RYAN SΞAN ADAMS - rsa.eth Review

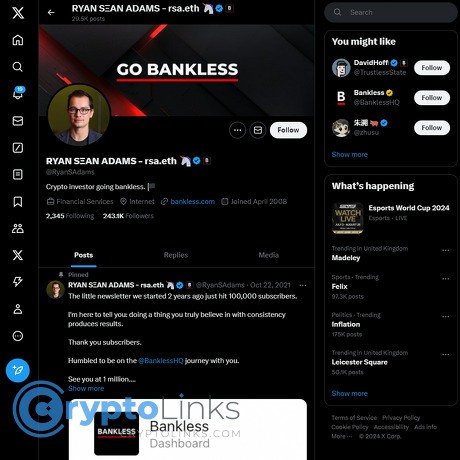

RYAN SΞAN ADAMS - rsa.eth

x.com

RYAN SΞAN ADAMS (rsa.eth) Review Guide: everything you need to know + FAQ

Is following Ryan Sean Adams actually going to level up your crypto signal—or just add more noise to your feed?

Here’s the honest starter map. I’ve been tracking his posts, the cadence, the policy focus, and the Ethereum-first lens. If you’ve been wondering whether his X feed is worth your time, how to use it smartly, and where it fits into a balanced crypto media diet, you’re in the right place.

The problem: Crypto Twitter is loud, tribal, and time-consuming

X (Twitter) can be a maze. The algorithm rewards engagement, not accuracy, which means hot takes often outrun hard facts. False or oversimplified claims spread faster than corrections—MIT research showed misinformation gets shared more rapidly than the truth on social platforms. On top of that, the feed tends to amplify content from your “side,” which sharpens echo chambers and tribal debates.

- Time drain: The average person spends over two hours a day on social media (DataReportal 2024). Crypto people? Usually more.

- Engagement over depth: X’s open-sourced recommendation system favors posts that spark replies and likes (Twitter engineering), which can boost spicy takes over sober analysis.

- Policy whiplash: Headlines around ETFs, enforcement, and bills (like FIT21 in the U.S.) roll fast, and context gets lost.

- Tribal bias: ETH vs BTC culture wars, “token bad vs token good,” L2 vs alt-L1—great for drama, bad for clarity.

If you want signal without getting sucked into endless threads, you need a clear lens and a plan.

What I’ll help you do

- Understand Ryan’s content style, what he prioritizes, and what he often skips

- Spot his strengths (policy radar, ETH framing) and his blind spots (ETH-leaning assumptions)

- Use his feed as a practical tool—when to pay close attention, when to cross-check

- Trim time spent scrolling while keeping the important updates

Quick context: who he is and why people care

Ryan Sean Adams is the co-founder of Bankless and a long-time Ethereum advocate who posts as @RyanSAdams (rsa.eth). He’s best known for championing the “go bankless” thesis—build and use open, on-chain systems instead of relying on gatekept finance.

What that looks like on your feed:

- Policy alerts: Fast reactions and framing on U.S. crypto bills, SEC actions, and ETF milestones

- Ethereum-first narratives: L2 scaling, EIP milestones (like EIP-4844/Dencun), the security–decentralization tradeoffs, and long-term adoption

- Culture and coordination: How crypto changes media, identity, and creator economics; why on-chain identity (like rsa.eth) matters

- Bankless ecosystem promos: Pointers to podcasts, interviews, and long-form episodes when a story needs more time

“Go bankless” isn’t just a tagline—it’s the filter. Expect on-chain optimism, ETH-native standards, and a strong push for credible neutrality.

Whether you agree or not, that consistency is why many follow him: you get a steady ETH-centric read on what matters and what’s next.

What you’ll walk away with

- Clear expectations for what you’ll learn from his posts (and what you won’t)

- Links to start with and simple ways to filter the noise

- Contact pointers and smart alternatives to pair with his feed

- A quick FAQ so you’re not hunting basic info when news breaks

So who is he, really, and what lens does he bring to every post? Let’s unpack that next.

