Michael Wrubel Review

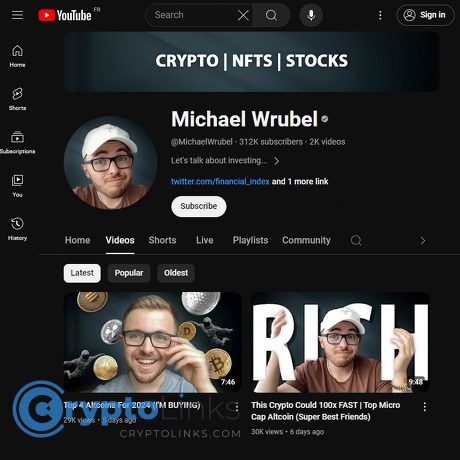

Michael Wrubel

www.youtube.com

Michael Wrubel YouTube Channel Review Guide: Everything You Need To Know + FAQ

Wondering whether to follow Michael Wrubel’s crypto calls, hit subscribe, or skip and move on? You’re not the only one.

I watched, compared, and stress-tested the Michael Wrubel YouTube channel so you can save time, dodge FOMO, and get value without the noise. If you’re trying to separate useful ideas from hype, this guide shows what the channel really offers, where it shines, what to watch for, and how to use it safely.

Bottom line: use YouTube for ideas, not instructions.

Crypto YouTube can be a maze

Bold thumbnails, “urgent” altcoin picks, and headlines built for clicks can push you to buy now and think later. The real trouble? Incentives are mixed, signals are noisy, and feedback loops are fast.

- Hype vs. homework: “Top 3 coins to 10x this month” sounds exciting, but without context on tokenomics, unlocks, or liquidity, it can be a trap.

- Hidden incentives: Affiliate links, paid promos, or existing bags may tilt coverage. That doesn’t make a creator dishonest—but you should account for it.

- Attention-driven moves: Research shows attention spikes can fuel short-term buying and whipsaws. See Barber & Odean’s work on attention-induced trading: SSRN.

- Social media pressure: Regulators have warned about following online tips blindly. Check the SEC’s alert on social media and investment risks: Investor.gov, and FINRA’s note on influencers: FINRA.

- Volatility + narratives: Crypto narratives can flip in hours. Gandal et al. documented manipulation in early Bitcoin markets—reminding us that hype cycles can be engineered: Journal of Monetary Economics.

Put simply: it’s easy to get caught; it’s hard to verify what’s real in time.

What you’ll get here (and why it helps)

I’ll keep this straight and practical—no fluff. Expect a clear review guide that answers the questions people actually ask before they subscribe or act on a video.

- How the channel works, what content to expect, and how it’s packaged

- What to watch for around incentives and disclosures

- Green flags vs. red flags you can spot in minutes

- A safe-watching checklist you can reuse for any crypto YouTuber

Who this is for

- Crypto-curious and retail investors: You want signal over noise and a way to avoid emotional decisions.

- Builders and operators: You want market narrative context without getting dragged into pump-chasing.

- Time-poor learners: You want a fast filter to tell if a video is education, entertainment, or a sales pitch.

What you’ll walk away with

- A realistic snapshot of what Michael’s channel offers

- Pros, cons, and risk notes—so you can decide how to use it

- Quick validation steps for any claim or “pick” you hear

- FAQ-style answers to the big “Is he legit?” questions

How I reviewed

I looked at a spread of recent and older videos to see patterns over time. I noted:

- Topics: altcoin lists, market updates, educational explainers, reaction content

- Disclosures: spoken disclaimers, description notes, sponsor tags, affiliate links

- Incentives: where money might flow (ads, promos, referrals, possible bags)

- Process quality: is there a clear thesis, risk framing, and validation path?

Then I pressure-tested ideas the way I would before putting a single dollar at risk: checking token unlock schedules, liquidity/volume, on-chain activity, team and roadmap credibility, and whether the touted “catalyst” is a real event or just a rumor.

Ready to see what Michael actually covers and what the core promise of his channel is?

