Satoshi Stacker Review

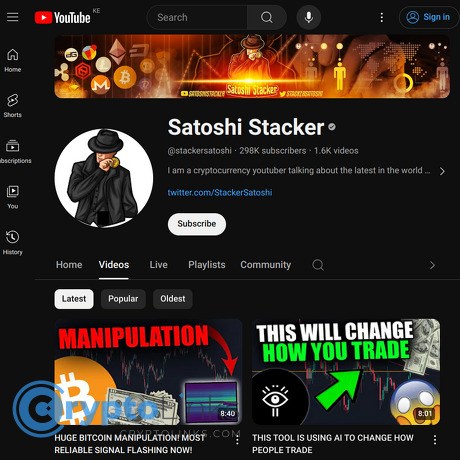

Satoshi Stacker

www.youtube.com

Satoshi Stacker Review Guide: Is This Crypto YouTuber Worth Your Time?

Ever hit play on a crypto video and wonder halfway through if you just burned 15 minutes on hype, not insight? If you’ve seen Satoshi Stacker in your recommendations, you’re probably asking: is he signal or just noise with shiny thumbnails?

Describe problems or pain

Crypto YouTube is a jungle. The algorithm prioritizes emotion and watch time, not accuracy. That means you’ll see a lot of “next 100x” claims, dramatic thumbnails, and hot takes that age about as well as milk.

- Hype overload: Bold titles and urgent language make everything feel like a must-trade. It isn’t.

- Buried substance: You want frameworks and takeaways, not 12 minutes of circular talk for one vague “buy zone.”

- Hidden incentives: Sponsored segments and affiliate links can tilt the narrative if they’re not clearly disclosed.

- Time sink: Sorting useful insights from clickbait eats hours you could spend executing a plan.

Quick reality check: The UK FCA found that a large share of younger investors were influenced by social media when choosing high‑risk products. If you’ve ever felt FOMO after a trending video, you’re not alone—and that’s exactly why you need a filter.

The goal here isn’t to dunk on creators. It’s to help you get what you came for: trustworthy breakdowns, clear takeaways, and practical signals you can actually use—without getting wrecked by overconfidence or stealth shilling.

Promise solution

I’ve put together a straight-talking review of Satoshi Stacker—what he covers, how he approaches research, who gets the most value, and what to watch out for. I’ll also share how I fit channels like this into a balanced research stack so you can watch smarter, not longer.

- Clarity over hype: What he’s good at, where he’s light, and how to calibrate your expectations.

- Practical guidance: How to extract value without turning every video into an impulse trade.

- Bias radar: Simple checks to spot influence from sponsors or affiliates fast.

Reminder: Nothing here is financial advice. Treat every video—his and mine—as raw input, not trade signals.

Who this guide is for

- Beginners who want plain‑English context without jargon traps or blind copy‑trading.

- Holders who care about market structure, macro signals, and narrative timing—not scalp trades.

- Active traders who use YouTube for idea generation but rely on their own rules for entries, exits, and risk.

If you value signal over noise and want a realistic way to use crypto YouTube without getting spun by the algorithm, you’re in the right place.

What you’ll learn

- What Satoshi Stacker covers and how often he posts

- His style, strengths, and blind spots (with actionable examples)

- Whether he’s “legit,” how he monetizes, and where bias can creep in

- How to get real value from his videos without taking dumb risks

- Straight answers to the most common questions people ask

Curious where the real value shows up—and where to start if you’ve never watched a full video? That’s exactly what I’m breaking down next: the channel at a glance, the formats that actually help, and the best first steps so you don’t waste time.

Meet Satoshi Stacker: The channel at a glance

Think of Satoshi Stacker as a fast-moving radar for crypto narratives and market structure. He’s not trying to be your textbook; he’s trying to be your early alert. If you like short, punchy updates that connect price action to real catalysts, this is the kind of channel that fits into the “check daily, act occasionally” bucket.

“In markets, the right five minutes beats the wrong fifty.”

What he covers

You’ll see a mix of Bitcoin cycle framing, altcoin narratives, and timely catalysts—enough to spark ideas without needing a PhD to follow along.

