ICO Drops Review

ICO Drops

icodrops.com

ICO Drops Review Guide: Is ICO Drops Really Worth Your Attention?

Have ICOs lost their golden touch, or could they still be the golden ticket you've been looking for?

If you're like most crypto enthusiasts, you've heard stories of those early ICO investors making enormous returns practically overnight. Initial Coin Offerings—or ICOs—used to be the hottest trend in crypto investing. In 2017 alone, investors poured over $6 billion dollars into ICOs, searching for massive profits in an instant.

But we all know the story didn't stay rosy for long. In reality, investing in an ICO soon became risky business, with scam projects, broken promises, and misinformation spreading faster than Dogecoin tweets. Has the ICO excitement completely faded away? And most importantly, is there still a reliable way to make smart choices with ICO investing today?

Problems Investors Face With ICOs

Let's just be honest: ICOs grew messy, confusing, and risky. As a crypto fan myself, I've noticed that beginners frequently face critical problems when deciding if and how to invest in ICOs. Here are the two major issues I've continuously seen crypto newbies struggle with:

Identifying Scam ICO Projects

This one is a real killer. ICO scams have robbed people of billions of dollars over the years, often leaving investors feeling betrayed, confused, and skeptical. How can anyone spot a genuine ICO from all those candied-coated crypto fakes? Many investors simply didn't know what to look for, and in a space crowded with sophisticated scammers, making the right choice became nearly impossible.

Lack of Structured Information

Even when a project wasn't a scam, learning the basic facts about an ICO frequently became frustrating. Imagine trying to find reliable, simple, and clearly categorized information from an ocean full of crypto hype and marketing buzzwords. With thousands of ICOs popping up everywhere, investors like myself found ourselves lost in unclear explanations, vague roadmaps, confusing token economics, and suspect whitepapers cluttered with big promises.

Wouldn't it be amazing to have all this clutter neatly sorted out for you in one easy, trustworthy place?

Promise Solution: ICO Drops Reviewed Honestly

This is precisely why I'm talking about ICO Drops. I've put countless crypto review platforms to the test over the past few years, and ICO Drops repeatedly shows up as a go-to resource for qualified crypto ICO intel.

Excited yet? Do you want to know if ICO Drops really deserves the hype it's gotten in investor circles, and if it solves typical ICO investing headaches effectively?

If you're ready to clear up the ICO confusion once and for all, stick with me. I'm going to look closely at ICO Drops—how it really works, who it's made for, and if it does a good enough job as the tool it claims to be. Curious now?

Let's jump right in:

What Exactly is ICO Drops?

I remember the hype wave in 2017-2018 when everyone rushed towards ICOs, hoping for quick and massive returns. But we all soon realized—not every ICO is what it claims to be.

This is precisely when platforms like ICO Drops stepped up to help investors stay safe and informed. But how exactly does ICO Drops work, and what makes it so popular in the crypto community?

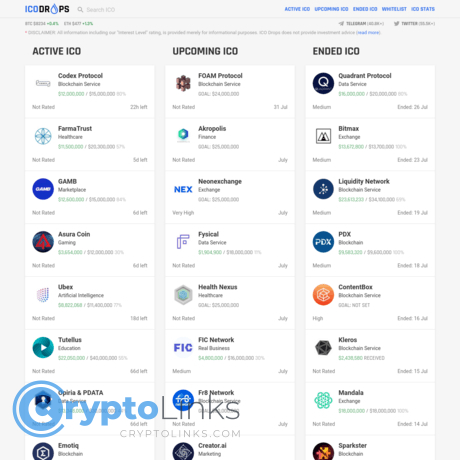

A One-Stop ICO Database

Think of ICO Drops as your friendly library of ICO projects. It neatly curates everything into an easy-to-follow catalog, split clearly into three convenient categories:

- Active ICOs – These are projects currently open for investments. You can quickly scan through and find ones you might catch early.

