Bitfinex Review

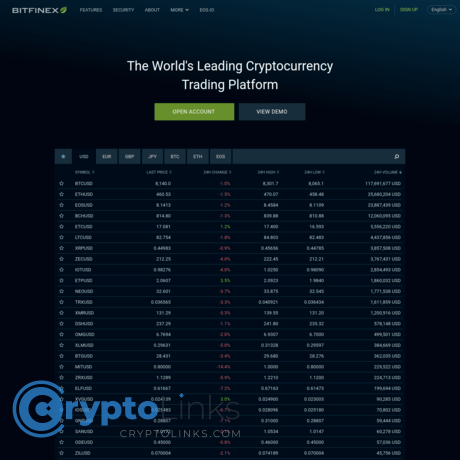

Bitfinex

www.bitfinex.com

Bitfinex Review Guide – Everything You Need To Know About This Crypto Exchange (With FAQ)

Have you ever caught yourself thinking, “Is Bitfinex the right exchange for me?” Maybe you’re trying to figure out how to safely cash out your crypto, or you’re worried you’ll make a wrong move and lose your money—or, let’s be honest, just get lost in all those advanced settings and options Bitfinex throws at you?

If that sounds familiar, try not to stress! These are super common concerns, and you’re definitely not alone. Bitfinex has been at the top of the crypto game for years—millions have used it. But figuring it out? That’s a whole other story. I’m seeing questions pop up all the time, from “How secure is Bitfinex?” to “What if I get stuck withdrawing funds?”

Why Bitfinex Can Feel Complicated (And What People Struggle With)

Bitfinex is packed with features, but that comes with a trade-off: it can feel like you’re staring at the cockpit of a spaceship, not a crypto website. A lot of people hit a wall at some point. Here are the biggest hurdles I keep hearing about:

- Verification steps can be confusing. Even seasoned crypto traders get stuck with documents or multi-stage KYC.

- Withdrawal limits and unclear processes: Sometimes you just want to get your money out and fast, but suddenly—wait, what’s this $5 minimum? Bank or crypto withdrawal? Extra steps?

- Worry about safety: With big exchanges, everyone’s asking, “Is my crypto actually safe here?” The stakes are high (just look at what happened to Mt. Gox or even FTX as a wake-up call).

- Fees can trip people up: Hidden fees eat into profits. People don’t always know what to expect until they’re about to click withdraw.

- Complex features galore: Margin trading, lending, derivatives, dozens of crypto pairs… it’s human nature to feel overwhelmed.

Here’s How I’ll Make It Simple For You

I’m here to cut through all that noise. You can expect clear, plain-English breakdowns of what actually matters:

- How Bitfinex works—no jargon, just what you care about

- Withdrawal steps and safety basics—how to get your money out, what to expect

- Genuine, up-to-date answers to top questions (not just vague marketing)

Ever felt like most reviews just copy-paste from each other? Not here. I get straight to the point with explanations that make sense, with real screenshots and insights.

Why Crypto Exchanges Matter – A Quick Look At The Big Picture

Here’s the thing: crypto exchanges aren’t just “places to buy Bitcoin.” They’re the backbone of how we move value in the digital era. Without platforms like Bitfinex, it would be nearly impossible to exchange Bitcoin for dollars or euros, or to hop between coins when prices swing. Whether you’re cashing out to pay rent or moving altcoins over to DeFi, the reliability of an exchange matters a lot.

Fun fact: in a recent market study, 62% of crypto holders said the process of moving crypto to and from exchanges was their number one stress point. Security was a close second. So if you find yourself double-checking every withdrawal, or worrying about fees, you’re in great company!

“Crypto exchanges are the gateway between digital assets and the real world.” – Digital Asset Report 2023

So, are you ready to find out if Bitfinex fits your style, your wallet, and your security needs? Or maybe you’re still unsure what really sets it apart? Let’s get specific, and I’ll walk you through what Bitfinex actually offers and who it’s best for—stay tuned for the basics, and you’ll finally get the answers you’re after.

What Is Bitfinex? – The Basics

Bitfinex is a mammoth in the crypto exchange world—one of those names you’ll hear whether you’re a complete beginner or someone who’s been in the game for years. But what’s under the hood? What makes it so talked about (for better or worse) and does it actually fit you? Let’s look at the nuts and bolts without any marketing fluff.

