Crypto Sensei Review

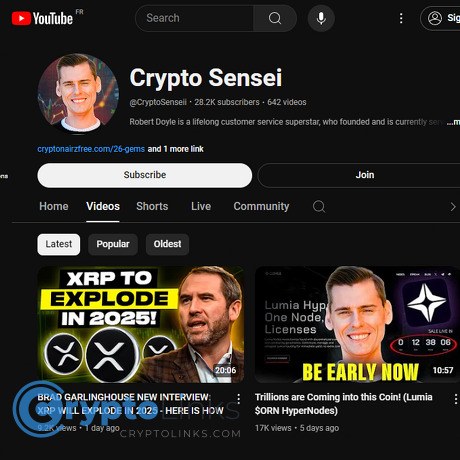

Crypto Sensei

www.youtube.com

Crypto Sensei YouTube Review Guide: Everything You Need to Know (+ FAQ)

Is the Crypto Sensei YouTube channel worth your time—or just another hype machine in your feed? Want straight talk, not moon math and “last chance” thumbnails?

I’m taking a close look at Crypto Sensei on YouTube. I’ll show what the channel does well, where to be cautious, how it stacks up against bigger names, and what actually matters if you care about XRP, altcoins, and practical crypto education.

The problem: YouTube crypto can waste your time (and test your emotions)

It’s easy to binge crypto videos and leave with nothing but FOMO, conflicting calls, and zero plan. You’ve seen it:

- Clickbait titles and overhyped thumbnails that push urgency over clarity.

- Conflicting predictions—“we’re going up” and “we’re going down”—in the same week.

- Undisclosed promotions and pay-to-shill deals that quietly steer the narrative.

- One-size-fits-all “price targets” with no risk plan or invalidation level.

- Education that entertains but doesn’t teach a repeatable process.

This isn’t just a vibe; regulators have flagged it. The UK’s FCA has repeatedly warned about high-risk investments pushed through social media and influencer hype (FCA InvestSmart). IOSCO’s 2022 report highlights how retail investors are swayed by online marketing and undisclosed incentives (IOSCO Retail Market Conduct). And when promotions cross the line, it gets costly—see the SEC’s action over a celebrity’s undisclosed crypto promo (SEC Press Release 2022-183).

On YouTube, attention is the asset. Your money shouldn’t be the collateral.

What I’m going to do for you

I’ll break down Crypto Sensei’s content style, research quality, transparency, and typical topics—especially around XRP and altcoin narratives. I’ll also compare where it fits relative to channels you probably know—Coin Bureau, Kitco News, Lark Davis, EllioTrades, The Chart Guys, Brian Jung, Boxmining, and CryptoWendyO—so you know when and why to watch it.

What you’ll get from this guide

- Who’s behind the channel and what to expect from the videos.

- How the content stacks up on research, accuracy, and transparency.

- Where it sits among other top crypto YouTubers—and when to pair it with them.

- What to watch for in XRP-focused content (including real risks and common traps).

- A simple way to use any crypto channel without getting wrecked.

- A straight-shooting FAQ answering the questions people actually ask.

Quick note

Nothing here is financial advice. This is a practical review and a way to think about crypto YouTube so you can research smarter and make your own decisions. Channels evolve—always check the About page and official socials for current disclosures and links.

Ready to see who runs Crypto Sensei and what the channel is really about—before you hit subscribe? Let’s open that up next...

Who runs Crypto Sensei and what the channel is about

The Crypto Sensei YouTube channel leans into crypto education, market commentary, and the kind of XRP talk retail investors keep searching for. Public profiles list Robert Doyle (Honolulu, HI) as the creator behind the “Crypto Sensei” brand—still, I always recommend checking the channel’s About page and official socials for the latest details.

What you’ll see on a typical week: market breakdowns, explainers on trending tickers or narratives, and opinion-led videos that connect the dots between headlines and price action. It’s the kind of content that helps you understand why a story matters, not just that it exists.

