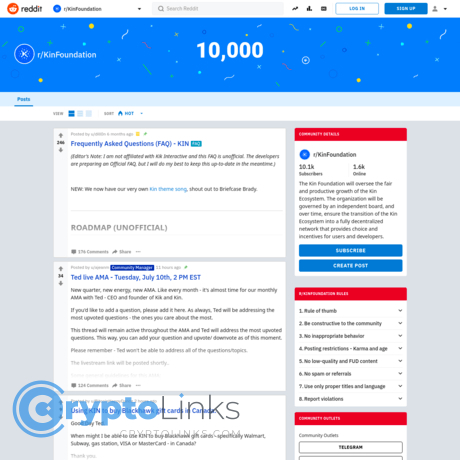

r/KinFoundation Review

r/KinFoundation

www.reddit.com

r/KinFoundation Reddit review guide: everything you need to know + FAQ

Wondering if r/KinFoundation is still worth your time for real Kin updates and community insight—or if it’s just old noise?

I’ve spent years reviewing crypto communities to figure out where the actual signal is. In this guide, I’ll show you how to use the Kin subreddit to find what matters, ignore what doesn’t, and save hours of scrolling. If you’ve ever felt lost in the mix of headlines, migrations, and “is Kin dead?” threads, you’ll get a clean path forward here.

Quick take: Reddit can be a goldmine for context and community pulse—but only if you know how to read it. Treat it like a research layer, not the final word.

Why r/KinFoundation can feel confusing (and how to fix that)

Kin’s history isn’t simple. You’ll see the Kik ICO, the SEC case, shifts in development, and scattered updates. Then you land on the subreddit and find a mix of historical posts, hot takes, and occasional fresh info. It’s easy to walk away unsure what’s current, what’s speculation, and what’s actually useful.

Here’s what typically trips people up:

- Old posts rank high: Reddit’s “Top” or “Relevance” views can surface threads from years ago. Great for context; risky for action.

- Headlines vs reality: You’ll see threads saying “abandoned” next to posts saying “still building.” Without timestamps and sources, that’s a recipe for confusion.

- Fragmented updates: Some announcements live on X, some in dev repos, some in Discords/Telegram, and some on Reddit. If you only look at one place, you miss the full picture.

- Wallets and contracts change: If the network or tooling shifted over time, older instructions can send you to dead links or spoofed contracts.

That mix makes newcomers ask the same questions on repeat: “Is Kin alive?”, “Which chain is the current one?”, “What wallet actually works today?”, “Where can I trade safely?” The subreddit has answers—just not always on the first page.

What I’ll help you do

By the end of this series, you’ll be able to use r/KinFoundation like a pro. I’ll show you:

- Exactly what to read first so you don’t get stuck in outdated threads.

- How to filter posts using search, sort, and flairs to extract real signal.

- Which flairs matter (and which to ignore when you’re short on time).

- How to sanity-check any claim with official links, repos, and explorers.

- Where to find fresh updates if subreddit activity is slow or sporadic.

Along the way, I’ll answer common questions like what happened to Kin, what it is today, and how to verify what you’re seeing without guessing.

Who this guide is for

- Kin-curious: You heard about Kin and want a fast, honest lay of the land.

- Returning holders: You held KIN in the past and want to understand current status without wading through years of threads.

- Crypto researchers: You evaluate communities and want a reliable way to read a subreddit’s quality and usefulness.

If you want clarity without fluff—and a way to confirm things yourself—you’re in the right place.

Before we start, a quick expectation check

- Subreddits evolve: Activity can ebb and flow. A quiet month doesn’t mean “dead”—it just changes how you should use the sub (more for context, less for breaking news).

- Always verify: For anything time-sensitive, cross-check with official channels, code repos, and block explorers. Reddit is a helpful map, not the territory.

- Stay safe: No DMs, no seed phrases, no unofficial links. If a post lacks sources, treat it as an opinion until proven.

