A Good Start to Q3 as Bitcoin Price Regains the $10,000 Handle

The price of bitcoin has cleared the $10,000 level once more, but where next?

After reaching a high near $14,000 on June 26th, the price of bitcoin then dropped sharply below the $10,000 psychological level to a low near $9600 just six days later.

Now that bitcoin has regained the critical $10,000 level, we look at the contributing factors behind the recent rally and the outlook for bitcoin’s price in Q3 and Q4 2019.

What are the Contributing Factors Behind Bitcoin’s Recent Rise?

Facebook’s Libra

On June 18th, Facebook announced its cryptocurrency project Libra and the revelation boosted cryptocurrency prices, including bitcoin which rose from $9000 to $11000 in the four days following Libra’s announcement.

Since Libra is not a decentralized and permissionless crypto-network, it is not seen as a threat to bitcoin and therefore is not expected to negatively impact on bitcoin’s price. Furthermore, bitcoin also differs to Libra as it is not controlled by any central authority, whether that be a central bank or a multinational corporation.

In fact, the opposite may even be true, where an increased interest in cryptocurrency is generated by the launch of Libra. At the recent Bitcoin 2019 conference in San Francisco, panel moderator and financial journalist Max Kesier even said that CNBC’s Joe Kernen had an epiphany with regards to bitcoin’s value and utility while discussing the Libra project on a live episode of Squawk Box.

When a currency is launched by a massive internet giant that may have too much market power and knows a lot of information about your friends and family, suddenly the proposition out forward by bitcoin makes more sense to most people and becomes more attractive.

Libra may even act as a massive on-ramp for bitcoin, where over two billion Facebook users will have an easier route into bitcoin. Since Libra is not a substitute for bitcoin, and gets people to think about money and different methods of transacting, it is likely Facebook’s foray into cryptocurrency will end up being a complement to the market leader.

