CryptoWendyO Review

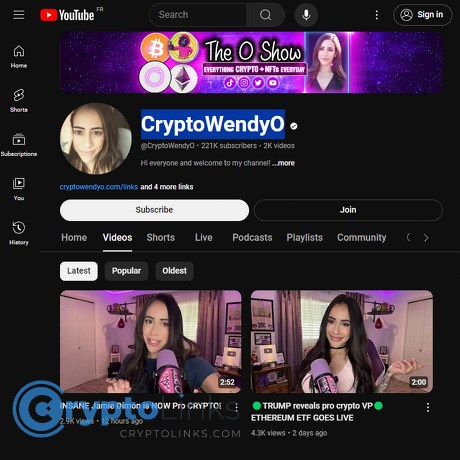

CryptoWendyO

www.youtube.com

CryptoWendyO YouTube Review Guide: Everything You Need to Know + FAQ

Scrolling crypto YouTube and wondering if CryptoWendyO is actually worth your time? Want daily context without getting dragged into a 45-minute hype marathon?

If you’ve felt that, you’re not alone. This guide cuts through the noise so you can decide fast whether her channel fits your goals, helps you avoid common traps, and actually makes you a sharper market participant.

The problem most crypto viewers run into

There’s no shortage of content—there’s a shortage of signal. Here’s what usually burns people out:

Here’s what I’ll do for you

I’m keeping this review practical and fast. You’ll get:

No fluff. Just the things that save you time and help you make better decisions.

Why this review should matter to you

I spend my days testing crypto channels, tools, and sites with a simple rubric:

That’s the lens I’m using here.

Quick verdict in one line

Actionable market updates and interviews with a trader-first tone—great for daily context on altcoins, NFTs, and risk mindset, as long as you still do your own research.

Want to know who CryptoWendyO is, what she’s known for, and whether her style fits your learning habits? Keep reading—next up, I’ll break that down so you can decide in under two minutes.

Who is CryptoWendyO and what she’s known for

CryptoWendyO runs at a fast pace: high-energy market coverage, trader-first angles, and a big, loyal community that cares about real outcomes for retail. If you’ve seen her on YouTube, you know the rhythm—news, charts, security, and straight talk. She’s built her brand around empowering smaller investors, pushing self-custody, and giving you enough context to act without panic or hype.

Background and audience

She didn’t show up as a VC suit or a venture-funded “media arm.” She grew by consistently covering what the market is actually doing and what that means for people with normal portfolios. That’s why her audience skews retail and global—people who want clarity, not a pitch.

When the headlines are loud, her framing tends to be simple: what matters, where the risk is, and what a sane plan could look like for a smaller account.

The O Show and events

Her flagship is The O Show—a mix of interviews, market talk, and community Q&A. Guests range from founders and on‑chain analysts to security researchers and policy voices. It’s useful because you hear builders unfiltered, then get a “how does this impact retail?” follow-up.

Content pillars at a glance

Tone and ethics

She’s known for no-nonsense delivery and frequent “not financial advice” reminders. You’ll often hear her separate opinion from fact, and rumor from confirmed—crucial in crypto where speed can beat accuracy.

“Your wins are yours, your losses are yours—protect both. Not financial advice, just self-respect.”

If you’re wondering how often she uploads, how long the videos run, and which formats pack the most signal per minute—want the quick answer before you hit subscribe?

Channel review: content quality, formats, and frequency

When I want fast, actionable context without wasting an hour, this channel is on my shortlist. Uploads are steady, segments are clearly framed, and the charts are always front and center. Some episodes stretch longer than I’d like, but chapters and timestamps keep it efficient. Interviews are as strong as the guest—great when builders show up with receipts, weaker when it turns into marketing talk.

“Clarity beats certainty—especially in crypto.”

Upload cadence and video length

Expect a dependable weekday rhythm with flexibility for breaking stories. You’ll typically see:

YouTube itself recommends using chapters to keep retention high, and you’ll notice she leans on that. If you’re in a crunch, chapter-hop through the headlines and the BTC/ETH levels first, then scan the altcoin section. For the nerds who like receipts on usability tips, YouTube’s own resources back this up: chapters help viewers navigate and stay engaged (YouTube Chapters, Creator Academy).

Production and structure

The flow is pragmatic: live or lightly edited, charts up, headlines pinned, and a recurring rhythm you can skim at a glance. A typical news episode feels like:

No flashy cinematics—just screen-share charts (usually TradingView), quick annotations, and honest commentary. That trader-first framing keeps the signal high.

Research and sources

Sources range from on-chain dashboards and exchange feeds to reputable crypto outlets and social intel. Importantly, she flags rumor vs. confirmed—critical in a market where speed can outrun truth. This isn’t just a nicety; the “false news outruns true news” finding is documented in peer-reviewed research (Science, 2018). That’s why you’ll hear explicit language like “unconfirmed” when a story is still developing.