- Not financial advice: This is a research playbook to help you think clearly and move efficiently.

If that sounds good, keep going—because next I’ll break down what r/KinFoundation actually is (and what it isn’t), so you know exactly how to use it without wasting time. Curious what kind of posts are worth your attention and which flairs to watch first?

What r/KinFoundation is (and what it isn’t)

r/KinFoundation is the Reddit hub where Kin’s community stores memories, shares context, and posts occasional development or ecosystem notes. Think of it as a living archive and a bulletin board rolled into one.

It’s not a trading signals room, a pump chat, or a customer support desk. If you show up expecting calls and daily catalysts, you’ll be disappointed. If you show up to learn the project’s timeline, understand sentiment, and spot links to tools and announcements, you’ll be right at home.

“Communities remember what press releases forget.”

That’s why I keep it bookmarked. When the news cycle gets noisy, the old threads often hold the receipts.

What you’ll find on the subreddit

Expect an uneven mix of historical breadcrumbs and present-day chatter. Typical threads include:

- News and announcements: Links to blog posts, ecosystem notes, or third‑party coverage. Quality posts usually add a summary and a source link (official site, docs, or verified socials).

- Roadmap and direction chatter: Community takes on what’s next, often with questions like “Is there an updated plan?” or “Who’s maintaining X?” These are good for gauging expectations, not final answers.

- App integrations (past and present): Posts recalling integrations from earlier cycles and asking whether anything similar is active now. Great for understanding how Kin was used in real products.

- Technical questions: Wallet issues, explorer confusion, chain specifics. The best answers cite docs, repos, or explorer transactions.

- Sentiment and meta posts: “Is Kin still alive?” “What happened to…?” These threads reveal what newcomers struggle with today.

Examples of useful post patterns to watch for:

- “[News] Kin wallet update – link to release notes + GitHub tag” → strong signal if the links are legit.

- “[Dev] Contract address confirmation – explorer + official docs” → practical and verifiable.

- “[Discussion] Where to check current chain activity?” → scan replies for block explorer links and recent timestamps.

Why this matters: research shows communities can be solid starting points, but verification is critical. The famous Science study on misinformation found that false stories spread faster than true ones on social platforms—so always check sources before acting (Science, 2018).

Sub rules, flairs, and pinned posts

Before you do anything, scan the top of the feed and the sidebar. That’s where the ground rules live:

- Pinned posts: Often summarize the latest context, point to official links, and consolidate FAQs. If the pin is recent, you’ve got a snapshot of where things stand.

- Flairs you’ll likely see: News, Discussion, Support, Dev. Use them like fast filters to reduce noise.

- Rules and automod notes: Most crypto subs ban spam, off-topic promos, and fake support. Stick to them to keep the place useful.

Quick workflow that saves time:

- Open the latest pinned post, then right-click any “official” link (site, docs, GitHub) and keep those tabs handy.

- Filter by News or Dev to see source-backed updates first. Then read Discussion for context and sentiment.

- On any support thread, look for answers that link to the official docs or a block explorer. If replies ask you to DM, skip them.

This structure isn’t just neat—it’s proven. UX research shows clear labels and filters improve wayfinding and cut search time (Nielsen Norman Group). On Reddit, that means flairs and pins are your best friends.

Activity snapshot and how to read it

Reddit activity ebbs and flows. Use a simple check to understand what the sub can actually do for you right now:

- Scan the last 30–60 days: Count posts per week, skim comment quality, and note whether upvotes go to sourced updates or hot takes.

- Assess freshness: If the top pinned post is older than a few months, treat it as background, not breaking info.

- Look at the ratios: A few posts with thoughtful, sourced comments can be more valuable than daily noise. Quality > volume.

- Time-shift your expectations: Slower cadence? Use the sub as a research archive and sentiment barometer. Faster cadence with sources? You can lean on it more for timely pointers—still verify externally.

