Daily Blockchain Visualisation Review

Daily Blockchain Visualisation

dailyblockchain.github.io

Daily Blockchain Visualization Review: What it shows, how to use it, and the FAQ you actually need

Ever wished you could actually seeBitcoin moving in real time—without fighting clunky explorers or staring at walls of TXIDs that mean nothing to your friends, students, or team?

If that sounds familiar, you’re not alone. Most tools are built for searching, not watching. When markets heat up or you’re trying to explain how the mempool works, static pages aren’t enough. You want a clean, visual feed of value flowing on-chain, minus the noise and the login traps.

Describe problems or pain

Making sense of raw blockchain data is harder than it should be. You can find any single transaction with a block explorer, but that doesn’t help you understand the story unfolding right now.

- Static lists = no context. Explorers show rows, not motion. You don’t see big flows forming, you just see line items.

- Beginner confusion. UTXOs, change outputs, mempool priority—try explaining those with a CSV view. People glaze over.

- Noisy dashboards. Heavy charts and dense filters are great for research, not for showing activity at a glance on a call or in a classroom.

- Privacy and paywalls. Many “live” tools want accounts, cookies, or ad tracking. Some even sneak in wallet connections. Hard pass.

- Timing mismatch. When blocks are congested, you need to see fees, mempool pressure, and “who’s moving” at that moment—not 15 minutes later.

There’s a reason visual tools stick: when you show how value flows, people get it. Research on visualization and comprehension backs this up—good visuals cut cognitive load and improve recall compared to raw text and tables. If you’re curious, Nielsen Norman Group has a solid overview on why visualization improves understanding: Data Visualization for UX.

“I just want to see if whales are moving to exchanges right now, not read through 400 transaction lines.”

Same. You shouldn’t have to babysit five tabs to get that answer.

Promise solution

Here’s the plan: I’ll walk you through Daily Blockchain Visualisation step by step—what you’re looking at, how to read the flows, and what features actually matter. No fluff. I’ll call out where it shines, where it falls short, and simple ways to use it for learning, teaching, and keeping an eye on big moves.

By the end, you’ll know whether it’s the right fit for your setup—or if you should pick an alternative and why.

Who this is for

- Curious beginners who want a friendly way to see how Bitcoin transactions move from mempool to blocks.

- Teachers and coaches who need a clean live view to explain confirmations, fees, and change outputs without losing the room.

- Analysts and ops folks who want a fast, no-login window to spot unusual flows as markets heat up.

- Content creators who need short, engaging clips that show the chain “breathing” during news events.

- Bitcoin watchers who keep an eye on exchange activity and large transfers without setting up complex dashboards.

What you’ll get from this review

- Plain-English walkthrough of the interface and what each element represents.

- Real usage tips to avoid common misreads (like mistaking change outputs for new recipients).

- Pros and cons based on actual use: speed, labels, filtering, and how it holds up under heavy traffic.

- Sample scenarios you can try today, like filtering for large movements or tracking a block as it fills.

- Quick answers to the questions everyone asks: Is it free? Is it real-time? Is it safe?

Imagine this: you set a minimum value filter, hit play, and immediately spot a chunky transfer linking a known exchange cluster to several fresh addresses. You pause, hover for the fee context, then watch those outputs settle into the next block. No login. No export. Just the story, right in front of you.

That’s the goal here—turn the noise into something you can actually use. So, what exactly is Daily Blockchain Visualization, who built it, and what does it show on screen?

Keep reading—next up I’ll explain what the tool is, where it lives, and what you’ll actually see when it loads.

What is Daily Blockchain Visualization?

A quick intro

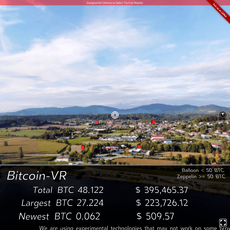

Daily Blockchain Visualization is a browser-based, open-source-style visualizer focused mainly on Bitcoin transaction flows. It animates activity in near real time so you can actually see value move, watch blocks fill, and spot connections between addresses or clusters where hints exist. No fluff—just the live story of the chain playing out on your screen.

“What you can see, you can understand faster.”

If you’ve ever stared at a wall of TXIDs and felt nothing, this flips the switch. Size, color, and motion do the heavy lifting so patterns jump out without you having to run queries or decode raw data.

