What is Bitcoin’s Halving and Why does it Affect the Price of Bitcoin?

What is Bitcoin Halving, and Why Does It Impact Bitcoin’s Price?

Ever wondered why the Bitcoin community goes wild every four years? You’ve probably seen the hype: headlines about Bitcoin halving being a “game-changer” for crypto, market experts making bold predictions, and Twitter debates erupting with excitement. But here’s the real question: What makes this event so significant, and how does it shake up Bitcoin’s price like clockwork?

Let’s break it down together. Bitcoin halving isn’t just some random event—it’s hardcoded into Bitcoin’s DNA, designed to limit its supply and keep it scarce. And if there’s one thing economics has taught us, scarcity can drive value. Imagine having the inside scoop on why this matters not just for Bitcoin but for investors, traders, and miners worldwide. Sounds intriguing, doesn’t it?

Why do people care so much about Bitcoin halving?

Let’s be real—this isn’t just nerdy blockchain stuff. Bitcoin halving grabs attention because it’s historically linked to big price swings. Whether you’re a seasoned crypto investor, a curious newbie, or running mining rigs in your basement, this event has real-world consequences. But why does halving generate such buzz? The answers may surprise you.

The supply and demand game

Okay, picture this: Every 10 minutes, new Bitcoin is created and rewarded to miners who maintain the network. But during a halving event, the payout miners receive is cut in half. So, fewer new Bitcoins enter circulation. Now, let’s think about demand. If demand for Bitcoin stays steady—or, more likely, keeps growing—while supply creation slows down, what happens? Prices often climb.

It’s a classic case of supply and demand at work. And the craziest part? We’ve already seen this pattern happen three times in the past decade. It’s not a promise, but history sure does have a way of rhyming.

Past halvings and market trends

Let’s see what history has taught us:

- 2012 Halving: The first-ever Bitcoin halving. Shortly afterward, Bitcoin’s price shot up from around $12 to over $1,000 within a year. That’s not hype—it’s numbers.

- 2016 Halving: This halving saw Bitcoin rise from about $650 to nearly $20,000 by the end of 2017. Talk about a massive bull run.

- 2020 Halving: Halving saw Bitcoin explode from $9,000 to $69,000 within 18 months, marking a new all-time high. That’s a 600% increase.

- 2024 Halving: The latest halving on April 19 saw Bitcoin explode from $63,670.02 to $108,135.00 within 8 months, marking a new all-time high.

Does this mean the next halving in 2028 guarantees another price surge? Not necessarily. But at the very least, the trend is hard to ignore.

Why this matters if you’re an investor or miner

If you’re an investor, Bitcoin halving is one of those events you mark on your calendar. The reduced supply often feeds into a wave of excitement, speculation, and—you guessed it—price action. Whether you’re in the game for trading or holding, timing matters, and halving is your golden opportunity to strategize.

But for miners, halving is a double-edged sword. Sure, Bitcoin might be worth more, but fewer rewards mean tighter margins. If you’re running mining operations, it might mean upgrading your gear, cutting costs, or even rethinking the whole operation. The stakes couldn’t be higher.

So, where does this leave us? Why is Bitcoin programmed this way, and what’s the big picture behind halving? In the next part, we’ll peel back the layers and explore exactly what Bitcoin’s halving is, how it works, and why it’s so important. Are you ready to find out? Let’s keep going!

What exactly is Bitcoin’s halving? Breaking it down

Alright, let’s cut through the noise and get straight to it—what does Bitcoin’s halving even mean? If you’re new to crypto or maybe just need a refresher, don’t sweat it. I’m here to break it down in a way that actually makes sense. We’ll start simple and then get a little deeper. Ready?

The basics: how Bitcoin rewards work

First things first—Bitcoin is powered by a network of miners. These miners aren’t digging for gold; they’re solving complex puzzles (aka cryptographic algorithms) to process transactions and secure the network. For their hard work, miners are rewarded with newly created Bitcoins for every block they successfully validate. This is where halving comes into play.

