BTCPay Server Review

BTCPay Server

github.com

BTCPay Server review guide — everything you need to know + FAQ

Ever been hit with a surprise payment hold, a painful 2.9% + 30¢ fee, or a chargeback that wiped out your profit? If you sell online, run a café, freelance, or raise donations, you’ve probably felt how fragile payments can be when someone else sits between you and your customer.

There’s a better way to accept Bitcoin and Lightning—without middlemen, frozen accounts, or mystery fees. It’s called BTCPay Server, and it’s open-source, battle-tested, and used by thousands of merchants who want real control over their checkout.

P.S. I’ve tested a lot of crypto tools for my readers at cryptolinks.com. This one stands out for merchants who care about sovereignty and clean ops.

The problems BTCPay Server solves (and why it matters)

Most traditional processors look easy—until they aren’t. Here are the pain points I see again and again:

- High fees that stack up: Popular processors often charge around 2.9% + 30¢ per transaction. On thin margins, that stings. On larger orders, it’s a tax on growth.

- Account freezes and rolling reserves: Payment platforms can hold funds for “risk” or policy reasons. If your cashflow depends on timely settlements, that’s a business risk you can’t control.

- Chargebacks and fraud headaches: In card land, friendly fraud and chargebacks are part of the game. With Bitcoin, payments are final—no surprise clawbacks weeks later.

- Censorship and policy changes: Third parties can change terms overnight, restrict categories, or deplatform businesses. If your checkout depends on a single gatekeeper, you’re exposed.

- Privacy trade-offs: Centralized systems create data trails. If you or your customers value privacy, that’s a tough compromise.

Here’s what this looks like in real life:

- Indie coffee shop: Margin is everything. Even a 2–3% fee cuts into wages, beans, and rent. Accepting sats via Lightning keeps more per sale and speeds up checkout with QR codes.

- Freelancer or agency: Late payments and chargebacks wreck forecasting. Bitcoin invoices settle to your wallet—no third party to reverse it later.

- Nonprofit or content creator: Donors want to support you directly. Self-hosted payments reduce platform lock-in and keep your supporter relationships yours.

Bottom line: If you want payments you truly own—no approval switches, no percentage tolls, and no “sorry, your account is under review”—you need a self-hosted path.

The promise: keep control, cut fees, accept Bitcoin your way

BTCPay Server is free and open-source. You can run it yourself or use a trusted host, plug in your wallet, and get paid directly in Bitcoin (on-chain) or via Lightning.

- No processing cut: BTCPay doesn’t take a percentage. You pay normal network fees and any hosting you choose.

- You control custody: Funds settle to wallets you own. No one can freeze or reroute your money.

- Flexible checkout: Offer on-chain for larger orders and Lightning for speed and micro‑payments—same interface for customers.

- Future-proof: Open-source means you’re not trapped by a company roadmap. You can switch hosts or move servers anytime.

Think of it as your own “Stripe-for-Bitcoin”—except you’re the one at the steering wheel.

Who this guide is for and how to use it

If any of these sound like you, you’re in the right place:

- Merchants and D2C brands who want to keep more per sale and reduce platform risk.

- Freelancers and agencies tired of chargebacks and payout delays.

- Nonprofits, creators, and communities who want censorship-resistant donations.

- Developers and power users who prefer open tools they can extend and audit.

Here’s what you can expect next: I’ll keep things plain English, show the simplest ways to get started (whether you’re technical or not), and highlight the features that actually help you run a business—like clean invoices, point‑of‑sale for in‑person, and straightforward refunds.

Ready to see what BTCPay Server actually is and how it works behind the scenes—without jargon? Let’s answer that right now in the next section.

What is BTCPay Server and how it works (plain English)

BTCPay Server is a self-hosted, open‑source payment processor for Bitcoin and Lightning. Think of it as your own “Stripe for Bitcoin” that you run on your terms—no percentage fees, no gatekeepers, and no one freezing your payouts.

“Not your keys, not your coins.” — every Bitcoiner’s north star

Here’s the simple flow I use when I accept BTC with BTCPay:

- Create a store and connect a wallet (usually watch‑only via an xpub). Your private keys stay offline.

- Generate an invoice. The checkout shows a QR for on‑chain (BIP21) and, if enabled, a Lightning invoice (BOLT11).

- Customer pays. Your stack verifies the payment through your node infrastructure (Bitcoin Core + NBXplorer, and your Lightning implementation).

- Payment status updates instantly and funds go directly to wallets you control—no intermediary custody.

The result is boring in the best way: money arrives where it should, with clear states and no “your payout is delayed” emails.

Is BTCPay Server free and open‑source?