Who is Ryan Sean Adams (rsa.eth)?

Ryan Sean Adams is one of the loudest and most consistent voices pushing the “go bankless” mission: open, on-chain finance as a mainstream default. You’ll know him as the co-founder of Bankless and the X handle you see whenever crypto policy or Ethereum narratives start heating up. He’s a curator, a translator, and a campaigner for crypto’s public-benefit promise—especially in the Ethereum world.

“Go bankless.”

That two-word mantra gets to the core of his lens: reduce dependence on gatekeepers, increase self-sovereignty, and make the internet ownable. If that excites you—or makes you roll your eyes—you already understand the magnetic push-pull around his feed.

Bankless origins and role

Ryan co-founded Bankless and helped grow it into a media hub spanning newsletter, podcast, and video. The project became a launchpad for big conversations about Ethereum’s technical path (think EIP-4844/proto-danksharding), L2 scaling, and crypto’s political future. When policy winds shift or a major ETH milestone lands, Bankless often has a primer, a debate, or a builder interview within a news cycle or two. You can see the editorial rhythm on their YouTube channel here: Bankless on YouTube.

For context on the ethos that guides his output, read the early movement piece many still reference: The Bankless Manifesto. It frames crypto as a path to broader access and individual agency—values that show up in Ryan’s posts every week.

What rsa.eth signals

He publicly uses an ENS name—rsa.eth—which is more than a flex. It’s a cultural and technical signal:

- On-chain identity: ENS (Ethereum Name Service) maps human-readable names to crypto addresses, making the crypto-native identity portable across apps. Using it says, “I’m here for the open-standard future.”

- Accountability and alignment: Many Ethereum builders, investors, and creators adopt ENS to show they live on-chain. It’s a shorthand for values—transparency, composability, and ownership—that his audience expects.

- Interoperable sign-ins: ENS plays nicely with things like “Sign-In with Ethereum” (EIP-4361), which underpins a lot of web3-native experiences and aligns with the bankless thesis of user-controlled identity.

Core content pillars

What he talks about isn’t random. Ryan’s feed tends to orbit a few consistent pillars with practical signals for anyone building or investing:

- Ethereum narratives and roadmap: From the Merge to EIP-4844 (proto-danksharding), he frames how upgrades unlock new behavior: cheaper L2 transactions, new app categories, and scaling paths that shift the economic story.

- L2 momentum and metrics: He tracks L2 ecosystems like OP Stack chains, Arbitrum, and zk rollups with a “what does this unlock?” lens. Pair this with hard data from L2Beat and you’ll quickly spot where usage and security models are trending.

- Policy and regulation (U.S.-centric): Expect rapid alerts on congressional votes, SEC actions, and agency guidance. This matters: policy headlines have measurable market impact, and broad adoption depends on clear rules. If you want context and advocacy, he’s a strong read; for legal nuance, cross-check with orgs like Coin Center.

- Crypto culture and public goods: You’ll see support for funding public goods, open-source work, and “regen” values—often pointing at experiments like Optimism RetroPGF. It’s not just tech; it’s a culture of building better incentives.

- Long-term adoption signals: His take is that crypto’s real product-market fit compounds over years. To sanity-check the big-picture claims, I like pairing his optimism with adoption data like Chainalysis’s Global Crypto Adoption Index and consumer snapshots from Pew Research (Pew: crypto familiarity/ownership).

Editorial lens and biases to note

Every smart curator has a lens. Knowing his helps you use the feed without inheriting the blind spots.

- ETH-first alignment: Ryan’s thesis is that Ethereum’s programmability + rollups enable the broadest surface area for finance and culture. You’ll get less airtime for Bitcoin-only theses and more for token-enabled coordination, L2s, and app-layer innovation.