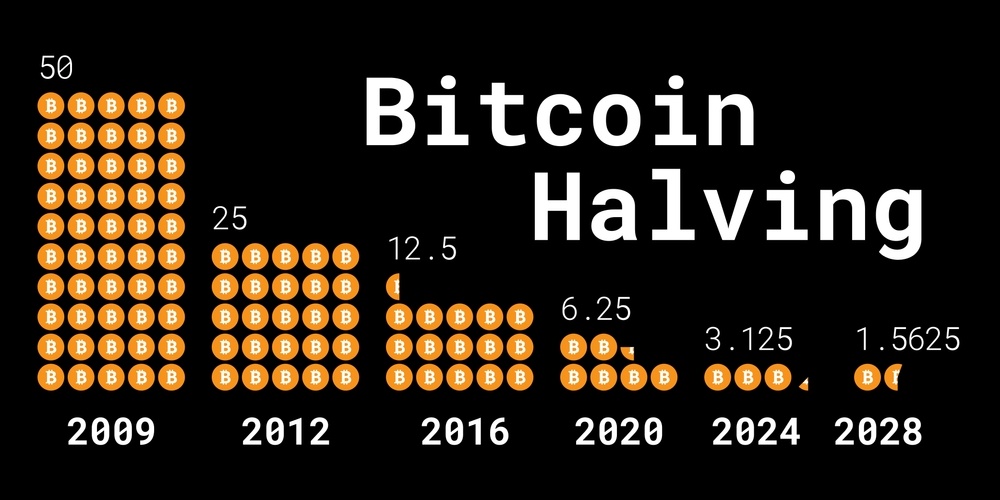

Here’s the catch: every 210,000 blocks (roughly every four years), the reward miners receive gets slashed in half. Back in 2009, miners were raking in a whopping 50 BTC per block. By 2024, that reward droped to just 3.125 BTC. This isn’t some random decision—it’s built into Bitcoin’s core design to control supply.

“The nature of Bitcoin is such that once version 0.1 was released, the core design was set in stone for the rest of its lifetime.” — Satoshi Nakamoto

That’s right—the halving mechanism is hardcoded into Bitcoin’s DNA. It’s part of what keeps Bitcoin unique, and why supply matters so much. But why cut rewards in half? Let’s take a closer look.

Why cut rewards in half?

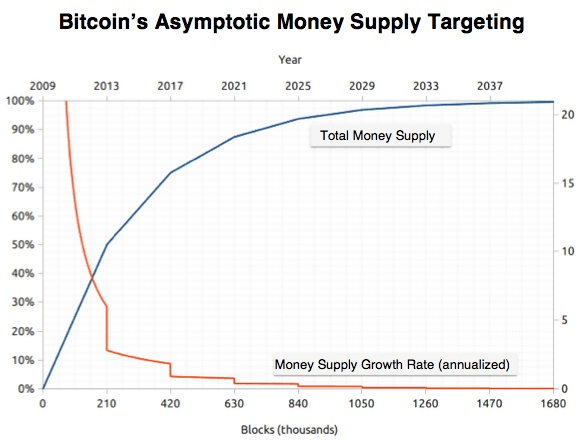

If you’ve heard people say Bitcoin is “digital gold,” this is where that comparison starts to make sense. There’s a total cap of 21 million BTC. That’s it. No more, no less. Once all 21 million coins are mined, there won’t be any new Bitcoin created. This scarcity is why Bitcoin is seen as a store of value.

The halving is designed to slow down Bitcoin’s supply over time. Think about it: if miners could just extract endless amounts of Bitcoin, it wouldn’t be rare—it’d just be like any other currency that governments can print whenever they want. Halving ensures the rate at which new Bitcoin enters circulation steadily decreases, which keeps scarcity in check.

To put it simply, it’s the opposite of inflation. While the dollar (and most fiat currencies) lose value over time due to overprinting, Bitcoin’s halving keeps its supply limited. That’s a game-changer when you’re talking about long-term value.

Where are we now in Bitcoin’s halving timeline?

Let’s talk timing. Bitcoin’s first halving was back in 2012, the second in 2016, and the third in 2020. So 2024 halving sliceed miner rewards, once again, from 6.25 BTC per block to 3.125.

What’s interesting is how each halving has led to not just a slowdown in supply but also massive conversations about its impact.

If history is any guide, halvings aren’t just a technical tweak for miners—they’re events that ripple through the entire crypto market. But how exactly does this shift affect Bitcoin’s price?

Let’s see how this plays out in the numbers and the psychology of the market in the next section. Spoiler: you’ll want to keep reading to understand how past halvings have shaked up Bitcoin’s value!

How does halving affect the price of Bitcoin?