When you want to verify claims she mentions, the usual suspects apply: project documentation, token unlock calendars, on-chain scanners (Etherscan, Solscan), and trustworthy data dashboards (e.g., Messari, Coin Metrics). She generally links primary sources in descriptions—use them.

Interviews and guest value

The guest list spans founders, analysts, and industry personalities, which is great for hearing how operators actually think. Value spikes when the conversation gets into:

Not every guest comes armed with details. When it tilts promotional, treat it as scouting: note claims, set reminders to verify, and wait for on-chain or code commits to back it up. Interviews are a great way to build a watchlist—not a buy list.

Community and engagement

Comments are active, social cross-talk is constant, and viewer questions often shape the next episode. You’ll see her pull trending tickers from the community, then run them through the “is there a story here today?” filter. Pro tip: check the pinned comment and video description after big news cycles—corrections and updates sometimes get parked there when stories evolve fast.

Engaged communities can surface edge cases you’d miss alone, but don’t outsource your judgment. Use the crowd to find topics; use your process to decide actions.

Sponsorships and disclosures

Like most crypto channels, there are sponsorships. The videos typically disclose partnerships verbally or via YouTube’s “Includes paid promotion” tag. That’s good practice—and it’s not optional. The FTC requires clear, conspicuous disclosures for endorsements and affiliate relationships (FTC Endorsement Guides).

Healthy way to watch sponsored content:

Bottom line: the content is steady, structured, and trader-oriented, with clear sourcing habits and a community that keeps the conversation moving. Want to know exactly what skills and insights you’ll pick up from watching—news context, TA basics, and risk systems you can actually use on your next trade? That’s up next.

What you can actually learn from her channel

Think of her channel as a daily trading companion: quick context, clear levels, and a reminder to keep your head when the market tries to mess with it. It’s not a “secret signals” feed—it’s “here’s what matters today and how a trader might manage it.” I like that.

“Strong hands aren’t born; they’re trained—one plan, one trade at a time.”

News and market context

Her market rundowns turn the firehose into a shortlist of drivers you can track. You’ll see her connect headlines to price behavior and liquidity—exactly what most people skip when they chase candles.

Sample you’ll recognize: when Bitcoin chops on headlines, she’ll say something like “watch DXY, funding, and BTC.D into the weekly close,” then mark key levels. That’s the difference between reacting to noise and managing a plan.

Pro tip from her format: keep a tiny notes doc with three things she repeats—macro cue (like dollar index), market breadth (dominance), and your coin’s one invalidation level. It turns 20 minutes of video into actionable awareness.

Technical analysis basics

She explains TA like a trader who’s been burned before—no mystical lines, just structure and risk. If you’re newer, you’ll actually use this.

Example trade frame you’ll see: “If price reclaims the 200 EMA on the 4H and closes above yesterday’s high, I like a starter with invalidation below that level; target the prior range high.” That’s a template you can adapt to anything—from BTC to small caps.

Altcoins and NFTs

She covers L1/L2 majors, trending narratives, and NFT moves with a “watchlist-first” approach. The goal isn’t to ape—it's to know what to watch and why.

Practical sample: if she highlights an L2 token like OP or ARB, you’ll usually hear “check unlock schedule and liquidity before chasing.” That one habit saves accounts.

Risk management and mindset

Here’s where the channel quietly shines. She repeats what most skip: position sizing, stops, and emotional control. Not sexy—very profitable to master.

Why this matters: research on retail trading shows overtrading and attention-chasing crush returns (Barber & Odean, multiple studies). Add in loss aversion (Kahneman & Tversky) and you’ve got a recipe for emotional exits. Her constant “have a stop, take profits” drumbeat is the antidote.

Beginner-friendly playlists and how-tos

If you’re new, her how-tos are short, blunt, and security-first. You’ll get the basics without a lecture.

Action tip: try a $50 “practice trade” with a written plan. The outcome matters less than the reps—you’ll learn entries, exits, and how your brain reacts.

The O Show (podcast)

If you prefer audio, her show is on YouTube and available on podcast platforms like Spotify. Interviews with founders, analysts, and security folks are great for catching narrative shifts while you commute or work out. I queue an episode, note one new metric or tool mentioned, and check it later—easy win.

Want to see how this stacks up against Coin Bureau’s deep dives, Altcoin Daily’s headline machine, or Benjamin Cowen’s cycle models? Keep going—next I break down where she beats each one, and where you should add someone else to your watchlist.

How CryptoWendyO compares to other top crypto YouTubers

If you want the sweet spot between pure education and boots-on-the-ground trading context, this is where she lands. She’s quicker and more opinionated than the textbook-style channels, but far less “moon-now” than the high-voltage call factories.

“In a market that never sleeps, your edge isn’t more noise — it’s clarity.”

Versus Coin Bureau (Guy)

Coin Bureau is your encyclopedia; Wendy is your terminal window with the chart up and the news tape flowing.

Real sample scenario: If there’s a surprise ETF headline, Coin Bureau might post an explainer on how ETFs affect flows and custody. Wendy will jump on a stream that day, pull up BTC/ETH charts, mark support/resistance, and talk invalidation levels so you can set a plan before Asia opens.

