Binance Launchpad Review

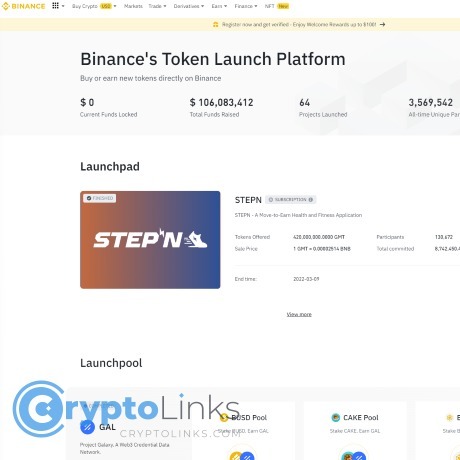

Binance Launchpad

launchpad.binance.com

Binance Launchpad Review: Is It Really Profitable or Just Hype?

Have you heard crypto traders claiming they've cashed in big on Binance Launchpad and wondered, "Can I actually make serious money this way too, or is it all hype?" Let's face it, Binance Launchpad is all the buzz lately, and if you're like most of my readers at Cryptolinks.com, you're probably skeptical, curious, or maybe even a little worried about risking your money blindly.

That's completely understandable! After all, we've all seen cryptocurrencies soar and crash overnight. So before you jump in headfirst, wouldn't it be great to know exactly what you're getting into?

Don't worry—I got you! Today I'm going to bring you crystal-clear answers to the questions you're secretly googling at night. Let’s start with the common concerns and fears around Binance Launchpad.

The Common Questions and Concerns I've Seen About Binance Launchpad

Through my experiences reviewing various crypto services at Cryptolinks.com, I've noticed recurring questions from readers like you. Here’s what usually bothers crypto investors before they test the waters of Binance Launchpad:

Is Binance Launchpad a Safe Way to Invest?

I'll be straight with you—no investment in crypto is completely risk-free. But Binance Launchpad substantially reduces risk compared to other platforms. How? Binance, being one of the world's most reputable crypto exchanges, carefully vets every launchpad project. This drastically helps lower the danger of scam tokens and shady projects you commonly see elsewhere.

- Security measures: Binance uses strict security protocols to ensure investor funds and data remain safe from hack attacks or breaches.

- Project legitimacy: Binance carefully reviews each token offering's whitepaper, financials, team background, community engagement, and practical use case—meaning they don't just list random tokens without thorough due diligence.

- Investor protection: While nothing can ever guarantee 100% safety, Launchpad's strict standards vastly boost confidence and minimize fraud or rug-pull scenarios.

Can You Actually Earn Consistent Profits, or is it Just Hype?

Here’s the juicy truth: Yes, you can absolutely earn profits from Binance Launchpad. Some projects in the past (think Axie Infinity, Polygon MATIC, and Harmony ONE, to name a few) surged dramatically shortly after launch, giving early participants excellent returns.

However, realistic expectations matter. Making consistent daily profits, like $100 a day from Launchpad alone, is unlikely. Here's why:

- Limited frequency: Launchpad sales don't happen every day, which makes daily profits tricky.

- Allocation limits: Each user receives a limited allocation based on their BNB holdings, meaning you can’t just invest unlimited amounts to reach daily profit goals easily.

- Market conditions: Crypto prices fluctuate dramatically. Sometimes immediately after launch, tokens dive instead of rise—a crucial consideration.

Still, private research shows a solid track record—according to Binance's post-launch analytics, many Launchpad tokens did rise significantly above their original sale prices in their first 30 days. Users who patiently traded and managed their investments strategically often saw nice returns.

In This Review, You'll Get Honest, Clear Answers

My goal here is simple—to give you a realistic picture, both good and bad, so you'll know exactly what Binance Launchpad is about, how it works, the risks involved, and whether it’s something that might suit your crypto investment goals.

Sounds fair, right?

This brings up the next obvious question: What exactly is Binance Launchpad, and why does everyone seem to care so much? Keep reading, because that's exactly what we're going to explore next.

What is Binance Launchpad and Why Does it Matter?