- Big-picture cycles: Bitcoin dominance, halving talk, “is altseason starting?” style mapping.

- Market updates: Where price sits in the range, key levels, and what might flip the bias.

- Narratives and themes: AI coins, L2 momentum, Real-World Assets (RWA), DePIN, and whatever’s catching flow that week.

- Project breakdowns: Why a coin matters now (upgrades, listings, unlocks, partnerships) and the short list of risks.

- Trade ideas and setups: “Watch these levels,” “here’s my plan if X happens,” and simple if/then structures.

- Context extras: Funding, open interest, BTC.D, and sentiment—used to color the story, not to overwhelm it.

Sample upload pattern you’ll recognize: “Bitcoin’s next move + 3 altcoins with catalysts this week,” or “Top narratives right now (with levels).” It’s narrative-first with just enough TA to make it actionable.

Upload rhythm and video style

Expect regular uploads—often several times a week—and more activity when volatility spikes or headlines hit. Videos usually land in the snackable range (think under 20 minutes), which keeps them easy to slot into your day.

- Rhythm: Multiple posts most weeks; faster cadence around major market moves or catalysts.

- Length: Short-to-medium (often 8–20 minutes). Quick enough to stay current, long enough to explain a thesis.

- Format: Screen share with charts and headlines; bullet-style takeaways; “top X” rundowns for quick scanning.

- Focus mix: Narrative-driven with TA support—TradingView levels, dominance, and simple structures rather than esoteric indicators.

That “tight update” format matters. Behavioral research shows investors react strongly to timely stories that connect information to action—Robert Shiller’s work on Narrative Economics is the classic reference here. In other words: stories that map to simple next steps stick. This channel leans into that.

The tone: hype vs. measured

He’s enthusiastic—optimistic when the tape’s strong and cautious when the structure looks heavy—but he generally avoids the “guaranteed 100x” nonsense. You’ll notice he frames ideas with conditions (“if we break this level…”) and catalysts (“if the upgrade lands on time…”). That balance keeps the energy high without asking you to suspend disbelief.

- Energy: Engaging and upbeat; you won’t feel like you’re watching paint dry.

- Expectation setting: More “here’s the setup” than “this can’t fail.”

- Emotional guardrails: Enough excitement to keep you curious, not enough to push you into FOMO—useful, because attention-chasing is a real risk in crypto.

Quick mental rule: if his excitement makes you want to buy right now, pause and write the if/then in your own words first. Controlling your trigger is half the game.

Best places to start

If you’re new to his channel, pick formats that maximize signal-per-minute and give you context fast.

- Market Overviews: Look for titles around “Bitcoin next move,” “week ahead,” or “market update.” These usually include BTC levels plus a couple of alt setups.

- Top Narratives Now: “Top 3 altcoins this month” or “narratives I’m watching” style uploads. Great for building a watchlist and setting alerts.

- Beginner-Friendly Explain-ers: Search his feed for basics like “halving,” “L2,” or “token unlocks.” A few of these will help you understand why a headline might move price.

- Catalyst Roundups: Any video that mentions dates—upgrades, mainnets, listings. Pair with a calendar tool and you’ll be ahead of most retail.

- Volatility Days: When the market whipsaws, he usually posts timely takes. These can help you avoid overreacting or chasing the wrong candle.

If you want to scan quickly, open his channel, sort by “Most recent,” and grab anything referencing the week ahead, top narratives, or BTC range. That’s the sweet spot.

Curious how consistent the research is behind those takes—and how to tell hype from honest homework in under two minutes? Keep going. Next, I’ll show you the exact tells I use to spot prep vs. guesswork, how he balances TA with fundamentals, and a quick audit anyone can run before risking a dollar. Want the 120‑second checklist?

Content quality: research habits, accuracy, and clarity

I’m not looking for fireworks; I’m looking for process. When I watch a crypto channel, I want to see how the story was built, not just the punchline. Here’s how I size up the substance behind the style—and how you can do the same in a few minutes per video.

