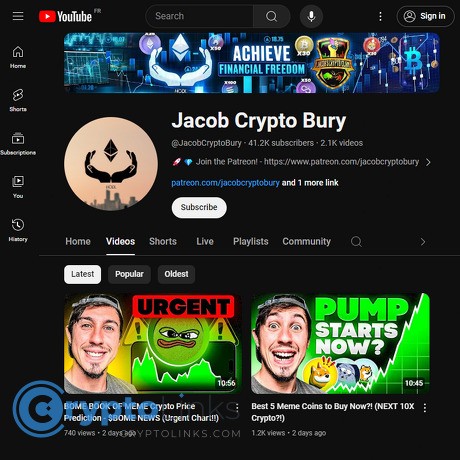

Jacob Crypto Bury Review

Jacob Crypto Bury

www.youtube.com

Jacob Crypto Bury YouTube Review Guide: Everything You Need To Know (+ FAQ)

Ever wonder if a crypto YouTuber can actually help you make smarter moves—not just hype the next coin and leave you holding the bag?

Same here. That’s why I put together a clear-eyed look at Jacob Crypto Bury’s YouTube channel—what you’ll get, what to be cautious about, and a simple way to use his content without risking your stack.

The real win: you’ll save hours, avoid common traps, and walk away with a plan to turn his videos into practical, safer research.

The problem most viewers face on crypto YouTube

Most channels mix legit analysis with aggressive promotion, fast-moving trades, and “can’t-miss” presales. That blend is exciting, but dangerous if you don’t have a process. The hardest part is separating education from entertainment—and both from paid promotion.

- Mixed incentives: Sponsored segments, affiliate links, and presale mentions can influence coverage. It’s not automatically bad—just something to spot and account for.

- Speed vs. safety: Timelines are short. Small caps and presales can pump hard—and unwind faster. Liquidity is often thin, so entries and exits matter.

- FOMO triggers: Thumbnail hype and “X100” titles push urgency. That’s a feature of the platform. Your rules need to be stronger than your emotions.

- Real-world risk data: Chainalysis reported that rug pulls made up a large share of crypto scam revenue in 2021, highlighting how new tokens and presales can be weaponized by bad actors.

- Regulator warnings: Agencies like the SEC and ESMA have warned about promotions and the high risks of crypto assets—especially when content feels like advice. See Investor.gov and ESMA’s consumer warning.

Bottom line: YouTube is great for idea discovery, but you need a filter. If you can tell what’s education, what’s entertainment, and what’s paid promotion, you’ll be miles ahead of the average viewer.

The promise: a balanced, honest review + a simple usage plan

Here’s what you can expect from this guide:

- What Jacob actually posts, who it’s for, and how his channel fits into the crypto YouTube landscape

- Strengths and blind spots—so you know when to pay attention and when to slow down

- A simple, repeatable way to use his ideas safely (without turning every video into a FOMO trade)

- Quick answers to common questions—risk basics and even the “Jacob & Co accepts crypto?” confusion

Use YouTube for ideas, not orders. Treat every coin mention as a starting point for your own research, not a finish line.

Who this guide is for

- New and intermediate crypto investors who want market updates, altcoin ideas, and presale talk—without getting wrecked

- People who like fast-moving narratives but want a plain-English way to filter content and set their own rules

- Anyone who’s been burned by hype before and wants a safer, repeatable approach

Quick verdict upfront

Good fit: Active viewers who enjoy altcoin hunting, daily market updates, and community chatter. If you like scanning new narratives and then doing your own checks, you’ll find value.

Not ideal: If you only want conservative, long-term-only content with deep accounting-level fundamentals, this isn’t that. It’s faster, more narrative-driven, and includes small caps and presales.

How to approach it safely:

- Assume small caps and presales are speculative. Treat them as high-risk by default.

- Never act on a single video. Verify tokenomics, liquidity, and vesting before you touch the buy button.

- Keep position sizes small and pre-define your exits. If liquidity looks thin or vesting cliffs are near, be extra cautious.

