Everything you need to know about Bored Ape NFT, ApeCoin and Yuga Labs

Ever wondered why everyone on your Twitter feed has a cartoon monkey as their profile picture? What’s the big deal with Bored Ape NFTs? Are these apes just overpriced digital doodles, or is there something much deeper going on? Oh, and wait—what’s ApeCoin? And who’s this mysterious Yuga Labs behind it all?

Let me tell you something: The Bored Ape Yacht Club (BAYC) is not your average NFT collection. It’s reshaping the way we think about art, communities, and even the future of the digital world. But, just like anything new and exciting, it comes with a mix of insane hype, confusion, and endless questions. So, let’s start breaking it all down.

The Big Questions: Why Should You Care About Bored Ape NFTs and Yuga Labs?

Before you dismiss it as an expensive joke, ask yourself this—how do you define value? Is it about exclusivity, the investment potential, or the doors it opens to once-in-a-lifetime opportunities?

The Problem with Understanding NFTs: Not Just Pictures

If you’re confused about NFTs, you’re not alone. Too many people assume they’re just “pretty pics on the blockchain.” But here’s the catch: being part of the Bored Ape Yacht Club goes far beyond owning digital art.

- For starters, owning a Bored Ape gives you entry into an exclusive club filled with celebrities, tech innovators, and investors. Think VIP parties, IRL (in real life) experiences, and heads-up access to digital projects.

- Utility takes center stage: BAYC NFTs unlock features, rewards, and even games within the Bored Ape ecosystem. Some owners have monetized their Apes in ways you’d never expect, such as licensing their Ape’s image for brands and merchandise.

- Financial growth: While not every NFT carries potential for profit, some Bored Ape NFTs were first minted for around $200 and later sold for millions (yes, millions!).

Bottom line: These aren’t just random JPEGs—they’re digital assets tied to a lifestyle, virtual perks, and huge financial incentives.

How ApeCoin Adds to the Ecosystem

If BAYC NFTs weren’t enough of a game changer, they went a step further and created ApeCoin. This isn’t just another random “meme coin.” ApeCoin acts as the glue holding together the entire Bored Ape ecosystem, bridging digital perks with the real world.

Here’s how it works:

- Exclusive opportunities: ApeCoin holders can participate in special BAYC events, metaverse projects, and governance decisions. Yes, the community is shaping its own future!

- Gaming expansion: It’s the official currency for Yuga Labs’ gaming initiatives. Forget traditional gaming currencies—you’ll need ApeCoin for in-game purchases and interactive experiences.

- Staking and rewards: ApeCoin staking allows users to lock up their coins for rewards, ensuring engagement and participation across the community.

Still think it’s just hype? Major celebrities like Snoop Dogg and Eminem are all in, and the token has made headlines for its role in shaping the Web3 space.

The Mind Behind the Madness: Yuga Labs

No, BAYC wasn’t created by accident. Yuga Labs, the company behind it all, knew exactly what they were doing—and they’ve set the bar sky-high for the entire NFT industry.

While many NFT projects fizzle out, Yuga Labs has kept BAYC at the forefront by pivoting BAYC from “just art” to “the future of digital communities.” They’re like the Pixar of NFTs—innovative, trendsetting, and constantly keeping you on the edge of your seat.

What makes their approach so different?

- Pioneering innovation: From building immersive worlds like Otherside to facilitating governance through ApeCoin DAO, Yuga Labs isn’t just riding the NFT wave—they’re creating it.

- Strategic collaborations: They’ve partnered with major artists, brands, and platforms to give BAYC a place in pop culture. Think festivals, metaverse parties, and even interactive branding.

- Community-first mentality: Yuga Labs treats BAYC holders like VIPs, providing access to exclusive events, airdrops, and countless perks that have turned the community into a global powerhouse.

So, with all this buzz around BAYC, ApeCoin, and Yuga Labs, one question remains: What exactly is the Bored Ape Yacht Club, and why has it taken the world by storm? Spoiler alert: It’s much bigger than digital art or status symbols. Get ready, because we’re diving deeper into this incredible story next!

What is Bored Ape Yacht Club (BAYC)?

At first glance, the Bored Ape Yacht Club (BAYC) might seem like just another bunch of quirky pictures. But trust me, there’s a lot more going on here. BAYC isn’t just about owning a digital ape—it’s about being part of something exclusive, something that feels bigger than yourself.

The moment you understand BAYC, you’ll see why it’s not just an NFT collection but a cultural movement. Let’s break it down.

What inspired the creation of BAYC

What inspired the creation of BAYC?

The creators of BAYC as well as the founders of Yuga Labs are Gargamel and Gordon Goner, which are pseudonyms. Before creating BAYC, the two friends had joined the crypto space in 2017 and they have featured mainly as traders and holders. However, they suddenly became aware of the opportunities that NFT provided and how it allowed them to contribute more to the ongoing crypto movement.

Gargamel, in an interview with Coindesk, stated that the emergence of NFT presented an avenue for them to showcase their creativity, and for the first time, take up active roles in the crypto community. He stated:

“It just seemed that … Hey, culture is coming to Ethereum. This is what we were waiting for. It felt like the doors were blown open to this whole new space, and as creative people that have been trying to be active – but in the end, quite passive – in interacting with crypto, we thought, here is a way for us to participate in crypto, and actually build something, even if it’s a ridiculous f**king club for apes.”

And so, they came up with an idea to create an exclusive club of NFT art owners that to an extent share the same experience or mentality. The idea that birthed this collection revolves around the fast-paced nature of the crypto market and the tendency of jumping blindly (aping) into crypto opportunities. So what happens when the market eventually slows down and there are no more crypto rewards and opportunities to capitalize on? BAYC looks to encapsulate the answer to this question as it postulates a future where crypto participants have become incredibly rich and bored. As such, they form a club and spend most of their time in a bar.

While speaking about how they came up with this idea, Goner explained that they believe that lazing around and spending money on weird stuff are some of the things they would do if they had made tons of money from crypto investments. He explained:

“And that’s the best part of that story, by the way. That was the turning point. I spent all night thinking about what that meant, that there was just going to be this d**k on the wall, as the first thing up. That’s when we came up with Bored Ape Yacht Club. The idea was that it was this place for degenerates to go, right? Because that’s who we were. We were they guys who aped into every f**king s**tcoin. We kind of are that person.”