- Upcoming ICOs – Stay ahead of the wave. You’ll see ICO launches planned for the future, allowing you time to do your research comfortably.

- Completed ICOs – Review past ICOs and track their performance so you can grasp trends, see past mistakes, or perhaps learn from success stories.

By curating these categories in one intuitively laid-out space, ICO Drops provides something crucial now—certainty in the crowded crypto world.

After all, a famous quote by Warren Buffett says it best—

"Risk comes from not knowing what you are doing."

And ICO Drops helps eliminate precisely that risk.

Ease of Use and User-Friendliness

One big reason crypto enthusiasts love ICO Drops is its user-friendly layout. You don't need to spend endless hours figuring out how to navigate the site; it's logical, uncluttered, and refreshingly simple.

Want details on an ICO?

Simply click, and there you have it—all information clearly presented:

- Team Members: Easily spot who’s behind the ICO project, their credentials, and past experiences.

- Token Information: Quickly view important details like token prices, supply, token type (ERC20, BEP20, etc.), investment minimums, and ICO launch dates.

- Project Roadmaps: Clearly see each stage of progress. Know exactly what to expect next from each ICO.

A recent psychological study showed people prefer platforms with visual simplicity and clear navigation, which ICO Drops masters so well—reducing that dreaded frustration we feel looking for straightforward ICO facts and figures.

But is curation and ease-of-use alone enough to trust ICO Drops with your investment decisions? Or are there some lesser-known features that truly set ICO Drops apart from other ICO listing sites?

Let's explore the main ICO Drops features in detail—are they really worth your trust and time?

ICO Drops Main Features and Benefits

When it comes to ICO investing, I know firsthand how important it is to have the right tools at your fingertips to make life easier. ICO Drops claims to simplify your crypto journey—but does it deliver on this promise? Let me walk you through some key features that users seem to really appreciate.

Calendar of ICOs and Token Sales

Ever missed out on a great investment just because you're swamped with everyday tasks? Yeah, I've been there too.

This is where ICO Drops' calendar shines. Organized clearly and updated regularly, it lists upcoming token sales along with crucial dates, funding goals, token pricing, and even social media links.

- Simplicity: You can instantly grasp major ICO events without information overload.

- Plan Ahead: It lets investors plan their capital and avoid missing promising ICOs.

- Spot Opportunities: Catch projects early for better rates and avoid panic-buying at the last second.

"Organization isn't just about perfection; it's about efficiency, reducing stress and clutter, saving time and money, and improving your overall quality of life." - Christina Scalise

Trust me, organized investing beats chasing missed opportunities every time.

ICO Ratings and Reviews—But are They Reliable?

When assessing ICO Drops, I'm always cautious of ratings provided by platforms themselves. So how trustworthy are ICO Drops' ratings and reviews?

- Transparent Criteria: ICO drops labels projects clearly (Hype, Risk, ROI potential), which helps you understand not just "good" or "bad," but what exactly makes a project promising or risky.

- User-Friendly Ratings: Easy-to-follow indicators rather than lengthy technical reports, ideal if you're short on time or prefer clear, simple indicators.

But here's a bit of caution: always supplement their ratings with external research. ICO Drops' simplicity is attractive, but simplicity alone can't tell you everything. Remember that no rating system is error-free—trust, but verify.

ICO Drops Telegram Channel and Social Presence

The last thing any crypto enthusiast wants is outdated information. ICO Drops addresses this issue with its active Telegram channel and social media presence, building trust and real-time communication with their community.

- Real-time Updates: Telegram notifications ensure you never miss critical updates or changes about ICOs or token sales.

- Engagement and Trust: Consistent communication fosters confidence and transparency. ICO Drops doesn't shy away from direct conversations or immediate feedback.

- Community Insights: Direct interaction and community discussions help gauge real sentiment around specific ICO projects, providing more genuine social proof.