Curious how Jacob’s content actually stacks up—style, cadence, and credibility? Let’s look at who he is and what to expect before you hit subscribe. Ready for the snapshot?

Who is Jacob Crypto Bury? Channel snapshot and credibility

Jacob Crypto Bury runs a fast-moving YouTube channel that sits squarely in the altcoin-and-opportunity corner of crypto YouTube. If you enjoy scanning new narratives, small-cap setups, and presale buzz—without waiting a week for someone to publish a 40-minute research tome—his feed is built for you. He speaks to the “active but learning” crowd: people who want to catch trends early, understand catalysts, and act with a plan.

Think of his content as a real-time radar. He tracks narratives (AI, gaming, meme coins, L2s), keeps an eye on Bitcoin/ETH levels that steer alt liquidity, and blends that with presale coverage and community chatter you’ll see in his Telegram/Discord. It’s energetic, idea-dense, and paced for traders and opportunistic investors who want to stay in the conversation every day.

“Speed gets attention; process keeps your capital.” I remind myself of this every time a thumbnail promises the next 100x.

Background and niche

Jacob’s footprint is the “altcoin hunting + market pulse + presale introductions” niche. He isn’t trying to be the macro professor or the 60-minute fundamentals analyst. Instead, he focuses on what’s moving now and what might move next.

- Altcoin focus: Frequent looks at trending sectors and low/mid-caps. Expect titles about “gems,” “narratives,” and “setups” rather than deep accounting breakdowns.

- Market news and sentiment: He’ll anchor ideas to BTC/ETH levels, funding flips, and calendar catalysts (FOMC, CPI, ETF headlines, token unlocks).

- Presales and early-stage ideas: Coverage of launchpads, new token sales, and early listings—framed as high-risk, high-upside opportunities.

- Community-driven: He sources buzz from social channels and brings that discussion on-screen. You’ll often see TradingView charts, basic TA (support/resistance, moving averages, RSI), and callouts from his groups.

Where he fits in the YouTube crypto landscape: imagine a spectrum from “slow, fundamentals-heavy research” to “pure hype.” He’s closer to the fast-twitch end—but not pure noise. The value is in surfacing ideas quickly and helping viewers spot where liquidity and attention are rotating this week.

Upload frequency and formats

Consistency matters on crypto YouTube, and Jacob generally keeps a busy schedule. Most weeks you’ll see near-daily uploads or at least several videos spaced across the week—enough to keep pace with shifting narratives.

- Market updates: Short to medium-length videos scanning BTC/ETH context, sector strength, and notable catalysts.

- Altcoin/Presale breakdowns: Idea spotlights with a quick thesis (why now, what could move price, main risks).

- How-tos and walkthroughs: Setting up wallets, using exchanges/launchpads, or following basic trading steps for newer viewers.

- AMAs/Livestreams: Occasional community sessions or live reactions when the market is hot.

Typical pacing: 8–15 minutes for updates and idea scans; longer if there’s a stream or a lot to react to. The format is designed for quick consumption—the kind of video you can watch over coffee before the U.S. session opens.

Transparency and disclosures

Because the channel often covers small caps and presales, disclosures and labeling matter—a lot. Jacob uses the standard “not financial advice” line and typically flags sponsored segments or partner links in the description. You’ll often find affiliate links to exchanges or launchpads, referral codes, and mentions of paid partnerships when they apply. On some videos, you may also see YouTube’s “Includes paid promotion” notice at the start.

- What I check every time:

- Scan the description for “sponsor,” “partner,” “affiliate,” or referral codes.

- Look for an on-screen or verbal disclosure if a presale is featured.

- Check if the “Includes paid promotion” tag appears (when used).

- Note any aggressive timelines or limited windows—those often pair with marketing pushes.

- Why it matters: Sponsored segments can create conflicts or skew which projects get airtime. Clear labeling helps you separate education from promotion so your decision-making stays clean.