- Open finance values: He emphasizes self-custody, censorship resistance, and composability. That often translates to pro-token, pro-governance experimentation—great if you build in DeFi, contentious if you’re anti-token on principle.

- U.S. policy focus: Many alerts center on D.C. The framing is advocacy-forward, so complement it with legal specialists for nuance. Still, if you trade or build in the U.S., this bias is useful—regulatory moves can reshape liquidity and user access overnight.

- Optimism with an agenda: Expect strong narratives early. It’s part of movement-building and can be energizing, but it’s also why you should bookmark threads and validate with primary sources before making decisions.

I like voices with a clear spine—especially when I know where they’re standing. With Ryan, that vantage point is Ethereum-forward, policy-aware, and culture-conscious. Curious what that looks like in your feed day to day—how often he posts, the formats he uses, and where the real value shows up for builders and investors?

What you get by following @RyanSAdams

If you feel crypto news hits like a firehose, his feed is the pressure valve. You’ll see the policy stuff early, the Ethereum roadmap framed simply, and the culture cues that hint where builders and capital might go next.

“In crypto, the fastest signal isn’t always the best—unless you know how to filter it.”

Posting cadence and format

Expect steady day-to-day posts with spikes when policy or Ethereum milestones break. The rhythm feels like this:

- Threads when context matters: Walkthroughs on L2 economics, ETH monetary policy, or why a new bill matters. Example: during EIP-4844 rollout, he broke down fee impacts for users and devs in plain English.

- Quote-posts to add framing: He’ll boost a regulator’s statement or a founder’s update, then give a one-liner that tells you why it matters for the bankless thesis.

- Policy alerts in real time: House votes (e.g., FIT21), SEC posture shifts, MiCA timelines, or ETF approvals get flagged quickly—often quicker than mainstream outlets.

- Show promos and clips: Short cuts from Bankless conversations with devs, policymakers, and founders. Handy when you want the gist before watching the full episode.

- Quick takes during news spikes: When markets whip or a protocol ships, you’ll get a concise “why now” take that helps you sort signal from FOMO.

He doesn’t spam; he clusters. If a story deserves attention, you’ll see a thread plus follow-ups linking primary sources, long-form interviews, and relevant dashboards.

Strengths you can bank on

- Fast policy awareness: If crypto regulation moves, you’ll likely see it here first with a builder-friendly read. Example: during the ETH ETF approval week in 2024, his feed correctly emphasized the institutional unlock and the narrative shift it signals for ETH as an asset.

- Big-picture framing on ETH and L2s: He’s good at turning complex upgrades (like proto-danksharding) into plain takeaways: cheaper L2s, more users, better UX. For context, public data on L2BEAT showed post-4844 fee compression and activity growth—a trend he flagged as momentum, not a one-off.

- Cultural read: Memes, founder energy, and “what the cool kids build next” matter in crypto. He has a nose for this. When Base, OP Stack, and consumer apps heated up, he was early in pointing to the builder migration and new retention patterns.

- Connecting dots across media: A tweet thread → a Bankless interview → a follow-up policy note. That cross-format arc keeps you from missing the second-order effects.

There’s a reason social sentiment often anticipates crypto volatility: research has linked X/Twitter activity to short-term price reactions. If you’re curious, studies like the MIT paper on information spread (Vosoughi et al., 2018) and several crypto-focused analyses on sentiment/returns (e.g., Mai et al., SSRN) help explain why fast narratives can move markets—even before fundamentals catch up.

Where to be cautious

- ETH-leaning lens: He’s transparent about it. If you’re Bitcoin-first or token-skeptical, expect friction with some takes.

- Aspirational narratives: Early calls on consumer crypto, L2 UX, or regenerative finance can be right on direction and early on timing. Treat them as theses to test, not inevitabilities.

- Not investment advice: Opinions aren’t trade setups. Backtest your own thesis; don’t outsource conviction to any feed.