And that's precisely what makes a good crypto platform exceptional—the human factor, the real-time dialogue between engaged communities and trustworthy experts.

But here's the burning question: How exactly can you leverage these features in your crypto investment strategy? Stay with me—I'll walk you through the exact process and share strategies I've picked up along the way next, helping you get the most out of ICO Drops in your investment decisions.

How to Benefit from ICO Drops Effectively

I've tested numerous ICO tracking platforms, but ICO Drops has continuously proven valuable for spotting genuine investment potential. Let me show you exactly how I've harnessed this platform to elevate my ICO investing success and how you can do the same.

Researching Promising ICOs

Not every ICO will turn into cryptocurrency gold—the simple truth is that many will fall flat or worse, fade into obscurity. But how can you tell the potential game changers from the duds right away? ICO Drops can be your hidden gem when navigating this tricky terrain.

Start your research journey by closely examining their ICO listings and pay close attention to projects marked as "High Interest." It has worked wonders for me when trying to spot projects that crypto communities are already buzzing about. Additionally, I always recommend verifying key project details ICO Drops provides, like clear information about the token sale, total supply, pricing, the quality of the team behind it, and the project's real-world usefulness.

- Team Check: Validate if the founders or advisors on the ICO Drops listing have successful crypto or financial ventures behind them. Trustworthy faces significantly lower risks.

- Project Roadmap: ICO Drops offers quick and easy access to ICO roadmaps; always ensure they are realistically planned without vague or overly ambitious claims.

- Community Interest: Social-proof matters. Projects actively discussed on ICO Drops' Telegram and Twitter are usually safer choices, as transparent, socially-engaged projects have less likelihood to turn into scams.

"Do your homework carefully before investing. Not all ICOs are created equal, and quality matters more than quantity in your ICO investment strategy," notes cryptocurrency investment analyst Tom Lee.

Numbers confirm his point: According to a recent ICO market study conducted by GreySpark Partners, ICO projects with significant community engagement and detailed roadmap transparency achieved better results and higher chances of long-term success compared to poorly communicated ones.

Tracking ICO Performance and Success Rates

ICO Drops is more than just discovering promising investments; it's an incredible library of past token sale performances and market data. Understanding history can give you more profound insights into the future.

Here's a straightforward, no-nonsense way I personally use historical ICO performance information on ICO Drops:

- Identify Market Trends: By studying ICOs historically listed on ICO Drops that performed well during specific periods, I uncover shifting investor preferences and profitable market trends. For instance, platform coins and infrastructure-related ICOs historically fared significantly better than niche-project tokens tagged with unclear use-cases.

- Compare Similar Projects: Want a ticket to more successful ICO investments? Match upcoming project details with similar past ICOs listed on ICO Drops. Have similar ideas succeeded repeatedly, or are they consistently flopping? Investors who study patterns avoid repeating expensive mistakes.

- Evaluate Investor Sentiment: Paying close attention to investor attitudes and discussions surrounding past ICO listings on ICO Drops categorically helped me avoid hyped-up investments that later tanked, saving substantial sums I could invest better elsewhere.

In my experience, ICO Drops is a weapon you want in your cryptocurrency investing toolkit, not simply to chase down exciting ICOs, but to build a stronger, smarter, and more profitable investment strategy.

However, before jumping into your ICO adventure, you might wonder if ICO investing is still genuinely profitable today, or perhaps you're wondering if it's too risky in 2025? Keep reading because I'm about to answer your most burning questions next…

Common Questions People Ask About ICOs, Answered

When it comes to ICO investing, I often see newcomers asking similar key questions. ICOs can seem exciting—and intimidating too. There's always curiosity mixed with uncertainty, so let's clear up those burning questions you're probably itching to ask.

Can You Make Money From ICOs?

Short answer: Yes, definitely—but only if you know what you're doing. ICO investing isn't like tossing a coin and hoping for the best (no pun intended). Sure, some investors backed projects like Ethereum's ICO in 2014, when ETH tokens were around $0.30 each, eventually reaping huge returns as Ethereum surged in value. But let's face it; such mega-success stories don’t happen every day.