Channel snapshot: Who Michael Wrubel is and what he covers

Hit play on Michael Wrubel’s channel and you’ll get a fast, retail-first tour of what’s hot right now: altcoin ideas, market stories that are brewing, and the headlines that could push prices. The tone is energetic and straightforward—think “here’s what I’m watching and why,” with a clear tilt toward coins and narratives that might move in the near term.

“Volatility rewards the prepared, not the impulsive.”

If you’re the type who likes curated ideas and a sense of what to look at today—not a 60-page report—this is the vibe.

The core promise of the channel

- Fresh altcoin ideas: Coins and sectors that are catching attention (AI, gaming, L2s, Solana ecosystem, RWA, and the occasional meme coin cycle).

- Market narratives that matter: Why a story (ETFs, Fed moves, big unlocks, exchange listings) could be a catalyst and what to watch around it.

- Timely news in plain English: Short explanations of complex headlines so you can decide if it affects your bag or your watchlist.

- “What I’m watching now” updates: The near-term pulse—especially useful when markets are moving fast and you don’t want to miss the next setup.

It’s designed to save you scrolling time. You get the gist, the angle, and usually a reason to keep an eye on a project.

Content formats you’ll see

- Trending coin breakdowns: Quick rundowns on why a token is moving, common catalysts, and the near-term bear/bull case.

- Market updates: Bitcoin and majors, altcoin strength/weakness, liquidity talk, and how the day’s news might spill over.

- Listicles: “Top coins to watch this week,” “undervalued altcoins,” “hidden gems under $1”—snackable idea lists for scanning fast.

- Reaction content: ETF approvals/rumors, SEC headlines, big exchange listings, high-profile partnerships—what it could mean and who benefits.

- Occasional how-tos: When a trend heats up, expect practical bits (setting up a new wallet, finding airdrop criteria, tracking unlocks) to get you pointed in the right direction.

Want to see the mix for yourself? Check the latest uploads tab and you’ll spot the pattern quickly—fast takes, clear titles, and a focus on coins with momentum or catalysts.

Posting rhythm and production style

Cadence: Multiple uploads per week is the norm, with extra videos when news breaks or a narrative heats up. That pace matters in crypto—attention windows are short, and ideas can go stale fast.

Length and pacing: Most videos land in the 8–20 minute range. Edits are snappy, with on-screen headlines, charts, and screenshots (think CoinMarketCap/TradingView visuals) to keep it moving. You won’t get a 2-hour deep research session here; you’ll get what you need to act if it fits your plan.

Why that matters to you: In crypto, attention can be a short-term catalyst. Academic work on “attention-induced trading” shows that when eyeballs concentrate, trading activity spikes—sometimes pushing prices temporarily in the direction of that attention. See Da, Engelberg, and Gao (2011) for the classic evidence on this effect: SSRN link. It’s one more reason timely uploads can be useful—if you have your risk rules set.

Who this channel suits best

- Best for: New-to-intermediate crypto users who want a steady flow of curated ideas and market talk without getting lost. If you like to track narratives and scan for setups, you’ll feel at home.

- Time-strapped investors: If you only have 15 minutes between work and dinner, the format helps you catch the day’s key stories and add/remove names from your watchlist.

- Not ideal for: Power users who need deep on-chain analytics, factor models, or code-level research. If you live in Dune dashboards, order flow tools, or GitHub commits, pair this with specialized sources like Token Terminal, Glassnode, Arkham, or your own Python notebooks.

Bottom line for fit: expect curated ideas and narrative context—less so the kind of granular token economics or on-chain cohort analysis that quants and protocol researchers crave.

Curious how the money side of crypto YouTube fits into all this—ads, affiliates, sponsors, and coin ownership? And how to tell when a video is a paid promo versus a clean take? Keep reading; I’m about to unpack exactly that and give you a simple way to spot conflicts before they spot you.