Research in advertising and consumer behavior consistently shows that clear disclosures help viewers recognize marketing and make more deliberate choices. If you want the official stance, the FTC’s Endorsement Guides spell out how influencers should disclose paid relationships—worth a skim if you rely on YouTube for investing ideas: FTC Endorsement Guides.

Bottom line on credibility: he’s a real, consistent presence with an audience that craves fast context and altcoin leads. The content style is energetic and opportunity-forward, and the channel does include sponsor-driven pieces—so you’ll want your own rules for filtering hype from homework. That’s where the next part comes in.

What will you actually see in your feed if you hit subscribe—daily market scans, altcoin “gems,” step-by-steps, and community signals—and how should you use each without overtrading? Let’s break that down next.

What you’ll actually find on the channel

Here’s what shows up in your feed when you hit subscribe to Jacob Crypto Bury’s YouTube channel: fast market reads, altcoin hunting, presale spotlights, hands-on walkthroughs, and plenty of community chatter. I watch with a notepad, because if you like to act on narratives while they’re hot, his cadence is built for you.

Daily market updates and narratives

Expect quick, punchy rundowns that connect Bitcoin/ETH levels with the story-of-the-day in alts. Think 8–12 minutes, minimal fluff, lots of “what matters now.”

- Levels and structure: BTC/ETH support and resistance, moving averages, open interest/funding, and fear/greed vibes.

- Macro-in-crypto English: CPI/Fed days, ETF flows, DXY, and how they can tilt risk-on/risk-off for alts.

- Narrative radar: Rotations into AI, gaming, L2s, RWAs, and meme seasons, with tickers to watch when flows pick up.

- Catalyst pings: Upcoming unlocks, listings, testnet/mainnet dates, and partnership teasers that can move price.

Why I like this: attention moves money in crypto. Multiple studies on attention-driven markets suggest that spikes in search volume and social chatter often precede short-term volatility and momentum. Use these updates as a heat map, not a green light.

“Ideas are free. Risk isn’t.”

Altcoin “gems” and presales

This is the adrenaline lane. You’ll see videos titled along the lines of “Top 3 Altcoins for 10x” or “New Presale Launch,” where he covers small caps or tokens raising before launch. He’ll outline a simple thesis (narrative + catalyst + valuation angle) and why a coin could run.

- What usually gets featured: micro-caps tied to hot themes (AI, DePIN, GameFi), low float tokens with near-term listings, and presales with flashy roadmaps or KOL buzz.

- What can make them pop: thin order books, community campaigns, first CEX listing, mainnet or staking launches, and social media bursts.

- What to double-check before you touch it:

- FDV vs. float: A tiny circulating supply with a massive fully diluted valuation can crush buyers when vesting unlocks hit.

- Token release schedule: Team/investor cliffs are gravity. Mark the dates.

- Liquidity reality: DEX depth and CEX volume. Can you exit without eating 5–10% slippage?

- Smart contract safety: Audit links aren’t a force field. Verify the actual report, not just a badge.

- Team and socials: Real names? Real commits? Organic community or botted comments?

Important context: research on crypto markets (from academic work on pump-and-dump schemes and attention-driven rallies) shows small caps can pump hard and retrace faster than you can click sell. That’s the game here—opportunity and danger live side by side. He’s good at surfacing names; your edge is in the verification.

Tutorials and how-tos

Not just hype—there are practical guides that help newcomers get set up and avoid rookie mistakes. These are the “save-yourself-hours” videos.

- Wallet setup: MetaMask/Trust Wallet basics, network adds (Arbitrum, BSC), slippage settings, and importing tokens safely.

- Trading flows: How to use DEXs like Uniswap/PancakeSwap, set limit orders on CEXs, manage fees, and avoid honeypot contracts.

- Launchpads and presales: Connecting wallets, whitelists, KYC badges, and typical pitfalls like fake sites or mismatched contract addresses.

- Security hygiene: Revoking approvals, hardware wallet checklists, and scam red flags in DMs and “support” chats.