“In bull markets, everyone sounds smart. In bear markets, only the process survives.”

Research approach and sources

Good prep leaves fingerprints. If a video claims a move is coming, I want to see the receipts—charts, sources, and a thesis you can test. Here’s my quick sniff test:

- Charts with context: Not just price candles. Look for annotations, levels, and a stated reason behind them. Bonus points if the timeframe is obvious (4H, daily, weekly).

- On‑chain visuals: Screenshots or references to dashboards like Glassnode, CryptoQuant, Santiment, or DeFiLlama when talking flows, stablecoin supply, TVL shifts, or exchange balances.

- Derivatives data: If funding rates, open interest, or liquidations are mentioned, you should see CoinGlass, Coinalyze, or similar. Claims about “overleveraged shorts/longs” need a screenshot.

- Macro notes: DXY, U.S. yields, or Fed expectations? A quick nod to CME FedWatch or a DXY chart shows he isn’t guessing.

- Project fundamentals: Links or visuals from Token Terminal, Messari, official docs, or Etherscan when discussing fees, revenue, emissions, unlocks, or supply.

When the storytelling is strong but the sources are thin, I tag it as “narrative-first.” That can still be useful—just not something I treat as a standalone decision input.

Pro tip: the best videos give you the exact source name on-screen or in the description. If you can’t recreate the view in 2–3 clicks, it’s entertainment, not research.

TA, fundamentals, and narratives

Most crypto creators blend three ingredients: charts (TA), fundamentals (on‑chain, tokenomics, usage), and narratives (what the crowd will care about next). Knowing which one is carrying the weight helps you use the video the right way.

- Technical analysis: I treat levels and structures as maps, not predictions. If a video marks clear support/resistance and mentions invalidation, I’ll set alerts there and let the market choose the path. That’s where the value is—turning an opinion into actionable boundaries.

- Fundamentals: Crypto fundamentals are quirky—fees, emissions, unlocks, treasury runway, active addresses. If a claim is “X is undervalued,” I want numbers: revenue trends, user growth, or supply schedules. No numbers? It’s just a vibe.

- Narratives: Narratives move crypto. Academic work on attention-driven trading (for example, Barber & Odean’s research on retail attention) shows how money chases what’s in front of people. In practice, that means a well-argued narrative can front-run flows—but only if you pair it with timing and risk control.

My takeaway: use TA for timing, fundamentals for conviction, and narratives for a watchlist. When all three line up, you’ve got something worth tracking.

Track record and how to evaluate it yourself

No one nails every call—period. What matters is transparency, calibration, and how quickly bad theses get retired. Here’s a simple, zero-drama way to review past ideas without falling into cherry‑picking:

- Create a calls log: Date, asset, one‑sentence thesis, timeframe, key level(s), invalidation. That’s it. If a video doesn’t offer those, you can’t score it.

- Grade on process, not outcome: Was there a plan and an exit? A loss with proper invalidation is good process. A win with no risk plan is luck in disguise.

- Use YouTube filters: Search the channel for the asset name and set “Sort by: oldest” or “this year.” Compare early claims to what happened, not just the last bullish clip.

- Look for post‑mortems: Pinned comments or follow‑ups acknowledging invalidation earn trust. Silence after misses is a red flag.

If you want something more quantitative, track hit rate and average R multiple (reward:risk). You’ll learn fast whether the calls are actually tradeable or just interesting.

Disclaimers and risk framing

Every serious channel reminds you it’s not financial advice. That’s the floor, not the ceiling. What I really want is risk framing baked into the idea:

- Timeframe: Is this a trade (days/weeks) or an investment (months/years)? No timeframe, no trade.

- Invalidation: The level or condition that proves the idea wrong. Without it, you’re just hoping.

- Position sizing: Even a hint like “I’d keep this small” is helpful. I personally cap individual trades at 0.5–2% risk.

- Liquidity and unlocks: If a small-cap is mentioned, a nod to liquidity or upcoming token unlocks shows respect for risk. You can cross-check unlocks at TokenUnlocks.