- Common themes: XRP updates and narratives, altcoin movers, cycle talk, regulation headlines, and practical “what this means for you” commentary.

- Format: charts on-screen, voiceover takeaways, curated headlines, and a storyline that ties it together.

- Utility: idea generation and context—useful if you want a relatable guide through fast-moving news.

“Clarity beats hype. Consistency beats luck.”

There’s a reason this style resonates. YouTube’s own documentation highlights how strong titles/thumbnails drive click-through rate and narrative structure improves watch time—exactly the incentives that shape crypto commentary on the platform. If you’re curious, see YouTube’s notes on CTR and impressions and watch time. And according to Pew Research Center, a sizable share of adults get news on YouTube, which explains why crypto channels skew toward timely, story-first videos you can follow quickly.

Channel basics: style, cadence, and format

- Style: conversational voiceover that blends education with opinion. Expect a mentor tone rather than a lecture.

- Cadence: regular uploads that react to news and ongoing narratives, especially around XRP and high-interest altcoins.

- Format: attention-grabbing thumbnails/titles (standard on YouTube), then a mix of charts, headlines, and plain-English takeaways.

- Length and pacing: efficient enough for a commute or coffee break; the narrative arc keeps you oriented even if you’re newer to crypto.

I like that the structure often moves from “what happened” to “why it matters” to “what to watch next.” That rhythm helps newer investors stay engaged without feeling lost, and it gives more experienced viewers a quick pulse check they can verify with their own tools.

Who this channel helps most

- XRP-curious investors who want consistent coverage and simple explanations of the latest headlines and narratives.

- Altcoin explorers who want ideas and context before going deeper with whitepapers, docs, and on-chain data.

- Busy retail traders who prefer relatable commentary to dense research PDFs.

- Early-stage learners who value a “talk me through it” mentor vibe.

If you prefer neutral, research-first deep dives with heavy sourcing, you’ll likely pair this with channels like Coin Bureau or macro interviews from Kitco News. That combo—relatable commentary plus rigor—tends to keep emotions in check. There’s a behavioral edge here, too: investors often underperform their own funds because of timing errors and emotional decisions, a gap documented in studies like Morningstar’s “Mind the Gap” research. A channel that keeps you engaged and focused can help reduce impulse moves—so long as you bring your own rules.

First impressions and brand

The “sensei” angle is clear: mentor energy, community-first tone, and a focus on turning headlines into usable takeaways. It’s friendly and motivating, which matters when markets chop and attention wanes. At the same time, personality-led brands can nudge your bias, so I keep a simple habit: enjoy the story, then separate facts from opinions in a quick checklist before making any move.

Want to see how I stress-test that balance between education and opinion—sourcing, accuracy, and the signals that tell you when to trust or tap the brakes? Keep reading; I’m about to share the exact filters I use to spot quality and avoid the traps that catch most viewers.

Content quality and transparency: what I look for (and how Crypto Sensei fares)

When I watch a crypto YouTube channel, I don’t care who “called” a price move last month. I care whether the creator helps me think better today. That means clear sourcing, honest context, and repeatable frameworks I can use without being glued to alerts.

“Trust, but verify.”

Research depth and sources

Strong crypto education blends narratives with receipts. I look for links to filings, on-chain dashboards, and primary announcements—not just screenshots and tweets. With Crypto Sensei, you’ll get a mix: sourced commentary in many videos and, at times, narrative-first takes that need a quick fact check before you act.

Good signs I watch for in any Crypto Sensei episode:

- On-chain context: references to XRPScan, Glassnode, Coin Metrics, or Whale Alert when discussing flows, supply unlocks, or exchange balances.

- Primary sources: links to SEC court documents, official company blogs, GitHub repos, or ISO 20022 specs when those terms appear.