- Policy prediction risk: Even when you see a strong read on DC or Brussels, regulatory paths zig-zag. Always click through to the bill text, the 19b-4/S-1 filings, or the official FAQ.

- Echo-chamber hazard: Ethereum culture is strong. Keep a couple of credible contrarians in your feed to avoid confirmation bias.

Best ways to extract value

- Treat it as radar, not gospel: Use his alerts to spot what matters now. Then validate with primary sources:

- Policy: read the bill page on Congress.gov or EU portals; scan official SEC/CTFC releases.

- Ethereum: check EIP sources, AllCoreDevs notes, and L2 metrics on L2BEAT.

- On-chain: verify narratives on Etherscan, Dune, or ultrasound.money.

- Save threads with intent: Clip his best explainers, tag them “policy,” “ETH roadmap,” or “L2 UX,” and review weekly. You’ll start seeing patterns that casual scrollers miss.

- Watch the second-order links: If he quote-posts a regulator or a founder, open the reply chains from credible researchers and lawyers. That’s where nuance (and edge) lives.

- Time your alerts: Turn on notifications for heavy policy weeks (hearings, ETF decisions) or major ETH events (Devcon, AllCoreDevs). Mute what you don’t need to keep your feed clean.

- Journal your takeaways: One sentence per big story: “What changed? Who benefits? What breaks?” It cuts through hype and makes you action-ready.

Here’s the emotional truth: you can’t be everywhere at once. The right feed turns chaos into clarity. But is his feed the right fit for you—or are you better off pairing him with counterweights? I break that down next, including who gets the most value and who should add balance. Ready to see where you land?

Is he right for you? Audience fit

Great fit

If you’re nodding along to an optimistic, on-chain future, you’ll feel at home. Here’s who tends to get the most value:

- ETH builders and operators — You’ll get fast context on L2 momentum, protocol milestones (think EIPs, scaling roadmaps), and where the culture is leaning next. Electric Capital’s latest Developer Report shows Ethereum consistently hosts the largest developer community in crypto, so an ETH-forward lens helps you track where builders really are.

- DeFi power users — Policy alerts, L2 growth, and staking conversations inform risk and opportunity. If you’re active on Arbitrum, Optimism, or Base, his framing helps you understand the “why” behind new primitives and incentives.

- Policy watchers — He’s quick on U.S. regulatory moves (e.g., FIT21 chatter, SEC posture, state-level developments). If you care about how rules will shape your roadmap or portfolio, this radar is useful.

- Long-term crypto adopters — If your thesis is that open finance beats closed systems over a decade, you’ll appreciate the narrative, even when the market chops.

Needs balance

Some readers should pair his feed with contrasting voices so you don’t get stuck in a single echo chamber:

- Bitcoin-first investors — You may feel the ETH framing is heavy. Balance it with Bitcoin security and macro voices such as Lyn Alden or Jameson Lopp.

- Strict token skeptics — If you prefer “no tokens, just protocols,” expect friction with L2 token design and incentive talk. Add independent research accounts and academics to your mix.

- Headline-driven traders — His posts are thesis and policy oriented, not trade signals. Pair with quant or on-chain analytics feeds if you’re seeking entries/exits.

- Legal purists — If you want only citations and memos, add policy-first sources like Coin Center and Paradigm Policy for black-letter clarity.

Known debates and critiques

Understanding the fault lines helps you interpret any hot take with a cooler head:

- ETH vs BTC worldview — Bitcoiners prioritize hardness and simplicity; ETH advocates prioritize programmable blockspace and app-layer experimentation. Expect culture clashes on what “decentralization” should optimize for.

- Token incentives — Are airdrops and emissions bootstrapping networks or just extracting attention? Example: OP and ARB distribution frameworks often get praised for ecosystem growth and criticized for governance capture—both angles show up in replies. For context on network risks and decentralization claims, check L2Beat’s risk framework.