Who built it and where it lives

It lives on GitHub Pages at dailyblockchain.github.io, which means it runs right in your browser—no installs, no extensions, and no wallet connection. Under the hood, it typically pulls from public Bitcoin node/mempool data sources to render fresh activity. Because it’s hosted statically and doesn’t ask for accounts or permissions, it stays simple and privacy-friendly by design.

If you’re technical, you can inspect how it works directly in the browser. That transparency matters when you want to trust what you’re seeing without handing over personal data.

What you’ll see on screen

Think of it as a living map of Bitcoin traffic. The main elements are simple and consistent:

- Nodes: individual addresses or clusters (groups of addresses that behave like a single entity). Clusters suggest relationships, but they aren’t guarantees.

- Edges: animated lines showing value moving from sender to receiver. The direction is obvious—you watch funds travel.

- Value bubbles: circle size scales with BTC amount. Bigger bubble = bigger move. It’s hard to miss whale-ish transfers.

- Tags (when available): hints like “Exchange,” “Miner,” or “Service” add context for well-known entities. Labels are helpful, not absolute.

- Live feed: mempool and/or recent blocks stream in, so you see unconfirmed transactions appear, then get packed into blocks as they confirm.

- Quick lookups: hover tooltips often show basics like value, time, and fee-related metadata so you can connect visuals to core details.

There’s an emotional kick to it too. When a huge bubble glides across the screen into a labeled exchange cluster, you feel that something meaningful just happened—even before you check a single number.

Why this visual approach works

Our eyes are ridiculously good at spotting size and motion. That’s not just a hunch—decades of research back it up. The preattentive features idea (color, size, movement) and the graphical perception work by Cleveland & McGill explain why certain visuals cut through noise. And Richard Mayer’s multimedia learning research shows people learn better from words + visuals than text alone.

In plain terms: animated flows + scaled bubbles = faster pattern recognition with less mental strain. You don’t need to “decode” a block explorer table; you just watch the network breathe.

A 30‑second example

Imagine a single input sends ~650 BTC to an exchange-linked cluster with a few change outputs. Here’s what that looks like in the visualizer:

- A large bubble appears on a relatively quiet node—your attention locks onto it instantly.

- It travels along an edge into a cluster labeled “Exchange” (label availability varies).

- Smaller bubbles branch off as change outputs—useful for understanding UTXO behavior without reading raw scripts.

- If you hang around for a block or two, you’ll watch that flow settle into a block strip as confirmations roll in.

In under half a minute, you’ve formed a mental model of “who moved what, roughly where it went, and when it landed”—something that usually takes multiple tabs and manual cross-checks.

What it is (and what it isn’t)

It’s a clean, real-time window into Bitcoin movement built to be understood at a glance. It’s not a forensic suite, a compliance tool, or an alerting system. Think “live visual context” first. When you need hard attribution or deep history, you’ll still hop into explorers and analytics platforms—but the visual lays the groundwork, fast.

Ready to see it in action without getting overwhelmed? Up next, I’ll show you the exact on-screen controls I use to load it, cut the noise, and follow the biggest moves in under 60 seconds—curious which single toggle changes everything?

Getting started: the basics and the UI at a glance

Access and setup

Open Daily Blockchain Visualisation on a desktop browser for the smoothest experience. It loads right in your browser—no signup, no fees, no extensions.

- Best on Chrome, Edge, or Firefox (latest versions). Safari works, but performance can vary.

- Turn on hardware acceleration in your browser settings if animations feel choppy.

- Let it sit for a few seconds the first time—data streams in live.

- If nothing appears, refresh and temporarily whitelist the page in any strict blockers. It typically pulls public data and needs those calls to paint the scene.

Quick start

- Step 1) Hit Pause as soon as it loads. This gives you a still frame to understand the layout.

- Step 2) Glance at the legend/tooltips so you know what colors and sizes represent in this session.

- Step 3) Set a minimum value filter (e.g., show ≥ 1 BTC) to reduce noise.

- Step 4) Press Play, then follow one or two large transfers from mempool to block.

“The first time you watch the mempool swell, you don’t just see Bitcoin—you feel the network breathe.”

Reading the view

Think of it as a moving map of transactions:

- Nodes are addresses or address clusters (groups that likely belong together). Larger nodes often hint at more value moving through.

- Edges are transfers. Thicker or brighter lines typically suggest higher value—watch those.

