Crypto Kirby Trading Review

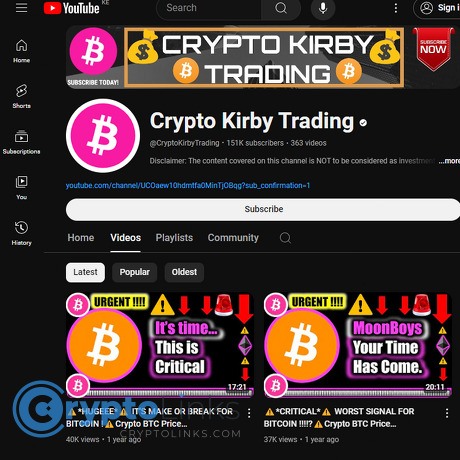

Crypto Kirby Trading

www.youtube.com

Crypto Kirby Trading Review Guide: Everything You Need To Know (With FAQ)

Ever watched a Crypto Kirby video, felt fired up by the levels and the confidence, and then wondered, “Is this actually helping me make better trades—or just pushing me to react?”

You’re not alone. I get asked about Crypto Kirby Trading on YouTube all the time—especially by people who want straight talk, less hype, and a practical way to use YouTube content without wrecking their accounts. So I put together a clear, helpful guide on CryptoLinks News to show you how to use channels like Kirby’s in a way that actually serves your plan.

In this review, I’ll walk you through what Kirby does well, where he can’t do the work for you, and how to turn any TA video into entry/exit rules, risk steps, and alerts you can trust. The goal is simple: less guessing, less FOMO, more structure.

The real problems crypto traders face on YouTube

Let’s be real—crypto YouTube is loud. It’s full of strong opinions, sharp edits, and “urgent” takes. That can be exciting, but it also creates decision chaos. The biggest problems I see traders run into:

- Contradicting calls in short windows. One video teases a breakout, the next flags a fakeout, and now you’re stuck between two opposing ideas with no plan.

- Hype thumbnails and urgency language. The algorithm rewards excitement, not process. That nudges viewers toward reaction instead of rules.

- No context for risk. Levels are clear, but sizing and invalidation are rarely spelled out. New traders fill in the blanks with leverage.

- Recency bias and overtrading. A hot stream can make you think the best trade is the next one—when sometimes the best trade is no trade.

Real example: BTC rips into a known resistance. A streamer says, “If we push through here, it could run.” You hear “run,” not if, market taps resistance, you long late, get wicked, then revenge short the bounce. Two losses in 30 minutes—both avoidable with a written invalidation level and fixed risk per trade.

This isn’t just a crypto thing. Behavior research backs it up. Overactive trading tends to hurt results:

- Barber & Odean (2000) showed that more trading often leads to worse performance for individual investors.

- DALBAR’s QAIB studies repeatedly find that investor behavior—not market direction—is a major driver of underperformance.

So the mission with any channel, including Crypto Kirby, is to turn noise into a process. When you approach content with structure, it becomes fuel for your plan—not a trigger for impulse trades.

What I promise in this review

Here’s how I’ll keep this useful and grounded:

- Clear breakdown of Crypto Kirby’s style, what he does well, and where you’ll need to bring your own tools.

- Real accuracy factors you should track yourself (levels, invalidation, confirmations) instead of blindly trusting a call.

- A practical framework to turn any TA video into entries, stops, scaling, and alerts you can repeat.

- A checklist that reduces overtrading and lets you judge your decisions—win or lose—by process, not drama.

Quick note on risk and expectations

No YouTuber is your financial advisor. Use channels for ideas, not instructions. The results you get come from your rules, not a single video. Keep these guardrails in place:

- Cap risk per trade. Many pros stick to 0.5–1% per idea. It keeps you in the game long enough to learn.

- Set invalidation in advance. If price hits your “I’m wrong” level, you’re out—no debate, no “one more candle.”

- Write the plan before the trade. Entry zone, stop, targets, and conditions that would cancel the setup.

- Track decisions. A simple journal beats the best thumbnail. You’ll spot patterns in your own behavior fast.

If you want straight Bitcoin TA with clear zones, Crypto Kirby can be a strong source of ideas. The key is knowing how to plug those ideas into a repeatable plan. Ready to see exactly what he covers, how often, and who it fits? That’s up next—want the quick snapshot or the deeper look first?