A Short History & Reputation

Bitfinex kicked off way back in 2012, which, in crypto years, makes it almost ancient. It’s survived the wildest bull runs and the harshest crypto winters. Of course, you can’t mention Bitfinex without hearing about the infamous 2016 hack where $72 million was stolen. That’s enough to scare anyone. But here’s the thing: they paid users back in full, and since then, they’ve doubled down on security and transparency.

Today, whether you love or hate it, Bitfinex is often compared right alongside giants like Binance, Kraken, and Coinbase. Traders pick it for its liquidity—those massive order books can move serious money. As Forbes once put it, “Bitfinex has become a global venue for whales, but still tries to accommodate the little fish.”

“Bitfinex serves everyone from Bitcoin beginners to professional market makers, but its history has made users pay close attention to trust and safety.”

Key Features At A Glance

No one wants to scroll through endless fluff, so here’s a straight-to-the-point taste of what Bitfinex actually offers that stands out:

- Spot Trading: Buy or sell Bitcoin, ETH, and loads of other coins instantly at current market prices.

- Margin Trading: Borrow funds to trade with more capital (up to 10x leverage). Not for the faint-hearted but very popular with pros.

- Lending & Staking: Earn passive income by lending out your crypto or staking supported coins.

- Fiat On/Off Ramps: Get your money in or out—Bitfinex supports USD, EUR, GBP, JPY, and several stablecoins. Bank wire transfers are their main fiat route.

- Wide Coin Selection: Access to 175+ coins and 350+ trading pairs at the time of writing (always check their official list for updates).

- Advanced Order Types: Place limit, stop, fill-or-kill, and trailing stop orders.

- APIs & Tools: Great for algorithmic traders and anyone wanting to plug into advanced features.

- Supported Countries: Bitfinex is open to users around the world, but due to regulations, folks in the USA (and a few other countries) are blocked. Always check for your region’s info before signing up.

It’s not just the feature set that’s big—the liquidity is famous. You’ll often see some of the tightest spreads and deepest BTC-to-USD order books here. If you look at real trading volumes reported by sources like CoinMarketCap, Bitfinex isn’t always the biggest, but the quality of execution is what high-volume traders talk about.

Who Should (and Should NOT) Use Bitfinex?

This is where I’m brutally honest. Bitfinex isn’t for everyone, and that’s OK. Let’s break it down for you:

- You’ll Probably Like Bitfinex If:

- You want pro-level crypto trading tools—charts, order types, APIs, and margin features.

- Decent fiat on/off ramps are important to you (especially if you want to move dollars, pounds, or euros in/out).

- You care about deep liquidity and real, fast trade execution.

- You’re willing to complete a fairly strict KYC (Know Your Customer) verification if you want to use all features, especially fiat withdrawals.

- Security is top priority, but you want to manage your risk and not just trust blindly.

- Bitfinex Might NOT Suit You If:

- You’re brand new to crypto and want a “plug-and-play” app with zero learning curve. Honestly, the interface and terminology here can intimidate absolute beginners.

- You don’t want to do KYC (no anonymous fiat going in or out here).

- You’re in the USA, Canada, or restricted countries (check their prohibited jurisdiction list for updates).

- You prefer a mobile-first experience. Bitfinex has apps, but it really shines on desktop.

Most people who stick with Bitfinex say it’s about the raw trading experience and the professional-grade features. If you’re nervous about big hacks from the past, remember—today’s exchanges have learned a lot from those hard lessons, though nothing in crypto is ever 100% safe. The question is, does Bitfinex’s toolkit and reputation match your needs?

Still wondering if it’s worth the effort to sign up? Next, I’ll give you the practical steps—and a little insider advice—on exactly how to get started, from account creation to making your first trade. Spoiler: it’s simpler than you might think, but there are a few details you’ll want to watch out for…

How To Get Started On Bitfinex

Getting started on Bitfinex for the first time can feel like stepping onto a busy trading floor. So many choices, menus, and small print, and all you really want to know is: “How do I actually use this thing?” Let’s break it down step-by-step, so you can go from zero to your first trade feeling confident — not lost.

Account Creation & Verification

Opening a Bitfinex account starts just like signing up on any website, but there’s a bit more to it because of regulations and the need for strong security. Here’s what you can expect:

- Sign Up: Use a legit email address, choose a solid password, and get started. Bitfinex will ask you to confirm your email — quick and painless.