When those elements show up, I listen harder. When they don’t, I enjoy the content but don’t act on it.

Red flags to watch for on any crypto channel

I keep a mental checklist. If too many boxes light up, I treat it as entertainment and move on.

- Guaranteed language: “Will,” “can’t fail,” “risk‑free,” or 100x thumbnails. Markets don’t do guarantees.

- No timeframe or invalidation: Price targets with no “wrong if” line are just storytelling.

- Undisclosed promos: Mentions of exchanges, launchpads, or tokens with referral links but no spoken disclosure. Always check the description for a sponsor note.

- Cherry-picking wins: Endless victory laps, no honest reviews of losers.

- One-sided analysis: Only bullish points, no bear case. In real research, both sides show up.

- Data-free claims: “Whales are accumulating” with no on‑chain chart or “retail is euphoric” with no sentiment source.

- Moving goalposts: Targets that shift after the fact without acknowledging the change.

If you want to get ruthless with your filtering, ask this one question after any bold claim: “What would I need to see that proves this wrong?” If the video already answered it, that’s a good sign.

Curious how to spot bias in under 10 seconds—and whether a sponsor might be steering the story? In the next section, I’ll show you exactly where creators make money, what the tiny on‑screen tells mean, and how to read disclosures like a pro. Ever noticed that little “Includes paid promotion” tag and wondered what it actually changes?

Is Satoshi Stacker legit? Monetization, sponsors, and bias

Crypto YouTube runs on incentives. That’s not good or bad—it’s just how the game works. The trick is learning to spot the money flows so you know when to lean in and when to raise an eyebrow.

“Show me the incentive and I will show you the outcome.” — Charlie Munger

How crypto YouTubers monetize

Here’s the standard menu of revenue streams you’ll see across crypto channels (and what each one tends to nudge):

- YouTube ads (AdSense) — Plays automatically. Doesn’t usually skew content, but incentivizes frequent uploads and timely topics.

- Affiliate links — Most common. Think exchanges, wallets, charting tools, VPNs. If you see “Get up to $X bonus,” that’s an affiliate. Examples: Bybit Affiliates, Bitget Affiliates, Ledger Affiliate Program. These can bias creators toward coverage that naturally funnels clicks.

- Sponsored segments — A paid plug inside the video (you’ll often hear “this video is brought to you by…”). Higher conflict risk, but not automatically bad if it’s disclosed and separated from analysis.

- Referral revenue share — Some exchanges share trading fees from referred users. This can subtly incentivize videos around trading opportunities, contests, or high-volatility narratives.

- Courses, newsletters, or communities — Paid products give creators a reason to tease frameworks on YouTube and promote the full package elsewhere. Useful for some viewers, bias for others.

- Advisory/allocations (less common, high-conflict) — If a creator has tokens or advisory ties, coverage can get rosy fast. Always look for a holdings disclosure when a coin is being covered glowingly.

What about Satoshi Stacker specifically? Expect the normal mix you see from established crypto channels: ad revenue, affiliate links, and occasional sponsors. If you see exchange links or “bonus” language in his descriptions, those are affiliate-based. That doesn’t make a video untrustworthy; it just means you should treat it as marketing + analysis, not pure research.

Transparency signals

You deserve to know what’s paid and what’s not. These are the signs I look for before I take any call seriously:

- Clear labels — “Sponsored,” “Paid partnership,” or a verbal callout early in the video.

- Description disclosures — A plain-English note that affiliate links earn the channel a commission.

- Segmentation — Sponsored integrations kept in a fenced-off block (with timestamps), not woven into the main thesis.

- Pinned comment — Restates the disclosure so it’s hard to miss on mobile.

- Consistency — If a project is covered multiple times, is there an ongoing relationship disclosed?

Why this matters: multiple peer‑reviewed studies show that clear disclosures improve trust and reduce misleading persuasion, especially when they’re upfront and unambiguous:

- Evans, Hoy & Childers (2018) — Clear influencer disclosures increase persuasion knowledge and help viewers judge content more critically.