A study from Investopedia shows us that even today there are promising ICO opportunities, but success relies heavily on thorough research, perfect timing, and the project's real-world value. Remember, while some investors have built fortunes investing in legit ICO projects, others lost money betting on scams or badly managed startups. So, be smart—do your homework, always.

What Is an ICO and How Does It Work?

In the simplest words, ICO—initial coin offering—is like crowdfunding, but using crypto tokens instead of equity or rewards. Typically, startups or blockchain projects issue a brand-new digital coin to investors who buy them with cryptocurrencies like Bitcoin or Ethereum. ICO tokens usually grant holders special benefits such as project governance, early product access, or future utility within the project ecosystem. Think of it like buying shares in an idea before it's even built.

If you'd like to dig deeper, SGR Law has a straightforward guide explaining ICO fundamentals clearly and simply.

Should I Invest in ICOs in 2025?

This question right here is probably buzzing inside your head—and you're hardly alone. Honestly, ICOs have their ups and downs, and the decision really depends on your personal risk tolerance, investment goals, and how deep you're willing to research.

According to recent insights from Coinbase and blockchain experts from SoluLab, ICO investing remains relevant even in 2025, yet with more caution and regulation than ever before. The ICO market has matured, becoming safer than it was five years ago, but risks still exist.

- Pros: Potentially high returns, getting in early on innovation, accessibility to global investment opportunities

- Cons: High volatility, regulatory uncertainty, potential for project failures and scams

"Never invest in any idea you can't illustrate with a crayon." - Peter Lynch

Bottom line? Approach ICO investing in 2025 with eyes wide open, careful due diligence, and always stay alert to new trends and developments.

Still curious about whether ICO Drops is the right tool to help spot ICO opportunities?

Coming up next, I'll openly reveal the notable pros and cons about ICO Drops, giving YOU a balanced picture—without any sugar-coating. Ready to find out?

Pros and Cons of ICO Drops Platform

Like any tool I've explored in crypto, ICO Drops isn't perfect. Let's have an honest look at what I've seen as key strengths and weaknesses you've got to know about.

Advantages of using ICO Drops

- Simplicity and Ease of Use: ICO Drops is refreshingly easy to navigate. Even for crypto newbies, there's no struggle figuring out where stuff is. It's intuitive and clean, a genuine relief from the cluttered crypto websites that flood the internet.

- Cleverly Curated ICO Listings: The platform keeps tabs on upcoming, ongoing, and past ICOs in a neat, orderly fashion. For example, if you were hunting down details on a promising token sale like Arbitrum or a new DeFi ICO, ICO Drops has always given me adequate and precise summaries.

- Regular Updates and Alerts: They don't just list ICOs and leave them there. ICO Drops's community channels keep providing timely alerts, quick info updates, and relevant ICO news. You won't miss an opportunity or important change often.

"The quickest way to double your money is to fold it over and put it back in your pocket." - Will Rogers

ICO Drops helps ensure your money doesn't disappear into questionable ICOs by keeping you updated. - Completely Free Access: Seriously, no hidden fees or premium gates. The entire ICO database, calendars, reviews, and evaluations are free to browse anytime.

- Community-Focused: They have a pretty active Telegram community—great if you're the type of investor who likes interacting or keeping an ear tuned to market sentiment.

Downsides and Limitations

- Not Always Fully Detailed: ICO Drops provides summaries and quick evaluations, but if you're into in-depth fundamental analysis, sometimes I feel it's not comprehensive enough. Sure, you get general ideas, but deeper details such as detailed financial breakdowns or developer insights might be missing.

- Possible Bias Towards Hot Projects: I've occasionally noticed that ICO Drops might prioritize highly hyped or trendy projects. Be cautious and double-check other sources—popularity isn't always reliability, and trendy doesn't always equal trustworthy!