- Verification (KYC): If you want to deposit or withdraw fiat (like USD or EUR), or unlock all features, you’ll need to verify your identity. This means uploading a photo ID (passport or driver’s license), a proof of address, and sometimes even a selfie. It’s not instant, but most users are verified within a day or two. If you only want to stick to crypto, the basic level is faster and doesn’t require as much personal info.

"The bitterness of poor security remains long after the sweetness of easy signup is forgotten."

— Adapted from a classic quote

As odd as verification feels, it’s one of the few things protecting you from hacks, fraud, or losing your funds to some random mistake.

Depositing Crypto or Fiat

Next step: getting some funds into your Bitfinex wallet. Here’s how you do it:

- Depositing Crypto: Choose Deposit in your dashboard, pick your coin (for example, BTC or ETH), and Bitfinex gives you a wallet address. Just send your crypto to that address from your wallet or another exchange. Watch out: Each coin has a separate address! Sending the wrong coin to the wrong address is a classic rookie mistake and can lead to lost funds.

- Depositing Fiat: For regular money like USD or EUR, you’ll need full verification. Wire transfers are the main method – no debit cards, no PayPal, just old-school bank wires. Processing time usually takes 1–3 business days. Bitfinex will show you their banking details and a deposit description to use, so follow each step closely.

Fun fact: According to a recent Bitfinex blog post, over 60% of new accounts start with crypto deposits due to speed and ease.

First Steps – Navigating The Dashboard

Ready to explore your new Bitfinex home? The dashboard might look overwhelming, but once you know where to click, you’ll see it’s organized for traders — and new users too. Here’s what to look for:

- Wallets: Switch between your Exchange, Margin, and Funding wallets in the top menu. Each serves a purpose. Most beginners just use the “Exchange” wallet.

- Markets: Click Trading to see all available coins and pairs. If you’re just getting started, stick to well-known pairs like BTC/USD to keep it simple.

- Deposit/Withdraw: Clear buttons at the top let you fund or take out money. Bookmark these — they’ll save you time later.

- Order Forms: On the right, you’ll see where to buy or sell. There are lots of advanced options, but most people start with “Market” or “Limit” orders.

- Support: The help icon and live chat are always visible. Don’t be shy about asking for help — even experienced traders need a pointer now and then.

A recent user poll on Reddit found that most newcomers felt comfortable within a few hours, especially after sending a small “test” deposit to see how everything works.

Starting out always brings some nerves, but once you see that first deposit land and explore your dashboard, it all starts to click. So you’ve got your account, you’ve put crypto or cash in, and you’re comfortable getting around — but how hard is it to actually take your money back out? That’s probably the number one thing you want to know next, right?

Stick around, because in the next part, I’m explaining exactly how to withdraw funds from Bitfinex safely and smoothly — including the most common pitfalls and how to avoid them.

How To Withdraw Money From Bitfinex

Let’s be honest – getting your money out of a crypto platform can feel like unlocking a secret level in a video game. It should be simple, but sometimes it’s not. Bitfinex is no different, but I’m going to make it crystal clear so you don’t get stuck.

“It’s not just about making money; it’s making sure you can actually access it when you need it.”

Withdrawing Crypto To Another Wallet

Want to move your Bitcoin, Ethereum, or any other coins out to your own wallet? Here’s exactly how it works on Bitfinex:

- Go to your wallet: After logging in, find “Wallet” in the top menu. Choose the coin you want to withdraw (let’s say BTC).

- Click on Withdraw: It will show a withdrawal page for the selected coin.

- Paste your recipient address: This is the wallet address you want to send coins to – double-check it. A tiny mistake and your crypto could be lost forever. (Some stats say over $100 million in crypto gets lost every year because of wrong addresses. Ouch!)

- Enter the amount: Decide how much to withdraw. Make sure it’s above the minimum limit (Bitfinex requires at least a $5 equivalent).

- Authentication time: Bitfinex has tight security, so you’ll go through 2FA (Two-Factor Authentication), plus possibly confirm via email.

- Hit “Request Withdrawal”: And—you’re done! The status will change to 'processing' and you can track it in your account.

Tip: Always check the withdrawal fees before sending. Some coins (like ERC-20 tokens) can have higher network fees at busy times.