- Colors separate roles or known entities when available (e.g., an exchange tag). Treat tags as hints, not absolute truth.

- Mempool vs blocks: unconfirmed transactions appear in the live flow; once a block is mined, confirmed transactions shift into that block’s cluster.

- Tooltips usually reveal the essentials: amount, timestamp, confirmation state, sometimes the fee context.

A real-world style moment: I pause, set a 5 BTC filter, and hit play. A large transfer (say 27.8 BTC) shows up from a cluster with an exchange label to a fresh address. Two outputs appear—one large, one small. That smaller one is likely the change output, not a separate “payment.” A couple of minutes later, both sit comfortably inside the next block. That’s a typical exchange withdrawal pattern you’ll start to recognize fast.

Key controls

- Pause/Play: Your best friend. Pause to inspect, play to watch the flow.

- Speed slider: Slow it down during busy periods; speed up when blocks are quiet.

- Value filter: Hide small transfers and let the whales float to the top. Try 1–5 BTC as a starting point.

- Labels toggle: Show/hide entity tags and annotations to keep the view readable.

- Zoom and pan: Focus on a hotspot, then reset the view when you’re done.

- Focus/highlight (when available): Click a node or edge to highlight its immediate connections and reduce clutter.

My 60-second starter routine

- Pause on load, set ≥ 2 BTC filter.

- Hover two or three large edges to check amounts and fee timing.

- Press play and track those edges into a block. Note the time it takes (that’s a rough read on current pressure).

- If the screen gets noisy, toggle labels off and slow to 0.75x speed.

Performance tips

- Keep a couple of heavy tabs closed. Live animations can be GPU-hungry.

- Raise the minimum value filter during peak hours to reduce rendering load.

- If animations stutter, lower the speed or pause and step through manually.

- Full-screen the browser window so zooming doesn’t crop tooltips.

Common misreads to avoid

- Clusters aren’t people: a cluster suggests related addresses, not a confirmed individual.

- Change outputs: the smaller output often goes back to the sender. Don’t assume every output is a “payment.”

- Internal exchange moves: big transfers between tagged entities can be housekeeping, not market-moving flows.

- Labels are imperfect: tags help context, but they can lag or miss new tagging.

Why motion helps your brain “get it” faster

Animation and interaction reduce the cognitive load of tracking change over time—if you control the pace. Research on animated transitions shows that motion can improve object constancy and comprehension when paired with simple controls like pause and hover (Heer & Robertson, 2007). Keeping the UI minimal and letting you pause/inspect aligns with how our working memory prefers to process streams of events.

Translation: slowing the feed and hovering large edges is not just a nice-to-have—it’s the shortcut your brain wants.

Now that you can open it, read it, and control it, the fun part starts: which features actually help you learn fast and spot meaningful movement—without getting lost in the noise?

Features that actually help you learn and spot movement

Real-time flow you can actually read

When the screen starts animating on Daily Blockchain Visualisation, you’re not staring at a spreadsheet—you’re feeling the rhythm of the Bitcoin network. Transactions pop in, link across addresses, and then settle into blocks. The bigger the move, the bolder it looks, so your eyes are naturally pulled to meaningful activity.

- Whale signatures: Set a minimum value and watch for thick, high-value arcs. If you’re scanning for 100+ BTC transfers (or your own threshold), the noise falls away fast.

- Block cadence: You’ll literally see the “breathing” of the network—mempool fills, confirmations clear it, and the cycle repeats. During busy periods, pending transactions bunch up on-screen. It makes fee pressure visible in a way charts can’t quite match.

- Moments that matter: Price volatility? Exchange maintenance? You don’t need a tweet to tell you something’s up—the visual flow tightens, large inputs funnel toward labeled exchange clusters (when available), and you get context at a glance.

“Don’t trust, verify.” In practice, that means looking at movement—not narratives. Watching it live hits different.

Entity hints that add context (without false certainty)

You’ll see tags for known services (exchanges, custodians, payment processors) when the data is available. It’s a great shortcut for context: a big transfer to a tagged exchange looks very different from funds bouncing between fresh addresses.

But here’s the nuance I appreciate: the visual clustering is based on common heuristics, not magic. It suggests relationships; it doesn’t swear to ownership. That lines up with what multiple studies have shown—address clustering (like the multi-input heuristic) is useful but imperfect:

- “A Fistful of Bitcoins” (Meiklejohn et al., 2013) documented how tagging and clustering can map network flows—but also where it can mislead.