For perspective, Reddit remains a meaningful niche news path for many users, especially around tech topics (Pew Research Center). That’s useful—but it’s also a reminder to cross-check anything market-sensitive with official channels and on-chain data.

Curious what Kin actually is, how it started, and why the story feels complicated? In the next part I’ll give you a fast, no-jargon refresher so the threads you just saw make a lot more sense—want the 60‑second version before you read another comment?

Kin 101: the fast refresher

Kin launched in 2017 out of Kik Inc. with a simple promise: make it easy for apps to reward users and move tiny amounts of value at speed. Think tipping, micro-rewards, and engagement loops that don’t get crushed by fees. It’s designed with a fixed, pre-minted supply and no inflation, so the pie doesn’t quietly grow behind your back.

“Trust, but verify—then verify again on-chain.”

What is Kin cryptocurrency?

At its core, Kin is built for in-app economies and microtransactions. Instead of bolting on clunky payments, Kin was meant to be the native “points that are actually money” inside consumer apps.

- Use case: tips, rewards, and user-to-user payments that feel instant.

- Fees: designed for low-cost transfers so tiny actions are economically viable.

- Supply: fixed and fully minted (commonly referenced at 10 trillion KIN—always confirm with an explorer).

- Focus: consumer-scale throughput, not speculative “number go up” mechanics.

If you’ve ever watched an app boost retention with points or badges, you get the idea. The difference here is portability and ownership: tokens you can move, not just a closed scoreboard.

What happened to Kin Crypto?

Here’s the compressed timeline I keep handy when I review Kin claims:

- 2017: Kik runs an ICO for Kin, raising roughly $100M. The SEC later alleges the offering was an unregistered securities sale (SEC complaint).

- 2019–2020: The court grants summary judgment against Kik; Kik settles and pays a $5M penalty. See the SEC’s 2020 announcement for specifics (SEC settlement).

- 2019: Kik Messenger is sold to MediaLab; the Kin ecosystem continues under the Kin Foundation and community (coverage: The Verge).

- 2020–2023: Development cadence and communications shift. You’ll find headlines calling Kin “abandoned,” usually referring to reduced official activity—not the disappearance of the token itself.

Two truths can be real at once: interest cycles come and go, but the token and its history are still on-chain. That’s why I always check fresh timestamps and sources before I accept any “Kin is back” or “Kin is dead” takes.

Where Kin runs and what to check today

Kin’s tech story includes migrations—first launched as an ERC‑20 on Ethereum, then to a custom chain inspired by Stellar, and later to Solana for throughput. If you’re stepping in now, confirm the current chain, tooling, and wallets before you press any buttons.

Here’s how I verify in minutes:

- Confirm the current chain and mint: On Solana, the commonly referenced KIN mint is KinDesK3K4Ynj5X6fAwPARi8hi9j6AGa8q. Open it on a reputable explorer like Solscan or SolanaFM. Check total supply, holders, and recent transfers.

- Cross‑check with official sources: Match that mint and any contract addresses against the official website and docs (kin.org and docs.kin.org). If they don’t match, stop.

- Wallet support: Confirm which wallets currently recognize KIN on the active chain (e.g., popular Solana wallets). Only install from official links and verify the token logo, ticker, and mint inside the wallet.

- DEX reality check: If someone claims “liquidity is back,” open a Solana DEX aggregator or the token’s markets on a reputable tracker to see pool sizes, volumes, and slippage. Screenshots aren’t data—live order books are.

- Legacy context: The original ERC‑20 KIN contract still exists on Ethereum for history (Etherscan). Don’t assume it’s active or liquid just because it’s there.

When I see bold claims, I triangulate: explorer data, official links, and a quick scan of recent community posts for corroboration. If two out of three disagree, I wait.

Want a fast system to separate real updates from old noise on r/KinFoundation? In the next part, I’ll show you exactly what to open first, which filters to use, and how to verify any claim in under 90 seconds—curious how that works?

