The Realities of Modern America And Its Awkward Relationship with Progressive Technologies

Throughout history, America had sold itself as the beacon of hope, the land of the free, an incubator of dreamers, and an economy that values social justice. However, in the last few decades, this neatly packaged identity has come undone, with the recent killing of an unarmed man in broad daylight serving as the last straw that broke the camel’s back.

As events unfolded, I couldn’t help but dissect the implications of America’s recent villainous take against social equality and its stance on technologies that border on such concepts. Here, I will explore the unraveling of the American myth and its ripple effects on global development.

The Tale of Modern America

The Stance of Modern America On Civil Rights

Without any doubt, America is the most powerful nation in the world, thanks to a well-packaged myth that the country is an enabler of fundamental human rights. Alas, this bubble, which America has carefully nurtured, has begun to backfire. It is not only the unfortunate event which sparked a nationwide protest that brings to mind America’s failings in the matter of social equality and civil rights. Instead, it’s the recurring of similar tropes all through America’s existence and the negligence of those in the position of power to implement policies to put an end to such scourges.

More damaging is the response of top government officials to the protests across the nation. If you are an avid follower of America’s human rights activism in other nations, you will understand that President Donald Trump’s decision to use military force to disperse “riots” in major cities goes against everything America has stood for in the past. As such, I can’t help but conclude that the nation has lost its way and can no longer claim the moniker “the land of the free and home to the brave.”

Instead of acknowledging the racial tension in the country and identifying viable ways to put the matter to rest, America’s president has immersed himself in blame-shifting and, subsequently. threatened to forcefully end protests. According to a report published on the Washington Post on the 2nd of June, President Trump has remained rigid in matters relating to the protest. The article reads:

“President Trump, for his part, has been reluctant to adjust his combative approach despite the widespread unrest. He continued to inflame rather than soothe the nation’s tensions on Monday, threatening to deploy federal troops if local officials don’t quell acts of violence and looting. Federal authorities used rubber bullets, flash bangs and gas to clear peaceful protesters outside the White House just minutes before Trump walked across Lafayette Square to St. John’s Church, where a fire was set Sunday evening.”

America’s Stance on The Global Economy

For what is worth, America is no different from other nations prioritizing the welfare of the majority. The only difference is that it answers to no one. There are no organizations or nations powerful enough to impose sanctions on the US. On the contrary, the US has single-handedly elected itself as the mouthpiece of humanity and would swiftly sanction governments deemed irresponsible when it comes to civil rights issues. To achieve this level of dominance, America has capitalized on the world’s reserve status of the US dollar and devised a way of making it difficult for countries at loggerheads with its policies to access foreign exchange.

It is for this reason states are beginning to intensify their efforts to create central bank digital currencies or accept the disruptive capacity of decentralized currencies to evade sanctions and what some have termed a ‘’witch hunt.’’ One country leading this narrative is China, as it seems to be the most determined and closest to developing a fully functioning and successful state-backed digital currency. There is no saying the level of impact China’s CBDC will have once it is launched, however, the consensus remains that America’s dominance in the global economy will experience a steady decline in the coming years.

While detailing this possibility, a publication by Finance Magnates opined on the growing interest in CBDCs. The report reads:

“The decentralized nature of cryptocurrencies is what makes them capable of weakening the impact of sanctions and the way they are imposed. Governments across the world looking to escape from western fetters have realized that crypto may be their golden ticket. With the global economic structure under more stress now than ever before, the chance for many of these countries to strike is at hand.”

Already, a growing percentage of countries are coming to terms with the need to identify other reserve currencies and reduce their dependence on the US dollar. Perhaps, another reason for America’s dwindling influence is that nations are more attuned to the unraveling of the American myth following the COVID-19 pandemic and America’s show of incompetence in the face of a racial crisis. Unlike America, China and several European nations have successfully jump-started their economies after a long shutdown to curtail the spread of coronavirus. Instead, the US is still struggling to flatten the curve. And just when it was about encouraging citizens to resume their normal lives, another tragedy, which could put its fragile economy under additional strain, struck.