Goner added that the whole idea bordered on the year 2035, long after much of the exciting crypto trends and money-generating opportunities had long faded away:

“We imagined it as, ‘Where would we go if we could go anywhere?’ It was the first time that we stopped thinking about what other people might want. And instead, the question became, “What would we want to buy?’ We just went back to our childhoods. And we said, ‘Oh, let’s put a swamp club in the Everglades, and fill it with apes who are just f**king super ‘80s hardcore and ‘90s hip-hop, and just super weird and crazy, you know?’ But more than anything, they’re just f**king bored, because the yield farms have dried up, and they’re all super-rich. It’s 2035 or whenever, and everyone who aped in is just rich beyond their wildest dreams. What do you do then? You just hang out with a bunch of apes and get weird, you know?”

Goner and Gargamel went on to recruit two software engineers, Emperor Tomato Ketchup and No Sass, to form the core founding team of BAYC. The collection eventually launched in April 2021. And while the initial response from the NFT community was lackluster, the project gradually generated hype and quickly became one of the hottest collections in the space. Before long, it surpassed CryptoPunk as the most valuable NFT collection with several celebrities including Paris Hilton and Steph Curry. So the question is: Why did BAYC become successfuL?

The Story Behind BAYC

It all started in April 2021, when a team of creators dropped 10,000 Bored Ape NFTs on the Ethereum blockchain. Each ape is randomly generated, meaning every detail—fur, hats, glasses, and yes, even expressions—is completely unique. But here’s the kicker: buying a Bored Ape doesn’t just give you ownership of the art. Nope, it’s your key to an exclusive virtual club.

We’re talking access to invite-only Discord servers, real-world meetups, and some pretty epic events. Want to party with celebrities and crypto entrepreneurs at a private yacht party? That’s just one of the perks BAYC holders have snagged.

If you think about it, BAYC tapped into something new at that time. It wasn’t just about buying NFTs; it was about creating a status symbol that exists both digitally and in real life. And let’s be real—who doesn’t want to feel like they’re part of an elite squad?

Why It’s So Valuable

Now, the question everyone always asks: “Why are these weird ape images worth so much money?” Well, let’s break it into three main reasons:

- Exclusivity: Owning a Bored Ape makes you part of a highly selective club. With only 10,000 in existence, scarcity drives demand through the roof.

- Perks: Holder benefits go beyond the art itself. From private events to receiving free companion NFTs like Mutant Apes or Bored Ape Kennels, you’re automatically in line for more value.

- Community Power: BAYC’s community is probably one of the strongest, most tightly-knit groups in crypto. It’s like being part of an elite inner circle where everyone wins together.

And yeah, the celebrity effect? That doesn’t hurt either. Which brings us to the next point…

From Art to Brand: BAYC in Pop Culture

Let’s take it back to when Steph Curry, Shaquille O’Neal, or Paris Hilton started rocking their Bored Ape avatars on social media. Turns out, BAYC is far more than just an art collection—it’s become a brand.

These apes have appeared pretty much everywhere: partnerships with Adidas, a music label called Ape-In Productions, fashion collaborations, and even movies in the pipeline. And you know those moments when celebrities casually flex their Bored Apes on Twitter or Instagram? Yeah, that’s exactly what keeps the hype alive and feeds the brand’s massive relevance.

Here’s a fun fact: when Justin Bieber bought his ape earlier this year for over $1.3 million, some thought that’s absurd. But for him? It was a way to signal, “Hey, I’m a part of this exclusive club.”

“People don’t just buy Bored Apes for the art—they buy them for the story, the access, and the world they’re stepping into.”

The result? Bored Apes aren’t just collectibles anymore; they’re culture. They’re slowly becoming part of the fabric of Web3 innovation, proving that NFTs can be more than digital files—they can be living, breathing ecosystems.

As BAYC grows bigger, though, one question looms: where does ApeCoin come into play, and how does this token drive even more innovation in this ever-expanding world?

How Does ApeCoin Fit In?

Alright, let’s talk about ApeCoin. If you’re even slightly curious about the Bored Ape Yacht Club (BAYC) ecosystem, you’ve probably heard of it. But what is it really? Is it a trendy crypto token riding the NFT wave, or does it have substance that could transform the space? Let me break it all down for you—it’s much more than just another cryptocurrency.

What is ApeCoin?

At its core, ApeCoin ($APE) is the native token designed specifically for the BAYC ecosystem. It’s not just a random add-on; it powers multiple aspects of the community, from exclusive metaverse projects to events and experiences. Think of it as the glue holding Yuga Labs’ ambitious Web3 vision together.

Unlike your run-of-the-mill crypto, ApeCoin is deeply integrated into the BAYC universe. For example, it will play a central role in Yuga Labs’ exploration of blockchain gaming and their highly anticipated metaverse platform, Otherside. Owning ApeCoin isn’t just about buying and holding a token; it’s about participating in a growing ecosystem that combines gaming, virtual assets, and community engagement.

Fun fact—shortly after it launched, ApeCoin was distributed to BAYC and Mutant Ape Yacht Club (MAYC) NFT holders for free. This wasn’t just a random giveaway; it was a thank-you to their loyal community and a way to bootstrap a new economy.

According to data from DappRadar’s NFT report, community-driven economies like BAYC generate significantly stronger user engagement. ApeCoin pulls this same thread by rewarding loyalty and active participation, which is key in today’s crypto landscape.

Where Utility Meets Investment

Let’s talk utility because ApeCoin isn’t a pump-and-dump scheme—it does real work. It’s a governance token, meaning holders can vote on decisions within the Bored Ape DAO (decentralized autonomous organization). Stuff like how funds are allocated or what initiatives the community should back. So, if you hold ApeCoin, you hold a voice in the future direction of BAYC’s broader ecosystem. That’s pretty powerful.

Then there’s staking. Yuga Labs and its collaborators rolled out staking pools for ApeCoin holders and BAYC/MAYC NFT owners. Basically, this means that you can lock up your ApeCoins and earn extra rewards over time, while still being part of a community-driven economy. It’s not your average crypto deal—it’s a way to reinforce long-term value and show that holding APE can pay off both socially and financially.

- DAO Governance: Imagine owning a share of a billion-dollar brand and getting a say in what comes next. That’s the kind of inclusion ApeCoin offers.

- Staking Opportunities: Want your crypto to work for you? With APE, stacking rewards is built into the ecosystem.

- Pioneering New Web3 Experiences: Otherside, exclusive events, and potentially more—APE ties all these future ventures together.

Another clear utility? Payments. ApeCoin is increasingly being accepted as a means of exchange within BAYC-related collaborations. For instance, it’s often used in NFT auctions, exclusive merch sales, and even ticketing for events that only Ape holders can access.

Here’s a quick example: When the Otherside’s “First Trip” demo took off, exclusive features tied to ApeCoin highlighted just how integrated this crypto is to every aspect of Yuga Labs’ projects. This is clearly no side hustle token—this is the fabric of how the community operates.

Should You Consider Investing in ApeCoin?