Who is Crypto Kirby Trading? Channel snapshot and first impressions

If you’ve ever watched Bitcoin rip $1,000 while your cursor hovers over the buy button, you’ll understand why a voice like Crypto Kirby’s pulls an audience. He keeps it fast, focused, and level-driven. The channel centers on Bitcoin technical analysis with straight talk and a clear “watch this zone” style. He leans into momentum windows, calls out traps, and sticks to tools most traders already recognize—so you can follow along without pausing every 10 seconds.

“Let’s get this crypto!”

That’s the tone: energetic, no fluff, and built around clear line-in-the-sand levels. Expect timely uploads around inflection points—breakouts, fakeouts, or meaningful retests—rather than endless commentary during dead chop. If your attention span is short when the market isn’t moving, his cadence makes sense.

Content style and topics

Most uploads focus on Bitcoin’s structure and momentum. He maps key areas, shows the “if this, then that,” and highlights traps that catch new traders offside. A typical session might look like this:

- Horizontal support/resistance: Prior highs/lows and range boundaries that define the battleground.

- Trend structure: Higher highs/lows vs. breaks in market structure on 4H/Daily.

- Fibonacci retracements/extensions: 0.5 and 0.618 “decision zones,” sometimes paired with liquidity grabs.

- CME gaps: Unfilled levels traders love to obsess over—useful context, not destiny.

- Momentum reads: RSI/MACD divergences and simple moving averages for confluence.

- Macro/sentiment sprinkles: Headlines, funding vibes, and the broad risk environment when it really matters.

Here’s a concrete example of how this plays out on-screen: he’ll mark a prior range high, watch for a wick through it (liquidity sweep), then look to see if price reclaims the level or rejects back into the range. If it reclaims, he’ll talk about potential continuation; if it rejects, he’ll flag the next magnet—often the mid-range or a 0.5–0.618 retrace. Simple, repeatable logic that removes the “guessy” feeling from the chart.

Why this matters: research shows that fast, real-time market noise can nudge traders into impulsive decisions. Barber & Odean’s classic work found that frequent trading tends to hurt performance. If a channel keeps you grounded in levels and invalidation instead of emotional scalps, that’s a real edge. Source: Barber and Odean (2000), Trading Is Hazardous to Your Wealth.

Formats and cadence

- Pre-recorded sessions: Polished, to-the-point breakdowns of key levels and scenarios.

- Live streams during heat: When volatility spikes—CPI days, sudden BTC range breaks, big news catalysts—expect real-time commentary.

- Rhythm: More content when the market’s alive; quieter when Bitcoin is stuck in a tight range.

That variability is a feature, not a bug. Content clusters around moments when actionable information exists, which is exactly when traders need a second set of eyes on the chart.

Who he seems to target

- Intermediate traders: People who understand support/resistance, trends, and invalidation but want another clear voice marking the same levels they’re seeing.

- Active Bitcoin watchers: Viewers who treat BTC as the market compass and prefer high-signal commentary over altcoin tours.

- Curious beginners: You can learn structure and patience from the format—just pair it with foundational education before putting cash on the line.

If you’re hunting deep altcoin fundamentals or tokenomics rabbit holes, this isn’t that. Think “map and momentum” rather than “whitepaper review.”

What I look for as a reviewer

When I watch, I’m checking whether the session translates into something tradable without guesswork. Here’s the checklist I keep open:

- Clarity of thesis: Is there a primary scenario and a clear invalidation level?

- Consistency of method: Are the tools and timeframes steady across videos so viewers can build a routine?

- Risk framing: Does the analysis acknowledge what would prove the idea wrong?

- Actionable structure: Can a viewer write a plan from this—entries/zones, stops, and targets—without filling gaps on their own?

- Follow-through: Are prior levels revisited so learning compounds over time?

One last thing: there’s power in a confident voice when the tape gets messy—but confidence can be a double-edged sword. In the next section, I’ll break down where this channel truly shines and where you’ll want to be careful. Which side do you think matters more for your P&L right now?

Channel link: Crypto Kirby Trading on YouTube

Strengths and weaknesses: my honest take

What he does well

I like how he marks the map. His charts are clean, his levels are clear, and the message is “wait for your zone, then act.” That matters. When Bitcoin is whipsawing, having two or three anchored areas to watch—rather than guessing every candle—can save you from death by a thousand paper cuts.