Now that we've mapped out ICO Drops' strengths and weaknesses clearly, you might be asking yourself—is ICO Drops truly your best bet, or is another ICO platform perhaps a better fit for your investing style?

Want to find out how ICO Drops stacks up against top alternatives like ICObench or CoinSchedule? Read on and we'll explore their key differences together.

Comparing ICO Drops With Other ICO Platforms

When it comes to navigating the crowded ICO market, the platform you choose can make all the difference. If you're considering ICO Drops, chances are you've also heard about alternatives like ICOBench and CoinSchedule. Let's take an honest look and see how ICO Drops stacks up against these top players.

ICO Drops vs ICOBench

ICO Drops has gained popularity because it simplifies complex data into easily digestible bites—perfect for beginners. But, what if you want something a bit more detailed? Let's look at ICOBench:

- Usability and Interface: ICO Drops wins here. It offers a cleaner, simpler layout with a clear organization into active, upcoming, and completed ICOs. ICOBench, while detailed, can easily overwhelm new users with data overload and intricate navigation.

- Depth of Analysis: ICOBench brings detailed reviews, ratings from experts, and comprehensive write-ups. In contrast, ICO Drops focuses primarily on brief, to-the-point summaries and simplified project ratings. If you are someone who loves to go deep into expert opinions and intricate reviews from various analysts, ICOBench might appeal more to you.

- Trust Factor and Biases: One issue I've noticed personally with ICOBench is potential review bias. There's been controversy in the past regarding paid reviews and questionable authenticity of expert ratings. ICO Drops, in comparison, gives a straightforward summary without trying to overly sell any project—it feels more neutral and trustworthy.

"Trust, but verify"—always a great rule, especially when your investments depend on it!

ICO Drops vs CoinSchedule

Maybe you've also heard of CoinSchedule as another competitor to ICO Drops. Let's quickly compare these two:

- Calendar Functionality: Both ICO Drops and CoinSchedule provide valuable calendars for ICO investors. However, ICO Drops categorizes ICOs clearly on their homepage, making it simpler for quick views. CoinSchedule leans more toward extensive filtering and sorting options, beneficial for thorough researchers but slightly cumbersome for quick look-ups.

- Feature-Set: CoinSchedule does a solid job by offering advanced analytics and graphics of ICO fundraising totals, industry distribution, and trends. It's ideal for investors hungry for comprehensive trend analysis. ICO Drops, with fewer bells and whistles, focuses on simplicity, clarity, and ease-of-use which suits the casual user perfectly.

- Project Ratings: ICO Drops provides snapshots and concise labeling like "High Interest," "Medium Interest," or "Low Interest" helping users quickly catch what's hot. CoinSchedule, however, doesn't emphasize user interest ratings as prominently, placing greater emphasis on raw data and project specifics instead.

A recent analysis by the University of Cambridge found 81% of ICO investors rely heavily on platform ratings to guide their investment decisions. So choosing the platform that matches your style is essential—whether detailed review (ICOBench), extensive trend-analysis (CoinSchedule), or clear simplicity (ICO Drops).

Still wondering if ICO Drops is your ultimate choice or if you'd better look further? There's more to explore—I’ll share some additional resources to boost your ICO investing knowledge next. Curious what those are? Let's check them out together!

Additional Resources Worth Checking Out

If you're genuinely interested in mastering the art and science of crypto investing and ICOs, I'm going to let you in on a small secret: don't rely on just one source! ICO Drops provides useful info, but to maximize your odds and knowledge, it pays to have other trustworthy references in your toolkit. Let me quickly show you some of the most valuable resources I've personally found helpful:

- CoinDesk: Personally, I always check CoinDesk first thing in the day. They provide breaking news, trends, and analyses that can impact crypto markets quickly. Their insights are fresh, unbiased, and straight-to-the-point.