Is Michael Wrubel legit? Money flows, disclosures, and conflicts to watch

“Show me the incentive and I will show you the outcome.” — Charlie Munger

If you want a clean read on any crypto YouTuber (including Michael Wrubel), follow the incentives. I’m not here to point fingers; I’m here to help you read the room so you don’t get blindsided by hidden money flows or subtle pressure tactics. Transparency isn’t a nice-to-have in crypto—it’s survival.

How crypto YouTubers typically make money

Crypto creators rarely live on ad revenue alone. The real earnings usually come from performance-based deals and integrations. Here’s the common stack:

- YouTube ads (AdSense): Pays per view, but fluctuates with CPMs and niches. Nice background cash, rarely the main engine.

- Affiliate links: Exchanges, wallets, trading tools, and newsletters. You’ll see URLs with ?ref=, ?utm_source=, or coupon codes. The creator earns when you sign up, deposit, or subscribe. Aligns incentives with volume, not necessarily your outcomes.

- Sponsorships/product placements: Set fee to feature a project or tool, often disclosed as “sponsored.” Can be a pinned segment or integrated talking points.

- Referrals and rev-share: Exchanges may pay a cut of trading fees. The more you trade, the more they earn—keep that in mind when leverage or frequent trading gets hyped.

- Courses/newsletters/Patreon: Direct audience monetization. Usually clearer incentives, but still requires “is this education or funneling?” thinking.

- Owning the coins covered: The biggest conflict. If a creator bought before the video, positive coverage can move price and provide exit liquidity.

- Advisory/seed allocations/launchpads: Less visible. If a creator has a private allocation or advisory role, the bias can be massive—even with a disclosure.

None of these are evil. The question is: are they disclosed clearly, and do they shape the tone and urgency you’re feeling?

Disclosures and what I look for

Strong disclosures are the difference between “informed idea” and “accidental shill.” I look for these signals on any Michael Wrubel video (and any crypto channel):

- Spoken disclaimer up front: A clear “This is not financial advice” and a plain-English note if the segment is sponsored or includes affiliates.

- Top-of-description transparency: Before the link stack, an explicit line like “Some links are affiliates” and, when relevant, “This video is sponsored by [X]”.

- Holdings disclosure: If he owns a coin he’s covering, I want it stated outright: “I hold [token]; not a recommendation.” Timing matters: disclose before the pitch, not after.

- Separate the sponsor from the thesis: If a project is a sponsor, I want the segment labeled and walled off from “objective” analysis.

- Corrections and follow-ups: If a call aged badly or facts change, responsible creators post updates or pin clarifications.

This isn’t just personal preference. The U.S. FTC’s endorsement rules require “clear and conspicuous” disclosures, and research shows disclosures change viewer behavior. For example, multiple studies on influencer advertising find that explicit labels (like “Sponsored” and “Ad”) reduce blind trust and improve decision quality. In crypto, where price can swing on sentiment, that’s non-negotiable.

Green flags vs. red flags

When I watch any crypto video, I’m scanning for these cues in the first two minutes:

Green flags (keep watching):

- Risk talk is real: Volatility, token unlocks, liquidity, and catalysts are discussed alongside upside.

- No “guarantee” language: You hear words like “probability, scenarios, invalidation” instead of “will 10x”.

- Specific disclosures: Sponsorships and holdings are named clearly, not buried in vague language.

- Balanced thesis: At least 2-3 cons for every pro. Bear case is treated seriously.

- Process over hype: Mentions research steps (docs, tokenomics, on-chain, roadmap) rather than “this is pumping.”

Red flags (hit pause):

- Urgency pressure: “Last chance,” “Don’t miss this 100x,” “I’m buying right now—link below.” Urgency benefits affiliates and sponsors, not your returns.

- Blurry disclosures: Euphemisms like “partnered with,” “friends at,” or disclosures buried below a wall of links.

- Pay-to-play launches: Thin analysis of presales/IDO/INO/NFT mints coupled with a prominent referral or whitelist link.

- Leverage nudges: Heavy promotion of derivatives platforms while hyping short-term trades. Classic rev-share incentive risk.