How to use r/KinFoundation like a researcher

You’re not crazy if Kin’s history feels confusing. It is. The trick is using r/KinFoundation as a research layer, not a final verdict. Here’s the exact playbook I use to turn the subreddit into a clean signal.

“Extraordinary claims require extraordinary evidence.” — Carl Sagan

Start with pinned posts and the subreddit wiki (if available)

Pinned posts are your fast lane. They usually capture the latest status, guidance, or resource lists. If the sub has a wiki, skim it before anything else—it’s where mods try to aggregate the best background so the same questions don’t get asked daily.

- 10‑minute onboarding:

- Open the sub and read the top 1–2 pinned posts end-to-end.

- Grab any links to official docs, repos, explorers, or FAQs and save them.

- Note which flairs the mods use (News, Dev, Discussion, Support). You’ll use these to filter later.

- If a wiki exists, scan the sections that mention wallets, chain details, and recent updates.

- Pro move: Take screenshots or save snapshots to the Wayback Machine so you can reference the exact state later if a post changes or disappears.

Use search and sort filters

Reddit’s built-in tools are simple, but they’re powerful for separating noise from useful context.

- Search terms that usually pay off: “roadmap”, “wallet”, “DEX”, “update”, “migration”, “contract”, “explorer”, “announcement”

- Use the sub-only search: type your query in the sub’s search bar and make sure it’s scoped to r/KinFoundation.

- Sort like this:

- New — the freshest chatter and any breaking claims.

- Top (This Year) — the biggest themes and milestone threads from the last 12 months.

- Top (All Time) — historical anchors (common examples: legal milestones, chain migrations, tool releases).

- Comments — posts with meaty discussions where the best fact-checking often happens.

- Quick operator tip: For tougher queries, try Google with site:reddit.com/r/KinFoundation your keywords. Reddit’s own search guide is here: reddithelp.com/hc/en-us/articles/205183686-Search.

Why this matters: social platforms amplify fresh but unverified info. One well-cited study in Science found that false news tends to spread faster than truth on social networks, largely because novelty drives engagement (Vosoughi, Roy, Aral, 2018). Your filters slow that impulse down.

Read by flair for faster signal

Flairs are your map. Mods use them to tag intent, and they’re a great way to prioritize what you read.

- Start with “News” and “Dev” — these are most likely to include references to official posts, repo updates, or explorer links.

- Then scan “Discussion” — sentiment and context live here. Sometimes the best reality checks are in the comments from long-time participants.

- Use “Support” carefully — helpful for troubleshooting, but also where scammers pretend to “help.” Read-only unless you absolutely need to ask something.

Real sample flow: I’ll filter by News, open the last 5–10 posts in new tabs, and immediately check whether they link to an official domain or a verifiable transaction. If a post lacks a source, it goes in my “opinion” bucket until proven otherwise.

Check sources and timestamps

This is where most people skip steps and get burned. Every material claim should be tied to a source you can verify.

- Look for official domains — links to the project’s official site, docs, or verified social accounts. If you’re unsure which domains are official, find that list on the official site itself and bookmark it.

- Verify on-chain — copy any mentioned token/contract/mint and paste it into the correct block explorer for the current chain. Confirm:

- It matches the address on the official site/docs.

- There’s non-trivial activity (holders, transfers, recent transactions).

- The creation date and metadata make sense for the claim.

- Check repo activity — if a post cites development progress, click through to GitHub (or the stated repo). Look at commit dates, open issues, and whether multiple contributors are active.

- Timebox the claim — a “new update” from 18 months ago is not new. Always note the post date and the source’s date. For long posts, scroll to the bottom: many docs show “last updated.”

- Snapshot important pages with archive.today or the Wayback Machine so you have a fixed reference.

Emotional check: if a post makes you feel urgency (“act now!”), pause. Urgency is a classic persuasion technique used to short-circuit your verification loop.