Given how much value has been lost to phishing and contract exploits in recent years (billions across DeFi exploits according to industry reports), these basics aren’t optional. I’ve seen one good tutorial prevent ten avoidable headaches.

Community and social channels

There’s a strong community backbone—Discord/Telegram mentions, watchlists, and signals-style chatter that tries to catch early moves. It’s buzzing, and that’s the double-edged sword: you get speed, but FOMO lurks.

- What you’ll see: ticker callouts, presale alerts, chart snapshots, and “first listing in X hours” pings.

- How I use it without overtrading:

- Signals to watchlist, not wallet: I add mentions to a tracker, then verify contract, liquidity, and unlocks.

- Three-source rule: If I see the same ticker from 3 independent mentions (not copy-paste), it graduates to research.

- Mute, then method: Notifications off, alerts on. I let my rules trigger me—not the chat.

Net-net, the channel gives you speed to story: market context in the morning, narratives at noon, and small-cap/presale ideas when the crowd is hunting. The real question is: which of these strengths actually fit your goals—and where can this style lead you into traps if you’re not careful?

Up next, I’ll break down where this content shines, where it can burn you, and who’s best suited for it. Want the honest trade-offs?

Strengths, weaknesses, and fit

Where Jacob shines

When the market moves fast, speed matters. Jacob’s channel wins on timeliness and narrative tracking. He’s quick to spot where attention is flowing—AI tokens after big tech earnings, gaming coins around major releases, RWAs when real-world adoption headlines land, or meme coin bursts when liquidity rotates to Solana or BSC. If you like scanning for opportunities, his cadence and energy keep you plugged into the day’s story.

- Timely coverage: Uploads often land around catalyst windows (FOMC days, ETF flow updates, sudden BTC dominance swings). That’s useful if you’re trying to gauge sentiment in real time.

- Narrative radar: He’s strong at connecting headlines to potential altcoin themes—exactly what short-horizon traders need to build a quick watchlist.

- Altcoin discovery: Plenty of small-cap and presale mentions. You’ll see names you won’t find on conservative channels, which is great for idea generation—if you manage risk.

- Clear, energetic delivery: Short, focused segments make it easy to grasp the thesis and decide if a project deserves your deeper research.

- Community signal: Polls, comments, and Telegram/Discord mentions act like a sentiment heat map. That social pulse can be helpful for timing if you’re disciplined.

“Hype is not a strategy. Process is.”

I like creators who respect the clock of crypto. Jacob does that. He sets the table fast—then it’s on you to decide what’s worth a bite.

What to watch out for

Speed cuts both ways. The same features that make his content exciting—sponsored segments, presales, quick timelines—can amplify FOMO if you’re not careful. Research from markets and behavioral psychology keeps repeating the same lesson: urgency nudges people into riskier, less-verified decisions. That’s the trap to avoid.

- Sponsored segments and affiliate links: They’re standard on YouTube, but they can tilt coverage. Disclosures matter; your filter should be “interesting idea, now verify.” The FTC endorsement guidelines exist for a reason—always account for incentives.

- Presale and small-cap risk: Low float, vesting cliffs, thin liquidity, and contract risk can make these rocket—or rugged. Academic and industry reports (e.g., Momtaz 2020 on ICO performance; PwC ICO reports) have highlighted high failure rates and severe dispersion in outcomes. Treat presales as speculative; size like it’s a lottery ticket, not a savings bond.

- Not always deep-dive research: Fast coverage can mean lighter treatment of tokenomics, unlock schedules, and on-chain holder concentration. Those details decide whether a chart breathes—or suffocates—after launch.

- Urgency and time pressure: Phrases like “last chance,” “100x,” or tight windows stoke FOMO. Scarcity is a powerful bias (Cialdini’s research made that famous). When you feel the itch to rush, that’s your signal to slow down.

- Survivorship and recency bias: Viral wins get airtime; quiet losses fade. Overweighting recent pumps is a classic retail mistake. Studies on retail trading behavior (e.g., Barber & Odean) showed that chasing attention and overtrading tended to hurt returns—crypto’s volatility magnifies that effect.