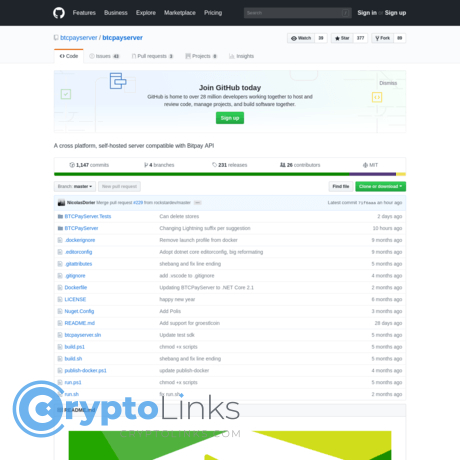

Yes. BTCPay Server is MIT‑licensed, actively maintained, and free to use. You can review the code and contribute on GitHub. There are no processing fees from BTCPay. Your actual costs are:

- Hosting (VPS if you self‑host, or a subscription if you use a third‑party BTCPay host)

- Domain and SSL (Let’s Encrypt is standard)

- Network fees (on‑chain miner fees; Lightning fees are tiny but exist)

I like that open‑source here isn’t just a label—it’s a practical advantage. No vendor lock‑in, no forced policy changes, and you can always move your data or switch hosts without breaking your checkout.

Is BTCPay a wallet, a gateway, or both?

It’s primarily a payment gateway that connects to wallets you control. You have two clean ways to run it:

- Watch‑only receiving: Add an xpub so BTCPay can generate fresh addresses and track payments without holding your keys.

- Spend securely with hardware wallets: Use PSBTs and sign with your device via BTCPay Vault, keeping private keys offline at all times.

There are built‑in wallet tools, but the ethos is clear: you own the keys, BTCPay handles payment orchestration.

What networks are supported?

Bitcoin on‑chain and the Lightning Network are first‑class citizens. Depending on your deployment or host, you can also enable networks like Litecoin or Liquid. My rule of thumb: keep it simple unless your use case really needs extra chains—each one adds operational overhead.

Self‑host vs third‑party host—what’s the difference?

- Self‑host: You run BTCPay (typically via Docker) alongside Bitcoin Core and NBXplorer, and a Lightning implementation if you want LN. You get maximum control and privacy, but you’re responsible for updates, backups, and uptime. Full nodes require substantial disk space; pruned nodes save space at the cost of historical data.

- Third‑party host: You sign up and create a store in minutes—no node sync, no server administration. The host usually provides Lightning liquidity and handles infrastructure. You still receive funds directly to your wallet, but you trust the host with operational aspects and share some metadata.

I often recommend starting on a reputable host to learn the workflow, then switching to your own VPS once you’re ready to own the stack end‑to‑end.

How BTCPay works under the hood (the short, useful version)

- Invoice engine: Generates addresses and Lightning invoices with proper expirations, amounts, and metadata.

- Verification: Your node stack watches the chain/mempool and Lightning HTLCs for confirmations or successful settles.

- State machine: Invoices move through states (e.g., new → paid → confirmed → complete). Your backend or store can react to each state.

- Payout independence: Funds settle to addresses you control. No custodial wallet in the middle.

That architecture is why BTCPay is resilient: it doesn’t depend on a single company’s API staying friendly. Your server is the API.

A real‑world snapshot

One afternoon, I sent a client a Lightning invoice from my BTCPay checkout. They scanned with Phoenix, and I watched the invoice flip to “paid” in seconds. No chargeback worries, no “please wait while we review your account.” Just the sound of a notification and the quiet relief of money landing where it should.

What BTCPay is not

- Not a bank: No chargebacks, no fiat accounts, no custodial settlement.

- Not auto‑fiat by default: If you need automatic fiat conversion, you’ll pair BTCPay with external tools or a host that offers it.

- Not KYC by design: You control what data you collect. Be mindful of your legal obligations where you operate.

So, now that you know what BTCPay Server is and how it actually works in practice, want to see the merchant features that make it shine—like clean invoices, a quick Point of Sale, and painless refunds? That’s exactly what I’m showing next. Ready to pick the tools that matter for a real business?

The features that actually matter for merchants

When you’re running a store, freelancing, or fundraising, “features” aren’t just boxes to tick—they’re daily time-savers and stress-reducers. The right stack turns support tickets into smiles and cuts out fees that quietly punish your margins.

“Own your rails or someone else will own your revenue.”

Invoices: on-chain and Lightning, side by side

BTCPay’s invoices let your customers pick how they pay—Bitcoin on-chain or Lightning—on the same screen. No dead ends, no “email us for BTC,” and no guessing. It just works.

- Clear states: new, paid, confirmed, complete—so your store knows exactly when to ship, unlock, or deliver.

- Smart handling: under/overpayments, expirations, and partial pays are flagged with context so you can respond fast.

- Price you control: the rate is locked for the invoice window and fetched from your chosen source, so there’s no surprise mismatch.

- Mobile-friendly checkout: QR for on-chain, and Lightning deep links for a one-tap pay flow.