- Boerman, Willemsen & Van der Aa (2017) — Disclosures affect viewers’ understanding of sponsorship and their word‑of‑mouth behavior.

- FTC Endorsement Guides — Require conspicuous disclosures; hiding it in a sea of links isn’t enough.

When I watch Satoshi Stacker, I check for the above before weighing any trade idea or project breakdown. If a sponsor is tied to the topic, I switch on “healthy skepticism” mode. If there’s clear separation and a balanced take, I’ll listen for the actual signal.

Community reputation

You can learn a lot by scanning audience feedback and channel health. Here’s how I read the room without guesswork:

- Comment quality — Look for specifics: viewers quoting timestamps, challenging levels, or adding sources. Pure “to the moon” comments = low signal.

- View-to-sub ratio — Consistent views relative to subs suggest real engagement. Spiky, inconsistent views can mean trend‑surfing or hit‑and‑miss topics (not always bad, but a tell).

- External mentions — Are insights shared by analysts on X/Reddit without drama? Or do you only see clips when there’s a giveaway?

- Responsiveness — Does the creator pin corrections or answer tough questions? Quiet channels during bad calls are a red flag.

- Growth pattern — Use tools like Social Blade to spot steady vs. suspicious growth. Natural curves beat sudden, inexplicable spikes.

From what I’ve seen, Satoshi Stacker enjoys an engaged audience that shows up for market context and narrative talk. That’s good—just remember that enthusiasm in the comments often tracks price action, not accuracy. I read the top 20 comments, not just the pinned one, and check whether any pushback gets answered.

My credibility take

Netting it out: Satoshi Stacker looks “legit” in the way most well‑known crypto creators are—he publishes consistently, frames content as opinion, and uses the standard monetization stack. The value is there if you want timely narratives and actionable catalysts. The risk is the same as anywhere on crypto YouTube: incentives can tilt coverage, especially around sponsors or exchange-driven content.

Here’s how I personally keep the bias filter sharp when watching him:

- If I hear a sponsor callout, I treat the next 60–90 seconds as promotional and wait for the analysis segment to resume.

- If I see exchange offers tied to the topic (e.g., a trading strategy video + referral bonuses), I assume trading is being nudged and shrink my position size or skip entirely.

- If a low-cap project gets repeated coverage, I check for unlock schedules, VC allocations, and token emissions before touching it.

- If there’s no timeframe or invalidation, it’s entertainment, not a plan. I archive it under “narrative watch,” not “trade setup.”

Want a quick one-glance bias detector for any Satoshi Stacker upload?

- Disclosure present? If yes, good. If not, look harder in description/pinned comment.

- Segmented sponsor? If the promo is quarantined, the analysis is easier to judge.

- Balanced language? Mentions of risks, unlocks, competition, or regulatory overhangs are green flags.

- Independent data? Screenshots of on‑chain dashboards, docs, or third‑party sources beat pure price charts.

I like the channel for narrative scouting and catalyst awareness. I’m careful around sponsored segments and exchange promos, because that’s where incentives talk the loudest. If you use the filters above, you’ll keep the signal and skip the noise.

Now, here’s the fun part: how do you turn what you watch into real, low‑stress results—without overtrading or falling for FOMO? In the next section, I’ll show you the exact workflow I use to convert a video into a watchlist, alerts, and a plan you can actually stick to. Ready to make YouTube work for you instead of your emotions?

How to get real value from Satoshi Stacker’s channel

You don’t need more noise—you need a way to turn a 10–15 minute video into decisions you won’t regret in a week.

“The market doesn’t reward the loudest voice; it rewards the most prepared.”

Here’s how I turn Satoshi Stacker’s updates into something practical, without FOMO or overtrading.

For beginners

Keep it simple. Your goal right now is clarity and consistency, not perfect entries.

- Start with broad market videos. When he says “support,” “resistance,” “RSI,” or “funding,” pause and confirm the meaning. A fast, clean glossary: Binance Academy.

- Build a tiny watchlist (5–8 assets). Example: BTC, ETH, one L2, one DeFi blue chip, one trending narrative coin. Track price, trend (up/sideways/down), and why it’s on your list. Use CoinGecko + a Google Sheet.

