Cardano Reddit Review

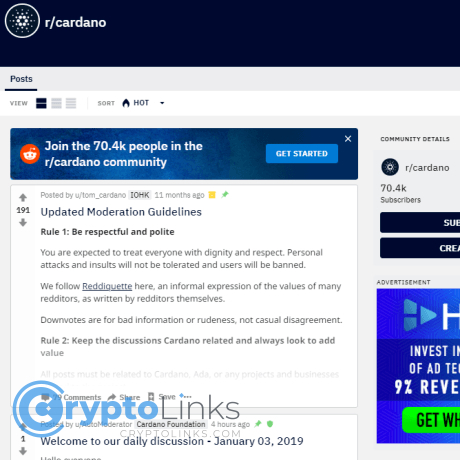

Cardano Reddit

www.reddit.com

Cardano Reddit (r/cardano) Review & Guide: How to Use It Right + FAQ

Ever open r/cardano and think, “Where do I even start?” If you want real updates, smart opinions, and zero time-wasting, you’re in the right place.

I use the Cardano subreddit like a fast-moving, community-powered newsfeed. The trick is separating signal from noise so you don’t miss the good stuff—like development updates, governance changes, AMAs, and postmortems—buried under price chatter and repeat questions.

True story: I’ve seen a crucial Hydra update and a CIP discussion get stuck under three “When moon?” threads and a meme. Without the right filters, you’d never see them.

The common problems (and why most people bounce)

Reddit can be incredible for crypto—if you don’t get overwhelmed first. Here’s what usually pushes people away from the Cardano subreddit:

- Too much noise. You’ll see price spam, repeated beginner questions, heated debates, and low-effort posts. The signal gets buried fast.

- Easy to miss the best threads. AMAs, development notes, governance/CIP updates, and Catalyst news often live in stickies or specific flairs. If you don’t know where to look, you’ll scroll past the gold.

- Scam risk is real. Fake “support” DMs and phishing links still show up around wallet issues and airdrops. One bad click can cost you real money.

This isn’t just a crypto thing. Information overload is a known problem in online communities—when noise rises, users stop exploring and engagement drops. If you manage the feed, your brain thanks you. If you don’t, you bounce. For a bit of background on why this happens, take a look at Nielsen Norman Group’s take on information foraging. And on the scam front, crypto-wide data shows social engineering remains a top attack vector; see the Chainalysis Crypto Crime Report for trends.

On r/cardano specifically, here’s how this plays out on any random day:

- 3+ threads asking the same wallet or exchange question (with conflicting answers).

- Price-only posts that add nothing new.

- A buried Hydra or Mithril update with actual release notes and GitHub links.

- One “support” reply that looks legit but points to a fake help desk (huge red flag).

The point isn’t to complain. It’s to fix your setup so the good stuff surfaces first, every time.

What you’ll get from this guide

- A simple system to find the highest-value posts in minutes.

- The flairs, threads, and filters that matter—and which ones to skip when you’re short on time.

- How to ask better questions, get help faster, and avoid scams without becoming paranoid.

Expect actionable steps you can use the same day. No fluff, no hype, just a workflow that works.

Who this guide is for

- Newcomers who want a clean learning path without getting lost in jargon.

- Holders and traders who need quick, credible updates from the Cardano subreddit.

- SPOs and builders who want feedback without coming off as shilly.

- Curious users who care about governance, staking, and what’s shipping next.

Quick takeaway

Treat r/cardano like your real-time Cardano newsfeed and Q&A hub. With the right filters and a few habits, you’ll spot legit releases, useful discussions, and governance changes fast—and skip the noise and scams.

Want the exact setup I use and how the subreddit actually works behind the scenes? Let’s start by looking at what r/cardano is, how the culture works, and which post types are worth your attention… ready to see it from the inside?

What r/cardano is (and how it actually works)

Think of r/cardano as Cardano’s public square: news in the open, questions answered in the threads, builders showing work, and everyday holders comparing notes. It’s community-run, not a help desk. No one owes you support, but you’ll be surprised how quickly people help when you show effort and bring receipts.

“Trust, but verify.” Screenshots aren’t sources. Links are.