Safety tips

- Never share your seed phrase — no legit helper will ask. Ever.

- Beware DMs — scammers monitor Support/Discussion threads and slide in as “helpers” or “mods.” Real moderators don’t troubleshoot wallets in private DMs.

- Check the messenger — click the user profile:

- Account age and post history (brand-new, all crypto promos = risk).

- Karma that looks organic (mixed sub history beats a fresh account).

- Hover before you click — make sure URLs match the displayed domain. Misspellings and hyphenated lookalikes are red flags.

- Cross-verify contract addresses — only from official docs or verified announcements. If you see an address in a comment, treat it as untrusted until confirmed.

- Use read-only mode when researching on a device that has a wallet extension installed. Better: a separate browser profile without any wallets.

- Report suspicious posts — good communities stay clean because users pitch in. Strong moderation culture is a positive signal you’ll evaluate shortly.

A quick checklist I use before trusting any post

- Source present? Link to official domain, repo, or explorer.

- Fresh enough? Post date and source date fit the claim.

- On‑chain evidence? Address/activity aligns with what’s being said.

- Author credible? Account history looks real; comments show understanding.

- Independent confirmation? At least one more reputable source matches it.

One last nudge: Reddit can be a solid information funnel when you treat it like a starting point. Pew Research notes Reddit is a meaningful news pathway for tech‑savvy readers—but that makes it a target for low-effort hype, too. Your job isn’t to trust or doubt by default; it’s to verify quickly and move on.

So after you collect all this, a fair question is: how trustworthy and useful is the subreddit itself right now? What signals should you weigh the most—moderation, transparency, or the ratio of real updates to noise? Let’s put it under the microscope next.

Is the subreddit trustworthy and useful?

I judge any crypto subreddit by one simple lens: can it help me make a smarter move in the next 10 minutes? That means clear housekeeping, traceable sources, and a community that answers questions without chest-thumping. If you’ve ever been burned by low-effort hype, I feel you—signal matters.

“In crypto, timestamps are truth—everything else is talk.”

Moderation and housekeeping

Good moderation doesn’t mean censorship; it means finding what you need without wading through sludge. Research on Reddit’s large-scale bans shows that consistent rules reduce toxic clutter and improve information quality (Chandrasekharan et al., PACM HCI, 2017). Here’s how I check the basics in under a minute:

- Rules that age well: Are the rules specific about price spam, referral links, and unverifiable claims? Vague rules = vague outcomes.

- Pinned posts that aren’t fossils: If the top pin references migrations, tooling, or recent dev notes with current dates, that’s a green flag.

- Flair discipline: Do posts use “News,” “Dev,” “Discussion,” etc., correctly? Consistent flairing makes the archive searchable.

- Visible mod presence: Do mods show up in threads to nudge people toward sources or lock low-effort drama? Even a light touch goes far.

- Automoderator hints: If you see routine cleanup (e.g., filters for scams or duplicate headlines), you’re in safer waters.

Quick test I use: sort by New and scan the first 20 titles. If more than a quarter are low-effort price chants or vague rumor posts, I adjust my expectations and lean heavier on external verification.

Signal vs. noise

The MIT “false news” study (Science, 2018) found misinformation spreads faster than facts. Crypto amplifies that effect. My fix is a simple “source-first” rule—if a post can’t point me to something verifiable, it’s just talk. Here’s how I separate keepers from clutter:

- High-signal posts usually include:

- Primary links: official docs, GitHub commits, explorer transactions, or verified social announcements.

- Timestamps and versioning: “Wallet release vX.Y (Jan 2024)” beats “Wallet is updated!”

- Reproducible steps: If someone claims a fix, they share steps or code, not just a screenshot.

- Low-signal posts often look like:

- “Big news soon” with no source.

- Listing rumors that don’t link to an exchange announcement.

- DM-based “support” or airdrop bait (hard pass—report and move on).