Put simply: enjoy the firehose, but bring an umbrella. The ideas can be solid starting points; the execution is on you.

Who will benefit most

Different viewers need different feeds. Here’s who tends to click with Jacob’s style—and who might not.

- Best fit: Active, curious investors who love scanning for altcoin narratives, then doing their own legwork. If you run watchlists, set alerts, and maintain a risk plan, you’ll extract value.

- Also useful for: Builders and marketers tracking sentiment and attention cycles; newcomers who want approachable walk-throughs—so long as they stick to small sizing and education-first actions.

- Less ideal for: Purely long-term, fundamentals-only investors who prefer quarterly theses and low turnover. They’ll likely find the frequency and small-cap focus noisy.

There’s a reason attention-driven content feels exciting: it speaks to the part of us that wants to catch the move now. But as I always remind myself:

“Ideas are free. Risk costs real money.”

So how do you keep the upside of fast ideas while protecting your downside? In the next section, I’m sharing the simple checklist and risk rules I use to turn YouTube content into a safer, repeatable process—want the exact steps I follow before touching a presale or small cap?

How to use Jacob’s content safely (my simple framework)

Great crypto videos can spark ideas, but ideas without a process can cost you real money. Here’s the simple, repeatable framework I use when watching Jacob Crypto Bury’s breakdowns, altcoin picks, and presale mentions—so I can learn fast without becoming exit liquidity.

“In crypto, survival comes first; upside only matters if you’re still in the game.”

The research checklist

When Jacob highlights a coin or presale, I run this checklist before I touch the buy button:

- Tokenomics

- Total/Max supply vs circulating supply. Calculate FDV = price × total supply. If FDV looks rich versus peers, I wait.

- Utility and sinks: What makes users hold or spend the token beyond speculation?

- Quick example: If he covers an AI micro-cap with 1B supply at $0.02, FDV is $20M. If only 5% is circulating, real sell pressure may explode on unlocks.

- Vesting & unlocks

- Check TGE %, cliff, and monthly unlock rate. If team + investors release >20–30% within 3–6 months, I assume heavy supply overhang.

- Use TokenUnlocks or CryptoRank to map dates.

- Liquidity & exchange depth

- On DEX, check pool size, lock status, and slippage on a test trade in a simulator (1INCH/0x quote). If a $1,000 buy moves price >2%, it’s thin.

- On CEX, look at order book depth and maker/taker fees. Thin books + high fees can kill trades.

- Tools: DEXTools, DexScreener, liquidity locks via Team Finance or Unicrypt.

- Smart contract & security

- Read contract on Etherscan / BscScan: owner privileges, mint functions, blacklist/fee mods, proxy patterns.

- Scan with TokenSniffer and GoPlus. These aren’t perfect, but they catch common traps.

- Verify audits (who did them and when). A fresh audit from a known firm beats a year-old PDF.

- Team & build momentum

- Doxxed founders? Past shipped products? Real LinkedIn footprint?

- GitHub activity matters for tech claims: GitHub commits/issues over the last 90 days.

- Holder distribution

- Top-10 holders % on Etherscan. If non-exchange wallets control >50% with short vesting, I size tiny or pass.

- Check if a single wallet can nuke the pool (LP owner, deployer wallets).

- Narrative longevity

- Is there a catalyst calendar (mainnet, listings, product release) in the next 30–90 days?

- Use Google Trends and LunarCrush to sanity-check hype vs. traction.

- Red flags

- “Guaranteed APY,” vague revenue sharing, or no clear legal language = hard pass.

- Brand-new site, anonymous team, and recycled contract code = assume risk is elevated.

Why I’m strict: Chainalysis’ 2024 report shows scams and rug-pulls remain a persistent share of illicit crypto activity. Treat presales and tiny caps like live wires until proven otherwise. Source: Chainalysis 2024 Crypto Crime Report.

