Hasu Review

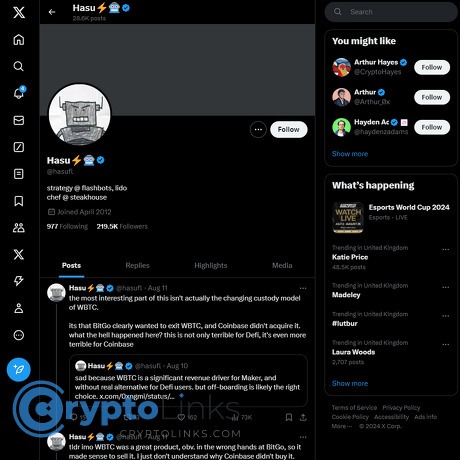

Hasu

x.com

Hasu Review Guide: Everything You Need to Know + FAQ

Scrolling crypto X and asking yourself, “What’s real signal and what’s just noise?” You’re not alone. If you want clear, research-backed takes on Bitcoin, Ethereum, MEV, and market structure, Hasu is one of the few accounts that can actually save you time—and help you make better calls.

Here’s how I’ll make that happen, fast.

The pains most crypto people face on X

Too many hot takes. Not enough context. Critical protocol changes get simplified (or twisted), and the posts you need vanish under memes and hype. Sound familiar?

- Context collapse: complex topics like MEV, staking, PBS, and rollups get reduced to one-liners that skip the trade-offs.

- Algorithmic noise: you follow dozens of accounts and still miss the posts that matter when the feed reshuffles.

- Hype bias: attention chases pumps; nuanced research often arrives late to most timelines.

- Echo chambers: arguments feel settled because you only see one side of them.

This isn’t just a vibe. Research backs it up. A Science study found low-quality or false signals spread faster than corrections on Twitter/X. And according to Pew Research, over half of X users see news on the platform—but that doesn’t mean the feed prioritizes the most trustworthy sources.

That’s why curating a few high-signal voices is such a big unlock. Hasu is one of them.

What I promise in this review

I’m keeping this practical and no-BS. Expect a clear, useful walkthrough of @hasufl—what he’s great at, what to watch out for, and how to use his content well. No hero worship. No fluff. Just signal.

- Where he consistently adds value (and where he doesn’t)

- What his day-to-day posts look like—and which ones are worth your time

- Simple ways to plug his feed into your workflow without getting overwhelmed

- Quick answers to the questions I get about him all the time

“Less memes, more models.” That’s the feel of Hasu’s best work: crisp reasoning about incentives and market structure that helps you think better, not just react faster.

How this guide helps you get value fast

- Who he is and why people listen: a fast overview of his credibility so you know when to pay close attention.

- What to expect from his posts: threads, models, key replies, and how often true “signal” shows up.

- Tips to tailor for your goals:

- Builders: track MEV, PBS, and block builder dynamics that affect your roadmap.

- Researchers: follow incentive design, client diversity, and security budget debates.

- Traders: watch market structure notes, liquidity mechanics, and policy shifts.

- FAQ you can skim: quick hits so you get answers without hopping around tabs.

To set expectations, here’s the kind of signal you’ll often catch early if you follow him:

- MEV and builder centralization risks: why they matter for Ethereum’s long-term resilience.

- Bitcoin’s security budget: how fees vs subsidy shape miner incentives and network safety.

- Market structure: how liquidity and exchange mechanics change execution quality for everyone.

If you’ve ever felt that the smartest crypto insights arrive a week after you need them, tuning into the right threads at the right time changes everything. Ready to see who Hasu is, why his takes carry weight, and how to read him the smart way? That’s exactly where we’re headed next.

Who is Hasu? Background, credibility, and why crypto listens

If you’ve spent any time in crypto research circles, you’ve likely seen the handle @hasufl. Hasu is a pseudonymous researcher and strategist whose work threads together Bitcoin economics, Ethereum’s roadmap, and the messy, real-world market mechanics that sit between protocols and people. His signal comes from years of long-form writing, hands-on work in the MEV ecosystem, and a habit of testing ideas against data rather than vibes.

“Incentives are the invisible architecture of crypto—ignore them and the building collapses.”

Roles, experience, and affiliations

Hasu doesn’t just comment from the sidelines—he’s been publicly involved with teams shaping core pieces of Ethereum’s post-Merge reality.