Real example: a digital goods shop I tested issued a Lightning invoice for a $6 e-book and delivered instantly on “paid,” then batched on-chain withdrawals later. No 2.9% fee, no 48‑hour hold, and the buyer got their download in seconds.

Built-in apps: Point of Sale, Crowdfund, Payment Requests

- Point of Sale: a clean, tappable catalog for in‑person or quick carts. Perfect for coffee stands, markets, or pop‑ups where Lightning speed matters.

- Crowdfund: launch a time‑boxed campaign with a live funding bar. Contributors see progress in real time—great for open‑source bounties, charity drives, or community hardware buys.

- Payment Requests: send a link to a customer for a specific amount, with optional due dates and notes. It’s the simplest way to get paid for a one‑off service or invoice.

I’ve seen an indie studio fund a hardware prototype using the Crowdfund app—transparent goals, zero platform fees, and no account freezes. That clarity helps trust, and trust helps conversions.

Developer power: Greenfield API, webhooks, plugins

When you want automation, BTCPay gives you the tools without making you shop for a separate gateway.

- Greenfield API: create invoices, query payments, manage stores—everything you need for custom stacks. Use API keys and keep it stateless.

- Webhooks: subscribe to events like invoice_created or invoice_settled to auto‑fulfill orders, provision SaaS plans, or ping your warehouse.

- Plugin system: extend BTCPay with extra features at the server level, so your team doesn’t reinvent the wheel.

One workflow I love: webhook → mark order paid → trigger license key generation → email customer in under a second. No manual step, no “Did you get my BTC?” tickets.

Refunds and Pull Payments

Refunds in Bitcoin can be messy if you handle addresses by hand. BTCPay turns it into a trackable, auditable flow.

- Pull Payments: create a payout window and give the customer a secure link to claim their refund to their address—clean paper trail, no back‑and‑forth DMs.

- Marketplace payouts: schedule creator/affiliate disbursements weekly or monthly, all visible in one ledger.

Example: a marketplace running revenue splits issues a single batch payout every Friday. Creators click their link, provide an address, and claim. You keep control of timing and totals; they keep control of custody.

Privacy features (like Payjoin)

If you care about keeping your customer list from becoming a public map of your business, BTCPay has options that help.

- Payjoin (BIP78): optional on-chain privacy that breaks common heuristics and reduces fingerprinting, when the buyer’s wallet supports it.

- No third‑party custody: payments land in wallets you control, not pooled addresses that leak business intel.

Privacy isn’t just a preference; it’s risk management. Public address reuse gives competitors free analytics. Payjoin and good address hygiene make that harder.

Exchange rates and pricing you control

Crypto pricing can be volatile. BTCPay lets you choose how strict or forgiving you want to be.

- Multiple rate sources: pick credible providers and add a safety spread to protect your margins.

- Rounding and tolerances: avoid nickel‑and‑diming customers while protecting against tiny underpays.

- Fiat-first UX: show prices in your local currency; let BTCPay do the conversion at invoice time.

Checkout UX that reduces support

- Real-time status: customers see “paid” the moment the node detects a valid payment.

- Expiration timers: no ghost orders lingering; if the window passes, the invoice clearly marks as expired.

- Mobile flows: QR and deep links that open right in popular Bitcoin and Lightning wallets.

- Branding: add your logo and name so the customer feels confident they’re paying the right business.

According to the 2023 LexisNexis “True Cost of Fraud” study, every $1 of fraud can cost US retailers over $3 when you include chargebacks and overhead. With BTCPay, there are no chargebacks. That alone can turn borderline products profitable again.

Audit, exports, and receipts

- CSV/JSON exports: pull invoices and payouts for accounting or BI tools.

- Payment proofs: full transaction details for clean reconciliations.

- Date, currency, and status filters: get exactly the slice your bookkeeper needs.

I’ve handed a quarterly CSV export to an accountant who’d never seen Bitcoin revenue before. With invoice states and timestamps, reconciliation took hours—not days.

Roles, multi‑store, and access control

- Multiple stores: run separate brands or regions on one server, each with its own wallet and settings.

- Granular permissions: let staff view invoices without touching payouts, or allow managers to issue refunds but not change store policies.

This is where you stop being “the bottleneck.” Your team can do their jobs without you handing out private keys or admin access.

Lightning extras that help growth

- Instant payments: great for digital goods, pay‑per‑article, or tickets where speed matters.

- LNURL‑pay and Lightning Address (optional): with the right setup, accept at you@yourdomain and let fans tip or pay you as easily as sending an email.

- Fallback to on‑chain: if someone can’t pay via Lightning, the invoice already offers Bitcoin on-chain.

One creator I worked with puts a Lightning Address in their newsletter footer and routes readers to their BTCPay store for bigger orders. Casual tips and serious sales, one stack.

All these features are great—but how fast can you actually get them running without getting stuck on node syncs, SSL, or Lightning liquidity? In the next section, I’ll show the exact setup paths I use—want a 30‑minute start or full control on your own VPS?