Before you start dropping your cash into crypto investments, you've got to clearly understand exactly what Binance Launchpad actually is—and why everyone's talking about it.

Binance Launchpad Explained Simply

Think of Binance Launchpad as crypto's answer to Kickstarter, but with extra perks specifically tailored for blockchain startups. Basically, it's a platform set up by Binance—the world's largest crypto exchange—that hand-picks promising new crypto projects and lets regular investors (you and me) buy tokens from these projects early, before they hit mainstream exchanges.

Here's how it typically works:

- Binance carefully screens crypto projects based on their potential and reliability.

- Once they pick a project, Binance helps promote and launch its initial token offering right on the platform.

- Investors can then buy tokens at an early, usually discounted price.

- As soon as the token officially lists on exchanges, investors have the opportunity to sell or hold for potential profits.

"Getting in early can mean buying strong projects at bargain-basement prices—something every investor dreams of."

Why Investors are Flocking to Binance Launchpad

There's no mystery behind Binance Launchpad’s popularity. It all boils down to potential profit and reputation. Let me quickly outline why crypto fans are obsessed with Launchpad:

- Early Bird Advantage: Investors get to buy tokens at entry-level prices, often much cheaper than when they list on open markets later. Remember famous Binance Launchpad projects like Axie Infinity (AXS), which started off priced ultra-low in early rounds, enabling some early investors to reap huge rewards when the tokens skyrocketed.

- Quality Projects: Binance Launchpad doesn't just list any crypto startup. It's picky, heavily screening each project's fundamentals, credibility, and potential market impact. Binance knows the value of its own reputation, so it avoids sketchy token sales.

- Instant Access and Convenience: Participating is easy—you simply need a verified Binance account. Everything happens directly within your familiar trading ecosystem, so no sketchy external platforms or complicated processes.

These aren't just claims—market figures back this up. For example, according to reports from analytics site CryptoRank, Binance Launchpad projects averaged an incredible ROI (Return on Investment) of over 2,000% back in 2021. Numbers like that naturally attract crypto investors seeking solid returns.

How is Launchpad Different from Binance Launchpool?

One thing I've noticed confuses readers a lot is the difference between Binance Launchpad and Binance Launchpool. Let's quickly clear that up:

- Binance Launchpad allows you to purchase newly launched crypto tokens at an early price via an organized token sale, lottery, or guaranteed allocation system before public release.

- Binance Launchpool, on the other hand, lets you earn tokens passively by staking already-owned crypto assets (such as BNB, BUSD, or ETH). You don't buy tokens directly—instead, you earn them gradually, by contributing your crypto holdings’ staking power.

To quickly illustrate this: Binance Launchpad lets you actively buy early, potentially more profitable deals, whereas Launchpool is about passively earning new tokens over time.

By understanding exactly what Binance Launchpad offers, it's clear why investors flock to it, dreaming about spotting the next explosive crypto growth story early...but you're probably wondering now, "What's the step-by-step way to actually join a Binance Launchpad token sale and grab your share of promising new tokens?" Don't worry—I dive into exactly how to participate clearly in the next section. Keep reading to unlock all the practical tips you need!

How Can You Participate in Binance Launchpad Token Sales?

Ready to get started with Binance Launchpad? By now, you're probably eager to know exactly how to grab your share in the hottest upcoming crypto token sales. Let's break it down simply and clearly with a step-by-step guide. Even if you've never done this before, I'll take you through everything you need—no fluff, no confusion.

"Before anything else, preparation is the key to success." – Alexander Graham Bell

Preparing Your Binance Account

First, let's quickly set the stage. You’ll want your Binance account ready and verified. Here's a straightforward checklist:

- Create your Binance account: Sign up at the official Binance website if you haven't already. Double-check you're visiting https://binance.com to avoid scams.

- KYC verification: Complete Binance’s identity verification process (Know Your Customer). Binance is a regulatory compliant platform, and verification ensures you can freely take part in Launchpad token sales. Typically, you’ll need a valid ID, a clear selfie, and proof of address.