- Reid & Harrigan (2013) analyzed how anonymity breaks through graph structure, again with caveats.

In other words, treat the labels as helpful hints. Powerful hints, yes—but hints. That’s why I like that the tool keeps things visual and honest instead of pretending certainty.

- What patterns look like: batched exchange withdrawals appear as a single input fanning out to many outputs; CoinJoin-like activity looks like a confetti of equal-sized outputs; consolidation shows many inputs collapsing into fewer outputs.

- What to watch for: thick lines into a tagged exchange during a price move (deposit wave), or outflows afterward (withdrawals and rebalancing). It’s a story you can read in seconds.

Exploration extras that make you smarter, faster

The interface is intentionally minimal—because less UI, more signal.

- Block-by-block progression: You can follow transactions as they jump from mempool to confirmed blocks, building an intuitive sense for “time-to-settlement.”

- Tooltips with context: Hover to see value, timing, and fee-related info. Knowing the fee and when it broadcasted helps you mentally tie congestion to confirmation speed.

- Easy navigation: One-click pause/play, drag to pan, scroll to zoom, and a simple value filter to cut the noise. That’s it. No maze of toggles to wade through when the market is moving.

Small touch, big payoff: pausing and stepping through a single large transaction’s path gives you a 30-second micro-lesson in inputs, outputs, and settlement. It’s the kind of “aha” moment that sticks.

What the animation teaches your brain (without a manual)

Some things are hard to learn from a static explorer but obvious here:

- Network mood: You’ll sense when the mempool is tight versus quiet. That instinct helps you understand why a low-fee transaction might sit for hours.

- Churn vs real movement: Not all volume is meaningful. Short, fast loops between unlabeled clusters often signal internal consolidation; clear funnels into or out of tagged services usually matter more.

- Timing fuel: Watch how fee levels correlate with confirmation speed. When blocks are packed, you’ll see low-fee transactions hang back visually—great for teaching fee dynamics.

I like tools that make me feel closer to what’s happening. This one does it. You see the story, not just the stats—and sometimes that’s exactly what you need.

But here’s the question I always ask when a tool feels this smooth: how trustworthy are the tags, clustering, and “near real-time” feed, and what blind spots should you expect? Let’s unpack that next.

Data quality, safety, and what it can’t know

Data and timing: how “live” is live?

I treat the feed as a live window with a short delay, not a courtroom transcript. Transactions propagate across the Bitcoin network in seconds, but what you see in your browser depends on node/API latency, local performance, and the tool’s refresh cycle. In quiet periods, it feels “instant.” During busy mempools, you’ll spot slight lag or a transaction that appears, changes fee, or vanishes due to Replace-By-Fee (RBF).

Why that happens:

- Propagation lag: Research has shown median propagation is fast but not uniform across the network. Decker and Wattenhofer found early evidence of multi-second propagation variance across peers (study).

- Different mempools, different views: Not all nodes accept the same transactions or keep them equally long (Bitcoin Core mempool policy), so a mempool snapshot isn’t globally identical.

- RBF and CPFP change the picture: BIP125 RBF lets senders bump fees by replacing a tx; Child-Pays-For-Parent can pull a stuck parent into a block. Your screen can shift as fees and dependencies change.

- Mini reorgs happen: A transaction may look “in a block,” then hop if there’s a tiny chain reorganization. Rare, but real.

“The blockchain shows what happened, not why it happened.”

That’s the mindset: it’s excellent for what’s moving now. If you’re doing forensic work, cross-check with a block explorer and keep a paper trail of txids and block heights.

Is it safe?

Yes—safer than most crypto tools because it runs in your browser and never asks for wallet permissions or keys. No sign-in, no seed phrases, no MetaMask pop-ups. It’s the “look, don’t touch” of on-chain tools.

Practical safety tips I use:

- Use it as a viewer only: Never paste private info. It doesn’t ask, and that’s a feature.

- Inspect if you’re cautious: It’s open-source style tooling, so you can review the code or save the page and run a local copy offline for demos.

- Privacy basics: If you’re sensitive about browsing metadata, open in a private window and block third-party trackers at the browser level.

The attack surface here is tiny compared to exchanges, wallets, or browser extensions. The trade-off is you don’t get deep, interactive power—just a clean, low-risk visual.