Now, let’s address the elephant—or rather, the ape—in the room. Should you consider ApeCoin as an investment? While I’m not here to play financial advisor, I can give you a glimpse into why some people see this token as more than a speculative gamble.

For starters, BAYC is a proven brand. Projects connected to trusted names like Yuga Labs tend to fare better than random new tokens flooding the crypto market. ApeCoin isn’t just currency; it’s access. It buys you entry into the exclusive perks and projects that everyone wants to be part of but few can afford.

That said, keep in mind the risks. The crypto market as a whole is highly volatile, and even the most well-built ecosystems can face turbulence. Prices fluctuate, trends change, and regulation could always shake things up.

Cautionary tale? Just look at the hype around Dogecoin vs. the growth of something like Ethereum. Meme culture fades, but utility-driven projects tend to have staying power. In that regard, ApeCoin’s close ties to Yuga Labs’ ambitious roadmap tilt it more toward the Ethereum camp than the Dogecoin one. As always, do your research and only invest what you’re willing to lose.

“Don’t just chase profits. Find value, understand the mission, and know the risks. That’s how you win in this space.” — Some of the most successful web3 builders live by this principle.

So yes, there’s potential for ApeCoin to appreciate in value, especially as Yuga Labs keeps delivering on its plans. But here’s something to chew on: what if the real value isn’t in flipping it for profit, but in holding it to secure your place in the future of the metaverse? Wouldn’t that be worth considering?

Speaking of the future, have you ever wondered how a single company—Yuga Labs—could consistently raise the bar for NFTs, gaming, and Web3 culture? Let me show you what’s next…

Who is Yuga Labs, and Why Are They So Important?

You can’t talk about Bored Ape Yacht Club without talking about Yuga Labs—they’re the masterminds behind it all. But here’s the thing, they’re not just NFT creators. They’re architects of a cultural movement, reshaping what digital ownership and community mean in the 21st century. Let’s explore what makes them so important, so you can get why they’re kind of a big deal.

Founders and Their Vision

A lot of people think the rise of Yuga Labs was pure luck. Spoiler: it wasn’t. This company was founded by visionaries who saw much further than a trend—they spotted a revolution unfolding.

Yuga Labs was co-founded by Greg Solano and Wylie Aronow, better known in the community under their pseudonyms, “Garga” and “Gordon.” The fascinating thing? They didn’t even come from tech-heavy backgrounds. Their passion for storytelling, culture, and community is what laid the foundation for the BAYC phenomenon. They imagined a world where access to an exclusive group could exist virtually but feel very real—and they pulled it off.

In their own words, they “wanted to create a kind of dive bar for the internet,” a space where like-minded people gather, joke, and build. This wasn’t about selling pricey digital art; it was about creating a new kind of tribe.

Doxxing Keyboard is operated by Hacker.

Doxxing BAYC founders

Remember that we stated that the two founders of BAYC used pseudonyms in an attempt to hide their identities. The two had kept their identities a secret, which is a common practice in the decentralized finance space. Those that support this practice argue that utilizing pseudonyms is a good way of ensuring that decentralization remains a key component of crypto projects. While there is some truth to this argument, using pseudonyms also offers bad actors an easier means to carry out their dastardly acts.

Bearing in mind the sensitivity of privacy in the crypto space, it is easy to see why the revelation of the identities of BAYC’s founders attracted a lot of scrutiny from both the pro-privacy and pro-transparency camps. In February 2022, Katie Notopoulos, while stating that the enormous size of the BAYC ecosystem requires that we scrutinize the competence and reputation of those with significant influence over projects, revealed that the real identities of the two creators of BAYC are Greg Solano and Wylie Aronow :

“As NFTs continue to expand into popular culture and Web3 goes mainstream, the issue of pseudonymously run companies dealing with real money — and lots of it — is a new economic and legal reality. There are reasons why in the traditional business world, the CEO or founder of a company uses their real name and not a pseudonym. For publicly traded companies, executives must be named in Securities and Exchange Commission disclosures and reports. For even smaller private companies, there are banking regulations and “know your customer” laws that require real names for banks lending money or holding accounts for companies. These laws are in part to prevent terrorists, criminals, or sanctioned nations from doing business in the US.”

In the aftermath of this revelation, Daniel Kuhn wrote that since Notopoulos only had to dig through public records to unravel the identities of BAYC’s founders, there was no foul play. He stated:

“Solano and Aronow could have chosen to keep BAYC as a widely successful NFT experiment and their identities secure. But they signed incorporation documents because there was a fortune to be made. It was in that moment of choice that the BAYC founders doxed themselves, forfeiting their right to privacy and secrecy. Now listen ye anons, I believe – along with my employer, which has a policy of respecting sources’ pseudonyms – that your identities are valid. That there is a general right to remain unknown, that pseudonymous celebrities may be trustworthy (within reason) based solely on the reputations they build. But if you must remain unknown, then you must also do everything you can to ensure that. No one is assisting you here. Crypto is an adversarial environment. Reporters are paid to bring private details to light. Competitors want your business secrets. The public has an unquenchable thirst for gossip. Scammers want to scam you, and knowing your secrets is leverage.”

Kuhn added that for an industry that is increasingly being influenced by corporate rules, the onus falls on those looking to remain anonymous to go the extra mile to keep their identities a secret:

“To some extent, crypto is playing by a new set of rules. It stands opposed to corporate and government power in trying to give people the ability to interact directly in a peer-to-peer fashion. It’s sold out a bit – giving an inch here and there for profits. It’s surrounded by rule-makers. It’s been forced to capitulate, sometimes. Not everyone is playing by crypto’s rules. Why would you expect otherwise? If you want to be anonymous, then you must cover your tracks. Rules were meant to be broken, after all.”

Lior Lamesh, co-founder and CEO for GK8, shares a similar view during an interview with Cointelegraph. He believes that Notopoulos was merely doing her job, which is to bring the hidden to the light. He stated:

“This should not be interpreted as a cause for concern. What can be said now is that these digital arts will almost certainly not be used as a conduit for money laundering because the BAYC team will implement new data protection methods. So, in terms of a chance to do the right thing, we can’t say the Buzzfeed journalist’s move is out of place.”

In contrast to Khun’s views, Giselle Nagle, operations head for PhotoChromic, told Cointelegraph that it should be the prerogative of individuals to either reveal their identities or not:

“To distill it down, there are two main aspects to your identity — personal and public. Pseudonymous identity works best when you need to trust that the individual behind the identity is who they say they are and when sensitive information is being exchanged. However, in both cases, the individual should have full autonomy over whether or not to expose their identity.”