- Clear, actionable zones: He’ll flag a support cluster, a resistance shelf, and an invalidation line. If price taps, rejects, or reclaims, you know which path you’re evaluating. For example, during a choppy range, he’ll often frame something like: “Watch the 4H range high; deviation and close back inside could be the trap.” That translates into a simple if-then structure you can actually use.

- Patience baked in: He emphasizes waiting for confirmation—retests, closes, momentum hints—rather than stabbing at mid-range. That’s a real edge for retail viewers who tend to chase.

- Good timing around inflection points: Streams often coincide with volatility spikes or key weekly closes. Even if you don’t trade, you walk away with levels worth alerting.

- Simple language, no cluttered indicators: Horizontal S/R, trend structure, and momentum. Less is more, especially for keeping focus when emotions run hot.

“Confidence without risk controls is just hope in costume.”

Sample use case: Let’s say BTC is pinballing between a well-defined 4H range. He highlights range high, range low, and a midline. Your play becomes: set alerts at those edges, only act on a reclaim or rejection with a close, and anchor stops just outside the level that proves you wrong. That’s way better than guessing inside the chop.

Where it falls short

It’s not a school; it’s a map. If you’re hunting full-scope education—indicator logic, backtesting frameworks, trade journaling templates, performance tracking—you won’t get a turnkey curriculum here. And if your focus is deep altcoin fundamentals or on-chain nuance, you’ll need other sources.

- No step-by-step training arc: You’ll need to build your own system: entries, position sizing rules, journaling, and review cycles.

- Limited fundamentals and alt breadth: The lens is mainly BTC with technical levels. If you live in small-cap alt land, treat his BTC read as your “market weather,” then do your own coin-level homework.

- Not heavy on testing receipts: You won’t see robust backtests or statistically grounded expectancy models. If you want quantified edges, pair this with a personal backtesting habit.

That gap is fine—as long as you know it’s a highlight reel of levels and context, not a full trading education.

Who will get the most value

- Rule-first traders who already use stop-losses, size small per idea, and journal outcomes. They’ll plug his zones into a pre-existing plan.

- Level-driven swing traders who want a second opinion on trend and momentum without noise.

- Patience-focused viewers who can wait for confirmation instead of market-ordering into every candle.

If you’re brand-new and itching to click buy/sell on every stream, hit pause. Watch, learn the structure, and practice on paper until your plan actually shows positive expectancy.

Red flags to watch for (general YouTube habits)

These aren’t about one channel—they’re about human nature. Your brain will try to sabotage you when the thumbnail screams and price rips.

- FOMO during live streams: Big candles + high energy = itchy trigger finger. Remember Barber & Odean’s research: frequent traders underperform due to overconfidence and excessive activity (“Trading Is Hazardous to Your Wealth,” 2000).

- Moving stops “just this once”: Prospect Theory and the disposition effect show we hate losses so much we’ll rationalize bad hold-and-hope behavior (Kahneman & Tversky, 1979). Don’t upgrade a trade into a bag.

- Confusing confidence with certainty: A strong voice is not a guarantee. Mark your invalidation before you care what anyone says.

- Leverage without a plan: If you can’t state your max risk in dollars before entry, you’re gambling. Keep risk per trade tiny (think 0.5–1%) and let compounding do the heavy lifting.

- Chasing every thesis: Treat YouTube as idea flow, not must-trade signals. One A+ setup with rules beats five “looks spicy” clicks.

Here’s a simple emotional check I use when a stream is pumping: if my heart rate ticks up, I step back and ask, “Where is my invalidation?” If I can’t answer instantly, no trade.

So you’ve got the strengths, the gaps, and the traps. The next question is the money one: how do you turn those clean Bitcoin levels into a concrete plan you can execute with calm—entries, stops, targets, alerts—without second-guessing at the worst moment? Keep reading; I’ll show you exactly how I transform a video into a step-by-step playbook you can repeat.

How to use Crypto Kirby Trading content the smart way

Turn videos into structure—not signals. If you’ve ever bought the top after a hype stream, I’ve been there. The fix is simple: don’t watch to be convinced; watch to refine a plan you already have. That’s how you make Crypto Kirby’s levels and momentum reads actually work for you.

