The Relationship Between Bitcoin Halving, Mining Profitability, and Speculation

The prevailing narrative of the upcoming bitcoin halving centers around its perceived impact on the price of bitcoin. A large fraction of crypto enthusiasts believes that the price of bitcoin will surge as a result of increased scarcity when block rewards reduce by a factor of 2. However, people seem to forget that bitcoin halving will likely have a multifaceted impact on the bitcoin economy, which makes such optimistic views somewhat dicey. For one, there is no telling how bitcoin halving will affect mining and, in turn, the security of the network.

In light of these uncertainties, I have decided to explore halving aftereffects on the bitcoin network, highlight arguments for and against the price uptrend narrative, and discuss the role of mining activities in this conversation. But, let’s first give you a recap on the concept of bitcoin halving.

What Is Bitcoin Halving?

What Is Bitcoin Halving

Bitcoin halving is the reduction of block rewards on the bitcoin blockchain by a factor of 2. At the moment, the bitcoin’s block reward is pegged at 12.5 BTC. And by May 14, this block reward will reduce to 6.25 BTC. Why is this so?

Satoshi Nakamoto, the creator of bitcoin, envisaged that without the proper framework, stakeholders of the cryptocurrency’s network will not be incentivized to maintain the consensus mechanism establishing the decentralization of the blockchain. Hence, Satoshi effected a crypto-economy, where people earn bitcoin for their contributions to the security of the entire ecosystem. To become eligible for this reward, miners dedicate their computing power to solving mathematics problems. The first person to solve this gets to unlock a new block, load transactions on it, and make extra earnings through transaction fees.

Therefore, the system makes bitcoin mining appealing and profitable for miners to fortify the defenses of the bitcoin blockchain. However, Satoshi also implemented a protocol, which would protect the bitcoin economy from inflation. This algorithm halves block rewards roughly every four years until the system attains its supply limit of 21 million BTC. As at when Satoshi launched the cryptocurrency, the reward for finding a new block was 50 BTC. Four years later, it dropped to 25 BTC, and in 2016, it fell to 12.5 BTC.

While this is a given, pundits have speculated that the upcoming halving might spur the next bitcoin bull market. The reason being that the supply of bitcoin after the halving wouldn’t match its demand, which is expected to cause the price of the digital assets to surge to new highs. As such, the hysteria regarding the prospect of the coming event is building up steam, and this is evident in the spike of the search of “Bitcoin halving” on Google. Although the growing interest might have a positive impact on the price of bitcoin in the days leading to the halving of bitcoin, there is, however, no saying whether this uptrend will hold post-halving. There are several factors, apart from the law of demand and supply, that might influence the aftereffect of the forthcoming bitcoin halving. In this article, I will focus on the profitability of bitcoin mining and speculations.

How Does Bitcoin Halving Intertwine with Bitcoin Mining?

