Austin Hilton Review

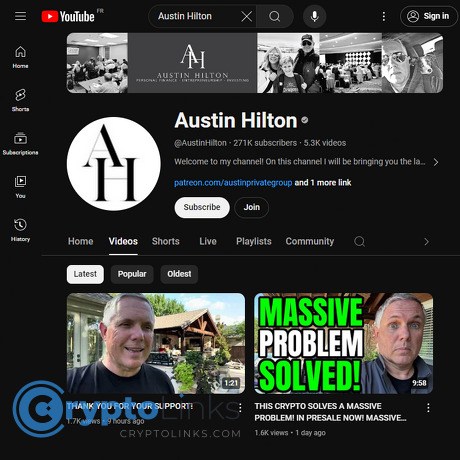

Austin Hilton

www.youtube.com

Austin Hilton YouTube Review Guide: Everything You Need to Know (with FAQ)

Have you ever watched a crypto video and thought, “Is this actually useful or just hype?” If you’re following or considering Austin Hilton on YouTube, you’re not alone. I put this review together to show you what you’ll really get, what to ignore, and how to use his content without getting wrecked.

Here’s the plan: I’ll keep it simple—what Austin covers, who it’s for, how reliable it feels, how he likely makes money, and where his channel fits in a smart crypto research stack. And yes, I’ll also clear up the surprisingly common confusion between the creator and the Hilton Austin hotel later on.

Why crypto YouTube can be risky (and what usually goes wrong)

Too many channels promise quick wins, push memecoins, and slap “do this now” in thumbnails. It’s hard to tell what’s researched vs. what’s sponsored, and beginners often turn entertainment into financial decisions without realizing it.

- Urgency overload: “100x by Friday” is fun to watch but wrecks patience and planning.

- Sponsorship blur: Some “reviews” are ads in disguise, and disclosures can be easy to miss.

- Cherry-picked outcomes: Big winners get airtime; the duds rarely get a follow-up.

- Herd temptation: When a video spikes a ticker, late entries often buy tops and panic-sell bottoms.

This isn’t just theory. Research shows attention spikes often precede retail buying and volatile whipsaws. A well-cited paper on the “attention effect” in markets found that investors are more likely to buy assets that grab their attention—think headlines and trending tickers—regardless of fundamentals (Barber & Odean, Journal of Finance). Crypto-specific analyses have documented coordinated pump-and-dump patterns around social media surges (Hamrick et al., arXiv). Meanwhile, regulators keep stressing clear disclosures for endorsements and affiliates (FTC Endorsement Guides).

Bottom line: YouTube can be a great source of ideas—but algorithms reward excitement, not risk-adjusted returns.

What I promise you’ll get here

I’m going to highlight where Austin Hilton’s channel brings real value, where it falls short, and give you a simple way to use his content safely alongside better data and tools. No drama—just practical advice you can actually use.

- Clear expectations: what his videos tend to cover and what they don’t

- Signals to watch for: research quality, sourcing, and disclosure cues

- A simple “use-it-right” checklist to turn ideas into informed actions (coming up)

Who is Austin Hilton?

Austin Hilton is a crypto YouTuber who covers market news, altcoins, memecoins, and trend-driven headlines with a retail-friendly, fast-take style. Expect quick news reactions, price-level commentary, and content aimed at what’s moving right now. You’ll often see videos on trending tokens, breaking headlines, and community favorites (yes, including coins like SHIB when they’re in the news).

If you like short, timely updates and the energy of “what’s hot today,” his channel can feel like a live feed for market mood. Here’s the channel link if you want a peek while you read: youtube.com/@AustinHilton.

What I looked at to build this review

- Content accuracy and depth: Are claims specific and supported, or more narrative-heavy?

- Research signals: Screenshares, sources, data references, and any repeatable frameworks

- Disclosures: Affiliates, partners, and how clearly sponsorships are labeled

- Track record: How time-sensitive calls aged during past hype cycles

- Cadence and timing: Frequency of uploads and whether it skews to headlines

- Production and clarity: Editing, pacing, and how easy it is to follow

- Community feedback: Viewer comments and sentiment (signal vs. noise)

- Ethics and conflicts: Any cues that help you weigh incentives

Who this guide is for

- Beginners to intermediates who want fast market takes and token spotlights

- People using YouTube for idea generation but willing to verify with their own research

- Anyone who wants a simple, safe way to use influencer content without getting pulled into FOMO

Curious whether Austin’s channel is actually worth your time this week and what you’ll see if you click a video today? In the next section, I’ll break down the channel’s focus, formats, cadence, and who will benefit most—so you can decide in 60 seconds flat. Ready?