Risk management basics for volatile assets

Jacob covers fast-moving narratives. That’s exciting—and exactly why I lock in guardrails before I trade:

- Portfolio risk budget

- Define max total exposure to small caps/presales (example: 10–20% of portfolio).

- Per-trade risk: 0.5–2% of portfolio. If I have $10,000, I plan to lose no more than $100–$200 if wrong.

- Pre-plan exits

- Write down invalidation: “If price closes below X or catalyst fails, I exit.”

- Scale out into strength: take 25–50% profits at pre-set targets, trail a stop on the rest.

- Consider simple rules like “cut at -10%/-15%” on micro-caps to avoid death-by-illiquidity.

- Right-size to volatility

- High 24h volatility = smaller size. ATR/vol bands help. No shame in tiny positions on fresh launches.

- Use low or no leverage

- Leverage magnifies slippage and gaps around unlocks/listings. If you must, keep it minimal and hedged.

- Avoid overtrading

- Overtrading historically hurts returns. See Barber & Odean (2000), “Trading Is Hazardous to Your Wealth.” SSRN

- Rules-based approaches tend to reduce drawdowns across markets. Trend/exit rules research: AQR’s Time-Series Momentum. AQR

Emotional rule I live by: If I feel urgent (“this is the one!”), I walk away for 15 minutes. Good trades still look good after a pause. FOMO trades almost never do.

Tools that help

Here’s my no-drama toolkit to keep Jacob’s ideas grounded in facts:

- Price alerts: TradingView, CoinGecko, CoinMarketCap

- On-chain explorers: Etherscan, BscScan, Solscan

- Wallet trackers: DeBank, Zerion, Zapper

- DEX liquidity and pair data: DEXTools, DexScreener

- Security checks: TokenSniffer, GoPlus Token Security

- Unlock calendars: TokenUnlocks, CryptoRank

- Code and docs: GitHub, project whitepapers, and audits linked from official sites

- Independent news and aggregation: CryptoPanic, The Block, Blockworks, CoinDesk

- Social/narrative signals: LunarCrush, Google Trends

Bonus sanity checks for presales: domain age via WHOIS, team identities (LinkedIn/Twitter consistency), and whether LP will be locked on launch (and where).

A simple workflow for each video

Here’s the loop I run when Jacob posts a coin or presale:

- Watch the video and capture the thesis in one sentence. Example: “Small-cap AI tool indexing on-chain data; mainnet in 60 days.”

- Verify the facts with the checklist above. If 2+ high-severity items fail (e.g., unlocked supply + no audit), I skip.

- Plan the trade or investment:

- Entry zones, invalidation level, first profit target, position size (risk-based).

- Set alerts; avoid market buying illiquid pairs.

- Execute small to start. I often begin with 25–33% of intended size and add only after confirmation (volume, unlock cleared, feature shipped).

- Stagger exits: Partial at TP1, trail the rest. If news is the catalyst, I plan to be out before the crowd fades.

- Review after 24–72 hours and again after 7 days. What worked? What rule saved me? What rule did I ignore?

Two real-world patterns I’ve seen:

- Presale with 10% TGE + 3-month cliff: I assume a sell wave at the first unlock. If I play it, I keep size tiny pre-unlock and only scale if liquidity deepens and unlock is absorbed.

- Hot narrative mid-cap (e.g., AI or RWA): I use alerts near prior highs and a tight invalidation. If funding flips extreme or social chatter spikes without news, I trim—hype exhausts quickly.

Jacob’s speed can be a huge edge—as long as your rules are faster. Want my short list of channels and tools that balance quick narratives with deeper research, plus the exact starter videos I’d queue up next? That’s up next in the mix. Ready to upgrade your feed without bloating it?

Alternatives, best starters, and helpful resources

How he compares to other channels

If you like fast narratives and altcoin hunting, Jacob is strong on timing and energy. To balance that, I mix him with channels that slow me down and force deeper checks.