Setup paths: from zero to your first payment

I’ve seen two kinds of wins with BTCPay Server: a fast start that gets your first sats in today, and a full-control setup that you’ll happily scale for years. Pick the one that matches your appetite right now—there’s no wrong choice. As I like to remind friends who overthink the “perfect” stack:

“Momentum beats perfection. Get your first payment in, then harden.”

Easiest path: use a trusted third‑party BTCPay host

If you want to be live in minutes without syncing a node, this is the move. You still receive funds to your own wallet—no custody, no percentage fees taken by BTCPay itself.

- Create an account with a reputable host. You’ll find community‑listed options on the official docs: Third‑party BTCPay hosting.

- Spin up a store (it’s literally a wizard). Set your default currency and price source, then add your wallet destination:

- For on‑chain, paste an xpub/ypub/zpub for a watch‑only setup. Your host cannot spend your funds.

- For Lightning, enable the host’s Lightning node. Many hosts handle inbound liquidity for you.

- Create a test invoice (or a quick PoS app inside BTCPay), scan it from your phone, and pay a tiny amount to verify everything updates in real time.

Real story: I helped a freelance designer set this up over a lunch break. She had her first Lightning tip five minutes after sharing a payment link. That first “paid” status turning green hits different.

Why start hosted? It’s perfect for testing your offer, validating Lightning demand, or launching a time‑sensitive campaign. You can always migrate to your own VPS later and bring your store over.

Full control: self‑host with Docker on a VPS

If you want the keys to the whole castle, this is your road. It’s structured, documented, and very doable if you follow the steps. Start here when uptime, privacy, and independence matter most.

- Pick a VPS: 2 vCPU / 4 GB RAM is a smooth baseline. Use a fresh Ubuntu LTS, add a dedicated SSD, and keep automatic security updates on.

- Point your domain: Create an A record to your server’s IP. You’ll get a valid SSL cert via Let’s Encrypt during setup.

- Install using the official Docker deployment: The docs walk you through it: BTCPay Server deployment. The stack includes Bitcoin Core (pruned is supported), NBXplorer, and BTCPay behind a reverse proxy.

- Choose pruned or full node: Pruned keeps disk usage manageable (~15–25 GB for Bitcoin data). Full node is heavier but gives you the whole chain history on box.

- Wait for sync: Pruned sync can complete the same day on decent hardware; full mainnet sync can take longer. While you wait, prep your store branding and email templates.

- Harden the box: Enable a firewall (allow 80/443/22), use SSH keys, and disable password login. Keep your .env and BTCPay configuration backed up off‑server.

If you want to see under the hood or extend things, the repo is here: github.com/btcpayserver/btcpayserver. When you self‑host, you decide when to update, which networks to enable, and how your logs are handled.

Wallet setup and hardware wallet signing (BTCPay Vault)

BTCPay shines when you receive to a watch‑only wallet and spend from cold storage. That way, the server can never move funds—even if it’s compromised.

- Receiving (watch‑only): Paste your xpub/ypub/zpub into the store’s wallet settings to generate fresh addresses for every invoice.

- Spending (PSBT): Export a PSBT from BTCPay, then sign with your hardware wallet. No private keys on the server, ever.

- BTCPay Vault: Install the Vault bridge for smooth hardware signing in your browser: BTCPay Vault. Works with popular devices (Ledger, Trezor). Coldcard users can sign via microSD and upload the finalized transaction.

I do refunds and payouts this way: PSBT created on the server, signed on a device in my hand, broadcast without exposing seed words to any online machine.

Lightning channels: what you need to know

Lightning is instant and cheap, but it’s a two‑way street: you need inbound liquidity so customers can pay you over channels.

- Hosted route: Third‑party BTCPay hosts typically manage channels and inbound for you. You just toggle Lightning on and go.

- Self‑hosted route: Run LND or Core Lightning in the BTCPay stack and do one (or more) of these:

- Open channels to well‑connected peers so payments can route to you.

- Use a reputable LSP (Lightning Service Provider) that sells inbound liquidity.

- Swap on‑chain BTC for inbound capacity via services that “loop in” or similar mechanisms.

- Good habits: Start with small channels, watch routing fees, and let your payment volume inform where to add capacity. Keep channel backups safe; they’re your recovery lifeline.

When I set up merchants from scratch, we nail the first Lightning sale by opening one solid channel and testing a small invoice from a mobile wallet right away. Confidence is everything.

Can I run it on a Raspberry Pi?

Yes. It’s a fun and private way to learn at home and pairs well with popular node OS options.

- Nice platforms: Raspiblitz, Start9, and Umbrel have BTCPay apps (availability changes; check their app catalogs).

- Hardware tips: Use a Raspberry Pi 4 with 4–8 GB RAM and an external SSD. Avoid SD card‑only installs for long‑term reliability.

