardware key for your X account and enable 2FA that isn’t SMS. SIM swaps are still rampant.

- Report fakes: Use X’s impersonation report and share the fake URL with watchdogs like Chainabuse so others don’t get burned.

Bonus filters: Mute words that flag low-signal bait (e.g., “100x,” “giveaway,” “airdrops soon,” “passive income”). It won’t block useful posts from Laura, but it will trim the replies you don’t need.

Now that your setup is tight, want to know which types of posts from Laura I never skip—and how I triage them in under 30 seconds? Let’s look at the specific post categories next and how I use each one in real time.

Best posts to watch for (and how I use them)

Breaking-news pointers

When the market is swirling, I look for two things in a post: the original source and the cleanest context. Laura’s breaking-news pointers usually give both—headline, why it matters, and a link to deeper reporting or primary docs. That’s gold when seconds count.

- What I watch for: links to official filings, court documents, or direct statements (not screenshots); one or two lines that frame the stakes; follow-up links to fuller coverage on Unchained.

- How I use it fast: I triage with a quick checklist—what happened, who’s involved, immediate risks, and where the source doc lives. If it’s a security incident, I’ll open an Etherscan tab and check the addresses mentioned. If it’s policy, I’ll pull the PDF and search for keywords like “injunction,” “settlement,” or “jurisdiction.”

- Why this works: Research shows false stories spread faster than true ones on social platforms, especially in breaking cycles (MIT/Science study). Sourced pointers help you avoid getting yanked by rumor momentum.

“Speed is currency, but context is compound interest.”

In practical terms, these posts help me decide whether to park on the headline or dig into the primary material. No FOMO, just signal.

Podcast drops and interviews

These are where you hear founders, devs, and regulators in their own words. I treat each drop like a searchable intel packet—title, guest, show notes, transcript, and sometimes pull-quotes in the thread.

- What I watch for: the guest’s role, the specific claim or policy angle teased, and a link to a transcript or show notes with references.

- How I use it:

- Scan first: I read the show notes for disclosures, timelines, or any references to audits, on-chain data, or legal filings.

- Listen smart: If it touches a sector I track (exchanges, L2s, stablecoins), I queue it at 1.25x and flag timecodes where the guest defines terms or commits to dates.

- Clip and catalog: I save one or two quotable lines and the episode link in my research notes with sector tags. It speeds up future comparisons across guests.

- Why this works: Podcast audiences tend to be more engaged learners and stick with content longer than typical social feeds, which helps with recall and nuance (Edison Research, The Infinite Dial).

When a founder says “the audit is done next month” on air, I write that down. Deadlines are receipts.

Investigation threads and follow-ups

These posts stitch together timelines, actors, and outcomes. If you research crypto beyond headlines, these are your reference layers.

- What I watch for: a clear sequence of events, named sources, and links to filings, on-chain evidence, or prior reporting. If there’s a visual timeline or bullet summary, even better.

- How I use it:

- Bookmark and tag: I save the thread and tag it by topic (e.g., “bridge exploits,” “enforcement,” “insolvencies”). It becomes a fast refresher when new news reopens an old story.

- Cross-verify: I click through to the primary docs and cross-check key claims. CourtListener for dockets, company blogs for official statements, and block explorers for transaction proofs.

- Build a cheat sheet: Three lines: who did what, when it happened, why it matters. That’s enough to brief a teammate or decide whether to re-weight a watchlist.

- Why this works: In a space where rumors sprint, structured follow-ups fight memory creep and keep you anchored to facts (see the MIT study above and Pew’s findings on how social news spreads).

You’re not trying to keep up with every rumor—you’re building a clean map so future headlines make instant sense.

Spaces and live discussions

Live audio is where nuance sneaks out—hesitations, clarifications, off-the-cuff reveals. When Laura hosts or hops into a Space, I treat it like a press scrum with replay.

- What I watch for: scheduled Spaces with a clear topic, speaker list, and pinned resources. If it’s tied to fresh news, I expect pointers to docs while people talk.

- How I use it:

- Set a reminder: If the Space is announced ahead of time, I hit the reminder so it pops up when it starts.

- Capture the nuggets: I note down any concrete claims, numbers, or promised dates. If a regulator or builder is present, I mark exact phrasing—they choose words carefully for a reason.

- Replay and reconcile: If I miss it live, I listen to the recording and cross-check statements against posts or transcripts posted afterward.

- Why this works: Live Q&A often surfaces the “missing context” that never fits in a single post, letting you adjust your stance before the next candle prints.

When the feed is on fire, I want the calmest room in the building. Live, recorded, attributable—that’s how you keep your footing.

Want to reach Laura directly, confirm the official handle, or avoid the classic impostor traps? I’ve got the exact links and quick answers up next—curious which contact method actually gets a response?

FAQ: quick answers you’re probably looking for

How do I contact Laura Shin?

If you’re reaching out for press, interviews, or a show-related request, use her official contact page: laurashin.com/contact. For media and booking requests specifically, the listed email is [email protected].

Quick tip: journalists triage by clarity. Put the essential facts in the first two lines. If it’s time-sensitive (like an exploit or major filing), say so in the subject line and include a brief timeline plus links to primary documents.