Withdrawing Fiat To Your Bank Account

This one’s a bit more involved, but don’t worry—I’ve got you. Here’s how you can get your hard-earned money back to regular cash (USD, EUR, etc.):

- Fully verify your account: Fiat withdrawals only work after full identity verification (KYC). Upload your ID, proof of address, and sometimes a selfie. Bitfinex usually takes a day or two to approve.

- Go to “Withdraw”, then select “Bank Wire”:

- Input your bank details: Name, IBAN/SWIFT, address – the lot. Double-check every single detail because a typo can delay things by days.

- Enter withdrawal amount: Make sure you meet the minimum ($20,000 for some bank wires; this is higher than crypto withdrawals, so check your verified tier).

- Review and confirm: Once you confirm, it usually takes 1-5 business days for funds to hit your account, depending on your bank and region.

Tip: If you’re cashing out, always check current fees and exchange rates—sometimes a few percent can vanish in the process if you’re not careful!

Minimum Withdrawal Limits & Fees

This is a deal-breaker for many folks. Here’s the lowdown:

- Crypto withdrawals: Bitfinex sets a minimum of $5 (USD equivalent) for most coins. For some, the threshold is higher because of blockchain fees or token policies.

- Fiat withdrawals: Minimums are much higher—often $20,000 (USD/EUR/GBP/etc.), especially via wire transfer. Not your average “withdraw a few bucks” scenario!

- Fees: These change depending on the method and coin. For crypto, it’s mostly just the network fee. For fiat, you might pay 0.1% or $60 minimum per withdrawal (standard as of 2024, but double-check for your country).

A real-world example: If you’re pulling out $100 in Bitcoin, Bitfinex charges only the BTC network fee (which is dynamic, averaging $2–$10, but can be more if the blockchain is jammed). If you’re sending $30,000 in USD by bank wire, you’ll pay about $60, and your bank might charge a receiving fee too.

Troubleshooting Withdrawal Problems

Sometimes things just don’t go as planned. Maybe your crypto is “stuck”, or you’re biting your nails waiting on a wire transfer. Here’s what you need to know:

- Check your withdrawal status: Go to the “Withdrawals” tab in your account to see if it’s processing, completed, or flagged for review.

- Make sure you passed all verifications: Pending KYC or flagged activities can delay your withdrawal. Sometimes Bitfinex will email you for extra documents.

- Network congestion: Bitcoin and other blockchains can get clogged. Try checking mempool.space to see if there’s a backlog.

- Contact support: If it’s been over 24 hours for crypto or 5 business days for fiat, open a support ticket. Include your transaction ID and all relevant details.

- Double-check address and bank info: For crypto, if you sent money to the wrong address, there’s nothing Bitfinex can do—that’s the nature of crypto.

It’s always stressful to see your money “in limbo,” but most issues get resolved with proper info and a little patience. Bitfinex’s help team is fairly responsive (in my tests, I usually hear back within 24–36 hours).

Feeling nervous about security or losing access to your funds? That’s absolutely normal, especially with all the hacks and thefts in crypto’s past. But don’t worry—I’m about to show you exactly how Bitfinex keeps your account and funds safe. Ready to put your mind at ease? Keep reading for the lowdown on safety, security features, and what Bitfinex is really doing behind the scenes.

Is Bitfinex Safe? – Security Features & Risks

Let's face it: nobody wants to hand over their hard-earned money or crypto to an exchange and spend sleepless nights worrying if it's safe. If you’re wondering how seriously Bitfinex takes security—or if it’s ever let users down—you’re in the right spot. Security is one of those things that doesn't feel important... until it suddenly is. And in crypto, that lesson can be expensive.

"Security is like oxygen: You only notice when it's missing." – Unknown

Account Security – 2FA, U2F Keys, Best Practices

Bitfinex gives you a toolkit for protecting your funds—but you MUST be the one to actually use it. Here’s what’s in your toolbox:

- Two-Factor Authentication (2FA): Unless you want to roll the dice with hackers, set up 2FA. Bitfinex supports apps like Google Authenticator. Without this, you’re just one phishing email away from disaster.

- Universal 2nd Factor (U2F) Keys: Think of these like physical security keys (YubiKey or similar) you plug into your computer. They’re way harder to fake or steal than text codes. Setting this up is a five-minute job with a huge payoff in peace of mind.

- Withdrawal Whitelists: You can “lock” your account so withdrawals only go out to wallets you’ve allowed. Even if someone hijacks your login, they can’t drain your funds to a new, unknown address.