- L2 centralization paths — Today’s rollups rely on sequencers and upgrade multisigs; the promise is progressive decentralization. If you want receipts, L2Beat documents training wheels, and that nuance matters when evaluating security assumptions.

- Staking concentration — Liquid staking dominance (e.g., the largest pools) triggers valid concerns about governance and client diversity. Track live operator distribution via resources like Rated to separate fear from facts.

- Policy strategy — Some want compromise and incremental wins; others want maximalist resistance to bad rules. You’ll see both schools clash around U.S. bills and enforcement actions. Cross-reference primary docs to keep your footing.

Risk management mindset

This is how I keep signal high without getting spun by my own bias:

- “Two-source rule” — Before you act, confirm a claim with a primary source (bill text, court filing, EIP/GitHub, official press release). Skim replies from known builders for rebuttals.

- Label narrative vs. evidence — In your notes, tag what’s a thesis (“ETH will capture global settlement”) versus what’s a fact (“EIP-4844 shipped”). Treat those buckets differently.

- Watch base rates — Headlines can skew risk perception. Chainalysis’ 2024 report shows illicit activity remains a small share of crypto volume; that context helps when policy panic spikes. Source: Chainalysis 2024 Crypto Crime Report.

- Assume ETH-leaning selection — It’s a feature, not a bug. Balance with at least one Bitcoin and one neutral research feed so you don’t only see what you agree with.

- Time-box the feed — Set a 10–15 minute window and save threads for later. Your PnL and build velocity improve when you batch your research.

- Never treat posts as financial advice — Define position sizing rules before narratives hit your screen. You’ll thank yourself in the next drawdown.

Follow people who expand your map, not your ego.

Curious how to turn this into a repeatable system—alerts, lists, and a dead-simple workflow that keeps the good stuff and cuts the rest? I’m about to share the exact playbook next. Want it?

Pro tips to use his content smarter

“Curate aggressively, verify relentlessly, and let the rest scroll by.”

Build a balanced X List

I keep a tight X List that blends high-signal ETH perspectives, sober macro, and policy clarity—so I get big-picture context without the noise. Here’s a starter pack you can recreate in under five minutes:

- Core signal: @RyanSAdams, @BanklessHQ, @TrustlessState, @VitalikButerin

- Thesis + investing: @cburniske, @twobitidiot, @krugermacro

- Media counterweight: @cryptomanran (for what’s buzzing—useful to pressure-test)

- Policy/legal: @jchervinsky, @coincenter, @BlockchainAssn

How I use it: I open this List, not the Home feed, when I want a clean pass on policy and Ethereum updates. Research shows interruptions and context switching tank focus—UC Irvine’s Gloria Mark found it can take ~23 minutes to regain full attention after an interruption. A curated List keeps me in “research mode” and off the algorithm treadmill.

Power trick: Pin the List to your sidebar, and on mobile long-press the List to add it to your bottom nav for one-tap access.

Cross-check fast, then go deeper

When a thread catches fire, I run a two-step filter: verify, then explore. It saves hours and reduces the chance I anchor on a hot take.

- Step 1 — Verify (60–120 seconds):

- Open the primary source (bill text, GitHub PR, foundation post). For U.S. policy, try site:congress.gov or site:govinfo.gov.

- Skim first replies from builders/analysts you trust. Look for names like core devs, researchers, or policy pros. If they disagree, flag it.

- Use quick search filters: from:RyanSAdams ("policy" OR "L2" OR "SEC") to find related context he’s already posted.

- Step 2 — Explore (5–10 minutes max):

- Watch the referenced clip at 1.25x or 1.5x speed; add a timestamped note for the key claim.

- Cross-check with one independent source (e.g., @coincenter for policy, EIP/GitHub for technical).

Why bother? A 2018 MIT study (Vosoughi, Roy, Aral) found false news spreads faster than true news on social platforms. A 2-minute source check avoids hours of narrative clean-up later.