The recent unrest, sparked by the senseless killing of an unarmed citizen and portraying a recurring theme in America’s unsuccessful fight against racism, has shown the world that “The American Dream,” once perceived as being flawless in the global terrain, is merely an illusion. While this is just becoming a known fact, there have been writings on the wall. As such, it comes as no surprise that America’s share of the world economy is dwindling. What this connotes is that economies adjudged as developing countries are finally bridging the gap between them and the so-called developed nations.

When viewed through the lens of the minority, it is difficult to trust the financial and social policies governing a system, which constantly erodes your fundamental rights. There is no reason to keep trusting infrastructures historically positioned to give undue advantage to the majority. It is also foolish to continue to believe that a selfish system that has stood for decades will suddenly reposition itself or erase the privileges presented to a social class or a race. Therefore, rather than allow the recurrence of tropes in the economic and social makeup of their country, Americans are currently on the streets voicing their disinterest in allowing social injustice to become a norm. And amidst these protests, there were sightings of placards hinting the role of decentralized economies and infrastructures in today’s economy.

How Modern America Perceives Cryptocurrency

Everyone expects a nation modeled as a shining beacon to champion courses that will benefit humanity rather than the purses of a few individuals. Instead, the opposite is the case. America relies on systems that make it difficult for the minority to have a fair shot at achieving success. That is why the government and beneficiaries of the country’s existing governing policies are determined to sideline technologies that threaten their power. We have seen this narrative play out in the ongoing tussle to ensure that the US dollar retains its dominance in light of the emergence of digital currencies. Hence, there is no major rush to implement regulatory frameworks that will establish the legality of decentralized currencies.