Two real-world-style examples of what I upvote and save:

- Good: “New wallet build v1.2.4—fixes stuck tx bug” + GitHub tag + checksum + a couple user confirmations. Bonus points if it links to an explorer showing the relevant transactions behaving as expected.

- Not good: “Kin relisted on MajorExchange?” + cropped image, no link, no date. If it mattered, there would be an official post and live order books you can see.

My 30-second scoring trick: give a post 1 point each for (a) primary link, (b) date/version, (c) reproducible proof. Two or more points = probably worth your time.

Community vibe

You can feel a subreddit’s health in the replies. I look for confident humility—people who say “here’s what I think, here’s the source.” A few markers that tell me it’s a good learning ground:

- Constructive disagreement: Debates that cite docs or past updates instead of dunking on newbies.

- Answer density: Practical questions get at least one helpful reply within a day or two.

- Memory keepers: Veterans link to archived threads for context (migrations, SEC notes, tooling changes) instead of rewriting history.

- Low doom/noise ratio: Nostalgia and frustration are normal; when they don’t drown out current facts, the sub stays useful.

If most conversations feel like “we’re solving this together,” you’ll learn faster and avoid common pitfalls. If it’s all cope or euphoria, treat it as mood music—interesting, not decisive.

Bottom line

I use r/KinFoundation for context, historical breadcrumbs, and sentiment checks. When something sounds time-sensitive—new builds, contract changes, liquidity shifts—I confirm it with official announcements and neutral data tools before I act. Want the exact toolset I keep open alongside Reddit so I can verify claims in under two minutes? That’s up next—ready for the shortlist I trust every week?

Handy Kin resources to keep alongside Reddit

Reddit is great for context and community takes, but when it comes to contracts, wallets, and real-time on-chain data, I keep these open in another tab. Here’s my go-to set and exactly how I use each one.

Official channels

- Website: kin.org — starting point for public-facing updates and ecosystem info.

- Docs/FAQ: docs.kin.org — the safest place to confirm the current chain, supported wallets, SDKs, and any canonical token details.

- GitHub: github.com/kinecosystem — check commit activity, SDK repos, and release notes to gauge real development.

- Verified social: twitter.com/kin_ecosystem — useful for timestamped announcements; always cross-check to avoid impostors.

Quick workflow I use: Open the docs, copy the official token mint/contract from there (never from a random comment), paste it into an explorer (below), and only then proceed to wallets or DEXs. That one extra minute prevents 99% of fake-token mishaps.

Research tools

- Block explorers (Solana):

- explorer.solana.com — Solana’s official explorer for transactions, accounts, and program status.

- solscan.io — friendlier token views; check “Mint Authority” (ideally disabled for a fixed supply) and holder distribution.

- Liquidity and pricing:

- CoinGecko — Kin and CoinMarketCap — Kin for market cap snapshots, exchanges, and historical charts.

- Birdeye and GeckoTerminal for live Solana pair data, depth, and slippage checks.

- DEX front-ends (Solana):

- Raydium and Orca. Always paste the mint address you verified in the docs; never search by ticker alone.

- News and primary references:

- SEC press release on Kik’s ICO case (2019) — primary source to understand the legal backdrop.

- SEC litigation releases — search “Kik” for judgment/settlement references to avoid secondhand summaries.

- Wayback Machine — great for verifying the timing of claims from older Kin pages or posts.

How I sanity-check a token in under two minutes:

- Pull the mint/contract from docs.kin.org.

- Paste it into Solscan and confirm: correct logo/name (if verified), mint authority disabled, holder count that makes sense (not 12 wallets), and recent transactions.

- Open Birdeye or GeckoTerminal to review liquidity pools and check if slippage will be ugly.

- Cross-check price feeds on CoinGecko and CMC for consistency.

Balanced reading list

- Investopedia: Utility Tokens — helpful context for what Kin was designed to be used for.

- Investopedia: Initial Coin Offerings (ICOs) — background on the funding model that led to the Kik/SEC showdown.