Let’s talk about what actually happens to Bitcoin’s price when halving comes around. If you’ve ever heard someone say, “Bitcoin gets scarce, and the price goes up,” they’re only partly right—it’s a bit more layered than that. Grab your favorite beverage; we’re about to break this whole thing down in a way that makes perfect sense.

The supply shock theory

Imagine walking into a local bakery that suddenly announced their most popular bread would now only be baked in half the usual quantity. Fewer loaves available, still the same number of loyal customers—they’d probably double the price per loaf, right? This is essentially how halving works for Bitcoin.

Every four years, the number of new Bitcoins that miners can earn gets cut in half. With fewer new coins entering circulation, there’s a noticeable change in the supply. When demand for Bitcoin remains strong—or even grows—this reduced supply creates what economists call a “supply shock.” It’s almost like turning off the tap on a big tank of water while people are still thirsty. The result? Pressure builds, and prices often climb.

Take the 2020 halving, for example. Right before the event, Bitcoin’s price was around $8,600. Six months later, it was knocking on the door of $20,000 and, within a year, hit its all-time high above $60,000. While this doesn’t guarantee similar events in the future, it’s hard to ignore what’s happened before.

Historical halving trends and price changes

If we give history a quick rewind, there’s a pattern that’s tough to miss. After the three previous halvings (2012, 2016, and 2020), Bitcoin experienced significant price surges.

- 2012 Halving: Price before the event? Around $12. A year later? Over $1,000. That’s not a typo—Bitcoin went parabolic.

- 2016 Halving: Pre-halving price hovered at $650. By the end of 2017? We saw the infamous $20,000 rally.

- 2020 Halving: As mentioned earlier, Bitcoin flirted with $60,000 within a year of its halving moment.

- 2024 Halving: The latest from $63,670.02 to $108,135.00 within 8 months, marking a new all-time high.

These numbers speak for themselves. But before you assume halving equals an automatic trip to the moon, remember: there’s more to the story. Each bull run also had external factors, like growing adoption, institutional interest, or even social-media-fueled excitement. Still, halvings undeniably kick off a strong momentum wave in Bitcoin’s history.

Speculation and market psychology

Now, let’s get real. In the lead-up to a halving, the air buzzes with speculation. Investors, traders, and even casual HODLers start talking, theorizing, and—most importantly—buying. This anticipation alone can create a strong price movement, even before the halving event happens.

Here’s the thing about humans: we’re emotional creatures, and when enough people convince themselves something big is going to happen, they act accordingly. That’s why you’ll often see Bitcoin climbing in the months leading to a halving. And after? Well, post-halving, excitement often transitions to a volatile period. Some might cash out for profits, while others wait for potential all-time highs.

“Markets are driven by greed and fear. Pre-halving optimism stokes the greed, but post-halving dips often test the nerves.” – Anonymous Crypto Analyst

While some seasoned investors thrive on this volatility, it’s not for the faint of heart. Short-term swings can be dizzying, testing your resolve. But it’s all part of the Bitcoin halving drama we’ve come to expect!

Here’s the real question: what happens to miners, the backbone of Bitcoin, when their rewards get slashed in half? Will the network stay strong, or will it face a shake-up? Let’s explore that next.

Why Do Bitcoin Miners Care About Halving?

Here’s the thing about Bitcoin halving—it’s not all fireworks and price pumps for everyone. While holders and traders usually relish the excitement of a potential price surge, Bitcoin miners face the cold reality that halving takes a direct hit at their revenues. Let’s break it down together.

Halving Reduces Miner Rewards

Imagine clocking into work and finding out your paycheck just got cut in half. That’s essentially what happens to Bitcoin miners every halving. The rewards for mining a block drop by 50%, meaning fewer Bitcoins rolling into their wallets for the same amount of effort.

This isn’t just numbers on a computer screen; it’s serious business. For smaller or less efficient mining operations, a halving can turn profitability into a distant memory. Some miners might even shut down their rigs altogether, unable to cover the costs of staying in the game.

Take the previous halving events as proof: In 2020, when block rewards dropped from 12.5 BTC to 6.25 BTC, many smaller miners were forced to close shop. At the same time, larger operations with cutting-edge equipment thrived, consolidating the mining landscape into the hands of those who could afford to upgrade. Halving is a brutal yet fascinating test for miners.

Energy Costs vs. Block Rewards

Miners don’t just use machines and hope for the best—they’re running high-powered equipment 24/7, which guzzles electricity like there’s no tomorrow. After a halving, the question of energy costs vs. block rewards becomes more critical than ever.