Set lightweight alerts

I only turn on notifications when the probability of real action is high. The goal is signal on-demand, not constant pings.

- When to toggle on:

- Policy weeks: stablecoin hearings, market structure bill markups, ETF filings/decisions.

- ETH moments: Devcon, ETHGlobal finals, major client releases, roadmap milestones (e.g., Dencun/Protodanksharding-era updates).

- What to mute (your sanity list):

- Keywords like: airdrop, memecoin, giveaway, price target, GM, whitelist.

- Personal triggers you know derail you—add them to X’s Muted words for 30 days and review monthly.

- Smart filter: Create a search bookmark: (from:RyanSAdams) (policy OR regulation OR ETF OR “L2” OR “roadmap”). Open it during volatile weeks.

Pro tip: Notifications feel urgent by default. Keep them off except for pre-planned windows. Your future self will thank you.

Save-to-read workflow

Ideas vanish in the feed. I use a lightweight capture-and-review loop so insights become decisions.

- Capture:

- Bookmark the thread on X and clip to a notes app (Notion, Obsidian, Evernote). Title with a verb: “Assess ETH policy shift — stablecoin framework.”

- Tag with policy, ETH roadmap, L2, or macro.

- Summarize (2–3 bullets, max 90 seconds):

- Claim: what’s being said.

- Evidence: link to the primary source.

- Action: watchlist, decision, or ignore.

- Review weekly:

- On Fridays, scan your “policy” and “ETH roadmap” tags. Archive, schedule, or share.

Why it works: The forgetting curve (Ebbinghaus) shows we lose most new info fast without reinforcement. A short weekly review converts passively consumed threads into retained signal—and that’s where the edge compounds.

Template you can copy:

- Title: [Topic] — [Date]

- 3-sentence summary

- Links: primary, counterpoint

- Decision: watch / act / ignore

- Tags: policy, L2, ETH, macro

One last thing—want the official links, emails, and extra resources I keep handy so you can move from “following” to actually doing something with this info?

Links, contact, and helpful resources

Official links to start with

- Primary X profile: https://x.com/RyanSAdams

- Bankless newsletter (long-form context, weekly themes, and essays): bankless.com

- Bankless podcast (interviews and timely debates): YouTube, Spotify, Apple Podcasts

If you only do one thing right now, follow the X handle above and add the newsletter. X keeps you current by the hour; the newsletter/podcast fills in the “why” behind the headlines. That tandem stops you from overreacting to a single post and gives you enough context to act intelligently.

How to contact Ryan (as commonly listed)

- Email: [email protected]

- Email: [email protected]

Want a higher chance of a response? Keep it simple and make the value obvious. Multiple outreach studies (from teams like Yesware and HubSpot) show that short, specific subject lines and clear CTAs tend to get better open and reply rates than vague pitches.

- Subject line ideas: [Policy] Short clip for next show | [Builder] L2 UX data (3 slides) | [Listener] Correction on SEC timeline (source inside)

- Get to the point fast: 3–5 sentences, one clear ask, and one link. If you need to attach materials, keep it to a single doc or deck link.

- Timing: Weekdays during U.S. mornings often work best for media inboxes. If it’s breaking policy news, send immediately and use a precise subject.

- Be quotable: Include a one-sentence takeaway he can share or react to on-air or on X.

- Polite follow-up: If no reply, one short nudge in 3–5 days. No “bumping” five times—quality over persistence.

Snappy outreach template

Subject: [Builder] Rollup fees fell 28% after X change — data for your next ETH segment

Hi Ryan — I run [project]. We tested [specific change] across [networks], and fees dropped ~28% (methodology linked). If you’re covering L2 UX soon, feel free to use the chart below. One-line takeaway: “[your quotable line].”

Link (2-min read): [URL]

Ask: Want the full CSV or a 3-slide summary?

Thanks, [Name] — [Role] — [X handle]

DMs can work in a pinch, but for anything substantive, email is the safer bet. Keep screenshots crisp, links clean, and your ask concrete.