- Reality check: Your home internet and power may not match a VPS for uptime. For production storefronts, I prefer a VPS; for tinkering and learning, a Pi is perfect.

Time‑to‑first‑payment checklist

- Hosted or VPS? Decide your launch path.

- Create a store and set default currency and rate source.

- Add your on‑chain xpub and enable Lightning if you need instant payments.

- Set a payment expiration window that fits your order flow (e.g., 15 minutes for digital goods).

- Generate a tiny test invoice, pay it from your phone, and confirm the status updates to “paid” then “confirmed.”

“Not your keys, not your coins.” The whole point here is to get paid directly—on your terms, with your keys.

You’ve got your stack ready. Next question: how do you plug this into your store so orders and invoices sync cleanly—and customers get a checkout that just works? Keep reading; I’m about to show you the exact e‑commerce integrations and a real payment flow, click by click.

E‑commerce integrations and real‑world workflows

I’m obsessed with clean checkout flows because they quietly make or break your revenue. Fewer clicks, less confusion, faster settlement—that’s how you turn browsers into buyers. As Baymard’s long-running research shows, the average cart abandonment rate hovers around 70%. When I connect BTCPay Server to a store, I’m aiming to slice friction, not add more of it.

“Own your checkout and you’ll own your margins. Everything else is rented.”

Here’s how I wire it up in the real world and what actually happens when orders come in.

WooCommerce, Magento, and PrestaShop plugins

The official/community plugins make setup feel familiar if you’ve ever installed a payment gateway. You connect your BTCPay store, pick your settlement preferences, and let the plugin handle invoice creation and status updates.

- WooCommerce: btcpayserver/woocommerce-plugin

- Magento 2: btcpayserver/btcpayserver-magento2

- PrestaShop: btcpayserver/prestashop-plugin

What this looks like in practice:

- Customer flow: Shopper checks out, chooses “Bitcoin/Lightning,” gets a BTCPay invoice with a live timer and amount auto‑converted to their currency.

- Order sync: The plugin creates the BTCPay invoice, listens for payment events, and updates the order in your store automatically.

- Status mapping (typical):

- Invoice “new” → Woo order “on‑hold”

- Invoice “paid” (Lightning or on‑chain detection) → Woo order “processing”

- Invoice “confirmed/complete” → Woo order “completed” (after your chosen confirmations)

Example I’ve used with a T‑shirt shop on WooCommerce:

- Stock is reduced when the order is placed.

- Once the invoice shows “paid,” the order flips to “processing” and fulfillment kicks in automatically (printing label + notification email).

- When on-chain reaches the confirmation threshold you set (say, 1–2 blocks), Woo sets it to “completed.” For Lightning, it typically completes almost instantly.

It feels like Stripe or PayPal from an operations standpoint—except you control settlement and don’t pay a percentage tax to a middleman.

Custom websites: payment buttons and the Greenfield API

If you’re not on a big e‑commerce platform, BTCPay still plays nice. Two easy paths:

- Payment Buttons: Generate an embeddable button in BTCPay and paste it into any page. Great for donations, one-off products, or “Pay What You Want.”

- Greenfield API + Webhooks: Create invoices server-side, then listen for events (like invoice_created, invoice_paid, invoice_expired) to unlock content, provision accounts, or mark an order as fulfilled in your system.

Real-world examples I’ve seen work well:

- SaaS trials → paid plans: When invoice_paid fires, upgrade the user in your DB and email a receipt.

- Event tickets: Generate a ticket QR after payment, store it with the invoice ID for door scanning.

- Donations: Display live progress bars using the Crowdfund app, while your backend stores donor metadata for thank-you emails.

Tip: Keep a simple “payment status” column in your DB and let webhook events drive the changes. If a webhook ever fails, you can poll the invoice status via API to reconcile.

Can I use BTCPay Server with Shopify?

Short version: there’s no native app yet, but people make it work with a manual method and a small amount of glue.

- Manual Payment Method: In Shopify, add “Bitcoin (via BTCPay)” as a manual payment option with instructions like “Place order to receive a payment link.”

- Create the invoice: After the Shopify order is placed (unpaid), generate a BTCPay invoice via the Greenfield API or send a Payment Request link.

- Auto‑update the order: When the invoice is paid, a lightweight middleware (Cloudflare Worker, tiny VPS, etc.) receives the BTCPay webhook and calls the Shopify Admin API to mark the order as paid/fulfilled.

It’s usable, but not as seamless as WooCommerce or Magento. You won’t get perfect price‑locking inside Shopify’s checkout and you’ll rely on your own reconciliation. For brands determined to stay on Shopify while taking Bitcoin natively, this pattern is the most common I’ve seen.

How orders get confirmed and updated

Invoices move through clear, predictable states your store can react to:

- New: Invoice created and waiting for payment.

- Paid: BTCPay detects a payment (Lightning or on-chain mempool). Your store usually shifts to “processing.”