Limits and caveats you should expect

This is the part that separates power users from panic-watchers. The visuals are honest, but interpretation can mislead if you gloss over context.

- Labels are helpful, not gospel: Tags for exchanges or services can be incomplete, outdated, or partly accurate. Exchanges rotate deposit addresses; clusters change over time. Treat a label as a hint, not a verdict.

- Clustering is probabilistic: Heuristics like “common-input ownership” work until they don’t—especially with CoinJoin or collaborative spends. Classic research (Meiklejohn et al., A Fistful of Bitcoins) mapped large clusters, but modern privacy tools can break assumptions.

- Internal exchange shuffles ≠ whales buying or selling: You might see 5,000–20,000 BTC moving between known hot and cold wallets. That often means rebalancing or custody changes—not a giant market order. I’ve seen “whale alerts” pop off while exchange balances on Glassnode barely budged. Context wins.

- Off-chain is invisible: Lightning, exchange order books, internal ledgers, and some cross-chain swaps don’t show here. The biggest market moves can happen without a single on-chain tick until settlement.

- Fee pressure shifts narratives: In congestion, a lot of small transactions can “look bigger” collectively than one fat whale. Without fee context, you might misread urgency.

- USD value is not the chain’s job: You’ll see BTC value flow; your brain turns that into dollars. Always check the timestamp and price—500 BTC at $40k isn’t the same story as 500 BTC at $70k.

Real-world example you’ll likely run into: a big labeled exchange wallet sends 12,000 BTC to a fresh cluster, then another 8,000 BTC arrives from different addresses. Looks like accumulation. In many cases, it’s just a scheduled cold-wallet consolidation. The fix is simple: verify if both sides carry the same entity tag over time, or paste the txid into a block explorer and check the pattern—batched outputs, regular sizes, and timing windows scream “ops,” not “whale.”

How I keep my reads sharp and my stress low:

- Confirm big moves in a separate explorer before reacting.

- Note if sender and receiver share the same entity tag—internal moves are common.

- Watch for batching patterns: many equal-sized outputs often mean payouts, not panic.

- Remember RBF: a “disappearing” tx likely just got fee-bumped.

With that framing, this tool becomes your “radar,” not your “autopilot.” Ready to put it to work without overthinking it? Up next, I’ll show exactly how I use this live view to teach, monitor big moments, and add context to fast markets—want the simple checklist I rely on when volatility spikes?

Practical ways to use it (without overthinking it)

Learn and teach

I use Daily Blockchain Visualisation as a “moving whiteboard.” It takes 30 seconds to get someone from confused to curious, and that’s the whole game. Here’s a simple walkthrough you can run with a friend, a class, or a team.

- Two‑minute demo: Pause the stream. Set a minimum value (e.g., 2–5 BTC) to cut noise. Point to the mempool side, say “this is the waiting room.” Hit play and watch a few transactions migrate into a block. When a block completes, count that as one confirmation.

- Explain confirmations in plain English: “Each block is like a page in a ledger. More pages stacked on top make earlier entries harder to change.” Then watch another block land. That second block is “2 confirmations.”

- Show change outputs: Pick a transaction with multiple outputs. Explain that Bitcoin often returns “change” back to the sender’s control. It’s normal, not “money to many friends.” This one tip prevents so many misreads.

- Teach fees and block pressure: When the screen looks busy and blocks fill fast, mention that fees tend to rise during congestion. On halving day 2024 (when Runes launched), this view would’ve looked like a rush-hour highway.

“When people see Bitcoin breathe in real time, the lightbulb turns on.”

There’s solid learning science behind this. Visuals plus narration boost understanding and recall (see Mayer’s multimedia learning and Paivio’s dual‑coding theory). Use the animation as your anchor; keep your words simple and focused.

Watch activity

I keep it open during newsy hours to answer one question fast: “Is something moving?” No spreadsheets, no overthinking—just a quick read of the room.

- Whale watch without noise: Set a higher threshold (e.g., 25–100 BTC). You’ll instantly see the chunky moves that matter. If big outputs start targeting tagged exchange clusters, that can mean funds are headed toward venues—context worth noting.

- Exchange patterns you can spot: Bursts of many similar-sized outputs from a known tag often signal UTXO consolidation or hot-wallet rebalancing. That’s operational housekeeping, not necessarily “sell pressure.”