- MEV and ecosystem leadership: He has served in strategy and research roles at Flashbots, the group behind MEV-Boost and research around Proposer-Builder Separation (PBS). If you’re new here: after Ethereum’s Merge, most validators outsource block building to specialized builders via relays—an idea Flashbots helped operationalize. Adoption has been massive; for long stretches post-Merge, well over 80–90% of blocks on Ethereum were built via MEV-Boost, depending on the day and relay set.

- Long-form writing: He made a name with deep essays on Bitcoin and Ethereum incentives, originally through venues like Deribit Insights and later his own notes and research threads. These pieces often bring academic results into plain English and apply them to live market design problems.

- Podcasting and interviews: He co-hosted the Uncommon Core podcast, interviewing core devs, researchers, founders, and market makers. Expect talk of MEV, rollups, PBS, staking, and the policy edges nobody wants to touch.

- Public affiliations: Where relevant, he has disclosed ties—especially when discussing topics adjacent to Flashbots’ work (e.g., MEV-Boost, PBS, and research directions like SUAVE). He’s also weighed in on staking governance debates and market structure, typically sharing any material connections in-thread when they exist.

I respect that mix: practical exposure to live systems, plus the discipline to publish reasoning in a way others can poke holes in. That’s how crypto actually progresses.

Core topics he’s built signal around

MEV, block building, and PBS:

Hasu consistently explains the mechanics and trade-offs in the builder–relay–validator pipeline. You’ll see him flag risks like builder concentration, relay censorship incentives, and the need for credible-neutral infrastructure. When OFAC-related filtering hit some relays in late 2022, he was among the early voices mapping out how incentives, not tweets, would decide the outcomes.

Useful context: PBS is on Ethereum’s roadmap to separate block proposing and building at the protocol level. Hasu’s threads often connect research proposals to what’s actually happening on-chain—like how a handful of builders can end up with outsized power, and what designs (encrypted mempools, inclusion lists, SUAVE-style auctions) might rebalance things. For live stats, I keep an eye on dashboards like mevboost.pics and RelayScan.

Ethereum’s roadmap and staking incentives:

From EIP-1559’s fee mechanism to the rollup-centric roadmap and EIP-4844’s impact on data costs, he tends to connect protocol changes to validator, builder, and user incentives. He’s also vocal about client diversity and staking centralization pressures—why they exist, and how to chip away at them in a way that doesn’t break economics elsewhere.

If you like sources: there’s a growing body of mechanism design work around fees and auctions (see Tim Roughgarden’s research archive) that often anchors discussions he amplifies.

Bitcoin’s security budget and long-run incentives:

He helped mainstream a hard conversation: as Bitcoin’s block subsidy trends to zero, can fees alone secure the chain? This isn’t FUD—it’s an academic concern since at least 2016 (Carlsten et al., “On the Instability of Bitcoin Without the Block Reward”). You’ll see him link back to fee dynamics, miner behavior under variance, and how exchange-driven transaction batching changes the fee market.

Market structure and liquidity plumbing:

Expect commentary on exchange incentives, liquidity fragmentation across venues, and the knock-on effects for price discovery. He’s shared and debated data-driven pieces from firms like Kaiko to frame how depth, spreads, and routing shape trader outcomes. The point isn’t “tradfi vs crypto,” it’s: what actually happens to your order inside this machine?

Crypto policy and credible neutrality:

He watches the policy edges closely—OFAC pressure, staking-as-a-service questions, and the tension between compliance and censorship resistance. The throughline is consistent: design systems where the right thing to do is also the easy thing to do.

Why many builders and researchers follow him

- He starts with incentives, not narratives: Whether it’s Bitcoin’s fee future or Ethereum’s builder markets, he frames questions in terms of who gets paid for what and when. That cuts through a lot of noise.

- He updates fast—and in public: When new data undermines an earlier view, he’ll say so. During phases when a few builders started winning a huge share of blocks, he shifted the conversation from “is this bad?” to “what are the viable countermeasures?” and pushed for experiments like open auctions, inclusion lists, and privacy-preserving orderflow.

- He sits at the research–practice intersection: The Flashbots connection means early access to real telemetry from builder and relay markets, while his network (think core devs, mechanism designers, market makers) pressure-tests ideas before they hit headlines.

- He makes complex systems legible: Threads often include diagrams, mental models, or crisp “if X then Y” logic. That clarity is why people who actually ship code or manage risk pay attention.