- Coin Bureau: research-first, longer videos, conservative tone. Great for fundamentals and risk context when Jacob drops a hot small-cap or presale idea.

- Benjamin Cowen: macro cycles, on-chain metrics, and seasonality. Helps sanity-check whether an alt narrative actually fits the broader market regime.

- Bankless: Ethereum, DeFi, and L2s with builder interviews. Useful when Jacob covers narratives like RWA, restaking, or ETH catalysts.

- The Chart Guys or Rainer TA: if you want pure technicals to refine entries/exits for coins you discovered on Jacob’s feed.

- Altcoin Daily / Crypto Banter: more headlines and market buzz. If you follow these, make sure you pair them with data-driven tools below to avoid echo chambers.

Quick reality check: peer-reviewed research has documented coordinated crypto pump-and-dump activity on social channels and exchanges, and classic studies on attention-driven trading show that chasing headlines tends to underperform. If a coin is everywhere, your risk of buying late likely went up. See: Hamrick et al. on crypto pump-and-dumps and Barber & Odean on attention-induced trading.

Best videos to start with

To get a quick, accurate read on whether his style fits you, I use a simple three-video sampler:

- One recent market update: Sort his channel by “Most recent.” You’re looking for BTC/ETH levels, a couple of narratives (e.g., AI, RWA, memes), and any catalysts he flags. Ask: does his thesis match what you see on TradingView and reputable news feeds?

- One altcoin breakdown: Pick a current small-cap or mid-cap video. As you watch, write down: token supply/FDV, unlock schedule, key investors, and immediate catalysts. Afterward, check CoinGecko’s supply figures, exchange depth, and any vesting calendars you can find.

- One tutorial: Choose a wallet/exchange/launchpad walkthrough. Does he show practical steps (fees, approvals, revoking permissions), or just the upside pitch? The best tutorials always include risks and safety tips.

Pattern-spotting trick: if his market update calls out AI + RWA + memes, see whether the alt breakdown aligns with those narratives. When the story and the technicals rhyme across videos, you have a cleaner thesis.

Red flags during this test run:

- FDV vs. reality: If FDV is sky-high and there’s no revenue/users, you’re paying for air.

- Unlock cliffs: Big unlocks within 30–60 days after a hype cycle often crush price.

- Thin liquidity: If a few thousand dollars moves the price, your exit risk is huge.

Extra reading and tools I recommend

Use fast content for ideas and slow content for validation. Here are some staples that keep me honest:

- Market and research: CoinGecko, Messari, DeFiLlama, Token Terminal

- On-chain and analytics: Glassnode, IntoTheBlock, Dune, Nansen

- Trading and alerts: TradingView, CryptoPanic

- Security and contract checks: Etherscan, De.Fi Scanner, Revoke.cash, Token Sniffer

- Wallet hygiene: MetaMask, Rabby, Ledger, Trezor

My Cryptolinks picks to round out your stack

To keep your setup balanced and safe, build a “barbell” of speed + verification:

- News aggregators: catch catalysts without scrolling all day. Try CryptoPanic and a curated mix of CoinDesk and Cointelegraph newsletters.

- On-chain analytics: confirm whether a “hot” narrative has real flows. DeFiLlama for TVL trends, Dune for custom dashboards, and Glassnode for BTC/ETH cycle context.

- Wallets: use a burner wallet for experiments and a hardware wallet for storage. Rabby is great for approvals visibility; pair with Ledger or Trezor.

- DEXs and aggregators: Uniswap and 1inch for routing; always check slippage and liquidity on Dexscreener before pressing buy.

- Security tools: make revoke.cash a monthly habit; scan contracts with De.Fi Scanner; verify team wallets and movements via Etherscan.

Put it all together like this: hear the idea fast (Jacob), validate the data slow (analytics + on-chain), then size small and set rules. That’s how you enjoy the upside without letting volatility bully your portfolio.

Want straightforward answers on legitimacy, presales, and whether his community chats are worth your time? I’ll tackle those next and give you simple rules you can actually use—ready to pressure-test your current approach?