- Congestion meter: When the mempool side thickens and blocks seal quickly with higher-value transactions, it’s usually a fee-up environment. During inscription spikes in 2023–2024, this view turned into a conveyor belt of full blocks.

- “Calm vs. chaos” in 10 seconds: On quiet days, the screen feels sparse and steady. On wild days, it’s kinetic and dense. That gut check helps decide whether to dig deeper in an explorer.

Important: this is context, not a trading signal. As research on Bitcoin’s microstructure shows, transaction flows reflect many things—fees, consolidation, internal movements—not just directional bets.

Content and ops

If you make content or run ops, this tool can do more than look pretty. It’s a live, visual heartbeat you can drop into your workflow.

- Create explainers that pop: Record 20–40 second clips with OBS or your browser’s recorder. Start paused on a big transaction, set your threshold (e.g., 10 BTC), then play and narrate: “Watch this flow into a block—now it’s 1 confirmation.” People remember motion.

- Live market coverage: Put it in a split-screen during CPI prints, ETF headlines, or protocol updates. When the screen starts lighting up, you can say, “We’re seeing heavier flows now,” and show rather than tell.

- NOC or war-room overlay: For ops teams, keep it on a side monitor. Pair it with a block explorer for drill‑downs. When you catch an odd burst—say, a service tag outputting to dozens of fresh addresses—you’ve got a visual cue to investigate.

- Training new hires fast: New analyst? Spend 15 minutes here. Have them label what looks like change, what looks like consolidation, and what looks like exchange inflow. They’ll ramp up way faster than with static lists.

Quick routines I actually use

- Morning scan: Threshold at 5–10 BTC for 60 seconds. If it’s quiet, I lower it to 2–3 BTC to see the cadence. If it’s wild, I push to 25+ to isolate the elephants.

- Event mode: During launches or upgrades, I watch how quickly transactions migrate into blocks. Rapid confirmations with high-value flows usually mean fees are elevated and senders are willing to pay for priority.

- Teach-in minutes: Show one large transfer entering a block, then rewind your clip and slow it down for a “chaptered” explainer on mempool → block → confirmation.

Common misreads to avoid

- Many outputs = whale distribution? Often it’s just UTXO consolidation or change. Look for patterns: similar output sizes and a fresh address receiving “change” is normal behavior.

- Tag = ownership certainty? Labels are helpful, not perfect. Treat them as hints. Internal exchange moves happen all the time and can be mislabeled by third parties.

- Fast blocks = price signal? Not necessarily. Fast blocks plus large exchange inflows might be noteworthy, but you still need a proper explorer or analytics tool for confirmation.

If you had a magic button to filter only the biggest transfers, export clips with timestamps, and set custom alerts, would you use it? I’ve got thoughts on what’s missing and how it could be 10x better—want to see the wishlist next?

Where it falls short (and what I’d like to see next)

I love watching the chain breathe here, but the cracks show up fast when you use it for real work. These aren’t deal-breakers—they’re opportunities. And if they get addressed, this thing goes from “cool” to “must-have.”

Coverage: Bitcoin only limits the story

Right now, it’s mostly a Bitcoin window. That’s fine for BTC watchers, but it misses the reality that huge flows live elsewhere:

- Stablecoins run the show on Ethereum and Tron most days. If $200M in USDT moves on Tron, you won’t see it here—yet. For context, public datasets from Coin Metrics’ State of the Network and dashboards like DefiLlama Stablecoins have tracked this shift for years.

- ETH, L2s, and Solana are where user activity spikes during mania. If you’re teaching or monitoring the market, multi-chain playback isn’t a “nice to have”—it’s table stakes.

Wish list: quick chain switcher (BTC/ETH/TRON/SOL + popular L2s), per-chain presets, and a stablecoin layer that highlights USDT/USDC flows across chains by entity where labels exist.

Controls and performance: when the screen gets busy

During mempool surges or when exchanges reshuffle cold wallets, the scene can bog down and the filters feel too blunt.

- Filtering is shallow: a single value toggle won’t cut it. I need conditional rules like “show > 50 BTC OR any flow touching a tagged exchange” and a quick switch between sats and BTC.

- Heavy scenes lag: weaker laptops stutter once the canvas fills with hundreds of edges. This is where smarter rendering helps—WebGL or Canvas rendering, level-of-detail (LOD) that collapses micro-flows, and background threading with Web Workers.