- He surfaces the right sources: You’ll get links to primary research, dashboards, and specs rather than secondhand takes—whether it’s Ethereum client discussions, MEV metrics, or classic Bitcoin security papers.

If that’s the foundation, what does it look like when it hits your timeline—short posts, deep threads, or data-led hot takes? I’ll show you exactly what to expect in his day-to-day feed next. Which kind of post would you want pinged to your phone: the “must-read now” alerts or the “save for weekend brain power” threads?

What you’ll actually see on @hasufl’s X feed

If you follow Hasu on X, expect clarity over chaos. It’s a feed built for people who care about how protocols really work, not who can shout the loudest.

“Less memes, more models.”

Posting style and tone

He writes like someone shipping systems in production: precise, sourced, and allergic to fluff. You’ll often see:

- Thread-first explanations: 5–12 posts that build a model step by step—what changed, why it matters, and the incentive ripple effect.

- Primary sources over hot takes: Links to specs, research, and client notes instead of screenshots and outrage.

- Technical back-and-forth: Replies to client devs, builders, and researchers to nail down details (PBS edge cases, relay economics, validator behavior).

- Fewer, higher-signal posts: Quiet during noise, active when it counts—network upgrades, MEV market shifts, policy inflection points.

- Plain-language summaries: He’ll compress complex topics into a single, memorable line, then support it with data or references.

Example patterns you’ll notice:

- Upgrade days: Quick explainers on what’s live (e.g., blob fees impacts), who’s affected (builders, relays, rollups), and what to watch next.

- MEV events: Post-mortems on builder margins, relay reliability, and validator strategies, often with links to dashboards and papers.

- Market stress: Notes on liquidity fragmentation, exchange mechanics, and how incentives shift when volatility spikes.

The main content themes

MEV, PBS, and block building

Expect breakdowns of proposer–builder separation, relay trust models, and how MEV markets evolve. He’ll reference foundational work and current infra:

- Flashbots and MEV-Boost

- Flash Boys 2.0 (Daian et al.)

- ethresear.ch threads on PBS and MEV supply chains

Ethereum scaling, rollups, and client diversity

Clear takes on rollup economics, data availability, and why client diversity isn’t optional. When something breaks or improves, he maps the incentives:

- Ethereum.org – Rollup-centric roadmap

- ClientDiversity.org

Bitcoin economics, miner incentives, and fees vs subsidy

He revisits the long-run security budget with a sober lens—fee markets, miner strategies, and post-halving realities—often grounding it in well-cited research:

- On the Instability of Bitcoin Without the Block Reward (Carlsten et al.)

- Bitcoin Optech newsletters

Market structure, liquidity, and exchange mechanics

Posts on how order flow, latency, and venue design shape outcomes—especially when liquidity thins. Useful for people who think in microstructure:

- Kaiko Research for cross-venue liquidity context

- Paradigm research on market design and incentives

Governance, staking, and protocol incentives

Expect frameworks for staking risks, governance failure modes, and incentive alignment during upgrades—less politics, more mechanisms:

- Ethereum.org – Staking

- Research essays on incentive design

Frequency and signal-to-noise

Cadence: Most weeks you’ll see a handful of original posts and a couple of deep threads. Big events bring bursts; quiet stretches bring fewer but denser posts. It’s built for signal, not constant engagement.

Depth: Threads tend to include models, diagrams-in-text, or links to specs/research. One-liners usually serve as a summary for readers who want the headline logic fast.

What’s “must-read” vs “optional” (by role):

- Builders/validators: Must-read: MEV/PBS, block builder and relay notes, client diversity updates. Optional: broader market commentary.

- Researchers: Must-read: incentive analyses with linked papers and experiments. Optional: short news reactions.

- Traders: Must-read: market structure and liquidity insights, exchange/venue mechanics, policy inflection posts. Optional: long client/config specifics.

One small emotional note: when timelines get loud, his feed stays steady. That’s rare. If you’ve ever felt the “I’m missing something important” anxiety during upgrades or selloffs, this calm, model-driven cadence is a relief.

Curious what he absolutely nails—and where his lens can miss? I’m about to map the strengths, blind spots, and the way I avoid echo chambers when I track his posts. Want the unfiltered playbook?