- Secure your account: Set up Two-Factor Authentication (2FA) using Google Authenticator or SMS to significantly boost your account security—consider this a must-have!

- Fund your Binance wallet: Deposit some crypto, usually BNB (Binance’s native currency), to your spot wallet, as most Launchpad events require holding or staking BNB.

Securing Your Allocation

Now your account is ready, how do you ensure you actually get those sought-after tokens? Here's how Binance Launchpad usually distributes tokens to investors:

- Subscription method: Binance commonly uses a subscription system based on the amount of BNB you hold prior to the token sale. The more BNB held, the larger your potential allocation. So, planning your BNB holdings strategically can pay off.

- Lottery method (less common now): Binance sometimes goes with a lottery-style format. Each lottery ticket correlates with a specific amount of BNB held. If your ticket wins, you can buy tokens.

Quick tip: Binance usually informs you clearly beforehand about the method being used. Stay updated on Binance's announcements page or their official Telegram channel to ensure you're fully informed.

Buying and Receiving Your Tokens

When you secure your allocation, here's what to expect next:

- Purchase confirmation: Once your allocation is finalized, your BNB (or other crypto required) gets deducted, and your new Launchpad tokens will shortly appear in your spot wallet.

- Distribution time: Tokens typically get distributed within a few hours to a day after the sale ends, just before trading opens on Binance.

- Next steps—trade or hodl?: Now it's entirely up to you! Some investors immediately sell their tokens upon market listing at a potentially higher price, while others believe in long-term holds (hodling). Decide based on your financial goals, risk tolerance, and confidence in the project.

At this stage, you might be wondering: "Okay, I know how to join, but can I actually profit from Binance Launchpad?" That’s exactly what we’ll explore next—Can You Really Make Money from Binance Launchpad?

Can You Really Make Money from Binance Launchpad?

If you're like most crypto enthusiasts, you've probably wondered, "Is Binance Launchpad really a profitable venture, or is it all smoke and mirrors?" After reviewing countless crypto platforms for Cryptolinks.com, let me put my cards on the table and show you how profitable Launchpad truly can be.

Realistic Profitability and Returns

Let's be upfront: Not every project is a guaranteed home run—but several Binance Launchpad offerings have led to massive profits. For example, think about Matic Network (now known as Polygon). Investors who participated in the Binance Launchpad sale in 2019 purchased MATIC tokens at just $0.00263. At their peak in December 2021, MATIC tokens reached an all-time high of over $2.68—meaning investors who held could have seen returns of over 100,000%!

However, don't let success stories blind you. According to studies of multiple Launchpad projects, average short-term gains in initial trading usually range between 100% and 400%, still very impressive, but far from the astronomical returns of exceptions like MATIC.

"Crypto successes make headlines; failures often go unnoticed." - Veteran Crypto Investor saying

Factors That Influence Earning Potential

While it's exciting to read about double and triple-digit gains from Binance Launchpad projects, several crucial factors ultimately dictate your earning potential:

- Project Quality: The team behind the project, their vision, track record, and how revolutionary or high-demand their solutions are.

- Market Conditions: Crypto markets fluctuate wildly. Bull markets usually amplify Launchpad gains, while bear markets or downward trends can weaken profitability.

- Timing of Launch: Participating early during launch windows when competition is lower can maximize your investment returns.

- Token Demand & Hype: Projects generating significant attention from communities, influencers, media, or celebrities can drastically increase token demand, especially immediately upon listing.

- Your Personal Strategy: Are you holding long-term or flipping quickly? Profits can vary enormously based on your chosen trading or investment style.

Examples of Past Binance Launchpad Success Stories

To illustrate just how profitable Binance Launchpad can be when conditions align perfectly, here are a few gems that stand out:

- Axie Infinity (AXS): Offered initially at $0.10 in November 2020, the token skyrocketed to a high of $165.37 within a year—a jaw-dropping 165,270% ROI for early holders.

- SafePal (SFP): Initially priced at $0.10, it surged to over $4 shortly after launch. Even investors who exited reasonably early walked away with substantial profit percentages.