- CoinGecko — Kin and CoinMarketCap — Kin — for supply metrics and exchange listings, which change over time.

Pro tip: studies and industry reports consistently show that fake tokens and support impersonators thrive on social platforms. Keep contract lookups anchored to official docs, and never copy addresses from comments or DMs.

Want a fast, no-hype checklist to answer “Is Kin still alive right now?” and where you can actually trade it safely? That’s exactly what I’m tackling next.

FAQ and wrap-up for r/KinFoundation

Is Kin still alive?

Yes—Kin still exists as a tradable token, and you’ll see community posts and the occasional update on r/KinFoundation. You’ll also see headlines calling it “abandoned” (usually pointing to reduced official activity around 2023). Take those as signals to verify, not conclusions.

Here’s how I sanity-check it quickly:

- Look at recency: Are there posts/comments in the last few weeks on the subreddit or official socials?

- Check the chain explorer: Find the current chain first via official links, then confirm token transfers and unique addresses in the last 30–90 days.

- Peek at code: If there’s a public repo, check last commits or releases. No commits doesn’t always mean no activity, but it helps frame expectations.

Working rule: if it isn’t on-chain, in code, or on an official channel, it’s just talk.

For context, independent research on social sentiment and crypto suggests attention alone is a weak predictor of outcomes. For example, Kraaijeveld & De Smedt (2020, Decision Support Systems) found that social buzz often adds noise without reliable edge across coins, and earlier work (Kristoufek, 2013) linked search interest to volatility rather than clean directional signal. Translation: use the subreddit as a pulse check, then make decisions from on-chain and official sources.

Where can I buy/sell KIN?

Typically you’ll find KIN on decentralized exchanges. Liquidity and routes can change, so treat the steps below as a process, not a fixed list of venues:

- Get the official token address first: Only from the official site, docs, or verified social. Do not trust ticker/name alone.

- Confirm the chain: Kin has migrated in the past. Match the token address to the correct explorer before you trade.

- Cross-check liquidity: Use respected DEX aggregators and pool analytics to view current liquidity, recent volume, and slippage estimates.

- Verify the pool/token on the explorer: Look for labels, mint/contract history, top holders, and whether the pool address is referenced by official channels.

- Test small first: If everything checks out, do a tiny test trade before scaling up.

Examples (not endorsements): if Kin is active on Solana, traders often route through aggregators like Jupiter, with liquidity sitting on venues like Raydium or Orca. If you see chatter about EVM activity, confirm on Etherscan and then check Uniswap/other EVM DEX info pages. Again—address first, venue second.

No source, no trust. If a Reddit comment drops a “correct” contract without an official link, treat it as unverified until proven otherwise.

Where’s the roadmap or latest dev updates?

Look for pinned posts on r/KinFoundation, then head to the official site/docs and any verified repos or social accounts. If you can’t find a recent roadmap, assume plans are in flux and move cautiously.

Here’s a quick way to confirm whether an update is real:

- Timestamp consistency: The Reddit post, official announcement, and repo commit should all line up within a reasonable window.

- On-chain breadcrumbs: Contract upgrades, mints, or program deployments should show on the explorer with credible addresses.

- Community echo: Above-average engagement from long-standing community members tends to accompany real updates. Astroturf often looks brand new.

My wrap-up

r/KinFoundation is a solid context hub and a quick way to take the project’s temperature. Use it to learn the history, spot what people are watching now, and collect links worth verifying. Then let official resources and explorers make the final call.

Before you act on anything you read:

- Run a 5-minute check: sort the subreddit by “new,” scan the last month, and open only posts with sources.

- Validate on-chain: correct chain, correct token address, recent activity, and real liquidity.

- Keep your guard up: no seed phrases, no DMs, no “support” links outside official domains.

That’s the playbook I use: friendly curiosity, ruthless verification. It keeps you safe, saves time, and turns Reddit from noise into signal.