For example, let’s say it costs $20,000 in electricity and maintenance to mine one Bitcoin. If Bitcoin’s price stays at $25,000 after the halving, miner profit margins shrink dramatically. This forces miners to either optimize their operations, invest in more efficient hardware (which isn’t cheap), or hope the price of Bitcoin shoots to the moon. It’s a life of constant calculation and adjustment.

Even big players have to navigate these challenges carefully. A report from the Cambridge Centre for Alternative Finance estimates that roughly 46% of mining operations rely on sustainable energy sources—partly as a way to control costs. The halving puts even more pressure to find innovative ways to stay competitive.

Impact on Bitcoin Network Security

Here’s a point you might not have thought about: when miners leave the network because of shrinking rewards, what does that mean for Bitcoin’s security? Miners don’t just mine blocks—they also play a key role in verifying transactions and maintaining the blockchain’s integrity.

While it’s true that halving events have caused temporary dips in Bitcoin’s hash rate (a measure of network strength), the network has always managed to adapt. As fewer miners compete for blocks, the protocol adjusts the difficulty of mining to ensure blocks continue to be validated approximately every ten minutes. This ensures Bitcoin’s security doesn’t collapse like a house of cards.

“Bitcoin is like a honey badger—it just doesn’t care,” as Andreas M. Antonopoulos puts it. This resilience is part of why Bitcoin continues to thrive despite the drop in miner participation after every halving. But it’s worth keeping an eye on whether future halvings could encourage centralization in mining, potentially affecting how decentralized the network really is.

What Does This Mean for Bitcoin Miners—And You?

Miners bear the brunt of halving events in ways most people don’t fully understand. The reward cuts are a game-changer for their profits, their strategies, and, in some cases, their survival in the industry. But here’s the kicker: their struggles might indirectly benefit you as an ordinary crypto enthusiast. The dynamics miners navigate to keep operations running often feed into Bitcoin’s price trends and potential long-term scarcity.

So, the obvious question is… if halving places so much pressure on miners and network dynamics, does it always guarantee a bull market like clockwork? Don’t worry; the next section dives into that mystery head-on. Stay curious—you might be surprised by what you learn!

Does Bitcoin Halving Always Lead to a Bull Market? Let’s Clear It Up

Let’s get real for a moment. Everyone loves a good success story, and Bitcoin’s halving events often come wrapped in hype about soaring prices and endless bull markets. But is it true? Does every halving guarantee Bitcoin’s price will moon? Not so fast. While history gives us some exciting clues, there’s a bigger, more layered story beneath the surface that you deserve to know.

Correlation, Not Causation?

It’s easy to connect the dots and think, “Halving equals price explosion.” After all, that’s what we’ve seen in previous cycles, right? While it’s true that Bitcoin has had incredible price runs following each halving, let’s hit pause for a second and ask the critical question: Is it solely because of the halving?

A study published by CoinMetrics pointed out that while halvings create a supply shock, it’s not the sole driver of price increases. Investor behavior, technological developments, and market maturity all play key roles. For example, in 2017 (a year after the 2016 halving), the ICO boom significantly fueled Bitcoin’s rally. It wasn’t just about halving—it was a mix of other factors creating the perfect storm.

“History doesn’t repeat itself, but it often rhymes.” – Mark Twain

This quote hits the nail on the head for Bitcoin halvings. Yes, there’s a pattern, bu

t let’s not forget the bigger picture. The market has many moving parts, and halving is just one piece of the puzzle.

Macroeconomic Factors

Now, let’s talk about the elephant in the room: macroeconomics. No one trades in a vacuum, and Bitcoin is no exception. In 2020, the third halving happened during a global pandemic. While Bitcoin’s price did eventually climb, that same year saw massive government stimulus packages and quantitative easing, pumping liquidity into every corner of the market—including crypto.

Inflation fears and reduced confidence in fiat currencies played a big role in Bitcoin’s rise. In contrast, a future halving could happen under completely different conditions, like tighter regulations, stricter monetary policies, or geopolitical crises. If inflation is tamed, or if a global recession strikes, those factors could easily overshadow the halving event. It’s kind of like expecting a sunny picnic during hurricane season—the timing and environment matter just as much as the event itself.

Could a Crash Happen Instead?