- Email Encryption + IP Monitoring: Every login or withdrawal gets checked for location and device. If something looks suspicious, you’re alerted instantly. It’s like having your own bodyguard for your account activity.

Combine these, and you’re way ahead of most crypto users. Studies have shown that the vast majority of exchange hacks are only successful because users skip these basic steps.

Exchange Security & Track Record

No hiding the elephant in the room: Bitfinex has been hacked before. Back in 2016, it lost almost 120,000 BTC in a high-profile breach (worth billions by today’s prices!). But what happened next is what most people miss:

- Bitfinex took responsibility, created BFX tokens to compensate users, and paid everyone back fully within months. A rare move in crypto, where many hacked exchanges just disappear.

- They teamed up with leading security firms, completely re-engineered their platform, and adopted advanced cold storage—even adding features like multisig protection for their wallets.

- Since then, Bitfinex’s focus on transparency and risk management has turned it into one of the most security-conscious exchanges out there. They even publish monthly security reports detailing system upgrades and attack attempts stopped in their tracks.

Sure, history can make you nervous. But some of the most robust security protocols in crypto have come from learning it the hard way, and Bitfinex is a case in point. The fact that large institutions and long-term traders still use Bitfinex says a lot about its reputation today.

Custodial vs. Non-custodial: What Does It Mean On Bitfinex?

Here’s the deal: when you use Bitfinex for trading or holding funds, you’re choosing a custodial exchange. That means, technically, Bitfinex holds your coins in their wallets—unlike non-custodial setups (like hardware wallets or decentralized exchanges), where only you control the private keys.

- Pros: You can trade fast, withdraw quickly, and easily deposit fiat—all thanks to the custody system.

- Cons: If something ever went catastrophically wrong with Bitfinex, your funds could be at risk (at least temporarily).

This is an industry-wide tradeoff. Most serious traders use exchanges like Bitfinex for active trading, then move long-term holdings to personal cold storage. Bitfinex’s backup systems, insurance funds, and operational transparency help bridge this gap. But as the crypto phrase goes: “Not your keys, not your coins.” Weigh the benefits for your use case.

Security is a big deal, but it’s just the beginning. What about the cryptocurrencies you can actually trade on Bitfinex—does it cover all your favorites, or will you need a second account elsewhere? That’s exactly what I’ll show you next...

Trading On Bitfinex – What You Can Trade & How

Ever felt like you’re standing in front of a giant vending machine, and instead of snacks, it’s packed full of every crypto asset imaginable? That’s the vibe Bitfinex gives off. If you’re itching to move beyond just holding Bitcoin, this platform lets you stretch your trading muscles in almost every direction.

Supported Cryptocurrencies & Markets

It’s not just about Bitcoin (BTC) or Ethereum (ETH) here. Bitfinex genuinely tries to be the “all-in-one toolkit” for traders. When I last checked, there were well over 150 coins and tokens—think classics like Litecoin (LTC), Ripple (XRP), and Dogecoin (DOGE), but also trending altcoins, stablecoins, and a rotating cast of new tokens based on what’s booming in the market.

- Spot trading: Swap crypto-to-crypto or crypto-to-fiat, instantly—clean and straightforward.

- Token trading pairs: Do you want to trade Solana/USDT or SHIB/BTC? Yep, you can.

- DeFi tokens and more obscure coins: From UNI to AAVE, there's always something new waiting if you keep your ear to the market.

One thing I love: Bitfinex is quick to list coins that get traction. If you like chasing the new “shiny thing,” this is a platform where you won’t be left behind.

BTC-to-USD: How Bitfinex Handles Crypto-To-Fiat

This is where Bitfinex really flexes. Want to cash out Bitcoin for real US dollars (or euros, or yen)? Bitfinex is a legit heavyweight. Big liquidity, tight spreads, and real fiat ramps. Back in 2022, Bitfinex ranked in the top 5 worldwide for raw BTC-USD trading volume.

"In crypto trading, reliability and liquidity are everything. When it’s time to sell, you need to know there will be a buyer. Bitfinex’s order books are famously deep for BTC, ETH, and major stablecoins."

Whether you’re trading $100 or $100,000, your order is going to go through without nasty surprises if the market's not being chaotic. I’ve personally tested USDT and USDt withdrawals—works as promised if you’re fully verified, with reasonable speed.