- The Sandbox (SAND): Starting at just $0.0083 per token at launch, Sandbox reached an impressive $8+ in November 2021, turning modest investments into significant wealth.

These examples showcase Binance Launchpad's immense potential, but remember, high returns do come with volatility and risks.

Now, here’s something fascinating to think about: If these examples are real, can you consistently turn Binance Launchpad—or even Binance in general—into a daily earning resource? Could Binance realistically earn you $100 each day, or is it too good to be true?

Let's find out: Is earning $100 daily from Binance a myth or a real, achievable goal? I'll share practical insights and strategies that can clarify this burning question in the next part.

How to Earn $100 Daily on Binance – Myth or Reality?

Let's face it—earning $100 every day from Binance sounds like the crypto dream, doesn't it? I receive countless emails at Cryptolinks.com, asking if achieving such consistent daily returns is actually possible or if it's just a wild crypto myth. This question speaks directly to our deepest impressions of cryptocurrency: is it truly life-changing, or just flashy hype?

"Dreams don't work unless you do." – John C. Maxwell

This quote perfectly captures the essence of earning consistent returns on Binance. The key isn't just the possibility—it's your commitment, strategy, and execution. To find out if the $100 daily goal is attainable, let's realistically explore practical methods you can apply right now.

Is a Daily Target Like $100 Feasible with Binance?

Let's get straight to the heart of this question. To achieve consistent earnings such as $100 per day, you must understand that Binance is not an ATM machine—it's a powerful platform that rewards knowledge, strategy, and consistent effort.

Is the target achievable? Yes, but with important nuance.

You must consider ways beyond purchasing new coins through Launchpad alone—earning consistent daily returns typically involves juggling multiple Binance features including:

- Binance Staking: Earn passive income by locking up your crypto assets. Stable returns range around 5-15% APY or upwards, depending on the token and lock-up periods you choose.

- Affiliate & Referral Programs: If you're good at inviting others, Binance pays you commissions from your referrals' trading fees. Skilled crypto-marketers occasionally surpass the $100-per-day benchmark by building solid affiliate networks.

- P2P Trading: Binance's Peer-to-Peer trading marketplace allows you to buy and sell crypto directly to others for profit. Active traders frequently achieve substantial daily profits leveraging market differences, but remember, trading carries and requires excellent understanding of prices and market trends.

- Binance Earn Programs: Flexible savings, locked savings, and liquid swaps—these Binance Earn products provide steady, modest returns that compound over time. Maximizing these offerings can collectively inch you closer to your daily goal.

But here's the kicker: earning exactly $100 every single day is rarely straightforward. Crypto markets fluctuate endlessly. One day you might make $200 in profits from an affiliate referral, the next day your staking might net you just $20–$30. Consistency requires flexibility, smart diversification, and a readiness to adapt your strategy frequently.

Practical Methods You Can Try

If you're serious about aiming for the magical "$100 daily," here's how you can realistically try to achieve it:

- Combine multiple income streams: For example, staking high-yield coins combined with promoting your referral link to friends or followers could yield a higher steady return.

- Start P2P trading: Arbitrage trading on Binance P2P is profitable if you learn carefully and monitor spreads closely. Some traders consistently earn $50–$150 in daily profit depending on trade volume and margins.

- Regularly stay updated with Binance's “Learn & Earn” opportunities: Binance regularly provides free tokens when users complete simple educational modules—yes, totally free crypto!

- Keep capitalizing on Launchpool opportunities: Binance Launchpool allows users to stake popular cryptocurrencies to passively earn newly listed tokens that could dramatically increase in value upon market validation.

Remember, the key isn't one magical solution—it's careful and diligent integration of multiple profitable features that Binance offers.

Managing Expectations and Reality Check

But let's keep expectations realistic; cryptocurrencies are not a guaranteed lottery ticket to daily riches. Each method brings both opportunities and risks. Consistent daily earnings also require your constant attention, discipline, and the willingness to adapt to dynamic crypto conditions.

A recent study from Chainalysis indicates that active cryptocurrency traders see varying profit consistency—only a small fraction maintain daily steady profits while the majority sees fluctuating daily returns. That's reality.