- Mobile is basic: pinch-zoom is jerky, labels overlap, and tabs refresh lose context. A lightweight “TV mode” for phones and tablets would be clutch.

Wish list: multi-rule filters, a “keep last N minutes” timeline that trims older edges automatically, and performance toggles (LOD on/off, opacity decay, snapshot mode).

Clarity and labels: the map isn’t the territory

“The map is not the territory.”

Tags and clusters are helpful—but they can mislead if presented as certainty. And clarity is kindness, especially for learners.

- Legend on-screen: I shouldn’t have to guess what a color or shape means. A persistent legend and quick tour would save a lot of “wait, what am I looking at?” moments.

- Label density: when things heat up, labels stack. Use collision avoidance, smart truncation, and hover-to-expand to keep the picture clean.

- Confidence cues: show attribution confidence (e.g., low/medium/high) and label provenance. This aligns with best practices in visual analytics (see works by Tamara Munzner and Colin Ware on uncertainty and perception).

- Accessible colors: a colorblind-safe palette and high-contrast option make a big difference for classrooms and streams.

Wish list: always-on legend, attribution confidence badges, and better label management with a “hide/show by entity” toggle.

Exports, sharing, and teaching tools

This is built for teaching—but it doesn’t yet give teachers what they need to capture and share the story.

- One-click export: PNG snapshot, MP4/GIF capture, and transparent background for overlays.

- Shareable moments: permalinks with time range, speed, and filters encoded so anyone can replay the exact view.

- Story mode: annotate key hops, pin arrows, and step through a flow with timestamps—for YouTube shorts, X clips, or live demos.

- Data handoff: JSON export of current graph and a simple webhook to push “events” (e.g., >1,000 BTC moves) into Slack/Discord.

Alerts and watchlists that actually help

When big money moves, I don’t want to stare at the screen—I want to be pinged.

- Custom thresholds: “notify on > X BTC” or “show only entities in my watchlist.”

- Entity rules: alert when funds leave/enter specific exchange clusters or known mixers.

- Mempool pressure: warn when fee bands spike above a set sat/vB.

Wish list: sound/visual alerts, email/webhook options, and a compact alert log with links to center the camera on the event.

Accessibility and internationalization

People all over the world learn from tools like this. Make it welcoming.

- Keyboard-first controls and ARIA labels for screen readers.

- Localized UI for major languages and a simple text size slider.

Transparency knobs

Tell me what I’m looking at under the hood so I can trust the picture.

- Data source disclosure: which indexer/API, refresh cadence, and known outages.

- Label provenance: where tags came from and when they were last verified.

- Selectable backends: let advanced users point to their own node/indexer for consistency with internal systems.

So if you need multi-chain coverage, smarter filters, or alerting today, what should you pair this with—and when is a different tool the better choice? Keep reading; I’ll stack it up against explorers, research suites, and whale-alert bots next and show exactly where each one shines.

Alternatives, comparisons, and quick FAQ

How it stacks up

Here’s the fast reality check: if you’re used to standard explorers like mempool.space or Blockchain.com Explorer, you’re getting tables, lists, and fee views. Useful, but static. This visualizer is about motion and context—you see value move, link, and settle, which often tells a clearer story than a page full of TXIDs.

Compared to research tools like OXT and Glassnode Studio, this is about live flows, not deep analytics. OXT shines for graphing address clusters and wallet fingerprints; Glassnode excels at clean, long-term metrics (supply in profit, exchange balances, SOPR). This visualizer sits in the “what’s happening right now” lane.

Versus whale-alert setups—think Whale Alert, Whalemap, or custom alerts on CryptoQuant—you’re trading configurability for a richer live picture. Alert bots ping you; this shows you the path those large UTXOs actually take and how they settle into blocks.

Why does the motion matter? Research in information visualization suggests animated transitions help people track changes and reduce mental overhead, especially for newcomers. See: Heer & Robertson (2007).

Real example: On high-volatility days (ETF headlines, sudden selloffs), mempool fee rates spike—mempool.space gives you fee heatmaps and RBF flags, but it won’t “show” the story of funds rushing from a cold wallet to an exchange. Here, a few oversized bubbles moving toward a tagged exchange cluster can make that narrative obvious in seconds. If you’re teaching or streaming, that’s gold.

Want other visual-first tools? TxStreet turns mempool pressure into a lively street scene; BitBonkers gives a 3D coin-drop view. They’re great for education and vibe-checks, less so for attribution or data export.