Channel snapshot and first impressions

Open Austin Hilton’s YouTube channel and you’ll see what I saw: a fast-moving feed centered on breaking crypto news, hot altcoins, and what’s buzzing right now. Titles lean newsy and practical (“ETF update,” “SHIB news,” “Bitcoin today”), thumbnails are clear and energetic, and the tone is retail-first. If you want a quick pulse on what the crowd is watching without living on Twitter all day, this is a useful feed to have on your radar.

“In crypto, speed is a feature…and a trap. Fast is fun, but facts save your stack.”

First impression: it’s a momentum-friendly channel that keeps you close to the headlines. That’s great for awareness. It’s less great if you’re the type who needs full-stack research in a single video. Expect timely reactions and clear summaries, not 45-minute deep research pieces.

Content themes

The recurring topics line up with what retail traders care about day to day. Think:

- News reactions: CPI/Fed days, ETF headlines, SEC actions, and crypto-wide risk-on/off shifts. Example: when an ETH spot ETF rumor hits, expect a same-day explainer with market implications.

- Altcoin spotlights: Trending tickers that retail actually clicks on—SHIB updates (burns, Shibarium notes), XRP lawsuit momentum, SOL ecosystem hits, and seasonal runners.

- Memecoin commentary: Quick takes on DOGE/PEPE or new memes when volume spikes. These are short, sentiment-heavy, and timing-sensitive.

- Market sentiment checks: Fear/Greed vibes, Bitcoin dominance chatter, and “what whales are doing” style headlines that frame short-term positioning.

- Catalysts and timelines: Halving countdowns, big listings, token burns, unlocks, and partnerships that can move a chart intraday.

It’s a steady stream of “here’s what’s moving and why,” with an emphasis on what traders might act on today, not next quarter.

Video formats

Expect a mix that respects your time when markets are moving fast:

- Short news hits (6–12 minutes): Quick context, key chart levels or headlines, a takeaway.

- List-style picks: “Top 3 altcoins this week” or “5 tokens to watch.” These act like watchlist starters.

- Price updates: Immediate takes when BTC/ETH cracks a level or rips on a catalyst.

- Reaction content: Screenshares of headlines, posts, or charts with commentary you can absorb in one pass.

- Occasional explainers: Basics around a hot theme (e.g., ETF impact, halving mechanics) so beginners don’t feel lost.

- Partner mentions: Brief sponsor or affiliate slots around exchanges, wallets, or project spotlights—watch the on-screen/text disclosures.

It’s built for speed: click in, grab context, move on. Perfect for mobile viewing between tasks or during market hours.

Posting cadence and recency

The upload pace is high—often multiple videos weekly and more when the market is spicy. That matters because recency is alpha in news-driven crypto. One strong reason to keep a timely channel like this in your rotation: attention spikes correlate with volatility and short-term opportunities.

There’s research to back that up. Studies have shown that crypto prices are sensitive to attention metrics and news flow (e.g., Google Trends and Wikipedia views co-move with Bitcoin activity). See work like Kristoufek (2013) on attention and Bitcoin, and broad evidence that social-media-driven headlines can spark sharp, temporary dislocations. Translation: if you’re late to the story, you’re often late to the move.

Because videos are time-sensitive, it pays to check timestamps before acting on anything. If a CPI print or ETF update came out hours ago, the edge might have passed.

Audience fit

You’ll get the most value here if you want fast, retail-friendly updates that translate big headlines into “what this might mean today.” A quick test:

- Good fit if you: like short briefings, track altcoin narratives, make watchlists, and prefer someone to filter the firehose for you.

- Not ideal if you: need in-depth on-chain analytics, deep tokenomics breakdowns, or coding-level protocol research.