Subreddit basics: culture, goals, expectations

Here’s the vibe you’ll feel within a few scrolls:

- What shows up: announcements, release notes, staking questions, governance/CIP debates, SPO talk, builder updates, market chatter, and the odd meme. It’s a healthy mix, some days heavier on tech, other days on community news.

- What people expect: sources, context, and respect. If you’re making a claim (“Node vX.Y.Z fixes peer issues”), link to the repo or an official post. If you’re asking for help, explain what you tried.

- How debates go: spirited, often sharp, but generally constructive. Good-faith disagreement is normal. Personal attacks get flagged fast.

- What it’s not: a hotline for lost funds, a price-prediction casino, or a shill arena. You’ll get better responses when you treat it like a shared knowledge base.

In practice, posts that age well are the ones that teach something, show progress, or open doors for others to contribute.

Flairs and post types that matter

Flairs are your compass. Click a flair under any post title to filter the entire subreddit by that topic. The ones worth your time:

- News: Official announcements, breaking updates, event recaps. Example: “Mithril mainnet update and release notes” with links to GitHub and a short changelog.

- Discussion: Big-picture takes and community polls. Example: “Should SPOs prioritize p2p tweaks before the next epoch?” Expect pros/cons and references.

- Development: Builder content. Example: “Aiken contract library v0.5 released” with repo, docs, and usage notes. If you build, live here.

- Question: Wallet issues, staking basics, node quirks. The fastest route to help—if you include screenshots (no keys), logs, and steps to reproduce.

- Governance/CIP: Proposals, parameters, and process talk. Example: “CIP-1694 feedback round — what should the constitutional committee look like?” Links to the CIP repo are standard.

- Catalyst: Funding rounds, proposal drafts, and post-mortems. Example: “Fund11 proposal AMA: tooling for SPO monitoring” with timelines and KPIs.

- Staking/SPO: Pool performance, relay setups, and operational tips. Example: “Node vX.Y.Z: memory footprint down 15% on Raspberry Pi—here are my metrics.”

Pro tip: if you only have 10 minutes, filter by Development and Governance/CIP. That’s where the shipping and shaping happens.

Rules and Automod: what gets removed (and why)

Mods here are active, and that’s a good thing. Peer-reviewed research on Reddit communities shows that consistent moderation improves discussion quality and reduces harmful content:

- Chandrasekharan et al., 2017 (CSCW) found that targeted moderation actions can reduce rule-breaking behavior site‑wide.

- Matias, 2019 (CSCW) documented how volunteer moderators’ consistent norms raise content quality and community trust.

On r/cardano, here’s what Automod and moderators routinely remove:

- Low-effort price posts and standalone “When moon/price target?” threads. There’s usually a daily or weekly place for that.

- Referral/affiliate links, stealth promos, and airdrop bait. Even if the product is legit, the format isn’t.

- Fake support and DMs offering “recovery” help. Instant nuke territory.

- Giveaways without clear rules, verification, or mod approval. Too easy to abuse.

- Ambiguous tech claims with no sources. If you say a node version fixes a bug, link to the PR or release notes.

If your post disappears, check the removal message. Most issues are fixable. A quick posting checklist I use:

- Did I include context (what, why, who it helps)?

- Do I have sources (GitHub, docs, explorer, official blog)?

- Is my title clear and honest (no hype, accurate flair)?

- Did I remove referral links and vague “DM me” lines?

Follow that, and Automod becomes a guardrail, not a roadblock.

Weekly stickies and recurring threads

Miss these, and you’ll miss half the value:

- Daily/Weekly Discussion: the acceptable place for price talk, headlines, and quick questions. Great for fast feedback, not for archiving knowledge.

- Dev/Tech Updates: recurring threads sharing node versions, wallet releases, Hydra/Mithril progress, and tooling. Perfect for scanning what actually shipped.

- Governance Roundups: summaries of active CIPs, parameter updates, and Voltaire milestones, often with links to the CIP repo and meeting notes.

- Catalyst Megathreads: proposal previews, AMAs, feedback windows, and voting reminders. Easy way to find builders you might want to follow.

- SPO Corners: operational tips, relay configs, topology discussions, and performance comparisons—with graphs and Cardanoscan links when done right.