- Timeline clarity: “Here’s what happened, here’s what’s confirmed, here’s what’s speculation.” That three-lane framing stops FOMO in its tracks.

Caution signs I keep on my radar:

- Unverified partnerships: claims like “X integrates with Y” without an official press release or docs. Quick fix: search the project’s blog or press page.

- Certainty language: “guaranteed,” “inevitable,” “next week for sure.” Markets punish certainty.

- Chart-only theses for non-TA topics: if the claim is about utility or adoption, I want usage metrics, not just candles.

Tip I use in real time: pause the video, open three tabs—project docs, one on-chain dashboard, one neutral news source—and see if the story holds up in under five minutes.

Accuracy and track record

I don’t keep a scoreboard of who nailed the last XRP move. That game rewards hindsight bias. What I track is whether a channel improves my decision-making. Crypto Sensei leans into narratives and education. That’s useful—if you treat it as idea generation and then validate.

Two simple patterns that separate signal from noise:

- Frameworks over forecasts: “If XRP’s weekly close reclaims the 200MA and exchange balances drop” is a framework. “XRP to $10 this month” is a forecast. One is testable; the other is entertainment.

- Base rates matter: When you hear a bold claim, ask: how often do assets of this type achieve that outcome? Behavioral finance research shows we overweight stories and underweight base rates (see Kahneman’s work on the planning fallacy).

Relevant context from research: Nobel laureate Robert Shiller’s “Narrative Economics” shows how viral stories move markets. That’s a feature, not a bug—just remember stories can outpace evidence.

Sponsorships and disclosures

Crypto YouTube runs on ads and sponsors. That’s fine—if the disclosures are clear. Whenever a product or token is highlighted, I expect to see a verbal disclosure, on-screen note, or a clear “sponsored/affiliate” tag with links. This isn’t nitpicking; the FTC Endorsement Guides say disclosures must be hard to miss.

Why I care: studies in online advertising show that obvious disclosures help viewers interpret content more critically, which is exactly what we want in crypto. Practical checklist I apply to any Crypto Sensei sponsor segment (or any channel’s):

- Is the sponsor labeled clearly? #ad or “sponsored” is a start.

- Is there a balanced overview? Pros and cons—even one legit risk—signal honesty.

- Can I verify claims? I click through to docs, audits, and team pages before I even consider testing a product.

One more guardrail: if something is “limited-time only” or uses urgency triggers, I slow down. Urgency is a marketing tool, not investment research.

Teaching style and usability

Crypto Sensei keeps the tone conversational and the pacing brisk. That’s a win for beginners and busy viewers who want to follow along without pausing every 10 seconds to Google jargon. I like when episodes use a simple scaffold:

- What changed: headline or on-chain shift

- Why it matters: the thesis in one sentence

- What would confirm/deny: two criteria to watch next

That format turns content into a repeatable habit. If you’re more advanced, pair these videos with raw data and a TA source so you get both narrative and structure. It’s the “two lenses” approach: story for context, data for conviction.

Emotional note, because we’ve all felt it: it’s easy to chase a thumbnail that screams moonshot. But the creators who help you write better rules—not bigger targets—are the ones that protect your capital. Ask yourself after any video: did I walk away with a checklist I can reuse, or just a price I want to see?

So here’s the fun part: given this teaching style and balance between narrative and sourcing, where does Crypto Sensei sit next to the research-heavy giants and the pure TA pros? Let’s look at how it stacks up—who you should pair it with and when to press play next.

Where Crypto Sensei fits among popular crypto YouTubers

People ask me all the time, “Who’s the best crypto advisor on YouTube?” The truth: there’s no single “best.” You get an edge by knowing which channel to trust for which job. That’s where this gets interesting.

“In a noisy market, curation is your edge.”

Quick comparison to known channels

- Coin Bureau — Polished, research-heavy, neutral tone. Expect 20–40 minute explainers on tokenomics, roadmaps, and risks. Example topics that perform well: updated takes on ETH staking withdrawals, Solana vs. Ethereum narratives, and Chainlink’s oracle moat. Great when you want fundamentals without the hype.