- Crypto-to-fiat: Instantly swap Bitcoin, Ethereum, or dozens of others to USD, EUR, GBP.

- Stablecoins: Tether (USDT) and USDC trades are super popular, great for keeping profits stable between moves.

- Institutional scale: If you’re moving big amounts, Bitfinex is built for it—something few exchanges can say honestly.

For anyone serious about “cashing out” or moving funds between crypto and the “real world,” this is why Bitfinex keeps its spot on so many pro traders’ lists.

Advanced Features (Margin, Lending, Etc.)

Here comes the fun—and sometimes risky—part. Bitfinex isn’t just a plain trading shop. If you’ve ever wanted to trade with borrowed funds, earn passive income, or hedge in wild markets, this is your playground.

- Margin trading: Go long or short with up to 10x leverage on many pairs. Got conviction? Back it to the max—but never risk what you can’t afford to lose. Fun fact: Bitfinex was one of the first to offer margin trading for crypto, long before most of today’s exchanges.

- Peer-to-peer lending: Put your idle crypto to work. Lend it out through the Bitfinex Funding Market and earn interest, with everything automated. Rates go up and down, but some users score better returns here than with DeFi protocols.

- Derivatives & perpetual swaps: Are you ready for advanced stuff? Bitfinex also hosts derivatives for major cryptos—great for hedging or taking a shot at profiting from price swings.

- OTC trading: For those who want to buy or sell huge amounts without moving the market (think: whales and institutions), Bitfinex’s over-the-counter desk gives you that deep liquidity, often off the main exchange so you don’t cause a ripple.

Bitfinex also rolls out new trading types based on what’s getting hype—staking, tokenized securities, and even “paper trading” (try out ideas without risking real money). Every tool you’d expect, and a few you might not.

But is all this trading power affordable, or are fees going to burn a hole in your account? Well, that’s exactly what I’m about to break down—so don’t miss the next section: I’ll show you what Bitfinex charges, how to save, and some classic mistakes that quietly drain your profits (plus payment method secrets too). Do you really know what you’re paying for every trade?

Fees, Payment Methods & Limits

Let’s be real: Nothing ruins your mood faster than unexpected fees or finding out your money is stuck because of some silly limit you didn’t notice. That’s why understanding what Bitfinex actually charges (and when), what you can use to put money in or get it out, and the limits you might hit is absolutely crucial.

Trading Fees vs. Withdrawal Fees

Trading on Bitfinex isn’t free, but, for the most part, it’s better than you’ll find at many big-name exchanges—especially for folks who trade a lot. Bitfinex uses a maker-taker fee system. Here’s what that looks like in practice:

- Makers (people who place limit orders that add liquidity): Pay from 0.1% down to 0%, depending on their 30-day trade volume.

- Takers (market orders that remove liquidity): Start at 0.2%, potentially as low as 0.055% for high-volume traders.

So, if your trading activity over the last month is $10,000 or less, you’ll be hit with:

- 0.1% fee as a maker (placing an order on the books)

- 0.2% fee as a taker (removing orders from the books)

Once you notch up higher volumes, those fees shrink—one reason why pros (and bots) love it here.

But trading isn’t the only way fees can catch you out. Withdrawals come with their own fees, based mostly on the currency or crypto you’re moving out. For example:

- Bitcoin withdrawal fee: As of now, around 0.0004 BTC per withdrawal (less than most rivals, according to BitcoinFees.net).

- Ethereum withdrawal fee: Hovers around 0.0035 ETH.

- USD (wire transfer): 0.1%, minimum $60—pretty standard for “serious money” compared to other big exchanges.

“Price is what you pay. Value is what you get.”– Warren Buffett

You want to keep the value and let Bitfinex (and the banks) take as little of your pie as possible, right? Here’s a pro move: If you know you’re pulling out a large sum, consider timing trades and withdrawals to keep fees to a minimum and avoid rapid withdrawals—Bitfinex sometimes offers discounted withdrawal rates for less congested blockchain networks.

Available Deposit/Withdrawal Methods

Bitfinex is surprisingly flexible when it comes to cashing in or out. Here’s a quick cheat sheet for what’s on offer:

- Crypto deposits/withdrawals: Bitcoin, Ethereum, USDT, and dozens more—all major coins supported.