In practice, I treat channels like this as my notification layer. They surface names and narratives quickly. Then I decide whether anything earns a spot on my research stack.

First-glance pros and cons

- Pros

- Timely and energetic: You see what’s moving when it matters, with clear, simple commentary.

- Easy to follow: No jargon spiral. Beginners won’t feel shut out.

- Great for watchlists: Surfaces tickers and catalysts you can validate elsewhere.

- Cons

- Hype risk: Momentum stories can sound compelling at the exact moment risk is highest. FOMO thrives on fast content.

- Uneven depth: Headlines > frameworks. Use it for awareness, not end-to-end due diligence.

- Sponsored segments: Legitimate in creator-land, but you need to separate ads from analysis and verify independently.

I’ll be honest: this style is exciting because it lines up with how crypto actually moves—in bursts. But excitement cuts both ways. As one trader friend tells me, “Volatility rewards the early, punishes the unprepared.”

So how strong is the signal beneath the sizzle? Next, I’m going to look at the content’s depth, accuracy, and research quality—what’s sourced, what’s not, and how you can tell the difference. Ready to see where the real edge is and where to bring your own tools?

Content depth, accuracy, and research quality

When I hit play on an Austin Hilton YouTube video, I’m asking one simple question: does this help me make a smarter decision, or just make me feel something? The answer usually sits in the middle — solid narrative reads, quick catalysts, and timely headlines, with less focus on frameworks and hard data you can lean on when things get choppy.

Market outlook approach

Austin is strongest when he’s reading the room. Bitcoin ETF buzz, halving cycles, Fed rate headlines, exchange drama — he catches those currents early and packages them in a way retail can act on fast. You’ll hear a lot of “what’s moving today” and “here’s the catalyst,” not as much about how liquidity, funding rates, or on-chain flows will shape the next week.

That’s not a knock — momentum and sentiment do drive short-term crypto moves. But attention cuts both ways. Research has repeatedly shown that retail chases attention-heavy assets and that these pops can reverse quickly:

- Retail buys attention-grabbing assets; reactions are often short-lived: Barber & Odean (2008)

- Online search and social buzz correlate with crypto price surges and corrections: Garcia et al. (2014)

So when Austin highlights “next week’s catalyst,” I treat it as a timing signal, not an investment thesis. I want to see a clear time horizon and the conditions that would invalidate the idea. If that’s missing, I assume it’s a short-lived narrative until proven otherwise.

- Green flags: multiple independent sources, exact catalyst dates, mention of liquidity/volatility risks, time horizon.

- Yellow flags: “right now” language without a framework, no mention of downside, no acknowledgement of past similar setups that failed.

Altcoin and memecoin coverage

Austin often surfaces trending tickers fast — SHIB updates, DOGE chatter, PEPE spikes, small-cap “watch these” lists. This is great for awareness. But with memecoins and early-stage alts, the difference between a 2x and a rug can be in the boring details: unlock schedules, top-holder concentration, liquidity depth, and how the team funds itself.

If a video puts a micro-cap on your radar, I’d immediately check:

- Tokenomics: total/fully diluted supply, vesting, and near-term unlocks.

- Concentration: top holders/wallets and any centralized ownership or team wallets.

- Liquidity: DEX liquidity size, lock status, and whether LP tokens are locked or burned.

- Contract risk: mint/blacklist functions, renounced ownership, recent code changes, and audit status.

- Narrative vs. cash flow: is there any utility or revenue, or is this purely a momentum bet?

Why I’m strict here: coordinated pumps are a known phenomenon. Academic work has mapped out how Telegram/Discord-driven schemes play the attention game and exit on retail liquidity — which can catch YouTube audiences in the crossfire. Worth a read: “Demystifying Cryptocurrency Pump-and-Dump Schemes” (2019).

Evidence and sourcing

Expect screenshares of headlines, X posts, TradingView charts, and sometimes Etherscan or aggregator pages. It’s helpful, but linking can be light and not every claim is paired with a primary source. I use his content as a starting point and then verify:

- Find the original source: official blog, SEC filing, or team announcement page.

- Validate the contract address from the project’s website and cross-check on Etherscan.

- Check time-stamped data: on-chain transactions, listing times, unlock dates.