“You don’t rise to the level of your goals; you fall to the level of your systems.” — James Clear

A simple viewing checklist

Use this every time you watch a new Crypto Kirby Trading video. It keeps you from chasing and turns the content into clean rules.

- Before you press play

- Write your current bias (e.g., “BTC ranging,” “short-term bullish within a larger downtrend”).

- Mark your own levels and invalidation on a clean chart.

- Set a goal: “I’m watching for confirmation at X level or invalidation at Y—no trade otherwise.”

- While watching

- Note his exact levels, higher-timeframe context, and what would prove his idea wrong.

- Capture the thesis in one sentence: “If price accepts above A with momentum, potential move to B; invalid below C.”

- Ignore the entertainment—write the numbers.

- Right after

- Update your chart: keep your levels, add his only if they align or are stronger.

- Build two “if-then” statements:

- If price reclaims Level A on volume, then long with stop at C.

- If price rejects A and loses C, then short with stop at A.

- Set TradingView alerts at A, B, C. No alerts = no trades.

Why this works: “If-then” planning (implementation intentions) has strong evidence behind it for improving execution under pressure. See: Gollwitzer (1999), APA.

Converting TA into a plan

Here’s how I convert one video thesis into something tradable.

- Thesis snapshot: “BTC is testing a key resistance zone; acceptance above could open a move to the next supply.”

- Entry: Not on the breakout wick—on the acceptance or the retest.

- Trigger example (long): 1H close above 42,000 with RSI making a higher low, then buy the 41,800–42,000 retest.

- Stop placement: Below the structure that proves the idea wrong.

- Stop example: 41,250 (below retest and prior 1H swing low).

- Scaling:

- Enter 50% on confirmation, 25% on retest tag, 25% only if momentum holds.

- Targets:

- First at 1.5R to pay yourself and move stop to break-even.

- Second at prior daily supply or next weekly level.

- Final runner trails under higher lows or an EMA.

Write it down. If you can’t summarize your plan in 3–5 lines, you don’t have a plan—just a hope.

Risk management that actually saves you

The pros obsess over risk, not entries. A few rules that stop pain fast:

- Cap risk per trade: 0.5–1% is plenty. Your edge compounds when your account survives.

- Position size formula (long example): position = (account × risk%) / (entry − stop).

- Account $10,000, risk 1%, entry 42,000, stop 41,250 → risk per unit = 750 → size = $100 / $750 ≈ 0.133 BTC (then adjust for contract type).

- Daily loss limit: 2R max. Hit it? Walk away. Discipline beats revenge trades.

- No stop moves: You’re not “giving it room”; you’re making up new rules mid-game.

- OCO orders: One-cancels-the-other for target and stop so execution isn’t left to emotions.

Evidence check: Overtrading crushes performance. See Barber & Odean (2000), Journal of Finance—more trades, worse returns for most individuals.

Tools and settings to mirror the analysis

Keep your chart clean and close to what you see on screen.

- Platform: TradingView with log scale when zoomed out.

- Core indicators:

- EMAs or SMAs: 20/50/200 for structure and trend bias.

- RSI 14 for momentum divergences; MACD 12/26/9 if you like confirmation.

- Horizontal levels and session/visible range volume profile (if you have it).

- Symbols:

- Spot: BTCUSD or BTCUSDT (your venue).

- Futures context:

CME:BTC1!to track potential gaps and weekend vs. weekday behavior.

- Alerts that matter:

- Price crosses key level.

- RSI crosses 50 or forms divergence at your level.

- Volume spike on breakout candle.

Pro tip: Build two layouts—HTF map (D/W) and execution (1H/15m). Flip between them so you never take a small-timeframe trade that violates the higher timeframe.

Common mistakes to avoid

- Trading the stream instead of the chart: A live chat isn’t a signal. Wait for your triggers.

- Chasing breakouts: If you missed it, you missed it. New opportunity > bad entry.

- Ignoring invalidation: “It’ll come back” is not risk management. Stops are the cost of being wrong with dignity.

- Skipping journals: Screenshot entry, stop, targets, and emotion at the time. Patterns pop fast when you can see them.

- Trading every idea: You only need a few A-setups each month. Let the rest go.

If you could pair this kind of structure with a channel lineup that covers education, TA, and catalysts without the noise… which mix would save you the most time? Let’s look at options you can plug in next.