Alternatives and complements

- @BanklessHQ — team-wide updates, show clips, and announcements

- @TrustlessState (David Hoffman) — ETH macro narratives and culture takes

- @VitalikButerin — research notes, cautions, and the why behind technical tradeoffs

- @cburniske — early-stage theses and token network framing

- @twobitidiot — market structure, governance, and sanity checks

- @krugermacro — macro context to avoid echo-chamber trades

- @cryptomanran — show-driven momentum and sentiment reads

- @coincenter and @jchervinsky — policy/legal clarity and primary-source interpretation

Mix these into a single X List to keep the feed focused, then toggle it on during policy weeks or big ETH milestones. It cuts noise and surfaces fast confirmations when a story breaks.

Still wondering the fastest way to verify it’s actually him on X—or the one subject line that gets the most replies? I’ve got quick answers and a 10-second checklist queued up next in the FAQ. Ready?

FAQ: Everything you wanted to ask about Ryan Sean Adams (rsa.eth)

I get these questions a lot. Here are the quick answers, plus a few safety checks so you don’t fall for impostors or waste time on dead ends.

How do I email Ryan Sean Adams (Bankless)?

Publicly listed options include: [email protected] and [email protected]. Keep it short and specific—he’s busy.

- Subject: lead with the ask and context (e.g., “Policy brief request: ETH staking research for Committee staff”).

- Body: 5–10 lines max. State the value, the timeline, and the one thing you want him to do.

- Attachments: avoid heavy files; link to a doc. Add a one-sentence summary of what’s inside.

- Signal: if it’s about news/policy, include a trusted source link so he can verify fast.

What is rsa.eth and why does it matter?

rsa.eth is his ENS name—an on-chain identity that maps a human-readable handle to crypto addresses and profile data. In plain English: it’s a Web3 username that can receive assets and signal reputation.

- Identity: ENS is widely used across Ethereum apps; it’s a shorthand for presence in the ecosystem.

- Payments & profiles: ENS names can resolve to addresses and public records. You’ll see rsa.eth referenced in ETH-native spaces as a trust anchor.

- Culture: using ENS aligns with the open-standards ethos he champions. Learn more at ens.domains.

Safety tip: never send funds just because a name looks right. Confirm you’re interacting with the correct name and resolved address in-wallet, and cross-check via reputable sources before moving any value.

How do I know it’s actually him on X?

Impersonators are common on crypto social. Here’s a fast verification checklist:

- Handle: confirm you’re on https://x.com/RyanSAdams.

- Cross-links: look for references from Bankless properties, such as @BanklessHQ or bankless.com.

- History: scroll back. Years of consistent tone, replies from known builders, and long-form clips are hard to fake.

- Skeptic mode: blue checks can be paid; they aren’t proof. Be wary of DMs asking for funds or “urgent” requests.

- Name spoofing: scammers use lookalikes (rn vs m, l vs I). Read the handle carefully.

Why be this cautious? Research shows false claims spread faster on social platforms than accurate ones—see MIT’s analysis of Twitter rumor dynamics (MIT). Pair that with the fact that a large share of adults regularly get news via social media (Pew Research), and verifying sources becomes non-negotiable.

Final take: Should you follow him?

If you care about Ethereum, crypto policy, L2 momentum, and the broader “bankless” thesis, he’s high-signal. You’ll get quick context on policy moves, strong framing for ETH-centric developments, and a steady read on culture.

- Follow if: you want timely policy awareness and an ETH-first lens on where crypto could be heading.

- Balance it with: contrasting voices (Bitcoin-first, regulatory skeptics, technical researchers) to keep your edges sharp.

- Your move: treat his posts as a radar, not a trade signal. Save, verify, and cross-reference before you act.

Bottom line: yes—if you’re aligned with the themes above. Just keep your verification habits tight and your inputs diversified.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.