- Look for conflicting coverage: does CoinDesk, The Block, or the project’s GitHub tell a different story?

- Separate news from opinion: copy the claim in quotes, save the link, and note whether it’s analysis or fact.

“Hype is sugar. Data is protein. One gives you a rush, the other keeps you in the game.”

Track record and accountability

He’s had some sharp narrative reads — especially during momentum windows like Bitcoin ETF approval week and SHIB community catalysts — but results vary, as you’d expect in fast-moving markets. What matters to me isn’t whether every pick moons; it’s whether calls are time-stamped, revisit-able, and judged against a stated horizon.

- Time sensitivity: many videos are built for the next 24–72 hours. After that, base rates and mean reversion kick in.

- Whipsaw risk: when a clip is about a single catalyst, I assume the trade may reverse once the catalyst is “in the price.”

- Self-audit idea: keep a simple log: video title, date, ticker, thesis, your time horizon, outcome at 1D/1W/1M. You’ll quickly see which styles fit you and which don’t.

I’d love to see periodic post-mortems on big calls (wins and losses). Viewers learn faster when a creator walks through what worked, what failed, and what changes next time.

What I’d like to see more of

- Clear thesis frameworks: why now, expected catalyst path, invalidation level, time horizon.

- Consistent links: primary sources in descriptions so viewers can check the raw facts.

- Post-call updates: quick follow-ups after major calls or events, even if it’s just “this didn’t play out — here’s why.”

- On-chain context: basic metrics like active addresses, exchange flows, MVRV, developer activity, and liquidity profile.

- Position transparency: held/not held, plus any paid relationships tied to coverage.

Bottom line for this section: the Austin Hilton YouTube channel is useful for catching what the crowd will talk about next. Treat it like your early-warning radar — then build your own checklist to separate signal from noise. Want a fast, no-jargon checklist you can run in under 60 seconds to decide if a fresh video is actionable or just entertaining? That’s exactly what I’m sharing next.

Practical value: can you act on it safely?

I treat Austin Hilton’s videos like a radar, not a GPS. They surface narratives fast. But to turn that into smart action, you need a repeatable process, real data, and rules you’ll actually follow when the candles get spicy.

“Hype is free; risk isn’t.” If a headline makes your heart race, slow your hands first.

Actionable takeaways

Here’s the simple playbook I use when a video sparks an idea (say it’s about an AI altcoin, a new Layer-2, or a memecoin that’s ripping):

- Turn the idea into a watchlist item, not a buy. Add the ticker to your list and set alerts on TradingView or your exchange app.

- Write the thesis in one sentence. “Betting that XYZ runs into the next unlock because of new listings and rising on-chain users.” If you can’t write it, you don’t know it.

- Check the last 24–72 hours. Has price already moved 30–80%? If yes, expect a pullback. I prefer entries after a retest rather than chasing green candles.

- Validate with data (5-minute check):

- Liquidity: Is there at least $1–5M in daily volume and healthy depth? Use CoinGecko, DexScreener, or GeckoTerminal.

- Top holders: Any whale owns 20%+? Check Etherscan or BscScan.

- Token safety: Honeypot? Suspicious code? Quick scan with Token Sniffer or GoPlus Token Security.

- Unlocks/emissions: Use TokenUnlocks. If a big unlock is within 7–14 days, I size down or wait.

- Decide the time horizon upfront. Is this a news scalp (hours), a swing (days–weeks), or a narrative hold (weeks–months)? Your exit plan should match this.

- Pre-plan exits. Pick invalidation (where you’re wrong) and profit-taking levels. Example: cut if it loses the breakout level with volume; take 25% off at +20% and trail stops.

- Sleep on it when sentiment is euphoric. FOMO fades after one good night’s sleep—and better entries appear.

Example scenario: Austin mentions a “memecoin wave” and you’re eyeing token ABC. You see +65% on the day with thin liquidity and whales holding 30%. Comments are chanting “100x.” I tag it “watch only,” set alerts, and move on. If 48 hours later volume broadens, whale concentration drops, and it reclaims a support on normal volatility, then I consider a small starter position with a clear invalidation. No hero moves.