How Does Bitcoin Halving Intertwine with Bitcoin Mining

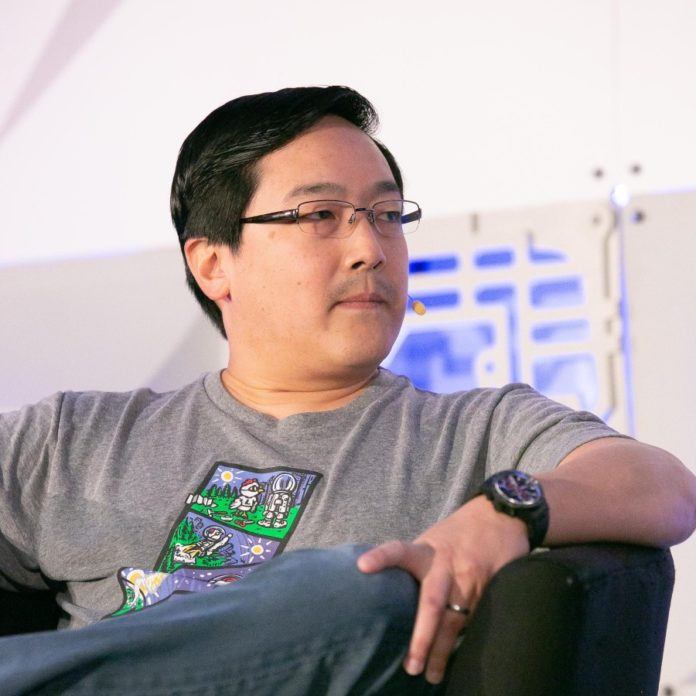

Having explained the fundamentals of bitcoin mining, you will agree that the mining of bitcoin is only profitable when the value of earnings surpass that of the cost of operation. In other words, to run a profitable mining business, a miner has to reconcile the cost of setting up a mining rig, the electricity consumed, and the money earned from such activities. That said, this basic accounting will come under scrutiny in the aftermath of bitcoin halving. Steve Tsou, Global CEO of RRMine, reiterated this sentiment when he stated:

Steve Tsou, Global CEO of RRMine

“The halving in 2020 will have great impacts on Bitcoin miners: 1) Miners with low mining efficiency will be forced to pause and re-evaluate their business operations. 2) Digital mining is becoming the racetrack for giant international companies because they have more advanced machines and cheaper sources of electricity.”

In a scenario where earnings no longer cover the cost of mining bitcoin, there is every possibility that miners would ditch bitcoin mining for other profitable mining activities. For this not to happen, the value of bitcoin must rise to cover for the deficit brought about by the reduction of the number of bitcoins earned after successfully finding a new block.

In light of this, Jeffrey Barroga, a digital marketer at Paxful, explained that hobbyists and small-scale miners might need to have a rethink as regards their chance of making profits if 2020’s halving does not induce a price rally. Barroga explains:

Jeffrey Barroga, a digital marketer at Paxful

“Mining is already competitive and resource-extensive as it is, and when you combine that with the impending block reward reduction in May, hobbyist miners and small players might find that whatever BTC they gain is insufficient to pay for the overhead costs of running their rigs.”

And from what history has taught us so far, it is not etched in stone that the price of bitcoin would experience a surge immediately after the halving of rewards.

According to a detailed report published in 2019, the price of bitcoin increased by 152% 90 days after the first halving of bitcoin. On the other hand, the post-halving price of bitcoin in 2016 was fairly stable.

The report reads;

“Bitcoin has seen two-block reward halvings in the past, with its next halving expected to occur in May 2020. 90-days prior to bitcoin’s first halving its price saw a 15% increase, whereas 90-day post-halving price increased by 152%. Mining profitability saw a 50% decrease as the block reward halved on 28th November 2012 but bounced back to its previous level as the price rallied. During its second halving Bitcoin saw a stronger pre-halving rally with a 55% price increase. However, its price started moving sideways in the post-halving period due to which mining profitability was unable to regain its previous level.”

As such, the price of bitcoin after a reward halving, to an extent, determines the profitability of bitcoin mining. If miners discover that they spend more than what they make, we will see an exodus of miners to other PoW consensus-based cryptocurrencies that do not consume as much electricity as Bitcoin. Needless to say, this will inadvertently affect the hashrate of the bitcoin network, which just recently hit its all-time high.

Note that hashrate in this context defines the difficulty of finding a new block and also indicates the security status of the network. Blockchains with high hashrates have a considerable number of miners vying for blockchain rewards, a high block difficulty status, and are less susceptible to attacks. Whereas the drastic reduction of hashrates suggests that the community of the blockchain’s miners has shrank, which entities can take advantage of to manipulate the content of the blockchain.

To mitigate this risk, pundits suggest that miners could avert the effects of halving by adopting more sophisticated mining machines or relocating to a region where electricity is cheap. According to Simon Harman, CEO of Australia-based Loki, “mining is a zero-sum game, in that all miners compete for the same reward. If profitability falls below zero, some miners will switch off their hardware to someone else’s benefit. The key to maintaining a successful mining operation is to always have the most efficient hardware and the cheapest electricity.”

What Will Happen If Miners Ditch the Bitcoin Blockchain?