Alternatives and complements: finding your “best” YouTube mix

There isn’t a single channel that can carry your entire trading approach. The real edge comes from a clean mix: one place to learn the “why,” one to sharpen your “when,” and one to catch catalysts before the crowd. Keep it simple. Keep it consistent.

“One source is a rumor; three is a cross‑check.”

Here’s how I build a practical stack that actually lowers noise and raises confidence without turning your brain into a notification feed.

Education-first picks

When I want context and patience, I reach for creators who teach frameworks over FOMO. That makes every TA video you watch more useful.

- Coin Bureau— Clear fundamentals, token mechanics, regulation, and project risks. I use these videos to filter what’s even worth my time. If a narrative or token fails the basics here, it doesn’t touch my watchlist.

- Benjamin Cowen — Cycle structure, Bitcoin dominance, and trend regimes. Great for setting a weekly base case: risk-on or risk-off? I pair this with my TA levels so I’m not forcing trades into the wrong market phase.

Quick example that pays for itself: If Cowen’s view points to a choppy, mid-cycle environment, I tighten targets and reduce position size across the board. When the cycle signals shift, I give winners more room. Research on forecasting shows that combining independent viewpoints reduces error—this pairing does exactly that.

TA-first streamers and traders

For real-time momentum and levels, these channels can keep you sharp. Use them as idea flow—not as plug-and-play signals.

- MM Crypto — Fast-paced BTC/ETH levels and breakout focus. Helpful when volatility expands. I set alerts around his highlighted zones and let price come to me.

- The Moon — Big-move framing, sentiment swings, and timing around news. I treat this as a heat check for retail excitement—useful for gauging when to be contrarian.

- DataDash — More balanced macro + TA. Great for swing traders who want calmer, thesis-driven outlooks beyond just BTC.

Pro move: build a “level map” by cross-referencing 2–3 TA channels. If zones cluster (e.g., multiple creators flag $BTC support around the same range), I respect it more—but I still trade only off my written rules.

News and banter channels

To spot catalysts and narrative shifts, I keep a light rotation of news-forward creators. The trick is separating headlines from execution.

- Crypto Banter — Narrative scanning, guest takes, and market-moving headlines. Useful for building a “catalyst watchlist” (token unlocks, ETF updates, regulatory moves, ecosystem grants).

How I use this without getting whipsawed:

- Tag catalysts in your journal: date, token, probable impact (liquidity in or out), and your plan if price reaches your level.

- Never buy just because a segment is hyped. News is context; your TA and risk plan are the trigger.

So who’s “best” to learn from?

The best is the mix that fits your brain and your schedule. Here are three “stacks” that I’ve seen work in the real world:

- Starter Stack (calm and consistent)

Channels: Coin Bureau + Crypto Kirby for levels + Crypto Banter for catalysts

Workflow: Weekend fundamentals video → set a weekly bias; two TA sessions midweek → mark entry/invalidations; daily 10-minute news scan → update watchlist, no impulse trades. - Swing Trader Stack (trend and timing)

Channels: Benjamin Cowen + Crypto Kirby + DataDash

Workflow: Monday: cycle check; Tue–Thu: TA levels and momentum confirmation; set alerts and scale in only when both trend and levels align. Hold winners; cut losers fast. - Alt-Season Scout (narratives with guardrails)

Channels: Coin Bureau (project filters) + MM Crypto (breakout watch) + Crypto Banter (narrative timing)

Workflow: Pick 3–5 tokens that pass fundamentals; wait for Bitcoin’s direction to be clear; only take alt setups that match your BTC bias and hit your pre-set levels. No FOMO entries after news segments.

Why this works: you’re essentially creating a small “ensemble” of views. Studies on forecasting show that averaging independent perspectives tends to reduce bias and improve outcomes. In trading terms, that means fewer forced bets and better alignment between thesis, timing, and risk.

If you’re feeling overwhelmed, remember this: your goal isn’t to watch more—it’s to decide better. Two or three channels you truly use will beat ten you half-remember.

Still wondering how this stack fits with Crypto Kirby specifically—like whether beginners should even start here, or if following his calls can work without blowing up your account? I’ve got blunt answers to those exact questions up next… ready?

FAQ: Everything you asked about Crypto Kirby Trading

Is Crypto Kirby good for beginners?