Workflow tip: open the latest sticky, hit Save, and check back across the week. When something major happens, the top comment usually links out to the official source or the relevant PR.

So the room is set: a culture that rewards signal, flairs that route you to the good stuff, rules that keep out the sludge, and stickies that condense the week. Next up, want my exact filter-and-search routine that surfaces the best posts in minutes—without getting sucked into the noise?

Turn Reddit noise into signal: my go-to method

Scrolling Cardano Reddit without a plan is like trying to drink from a firehose. The trick isn’t to read more—it’s to filter smarter. When I open r/cardano, I want high-signal threads first: releases, real dev talk, governance changes, and honest postmortems. Everything else can wait.

“In a market where attention is scarce, your filter is your edge.”

There’s a reason this works. Peer‑reviewed research shows early upvotes can distort perceived quality—one experiment found a single early upvote increased final ratings by roughly 25% on a large social news site (Muchnik, Aral & Taylor, Science 2013). Translation: Hot can be hype. I use steps that reward substance over noise.

Sorting and searching that actually works

Here’s the routine I use to get the best of Cardano Reddit in minutes:

- Start: Top (Week → Month) — This shows what the community found valuable after the dust settled. It reduces the “early upvote” bias and highlights AMAs, release notes, CIP debates, and quality explainers.

- Then: New (last 200–300 posts) — I scan for fresh releases, outage notices, wallet fixes, and SPO updates before they trend.

- Filter by flair — Click a flair to narrow your feed. I pin separate tabs for:

- Development (builders, tooling, Hydra/Mithril, libs)

- Governance/CIP (CIP-1694 and beyond)

- Catalyst (funding rounds, audits, milestones)

- Staking/SPO (performance, upgrades, ops)

- Use targeted search — Two fast ways:

- Reddit search with flair:flair_name:"Development" Hydra or flair_name:"Governance" CIP-1694. Example: Development + Hydra

- Google’s site operator:site:reddit.com/r/cardano CIP-1694 objections or site:reddit.com/r/cardano Mithril release notes to pull deep threads you might miss in-app.

- Save the best queries — Bookmark your “Top (Month)” and flair searches. Bonus: add .rss to any search URL and pipe it into an RSS reader for quiet, automated monitoring.

That’s the entire playbook: community‑curated first, fresh second, laser‑focused queries third. Five minutes later, you’ve seen the signal and skipped the rest.

Must-follow content on r/cardano

When I scan, these are the threads that consistently deliver ROI:

- Release notes & upgrade announcements — Node updates, wallet releases, Hydra/Mithril versions. Look for GitHub tags and changelogs. Example search: release notes | changelog

- Weekly IOG/CF/EMURGO updates — Summaries of engineering progress, governance work, and ecosystem news. These threads often link to official blogs and repos.

- CIP discussions — Especially governance-shaping proposals like CIP‑1694. Watch for rationale, trade‑offs, and dissenting views with sources.

- Catalyst (funding) posts — Proposals, milestones, audits, and post‑funding reports. Useful to gauge real building vs. pitch decks.

- SPO performance threads — Uptime, pledge changes, block production, relay specs. Great for both delegators and operators.

- AMAs and postmortems — After outages, policy changes, or major releases, AMAs and incident write‑ups surface sharp details that marketing materials skip.

Spotting hype vs. substance

I treat every “big news” post on the Cardano subreddit like a mini‑investigation. Fast checks save money and headaches:

- Evidence or it didn’t happen — I want one of:

- GitHub link to commits, tags, or release notes

- Cardanoscan data for on‑chain claims: cardanoscan.io

- Official org post from IOG/CF/EMURGO or a verified wallet/team

- Time-bounded results — “We hit X TPS on testnet” is fine if there’s a reproducible benchmark, settings, and date. Vague speed claims without context are marketing, not engineering.

- Clear scope — Is this mainnet or testnet? Prototype or shipped? A CIP idea or accepted standard? Good posts say exactly where things stand.

- Reproducibility — Bonus points for docker commands, scripts, or repo instructions. If no one else can run it, it’s a promise, not a result.