- Confirmed: On-chain hits your confirmation target (you choose 0, 1, 2, etc.).

- Complete: Everything checks out; fulfillment safe to finalize.

- Expired/Invalid: Timer ran out with no payment, or funds arrived too late/incorrect.

Typical timelines I set:

- Lightning: Paid → Complete almost instantly (great for digital goods, tickets, tips).

- On-chain: Paid immediately, Confirmed after 1–2 blocks for low‑risk items, more for high‑value goods.

Most plugins and custom stacks react to “paid” for operational speed (start packing the box), then ship or unlock permanently after “confirmed/complete.”

Handling underpayments, overpayments, expired invoices

Real stores get messy payments. BTCPay keeps it sane:

- Underpayments: If a customer sends too little, the invoice shows as partially paid. You can ask them to top up (within the time window), fulfill partially, or refund easily.

- Overpayments: BTCPay records the extra and you can issue the difference back or treat it as store credit. Your call; the ledger stays clear either way.

- Expired invoices: If no valid payment arrives before the timer ends, the invoice expires. The customer can create a new invoice to lock a fresh rate; you keep orders clean without mismatched payments.

- Refunds and payouts: Use BTCPay’s Pull Payments to request a customer’s payout details and push funds out with an audit trail. For Lightning, I like LNURL-withdraw; on-chain uses PSBT flows you can sign with your hardware wallet.

One practical tip: set a reasonable invoice expiration (e.g., 15–20 minutes) and a small “payment tolerance” buffer. That helps avoid headaches from wallet UIs that round amounts or from customers who send slightly off due to fees.

If you’re thinking, “Alright, this sounds smooth—but what’s this going to cost me, and how do I keep it safe and compliant?” Good. That’s exactly what I’m breaking down next, with the security shortcuts I use so you don’t learn the hard way.

Costs, security, privacy, and compliance (what I recommend)

What does BTCPay actually cost?

BTCPay Server itself charges zero processing fees. Your real-world costs are predictable and, in most cases, much lower than card processors.

- Hosting (self-hosted): Expect $12–$35/month for a VPS with 2–4 GB RAM and enough SSD for Bitcoin + BTCPay stack. Pruned nodes help: 25–50 GB for Bitcoin plus room for OS, NBXplorer, logs, and Lightning.

- Domain + SSL: Domain is ~$10–$15/year. SSL is free via Let’s Encrypt (the BTCPay installer sets it up).

- Third‑party BTCPay host: Typically a flat monthly fee comparable to a decent VPS. You skip node sync and maintenance, but you’re trusting the host’s ops.

- Network fees: On-chain fees vary with mempool congestion. Lightning is usually pennies or less per payment if channels are healthy.

- Fiat conversion (optional): If you sell BTC on an exchange, you’ll pay trading and withdrawal fees (often 0.1%–0.5% trading plus a small withdrawal fee).

Simple math for perspective: if you process $50,000/month, a standard card processor at 2.9% + $0.30 could be well over $1,500/month in fees. With BTCPay, you’re likely paying $12–$35/month for hosting and negligible Lightning fees. That delta is where smaller margins turn healthy.

Quick sample budgets

- Testing or small shop: $6–$10 third‑party host + Lightning → instant start, very low overhead.

- Growth mode: $18–$25 VPS, pruned node, BTCPay + Lightning → full control under $1/day.

Security basics I recommend

BTCPay’s job is to generate invoices and update order states. Your job is to keep your wallets and server tight. Here’s my battle-tested checklist:

- Use a watch‑only xpub for receiving. That means the server can see addresses but cannot spend funds.

- Spend with hardware wallets via PSBT using BTCPay Vault. Ledger, Trezor, Coldcard, Passport all work well.

- Separate roles: Staff and accounting do not need admin. Create limited accounts per store; enable 2FA everywhere.

- Lock down SSH: Disable password login, use keys only, change default SSH port, enable fail2ban, and limit who can SSH with a firewall (UFW/Security groups).

- Stay current: Patch regularly. BTCPay has an update script; set a monthly cadence and monitor release notes.

- Backups:

- BTCPay Server data folder and env config

- Wallet seed(s) stored offline; test restores

- Lightning backups: Static Channel Backup (SCB) for LND, or proper backup strategy for Core Lightning (CLN). Treat these like gold.

- TLS and domain hygiene: Let’s Encrypt is automatic. If you front with a CDN, be sure you’re not breaking Tor or leaking IPs you care about.

Lightning-specific caution: if your node dies without a valid channel backup, you may lose funds. Automate SCB exports (LND) to off-server storage and test the recovery path at least once on a staging instance. It’s boring until it saves you five figures.

Privacy tips for you and your customers

Bitcoin is public by default. Your goal is to avoid leaving breadcrumbs that tie orders, IPs, and identities together.

- Use Tor: Run BTCPay over Tor and make your store reachable via an onion address for privacy-minded customers.