- Paper-trade first. Use TradingView’s paper trading to practice what you just learned. Research on retail behavior shows frequent trading often hurts returns (see Barber & Odean, 2000: “Trading Is Hazardous to Your Wealth”). Practicing without money helps you spot your own habits before they get expensive.

- One takeaway per video. Write down a single sentence: “If BTC holds above X for Y days, trend remains up.” This keeps you focused on signals, not noise.

For holders

Use his narrative segments to sharpen timing and manage expectations—without losing your core thesis.

- Turn narratives into calendars. When he mentions catalysts (ETF flows, FOMC meetings, CPI prints, network upgrades, token unlocks), add them to your calendar with a reminder. Handy sources:

- CPI release schedule

- FOMC calendar

- Spot ETF flow dashboards

- TokenUnlocks for vesting events

- Set rules for adds and trims. Example: “Add 10% to BTC if weekly closes reclaim 200D MA and ETF flows stay positive; trim 10% if weekly RSI enters euphoria while funding is elevated.” You’re aligning long-term conviction with short-term confirmation.

- Expect “buy the rumor, sell the news.” If he highlights a big event, decide beforehand whether you’ll scale in early or wait for the post-event cooldown. Pre-commitment beats emotions.

- Quarterly check-ins only. For true holders, assess narratives every 90 days—not daily. Protect your mental space and your thesis.

For active traders

Ideas are cheap. Execution wins. Treat each video like a hypothesis you’ll test, not copy.

- Translate talk into alerts. If he says “BTC liquidity near 60k could get swept,” set two alerts: one above the level for breakout behavior and one below for the sweep. Wait for the reaction, not the headline move.

- Always define invalidation. Example: “Long above 60,200; invalidation below 59,700 on 1h close.” If that breaks, you’re out—no bargaining.

- Risk math you can do in your head. Account $10,000, risk 1% ($100). Stop is 2% away. Position size = 100 / 0.02 = $5,000 notional. That’s it. Keep it consistent.

- Journal like you mean it. Log date, thesis (from the video), entry, invalidation, R target, outcome, and a 1‑line lesson. A simple Notion/Sheet beats memory. Reflection improves discipline, period.

- Never chase mid‑video pumps. If price runs 5–10% during the video, let it go. Write the setup you would have taken and wait for the next one. FOMO is the market’s favorite tax.

Build a balanced research stack

One channel shouldn’t be your only lens. Pair commentary with neutral data and primary sources.

- Price/structure: TradingView, CoinGecko

- On-chain (free tiers): Glassnode, CryptoQuant, Santiment

- Derivatives sentiment: CoinGlass (funding, OI, liquidation maps)

- Project truth: official docs, GitHub, and governance forums; avoid relying on secondhand summaries

- News feed: CoinDesk, The Block, and official project blogs

My simple three‑panel view for every idea:

- Narrative: What is the story and catalyst?

- Data: What do price, flows, and on‑chain say?

- Risk: Where am I wrong, and what do I lose if I’m wrong?

Save time and avoid noise

- Use timestamps + 1.5–2x speed. Get the market view, skip the fluff. Open the transcript and search for keywords like “levels,” “funding,” or “catalyst.”

- Notification strategy. Click the bell but be ruthless: if you’re a holder, prioritize “macro update” and “narratives” uploads; if you’re a trader, favor “levels” and “setups.” For power users, plug the channel’s RSS into Feedly and filter by keywords.

- Two‑tab rule. Watch in tab 1, verify in tab 2 (CoinGecko chart, TokenUnlocks schedule, ETF flow dashboard). Trust—then verify in 60 seconds.

- 15‑minute cap. If a video doesn’t give you one clear action (alert, calendar, note), stop watching. Information without action is just entertainment.

- “Capture, don’t chase.” Write the exact conditions you’ll act on. If price has already moved beyond those, stand down. You’re not late—you’re disciplined.