And while we’re at it, let’s address the unspoken worry. Could the next Bitcoin halving lead to a crash instead of a rally? Short answer: absolutely. Remember, halving doesn’t guarantee smooth sailing. In fact, Bitcoin has a knack for shaking out weak hands before making big moves. Just look at the massive corrections that usually follow bull runs. In 2013 and 2017, we saw vicious pullbacks even after halvings had set off explosive growth.

Some traders call this the “honeymoon phase” of halving euphoria where prices initially rise but then experience harsh reality checks. It’s a reminder that Bitcoin’s volatility doesn’t go on vacation. What if sentiment swings lower just when you least expect it? That’s the kind of uncertainty you can’t ignore if you’re serious about Bitcoin.

So, does halving automatically mean a bull market? Maybe not. But here’s the real question: Are the pros expecting a repeat of past trends, or do they see something entirely new brewing in 2024/25? Stick around—a few insiders are ready to spill the beans next.

Insights from Bitcoin Halving Experts

They say history doesn’t repeat itself, but it often rhymes, right? That’s exactly why insights from Bitcoin halving experts are pure gold for anyone watching the 2024 event unfold. So, what’s the word on the street from the pros who’ve seen it all before? Let’s unpack it.

2024/2025 Predictions from Industry Analysts

What’s got the crypto world buzzing? Analysts across the board are brimming with predictions about the potential impact of the 2024 halving—and trust me, they’re not just throwing darts at a board. When PlanB, the creator of the famous Stock-to-Flow (S2F) model, points out how halving events are intrinsic to Bitcoin’s scarcity-driven value, people listen. For those wondering, his model predicted significant price surges after previous halvings—and while not spot on every time, it’s leaned frighteningly close.

Then, there’s Willy Woo, the on-chain analyst, who expects miners’ reduced block rewards to ripple through supply metrics in 2024. He suggests that retail interest—especially from newcomers—could see a sharp boost post-halving as Bitcoin’s unique value proposition becomes even clearer (scarcity has a way of grabbing attention). Woo’s insight? Expect long periods of consolidation before any potential breakout, but that breakout could be monumental. Are you prepared?

Even Mike McGlone from Bloomberg Intelligence has chimed in, referring to Bitcoin as a “pre-halving coiled spring.”

Lessons from Previous Halvings

Let’s not forget the crypto OGs–seasoned traders who know halving cycles like the back of their hand. They’ve been here since the first halving in 2012, followed by 2016, and then the recent one in 2020. So, what’s the wisdom from those who’ve weathered the past three halvings?

- Lesson 1: Patience pays off. After the 2012 halving, it took months before the market saw exponential price growth. The 2016 and 2020 halvings followed a similar pattern. Are price explosions immediately after halving possible? Unlikely. But waiting has often rewarded the patient HODLers.

- Lesson 2: Anticipation is often more chaotic than the event itself. Traders report that prices tend to swing wildly leading up to halving, fueled by speculation and market psychology. Post-halving? Things calm down—until the supply shock starts to be felt. It’s like a delayed fuse.

- Lesson 3: Be ready for surprises. Who could forget 2020? The world grappled with COVID-19, yet Bitcoin rebounded spectacularly after halving, climbing to its peak of over $60,000 not long after. Outside forces matter—but seasoned investors say halvings set the foundation for massive growth anyway.

One trader famously remarked after the 2016 halving: “If you’re not planning for Bitcoin’s future supply cap, are you even paying attention?” It’s bold—and maybe a little smug—but there’s truth there.

The big takeaway from these experts and traders is simple: You can’t afford to be complacent. Whether it’s charting market sentiment, understanding on-chain fundamentals, or thinking long-term, the halving shouldn’t just be news you read—it has to be part of your strategy.

But here’s a question for you: What’s your plan for the 2024 halving? There’s no perfect formula, but sticking around for what’s coming next might just help you craft one.

How can you prepare for the next Bitcoin halving?

The Bitcoin halving isn’t just another date to circle on the calendar—it’s an event that could make or break your strategy, whether you’re an investor, a trader, or a miner. You know it’s coming. The real question is: Are you ready for it? Let’s talk about what you can do now to position yourself for the opportunities and challenges that come when the halving hits.

Think long-term investments

If you’re a HODLer, this one’s for you. Bitcoin halvings have historically been followed by price increases, but let’s not forget the key here: patience. It’s easy to get caught up in short-term volatility, but the real winners are often those who stay focused on the long game. Remember, every halving reduces supply, and with Bitcoin’s demand growing year after year, the math eventually starts to make sense.