Risk management signals

Sometimes creators mention risk rules (position size, stop-losses, timelines). If that’s missing, add your own. I keep it boring and consistent:

- Risk per idea: 0.5–1.0% of portfolio at max. If you’re wrong, you live to trade another day.

- Position sizing: Determine your stop first, then size. Thin DEX pairs get half-size or zero-size.

- Avoid averaging down on hype plays. For speculative coins, add on strength only (breakout + retest), never on weakness.

- Staged entries: Start with 25–33% of your planned allocation; only add if the thesis keeps proving right.

- On-chain reality check: For DEX-only tokens you can’t hard-stop reliably, use alerts and hard rules to cut manually. Slippage kills—plan for it.

- Time-box the trade: News trade? Hours. Momentum swing? Days/weeks. If price goes nowhere within that window, I close it and recycle capital.

Why so strict? Retail tends to chase attention and underperform because of it. See Barber & Odean’s research on attention-driven buying, and studies documenting crypto pump-and-dump dynamics. Guardrails aren’t optional in this game.

Tools and data to pair with the channel

When a video sparks interest, I cross-check with a fast toolkit:

- Liquidity and trading health

- DexScreener / GeckoTerminal: Pools, volume, depth, LP locks, slippage impact.

- CoinGecko / CoinMarketCap: Markets, spread, real volumes, historical data.

- Uniswap Info: Pair analytics; look at liquidity growth/decay.

- Token structure and security

- Etherscan holders tab: Top-10 concentration, contract flags, comments.

- TokenUnlocks: Upcoming unlocks and cliffs.

- Token Sniffer / GoPlus: Quick red-flag scans.

- LP lock/ownership: Check Team Finance or Unicrypt where applicable.

- Usage, adoption, and dev activity

- DeFiLlama: TVL trends; does the project actually attract capital?

- DappRadar: Active users/transactions for dapps and chains.

- Messari (free profiles): Basic fundamentals and tokenomics.

- Santiment (free tier): Dev activity, social spikes, funding rates.

- Bubblemaps: Holder clustering to spot whale rings.

- Market context and sentiment

- CoinGlass: Funding, open interest, liquidation heatmaps.

- Fear & Greed Index: Quick sentiment snapshot.

- TradingView: Alerts, basic TA, structure and volume at key levels.

Pro tip: build a 10-minute routine. If a coin can’t pass liquidity, holders, unlocks, and usage checks in one short sitting, it’s not urgent. There will always be another trade.

Community and feedback

There’s real value in the comments under Austin’s videos—narrative hints, counterpoints, even links to docs. But crowds can nudge you into bad timing.

- Sort by newest to catch fresh critiques and missing risks.

- Watch view velocity. When a video is exploding in views and comments are pure euphoria, you may be late. I often wait for the first pullback.

- Weigh skepticism higher than cheerleading. A smart red flag in the comments can save you weeks of pain.

- Remember the attention trap. Retail herding around “hot” tickers is a known underperformer—again, see Barber & Odean—so I size smaller when sentiment is one-sided.

One last thing before we keep going: when a creator highlights a token, how do you know if it’s just a good pick—or a paid segment nudging you to click buy? In the next part, I’ll show you exactly how I spot affiliates, sponsorships, and conflicts in crypto videos and what to do about them. Ever wondered if that “hidden gem” was an ad in disguise?

Monetization, sponsorships, and ethics

When money meets momentum, judgment gets foggy. Crypto YouTube isn’t a charity—it’s a business. Understanding how a creator gets paid helps you weigh what you’re hearing before you click “buy.”

“Trust is built in drops and lost in buckets.”

If you watch Austin’s videos, assume there are business incentives at play. That’s not an accusation—it’s the normal model on this platform. Here’s how I unpack it so I can learn without getting lured.

Affiliates and promos

Expect links and codes in video descriptions. They typically fall into a few buckets:

- Exchanges: “Up to $X bonus” or fee discounts for signing up/depositing. Usually CPA (one-time payout) or revenue share. Always check the fine print—those big bonuses often require large deposits or high-volume trading.

- Wallets and security: Hardware wallets, MPC wallets, or browser wallets with referral codes. Look for whether the code gives you a discount or just pays the creator.