Consistency at the $100/day mark is achievable, but only with:

- Solid knowledge (constant research and education)

- Realistic market awareness (understanding crypto volatility)

- Dedicated effort (daily commitment to tracking results and adjusting strategies)

Now, with all this said, let's make sure you aren't caught off guard. Earning consistent profits comes hand-in-hand with risks and challenges—are you truly prepared for those? Wondering what exact pitfalls and risks await you, and more importantly, how to easily avoid them?

If so—I highly suggest you stick around, as I'll clearly reveal these risks and how you'll confidently handle them next...

Understanding Risks and Challenges with Binance Launchpad

I completely understand the excitement around Binance Launchpad—I’ve seen firsthand how new crypto projects can launch investors into tremendous profits overnight. However, before you dive headfirst into this opportunity, you must clearly recognize and appreciate the risks involved. Being aware of what's at stake gives you the upper hand by keeping your expectations realistic and protecting your hard-earned capital.

"Risk comes from not knowing what you're doing." - Warren Buffett

Market Volatility and Token Price Risks

I have to be brutally honest here: once a Launchpad token is listed, wild price swings and massive volatility are not unusual. In fact, I've seen new tokens shoot sky-high within minutes, only to crash violently afterward.

Remember when MATIC (now Polygon) was launched through Binance Launchpad back in 2019? Investors who missed optimal entry and exit points found themselves facing enormous price fluctuations. MATIC surged over 900% initially, but those failing to act swiftly saw significant drops.

- The Quick Pump-and-Dump: Prices can rise rapidly on launch day due to hype but may fall sharply afterward, exposing you to potential losses.

- Emotional Investing: Strong volatility triggers panic buying or selling—leading to poor judgment, impulse decisions, and ultimately lower profitability.

My tip? Always have a clear plan before launch day arrives—set entry and exit metrics and stick to your rules!

Project Performance and Due Diligence

Binance Launchpad hosts some impressive projects—but let's face it, even the most promising ones can sometimes fail to perform as expected. Blindly buying into celebrity endorsements or heavy social media hype frequently backfires. I once witnessed fans blindly buying tokens merely because a famous influencer tweeted positively—in the end, many were left disappointed with mediocre returns.

To avoid being another victim of influencer mania, here’s how you can protect yourself:

- Look Under the Hood: Closely examine a project's whitepaper, team members, developing technologies, competitors, funding sources, and roadmap.

- Community Sentiment and Expert Reviews: Don't just trust flashy ads or influencer promotions. Look for thoughtful, independent opinions across reputable crypto communities or platforms such as Cryptolinks.com itself.

- Historical Records: Verify how previous Launchpad projects performed over several months post-launch—not just days or weeks.

Security Risks and Common Pitfalls

I cannot stress this enough—ensuring the security of your Binance account and transactions is critical. I’ve received messages from readers who've fallen victim to phishing scams or fraudulent websites impersonating Binance Launchpad.

- Phishing Attacks: Scammers often pose as Binance’s official website or emails. Always double-check URLs and never click suspicious links.

- Account Vulnerability: Secure your Binance account with 2FA authentication and avoid accessing your wallet from public Wi-Fi networks.

- Fake Launchpad Sales: Watch out for offers promising earlier access or cheaper prices—genuine sales take place only through Binance's official platform!

By taking necessary precautions, you vastly reduce your vulnerability—protecting not only your wallet but your peace of mind as well.

Now, you already have a handle on the risks—that's your edge in the game. But how do you gain even bigger advantages and avoid costly pitfalls moving forward? Curious about essential resources, tools, and strategies that'll keep you ahead of the majority? I'll reveal everything in detail in the next section. Continue reading to access powerful secrets and proven tools that'll help you maximize your Binance Launchpad opportunities!

Essential Resources and Tools for Maximizing Binance Launchpad Opportunities

You know what I've learned after reviewing countless cryptocurrency tools and platforms? Success often comes down to having the right resources ready when opportunity strikes. Binance Launchpad is no exception—having solid tools and helpful communities at your fingertips can give you a significant edge.