- No downside section: If risks, supply unlocks, or treasury concentration never come up, the analysis is incomplete.

If you’ve ever watched a video, felt the adrenaline, and bought a green candle, you know how this works. Urgency language isn’t accidental. It converts.

How to spot paid promos on any channel

You don’t need insider access. Here’s a quick, practical scan I use:

- Look for YouTube’s “Includes paid promotion” tag: It appears as a small overlay at the start. Not all paid placements use it (some creators skip it), but when you see it, treat the segment as an ad.

- Listen for sponsor callouts: Phrases like “Thanks to today’s sponsor…” or “This segment is brought to you by…” are explicit markers.

- Check description and pinned comment: Ctrl/Cmd+F for “sponsor,” “affiliate,” “ad,” “paid,” “ref.” Multiple unique links with ?ref= or ?utm_ parameters are a tell.

- Watch the link order: If a coin is praised and the first links push an exchange, a pre-sale portal, or a tool tied to the trade, there’s likely a commercial angle.

- Spot the mid-roll: A sudden shift in tone, a logo flash, or a “quick word from our sponsor” around minute 2–5. That’s your labeled ad break—good if disclosed, risky if blended with the thesis.

- Cross-platform push: Giveaways that require exchange sign-ups or retweets typically support affiliate or sponsor goals. Treat them as marketing, not alpha.

Academic work backs this skepticism. Studies on crypto pump-and-dump dynamics (e.g., Hamrick et al., 2019) show coordinated promotions trigger short-lived price spikes that reverse quickly. Social media attention is a powerful catalyst—great for views and referrals, not always for your PnL.

So, is Michael Wrubel legit? The better question is: are the incentives visible and handled responsibly, and do you feel informed—not rushed—after watching? That’s the standard I use. Now the real challenge: even when incentives are clean, how useful is the content—and what does “accuracy” even mean in a market this volatile? Let’s take a hard look at that next, so you can tell entertainment from execution without getting burned. Ready to stress-test the “altcoin pick” game?

Usefulness of the content: expectations, accuracy, and risk

If you’re watching Michael Wrubel’s YouTube videos for altcoin ideas, the real question isn’t “Did this coin pump?” It’s “What can I reliably extract from this video without getting wrecked?” Here’s how I frame it so you can tell when a clip is useful, when it’s just fun, and when it’s quietly risky.

“Amateurs chase winners. Pros chase process.”

Entertainment vs. actionable research

Some videos are built to entertain. Others are built to help you make a decision. Both have a place, but you should know which you’re getting before you click buy.

- Entertainment cues: big thumbnails, “next 10x” titles, mystery altcoins, fast cuts, and strong urgency. These keep you engaged but usually stop short of verifiable details like token schedules, treasury health, or real catalysts with dates.

- Actionable cues: links to primary sources, clear thesis statements (“narrative: AI infra; catalyst: mainnet Q4; risk: unlock in 6 weeks”), specific metrics (TVL growth, user numbers, on-chain revenue), and what would invalidate the idea.

- Example of good “actionable” structure: “Here’s the project doc, here’s the gov proposal, here’s the unlock calendar, here’s the liquidity profile, here’s why I’m wrong if X happens.” If a Michael Wrubel video hits those notes, put it in your “research” bucket, not the “entertainment” bucket.

There’s also a middle ground: inspiration. A video might spark a new rabbit hole (AI coins, RWA, data availability). That’s valuable—just don’t confuse inspiration with execution.

Track record reality check

Crypto YouTube highlights wins because viewers love wins. But accuracy in this game is messy.

- Hits don’t equal a repeatable edge: Almost every channel can point to coins that ran after coverage. Markets rotate. A hot narrative (think AI tokens like FET/RNDR) made many calls look smart for months, then corrected hard. A good review asks: Was the thesis clear, or was it a lucky tailwind?

- Outcome ≠ quality: You can do everything right and still lose on a surprise unlock, exploit, or regulatory headline. Judge the process: sources cited, risks named, timeline defined, and signs of discipline.