FAQ and my final take

Is Jacob Crypto Bury legit?

Yes—he’s a real, active creator with frequent uploads and a lively community around altcoins and presales. Like any channel in this niche, you’ll see sponsored segments and affiliate links. That doesn’t make the content useless; it just means you should treat picks as ideas, not orders.

- Quick check: scan video descriptions for “sponsored,” “affiliate,” or “paid partnership.”

- Reality check: if a project looks too perfect, it probably paid to look that way. Cross‑verify before you touch your wallet.

What do I need to know before getting into crypto?

Crypto moves fast and cuts deep. Bitcoin’s annualized volatility is often several times higher than stocks, and small caps can swing multiple double‑digits in a day. You don’t need to predict—just plan.

- Pick a risk budget: a fixed amount you’re okay losing on speculative bets. Protect the rest.

- Pre‑plan exits: set take‑profit ladders and a max drawdown where you reduce or exit. For example, trim 25% on strength, cut risk if price closes below your invalidation.

- Size small: many traders cap new ideas at 1–3% of portfolio until they “earn” a larger weight.

- Avoid leverage early: it magnifies mistakes. Learn spot first.

- Custody basics: use a hardware wallet for core holdings, 2FA everywhere, and never sign random contracts.

“Plans beat predictions.” Keep a simple journal: why you bought, your targets, your stop rules, and the outcome. You’ll improve faster than chasing hot takes.

Does Jacob and Co accept crypto?

Different “Jacob.” Jacob & Co. (the luxury watch brand) has publicized crypto-friendly moves—reports noted Bitcoin payments for select pieces like the Astronomia Solar Bitcoin. That has nothing to do with Jacob Crypto Bury on YouTube.

Are presales safe if he mentions them?

Presales are the deep end: huge upside potential, but the risks stack up—low float at launch, vesting cliffs, limited liquidity, and smart‑contract or admin‑key dangers. Treat them as speculative, even if they’re hyped.

- Vesting & unlocks: check schedules on tools like TokenUnlocks. Sharp drawdowns around big unlocks are common.

- Liquidity reality: how much can actually be sold before price craters? Look at DEX/market depth, not just FDV.

- Contract risk: verify audits and permissions. Can the owner mint more tokens or pause transfers? Check “Owner”/“Proxy” on explorers (Etherscan/BscScan) and look for multisig control.

- Team and paper trail: real builders leave footprints—GitHub, past products, credible backers.

Context: industry research (e.g., Chainalysis Crypto Crime reports) has shown rug pulls became a major share of scam revenue during DeFi’s boom and remain a persistent threat. That doesn’t mean every presale is a scam—it means your default stance should be cautious and your sizing small.

Is his Discord/Telegram worth it?

It can be—if you use it right. Community chats are great for quick idea flow, but they also push urgency and overtrading.

- Use “read‑only” mode: build a watchlist from the chatter, then do your own checks before acting.

- Mute notifications: alerts create FOMO. Your plan matters more than the room’s excitement.

- Security first: imposters and fake airdrops are everywhere. Never click DMs, only use verified links, enable 2FA, and treat anything “urgent” as a red flag.

Worth noting: classic behavioral research (Barber & Odean) showed frequent trading tends to hurt returns for most retail investors. Translation: don’t let chat velocity become your strategy.

Bottom line: how I’d use his channel

My take: Jacob Crypto Bury is a strong follow for fast narratives, altcoin discovery, and community buzz—if you pair it with strict rules and independent validation.

- Use for ideas, not orders: pick 1–2 leads per week, ignore the rest.

- Run your checklist: tokenomics, unlocks, liquidity, team, contract, and catalysts. No green lights? No trade.

- Start small and scale: begin with a test position, add only after confirmations.

- Document everything: what you saw, what you verified, your plan, and the result. Iterate.

Do that, and you’ll get the upside of fast content without becoming exit liquidity for the next hype cycle.

CryptoLinks.com does not endorse, promote, or associate with youtube channels that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.