"In crypto investing, preparation isn't half the battle—it's the entire battlefield."

Tracking Upcoming Launchpad Offers

Missing Launchpad dates or key project announcements can literally cost you money. I always encourage readers to stay ahead with trustworthy sources that provide near real-time updates. Here are some proven resources to instantly boost your Launchpad kill-rate:

- Official Binance Launchpad – The definitive first stop. Subscribe and stay alerted directly from Binance.

- CoinMarketCal – A crowd-sourced crypto-events calendar that's highly accurate and community-verified. I've used it countless times myself, and it rarely disappoints.

- Official Binance Twitter - Social media updates from Binance are fast and reliable. Turn notifications on to stay ahead.

Crypto Market Analytics Tools

Want a way to predict Launchpad project performances with more confidence? Using analytical tools helps you quickly and reliably gauge market sentiment, project strength, and token potential. I personally recommend:

- CryptoQuant – Great for tracking market movements, whale wallets, and trading volume patterns around launches. Surprise price moves become less surprising.

- Glassnode – Provides data-driven insights, on-chain analytics, and liquidity measures. Invaluable for timing entries and exits strategically.

- CoinGecko – Simple yet comprehensive data for quick views on tokens' relative market caps, circulating supplies, and historical price fluctuations.

Remember, data-backed decisions consistently outperform hype-based gambles. A friend of mine tripled his gains simply by quickly checking liquidity patterns before investing—that could easily be your story too.

Community and Educational Resources

Warren Buffett once said, "Risk comes from not knowing what you're doing." Education and community support can't be overlooked. Connecting with experienced Binance investors can sharpen your skills dramatically in short time:

- r/CryptoCurrency on Reddit – A vibrant community offering practical tips and honest reviews on upcoming Launchpad projects. I've found real-time investor sentiment here extremely reliable.

- Binance Official Telegram Group – Instant announcements, direct admin interaction, and timely Q&As about launches and events.

- Binance Academy – Anytime you feel uncertain, head here for clear, accurate guides tailored specifically for crypto investors.

These resources aren't random—they've helped thousands of crypto enthusiasts increase their returns with Binance Launchpad. Armed with the right tools, you'll immediately reduce risks and magnify your profit potential.

But hold on! Before you rush off to check these resources, don't you wonder what fellow investors are asking about Binance Launchpad most frequently—questions so crucial they can mean the difference between profit and loss?

Stick with me, let's quickly answer some of those burning FAQs together in the next section!

Frequently Asked Questions (FAQs) on Binance Launchpad

Whenever I discuss Binance Launchpad with my readers here on Cryptolinks.com, certain questions inevitably pop up. To save you some time, I've compiled the most common queries I get, along with clear, straightforward answers so you know exactly what you're dealing with.

Can You Make Money from Binance Launchpad?

Let's get real: Binance Launchpad has definitely produced substantial returns for investors in the past. For instance, popular projects like Polygon (MATIC), Axie Infinity (AXS), and The Sandbox (SAND) provided early adopters with compelling profits right after their launch. However, this doesn't guarantee profits every single time. The profitability of Binance Launchpad projects depends heavily on:

- Project Quality: Strong fundamentals, solid teams, and real-world use cases significantly increase profit chances.

- Market Sentiment: Positive market conditions boost token demand, while a bearish market can hinder immediate returns.

- Entry and Exit Timing: Selling too early might miss long-term growth, while holding too long can see initial gains evaporate due to market volatility.

Bottom line? Yes, you can make money from Binance Launchpad—but it's not an absolute certainty. Your result largely comes down to staying informed, timing your actions wisely, and managing risks effectively.

What's the Risk of Binance Launchpool, and How Does it Impact Earnings?

Binance Launchpool (which is actually different and simpler than Launchpad) is popular for letting you stake your BNB or other tokens to farm newly launched tokens for free. While it sounds ideal—earning free tokens with zero principal loss—it's still not risk-free. Here's what you should keep in mind:

- Price Volatility: Tokens earned can fluctuate significantly in value right after launch. Even though they're "free," their value might drop, lowering your profit.