- Attention effects are real—and dangerous: Classic research on attention-induced trading (Barber & Odean) shows that retail flows chase what’s on screen. In crypto, that can turbocharge thin coins for a day or two—and then reverse just as fast. If a Michael Wrubel video mentions a small-cap, expect a short-lived liquidity surge, not a guaranteed trend.

When I watch, I note whether the call relies on structural drivers (tech milestones, token economics, user growth) or on attention cycles. The former ages better.

Timeframes and volatility

Timing turns the same pick into genius or disaster. YouTube naturally compresses time because content must be fresh. Your wallet shouldn’t.

- Short-term (hours–days): News flashes, listing rumors, influencer mentions. High variance, high slippage, high taxes/fees if you churn. Good only if you already have a system.

- Medium-term (weeks–months): Roadmaps, mainnet launches, staking changes, tokenomics revisions, seasonal flows. Better for most retail if you size sanely and set invalidation points.

- Long-term (6–24 months): Adoption curves, infra upgrades (L2 throughput, DA layers), and macro cycles. Lower stress, but you’ll sit through drawdowns. This is where a well-argued thesis from a video can actually compound.

Real world example: A “top altcoins before the ETF decision” video can look brilliant for 48 hours and awful the next week if the ETF headline gets priced in then fades. Meanwhile, a boring thesis on fee-generating L2 ecosystems can underperform for months and then crush when dev activity and users finally inflect.

Validate claims yourself

Trust, but verify—in minutes, not hours. If a Michael Wrubel clip puts a coin on your radar, run these quick checks before you touch the buy button.

- Project sources: Read the docs, team blog, and GitHub. Look for recent commits, actual contributors, and shipped features—not just forks and vanity PRs.

- Token unlocks and supply: Check schedules on TokenUnlocks or the project’s docs. Big unlocks within 30–60 days can nuke short-term setups. Compare FDV vs. market cap; an already-stretched FDV with heavy future emissions is a common widow-maker.

- Liquidity and volume: Is there deep liquidity on major CEXs/DEXs? Thin books mean you’ll be exit liquidity when a video goes viral. Check 24h volume quality, not just headlines.

- Holder concentration: On Etherscan/Solana explorers, look at top wallets. If a handful of addresses control the float, your “investment” is a negotiation with a few whales.

- Real catalysts, real dates: Confirm roadmap items on official channels—governance forums, GitHub milestones, or exchange announcements. Rumors without a verifiable source aren’t catalysts; they’re bait.

- On-chain traction: For protocols, scan TVL trends, active wallets, and revenue/fees on dashboards (DefiLlama, Token Terminal). Flat or declining fundamentals usually don’t deserve premium narratives.

- Risk memo in one minute: Write a single sentence: “I’m buying because X before Y date; I’m wrong if Z.” If you can’t fill this in, you’re not ready—you’re excited.

There’s also the human factor. After a strong video, prices can spike just because thousands of people watch the same thing at the same time. Several academic papers on social-media-driven trading document these short-lived surges in attention and volume. That’s not a reason to avoid all YouTube ideas; it’s a reason to plan entries and exits like an adult.

“You don’t need to catch every rocket; you just need to avoid the ones that explode on the launchpad.”

Want a simple, repeatable way to turn a Michael Wrubel idea into a safer trade or investment—without killing the upside? In the next section, I’ll share a 5-step checklist I use before I act on any video. Curious what step one is?

How to use Michael Wrubel’s channel the smart way

You watch a Michael Wrubel video, your heart races, the coin he’s covering is already up 18%, and the comments scream “sending it.” Should you ape? Breathe. There’s a smarter way to turn idea flow into results without torching your stack.

“We don’t have to be smarter than the rest; we have to be more disciplined than the rest.”

— Warren Buffett

My 5-step safe-watching checklist

- 1) Pause for signal, not adrenaline. Give it a minimum of 30–90 minutes. If the coin ripped right after the video, the odds favor a cool-off. Research on “attention shocks” (Barber & Odean, 2008; Da, Engelberg & Gao, 2011) shows that sudden spikes in attention often create short-lived price pressure followed by mean reversion.