- Community scrutiny — Scan top comments from known SPOs, devs, or governance contributors. Pushback with data is a good sign.

Red flags I skip instantly: screenshot‑only “partnerships,” “listing soon” whispers with no source, and posts that promise “guaranteed yields.” Hype avoids details; substance can’t wait to show them.

Save time with tools and habits

Small habits compound. Here’s what keeps my Cardano Reddit intake sharp and quick:

- Saved searches — Bookmark these and you’re always two clicks from signal:

- Development + Mithril

- Top (Month) Governance + CIP

- SPO performance

- RSS for stealth monitoring — Add .rss to any search URL (example: append &sort=new if needed). Pipe it into your reader to catch releases without opening Reddit.

- Follow consistent value‑adders — People who link repos, share benchmarks, or summarize governance calls. Save their posts; skip accounts that only ask for price predictions.

- Flair‑focused tabs — Keep one tab for Top (Month), one for New, and one each for your top flairs. It makes scanning feel like checking email folders.

- Weekly 7‑minute power scan —

- 2 min: Top (Week) for AMAs, releases, CIPs

- 3 min: New (fresh fixes/outages)

- 2 min: Saved flair searches for your niche

That’s it. Consistency beats marathon scrolling.

Cardano Reddit is a goldmine when you push evidence to the front and let speculation fall away. Want to turn this into real learning, smarter staking, or faster developer feedback—the exact threads to use, the best way to ask, and the posts that attract serious help?

Coming up next: the practical playbook I use to learn, build, and stake without wasting time. Which part do you want first—wallets, SPO tactics, or dev workflows?

Learn, build, and stake: using r/cardano the smart way

I use r/cardano as a practical lane: learn the basics fast, stake with confidence, share pool updates without annoying people, and move a project from “idea” to “mainnet ready.” It works if you show up with a plan and post the kind of details that make others want to help.

“Proof beats promises.” On Cardano Reddit, receipts win: logs, links, repos, screenshots, and on-chain data.

Beginners: wallets, staking, and first questions

If you’re new, you’ll get quality answers fast when you ask clearly and use the right flairs. Here’s the starter path I recommend when I help friends onboard via Cardano Reddit:

- Pick a trusted wallet (light, hardware-friendly, actively maintained): Lace, Nami, Eternl, Yoroi, Typhon. If you own a Ledger or Trezor, confirm support in the wallet docs before you install.

- Security basics you’ll see repeated by the community:

- Never share your seed phrase. Ever.

- Mods won’t DM you for keys or “support.” If someone does, it’s a scam.

- Only download wallets from official links listed in the wallet’s verified site or GitHub.

- Stake in minutes (what I tell newcomers to post if they’re unsure):

- Which wallet version and OS you’re on.

- The pool ticker you’re considering and why.

- Any error messages when delegating.

How I evaluate pools (and what the subreddit typically asks you to check):

- Saturation (stay under the cap), fees (340 ADA fixed is standard; margin varies), and pledge (signals skin in the game).

- Blocks minted and reliability over multiple epochs.

- Explorer proof: Cardanoscan stats, PoolTool, or AdaPools links for transparency.

Post like this and you’ll get helpful replies instead of shrugs:

- “Lace v1.14 on macOS 14.5. Delegation to ticker BERRY fails with ‘UTxO balance insufficient by 0.45 ADA’. Tried reducing tokens in the same UTxO; same error. Here’s the tx hash (redacted). Any ideas?”

Usability research (Nielsen Norman Group and similar) consistently shows that scannable, structured posts get more and better responses. That’s exactly what I see on r/cardano every week.

SPOs: getting feedback without shilling

Promotion gets ignored, evidence gets respect. Use the subreddit to update, educate, and improve your pool—not to spam it.

- Post in the right place: Look for the weekly staking/SPO thread or a mod-designated megathread. Standalone ads get removed or downvoted.

- Share transparent metrics:

- Ticker + Pool ID (be exact).

- Pledge, margin, fixed fee (340), and any recent changes.

- Blocks minted this and last 5 epochs; uptime; relays count/regions.

- Explorer links for verification.

- Explain your value beyond yield:

- Open-source tools, guides, or monitoring dashboards you maintain.