- Trading tools and tax software: Free trial links, “1 month off,” or pro-tier upsells. If you see a link, assume there’s a commission or comped access.

- Project partners: New token/ecosystem spotlights with a link to the site, launchpad, or DEX. Treat these as marketing touchpoints, not research.

My rule: if a link could influence behavior—sign-ups, deposits, or trades—I treat it as a financial relationship until proven otherwise. I’ll still click to learn, but I decide later whether to act.

Sponsored segments and disclosures

There are usually three flavors:

- Integrated shoutouts: 60–120 seconds in the middle of a video.

- Dedicated spotlights: Entire videos on one token or platform.

- Pre-roll mentions: Quick sponsor labels at the start.

The FTC requires “clear and conspicuous” disclosure of material connections, and YouTube even provides a “Includes paid promotion” toggle that triggers an on-screen label. Look for:

- On-screen text: “Sponsored,” “Paid promotion,” or “Partner.”

- Verbal disclosure: A plain-English statement at the start of the segment.

- Description notes: A sentence explaining the relationship near the link.

Why I’m strict about this: research shows many viewers miss small or vague disclaimers, especially when they’re buried or rushed. Multiple studies on influencer marketing and retail investor behavior find that disclosures reduce persuasion only when they’re obvious and well-timed. You can skim the FTC’s endorsement rules here: FTC Endorsement Guides, and YouTube’s policy note here: YouTube paid promotion disclosure. Bottom line: if it’s sponsored, I treat it like an ad and verify independently.

Conflicts of interest

Creators may own the tokens they discuss. That can be fine if they’re upfront, but it matters for timing. I look for:

- “Held/not held” statements: A quick “I own X” or “I don’t own this.” If it’s missing, I assume there could be exposure.

- Vesting/airdrops/allocations: Any early access, lockups, or grants should be disclosed. If a video is bullish right before a big unlock, I slow down.

- Cross-platform hints: Sometimes disclosures appear on Twitter/X or in community posts. I check both.

There’s a well-documented pattern where attention drives short-term buying and then mean reversion kicks in. Classic work by Barber & Odean (2008) and Da, Engelberg & Gao (2011) shows attention-fueled spikes often fade. That doesn’t mean every spotlight is a pump—it means I assume crowded entries are dangerous.

Red flags checklist

- Urgency: “Get in now,” countdowns, or “next 100x” language meant to push action over analysis.

- Guarantee vibes: Any phrasing that sounds like a sure thing. Markets don’t do guarantees.

- No source trail: Big claims without links, docs, or dates you can verify.

- Pay-to-play feel: A string of unknown tokens only shown with referral links and no independent context.

- Telegram/Discord gating: “Alpha” behind a paywall that leans on FOMO. Be careful with VIP upsells.

- Unverified audits or team: Logos slapped on slides with no links to official reports or LinkedIn/GitHub trails.

- “New listing” bait: Links to swap pages without contract verification, or claims of imminent listings without exchange announcements.

- Botty comments: Repeated “I doubled my money” spam and giveaway imitators—common around sponsored pushes.

None of these prove bad intent. They’re just signals to hit pause and research.

How I personally use this channel

I treat it as a fast news and narrative scanner—not a trading signal. My workflow looks like this:

- Tag the theme, not the ticker: If a video highlights AI, RWA, or memecoins, I note the sector first. Narratives outlast single picks.

- Build a watchlist, then verify: I run five quick checks before any move:

- Liquidity and slippage: CEX/DEX depth on CoinGecko/CMC and a swap sim to see slippage at my size.

- Supply schedule: Token unlocks/vesting, team/VC cliffs, and emissions. If a big unlock is near, I wait. (Unlock trackers help.)

- Holder quality: Top 10 wallets, contract risks, and renounced/upgradeable status.

- Build signals: GitHub commits, website age/domain history, docs clarity, and whether the team shows real profiles.

- News vs price: If the token pumped >30% in 24–48 hours after broad coverage, I let the hype cool.

- Size small, time longer: If I ever act, it’s a test size with a prewritten exit. No market orders, no chasing green candles.

- Separate ads from insights: Sponsored spotlights get filed under “marketing.” I harvest the narrative, then look for better entries in the same sector.