- 2) Write the thesis in one sentence—and the top two risks. If you can’t capture the “why now” in one line, you’re not ready. For example: “Layer-2 ABC could re-rate if mainnet ships in Q4 and fees drop 70%.” Risks: “Token unlock in 2 weeks; TVL is flat.” If your sentence relies on vibes, pass.

- 3) Confirm with independent sources. Cross-check the big claims before you move:

- Token unlocks/vesting: TokenUnlocks

- Liquidity, TVL, fees: DeFiLlama

- Volume/market depth: Your exchange order book + CoinGecko

- Dev activity: GitHub repos (commits over time, not one big burst)

- Funding/open interest: CoinGlass (spiking funding = crowd long, be careful)

- Catalysts: Official X/Discord, CoinMarketCal (real event or rumor?)

- 4) Make a plan on paper: entry, invalidation, size, exits.

- Entry: “Scale in 25% chunks at pullbacks or limit orders near prior support.”

- Invalidation: “If mainnet date slips again or price closes below key support for 24h, I’m out.”

- Size: Speculative idea = 0.5–2% of portfolio; high conviction after research = still under 5%.

- Exits: “Take 25% at +20%, trail the rest; hard stop at -8% or thesis break—whichever comes first.”

- 5) Start tiny, then earn your size. Open a “probe” position (0.25–0.5%) to watch with skin in the game. If the thesis proves out (volume holds, catalyst confirmed, funding normalizes), add. If not, you paid a small fee to learn.

Basic risk rules that save you

- No all-in on a YouTube pick—ever. One hot thumbnail shouldn’t decide your net worth.

- Define risk in advance. Price-based stop, time-based stop (e.g., “If the event passes and price doesn’t react in 72h, exit”), or thesis-based stop (catalyst canceled).

- Micro-caps are dessert, not dinner. Keep single micro-cap ideas under 1% until they “earn” upgrades with real traction and liquidity.

- Protect the downside first. If you’re unsure, slash size in half. You can always add. You can’t un-wreck a portfolio.

- One-idea limit per day. This cuts revenge trades and overtrading—common pitfalls found in retail behavior studies (Barber & Odean, 2001).

FOMO filters that actually work

- The 24-hour rule. If it only looks good right now, it’s probably not good. Attention spikes fade; good theses age well.

- Find the strongest counter-argument. Search “project name + risks” on X/Reddit. If the best bear case would have stopped you before you watched, it should stop you after.

- Check for attention signals. Did open interest, Google Trends, or YouTube views just spike? Attention-driven buys can mean short-term tops (again: Da, Engelberg & Gao).

- Refuse to buy vertical candles. If a coin is already +15–30% post-video, set alerts near logical pullbacks. Chasing green candles is how you fund someone else’s exit.

- Language test. If your inner voice says “I don’t want to miss it,” you’re not investing—you’re negotiating with fear. Step back.

Helpful follow-up habits

- Keep a one-page trade journal. Note the video date, your thesis sentence, entry/exit plan, and the result. Wins and losses both teach. Patterns show up fast.

- Set smart alerts. Price, volume spikes, and event dates. Alerts prevent screen-glued decisions and improve your entries.

- Bookmark sources per project. Official site, docs, X, Discord, DeFiLlama, Messari profile if available. You’ll move from reacting to preparing.

- Weekly review ritual. Ask: Did the catalyst happen? Did liquidity improve? If the reason you bought is gone, the position should go too.

- Separate watchlist tiers. “Monitor,” “Ready with plan,” and “Pass for now.” This cuts impulse clicks into structured action.

Here’s a quick real-world template you can copy the next time a Michael Wrubel video opens a loop in your head:

- Thesis: “XYZ L2: mainnet in Q4, partner announced, fees projected -60%.”

- Risks: “Unlock in 12 days (TokenUnlocks), TVL stagnant (DeFiLlama).”