Want fast clarity on the questions everyone asks—how often he uploads, what he focuses on, and whether you should trust his calls? I’ve answered those next, straight up. Ready to get the quick facts you actually need?

FAQ: People also ask about Satoshi Stacker

Who is Satoshi Stacker?

Satoshi Stacker is a crypto YouTuber who covers market updates, narratives, and coin breakdowns for retail viewers who want quick, actionable context. Think: Bitcoin cycle talk, hot alt narratives, catalysts to watch, and simple explanations without too much jargon. If you’re sifting for signals you can use the same day, his channel is designed for that pace.

Channel link: https://www.youtube.com/@stackersatoshi

Is Satoshi Stacker trustworthy?

He’s generally helpful for timely narratives and digestible market structure. That said, I treat every crypto channel the same: useful for ideas, not instructions. I always check for disclosures in the description, note whether sponsored segments are called out, and verify any strong claims with outside data. This isn’t shade—it’s just how you avoid bias traps on creator-driven platforms.

Why I’m strict about this: The FTC’s Endorsement Guides require clear disclosure for promos. If a video mentions a partner, it should be obvious. Here’s the FTC resource: FTC Endorsement Guides.

Does he give financial advice?

No. Content is educational and opinion-based. You’re responsible for your decisions. I treat any trade or thesis mentioned as a lead to research, not a button to click.

How often does he upload?

Typically several times per week, with more frequent posts when markets heat up (ETF headlines, Bitcoin halving windows, major L1/L2 upgrades). Expect bursts around big catalysts and quieter stretches in low-volatility weeks.

What coins/topics does he focus on?

- Bitcoin cycle structure: halving timelines, liquidity regimes, ETF flows

- Trending alt narratives: L2s, modular stacks, AI + DePIN, restaking, RWA

- Catalysts and upgrades: mainnet launches, token unlocks, exchange listings

- Market structure: support/resistance, sentiment snapshots, funding/open interest notes

Examples you’ll often see: Bitcoin macro trend updates, “top altcoins this month,” or “narratives heating up” rundowns that tie news and charts together.

What are the pros and cons?

- Pros: timely narrative coverage, accessible breakdowns, frequent updates, clear takeaways

- Cons: standard YouTube incentives (sponsors/affiliates), occasional hype risk in hot markets, uneven depth across lesser-known projects

I like the pace for scanning narratives, but I still build my own entries/exits instead of copying any trade ideas.

How should beginners use his content?

- Start with market overviews; write down the 3–5 key points per video

- Pause on new terms and look them up—don’t let jargon snowball

- Build a simple watchlist from the narratives he repeats

- Practice with paper trades first so you can test your timing without stress

Small habit that helps: if he mentions a catalyst (upgrade, unlock, listing), add it to your calendar with a link to the source. That way you’re ready before the crowd.

How do I fact-check his calls?

- Charts: confirm levels and trend structure on TradingView

- On‑chain/trends: check dashboards (e.g., Glassnode), and derivatives data (e.g., CoinGlass)

- Fundamentals: read the project’s docs/roadmap and scan Messari or Token Terminal for usage and revenue

- News verification: cross-check with independent outlets before treating any rumor as real

- Timeframe and invalidation: note what would prove the idea wrong and by when—if those aren’t stated, set your own

Bonus tip: screenshot the chart and write “thesis, trigger, invalidation, timeframe” on it. It forces clarity and keeps you from drifting into vibes-only trades.

Does he disclose sponsors?

Most crypto creators do, usually in the first minute and in the description. If a segment includes a partner, you should see clear labeling and links. If you don’t, assume bias and verify twice. Again, this isn’t specific to him—it’s a universal YouTube rule I follow.

Can I just copy his trades?

I wouldn’t. Even if a thesis is solid, your entry/exit, size, and risk tolerance are different. Treat videos as idea generation. Turn them into rules you can test, then scale only what proves itself.

Any quick signs a video might be more hype than help?

- Big claims with no timeframe or invalidation

- One-sided storytelling (no bear case)

- Undisclosed affiliate or sponsor links tied to the exact topic

- “Guaranteed,” “risk-free,” or “can’t lose” phrasing—instant pass

Where can I find tools to research what he mentions?