What Will Happen If Miners Ditch the Bitcoin Blockchain

As stated earlier, the security of the bitcoin blockchain will lose its potency if miners were to snub bitcoin for more profitable mining activities. Nonetheless, there are other implications. For one, miners might choose to sell their bitcoin holding, which might further pull the price of the digital assets downwards. Hence, instead of the widely projected bull rally, the bitcoin market might tumble as a result of the unprofitability of bitcoin mining.

This assertion rings true as two other cryptocurrencies with similar consensus algorithms as the bitcoin protocol will also experience halving in 2020. Prior to bitcoin’s halving in May, the block rewards of BCH and BSV networks would have halved, and experts believe that these strings of events would have a ripple effect on the crypto mining community as a whole. Recall that mining war is not a new thing in this space, especially for cryptos deeply-rooted in bitcoin’s consensus functionality.

However, there is another possibility. Rather than ditch bitcoin, miners could adopt what we call merge mining. With this, miners can concurrently mine both bitcoin and a low energy consuming coin in the background at no additional cost. Therefore, it becomes possible to mitigate the shortcomings of bitcoin mining by supplementing earnings with profits made from another mining activity.

As regards security, the potential fall of the hashrate of the bitcoin blockchain resulting from an exodus of miners could spur more people to take up bitcoin mining. This notion holds as lower hashrates translates to lower blockchain difficulty, which will appeal to hobbyists or small-scale miners. Hence, the bitcoin mining economy is a never-ending cycle in a competitive ecosystem, where one entity profits from the demise of another.

The Litecoin Case Study

The Litecoin Case Study

In 2019, the Litecoin blockchain activated its halving protocol, which saw the blockchain reward decrease from 25 to 12.5 LTC. Ahead of this halving, the creator of Litecoin, Charlie Lee, projected that the price of Litecoin would rise post-halving. When asked about the factor that bore this assertion, Lee gave an all-too-common sentiment void of sophisticated analysis. He based his expectation on people’s reaction to market trends.

Charlie Lee stated:

Creator of Litecoin, Charlie Lee

“So a lot of people are buying in because they expect the price to go up and that’s kind of a self-fulfilling prophecy. So, because they’re buying in, the price does actually go up.”

Contrary to this notion, the immediate effect of halving on the price of bitcoin was not all that straightforward. Although the price of Litecoin had jumped from $79 to $100, however, this trend was unsustainable as the price retracted. That was not all. The hashrate of Litecoin dropped by 40%, which highlighted the argument raised earlier in this article. And by December, it had set new lows for the year 2020. If the aftereffect of Litecoin is anything to go by, then the prospect of Bitcoin’s upcoming halving is looking less optimistic.

Nonetheless, there is a valid counterargument that history seems to favor bitcoin halving, with 2016’s halving resonating as a perfect case study. Recall that the price of bitcoin went ahead to reach an all-time high at the end of 2017. While this is a given, there were a lot of factors that could have had a hand in this. The first is the ICO boom experienced during the same period. There was so much hype surrounding cryptocurrency that it was almost impossible for the price of bitcoin not to sustain an uptrend.

Another factor was the growing visibility of crypto in the global market. I remember how, for the first time, governments and established companies began to show interest in the nascent technology. All this attention fed a hysteria that eventually led to the bull market of 2017. In other words, it all boils down to speculation.

Crypto market analysis firm, Coin Metrics, reiterated this sentiment in a report that discussed the lack of historical data to develop a faultless template to predict the price of bitcoin before or after the forthcoming halving.

The report explained that “the short history and infrequent nature of block reward halvings have prevented us from drawing strong conclusions.” Also, the report asserted the speculative side of the bitcoin market and stated that it could only take the proactiveness of a small fraction of investors, acting on the premise of the bitcoin’s projected price trends, for the bull market to kick in.

The report reads:

“In fact, all that is required is the existence of a small fraction of market participants who control enough capital and act upon this information to force prices to react… Even if no logical cause-and-effect relationship exists between halvings and prices, the narrative (or belief that others will act on this narrative) can cause a self-fulfilling increase in prices as market participants attempt to enter positions in advance of other market participants doing the same thing.”

Hence, speculation is the ultimate price indicator.