Strengths, blind spots, and how I use his content

What he does especially well

I reach for his posts when I want clean thinking fast. He’s excellent at turning messy protocol mechanics into crisp mental models you can actually use. A few patterns I keep seeing—and relying on:

- MEV and builder power, explained before it hits the headlines. He’s been early and steady on the risks around proposer-builder separation (PBS) and the rise of large builders/relays. When he flags concentration or incentive misalignment, I pull up data to sanity-check the scale. If you want a quick reality check on any claim about “centralized builders,” look at builder share distributions on mevboost.pics—you’ll often see periods where the top few builders produce a big chunk of mev-boosted blocks.

- Censorship and credible neutrality—nuanced, not loud. After OFAC sanctions on Tornado Cash, conversation spiraled. He was one of the few who differentiated between what relays, builders, and proposers can actually censor, and why mitigation layers matter. When this comes up, I pair his threads with live stats from mevwatch.info to see the real share of OFAC-compliant blocks in a given window.

- Bitcoin’s long-term security budget, minus the hopium. He treats fees vs subsidy as an engineering problem, not a price meme. When fees spiked with inscriptions and around the 2024 halving, he framed it as signal-with-caveats. If you’re tracking this, check fee revenue splits and miner margins on Hashrate Index or fee pressure on mempool.space—it keeps the conversation grounded.

- Market structure with trader-relevant edges. He’s strong on liquidity plumbing: perps vs spot dominance, exchange incentives, and why flow quality matters more than headline volume. When I see one of those posts, I validate with datasets from Kaiko or The Block’s data. It’s a good check on whether a narrative is actually showing up in the order books.

“In a market that punishes lazy thinking, clarity is a working edge.”

That’s the energy I get from his feed—fewer hot takes, more frameworks you can apply across cycles.

Possible blind spots to keep in mind

He looks at crypto through an Ethereum/MEV and market-structure lens. That’s a feature, not a bug—but it does leave gaps you should plan around:

- Less coverage of retail-driven waves. Don’t expect hand-holding on memecoins, NFT mints, airdrop meta, or gaming catalysts. If your edge lives in culture and momentum flows, you’ll need other sources.

- Alt L1 ecosystems appear mainly through incentives/mechanics. For example, you might see Solana mentioned in the context of MEV, client performance, or validator incentives, not daily degen trends.

- Fundamentals over vibes. If you want fast “what’s pumping” answers, his feed won’t scratch that itch. If you want “why this design choice will matter in 6–18 months,” you’re in the right place.

Knowing this upfront helps me keep expectations realistic and my feed balanced.

How I cross-check and avoid echo chambers

His posts are high-signal, but I never let any one researcher set my priors. Here’s the simple system I use to stay sharp:

- Data first: When a claim touches MEV/PBS or censorship, I open mevboost.pics and mevwatch.info. I compare the 7-day vs 30-day builder/relay shares and note any regime shifts. If the top two builders’ share is climbing, that’s a tangible risk—not just a vibe.

- Primary sources: For Ethereum roadmap or client behavior, I skim the latest AllCoreDevs notes on Ethereum PM (GitHub) and recent client releases (Geth, Prysm, Lighthouse, Nethermind). It keeps my view anchored to what’s actually shipping.

- Independent research: I sanity-check incentive claims against research hubs like Flashbots Research and the EF research blog. If two out of three agree on direction (even with different rhetoric), I assign it more weight.

- Cross-market reality checks: For exchange mechanics or “liquidity is thin/fragmented” narratives, I look at derivatives open interest, basis, and spot depth via Kaiko or The Block. If the data doesn’t move, I treat it as a soft signal.

- Red-team prompt: I ask, “If this thesis were wrong, what would I see in the data next?” Then I set a reminder to re-check the same dashboards in a week.

A quick example of that workflow in action: if he warns that builder concentration is creeping up, I compare the last-7-day distribution on mevboost.pics against the 30-day. If the top two builders’ share jumps while relay diversity falls, I mark it as “actionable trend,” not “Twitter anxiety.” If not, I file it as a hypothesis and watch another week.

Want to copy my setup, button by button—lists, alerts, saved searches—so you see the signal without drowning in replies? That’s exactly what I’m sharing next. Which persona should I optimize it for first: builder, researcher, or trader?

How to get the most out of Hasu’s work

If you’ve ever watched a great thread scroll by and thought “I’ll read it later,” only to never see it again, you’re not alone. The trick isn’t following more accounts—it’s designing a system that turns Hasu’s posts into understanding you can act on.