I keep a running list of my go-to tools and references here: my research resources. Use them to cross-check charts, on‑chain activity, token economics, and roadmap claims.

Want a no-BS checklist you can run through in 30 seconds before acting on any video? That’s next—plus how I personally filter his uploads for different market regimes.

My verdict on Satoshi Stacker and what to do next

Bottom line: I keep Satoshi Stacker in my rotation for fast narrative reads and timely market context. He’s strongest when big themes are moving—Bitcoin cycle shifts, ETF flows, halving windows, or when alt narratives heat up. If you like storylines anchored to price action and clear takeaways, you’ll get value here. Just remember: it’s a signal, not a trading plan.

Quick pros and cons

- Pros

- Strong narrative focus: Useful when rotations happen. For example, when L2s or AI coins trend, he’ll flag catalysts and sentiment shifts quickly.

- Frequent updates: Good tempo during volatile weeks—handy for holders who want context without living on Crypto Twitter.

- Clear takeaways: You’ll usually leave with a few levels, catalysts, or projects to research—no fluff required.

- Cons

- YouTube incentives: Titles/thumbnails can lean punchy. That’s the platform. Treat urgency as a prompt to research, not a buy button.

- Occasional hype risk: Especially in hot alt seasons. Great for idea generation—dangerous if you skip risk controls.

- Variable depth: Breadth beats depth on some uploads. Pair with docs, tokenomics, and unlock schedules if you go beyond watchlist mode.

Should you subscribe?

Yes if you want regular market context, coin narratives, and catalyst tracking without getting lost in jargon. It’s best for beginners to intermediate users and holders who want storylines tied to levels and events. Active traders can mine ideas and then plug them into a personal system—entries, invalidation, sizing. That last part matters: research says frequent, reactive trading hurts returns for most people (see Barber & Odean, “Trading is Hazardous to Your Wealth,” Journal of Finance; SSRN). Use channels like this to focus, not to overtrade.

A simple checklist before acting on any video

- Confirm the thesis with independent data: Price/volume, funding, open interest, token unlocks, and basic on-chain or supply info. One good, neutral dashboard beats ten opinions.

- Define invalidation and risk per trade: Know the exact level that proves you wrong and the % you’re willing to lose if hit. No level = no trade.

- Time horizon + catalyst: Is this a multi-week narrative, a single event (upgrade/listing), or a swing inside a range? If you can’t say, you can’t size.

- Sponsorship check: If the video is sponsored or includes affiliate links tied to the coin/platform, raise the scrutiny. Disclosed doesn’t mean bad—it just means verify harder.

- Liquidity and slippage: Thin books kill PnL. Check pairs, venues, and depth. If your size moves the price, your plan needs adjusting.

- Fees and mechanics: Perps funding, spread, borrow rates, and gas add up. Fast trades with high friction is how edge leaks.

- Position sizing: Keep risk small relative to your account. Evidence shows attention-driven, frequent trades underperform (see Barber et al., “Attention Induced Trading,” SSRN).

- Exit plan: Pre-plan scale-outs at targets and a time-based exit if the catalyst passes.

- Journal it: Write the thesis, entry, invalidation, and result. Pattern recognition beats memory every time.

Example workflow: He flags “AI altcoins into earnings + big tech AI events.” I confirm volume/funding, check token unlocks, set alerts near prior highs, risk 0.5–1% with a clear invalidation, and pre-schedule an exit if the event under-delivers. That’s how you turn a narrative into a plan.

Final thoughts

I like Satoshi Stacker for fast narrative mapping and easy-to-digest market updates, especially when catalysts cluster. Use the channel to spot opportunities, then slow down and pressure-test the idea with your own rules. Keep your risk tight, ignore the urge to chase, and you’ll extract real value without the stress.

Want a short list of channels that pair well with this style? Tell me your goals and I’ll send tailored picks on CryptoLinks.

CryptoLinks.com does not endorse, promote, or associate with youtube channels that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.