- Geographic redundancy, bare-metal vs. cloud rationale, disaster recovery notes.

- Community participation: helping newcomers, answering tech questions, or writing runbooks.

- Ask for specific feedback: “Is our margin fair for a small pledge pool with consistent blocks?” gets real discussion.

Example post structure I’ve seen work well:

- [SPO Update] Ticker: EXAMPLE — Pledge 80k ADA, Margin 2.5%, Blocks: 7 in epoch 492 (33 last 5). New relay in Singapore to improve Asia latency. Here’s our Cardanoscan + monitoring screenshot. Looking for feedback on margin vs. payout expectations.

When SPOs show receipts, delegators respond. When they post slogans, they don’t.

Devs: from idea to mainnet

Builders get excellent help on r/cardano when they include the nuts and bolts. I keep a quick template for posting issues or progress:

- Use the Development flair and lead with the problem in one line.

- Environment: cardano-node/cli versions, OS, toolchain (Plutus, Aiken, Marlowe), network (preprod/preview/mainnet).

- What you tried: exact commands, minimal reproducible example (repo/gist), and logs with timestamps.

- Expected vs. actual behavior + tx hash if applicable.

- Ask for feedback on design trade-offs, not just fixes. You’ll get smarter responses.

Examples that tend to get traction:

- [Aiken] Inline datum with CIP-68: minting works on preview, fails on preprod with Phase-2 validation error. Aiken v1.x; script + test repo linked. Is this a version mismatch or parameter issue?

- [Plutus] Endpoint returns “Collateral inputs insufficient” after node upgrade to 8.x. Here’s my wallet UTxO set, CLI command, and log excerpt. What changed?

- [Marlowe] Need review of contract-state transitions and close conditions before mainnet. Looking for gotchas and test scenarios I missed.

Pro tip: include CIP context where relevant (e.g., CIP-68 for NFTs, CIP-1694 for governance metadata) and link to the PR or spec. It signals you’ve done homework and invites high-signal reviewers. You’ll often find collaborators and auditors in the comments.

Governance and Catalyst: where to plug in

r/cardano is a solid map for the governance era: CIPs, Voltaire updates, and Catalyst funding cycles. If you want your voice to matter, show up prepared.

- Track CIPs: Watch threads discussing changes like CIP-1694 (governance) and standards impacting wallets, metadata, or DApp UX. Ask: What breaks? What improves? Who bears the cost?

- Join proposal discussions early. Strong questions to ask:

- What user problem is this solving right now?

- What milestones and success metrics are measurable on-chain or via GitHub?

- Is the budget realistic for the scope and team track record?

- Catalyst voting basics (what the sub will remind you of):

- Register your wallet ahead of deadlines; keep the voting QR/app safe.

- Skim proposal summaries, then deep-dive your top picks. It’s normal to pass on most.

- Cross-check claims with official docs, repos, and explorer data.

Sample comment that moves the needle (and often gets answers):

- “Your Catalyst proposal promises a 2x TPS improvement. Which benchmark suite do you use, can we reproduce it on preprod, and will you publish profiles and traces per commit?”

When governance threads get tough but fair questions, the whole ecosystem levels up. That’s the edge of Cardano Reddit: curious, evidence-seeking people keeping each other honest.

I’ll end this part with a simple nudge: before you click any “airdrop,” “support,” or “urgent fix” link you see in a thread, do you know the four red flags that catch 90% of scams? I’ll show you my 60-second checklist next—exactly what I use before I stake, upgrade, or sign anything on r/cardano.

Stay safe: scams, airdrops, fake support, and good etiquette

I’ve watched more people lose ADA to “helpful” strangers and shiny airdrops than to bad trades. The good news: a few habits will block almost every scam you’ll meet on Reddit. Keep your guard up, keep it simple, and remember—slow is smooth, smooth is fast.

“Trust, but verify.” In crypto, skip the first part and double the second.

Red flags to avoid

If you only remember one thing, remember this: no legit Cardano team will DM you first for “support”. Here are the most common traps I see right now, with how they typically look:

- “Support” DMs after you post a question. Scammers watch the subreddit and pounce with cloned logos and friendly language. They’ll push you to a Telegram/Discord and ask for your seed or a “sync file.” Real teams don’t operate like this—mods won’t DM you, and wallet teams won’t ask for keys.