Versus Altcoin Daily

Altcoin Daily is a firehose of headlines. Wendy filters the news through a trading lens and adds levels so you’re not guessing.

Real sample scenario: “10 altcoins to watch” pops up everywhere. Wendy’s version likely says: “Here are the narratives; here’s where I’d get interested; if price loses this level, I’m out.” That framing turns hype into a checklist.

Versus Benjamin Cowen

Benjamin Cowen lives in models and macro cycles—the bull market support band, logarithmic regression fits, on-chain top signals.

Real sample scenario: BTC approaches a long-term regression boundary. Cowen explains the historical odds of rejection or expansion. Wendy maps the intraday ranges, liquidation clusters, and where she’d place stops if taking a stab.

Versus aantonop, 99Bitcoins, CryptosRUs, Crypto Banter

Real sample scenario: A new L2 launches a points program. aantonop would explain rollups and security assumptions; 99Bitcoins would publish a beginner guide; Banter might host devs and traders in a panel; CryptosRUs fields community questions; Wendy looks at liquidity, token unlock schedules, and where early price discovery could trap late buyers.

Who gets the most value from CryptoWendyO

If you had to choose just one for a daily market compass, would you rather get polished encyclopedia entries or a trader’s map with risk lines drawn in red? Next up, I’ll show you the exact 15–25 minute routine I use to follow her without FOMO or burnout—want the checklist?

How to use her channel the smart way (and avoid overwhelm)

You don’t need 3 hours a day to get value. Here’s the simple system I use so her channel fits into a 15–25 minute daily window without wrecking focus or triggering FOMO.

Start-here plan

Think “light daily context, one deeper rep each week.”

Sample week that actually fits a life:

Rule of thumb: If it’s not in your plan, it’s not your trade.

Alerts and filters

Use notifications so the right videos float to the top without you doom-scrolling.

Cross-verify before action

When something sounds actionable, run this quick verification. It takes 5–8 minutes and can save you from bad trades.

Example you can copy: She covers “XYZ chain launches incentives on Friday.” I’ll check: a) official announcement, b) TVL trend on DeFiLlama, c) token unlocks, d) liquidity on major DEX/CEX. If two or more look weak (thin liquidity + unlock soon), I pass or trade tiny with a hard stop.

Anti-FOMO checklist

Behavioral finance research shows checklists reduce bias-driven mistakes. The moment you feel the itch to chase, run this 45-second list:

“Impulse is not alpha.” Pre-commitment and stop-losses are proven tools against the disposition effect (holding losers, selling winners too fast).

Time-saving routine

Cut fluff, keep the signal.

Date:

Market bias (bullish/bearish/neutral):

Key BTC level:

Key ETH level:

Narrative to track (1–2 max):

Watchlist (3–5 max):

Action if X happens:

Stop level / Invalidation:

Quick question before you move on: do you want a straight answer on whether this channel belongs in your daily rotation—and the most common questions people ask about it? Keep going; that’s exactly what I’m covering next.

FAQ and final take on CryptoWendyO

What is CryptoWendyO known for?

Short, practical market briefings, chart-first takes, and interviews that let founders and analysts speak plainly. On a typical weekday stream you’ll see:

It’s trader-leaning without the moonboy theatrics. Expect frequent “this is my opinion, not advice” framing and a focus on helping retail think more like risk-aware operators.

Who is the biggest crypto influencer on YouTube?

“Biggest” depends on the yardstick—subs, average views, watch-time, or industry pull. The usual heavyweights include Coin Bureau, Altcoin Daily, Benjamin Cowen, aantonop, 99Bitcoins, Crypto Banter, and CryptosRUs. Wendy holds her own in the trader-news lane by staying current, showing charts, and keeping the talk grounded in risk and process.

My rule: pick creators by how well they match your goals (education vs. trading vs. macro) rather than chasing the biggest channel. Over time, breadth beats bias.

Does CryptoWendyO have a podcast?

Yes—The O Show is available on major platforms. It’s ideal for commutes or gym time when you still want market context and interviews.

Expect conversations with founders, analysts, and security voices. Treat any token talk as a starting point for your own research.

Is this the best crypto guide on YouTube?

No single channel is best for everyone. If you want a steady drip of market context + simple TA + trader mindset tips, this channel fits well in a smart rotation. A few reasons it works:

Quick sanity check before acting on any video: Is there confirmed news? What’s your invalidation? Did you check liquidity and upcoming unlocks? If you’re chasing a green candle, pause.

My final take

Subscribe if you want consistent, trader-minded context without the hype. Use her updates to shape your daily watchlist and plan, but verify with your own tools:

I’ll keep tracking her uploads and update this guide on cryptolinks.com so you always know if the channel remains worth your time. As always, nothing here is financial advice—stay curious, stay skeptical, and protect your capital first.

CryptoLinks.com does not endorse, promote, or associate with YouTube channels that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.