Subject: Time-sensitive: [Company/Protocol] [Event] — docs + sources included

Hi Laura,

One-sentence summary of the news/tip.

Why it matters in one line.

Links to primary documents (filings, on-chain transactions, repo commits).

Any sources willing to go on record or provide corroboration.

Your name, role, and best contact.

Security sanity check: never include private keys, seed phrases, or exchange account screenshots. If the material is sensitive, ask if there’s a preferred secure channel before sending anything risky.

Is @laurashin the official account?

Yes—the official X handle is https://x.com/laurashin.

- Cross-verify: match the handle from laurashin.com or Unchained’s official channels.

- Ignore the checkmark: on X, a blue check is not proof. Handle accuracy beats cosmetics.

- Watch for reply-bait impersonators: common scam pattern is “lookalike handle + fresh account + replies with shady links.”

Regulators and researchers have flagged social platforms as a common vector for impersonation scams. The FTC has repeatedly warned that scammers often use public figures’ likeness to push fake giveaways or phishing. If a “Laura” account asks you for money or crypto in DMs, it’s a scam—full stop.

How long does it take to verify Crypto.com in the USA?

It’s not tied to Laura, but lots of readers search this while setting up their stack. Crypto.com says account verification usually takes from a few hours up to a couple of business days. If it’s been longer than 3 business days, contact Support via https://chat.crypto.com/. Source: Crypto.com Help Center.

- Pro tips: use your legal name as it appears on your ID, ensure your selfie matches lighting/angle guidelines, and upload high-resolution images.

- U.S.-specific: be ready to provide SSN and proof of address if requested. Mismatches cause delays.

- Timing reality: during market spikes, KYC queues swell across exchanges—expect slower turnarounds and watch for “action needed” emails.

Can I pitch a story or send tips?

Yes—use the contact page. Keep it tight and verifiable. What wins attention:

- One-paragraph summary with what happened, who’s involved, and why it matters.

- Evidence links: on-chain transactions, court filings, GitHub commits, press releases, archived pages.

- Status: embargoed, on/off record, or background—and who can be quoted.

If you believe there are legal or safety risks, say so upfront and ask for guidance on a secure channel. Never post sensitive docs publicly to “prove” your tip—bad actors monitor those keywords and threads.

For context, researchers like Chainalysis have consistently reported that scams are a leading driver of crypto-crime revenue in many years. Verifiable evidence helps separate real leads from noise and protects readers from misinformation.

Want the exact, step-by-step setup I use to turn her posts into a low-noise research stream? I’m about to share the simple action plan I rely on when markets go wild—want it?

My verdict and next steps

Strengths and trade-offs

Here’s my bottom line: if you want clear, sourced crypto updates without hype, following @laurashin is worth it.

- Strengths: consistent reporting standards, sharp interviews, helpful context, and low noise. For example, around big moments (spot BTC ETF approvals, major exploits, headline legal cases), she typically pairs a headline with links to primary docs or long-form interviews so you can get the “why,” not just the “what.”

- Trade-offs: fewer hot takes and no trading calls. If you want memes or price targets, look elsewhere. This is journalism-first.

That trade-off is exactly why I keep her in my signal stack. When markets are chaotic, I want a feed that cuts through rumors and points me to the sources fast.

Your action plan

- Follow the official account: https://x.com/laurashin.

- Add to a “Signal” List so her updates sit beside a handful of other trusted reporters and researchers. Check that list first when news breaks.

- Turn on alerts during big events (hearings, major hacks, ETF/SEC updates). Turn them off during quiet weeks so you don’t burn out.

- Subscribe to Unchained for deeper context: interviews with founders, devs, regulators, and investigators often answer the questions headlines can’t. Start at unchainedcrypto.com.

- Bookmark high-signal threads and pair them with primary sources (complaints, audit reports, blog posts, contracts). A 5-minute scan now saves hours later.

- Set a 10-minute weekly review (I do Fridays): skim her latest posts and queue any long-form episodes that impact the sectors you track.

Safety and common sense

Reporting ≠ endorsement. Treat any single post as a starting point, not a finish line.

- Verify before you act. False stories spread fast on social platforms—an MIT study found false news can travel “farther, faster, deeper” than true stories on X/Twitter (MIT).

- Beware impersonators. Double-check the exact handle is @laurashin. A blue check isn’t proof. Cross-verify from laurashin.com or Unchained links.

- Assume DMs are traps. Scammers often pose as journalists or researchers. Chainalysis shows scams remain a persistent on-ramp for crypto crime (Chainalysis). Never send funds, never share keys or seed phrases.

- Reduce FOMO errors. Quick actions under stress lead to mistakes; heavy multitaskers are measurably worse at filtering noise (Stanford study: PNAS). Slow down, cross-check, then decide.

Conclusion

If you want clear, reliable crypto updates on X, Laura Shin is a strong follow. Plug her feed into a simple workflow, use notifications only when it counts, and let the longer interviews fill in the gaps. You’ll stay informed without living on your timeline.

And if you’re new here, bookmark cryptolinks.com—I keep these guides fresh so you always know where the real signal is.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.