He’s helpful if you want to learn how traders frame market structure and timing. You’ll pick up how levels like prior highs/lows, EMAs/SMAs, and liquidity zones matter. But if you’re brand new, pair his videos with an education-first channel and practice on paper before risking a dollar.

Here’s what I tell new readers who watch his channel:

- Shadow-trade first: take his thesis, write a plan (entry, stop, targets), and track outcomes without money for at least 20 trades.

- Risk tiny when you go live: 0.5–1% risk per trade is a smart ceiling until your journal shows you can follow rules.

- Avoid overtrading: research by Barber and Odean shows frequent trading hurts retail results; don’t chase every stream.

Sample approach: if he highlights a “retest of a broken range high,” I set an alert a bit before that level, define an invalidation (e.g., under the previous swing low), and size the trade so a stop-out is just 0.5–1% of my account. No plan, no trade.

Who is the best YouTuber to learn crypto trading?

There isn’t a universal “best.” Different brains, different lanes. Many people mix:

- Foundations: channels with risk, cycles, and patience.

- TA levels: a straightforward chartist like Crypto Kirby for timing and key zones.

- News/sentiment: a stream that catches catalysts so you’re not blindsided.

What matters is that you keep your rules the same across all inputs. Consistency beats charisma.

What is the best crypto guide on YouTube?

Look for a playlist that actually teaches you to build a system. It should cover:

- Position sizing: how to risk a fixed % per trade

- Entries/exits: triggers you can write on a sticky note

- Psychology: handling FOMO and losses (loss aversion is real per Kahneman & Tversky)

- Journaling: log, review, and improve (goal-setting research by Locke & Latham backs this)

Then use Kirby’s levels as context. Example: if the playlist teaches “breakout-retest,” and Kirby marks a range top, your system might say, “Enter on retest with a stop under the retest low; scale out at 1R, 2R.”

Does Crypto Kirby offer paid groups or signals?

Offerings change. Always check his current links on his channel. Whatever you join, keep expectations grounded:

- No one can guarantee results. If they do, that’s a red flag.

- Keep autonomy: you should be able to say “no trade” even if a group is hyped.

- Journal every call you follow so you can measure whether it fits your edge.

Rule of thumb: If a paid room stops you from using hard stops or pushes oversized positions, walk away.

Can you make money following his calls?

Yes, sometimes you’ll agree with a thesis that works. The real question is whether you can apply process every time. A few tips backed by research and practice:

- Use stop-losses: studies (e.g., Cass Business School research by Clare, Seaton, Smith, Thomas) show stop rules can cut drawdowns, which helps survival.

- Set profit targets in ladders: take partials at predefined R-multiples to reduce emotional decision-making.

- Avoid reactive sizing: don’t increase size just because the last two trades won. That’s how streaks trick you.

Real-world example: if Kirby says “watch for a sweep of liquidity below last week’s low,” I’ll plan a limit entry slightly above that zone, put my stop just beyond the invalidation wick, and pre-place two target orders at 1.5R and 3R. If price never tags the zone, I do nothing. Missed trades are not losses.

Is Crypto Kirby biased toward Bitcoin?

Yes—his content leans BTC-first. That’s not a bug if you trade altcoins. BTC often acts like the market’s gravity. Here’s how I use it:

- BTC as compass: if his read is “BTC risk-off,” I automatically tighten alt risk or sit out.

- Alt entries with BTC confirmation: I’ll only take an alt setup if BTC structure aligns (e.g., above a key daily level).

- Don’t force correlation: if an alt has its own catalyst, I log it as an exception and reduce size.

What’s the safest way to act on a Kirby video the same day?

Here’s my fast checklist when a stream drops and markets are moving:

- Write the thesis in one line: “If BTC reclaims X, I’ll long to Y; invalid under Z.”

- Set alerts, not market orders. Let price come to you.

- Risk fixed % (0.5–1%), never “all-in because it’s urgent.”

- Pre-place stop and first take-profit so emotions don’t interfere.

- Stand down if your plan isn’t crystal clear in 60 seconds. Confusion = no trade.

Does following YouTube TA actually help performance?

It can—if you turn ideas into rules. A few anchors:

- Overtrading is costly: academic work on retail behavior shows high turnover lowers returns. Fewer, better trades win.