As for 0xngmi, the pseudonymous founder of DefiLlama, the whole essence of the blockchain movement is that users should be empowered to make their own choices whether it is to invest in a project founded by an anonymous team or not. He wrote:

“You have your money and you can use it any way you want, whether that be by putting it on straight up ponzis, buying worthless coins, or farming on some protocol with an anon founder that could rug the whole thing. It lets users make their own risk assessments and execute them, without anyone restricting their autonomy… Let’s embrace this. If people want to put money on protocols with anon founders then that’s it, there’s no need for anyone to make decisions for anyone else, just let people make their own choices. Let’s abandon the idea that users are stupid and need to be protected by someone with more knowledge, they are just mature people that are making their own decisions based on their own risk assesments.”

0xngmi added that this is their approach at DefiLlama as they do not discriminate when listing decentralized projects:

“This is our approach at defillama: we list everything. Our role is just to provide accurate data, we don’t make decisions for our users. We won’t remove any protocol because a user could discover it on defillama, instead we treat users as autonomous people that can make their own decisions and we certainly don’t believe we are better than them and should be telling them what to do.”

Funny enough, following the doxxing fracas, BAYC announced that members had to scale KYC requirements to access one of its upcoming products.

Yuga Labs’ Impact on the NFT Landscape

Yuga Labs didn’t stop when BAYC took off—they’ve been busy reshaping the entire NFT ecosystem. In just a few short years, they’ve raised the bar so high that even their competitors are basically playing catch-up.

First off, they’ve introduced NFT holders to the concept of utility-based ownership. Owning a Bored Ape isn’t just about having a cool profile picture. It’s a ticket to exclusive live events like yacht parties, NFT-driven merch sales, and even innovative digital experiences. They’ve gamified the process of ownership, turning it into something people don’t just hold—they live.

And remember when Yuga Labs acquired CryptoPunks and Meebits? That wasn’t just a flex—it solidified their status as leaders, uniting some of the NFT world’s most iconic creations under one roof. Oh, and they’re not stopping there. The upcoming metaverse project, Otherside, hints at their bigger ambitions: dominating not only NFTs but the future of virtual spaces.

Think about it—Yuga Labs doesn’t just want to create collectible NFTs; they want to shape how we interact, play, and live in entirely new digital ecosystems.

Other Projects You Might’ve Missed

Sure, the Bored Ape Yacht Club gets all the headlines, but the Yuga Labs playbook is much thicker than that. Here are some of their other creations driving waves in the space:

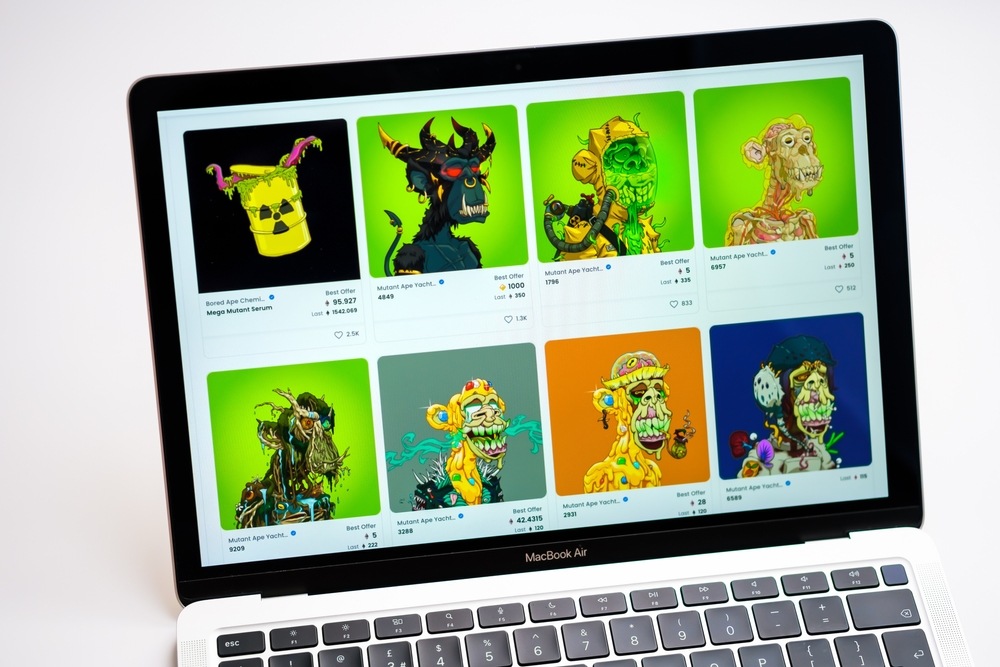

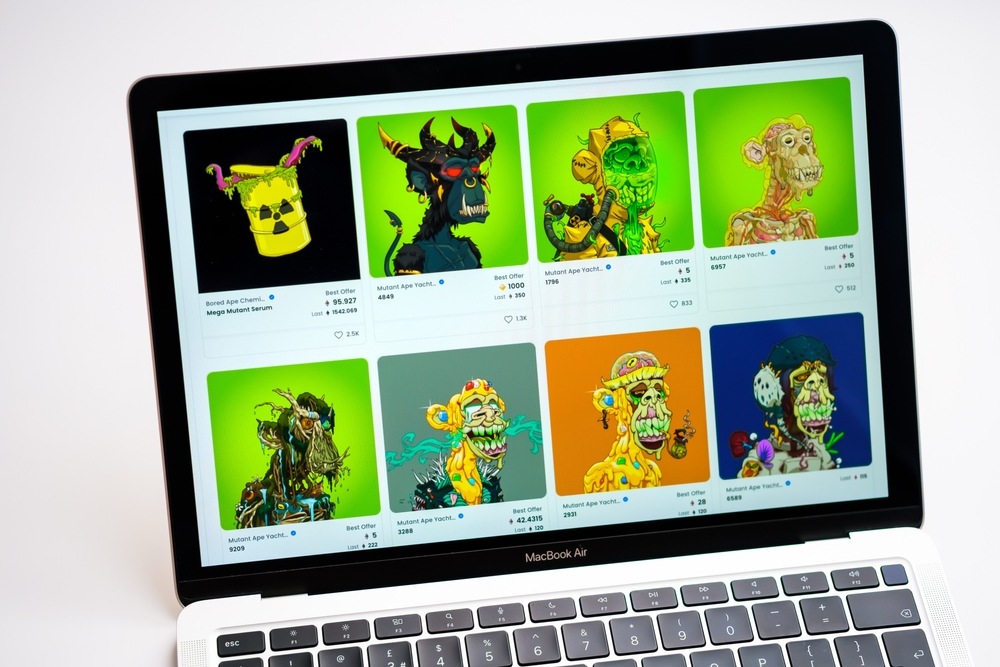

- Mutant Ape Yacht Club (MAYC): Think of this as the Bored Ape spinoff—but with a twist. These NFTs were introduced as a secondary layer of the ecosystem, fun for collectors and cheaper for new fans who couldn’t snag an OG ape. Oh, and they added an entirely “mutant” aesthetic that took things in a wildly creative direction.