- “Airdrop/claim” pages using lookalike domains. Example patterns: mɪnswap, adalyte, yorroi with one extra or swapped character. The page will ask you to “connect” and sign a transaction. That signature can transfer your assets. If you didn’t see it announced on official channels you already follow, it’s bait.

- Seed “recovery” tools and browser plug-ins. Posts or DMs saying “use this tool to fix stuck funds” are just key-stealers. A real fix is never a random executable or extension.

- Impersonation accounts (IOG/EMURGO/CF logos, fake staff names). Always click through to the profile:

- Is the account new, with little karma and generic comments?

- Does their post history align with the brand or role?

- Do links match the official site exactly? (cardano-foundation.org, not cardano-foundatlon.org)

- Giveaways that require sending ADA first. “Send 100, get 200 back” is a classic theft. No reputable Cardano org runs these.

Why so much social-engineering? Because it works. The FBI’s IC3 reports show investment and social-media–initiated scams hitting record losses in recent years, with crypto often involved. Scammers don’t hack wallets—they hack people. Don’t be their easy target.

Privacy and OpSec on Reddit

Reddit isn’t your friend when it comes to privacy. Treat it like a public square:

- Never post seed phrases, private keys, or recovery files. Not to anyone, not ever. Not even “screenshot cropped.”

- Don’t tie wallet addresses to your real identity. If you share a transaction hash for debugging, consider a fresh address next time.

- Turn on 2FA for Reddit (preferably a security key/WebAuthn) and use a unique, strong password via a password manager.

- Separate your browsing. Use a dedicated browser profile with no extra extensions for wallet activity. Hardware wallet + read-only wallet setups keep you safer.

- Scrutinize every signature prompt. CIP‑30 dApps can request actions you don’t intend. If you can’t explain the effect of the transaction or message you’re signing, cancel it.

- Audit extensions and mobile apps. Install from official links only. Remove anything you don’t use. One malicious extension can drain everything.

Posting well: how to get help faster

You’ll get better answers (and avoid scammers) when you post with clarity. Before you hit submit:

- Provide context: wallet/app name and version (e.g., Lace, Eternl, Yoroi, Nami), OS/device, hardware wallet model/firmware if used.

- Show the evidence: transaction hash on an explorer, error messages, logs, and screenshots with sensitive info redacted.

- Explain what you already tried: steps taken, guides followed, any reinstall/reindex attempts.

- Cite sources: link to the doc, GitHub issue, or post you’re referencing.

- Be specific, be civil. “Wallet broken, please help” invites guesswork (and scammers). A calm, detailed post gets real contributors on your side.

Extra tip: if someone offers help, check their comment history. Do they actually solve Cardano problems, or do they funnel people to DMs? Awards and flashy flairs don’t equal credibility—patterns of useful replies do.

More trusted places to check details (outside Reddit)

When a claim looks big (airdrops, upgrades, outages, staking changes), take 60 seconds to cross‑check here:

- Official docs and blogs:

- docs.cardano.org

- IOG blog

- EMURGO and Cardano Foundation

- Governance and proposals:

- Cardano CIPs (GitHub)

- Project Catalyst and Catalyst docs

- Explorers and network data:

- Cardanoscan (transactions, pool stats)

- cexplorer (additional chain metrics)

- Q&A and technical help:

- Cardano Forum

- Cardano Stack Exchange

- IOG GitHub, Cardano Foundation GitHub, EMURGO GitHub

- Wallet support pages:

- Ledger Support • Trezor Support

- Lace • Yoroi • Eternl • Nami

Cross-checking takes less than a minute and saves you from months of regret. If something still feels off, ask publicly and tag sources—good actors won’t mind being verified.

One last thought before we go on: people keep asking, “Is Cardano a bad investment?” The honest answer isn’t a slogan—and it’s exactly what I’m tackling next. What would change your mind, facts or feelings?

FAQ: Real questions people ask about Cardano on Reddit

Quick note: nothing here is financial advice. I’m sharing how I approach these questions based on patterns I see on r/cardano, on-chain data, and years of watching crypto cycles.