- CoinTelegraph: Another frequent go-to for me. CoinTelegraph offers engaging, visually appealing, and easy-to-absorb news and beginner-friendly guides for those just entering the crypto world. Their ICO analyses and in-depth reporting make it simple to understand complex technical topics.

- Coinbase Learn: Coinbase has built one of the clearest educational resources for crypto newcomers, covering everything from basics like "What is Bitcoin?" all the way to detailed breakdowns on advanced topics. It's interactive and practical for hands-on learning.

- Investopedia Crypto Education: Investopedia is legendary for simplifying difficult concepts. Their crypto section is no different—clear explanations, examples, and tutorials help you really grasp what you're investing in, making them ideal for easy, reliable learning.

Now, I'm sure you're thinking "Great! These resources sound solid, but can ICO Drops really match up? Should I fully trust it?" — Well, I'm glad you're wondering, because that's exactly what I'm going to reveal next.

Curious if ICO Drops is the ultimate ICO investing guide, or should you pair it with other tools to protect your investments? Hold tight, because I'm about to answer that for you in full clarity—right in the final segment coming up!

Final Thoughts: Should You Trust ICO Drops?

If you've made it this far, you're likely still wondering: can I really rely on ICO Drops to guide my crypto investments in 2025? Let's boil it down together and see whether or not ICO Drops truly deserves your attention.

Who Will Benefit Most From ICO Drops?

Speaking personally from my experience on Cryptolinks.com, ICO Drops offers clear value for two main groups:

- Beginners and casual ICO investors: If you're new to ICOs or haven't built your own solid research methods yet, ICO Drops is a fantastic starting point to find simplified and reliable information. Their user-friendly interface and well-organized ICO calendar make investment planning easy for beginners.

- Time-conscious investors: ICO Drops really shines by presenting structured, quick-glance data. Users who love efficiency and prefer clear, at-a-glance project summaries over extensive, technical ones will definitely appreciate this platform.

However, for seasoned ICO hunters looking for deep-dive, technical assessments, ICO Drops might seem a bit surface-level and won't satisfy all your detailed analytical needs.

Is ICO Drops the Ultimate ICO Guide?

To keep it short and honest: no single platform can ever be the ultimate ICO guide.

ICO Drops, no doubt, does a strong job in providing concise, easy-to-understand summaries, assessments, and historical ICO data. Yet, it’s unrealistic (and potentially risky) to rely solely on ICO Drops or any single platform for making major financial decisions. Remember, the ICO investment landscape remains tricky and requires comprehensive judgment based on multiple information sources.

Better Alternatives or Complementary Tools?

I strongly recommend you complement ICO Drops with deeper analytical platforms or broader crypto resources to maximize your investment safety and success rate. Some smart supplemental resources could include:

- CoinDesk and CoinTelegraph: For insightful crypto market news, expert opinions, and ICO analyses.

- Blockchain explorers such as Etherscan, BscScan, or Solscan: These can verify wallet activities and token distributions directly, helping you uncover potential red flags.

- Project communities on Discord, Telegram, Twitter, and Reddit: Advisor insights are helpful, but nothing beats direct contact with developers and the real community behind ICO projects. Gauge community activity and sentiment—these insights often speak volumes.

Using ICO Drops alongside these additional tools will give you a more balanced, detailed view tailored precisely to your investment needs.

Final Verdict on ICO Drops for Investors in 2025 (Conclusion)

So, should you trust ICO Drops? My bottom-line opinion after reviewing countless crypto resources on Cryptolinks.com remains cautiously optimistic.

ICO Drops is indeed reliable for quick, clear, beginner-friendly overviews and serving as a neat starting point in ICO research. Yet, I strongly advise pairing ICO Drops with further investigation and cross-checking tools to confidently determine which ICO projects deserve your time, trust, and money.

In crypto, the more thorough you get, the safer you'll be—and ICO Drops can definitely help you start strong.