- Bored Ape Kennel Club (BAKC): Because why wouldn’t your virtual ape deserve a digital pet? These dog-themed NFTs were gifted to BAYC holders, proving Yuga Labs knows how to keep their community engaged and rewarded.

- Otherside: Yuga’s upcoming metaverse project is what promises to be their biggest endeavor yet. Blurring the lines between gaming, virtual real estate, and NFTs, it’s set to rival platforms like Decentraland and The Sandbox. Those who’ve seen sneak peeks call it a game-changer.

All these moves tell one story: Yuga Labs isn’t content with just being a trendsetter in the NFT space. They’re working towards building a digital universe that blends art, tech, and culture in ways we’ve never experienced before.

“Innovation distinguishes between a leader and a follower.” – Steve Jobs

And right now, Yuga Labs is standing tall as the leader.

But here’s the part no one talks about enough—when you’re the leader in a booming space like this, controversy is going to follow you. The question is, are Bored Apes and Yuga Labs just riding the wave, or are they weathering the storm too?

Why Are Bored Ape NFTs So Controversial?

If there’s one thing about Bored Ape NFTs that sets the internet ablaze, it’s the debates. While some sing their praises as revolutionary, others accuse them of being overhyped nonsense. But hey, isn’t it true that anything bold and new always comes with its fair share of controversy? Let’s explore why Bored Ape NFTs stir the pot so much.

Are They Overhyped?

Let’s address the big elephant—or should I say, ape—in the room. Critics often argue that the Bored Ape Yacht Club is nothing more than an expensive trend, a bubble waiting to pop. After all, are these cartoon pictures really worth tens or even hundreds of thousands of dollars?

Think about it: back in 2021, the buzz around BAYC reached fever pitch as influencers and celebs jumped on board. Stars like Justin Bieber, Jimmy Fallon, and Paris Hilton proudly displayed their apes, sparking major FOMO across social media. But here’s the twist—this public attention only added fuel to claims of artificial hype. Some skeptics believe the skyrocketing prices are a bubble inflated by hype alone, disconnected from any tangible value.

And sure, it’s a fair concern. But to counter that, BAYC fans argue that the prices reflect more than the art; they represent entry into an elite community, access to exclusive perks, and ownership of a digital brand revolution. Yet the big question remains: Can that value hold as trends shift?

Environmental Impact

We’ve got to be real here—NFTs are a hot topic in the environmental conversation, and Bored Apes haven’t been immune to criticism. Initially launched on Ethereum, which operated on an energy-heavy proof-of-work (PoW) system at the time, BAYC added to concerns over blockchain’s carbon footprint.

“The Ethereum network used more electricity in a year than some entire countries,” noted a 2022 Cambridge study. That’s the kind of stat that makes people uneasy.”

Fast forward to the Ethereum Merge in 2022, which transitioned the blockchain to the far more sustainable proof-of-stake (PoS) model, dramatically cutting energy consumption by over 99%. But let’s be honest, the accusations surrounding BAYC’s past environmental impact haven’t been forgotten by critics who question whether a digital collectible is worth such a toll in the first place.

Still, BAYC enthusiasts point out that both the blockchain industry and Yuga Labs (the team behind Bored Apes) have shown a willingness to adapt for the better. But, does this shift ease the tension for those worried about sustainability?

Scams and Fakes in the NFT World

As they say, success attracts imitators—and boy, did the Bored Ape Yacht Club attract a flood of knockoffs. The more popular the apes became, the more scammy copies and fake projects sprouted overnight like weeds trying to cash in on the hype.

Fake BAYC collections have duped buyers into purchasing worthless imitations, resulting in huge financial losses. Even legitimate owners haven’t been immune to theft—some high-profile hacks have resulted in stolen NFTs worth millions. One infamous case? The phishing scam that tricked actor Seth Green, making headlines as his prized Bored Ape was nabbed by cyber criminals.

- Fakes: Fraudsters create duplicate or eerily similar ape NFTs, confusing buyers on platforms like OpenSea.

- Phishing: By impersonating marketplaces or creators, scammers steal login info and wipe out collections.

- Pump-and-dump schemes: Rogue projects prey on newcomers by hyping lookalike ape collections, then disappearing with investors’ funds.

Despite all this, Yuga Labs and the broader community have implemented measures to combat scams, such as verification badges for genuine collections. But let’s be honest—the NFT space as a whole still has some trust issues to fix.

So, here’s the million-dollar question: Do these risks make owning a Bored Ape too dangerous, or just part of the wild frontier of NFTs? And if you’re still interested in being part of this game, how do you safely snag your own ape? That’s the kind of thing we’re about to get into next…

Pink shiba inu dog wearing fez hat and shoes NFT artwork illustration

What are MAYC and BAKC?

As part of the utilities made available, Yuga Labs has prioritized BAYC holders whenever it issues new NFT collections. More specifically, it usually distributes new NFTs to holders for free. In other words, part of the privileges of being a member of BAYC is that you get to receive free NFTs as in the case of the Bored Ape Kennel Club. Following the successful stint of BAYC, the creators decided to airdrop another collection of NFTs, called Bored Ape Kennel Club.

This time around, the NFTs were not sold to interested buyers. Instead, each BAYC holder received a free Kennel-themed NFT. As such, the BAKC collection consists of 10,000 NFTs just like the BAYC collection. At the time of writing, the floor price of BAKC is around $30,000. According to Gargamel, this move, in addition to the community’s charity works, was unprecedented and it did cement BAYC’s place at the top of the NFT market:

“One of the most innovative things we did was dropping our Bored Ape Kennel Club. We were exhausted, and we were thinking, ‘What if we just gave every Ape a dog?’ Everybody was aping into dogecoins. And crypto is so much about trust, so how do we signal that we want to stick around, we want to build utility here, and we want to think about the long term? What’s the best way to do that? So we thought, ‘Hey, what if we gave every single person an NFT for free, and gave all the royalties [off sales from exchanges like OpenSea] to charity?. We ended up donating around $900,000 to different animal charities for that.”

As a follow-up to the BAKC airdrop, Yuga Labs went a step further to launch another collection centered on the mutated variations of existing Bored Ape NFTs. To achieve this, Yuga Labs airdropped mutant serums with which BAYC holders can mint zombified versions of the Bored Ape NFTs in their possession. This collection was aptly named Mutant Ape Yacht Club (MAYC).