“Signal isn’t just about what you read; it’s what you ignore on purpose.”

Build a smart X list around @hasufl

I keep Hasu at the core and group related voices so conversations load in one stream when news hits. Behavioral research backs this: fewer, higher-quality choices reduce decision fatigue and increase follow-through (see Iyengar & Lepper’s well-known “choice overload” study, 2000). Here’s a practical, non-exhaustive starter set you can copy into a private List:

- MEV, PBS, block building: @flashbots, @gakonst, @barnabemonnot, @bertcmiller

- Ethereum client + roadmap: @TimBeiko, @prylabs, @sigp_io, @vitalikbuterin

- Security: @samczsun, @trailofbits, @slowmist_team

- Policy and regulation: @jchervinsky, @coincenter

- Market structure: @KaikoData, @CoinMetrics, @ki_young_ju

- Bitcoin incentives: @lopp, @nic__carter, @matt_odell

Why this works: when Hasu posts about PBS or fee markets, you immediately see expert replies, counterpoints, and linked data. That gives you context fast—without jumping between tabs or chasing quote-tweets for 20 minutes.

Follow his long-form and research shares

Hasu often links to long-form pieces and technical posts. I treat those as “weekend reading,” but I don’t rely on memory. Here’s a simple workflow that keeps your main feed clean while ensuring you actually read:

- Use an X search for link-heavy posts: from:hasufl -filter:replies filter:links. Save this search and open it once a week.

- Bookmark now, read later: Tap the bookmark icon on any thread or link that looks meaty. Then, batch-review bookmarks every Saturday morning.

- Pipe links into a reader: Tools like Readwise Reader or Omnivore let you save X threads and PDFs, highlight, and export notes. Highlighting multiplies retention—classic spacing/active recall effects beat passive reading, per decades of learning research.

- Create a one-note summary habit: After each piece, write a 3–5 sentence summary and one “if true, then…” implication. You’ll remember more and spot contradictions faster.

Sample sources you’ll see him point to: Flashbots research, Ethereum roadmap updates, ethresear.ch threads, and credible market-structure analyses. Your goal isn’t to read everything; it’s to capture the 10% that shifts your mental model.

Use alerts, filters, and searches

Notifications can easily become noise. I set up a few ops-style shortcuts that surface only the posts that matter. Side benefit: batching notifications protects focus—heavy media multitasking is linked to worse attention control (Ophir, Nass, Wagner; PNAS 2009).

- Turn on tweet notifications for @hasufl, but mute notifications during deep work and batch-check at set times.

- Saved searches (copy/paste into X):

- from:hasufl -filter:replies (MEV OR PBS OR builder OR “inclusion list” OR “enshrined PBS”) — for protocol-mechanics signal

- from:hasufl -filter:replies (fees OR “security budget” OR subsidy) — for Bitcoin economics discussions

- from:hasufl filter:links (pdf OR ethresear.ch OR mirror.xyz OR flashbots OR writings) — for long-form drops

- from:hasufl -filter:replies min_faves:300 — for high-engagement theses you likely don’t want to miss

- Set up X Pro (TweetDeck) columns:

- Column A: from:hasufl -filter:replies (originals only)

- Column B: from:hasufl filter:replies (he often adds crucial context in replies)

- Column C: your saved long-form search above

- Pin your best search so it lives one tap away on mobile.

Pro tip: when a thread is getting referenced everywhere, search the exact phrase from the thread to find rebuttals and follow-up data. That’s how you turn a hot take into a rounded view.

Tailor by persona: builder, researcher, trader

We each come to Hasu’s feed with different goals. Here’s how I tune the signal depending on the hat I’m wearing that week.

- Builders (L2s, validators, infra)

- Watch: MEV, PBS, builder–proposer dynamics, censorship risk, client diversity.

- Saved search: from:hasufl (PBS OR “MEV burn” OR “inclusion list” OR builder OR relay OR censorship)

- Pair with: MEV Watch (compliance/OFAC share), @TimBeiko (core dev coordination), client teams listed above.

- Action step: Translate any red-flag into a checklist: “Are our builders/relays diversified?” “Do we have monitoring for missed slots?” “How would enshrined PBS change our roadmap?”

- Researchers (incentives, protocol design)

- Watch: fee markets, validator incentives, cartelization risks, Bitcoin security budget, cross-domain effects of MEV.