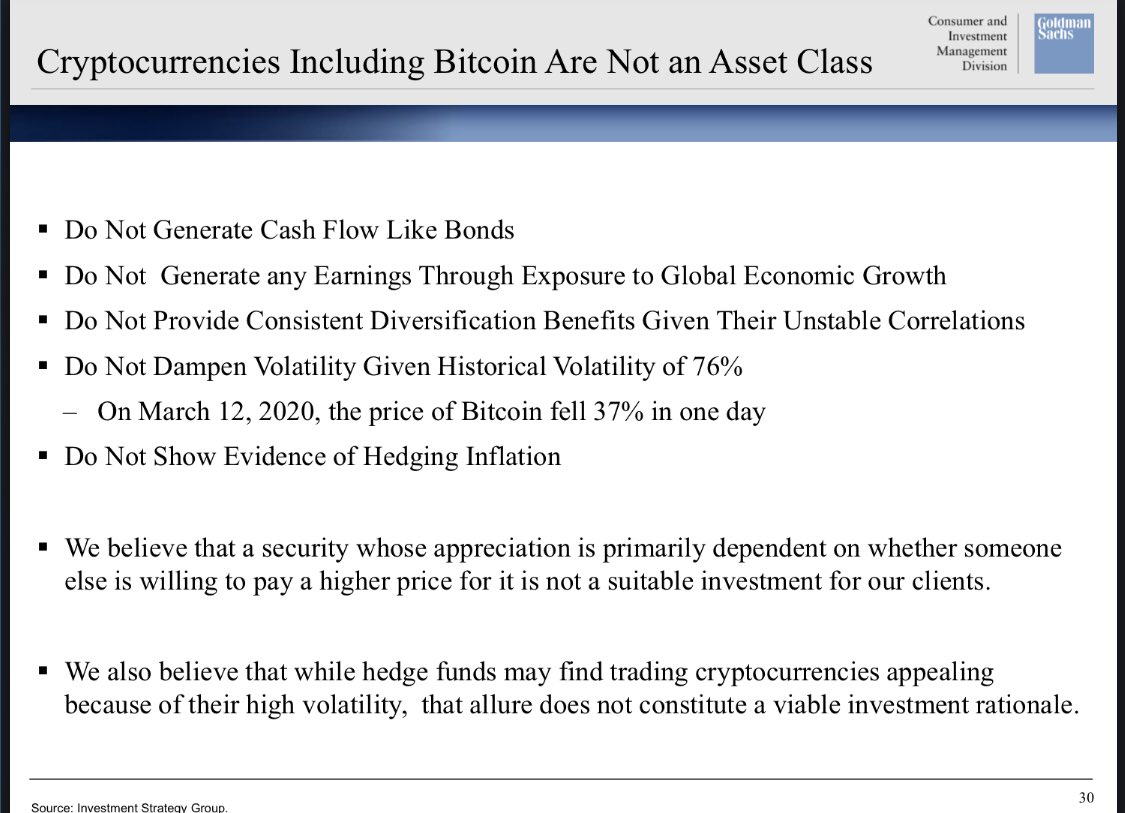

Likewise, we have witnessed how major banks in the US have antagonized and downplayed bitcoin’s viability. The latest of these attacks was on the 27th of May when Goldman Sachs’ analysts took a derogatory shot at Bitcoin’s eligibility as an investment class. In the presentation entitled “US Economic Outlook & Implications of Current Policies for Inflation, Gold and Bitcoin,” the bank claimed that “cryptocurrencies, including bitcoin, are not an asset class.” The analysts explained:

Goldman Sachs’ analysts took a derogatory shot at Bitcoin’s eligibility

“We believe that a security whose appreciation is primarily dependent on whether someone else is willing to pay a higher price for it is not a suitable investment for our clients.”