Quick answers to common questions (People Also Ask)

- Is it free? Yes. No account needed.

- Is it real-time? Near real-time with a small delay.

- Which chains are supported? Primarily Bitcoin.

- Is it safe to use? Yes—browser-based, no wallet connection.

- Can I filter by value or type? Basic value/visibility controls; not forensic filters.

- Can I export data? Not really—think “live display,” not data dumps.

- Does it identify exchanges? Sometimes, but labels aren’t perfect.

- Good for trading signals? It’s context, not a signal engine.

- Mobile friendly? Works, but desktop is way better.

When to pick an alternative (and what to pick)

- You need multi-chain coverage: Check Nansen (paid, strong labels on EVM chains), Dune (custom dashboards, community-built), or Arkham (labels + entity tracking; paid tiers).

- You want heavy filtering and attribution confidence: OXT for Bitcoin heuristics; enterprise options like Chainalysis or TRM for professional investigations (pricey).

- You need alerts and automation: Whale Alert for big transfers, CryptoQuant for exchange flows and custom alerts, or Glassnode alerts for on-chain metrics.

- You care about fee strategy and mempool details: mempool.space for live mempool depth, feerate distributions, RBF/CPFP signals, and block templates.

- You need clean exports or CSVs: Blockchair lets you query and export across multiple chains.

- You want historical analytics and macro reads: Glassnode Studio, Coin Metrics, or IntoTheBlock for time series, supply dynamics, and exchange balance trends.

One more practical note: when exchanges do cold wallet maintenance or consolidation, you’ll often see huge, batched outputs with tons of change. Alert bots will scream about “10,000 BTC moved,” while this visualizer makes it obvious those funds are not necessarily hitting the open market. That context can save you from reacting to the wrong signal.

So where does that leave you—keep this in a side tab for the live story, or switch entirely to analytics? I’ve got a simple rule of thumb I use daily. Want it?

Verdict: should you use Daily Blockchain Visualization?

If you want a fast, free, no-login way to actually see Bitcoin move, this is an easy yes. It’s a lightweight companion that turns the firehose of raw data into a story you can follow. It won’t replace a full explorer or analytics stack, but it makes the “what’s happening right now?” question a lot easier to answer.

When it’s a win

- Teaching and onboarding: Show how transactions flow, fees change, and blocks fill without burying people in hex or CSVs.

- Live monitoring: Keep it open during busy hours to spot large transfers and exchange-related action as they unfold.

- Content and presentations: Record short clips for explainers, market updates, or team briefings.

When you’ll want more

- Forensic work: You’ll still need explorers, tagging databases, and proper analytics for attribution confidence.

- Heavy filtering and alerts: If you live on custom rules, thresholds, and notifications, pair this with dedicated tools.

- Multi-chain tracking: If you’re watching ETH, stablecoins, or L2s, you’ll need something broader.

Why the “pause and filter” routine works: research on animated visuals consistently shows that segmenting and signaling reduce overload and improve understanding—especially for newcomers (Mayer’s multimedia learning; Tversky, Morrison & Betrancourt). In plain English: slow it down, highlight what matters, and you’ll learn faster.

Pro tip: get signal in under 60 seconds

- Start paused. Scan the legend and labels so you know what you’re looking at.

- Set a value floor (e.g., show only larger transfers) to cut noise.

- Hit play at reduced speed, then zoom and “follow” a few standout flows.

- Cross-check one txid in an explorer like mempool.space to confirm fees, inputs, and confirmations.

- Recording? Use a lightweight screen recorder (OBS or your OS’s built-in tool) for quick clips.

Shortcut: Start paused. Set a floor. Follow one story. Confirm in an explorer.

A quick real-world sample: during a busy market hour, a 300+ BTC cluster stepped through a few consolidation outputs before landing on an exchange-labeled wallet. Watching the path here, then validating the txid in an explorer, made it clear this was a deposit wave—not a cold-storage reshuffle. That distinction matters when you’re reading the room.

Final word

Recommendation: use Daily Blockchain Visualization for the story and the speed. It’s a smart way to learn, to teach, and to keep a pulse on big movements without getting lost in the weeds. For the fine print—attribution, history, alerts—pair it with stronger analytics and a solid block explorer.

I’ll keep testing updates and sharing the best picks on Cryptolinks.com/news/.