Note that the extent of the mutations depends on the tier of serums used by the BAYC holder. In total, there are 3 tiers named M1, M2, and M3. M1 and M2 serums usually yielded Mutant Apes that share some physical traits with the original Bored Apes NFTs. in contrast, the M3 serum effectively creates NFTs with very unique traits, which is why Mutant Apes mutated with M3 serums tend to cost more on the open market.

While speaking on the grotesque appearance of Mutant Apes and how surprisingly successful it has been, Will Gottsegen highlighted that, regardless of the factors propelling BAYC, its lack of artistic excellence may truncate its dominance:

“For now, this is what NFTs are, culturally. Mainstream consumers with a peripheral knowledge of NFTs aren’t thinking about Folia’s generative art experiments, or Hic et Nunc’s relatively diverse digital art collection, or even Meebits, the 3D NFT project from the creators of CryptoPunks that riffs on digital minimalism. Bored Apes, with their overwhelming aesthetic sameness and their all-important community aspect, are the blueprint, as they have been for the better part of this year. Of course, there are plenty of reasons to doubt whether BAYC will remain on top. The crypto market tends to move in cycles; if everything suddenly crashes, new NFT paradigms may emerge. There’s also the fact that Bored Ape-style NFTs are almost universally unappealing to look at (Lazy Lions, especially – Cool Cats get a pass, I think they’re kind of sweet). A Bored Ape spin-off collection called Mutant Ape Yacht Club takes those uncanny visuals to a grotesque extreme. It’s as if they’re daring you to mock them, to question how anyone could spend so much on these images. That the BAYC template has created real cultural impact beyond crypto is why it remains immensely successful, and it will always have a place in the canon for that reason. But there’s no reason it needs to continue to dominate to the exclusion of everything else.”

Daniel Roberts, the editor-in-chief of Decrypt also reiterated Gottsegen’s thought in an opinion piece where he noted that the explosion of “cartoon” NFTs, particularly BAYC, has diluted the potency of the NFT movement. He wrote:

“But I also blame Bored Apes for most of the NFT vitriol out there, and I don’t fault people who point to Bored Apes and conclude that NFTs are stupid. Those people aren’t reading about Art Blocks and the rise of generative art, or Axies and how they function as game pieces in a thriving digital world, or essays sold as NFTs through Mirror, or songs as NFTs via Royal. They see a cartoon ape with its tongue out that is supposedly worth $1 million, and they roll their eyes. When I watch that animated video of Bored Apes in space, I cringe just a little. There is no doubt that Bored Apes have become the poster child for NFTs. Is that good for the space?”

The rise of an NFT dynasty

Just as experts began to doubt the sustainability of BAYC, Yuga Labs reaffirmed its growing influence in the NFT space by buying the competitors. In what seems like a calculated move to dominate the NFT market, Yuga Labs, on March 11, 2022, acquired CryptoPunks and Meebits from Larva Labs. Note that CryptoPunks was BAYC’s major competitor. Hence, it is easy to see why Yuga Labs pursued this deal. With this acquisition, the company now owns the IP rights and copyrights to 1,711 Meetbits and 423 CryptoPunks.

Unsurprisingly, Yuga Labs has opted to replicate its BAYC working template for its two newly acquired collections. More specifically, holders of any of the CryptoPunk and Meebits NFTs that Yuga Labs controls now have commercial rights over their holdings.

While this is a given, experts have begun to raise concerns over the impact of Yuga Labs’ decision to acquire two of the most prominent collections in the NFT space. As argued in an article published on Coindesk and titled “The First NFT Monopoly,” Yuga Labs’ future decisions would have more impact on not just the value of BAYC, CryptoPunks, and Meebits but also the NFT market at large. The author, Will Gottsegen, explains:

“…Yuga Labs plans to add “utility” to the collection. ‘Utility’ is an increasingly nebulous buzzword in the NFT sector, and tends to refer to perks for investors down the line. If your NFT unlocks access to a private Discord channel, or to a pre-approved green list for another NFT mint, or a special 3D item on a metaverse platform – broadly speaking, that’s ‘utility.’ (Utility also has the potential to bring certain tokens under scrutiny from the SEC, since it can make NFTs look a lot like investment contracts.) What this means in practice is that the value of CryptoPunks will likely be closely tied to the value of Yuga Labs. Larva Labs isn’t exactly a mom-and-pop business, but its stubborn refusal to pump the value of its tokens in this specific way put it somewhat at odds with the ‘number go up’ ethos of the broader crypto community. (This isn’t to say its intentions were always totally pure – a controversy around a CryptoPunks subcollection known as ‘V1 Punks’ suggests the Larva Labs team hasn’t always handled community outreach in the best way.)”

Gottsegen went further to highlight the role of Andreessen Horowitz, the venture capital firm, in all of this, knowing fully well that the company has investment ties with all of the juggernauts of the NFT market, including Yuga Labs and OpenSea. He wrote:

“Where Bored Apes go, the rest of the NFT market goes. Now, whether they like it or not, CryptoPunk holders are joined at the hip with their Bored Ape counterparts. Such is the Matroyshka doll-like structure of the NFT market. Andreessen Horowitz has a stake in many of the valuable companies in crypto; OpenSea, an Andreessen Horowitz investment, controls most of the volume in the NFT market; and Yuga Labs, also reportedly an Andreessen Horowitz investment, now controls some of the market’s most valuable intellectual property. There’s no antitrust legislation in crypto – but maybe that’s the point.”

Armed with an array of prestigious NFT collections, Yuga Labs has announced plans to introduce its very own metaverse featuring BAYC, MAYC, Cryptopunks, Meebits, Cool Cats, CryptoToadz, and World of Women. Called Otherside, this metaverse would incorporate an interoperable landscape where all of the above-mentioned NFTs can coexist.

What are ApeCoin and ApeCoin DAO?

In March 2022, Yuga Labs launched ApeCoin, an ERC20 token designed to create more utilities for BAYC members. More importantly, ApeCoin functions as the governance token as holders can participate in the decision-making process of the BAYC ecosystem. Like most decentralized applications, the BAYC relies on ApeCoin to ensure that members can reach a consensus about policy changes and system upgrades.

Also, Yuga Labs announced that it would adopt ApeCoin as the utility token for all the services and products it launches henceforth, including Otherside. Yat Siu, the co-founder of Animoca, the company Yuga Labs is partnering with to build Otherside, noted that ApeCoin encapsulates BAYC’s culture, technology, and creativity. He stated:

“ApeCoin a token that represents the zeitgeist of NFTs today. It is, in a sense, the expression of the current culture of NFTs… ApeCoin itself has some starting utility, which will kick off with games and more to come. The benefits will be the creative energy that combines this mix of technology and culture that the BAYC community has kicked off already which will reach much larger audiences due to the fungible and transferable nature of ApeCoin.”