- Fiat deposits/withdrawals: USD, EUR, GBP, JPY. But here’s the catch: You need full verification (KYC complete) for bank transfers.

- Bank transfer methods: SWIFT, SEPA (for Europe), and wire transfers. No credit/debit card direct support at the moment—something Bitfinex users have been asking for in forums worldwide.

Speed also matters. Crypto deposits usually process in minutes, but big fiat transfers via bank can take 1-3 business days. Withdrawals may face review if the amount is substantial or if your account triggers any compliance flags—something that spooks new users but is perfectly normal at this level.

Limits – From Minimum Trades To Maximum Withdrawals

Limits aren’t just small print—they seriously impact how you use Bitfinex.

- Minimum trade size: Typically 0.0002 BTC (or equivalent), though it varies by coin.

- Minimum withdrawal: For many currencies, it’s as low as $5 (in crypto equivalent). This is great for small portfolios, but watch gas fees on certain coins; network congestion can still eat into your withdrawal.

- Maximum withdrawal: It’s mostly dictated by your verification level. Fully verified users can pull out up to $10M per 24 hours via bank transfer. For non-verified or low-KYC accounts, expect daily limits in the low thousands (if you can withdraw fiat at all).

One thing I’ve noticed: Sometimes, Bitfinex adjusts limits or fees under market stress or for specific accounts if there’s odd activity—so always check the wallets page for up-to-date details before making a big move.

Are these fees and limits exactly what you expected? Or do you still have worries about getting your money back from Bitfinex—or whether your country is even supported? I’ve got all your burning questions coming up next, including the real reasons why your withdrawal might get delayed (with real solutions!). Curious how long verification actually takes, or what to do if things go sideways? Get the answers just ahead…

Frequently Asked Questions About Bitfinex

How do I withdraw money from Bitfinex to my bank account?

Withdrawing your funds to a bank account on Bitfinex is possible for fully verified users. The process goes like this:

- Head to the “Withdraw” section on your Bitfinex dashboard.

- Select your fiat currency (like USD, EUR, or GBP).

- Enter your bank account details. Make sure the account name matches your Bitfinex-verified identity to avoid any hiccups.

- Pick your amount, double-check the info, and submit. You’ll usually need to confirm via email.

Most fiat withdrawals are done by wire transfer. In my experience and based on the feedback I see from others, these transfers can take anywhere from 1–5 business days, depending on your bank, country, and the workload on Bitfinex’s side. Remember, you’ll need to have completed full KYC (Know Your Customer) verification, which can take a bit, so factor this in if you’re planning to withdraw for the first time.

What is the minimum withdrawal on Bitfinex?

Bitfinex has set the minimum withdrawal for most cryptos at the blockchain fee plus a small fixed exchange fee (often as low as $5). For fiat withdrawals, the minimum is generally $10,000, which is much higher than on some newer exchanges. This can be off-putting if you only have a small balance. Always double-check Bitfinex’s official fee schedule, since crypto and fiat minimums can change based on network congestion and bank policies.

Is Bitfinex safe to use?

Bitfinex has come a long way in terms of security. Back in 2016, it was hit by a huge hack—but since then, it’s ramped up its safety with things like:

- Two-Factor Authentication (2FA)

- Universal 2nd Factor (U2F) support for hardware security keys

- Advanced withdrawal whitelisting

- Regular penetration testing

No exchange is risk-free, but today Bitfinex is seen as one of the more secure options, provided you take basic steps like turning on 2FA and not keeping large sums you’re not trading. I always suggest keeping only what you need for trading on exchanges, and storing bigger holdings in a private wallet.

How long does it take to get verified?

Verification times can really vary. For most people, Bitfinex’s verification takes 2–3 days if you submit all documents correctly. Sometimes, though, especially during busy times or if your documents aren’t clear, the wait can stretch to a week or more. Pro tip: double-check your IDs, proof of address, and make sure all info matches your account. If you’re in a hurry, follow up via their support ticket system.

Does Bitfinex support my country?

Bitfinex is available in most countries, but not everywhere. Residents of the USA, Canada, North Korea, Iran, Crimea, Syria, and a few others can’t use the service. They keep their restricted jurisdictions page updated, so it’s worth checking before you go through verification. If you’re outside those blackout zones, you’re probably good to go.

What if I have a problem? How do I contact support?