- Kitco News — Macro interviews with investors, economists, and market pros. Useful when you need the big picture on rates, liquidity cycles, gold vs. Bitcoin, and regulatory signals. Pair this with crypto channels to avoid tunnel vision.

- The Chart Guys — Tight technical analysis, minimal fluff. Clear levels, patterns, and risk framing. If you want actionable TA on BTC, ETH, and majors, this is the cleanest “just the charts” format on YouTube.

- Lark Davis, EllioTrades, Brian Jung — Fast-moving news, narrative tracking, and retail-focused ideas. Expect “what matters today” energy with lists, catalysts, and sentiment reads. Great for idea flow and market momentum checks.

- Boxmining — Early insights and practical guides. Historically strong at spotting new sectors and explaining how to use them (wallets, bridges, staking tools).

- CryptoWendyO — Trader-first lens with market commentary and TA. If you like clear invalidation points and risk talk wrapped in current events, this is a solid daily check-in.

Why does this mix matter? Pew Research has reported that a large share of adults now consume news on YouTube, with creator-led commentary playing a major role. That means your results depend less on “one guru” and more on how you blend formats—research, macro, TA, and narrative. Source: Pew Research Center.

How Crypto Sensei fits this lineup

Crypto Sensei sits near the narrative/explainer lane, leaning into XRP and trending altcoins while keeping things accessible. Think: short-to-mid videos that connect headlines to simple frameworks you can actually use. It’s not a TA-only shop and it’s not a 40-minute whitepaper breakdown either. It’s that middle ground that keeps you engaged without putting you to sleep.

- Strength: Opinion-backed education. You get context for why a story matters and where it could go next.

- Typical rhythm: News reacts, XRP updates, altcoin narratives, and timely “here’s what I’m watching” rundowns.

- Best use: Idea generation. Use the stories to build a watchlist, then verify with neutral research and TA.

If you follow XRP and like clear takes that don’t require a PhD, this slot in your YouTube stack makes sense. When a big headline hits—say, a court update or a liquidity partnership rumor—Crypto Sensei is the “what does this mean for us?” perspective you can scan before you go deeper.

When to watch which channel

- Need fundamentals and risk factors: Watch Coin Bureau, then use Crypto Sensei to pressure-test the narrative angle.

- Need macro context for timing: Catch Kitco News interviews, then decide if the Crypto Sensei story still fits the liquidity backdrop.

- Need entries/exits: Pair Crypto Sensei’s story with levels from The Chart Guys or CryptoWendyO.

- Need ideas and energy: Run Crypto Sensei alongside Lark Davis, EllioTrades, or Brian Jung to surface themes fast.

- Need early how-to or practical guides: Check Boxmining to operationalize the ideas you picked up.

One last thought before we get specific: narratives are great for finding opportunities, but they can also blindside you if the token’s real-world usage doesn’t match the story. So what shows up most on Crypto Sensei—and where can it go wrong or right for you?

Next up: XRP, altcoins, and the market narratives you’ll see a lot—plus the traps to avoid. Curious which claims deserve extra scrutiny?

Topics you’ll see a lot: XRP, altcoins, and market narratives

If you watch for long, you’ll notice a rhythm: big XRP headlines, hot altcoin rotations, and timely macro narratives. That’s not a bad thing—momentum and attention drive crypto. Just pair the story with a few quick checks so you’re surfing waves, not getting dragged by them.

“Hope is not a strategy; markets tax it heavily.”

XRP: what can go wrong? Key risks to consider

XRP content is engaging because the story is huge. But every strong story has a shadow. Here are the common risk angles I watch when XRP is front and center:

- Supply and escrow optics: XRP’s large total supply and Ripple’s monthly escrow releases create a permanent “how much supply might hit the market?” question. Even if much is re-locked, the overhang is part of the narrative. Skim Ripple’s own Markets Reports for context, then check independent charts for net circulating changes.