- Opportunity Cost: The tokens staked could potentially yield better returns elsewhere. You're temporarily "locking" your assets, missing out on other lucrative opportunities.

So yes, Launchpool is relatively safe, but remember: just because something feels free doesn't mean it's truly risk-free. You need to weigh the potential gains against possible dips in token values and use smart portfolio diversification.

How Do You Make $100 a Day on Binance?

One of the top questions asked by my readers is about achieving consistent daily earnings like $100 using Binance. Let's quickly recap practical approaches you can implement:

- P2P Trading: Pitch and trade cryptocurrencies peer-to-peer on Binance's dedicated platform at favorable spreads.

- Binance Referral Program: Build referral commissions via inviting new users onto Binance and earning a percentage from their trades.

- Staking & Earn Products: Maximize yield-generating offerings available on Binance Earn, including staking, flexible savings, and locked savings.

- Launchpool Tokens: Farm promising new tokens by staking existing holdings and potentially sell your earnings profitably during bullish market conditions.

However, keep your expectations grounded: reaching a steady daily earning involves substantial capital investments, savvy trading skills, and consistent effort. $100 daily isn't impossible, but you'll need discipline, proper education, and realistic goal-setting to achieve it.

Additional FAQs from Readers

- Do You Need BNB to Participate? Typically, yes. Binance Launchpad normally requires holding BNB tokens to secure allocations. Having BNB isn't just helpful—it's practically essential for maximizing your participation.

- Is Binance Launchpad Good For Beginners? It can be, as it's straightforward to use. However, beginners must study projects closely. Launchpad doesn't completely eliminate the risks of investing in new crypto tokens—it only simplifies access.

Now, you're probably wondering: is Binance Launchpad really right for you? That's precisely what I'm about to reveal next—sharing my honest and final verdict on whether Binance Launchpad deserves a spot in your crypto investing strategy. Curious? Let's explore this together in the next section.

My Personal Verdict: Is Binance Launchpad Worth Your Attention?

Alright, it's time for some straight talk. After reviewing Binance Launchpad thoroughly, weighing the good and the bad, I'm ready to give you my transparent and honest take on whether you should really give this platform serious consideration.

Who Should and Shouldn't Use Binance Launchpad?

After closely observing my readers (and experimenting myself), here's who I think would benefit the most from Binance Launchpad:

- Good for: Experienced traders, crypto enthusiasts comfortable with research and volatility, and anyone willing to accept higher risks for greater potential rewards. If you're already familiar with token launches, ICOs or previous Binance Launchpad projects, you'll easily understand and navigate these opportunities.

- Not suitable for: Beginners with very limited understanding of crypto or investors who can't afford to lose the invested amount. If the potential downside causes you discomfort or financial stress, Binance Launchpad probably isn't the investment choice for you. Stick to lower-risk alternatives first, and build your crypto experience slowly.

Final Thoughts: Should You Try Out Binance Launchpad?

My short answer: Yes, Binance Launchpad is absolutely worth your attention—but proceed cautiously.

If you're clear-headed about the volatility involved and realistic about your expectations, Launchpad can offer excellent opportunities. From analyzing past project launches and outcomes, I've seen promising returns frequently—but not always. So, while potential to make money definitely exists, success isn’t guaranteed.

Keep these recommendations in mind to approach it wisely:

- Always do your own detailed research. Take extra time checking out the project's roadmap, management, use cases, and community sentiment.

- Limit your initial investment. Carefully gauge how much capital you allocate at each Launchpad event and how it aligns with your overall investment strategy.

- Stay diversified. Spread your resources across different token launches, crypto investments, and even non-token crypto opportunities (like staking or holding stablecoins) to minimize overall risks.

At the end of the day, Binance Launchpad presents a thrilling yet practical path to significant crypto profits—particularly if you approach it with eyes wide open, a sound plan, and a realistic mindset.

I encourage you, my readers at Cryptolinks.com, to experience it firsthand—just remember, always invest responsibly, embrace volatility calmly, and stay well-informed.