That said, Yuga Labs has gone the extra mile to ensure that it evades the regulatory implications of issuing an asset that may indeed prove to be unregistered securities. And so, the company has set up a convoluted system for the management and issuance of ApeCoin.

Going by the information made available, the issuance of ApeCoin was undertaken by ApeCoin DAO, which consists of council members namely, Reddit co-founder Alexis Ohanian; Amy Wu, head of crypto exchange FTX’s venture arm; Maaria Bajwa of Sound Ventures; Animoca Brands’ Yat Siu; and Dean Steinbeck of Horizen Labs. They will be responsible for enacting the decisions of the BAYC community.

Notably, these individuals will also double as the committee members of the Ape Foundation, an entity created for the sole purpose of managing daily operations. That said, Yuga Labs and the founders of BAYC control a sizable share of ApeCoin’s total supply. Specifically, Yuga Labs has received 160 million APE with 10 million APE going to charity. Apart from this, 10 million APE has been allocated to BAYC founders and another 140 million APE went to launch contributors, which is believed to include Yuga Labs’ partners and investors.

How to Get Your Own Bored Ape NFT

So, you’ve seen the hype—celebrities flaunting their Bored Apes, people talking about “exclusive memberships,” and massive price tags. Now, you’re curious. How do you actually get one of these coveted Ape NFTs for yourself? Whether you’re ready to take the leap or just exploring, let’s break this down step by step.

Where to Buy Bored Ape NFTs

First things first: You’ll need to know where to go. The most popular platform for buying Bored Ape NFTs is OpenSea, the largest NFT marketplace in the world. It’s where most transactions involving BAYC take place. Another growing option for NFTs is Coinbase NFT Marketplace, which integrates crypto trading and NFTs for a seamless user experience.

Here’s why OpenSea is the go-to for most buyers:

- It’s easy to use, even for first-timers.

- It has verified collections to help you avoid scams. Look out for the blue checkmark that ensures you’re buying an authentic BAYC NFT.

- It allows bidding, meaning you might score an Ape slightly below market price if you’re lucky and patient.

If you’re exploring other marketplaces, just make sure to stick with reputable ones. In the NFT world, where there’s cash, there are scammers waiting to take advantage.

What You Need to Get Started

Think of this as your pregame checklist. Don’t jump into BAYC without the right tools in place:

- Get a crypto wallet: Most Bored Ape NFTs are bought using Ethereum (ETH), so you’ll need a wallet that supports it. Popular choices include MetaMask or Coinbase Wallet.

- Buy Ethereum: You’ll need ETH to make a purchase. You can grab it on platforms like Coinbase, Binance, or Kraken, and then send it to your wallet.

- Connect to the NFT marketplace: Once your wallet is set up, link it to OpenSea or the marketplace of your choice. It’s just a couple of clicks, and you’re good to go.

- Do your homework: Check the Bored Ape’s history! OpenSea provides a tool to track the NFT’s transaction history and details like rarity. Rare traits can significantly drive up the value.

And one more thing: always beware of phishing links or fake collections! A general rule? Bookmark official sites and triple-check URLs before you make a move.

How Much Will It Cost You?

Alright, here’s the part that might make you gulp—what does it really cost to own a Bored Ape? Well, as of now, the floor price (the cheapest Ape available) is thousands of dollars, often ranging upwards of six figures. The exclusivity comes at a price, with average sales occasionally exceeding $100,000 during BAYC’s peaks.

Why do people spend these jaw-dropping amounts? It’s not just the artwork—it’s a ticket to an elite club. Think exclusive parties, early access to other NFTs, brand collaborations, and even actual yacht events. Owning a Bored Ape also unlocks additional opportunities, like staking ApeCoin, accessing the Otherside metaverse, or being part of a DAO (Decentralized Autonomous Organization) that steers the community.

“The value goes beyond the JPEG—it’s about being part of a global, connected community that’s shaping the future of NFTs and Web3.”

Still, you need to budget carefully. The NFT market is volatile, and prices fluctuate rapidly. If you’re not ready to drop big money, monitoring secondary sales or new listings for potential price dips might be your best bet.

One question remains though: Is buying just the beginning of a bigger opportunity? Curious about what you can actually do with a Bored Ape after you own one? Let’s explore that next…

What the Future Holds for BAYC, Yuga Labs, and ApeCoin

Let’s talk about the future. The NFT world is still young, and projects like Bored Ape Yacht Club (BAYC), ApeCoin, and Yuga Labs are sitting at the forefront of what’s coming next. But where do we think everything is headed from here? The last few years were just the start—now it’s about what comes next, and trust me, it’s going to be fascinating.

The Blockchain Gaming Revolution

Yuga Labs is planting their flag in the gaming world, and they’re dead serious about it. Blockchain gaming could be the biggest disruptor for the traditional video game industry, blending player ownership with top-tier experiences. The initiative isn’t just an experiment—it’s a shift in how games might be structured in the future.

If you’ve been keeping an eye on projects like Otherside, Yuga Labs’ metaverse play, you already know they’re not here to build just another virtual world. They’re working on something bigger: a place where gaming, trading, and even community-building live under one roof—and ApeCoin is the key currency for it all.

Imagine this: owning in-game items as NFTs, trading them seamlessly, and actually having the ability to own a piece of the gaming ecosystem. This isn’t far-off science fiction—it’s likely coming sooner than you think, and BAYC members are poised to be at the heart of it. Could this redefine the entire gaming industry? Maybe.

Expanding the Metaverse Vision

“The metaverse is going to be bigger than the internet itself.” That’s a quote from billionaire investor Mark Cuban, and, like him or not, it’s hard to shake the weight of that statement. Yuga Labs’ work with Otherside is aiming to bring that kind of reality to life. Their vision revolves around blending entertainment, ownership, and collaboration to create an online environment where people aren’t just users but participants and creators.

So, what makes this different from every other metaverse project out there? Yuga Labs already has a loyal base through BAYC, and they’re using ApeCoin to tie together transactions, rewards, and governance into a cohesive system. Metaverses are a lot bigger than avatars—they’re evolving into online worlds where digital ownership matters more than ever.

Still skeptical? Consider that companies like Adidas and even world-famous musicians like Snoop Dogg are already participating in Yuga Labs’ projects. This isn’t just conceptual—it’s happening right now.

Will BAYC Keep Its Value?

This is the question that lingers in every potential buyer’s mind. Will those animated apes hold their value as the NFT market grows and evolves? The truth is, nobody knows for sure. That’s the nature of both art and investment—it’s speculative by design.