- Utility vs. big-claim narratives: “Global reserve” or “ODL everywhere” sounds exciting. The test is actual usage: active corridors, volumes, counterparties, and costs. Look for proof beyond logos—consistent volume data and real payment partners using XRP in production.

- The velocity problem: Bridge assets that move fast between buyers and sellers may not capture much value if holders don’t need to hold. It’s an old but relevant idea; if you’re new to it, read Multicoin’s breakdown on token velocity: Understanding Token Velocity.

- Regulation and legal uncertainty: Headlines can swing sentiment hard. For example, XRP rallied on the 2023 ruling that programmatic sales weren’t securities; then the case dragged on. Keep tabs via neutral coverage like Reuters, and remember appeals and remedies can take time.

- Competition and tech reality: Cross-border settlement is crowded. Think SWIFT gpi, stablecoins like USDC, and CBDC pilots tracked by the Atlantic Council’s CBDC tracker. Tech edges are a start; entrenched distribution wins deals.

None of this means “XRP won’t work.” It’s the checklist I use to separate momentum from meaningful adoption so I don’t get trapped by my own optimism.

Altcoin coverage and macro takes

Expect plenty on L1s/L2s (Ethereum, Solana, Base, Optimism, Arbitrum), stablecoins, CBDCs, and Bitcoin’s cycle mechanics (halvings, liquidity, ETFs). These videos are great for surfacing ideas—just run them through a quick evidence filter.

- Developers and traction: Are builders shipping? The Electric Capital Developer Report is a useful benchmark for dev activity by ecosystem.

- Real revenue and users: Check dashboards like Token Terminal and Artemis for fees, active users, and protocol revenue before you buy the story.

- Macro and flows: Bitcoin ETF inflows/outflows shape risk appetite. A fast glance at Farside’s ETF flow tracker can explain why everything feels “risk on” or “risk off” that week.

When a segment claims “altseason is back,” make it earn that claim with data: rising fees, sustained users, stronger developer counts, or clear catalysts (upgrades, launches, integrations).

Trading vs. investing: how to listen

Same video, two very different games. Listen for which game is actually being discussed.

- If it sounds like a trade setup: I ask three questions:

- What invalidates it? (A level, a news event, a time window)

- What’s the timeline? (Hours, days, weeks)

- What’s the risk/reward? (Is there a clear stop and target?)

- If it sounds like a long-term thesis: I want fundamentals:

- Users and retention (not just one weekend spike)

- Revenue/fees vs. token emissions

- Decentralization and governance (who controls upgrades/treasury?)

- Regulatory posture (exchange support, legal clarity, KYC/AML exposure)

Short-term narratives live and die on catalysts; long-term theses live and die on cash flows, users, and credible roadmaps.

Red flags to watch in any XRP/altcoin video

- Unverified partnerships: “Signed with a top-5 bank” without filings, quotes, or a press page you can find yourself. If it’s real, it’s usually on an official newsroom or regulator portal.

- Guaranteed timelines: “By Q4 for sure” in a space where audits, integrations, and compliance eat calendars. Treat dates as placeholders, not promises.

- Overly precise price targets: “$10.37 by June” is entertainment. Markets don’t respect round numbers, much less oddly specific ones without a model.

- Chart-only certainty on news-driven assets: If regulation or partnerships are the main drivers, pure TA without scenario planning is a warning sign.

- Pay-to-play signals: Aggressive affiliate links or undisclosed promos around thin-cap tokens. Default to skepticism and look for disclosures.

Remember, narratives move price in the short term; adoption keeps it there. The trick is telling which you’re hearing—right now, in this video—and acting accordingly.