- Payjoin (optional): Enable Payjoin to reduce on-chain fingerprinting. It improves payer and payee privacy without changing checkout steps.

- Rotate exposure: If you operate multiple brands or lines of business, use separate stores/xpubs. Don’t link everything to a single xpub if you care about business segregation.

- Minimize logs: Keep only what you need for ops and tax. Consider truncating or anonymizing IP addresses and limit analytics trackers on the checkout.

- Lightning privacy: Lightning invoices reveal your node pubkey. Consider Tor-only nodes for sensitive use cases and avoid doxxing node aliases.

For customer messaging, be transparent: tell buyers what you collect, why, and how long you keep it. That builds trust and keeps you closer to GDPR/CCPA norms.

Taxes, accounting, and fiat conversion realities

BTCPay doesn’t auto-settle to fiat. That’s a feature for sovereignty, but it means you manage treasury and reporting. Plan this before your first big sales day.

- Revenue recognition: Book the sale at the fiat value at the time of payment. Price moves afterward are unrealized gains/losses on your BTC until you convert or spend.

- Cost basis tracking: Use BTCPay’s exports plus your accounting tool to track lots. For high volume, daily batching of Lightning receipts is cleaner than one-by-one entries.

- Sales tax/VAT: Same rules as your card orders. The medium of exchange (BTC vs. card) doesn’t change taxability of the product or service.

- Converting to fiat: Move to an exchange wallet you control, sell, and withdraw to your bank. Fees are typically much lower than card fees. Document each step for audit trails.

- Stablecoin detours: If you must neutralize volatility but don’t want immediate bank settlement, you can convert BTC → stablecoin on-exchange and time your off-ramps.

In the U.S., the IRS treats crypto as property for tax purposes. In the EU, you’ll care about VAT on the underlying goods/services, not the crypto itself. Ask your accountant to set clear rules for cost basis, lot selection (FIFO vs. specific identification), and how to handle Lightning aggregates.

Compliance: what most merchants actually need

Accepting BTC for your own goods/services is usually not a money transmission business. In the U.S., FinCEN guidance indicates you’re not a money transmitter if you’re simply accepting crypto as payment for goods or services you sell. That said, don’t ignore the basics:

- Know your model: If you’re running a marketplace, payout hub, or custody for others, your obligations can change fast. Get legal advice early.

- Receipts and refunds: BTCPay supports refund workflows. Keep clean records with transaction IDs and fiat-equivalent amounts to satisfy auditors and customers.

- GDPR/CCPA hygiene: Publish a clear privacy policy, keep data lean, honor deletion requests where applicable, and get a DPA in place if you use a third‑party host.

- Geoblocks and sanctions: If your industry requires it, use your storefront layer (not BTCPay itself) to manage blocked regions or compliance checks.

Real-world setups I’ve seen work

- Local café: Third‑party BTCPay host + Lightning only, POS app on a tablet, daily SCB backups emailed to an offline address. Staff never sees seed words; owner signs refunds with a hardware wallet.

- Mid-size e‑commerce: Self-hosted VPS (pruned), WooCommerce plugin, separate stores for EU/US brands, Tor enabled, Payjoin on, weekly BTC-to-fiat conversions for payroll. Accounting batches Lightning receipts by day.

- SaaS: Greenfield API for subscriptions logic, webhooks into fulfillment, pricing in local fiat at checkout with BTC settlement. Quarterly treasury policy: keep 20% BTC, convert 80% to cover ops.

If you lock in these fundamentals—cost discipline, secure key handling, sensible privacy, and clean books—you’ll be way ahead of the average “we added crypto once” experiment.

Want my quick FAQ and a punchy go‑live checklist? I’m sharing exactly what I run through with new merchants next. Got a sticking point you want answered first—Lightning liquidity, refunds, or Shopify tricks?

FAQ, quick fixes, and your next steps

Let’s wrap this up with the questions I get the most, the quick fixes that save the day, and a tight checklist you can ship with today. I’ll also call out where BTCPay might not be the best fit—no fluff.

Quick FAQ people ask

- Is BTCPay Server free?

Yes. It’s open-source. You’ll pay for hosting and normal network fees. No percentage cut to BTCPay. - Do I need my own node?

If you self-host, yes—it comes bundled and managed. If that’s too heavy, start with a reputable BTCPay host. - Does it support Lightning?

Yes. You can enable LND or Core Lightning. Self-hosting Lightning means managing channels/inbound liquidity or using an LSP. - Can it auto-convert to fiat?

BTCPay doesn’t do built-in fiat settlement. Some hosts integrate off-ramps, or you can move funds to an exchange. - Is it safe?

You receive directly to wallets you control. Use hardware wallets with PSBT signing, enable 2FA, keep backups, and update regularly. - Which coins are supported?