Example pattern I keep seeing across crypto YouTube: a new microcap gets attention, price spikes hard intraday, then retraces 30–60% within a few days. That aligns with attention-driven trading research. So I like the content for awareness, but I don’t press the buy button because a video is trending.

Want to see the exact tools, dashboards, and alternative voices I use to balance fast takes with hard data? I’m about to share my shortlist next—ready to build a safer research stack?

Alternatives and resources to round out your research

If you like fast-take crypto content, the smartest move is to balance it with data, dev signals, and macro context. Here’s the exact stack I use so I’m not stuck in one creator’s echo chamber.

Similar creators worth checking

- Macro + market structure

- Real Vision (Raoul Pal) — big-picture liquidity cycles, rates, and risk appetite.

- Crypto Crew — simple, rules-based cycle reads (useful as a sanity check).

- Benjamin Cowen — data-driven cycle and dominance analysis; less hype, more charts.

- The Macro Compass (Alfonso Peccatiello) — rates/liquidity explained in plain English.

- On-chain analytics and fundamentals

- Glassnode — supply dynamics, holders, and cycle metrics.

- CryptoQuant — exchange flows, miner activity, funding data.

- Messari — research-driven sector breakdowns and token reports.

- Security and risk

- PeckShield Alerts — exploits and security incidents in real time.

- SlowMist — audits, threat intel, and post-mortems.

- REKT News — plain-English breakdowns of what went wrong and how to avoid it.

- Developer and ecosystem updates

- Electric Capital Developer Report — who’s actually building and where.

- Token Terminal — protocol revenue, fees, and user trends.

- Artemis — chain-level metrics and app usage.

Research-backed tip: Herding and attention-driven trading are real. Studies show retail investors often chase attention and social buzz, which can hurt returns (Barber & Odean, 2008; Bikhchandani, Hirshleifer & Welch, 1992). Building a mixed media diet cuts that bias.

Tools and news sources

- Price and market structure

- CoinGecko or CoinMarketCap — price, market cap, listings, basic liquidity.

- Coinglass — funding, open interest, liquidation heatmaps.

- Laevitas — options skew and term structure for BTC/ETH.

- Crypto Fear & Greed Index — quick read on sentiment extremes.

- On-chain and flow

- Glassnode, CryptoQuant, Santiment — supply dynamics, exchange flows, whale behavior.

- DeFiLlama — TVL, stablecoin flows, chain-level trends.

- Liquidity and trading checks

- DEXTools or DexScreener — pooled liquidity, slippage risk, holder concentration.

- Exchange listings — is there real spot liquidity, or just thin DEX pools?

- Tokenomics and unlocks

- TokenUnlocks — upcoming unlock cliffs and potential sell pressure.

- CryptoRank — vesting schedules, fundraising rounds, and FDV vs. MC.

- Security and contract sanity checks

- Etherscan / Solscan — contract verification, holders, and top wallets.

- GoPlus Security — basic token risk flags (trading pause, mint, blacklist functions).

- Honeypot.is (EVM) — quick tradeability test on new tokens.

- Developer activity and repos

- CryptoMiso — GitHub commit activity rankings.

- GitHub — star/commit velocity on the actual project repo (beware mirror repos).

- Newsletters and reports

- Messari newsletters — sector updates and key charts.

- The Defiant and Bankless — DeFi/NFT narratives and education.

- Chainalysis Blog — compliance and on-chain crime trends.

How I mesh these with fast-take videos: if a token hits my feed, I check three things before it earns my attention:

- Liquidity — DEX pool depth and spread on DEXTools/DexScreener.

- Supply risk — unlocks and vesting on TokenUnlocks.

- Holder quality — top wallets and exchange inflows on Etherscan + CryptoQuant.

If it passes, I’ll look at Token Terminal or Artemis for usage and revenue. No fundamentals? It stays a watchlist narrative, not a buy.

Build a balanced crypto media diet

Here’s a simple weekly rotation that keeps me informed without drowning in noise:

- Daily (15–30 min): 1–2 fast-take creators for awareness + check CoinGecko, Coinglass, and a quick scan of PeckShield/SlowMist alerts.

- Midweek (45–60 min): One deep-dive source (Messari report, Real Vision episode, Glassnode weekly) to stress-test narratives.