Bitfinex customer support is handled via an online ticket system—you submit your issue, and support gets back to you by email. They answer most queries within 24–48 hours, though it can take longer for complex requests. There’s also a live chat option for urgent issues, but it’s not always available. You can find the help widget on the bottom right of the dashboard or go straight to their submit a request page. For general answers, their Help Center is honestly pretty thorough and gets updated fast.

Other questions I get from the crypto community

- Can I buy crypto with a credit card on Bitfinex?

Not directly yet—Bitfinex mainly supports bank transfers for fiat deposits and withdrawals, but you can use third-party payment providers for card purchases. Fees will vary. - Are there mobile apps?

Yes, Bitfinex has official iOS and Android apps—perfect for trading or monitoring markets while you’re on the move. - Does Bitfinex offer staking or other ways to earn?

They offer staking, margin trading, and lending services, so you can earn with your crypto—even if you’re not an active trader.

Still have a question that’s been bugging you about Bitfinex, or want to know what really sets it apart from other big exchanges? Stick around—I'll be breaking down how Bitfinex stacks up against the competition in the next section.

How Bitfinex Compares & Final Thoughts

Other Top BTC-To-USD/Crypto-To-Fiat Exchanges (and Resources Worth Checking Out)

Bitfinex has always had a special place on my watchlist because of its BTC-to-USD volume and liquidity. Still, it’s far from your only choice—especially with so many crypto-to-fiat exchanges stepping up their game.

Want quick access to your funds in USD or EUR? You’ll want to keep an eye on these names too:

- Coinbase – Probably the easiest for most new users; very “bank-like” experience, but watch out for those fees.

- Kraken – Highly rated for fiat on/off-ramps and usually strong on security. Sometimes the interface isn’t as pretty, but it gets the job done.

- Binance – Giant selection, but not always the smoothest fiat withdrawal for everyone (especially US residents).

- Gemini – Well-polished, US-regulated, a favorite for big transfers, but limited selection compared to Bitfinex.

If you’re ultra-focused on turning your crypto into cash (and vice versa) take a look at my full review of the best crypto-to-fiat exchanges—I always keep it up to date as these platforms shift and regulations change.

A cool stat: Around 70% of global Bitcoin volume regularly passes through just five exchanges according to Kaiko’s 2023 industry report. Bitfinex is almost always in that top group, showing you its place in the big leagues.

Should You Use Bitfinex?

Alright, here’s my honest take, summarizing all the hours I’ve spent poking, prodding, and even yelling at the screen during late-night trades:

- If you’re interested in advanced trading, big withdrawals, or margin features, Bitfinex delivers pretty much everything you could want. The liquidity on BTC/USD is top-tier (seriously, huge orders barely dent the price), and pro tools are everywhere.

- If you’re nervous about security, I get it—Bitfinex’s history includes some rough patches. But I have to admit, their security approach now is thorough (think: 2FA, withdrawal whitelists, strong anti-phishing education).

- If you hate clunky verification, this isn’t the easiest onboarding experience. But once you’re in, the hoops do help keep scammers away (and most legit users only do it once).

- Just looking for the fastest, simplest way to buy your first crypto? Honestly, you’re probably better served with something like Coinbase. But if you graduate to higher volumes, Bitfinex could be worth learning.

Watch out for withdrawal fees—they aren’t the lowest in the industry, but they’re not hidden either. Serious traders won’t be surprised, but first-timers might be. And if you ever get stuck, Bitfinex’s support team, while not always instant, has gotten way better over the years (I say this from personal experience, thank goodness for live chat upgrades!).

Wrapping Up: Is Bitfinex Worth It For You?

So, after breaking it all down—who is Bitfinex actually best for? Here’s my go-to rule:

If you want deep liquidity, full-featured tools, and don’t mind a bit of learning curve, Bitfinex stands tall among the options—especially when trading serious amounts or juggling multiple assets.

It’s not for everyone. But for the right trader? It’s a powerhouse. Just be sure you understand what you’re signing up for, follow security best practices (seriously, set up that 2FA), and read those fee tables before moving big money in or out.

Curious how Bitfinex compares face-to-face with other top crypto-to-fiat exchanges? Want a fresh look at which platforms are getting better (or worse) right now? Check out my best crypto-to-fiat exchange review or drop your thoughts in the comments—there’s always someone new learning from your experience.

That’s it from me. Whatever your choice, trade safe and smart, and don’t forget to bookmark this guide for your next crypto adventure!