There’s one thing, however, that’s for certain: Yuga Labs isn’t slowing down. They’ve built an ecosystem where value is tied not just to the art itself but to the perks, the innovation, and the sense of exclusivity. If they keep leading the metaverse and gaming charge, demand could remain strong over time.

On the flip side, challenges will come—competitors, changing trends, and regulatory shifts could all play a role in shaping their future. But here’s something to ponder: Historically, first-movers in any space—think Bitcoin in crypto—tend to hold special value. Could BAYC be one of those cases?

So, are you wondering how to start exploring this world further? You’ll want resources to guide you through this maze of opportunities. What’s the best way to stay ahead in the NFT and ApeCoin space? Let’s find out in the next section.

Resources to Help You Learn More About BAYC, Yuga Labs, and ApeCoin

If you’re curious to explore this fascinating world further, I’ve got you covered. Below, you’ll find some key tools and platforms to expand your knowledge, uncover opportunities, and stay ahead in the game. Whether you’re looking to buy your first Bored Ape NFT or just trying to understand what the hype is all about, these resources will set you on the right path.

Explore NFT Marketplaces

NFT marketplaces are where the magic happens. These platforms let you see live listings, price trends, community engagement, and even the best rare finds. Here are some heavy-hitters you may want to check out:

- OpenSea: OpenSea is the most popular NFT marketplace. It’s like the Amazon for digital collectibles. You can easily browse, make offers, and even see historical data about Bored Apes specifically. Don’t forget to double-check listings to avoid purchasing any fakes!

- Rarible: Rarible shines if you’re looking for a platform with more community governance features. While BAYC primarily circulates on OpenSea, Rarible has unique features for collectors looking to explore other NFT opportunities, too.

- Coinbase NFT Marketplace: Coinbase isn’t just for cryptocurrencies anymore. Their dedicated NFT platform is beginner-friendly, making it a good option for those new to the scene.

All of these marketplaces are easy to navigate, but remember to keep your wallet secure when making transactions! NFTs can be fun, but safety should always come first.

Yuga Labs Official Website

Why rely on just speculation or random Reddit posts when you can hear it straight from the source? The Yuga Labs official website is a treasure trove of information. Here, you’ll find updates about upcoming NFT launches, ApeCoin projects, and their ambitious “Otherside” metaverse vision. It’s the place to stay in the loop for all things Bored Ape-related.

For example, did you know about the exclusive in-person events and partnerships hinted at on their roadmap? The insights here can give you an edge whether you’re investing or just learning.

Educational Blogs and YouTube Channels

The NFT world moves fast, and staying informed is half the battle. Thankfully, there are tons of creators and bloggers who break down these complex ideas into easy-to-understand content. When it comes to BAYC, ApeCoin, or even Yuga Labs, here are some of my favorite kinds of resources to look out for:

- YouTube Tutorials: Channels like The Defiant or Bankless often publish engaging, easy-to-watch videos that summarize NFT trends and projects like BAYC. Plus, watching someone explain these topics always feels a little more dynamic.

- Crypto Blogs: Sites like Coindesk or Cryptonews cover NFT-related stories. You can also pop into niche blogs that post detailed breakdowns of cryptocurrency-backed ecosystems like ApeCoin.

- Podcasts for Deeper Dives: If you love multitasking, try podcasts like Modern Finance by Kevin Rose or Unchained. They often bring in NFT and web3 experts who discuss projects like BAYC and Yuga Labs from multiple perspectives.

Building a good habit of browsing these resources weekly can keep you updated and help you better understand not only BAYC but the broader NFT market.

Why These Resources Matter

Whether you’re a casual observer, planning to be a first-time buyer, or someone looking to invest strategically, these tools are invaluable. Think of them as the ultimate insider tips to navigate the NFT world without getting overwhelmed or falling for common traps. After all, doing your research can mean the difference between joining the future or missing out.

Are you wondering how to make the leap from learning to action? Stay tuned—we’re about to explore what being part of the Ape Club really means, as well as what risks and rewards you should weigh carefully before making any moves.

Wrapping It Up: Is Joining the Ape Club Worth It?

Alright, so we’ve covered a lot so far—Bored Ape Yacht Club (BAYC), ApeCoin, Yuga Labs, and how they all connect to what seems like the wildest NFT ecosystem out there. But now comes the big question: Is this all worth your time, attention… and money?

Pros and Cons Recap

Let’s keep it real. Joining BAYC isn’t an easy decision, and it definitely comes with its set of pros and cons. Here’s a quick reminder:

- Pros: You’re not just buying an image; it’s access to exclusive events, collaborations, and potentially powerful networking opportunities. Plus, ApeCoin adds another layer of utility, making the ecosystem richer for those who really want to engage.

- Cons: This is not an entry-level hobby. The buy-in cost for a BAYC NFT is insane for most people, and the long-term value isn’t guaranteed. Also, the space still has risks like scams or market downturns.

If you’re someone who loves being at the frontier of tech, art, or blockchain culture—and you’ve got the funds to back it up—this might be your thing. But those expecting guaranteed financial returns might want to tread carefully.

My Personal Take

I’ll be honest. I find what Yuga Labs has built to be nothing short of amazing. It’s not perfect, but they’ve redefined what digital art and blockchain can mean for community, culture, and even the way we spend our time online. I’m fascinated by how they’ve managed to turn static images into living, breathing ecosystems.

That said, it’s important to understand that projects like BAYC are not for everyone. This space moves fast, and just as prices can skyrocket, they can also crash hard. If you’re getting into this because it truly excites you—because you love what NFTs stand for and want to explore this evolving space—it could be worth the risk. But if you’re only here hoping for a quick money flip, you might end up disappointed.

Here’s a good principle to keep in mind: spend time learning the space before dropping a ton of money. Start small, get comfortable, and stay informed. Too many people skip the research phase and get burned.

Ready to Take Your First Step?

So, where does all this leave you? If you’re sold on the idea of owning a Bored Ape and stepping into what is arguably one of the most talked-about NFT communities in the world, your first step is getting prepped for a big investment. Make sure you understand how to buy safely, set up an Ethereum wallet, and stay clear from scams.

If owning a BAYC NFT isn’t in the cards for you right now, there are still ways to stay involved. Keep an eye on ApeCoin—it’s accessible for smaller investments—and track the developments in Yuga Labs’ broader ecosystem like Otherside. You don’t have to spend six figures to learn and stay ahead of the game.

Ultimately, the choice is yours. Whether you join the Ape Club or simply follow along out of curiosity, this space is a glimpse into the future. And one thing’s for sure—the digital world isn’t slowing down anytime soon. Stay curious and keep exploring. Who knows what’s next?