- Confirm: Partner link on official X, repo activity consistent, funding neutral (CoinGlass).

- Plan: “0.75% probe at support; add 0.75% only if volume holds and partner announcement goes live. Stop if delay >2 weeks or daily close below support.”

- Exit: “Trim 25% at +20%, trail rest; if catalyst priced in and momentum fades, flatten.”

You can enjoy the energy of the Michael Wrubel YouTube channel without letting it run your portfolio. The trick isn’t finding the next 100x; it’s avoiding the 50% drawdown while you look for it.

Still have the big questions on your mind—trust, ownership of coins he covers, posting cadence, and how accurate his picks really are? Keep going; the quick-hit answers you want are next.

FAQ: People also ask about Michael Wrubel

Is Michael Wrubel trustworthy?

Trust isn’t binary—it’s pattern recognition. When I assess a YouTube crypto channel like Michael Wrubel’s, I look for:

- Consistent disclosures: Clear mention of sponsorships, affiliate links, or if a video “includes paid promotion.”

- Balanced risk talk: Acknowledging downsides, not just upside targets or “next 100x” language.

- Follow-up and accountability: Revisiting past calls and updating the thesis—especially when the market proves it wrong.

- No guarantee/urgency pressure: “Must buy now,” “guaranteed,” or “I’m all in” are yellow-to-red flags.

Research backs this approach. Advertising studies show that clear sponsorship labels reduce perceived credibility and help viewers make more informed decisions (consistent with findings in the influencer-marketing literature and FTC guidance). If a creator is transparent and regularly surfaces the risks, I give more weight to their commentary—then I still verify independently.

Does he own the coins he talks about?

Always assume possible ownership unless it’s clearly stated. Practical checks:

- Read the description: Look for “I own,” “I’m long,” “I was paid,” or “no position.”

- Listen for spoken disclaimers: Some creators state holdings on camera.

- Paid promotion tag: If YouTube shows “includes paid promotion,” treat the video as sponsored and evaluate accordingly.

Most crypto YouTubers don’t share wallet addresses, so you won’t always confirm holdings on-chain. That’s fine—just price the uncertainty into your decision-making and size positions appropriately.

How often does he post?

Expect a regular cadence typical of active crypto channels, with frequency often picking up during big market moves or news cycles. If you follow for timely altcoin ideas, turn on notifications—but don’t confuse timing with urgency. A 24-hour pause rarely ruins a good thesis.

Are his picks accurate?

Some will hit, some won’t—that’s the reality of every crypto YouTuber, including Michael Wrubel. Accuracy in this market is heavily path-dependent:

- Short-term volatility: A coin can pump 30% on narrative then retrace 40% on token unlocks or liquidity shocks. Research on token unlocks has shown pressure around large releases—check schedules before acting.

- Attention effects: Retail often buys what’s trending. Classic market research (e.g., attention-driven buying) shows hot headlines can skew entries and exits.

I judge creators on process—clear thesis, catalysts, risks, invalidation—not on cherry-picked outcomes. If a video helps you build your own process, that’s a win even when the trade isn’t.

Is this financial advice?

No. YouTube crypto content is commentary and opinion. Treat it as idea flow, not instructions. You’re responsible for entries, exits, sizing, and timing. If a video nudges you to research a project—great. If it tells you exactly what to buy and when—step back and reassess.

What are the risks of following YouTube calls?

- Buying tops after virality: Social media attention can front-run you; late entries often get poor risk/reward.

- Hidden incentives: Sponsored mentions, affiliate links, or undisclosed positions can bias coverage.

- Illiquidity: Smaller caps move fast on thin books; exits can be brutal.

- Overtrading: Behavioral research shows retail traders who chase news trade too much and underperform.

- Narrative whiplash: One negative headline can nuke a “great” setup, especially in altcoins.

Pro tip: If a coin is up big within hours of a viral video, wait. Good theses last longer than one candle.

How should beginners use his channel?

Use Michael Wrubel’s videos to learn the landscape, then test your own process in small, controlled steps:

- Write the thesis in one line: “This coin because [catalyst] by [timeframe].”