Here’s where you need to shift your mindset. Instead of trying to time the market perfectly (seriously, how’s that ever worked out for anyone?), consider dollar-cost averaging (DCA). A study by Arcane Research found that Bitcoin DCA investors tend to outperform those who try to predict every peak and dip. Small, consistent investments can help you weather the stormy swings and participate in long-term gains without losing sleep.

“You make most of your money when you wait. Impatience just gets you broke faster.” – A seasoned crypto trader.

Reassess your mining plans

For miners, the halving is like both a wake-up call and a gut punch. Every block mined will reward you with half of what it did before—a guaranteed pay cut. So what now?

First, calculate. Do the math on energy costs, equipment efficiency, and how future rewards might impact your profit margins. If your rig is guzzling power without delivering returns, it’s time to rethink your setup. Consider upgrading to energy-efficient hardware or joining mining pools to spread costs and risks.

For example, the Antminer S19 Pro has been a go-to option for miners preparing for this kind of change. Its power efficiency may keep you competitive when smaller players get squeezed out post-halving.

Secondly, think about geography. Places with low electricity costs, like Texas or regions in Canada, are becoming mining hubs. Moving operations—or finding hosting in those areas—could help you stay profitable when others might be forced to exit the game.

Stay updated on halving news

This might sound obvious, but in a space as fast-moving as crypto, staying informed could be your biggest edge. Halving news isn’t just limited to the event itself. The lead-up often brings buzz, predictions, and even FOMO from other investors. Missing out on early signals can set you back.

- Follow reliable sources (you’re already on the right track if you’re here). Keep an eye on not just news, but analysis and real-time data.

- Set up alerts for Bitcoin’s block progress.

- Engage with crypto communities on platforms like Reddit or Twitter, where halving insights and opinions flow fast.

And hey, you don’t have to do it alone. Make sure to bookmark our blog for the in-depth breakdowns and expert analysis we’ll deliver as 2025 approaches.

Now, here’s something to think about: If Bitcoin’s halving mechanism creates scarcity this effectively, what do you think that scarcity does to its long-term adoption? Is it really just a speculative tool, or is it a cornerstone of its value? In the next section, I’ve rounded up some killer resources that can help you unlock even deeper insights. Ready to level up your Bitcoin game?

Recommended resources for mastering Bitcoin halvings

So, you’ve learned what Bitcoin halving is and why it’s such a big event. But how do you stay on top of it and actually make sense of all the noise? The secret lies in having the right resources at your fingertips. Whether you’re a seasoned trader, a miner, or just someone who loves following Bitcoin’s incredible journey, here are some tools and links that’ll give you the edge.

Read expert blogs and guides

If you want to deepen your understanding of Bitcoin halving, the best thing you can do is learn from industry experts. Some of the most reliable voices come from well-known platforms like Coinbase’s Bitcoin halving guide. They break it down in a way that’s digestible, even if you’re not a full-on crypto geek. Want some bite-sized knowledge with a solid track record? You can’t go wrong here.

Here’s another gem: ARK Invest. You might know them for their forward-thinking analysis in tech, but their reports on Bitcoin halving and its financial implications are just gold. They don’t just describe what’s happening—they give you clear, actionable insights on what it might mean for future BTC performance.

Keep digging into credible sources like this, and suddenly, the halving doesn’t feel so mysterious anymore. It’s more like a puzzle you can start putting together as you learn piece by piece.

Join discussions with the crypto community

Here’s the thing: Some of the sharpest ideas and trends come straight out of community discussions.

Platforms like Reddit’s r/Bitcoin are buzzing with halving-related conversations. Whether it’s people sharing their predictions, discussing mining strategies, or debating how this will impact the next bull or bear market—there’s plenty of value in these threads.

Of course, we can’t forget about the action on Twitter. Crypto Twitter is insane when it comes to hype and analysis around Bitcoin halvings. Hit follow on accounts like @CryptoCobain or @DocumentingBTC, but don’t stop there. Jump in, engage with the tweets, and maybe post your own thoughts. Collaboration isn’t just for miners or developers—it’s for the entire Bitcoin crowd.

If you enjoy chatting live, Discord and Telegram groups are where things get even more real. These communities let you connect with miners, traders, and analysts who are all hyped about Bitcoin’s upcoming shrinking supply.