- Rule-based stops reduce tail risk: multiple studies show stop strategies can curb drawdowns, which keeps you in the game long enough to compound.

- Journaling builds skill: consistent review and goal-setting improve execution quality over time.

So, yes, watch Kirby for levels and timing—but convert every idea into a written plan with fixed risk. That’s the difference between “interesting” and “profitable.”

One more thing... Want my short, no-fluff action plan for using his next two videos without risking your account? I’ve got it queued up next—along with my honest verdict on whether he stays in my rotation. Ready for the punchline?

My verdict and what to do next

Crypto Kirby Trading earns a spot in a serious trader’s rotation. The value is in the timely Bitcoin levels, a steady read on momentum, and the push to stay patient around inflection points. It’s not a full education stack—and that’s fine. Pair his videos with your own rules, an education source for fundamentals, and a consistent way to measure what works for you.

If you want straight talk: use Kirby for levels and scenarios, not for signals. The moment you translate a video into a written plan with fixed invalidation, your odds improve. That’s not opinion—research on traders shows the problem isn’t “bad calls” as much as impulsive execution and overtrading. Barber & Odean’s widely cited study found high-turnover traders significantly underperform due to poor timing and costs. Translation: fewer, better-structured trades beat constant chasing.

Action plan for this week

Here’s a tight five-day sprint to turn watching into an actual process:

- Pick two recent videos from Crypto Kirby Trading. Before you press play, write down your current bias, key levels, and what would prove you wrong.

- Extract the exact zones Kirby highlights (support, resistance, trend lines, moving averages) and note the timeframes he references. Set TradingView alerts on those zones before you forget.

- Build one paper trade from a single thesis. Define:

- Entry: trigger condition, not just a price (e.g., 4h close reclaiming a level).

- Stop: below/above invalidation, not a feeling (consider 1x ATR beyond the swing).

- Risk: cap at 0.5–1% of equity.

- Targets: scale out at 1R and 2R; leave a runner if market structure agrees.

- Preload orders as if you were live: OCO (one-cancels-other) with stop and target attached. Don’t enter—just simulate.

- Journal the plan in one page: why this, why now, what kills the trade, how you’ll manage it if it moves quickly. Journaling reduces hindsight bias and improves decision recall—exactly what you need to refine your edge.

- Track outcome without money. Did the logic hold? Did the entry trigger? Would your stop have saved you? Did your partials hit?

- Only then size tiny (think “tuition size”) and repeat the same plan. Consistency first, size later.

Example plan: “If BTC prints a 4h close back above the 200-day EMA with volume above its 20-period average and RSI > 50, I’ll enter on the next retest. Stop 1x ATR below the reclaimed level. Risk 0.75% of equity. Take 50% at 1R, 25% at 2R, trail the last 25% under higher lows until invalidation.”

Pro tip: If an alert tags you outside your trading window or you’re not at your desk, skip it. Missed trades are cheaper than forced trades. Again, overtrading is the silent account killer—every serious study on retail outcomes points to discipline and selectivity as the difference makers.

Where CryptoLinks fits in

Use CryptoLinks to round out what you get from Kirby without falling down tool rabbit holes. I keep it simple and vetted so you can build a stack fast:

- Charting and alerts: clean templates, alert bots, and watchlist tools that mirror the setups you see on YouTube.

- Risk and journaling: position size calculators, risk-of-ruin tools, and trading journals that track R-multiples instead of PnL emotions.

- On-chain and market data: dashboards for funding, open interest, and liquidity pockets to validate or fade a thesis.

- News feeds and calendars: curated sources and event trackers to avoid getting blindsided by macro or protocol updates.

Grab the few things you’ll actually use every day. Your tools should make trades clearer, not busier.

Final thoughts and next steps

If you like direct Bitcoin analysis and clean zones, add Kirby to your rotation, no question. Just keep the relationship healthy: videos for ideas, your rules for execution. Set alerts, write the plan, cap risk, and let time do the compounding.

“Channels give you ideas; your rules give you an edge.”

Next steps from here:

- Line up two Kirby videos and one fundamentals video you trust.

- Build one paper plan with exact triggers and invalidation.

- Journal it, review it this weekend, and decide what to keep, cut, or scale.

Keep it simple, protect the downside, and let consistency be your unfair advantage.

CryptoLinks.com does not endorse, promote, or associate with YouTube channels that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.