Increased Mainstream Interest

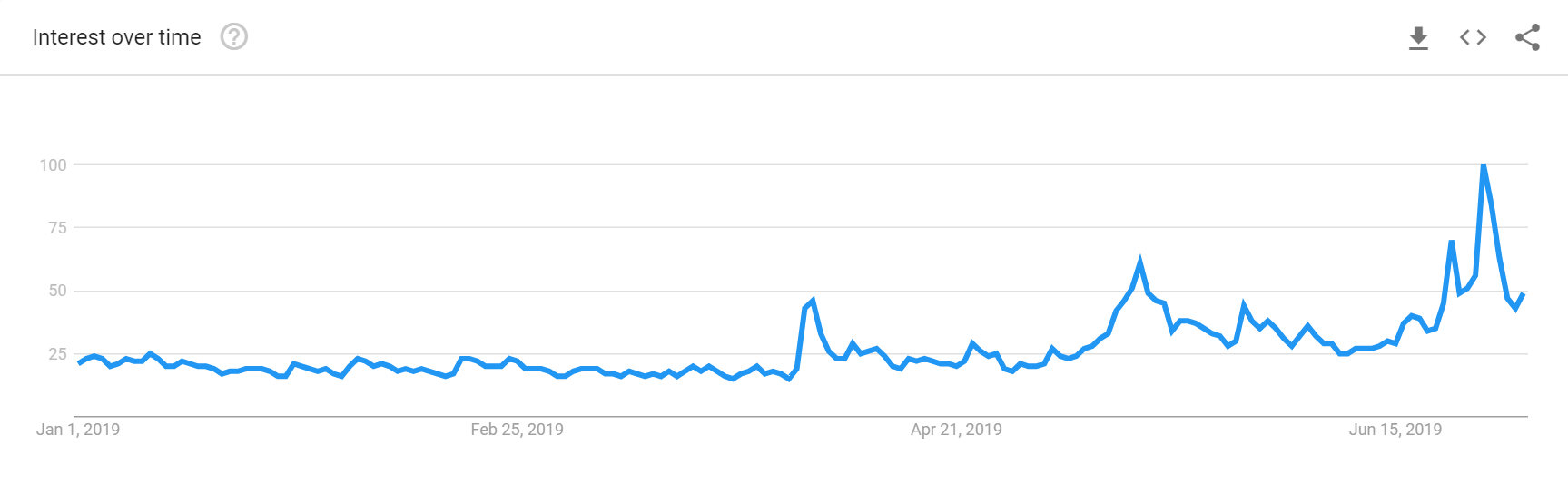

Bitcoin has also seen elevated levels of mainstream interest in recent months as it bounced off its 2019 lows around $3,000 in February 2019 to around $11,000 at the time of writing. One main indicator of mainstream interest in bitcoin is to look at how many Google searches are for bitcoin.

The correlation between bitcoin internet searches and fluctuations in the price of bitcoin is as high as 80.8% according to recent research. In an increasingly digital economy, it is intuitive that internet searches may be leading indicators for consumer behavior. Even Google’s chief economist, Hal Varian, released a research paper linking searches for jobs and unemployment category keywords and the number of initial claims for unemployment benefits.

As the chart below shows, there has been a recent uptick in the number of Google searches for the term bitcoin. Since the start of 2019, Google searches for bitcoin have been on an upward trend. Bitcoin is the most frequently Googled in Nigeria, South Africa, Austria, Switzerland, and the Netherlands according to Google Trends.

Source: Google Trends

Forbes noted on June 30th that, for the first time since the bull market of late 2017 and early 2018, the number of Google searches for “bitcoin” has surpassed “Jesus”. What is also interesting is that the spike in search activity for bitcoin is not mirrored for other major cryptocurrencies such as Ethereum or Ripple; could it be a leading indicator once more that a massive bull market is underway?

A recent report from digital asset research firm Delphi Digital makes the case that enthusiasm from retail investors is returning to the bitcoin market. The report points to the increasing premium on Grayscale’s Bitcoin Investment Trust (GBTC), which allows investors to access BTC without having to worry about security and storage.

Dovishness from the Federal Reserve

Many market commentators maintain that the US central bank, the Federal Reserve, is unintentionally pushing bitcoin to new highs. Since the financial crisis in 2007-2008, the policy of easy money has swollen the Federal Reserve’s balance sheet to heights not seen before and there is more money floating in the system thanks to quantitative easing.

These policies have effectively weakened the US Dollar and act to improve the competitiveness of the US economy by boosting exports. However, as the central bank delays interest rate increases and hints at further quantitative easing, investors have been spooked and moved into so-called safe haven assets like gold, the Swiss Franc, the Japanese Yen and… bitcoin.

Two days prior to bitcoin entering the $10,000 in late June, the Federal Reserve Chairman Jerome Powell announced the decision to keep benchmark interest rates steady at 2.25%-2.5%. Because of growing geopolitical risks and inflation, it is believed that the Fed is under pressure to cut interest rates rather than normalize them.

In early June, the Fed indicated it was ready to cut interest rates, departing from a slow and steady return to historically normal levels for interest rates. However, commentators have noted that in the current low-interest rate environment, reducing benchmark rates further is not likely to have the same effect as it did during the financial crisis, when rates were as high as 5%. Therefore, the US central bank is due to turn to more unconventional policy tools in the next recession, which could include more quantitative easing.

Since the USD is the world’s reserve currency, the decisions on monetary policy have a wide effect across financial markets, including bitcoin. ING economist Robert Carnell stated in late June that, “It seems that the world is so awash with money, that it is creating financial asset price inflation wherever you look..” adding that, “something is wrong here”.

When the rest of the world wakes up to the financial tricks of central banks in an attempt to contain the financial crisis of 2008, bitcoin will shine even more.