As you keep exploring these hubs of activity, one thing becomes clear—there’s no shortage of people willing to share, debate, or just throw crazy ideas into the mix about Bitcoin halving’s future. What’s their favorite prediction for event? Guess you’ll just have to see for yourself!

Feeling fired up yet? Good. Because understanding the halving is just half the battle. What happens next? Let’s explore the dynamics and possibilities in the final stretch. Don’t miss it.

Wrapping it all up: Why Bitcoin halving is worth your attention

So, here we are—at the grand finale of our halving exploration. Let’s piece everything together and figure out why Bitcoin halving isn’t just a niche topic for crypto nerds but one of the most talked-about events in the blockchain world. If you’re holding, mining, or just looking at Bitcoin from the sidelines, understanding halving could make all the difference in how you approach the next big move in this space.

Halving’s impact on Bitcoin price and supply

Here’s the big takeaway: Bitcoin halving is where technology meets economics in the most fascinating way. Halving literally changes the dynamics of supply and demand in Bitcoin’s market. Remember, we’re heading towards a future where a fixed supply of just 21 million BTC will ever exist. So far, with every halving, the supply growth slows down, while demand (historically) ramps up as more mainstream attention pours in. It’s like the perfect setup for potential price increases.

Just look back at the data. After the 2012 halving, the price of Bitcoin climbed from around $12 to over $1,000 within a year. In 2016, BTC was sitting at about $650 before the halving and jumped to nearly $20,000 by late 2017. Then came the 2020 halving—Bitcoin went from $9,000 a few months before to hitting an all-time high of $69,000 in November 2021. The latest halving on April 19 saw Bitcoin saw currently going Bitcoin from $63,670.02 to $108,135.00 within 8 months in December, marking a new all-time high. Crazy patterns, right?

But the key word here is potential. Nothing is guaranteed, and while halvings have historically boosted prices eventually, other market forces like regulations or global events could play a big role. Still, it’s hard to ignore how this built-in scarcity model shapes Bitcoin’s long-term trajectory.

Prepare for the volatility ahead

If history is anything to go by, one thing is certain after every halving—volatility takes over. The months leading up to and following a halving have some of the wildest price swings. Speculation floods the market, everyone has a “hot take,” and emotions run high. This is where being prepared and informed can seriously pay off.

Are you ready for price runs that feel like a roller coaster? Maybe. But it’s not just about riding the ups and downs. It’s about having a plan. If you’re a long-term investor, keep your eyes on the bigger picture: Bitcoin’s long-term scarcity and adoption curve. If you’re a trader, this is where strategy and timing come into play. And if you’re a miner, profitability gets laser-tight, meaning it’s time to crunch your numbers and optimize like never before.

The one thing nobody should do? Ignore what’s coming.

Keep exploring Bitcoin’s unique design

What I love about Bitcoin’s halving isn’t just the market frenzy that surrounds it. It’s the genius of its design. Halving isn’t a random event. It’s a core piece of the code, functioning like clockwork to control supply, maintain scarcity, and protect Bitcoin’s value as a transparent, decentralized currency. In a world where trust in fiat systems continues to dwindle, Bitcoin’s fixed rules offer something extraordinary.

If you’re just catching up with all this, use this as your chance to dig deeper—into Bitcoin’s 21 million cap, its game-changing approach to digital scarcity, and the larger picture of how it challenges traditional finance. This isn’t just a four-year event; it’s a roadmap that secures Bitcoin’s future.

Conclusion: Be ready for Bitcoin’s next big event

Bitcoin halving happens every four years, but it’s much more than a recurring date on the calendar—it’s a milestone that reminds us why Bitcoin works. It’s about scarcity, supply, demand, and how technology rewrites traditional financial rules.

Whether you’re mining, trading, holding, or simply watching from afar, this is your chance to gear up for what’s ahead. Study pasthalvings, brush up your strategies, and most importantly, stay informed. The more you know, the better equipped you’ll be to spot the opportunities—and the risks—heading into 2025. And hey, when the dust settles, join the conversation. The crypto community has been through this cycle three times already, and there’s no better place to learn than by engaging with people who’ve seen it all.

So, here’s my takeaway for you: Pay attention. Prepare smartly. And buckle up, because 2024’s halving that happended this year might just be one of the most exciting ones yet.