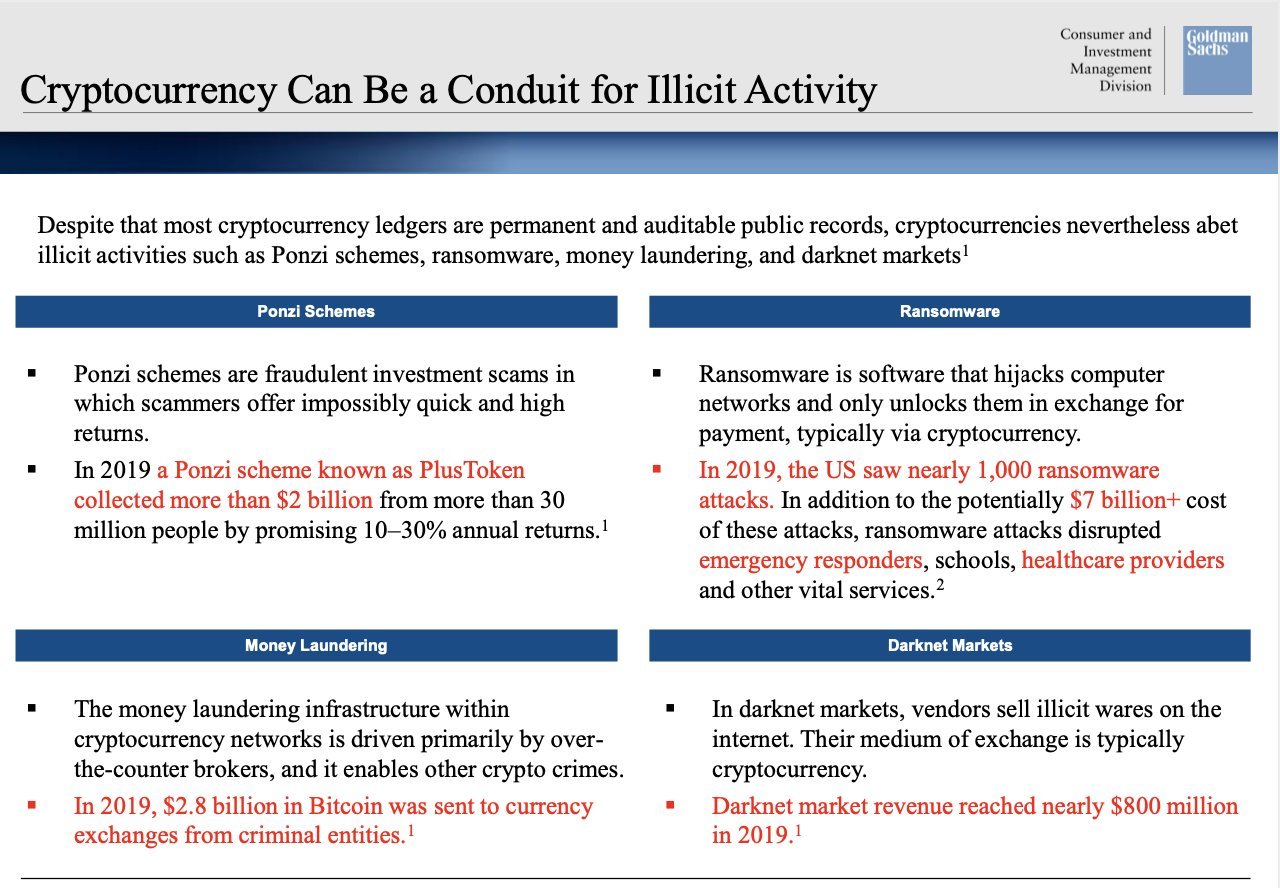

The bank highlighted several instances where bitcoin had been in the middle of scandals

Furthermore, the bank highlighted several instances where bitcoin had been in the middle of scandals, especially those relating to frauds, ransomware, drug trafficking, and other illicit activities. Likewise, it highlighted that Bitcoin’s value is majorly dependent on the perceived scarcity of the coin and borne out of fallacy. The analysts explained that it is possible to fork the Bitcoin blockchain with the press of a few buttons and create more coins, thereby negating the argument that the digital asset is ideal as a hedge against inflation.

Remarkably, in what seems like an indicator that investors are becoming aware of the economic shift highlighting the need for decentralized finance, the crypto community largely ignored Goldman Sachs’ viewpoint. For one, Cameron Winklevoss, co-founder of Gemini, shrugged off these comments as outdated antics. He tweeted:

Cameron Winklevoss

“Hey Goldman Sachs, 2014 just called and asked for their talking points back. Bitcoin was declared a commodity by the CFTC in 2015 in the Coinflip order…so yea it’s an asset whose price is set by supply and demand. Just like gold. Just like oil. It’s a commodity.”

Like Winklevoss, other high-profile crypto supporters have downplayed Goldman Sachs’ credentials in such matters. Some even referenced the bank’s bearish stance on the internet way back in 1994 as a pointer that the financial institution is not always right. Others see Goldman Sachs’ statements as an extension of how the centralized system views the industry. To these individuals, the bank received bailout funds, and so, it is part of the system Bitcoin is looking to replace.

Bitcoin and other decentralized assets are the exact opposite of what the American economy stands for. Unlike the US financial system, bitcoin enables a network where race, age, religion, or social caste do not come to play. Your background does not matter once you enter the bitcoin market because it does not reward participants for upholding distorted beliefs. Conversely, the reward mechanism of the technology only recognizes the output of your computer and efforts to ensure the elimination of centralized elements.

On the other hand, America will only support a financial instrument that preserves its sovereignty. Take, for instance, the decision of the government to halt the sale of the Ton token. According to the CEO of Telegram, Pavel Durov, the US did not only stop the platform from distributing this token within its border but went further to prevent the Dubai-based company from selling its product in the global market, just because it violated the country’s securities laws. Durov wrote:

CEO of Telegram, Pavel Durov

“The U.S. court declared that grams couldn’t be distributed not only in the United States, but globally. Why? Because, it said, a U.S. citizen might find some way of accessing the TON platform after it launched. So, to prevent this, grams shouldn’t be allowed to be distributed anywhere in the world—even if every other country on the planet seemed to be perfectly fine with TON.”

Durov went on to reveal the implications of this pronouncement. According to him, the court and the SEC decision imply that America has the power to impose its law in other jurisdictions. He stated:

“We, the people outside the U.S., can vote for our presidents and elect our parliaments, but we are still dependent on the United States when it comes to finance and technology. The U.S. can use its control over the dollar and the global financial system to shut down any bank or bank account in the world… Unfortunately, we—the 96% of the world’s population living elsewhere—are dependent on decision-makers elected by the 4% living in the U.S.”

Final Thoughts

Unfortunately, these developments underscore the way America runs its economy. The country’s economic principle makes it almost impossible for the minority to climb the social ladder unimpeded. While it is impossible to fully eradicate this prevailing narrative, individuals at the receiving end of a vicious cycle of social injustice have begun to embrace the option of choosing alternative systems. Now, they can circumvent all those unnecessary processes involved in conventional loan marketplaces by adopting infrastructures entrenched in the components of decentralized finance. Similarly, they can boycott the more restrictive traditional asset markets for the more liberating crypto market.