Want a dead-simple, repeatable way to turn any video into a research checklist in under two minutes? That’s exactly what I’m sharing next—ready to steal the workflow?

How to use this channel without getting wrecked

YouTube is an edge if you treat it like research fuel, not trading signals. Here’s the simple system I use so a great video never turns into a bad decision.

A simple DYOR workflow for each video

Use this 4-step checklist every time you watch:

- Write the thesis in one sentence. If you can’t sum it up, you don’t understand it.

- List the evidence shown. Screenshots, links, on-chain charts, filings, team posts, code updates.

- Find one confirming and one conflicting source. Forces balanced thinking.

- Decide: watchlist, paper trade, or pass. No thesis = no trade.

Here’s a real example of how I’d handle a hypothetical XRP-focused video:

- Thesis: “XRP usage in cross-border payments is increasing and could boost price into year-end.”

- Evidence in video: Headlines on partnerships, court-date chatter, a few charts of remittance volumes.

- Confirming source: Ripple’s quarterly reports and XRP Markets Reports (utility, ODL corridors, volumes). If numbers align, that’s a legit check.

- Conflicting source: Independent on-chain dashboards (e.g., Dune queries, Glassnode-style metrics if available), plus official escrow release data. If active addresses or settlement volumes aren’t trending with the story, I downgrade confidence.

- Decision: If evidence is mixed, I put it on the watchlist and paper trade a setup. If on-chain + business data is clear, I consider a small position—only after setting invalidation.

Rule: “No sources, no position.” Flipping coins is not a strategy.

Why this works: checklists reduce errors. In medicine, simple checklists cut severe ICU complications dramatically; the same principle reduces impulsive trading mistakes. Overconfidence is costly—active traders who churn the most tend to underperform, as shown by Barber & Odean’s research (“Trading Is Hazardous to Your Wealth,” 2000). Your checklist is your seatbelt.

Risk management basics to keep you sane

Strong opinions are fine; strong position sizes are not. I keep it simple:

- Position sizing: I cap a single idea at a small slice of my liquid portfolio. For traders, many keep risk per trade tiny (think fractions of a percent). The goal is to survive losing streaks, not to be a hero on one call.

- Invalidation first: Before I enter, I write the condition that proves me wrong (a price level, a key metric, or a specific news event). If that happens, I’m out—no debates with myself.

- Pre-commit rules: I write the exit plan and size before I click buy. I don’t change it because a YouTuber sounds confident.

- Separate buckets: Long-term conviction positions and short-term trades live in different “buckets” with different rules. Mixing them is how people blow up.

A quick sanity check I use: if a trade going to zero would make me change my life plans, the position is too big. Most people don’t fail from bad ideas; they fail from bad sizing.

Tools and resources that help

- Learn and earn: I like Coinbase’s Learn and Earn when it’s available. Short modules, occasional token rewards, and you pick up basics fast before risking capital.

- Project reality checks: Whitepapers, docs, and GitHub repos tell you what’s built, not just what’s promised.

- On-chain + analytics: Open dashboards (e.g., Dune), or paid suites like Glassnode/CryptoQuant if you’re advanced. Look for user counts, active addresses, fees, settlement volumes—not just TVL.

- News you can cite: Reputable outlets and primary sources beat rumor threads. I save links inside a notes app for every thesis.

- Trade journal: Google Sheets or Notion works. Track thesis, size, entry, invalidation, outcome. The moment you start journaling, your win rate tends to improve because you stop repeating the same mistake.

- Price alerts, not price addiction: TradingView or CoinGecko alerts at your levels keep you from staring at candles all day.

One more reason to keep this tight: timing the market is hard. The average investor historically underperforms broad markets largely because of poor timing and behavior gaps (see DALBAR’s QAIB studies). Systems beat vibes.

Notifications and time management

Most crypto losses start with FOMO and end with regret. I run a notification diet:

- Batch-watch at set times: I queue videos and watch once or twice a day—no constant drip. 1.25–1.5x speed, pause to take notes, then act or archive.