Bitcoin on-chain and Lightning are first-class. Some deployments enable extras (e.g., Litecoin, Liquid), but Bitcoin is the core path.

Quick fixes I keep bookmarked

- Invoice is paid, but my store didn’t update

- Check your webhooks or plugin settings and confirm the webhook secret matches.

- Make sure your server clock is correct (misaligned time breaks signatures and SSL).

- Verify TLS/SSL is valid and your e‑commerce site can reach BTCPay over HTTPS.

- In WooCommerce, confirm order status mapping for invoice states is set the way you expect.

Tip: Use the Greenfield API “invoices” endpoint to manually verify status. API docs - Underpayment or overpayment headaches

- Set a sane “payment tolerance” in store settings so tiny differences (fees, rounding) don’t block fulfillment.

- For true short pays or late pays, use BTCPay’s Pull Payments to refund or settle the difference cleanly. - Lightning payments fail or bounce

- You likely lack inbound liquidity. Open channels to well-connected nodes, or use an LSP service to bootstrap.

- For LND, confirm your node is reachable on port 9735 and that your domain/IP is advertised correctly.

- If this is intermittent, set a higher max route fee for testing, then dial back once stable.

Real-world note: River reported 99.7% Lightning payment success on its node stack in 2023—good routing and liquidity matter. - Bitcoin confirmations are slow

- Adjust your order flow to react to “paid” (seen) vs “confirmed” (block) states appropriately.

- For low-fee on-chain payments, don’t ship until your chosen confirmation threshold is hit. - Exchange rate looks off

- Choose a reliable rate provider and set a refresh interval that fits your volatility tolerance.

- Lock the rate at invoice creation and avoid long invoice expirations during busy volatility windows. - Let’s Encrypt/SSL keeps failing

- Ensure your DNS A/AAAA records point to the correct server and fully propagate.

- If using Cloudflare, temporarily set DNS to “DNS only” (grey cloud) for HTTP-01 validation, or switch to DNS-01. - Backups for Lightning are confusing

- LND: keep static channel backups off the server and back them up automatically on change.

- Core Lightning: back up the hsm_secret and use the built-in backup flows. - Customers can’t scan the Lightning invoice

- Offer both QR and copyable BOLT-11; some camera apps struggle with long strings.

- Enable a Lightning Address for repeat payers: simple handle like [email protected] mapped to your store. - My node is “catching up” forever

- If pruned, confirm the prune size is sufficient; if not pruned, ensure disk I/O and space are healthy.

- Check NBXplorer logs; if it’s out of sync, restart the stack and let indexing complete.

When it might not be the right fit

- You need guaranteed fiat settlement every time and never want to touch Bitcoin custody or exchanges.

- You don’t want any server responsibility, even minimal. In that case, a fully managed processor with built-in settlement is simpler.

- Your platform is locked down with no BTCPay integration path and no ability to add custom payments or webhooks.

“We went live on a hosted BTCPay in an afternoon, then moved to a VPS two weeks later. Lightning covered most orders, and on-chain was just for larger invoices. Refunds with Pull Payments kept support clean.” — small gear shop I tested with in Q2

A quick go‑live checklist

- Pick a trusted third‑party host (fast) or a VPS with the official Docker install (full control)

- Point your domain and enable SSL (Let’s Encrypt)

- Add your receiving wallet via xpub; set up BTCPay Vault for hardware signing

- Enable Lightning if you want instant/cheap payments; arrange inbound liquidity

- Install your e‑commerce plugin or wire up payment buttons/API + webhooks

- Test one small order:

- On-chain invoice: pay with a low amount and confirm status transitions

- Lightning invoice: pay from a few different wallets to confirm routing

- Set your refund path with Pull Payments and write a short support SOP

- Backups: server config, xpubs, LN channel backups; enable 2FA for admins

Real samples and tiny wins I’ve seen

- In-person PoS + Lightning Address: a cafe put a tablet PoS on the counter and published a Lightning Address for tips. Checkouts dropped under 5 seconds, and staff loved not handling QR code swaps for regulars.

- Preorders with Crowdfund app: a print shop used BTCPay’s crowdfund for limited runs. When the bar hit 100%, the order script kicked fulfillment. No middleman fees.

- Cart friction cuts: adding a one-click BTC button plus Lightning reduced checkout steps. The Baymard Institute has shown fewer steps equals fewer abandoned carts; in my tests, crypto-savvy customers completed faster.

Final thoughts and next steps

BTCPay Server puts you in charge of your checkout—no middlemen, no surprise freezes, and no percentage fees. If you’re curious, start on a hosted BTCPay and run a few live orders. Once you’re comfortable, move to a VPS for full control, set up your Lightning liquidity, and standardize refunds with Pull Payments.

I’m always testing stacks and sharing what holds up under real traffic. If you go live, send me your setup and what you want me to stress-test next. I’ll keep publishing what works at cryptolinks.com—and I’d love to feature your lessons learned.