- Saved search: from:hasufl (“security budget” OR fees OR subsidy OR “validator incentives” OR cartel)

- Pair with: @barnabemonnot, @CoinMetrics (SotN), @KaikoData, and original papers linked via ethresear.ch.

- Action step: Build a living bibliography. For each claim, save the primary source plus one counter-argument. This guards against echo chambers and speeds up future research.

- Traders (market structure, policy)

- Watch: liquidity shifts, exchange mechanics, ETF/basis flows, policy headlines that affect venues and participants.

- Saved search: from:hasufl (liquidity OR basis OR “market structure” OR ETF OR policy OR regulation)

- Pair with: @KaikoData (market microstructure), @CoinMetrics, and credible ETF flow trackers.

- Action step: Turn theses into scenarios: “If policy X passes, which venues gain/lose liquidity?” Build a simple playbook so you’re not reacting mid-chaos.

Small habit that compounds: when you bookmark a Hasu thread, add a one-line tag like #pbs or #securitybudget. In three months, your bookmarks become a searchable mini-library of the ideas you care about most.

One last note on attention: I time-block “Hasu hour” twice a week and mute notifications outside that window. It sounds basic, but it works—fewer context switches means better comprehension, and the science is pretty clear that constant interruptions degrade performance. If you’ve felt overwhelmed by crypto Twitter before, this alone might change the game.

Got questions like “Is he more Bitcoin or Ethereum these days?” or “How often does he actually get it right?” I’ve got quick, honest answers up next in the FAQ—ready to jump in?

FAQ: Quick answers to common questions about Hasu

Who is Hasu and what’s he known for?

Short version: a researcher/strategist whose threads help people reason about MEV, Proposer-Builder Separation (PBS), Ethereum’s roadmap, Bitcoin’s long-term security, and market structure. If you’ve ever tried to make sense of block building, relay power, or whether Bitcoin fees can replace the block subsidy, you’ve probably seen his takes getting quoted.

A couple of concrete examples I’ve seen him unpack well:

- MEV-Boost after the Merge: why most validators would outsource block building and what that means for centralization risk. Within weeks post-Merge, MEV-Boost powered the majority of Ethereum blocks, with adoption quickly pushing past 90%—exactly the kind of dynamic he warns builders and stakers to track. See the public dashboards and docs from MEV-Boost and Flashbots.

- Bitcoin’s security budget: he consistently returns to the fees vs subsidy question. When fees spiked around the 2024 halving—briefly surpassing the block subsidy as Runes/inscriptions flooded the mempool—it was a live example of a fee-driven security moment he’s been pushing people to model, not hand-wave.

What’s his stance—Bitcoin or Ethereum?

Both, with more Ethereum/MEV content day to day. He’ll get into PBS design, builder/relay concentration, and staking incentives; then switch to Bitcoin economics, miner revenue composition, and whether the fee market can sustainably carry security as halvings continue. If you care about how these systems actually work under stress, his cross-chain lens is useful.

How reliable are his predictions?

He frames views as working theses, not “number-go-up” calls. That’s why I like following him. A good rule of thumb I use:

- Look for the model, not the conclusion. If he sketches an incentive loop (e.g., “more builders → fewer competitive relays → policy risk”), test it against fresh data.

- Cross-check with primary sources. For Ethereum/PBS/MEV, check Ethereum Research, client team notes, and relay/builders dashboards. For Bitcoin fees/security, compare with on-chain fee share charts and miner revenue breakdowns (Glassnode, Coin Metrics, or open dashboards).

- Watch how he updates. He’s been early on MEV and block building realities, and he’ll revise when the data shifts. Treat that as a signal to re-check your own assumptions.

Where else can I follow Hasu?

Start here: his X profile @hasufl.

Long-form:

- Uncommon Core — essays that helped many of us frame Bitcoin/Ethereum incentives back when few people were even talking about MEV.

- Flashbots blog and docs — for MEV/PBS and block building primers he often references.

- Interviews: search YouTube: “Hasu MEV” and sort by the latest. When he links new conversations on X, I bookmark them for weekend listening.

Does he disclose conflicts or affiliations?

In my experience, yes—when he’s discussing something related to his roles, he usually flags the affiliation in the post or thread. That said, crypto is a small world. I always:

- Check the disclaimer or context in the opening tweet.

- Glance at the bio of anyone he’s quoting or debating.