“Why is Cardano a bad investment?”

I see this question a lot, usually after a red week or a spicy Twitter thread. The honest answer: it depends on your goals, time horizon, and risk tolerance.

Concerns I see raised (often fairly):

- Timelines feel slow. Cardano favors peer-reviewed research and formal verification. That can trade speed for certainty. If you want “ship fast, fix later,” Cardano will frustrate you.

- Crypto is brutally volatile. ADA has had multiple 70–90% drawdowns across cycles. That’s not unique to Cardano—most L1s have similar tails—but you need to be mentally prepared.

- Adoption and competition.Ethereum still dominates dev mindshare. Solana, Cosmos, and others move fast. If you care about network effects today, that matters.

What supporters point to:

- Research-first stack. Extended UTXO, Plutus, and formal verification are designed for correctness and parallelizability long term.

- Scaling in motion. You’ll see recurring r/cardano threads on Hydra (state-channel style throughput), Mithril (fast bootstrapping and lightweight clients), and UTXO-level improvements. Look for posts that include GitHub releases, node versions, and change logs—not just slogans.

- Governance. Voltaire and CIP processes attract people who want transparent, on-chain rulemaking. If governance quality matters to you, this is a plus.

How I pressure-test big claims on r/cardano:

- Is there a source link (GitHub, CIP, official blog) or just a screenshot and a take?

- Does the post cite on-chain data (transactions, fees, TVL, unique wallets) or “my cousin’s telegram group”?

- Are devs or SPOs in the comments adding technical context—or is it pure hopium/doomium?

For anyone asking if Cardano is a “bad investment,” the real question is: what risk are you paying for what kind of future? Research-focused L1s can underperform in euphoric phases and surprise in builder phases. Crypto returns also show heavy tails and momentum effects in multiple academic studies—timing and rebalance discipline matter more than hot takes.

“How much will 1 ADA be worth in 2025?”

No one knows—and if they claim they do, mute or move on. Price targets without drivers are noise. On r/cardano, I ignore any prediction that doesn’t tie to real inputs.

What I watch instead:

- Roadmap releases: node upgrades, Hydra milestones, Mithril adoption in wallets/exchanges.

- Usage signals: transactions per day, average fees paid (in ADA), stable daily active addresses, and DApp usage growth.

- Builder momentum: quality repos, frequent commits from known teams, libraries/tooling adoption (Plutus, Aiken, Marlowe).

- Macro: liquidity cycles, rates, and Bitcoin’s regime. Alt L1s historically track broader crypto liquidity more than narratives.

Simple scenario thinking (not predictions):

- If ADA is “higher,” I’d expect a clear uptick in fee revenue, more active DApps, and recurring posts about shipped CIPs and stable node versions.

- If ADA is “flat or lower,” you’ll still see good tech shipped sometimes—but without sustained user growth, price usually won’t care.

On the subreddit, keep price talk in the designated daily or weekly threads. Mods remove standalone price posts to keep things useful for everyone.

“Will Cardano make me a millionaire?”

The internet loves this question. Here’s the sober version.

The math:

- Turning $10,000 into $1,000,000 is a 100x.

- Turning $5,000 into $1,000,000 is a 200x.

For a top-10 L1, a clean 100x from here usually implies a massive market cap expansion plus years of execution. Could crypto pull a black-swan melt-up again? Sure. Should you plan your life around it? No.

What I actually do:

- Position sizing: I keep any single coin at a size where a 70–90% drawdown won’t wreck me emotionally or financially.

- Time horizon: I think in multi-year cycles and assume brutal volatility along the way.

- Rules over predictions: pre-set add/trim bands beat chasing narratives.

On r/cardano, you’ll see both “we’re early” and “it’s over” every month. The posts worth reading explain trade-offs, cite sources, and respect risk. That’s the vibe I look for.

“Where should I post price or portfolio questions?”

Mods keep the front page usable by funneling price talk into specific threads. That’s not censorship—it’s quality control. If you want answers fast and your post to stick, use the right lane.

- Use: the Daily Discussion or weekly market threads flagged by the mods.

- Avoid: standalone “Will ADA hit X?” posts—Automod will nuke them.