- Weekend (60–90 min): Research 1–2 tokens: unlocks, liquidity, holders, dev activity, and a clear thesis. If I can’t write a 3-sentence thesis with risks, I don’t touch it.

Why this works: you separate idea discovery (fast videos) from decision-making (data + rules). That gap protects you from FOMO — and the evidence says reducing attention-chasing improves outcomes over time.

Want me to answer the most common questions about this creator — and solve the weird “Hilton Austin” hotel confusion that keeps showing up when you search? I’m tackling that next. Which question are you hoping I clear up first?

FAQ: Everything you need to know (and clearing up the hotel confusion)

Austin Hilton (YouTube) — key FAQs

What’s his niche?

- Fast crypto news, altcoin/memecoin spotlights, and market sentiment updates.

- Expect timely reaction videos like “X pumps on Y news” or “Top 3 coins before the weekend.”

- Entertainment-first pacing with trading angles; great for staying in the loop when headlines are flying.

How reliable is the info?

- Useful for awareness and narrative spotting — treat it as an idea feed, not final research.

- Short-form commentary naturally skips some fundamentals. Back it up with your own tokenomics checks, liquidity review, and unlock schedules.

- Why I’m careful: research on attention-driven trading shows social content can spark short-lived price pressure and herding. The FCA reported that a big chunk of young investors cite social media as a key influence, which correlates with more frequent high-risk behavior. Translation: it’s easy to get swept up — set rules before you click “buy.”

Is content sponsored?

- Expect affiliates (exchanges, wallets) and occasional sponsorships. Look for on-screen or description disclosures.

- Rule I follow: treat sponsored spotlights like ads. If a token is shown, verify the vesting, top holders, and centralized exchange exposure before you even consider it.

- If you’re unsure about disclosures, the FTC’s influencer guidelines are a good yardstick for what “clear and conspicuous” should look like. See: FTC Endorsement Guides.

Hilton Austin (the hotel) — common questions people ask by mistake

Amenities

- Large event/convention space in downtown Austin.

- Two on-site restaurants, an in-lobby Starbucks, business center, and fitness center.

- Heated rooftop pool with skyline views and cabana-style seating (seasonal policies can apply).

- Free Wi‑Fi common in public areas; room tiers can vary. Always check the hotel page for current perks.

If you’re actually looking for the hotel, here’s the official page: Hilton Austin.

How many floors is the Hilton Austin?

The property is commonly listed at around 31 floors. If you need precise room-stack data (event planning, room blocks), confirm directly on the hotel site or by phone, as renovation details can change.

Does Hilton Austin have parking and a pool?

- Parking: Typically offers self-park and valet for a nightly fee; rates shift with events and seasons.

- Pool: Rooftop pool usually heated; check hours, seasonal closures, and any guest-only rules.

Always verify pricing and amenities on the hotel’s page because these change with demand and local events like SXSW or F1.

Final tips for using crypto YouTube safely

- Use videos to build a watchlist, not a portfolio. Add tickers to alerts; enter only after you’ve validated the basics.

- Run a quick fundamentals check:

- Tokenomics: emissions, unlocks, and top-10 holder concentration.

- Liquidity: depth on major DEXs/CEXs; avoid thin pools that can slip 5–10% on small orders.

- Dev and community: active GitHub or public roadmap; real users vs. botted Telegram spikes.

- Size positions small. I cap speculative plays to a tiny slice of my portfolio and use staged entries.

- Time matters. Attention spikes rarely last. A 24-hour cooling-off period cuts FOMO and bad fills.

- Write your exit before entry. Where do you trim? Where do you cut? No plan = the market will choose for you.

- Treat sponsorships as ads. If money is involved, assume bias and verify twice.

My rule of thumb: Ideas from creators, conviction from data, risk from my plan — in that order.

My bottom line

Austin Hilton is great for timely chatter and surfacing trending tokens. I use his videos to spot narratives fast, then I confirm everything with hard data before I act. If you pair that approach with strict sizing and clear exits, you’ll capture the upside and avoid the predictable traps that hit most retail viewers.

CryptoLinks.com does not endorse, promote, or associate with youtube channels that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.