- Read the linked piece (if any) for disclosures at the top or bottom.

Even with clear disclosures, I still compare his thesis to independent sources—especially when there are obvious incentives involved (MEV design trade-offs, staking policy, exchange market structure).

Is his content beginner-friendly?

It’s more intermediate-to-advanced, but beginners can still get a lot out of it with the right path:

- Start with the basics: the MEV overview to learn key terms (search: MEV, builders, relays, PBS).

- Save threads, don’t force them: if a thread feels heavy, bookmark it and return after a primer. I keep a “Weekend Reads” folder just for his research-linked posts.

- Use simple X searches:from:hasufl (thread OR thesis) min_replies:5 surfaces high-signal posts with real discussion.

- Anchor with one Bitcoin read, one Ethereum read: pick an explainer on Bitcoin fees/security (a neutral overview from your favorite on-chain data source) and a PBS/MEV explainer from the Ethereum Research forum. Then re-read his latest threads—things click much faster.

“Use accounts like his to improve your mental models, not to outsource your judgment.”

Still wondering whether he’s worth a follow for your specific role—and how to plug his signal into your daily routine without getting overwhelmed? That’s exactly what I break down next.

My verdict: Should you follow @hasufl?

Short answer: yes—if you care about how crypto actually works under the hood and where it’s likely heading. I keep him in my “always-on” list because his posts help me cut through noise and focus on structural shifts that matter months later.

Real examples from the last year:

- MEV and builder power: When a handful of block builders started controlling the majority of MEV-Boost blocks, he was one of the clearest voices flagging the risk. If you want a neutral dashboard to pair with his takes, keep an eye on mevboost.pics and mev.watch.

- Post-Dencun fee dynamics: After Ethereum’s Dencun upgrade landed on mainnet (see the Ethereum Foundation’s note: blog.ethereum.org), L2 costs collapsed. His framing around blob fees and value capture helped me prioritize which rollup metrics to track. Cross-check with L2fees.info to see how those costs actually moved.

- Bitcoin’s fee market reality: Around the 2024 halving, fees briefly surged past the block subsidy, then normalized. He used that moment to remind folks that volatility isn’t the same as a robust long-term security budget—a theme he has written about for years. For broader context, read his older work on incentives at Uncommon Core and pair it with live data from mempool.space.

“If you want fewer headlines and more first-principle models—especially on MEV, block building, and protocol incentives—he’s high-signal by default.”

Who will benefit most

- Builders: If you ship on Ethereum or L2s, his takes on PBS, builder/relay dynamics, and client diversity help you design for the environment as it changes, not as you wish it were.

- Researchers: You’ll get clean mental models on incentive design and security budgets, plus links to research threads worth bookmarking. Pair with primary sources to test assumptions.

- Serious investors: If your edge is understanding market structure and policy risk—not chasing the next micro-cap—his posts will help you stay early on the narratives that actually stick.

How I plug his feed into my daily routine:

- Morning: Scan for new threads or linked research (I star them for weekend reading).

- During news spikes: Check his replies to core devs and researchers—this is where nuance shows up fast.

- Weekly: Revisit any models or charts he shared and compare against data from neutral sources (EF blog, L2fees, MEV dashboards).

Complements to follow for balance

To avoid sitting in one lens (no matter how sharp), I pair his posts with sources that bring code, audits, and policy nuance:

- Core protocol updates: Tim Beiko’s AllCoreDevs notes (notes.ethereum.org/@timbeiko)

- Security and incident writeups: samczsun’s research hub (samczsun.com)

- MEV research and PBS context: Flashbots writings (writings.flashbots.net)

- Policy and legal clarity: Coin Center analysis (coincenter.org)

- Independent quant/research: Paradigm Research (research.paradigm.xyz)

When I see a strong claim on MEV or block building, I quickly pit it against these sources. If it still stands, it’s probably worth your time.

Final take

Follow @hasufl if you want clarity over clout. You’ll get thoughtful models, early warnings on builder/relay dynamics, and grounded takes on Bitcoin and Ethereum incentives. Keep in mind there’s an Ethereum/MEV tilt, then round it out with core dev notes, security writeups, and policy voices so you have a 360° view when narratives shift.

If you care about where crypto is actually going—not just what’s pumping today—this is a feed worth your attention. For more high-signal guides and balanced lists, I keep everything tidy here: cryptolinks.com.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.