- Do this instead: search first, then post with context.

Example of a good post in the daily thread:

Title: ADA position sizing help

Context: I hold 40% BTC, 40% ETH, 20% ADA. Time horizon 3–5 years. I’m staking ADA. Questions:

1) Is 20% too high for a single L1 outside BTC/ETH?

2) If I want to rebalance quarterly, what on-chain metrics would you watch to justify keeping this weight?

What I tried: Read the rules and checked recent node release notes. Open to constructive critique.

Posts like that get useful feedback fast because you’ve done the homework and respected the subreddit flow.

Want my quick setup to make r/cardano 10x more useful in five minutes a day? That’s next—ready to turn Reddit into your personal Cardano command center?

Your r/cardano game plan (simple and fast)

You don’t need to live on Reddit to get real signal from r/cardano. Set up a simple flow once, then spend 5–10 minutes a few times a week. That’s enough to catch releases, governance updates, and legit dev threads without swimming through noise.

5-minute setup checklist

Do this now and you’ll save hours later:

- Join r/cardano, scan the sidebar rules, and note the stickied threads. Anything labeled Weekly, Megathread, or Sticky is where the highest-value roundup usually lives.

- Sort smarter: set the subreddit to Top → This Month to see what the community found useful. Then switch to New to catch fresh releases and fixes.

- Filter by flairs you actually care about. On desktop, click a flair bubble (like Development or Governance/CIP) to filter. You can also use search operators:

- Development updates on Hydra: flair_name:Development Hydra

- Governance/CIPs (e.g., CIP-1694): CIP-1694

- Save searches and create a quick bookmarks folder. Hit “Save search” on Reddit (the little star) for your go-to queries, and add a browser folder called “r/cardano” for:

- Your favorite stickies (weekly discussions, governance roundups)

- Dev topics you follow (Hydra, Mithril, Plutus/Aiken/Marlowe)

- Pool/SPO threads if you stake or run infrastructure

- Follow official org accounts and bookmark source links. Don’t rely on reposts. Keep these in the same folder:

- IOG blog and IOG status

- Cardano Foundation updates

- EMURGO blog

- cardano-node releases, Hydra releases, Mithril releases

- Cardanoscan (network stats, transactions)

- Save posts from trusted contributors. Hit “Save” on high-signal authors who post repos, changelogs, dashboards, and data screenshots. Your Saved list becomes your personal newswire.

Why a checklist? In busy environments, simple checklists reduce errors and save time. It’s documented across fields, from design to medicine. If it works in surgery, it’ll work on Reddit signal-gathering too.

Keep your edge

Here’s how I stay accurate and fast without getting dragged into drama:

- Two tabs, always: open the Reddit thread in one tab, the source of truth in another (GitHub release, official blog, Cardanoscan). If the source doesn’t back the claim, I treat it as opinion.

- Wait for confirmation on hot news. Big claims spread faster than accurate ones. A well-known MIT study found false news travels further and quicker on social platforms—so pause, check, then act. Source

- Automate quick checks:

- IOG Status during upgrades or network hiccups

- Cardanoscan epochs for staking/epoch timing

- Mithril dashboard for snapshot health

- Use the right thread for speed. Questions about wallets, SPO ops, or portfolio talk? Drop them into the daily/weekly threads. Mods and power users look there first, and you’ll get answers faster.

- Share your sources when you ask. A short post with what you tried and a link (repo, log, Cardanoscan tx) gets better help. UX research shows people respond faster to scannable, well-structured questions. Keep it short, linked, and clear.

- Upvote useful, report scammy. This is how the feed stays clean. If something looks off—shortened links, “support” DMs, or miracle airdrops—report and move on.

Conclusion and next steps

Set your filters, save your searches, bookmark the official sources, and give yourself permission to ignore the rest. You’ll start seeing what’s real, what’s shipping, and what actually matters—without losing time to noise.

Use this game plan for a week and tune it to your interests. If you stumble on a great thread or a smart setup trick, share it—I’ll check it out and update this guide on Cryptolinks.com/news.

Simple habit, big edge: sort by Top (Month), scan New, verify with sources, save the good stuff. That’s it.