- List two real risks: Token unlock, low liquidity, regulatory headline, team execution.

- Verify one hard fact: Check the project’s docs, recent updates, or the actual date of the claimed catalyst.

- Paper trade first: Track your hypothetical P/L for two weeks before risking capital.

- Size tiny: Start with amounts you can ignore emotionally. If it’s keeping you up at night, it’s too big.

What complements this channel?

Balance any YouTube channel with neutral sources and tools:

- Project-owned info: Whitepapers, docs, GitHub activity, and official announcements.

- Market data dashboards: Liquidity, volume, funding rates, open interest.

- Token mechanics: Supply, unlocks, emissions, insider allocations.

- A simple journal: Note why you acted, what you expected, when you’d exit. This is where most “edge” is built.

If you want the latest uploads to scan for ideas, here’s the channel: youtube.com/@MichaelWrubel. Just remember: information is not a signal until you validate it.

Quick gut check: If you watched a video and felt FOMO, would a 24-hour pause improve your odds—or kill the opportunity? Keep that thought handy, because next I’m laying out a clear, one-scan verdict on whether you should subscribe and who should skip. Ready for the punchline?

Verdict: Should you watch and subscribe?

If you want a steady stream of crypto narratives, altcoin talk, and timely market commentary, this channel earns a spot on your watchlist—so long as you bring your own rules. It’s best used as idea flow and sentiment radar, not as a signal to market-buy whatever just flashed on screen.

Bottom line: Watch for ideas. Act only after your own checks. Protect your capital first.

Who gets the most value

- Curators and scanners: You like to scan narratives (AI, RWA, L2s) and build a watchlist fast, then do your homework elsewhere.

- Retail investors who want context: You prefer digestible market takes that highlight catalysts and sentiment shifts before you dig into docs, tokenomics, and on-chain data.

- Beginners with guardrails: You’re learning the lingo and patterns, and you’re willing to use a cool-off period and tiny sizing while you practice.

Why this approach works: attention can move prices in the short run. Research by Barber & Odean (2008) showed retail flows chase attention-grabbing assets. In crypto, Liu & Tsyvinski (2018) found that attention proxies (like search interest) correlate with short-term returns and volatility. YouTube coverage can be an attention spark—not a thesis. Treat it as a starting signal to research, not a green light to buy.

Real-world example: A small-cap altcoin gets highlighted. Liquidity spikes for a few hours, spreads widen, then price mean-reverts. If you had a 24-hour cool-off and checked token unlocks, insider allocations, and on-chain activity first, you either sized tiny or passed—both wins.

When to skip

- You need deep technical analysis: If you rely on heavy quant, detailed tokenomics modeling, or institution-grade reports, you’ll want specialized tools and research to complement this channel.

- You struggle with FOMO: If a bold thumbnail makes you feel like you’re missing the last train, unsubscribe from alerts and only review after markets cool down—or skip entirely.

- You trade illiquid microcaps: If your edge is precision entries in thin markets, any mainstream coverage increases slippage and risk. Stick to your niche sources.

Final thoughts and next steps

I watch channels like this to catch what the crowd might talk about next, then I verify, plan, and size with discipline. That’s how you turn noise into signal.

- Use a 24-hour cool-off. Attention pops fade fast; good theses don’t.

- Write a 3-line thesis before any move: Narrative, catalyst, invalidation. If you can’t write it, you’re guessing.

- Cap risk. Keep any single YouTube-inspired idea to a small slice of your portfolio. No exceptions.

- Check the traps. Token unlocks, treasury/insider holdings, exchange liquidity, and real dev activity. If one is off, pass.

- Track yourself. Keep a quick journal: what you watched, what you did, and why. You’ll level up faster than any “top 10” list can promise.

If the style fits you, subscribe to the channel here: https://www.youtube.com/@MichaelWrubel. Just remember: watch with intent, not emotion. And if you want straight-shooting reviews and tools to help you stay sharp, keep an eye on Cryptolinks.