- Creator alerts, not market sirens: I keep alerts on for a short list of creators I trust and turn off everything else. Less noise = better decisions.

- The 30/30/30 method: 30 minutes to watch and note a thesis, 30 minutes to find one confirming and one conflicting source, 30 minutes to structure a plan (or pass). If it can’t survive 90 minutes of scrutiny, it doesn’t get my money.

- Weekly review: Once a week I review wins/losses and ask: did I follow my rules? Any channel pushing me into FOMO gets muted for a while.

A great video should make your notes better—not your position size bigger.

Want quick answers to the questions I get most about this channel—and my bottom-line take? I’m covering that next. Curious which type of viewer tends to get the most value and who should probably skip it?

Crypto Sensei Review FAQ and my final take

Here are quick answers to the questions I get most, plus my bottom line after watching the channel across news cycles and altcoin hype waves.

Who is Crypto Sensei?

It’s a YouTube channel centered on crypto education and market commentary with a noticeable focus on XRP and trending altcoin narratives. Public listings attribute the creator to Robert Doyle (Honolulu, HI). As always, the smart move is to confirm via the channel’s About section and official socials for the latest details: https://www.youtube.com/@CryptoSenseii.

Who is the best crypto advisor on YouTube?

There isn’t a single “best.” Different goals, different feeds:

- Deep research and fundamentals: Coin Bureau

- Macro and pro market context: Kitco News

- Technical analysis: The Chart Guys

- Retail-friendly updates and narratives: Lark Davis, EllioTrades, Brian Jung, Boxmining, CryptoWendyO

- Narrative-focused education with an XRP tilt: Crypto Sensei

One tip I live by: use at least two contrasting sources. Research on investor behavior shows attention and confidence can push people into subpar decisions. Barber & Odean (2001, 2008) documented how overconfidence and attention-chasing hurt returns. Crypto is even faster. Balance the hype with neutral research and a TA view before acting.

What app pays you to learn about crypto?

Coinbase Learn and Earn runs short lessons and sometimes rewards you with tokens after a quick quiz. It’s not always available and varies by region, but it’s a low-risk way to learn the basics before you buy. Check availability here: Coinbase Learn & Earn.

Is Crypto Sensei worth subscribing to?

If you want accessible explanations, consistent XRP coverage, and narrative-driven commentary, yes—it’s worth adding to your rotation. The value is idea generation and staying engaged. You’ll get:

- Walkthroughs of current headlines and how they might affect XRP/altcoins

- Chart talk that’s approachable for newer investors

- Narratives around adoption, regulation, and cycles that keep you in the loop

What I recommend in practice:

- Pair these videos with a research-heavy source (fundamentals) and a pure TA source (risk/levels).

- When you hear a bold claim—partnerships, timelines, or precise targets—pause and verify via primary sources.

Rule of thumb: If a title triggers FOMO, write the thesis in one sentence and find one confirming and one conflicting source before you touch the buy button.

Why this matters: studies on crypto and social attention (e.g., Kristoufek, 2013; Garcia et al., 2014) show that spikes in search and social chatter often line up with price surges—and reversals. YouTube is a powerful attention engine. Use it to spot themes, not to outsource decisions.

Final verdict

Crypto Sensei is engaging, easy to follow, and especially useful if you track XRP and altcoin storylines. I use it as a narrative compass—not as a trade signal or a substitute for independent research.

- Strength: digestible explanations and consistent coverage of trending narratives

- Best use: idea generation and staying motivated through the noise

- How to watch: subscribe if the style fits, then cross-check with neutral fundamentals and clear TA levels

As always, keep your risk rules front and center. The channels that help you think better are keepers. If you want to take a look, here’s the link again: Crypto Sensei on YouTube.

CryptoLinks.com does not endorse, promote, or associate with YouTube channels that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.