Upcoming Block Reward Halving

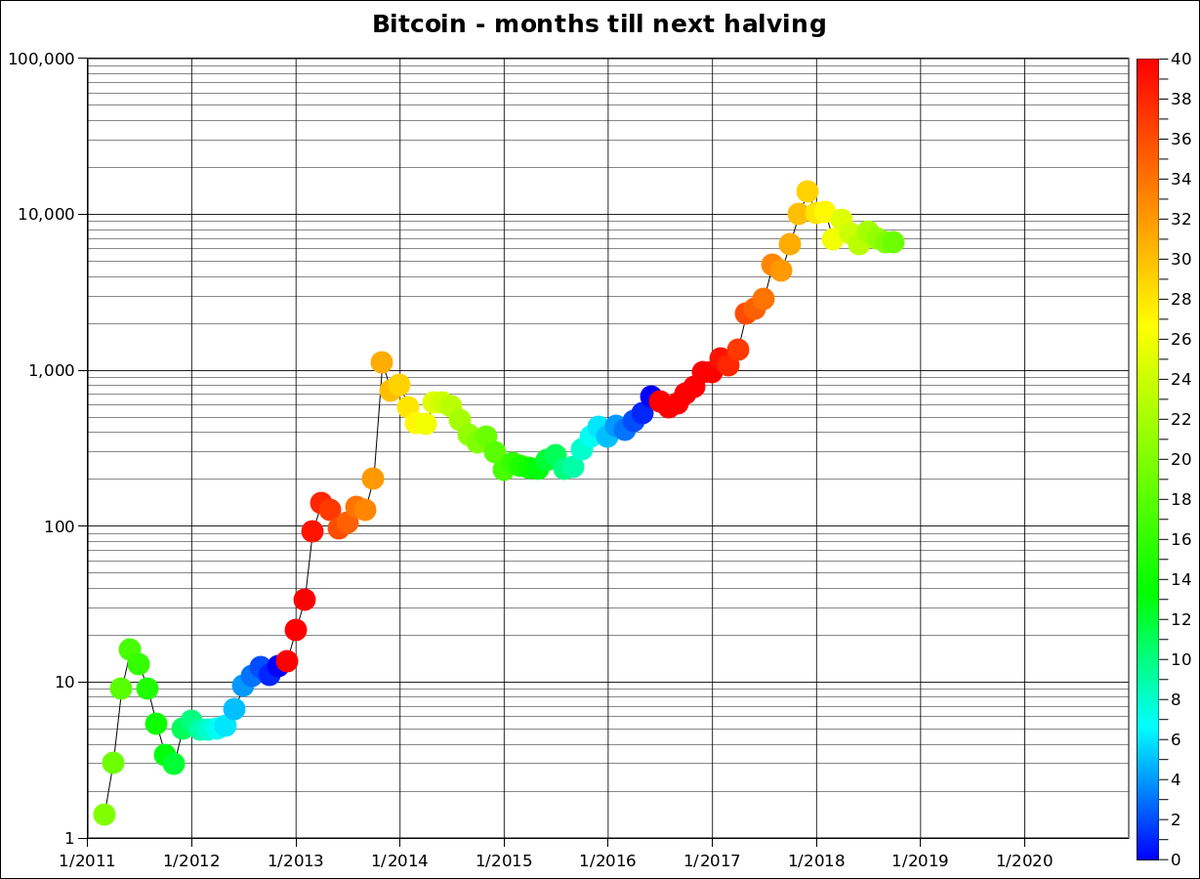

Bitcoin’s block reward halving is due to occur sometime in May 2020, less than one year away. Basically, the block reward miners receive for mining is cut in half roughly every four years. Once these block reward halvings take place, the selling pressure on bitcoin is reduced, since miners now effectively earn half as much as they used to, in bitcoin terms.

As the event approaches, bitcoin should display more bullish strength as markets price in the event. Historically, we have seen the price of bitcoin increase in the run up to the halving and in the following months.

The chart below illustrates that the appreciation in the price of bitcoin is far more aggressive after the block reward halving, but does start increasing about 10-14 months before the event as well.

Source: @100trillionUSD

Increased Volume for Bitcoin Futures Contracts

The CME began offering bitcoin futures contracts towards the end of 2017 while bitcoin was near its peak of $20,000. However, the volume geared towards trading these contracts was quite low. However, in recent months that has changed and played a part in bitcoin’s recent rally.

As the chart below shows, the volume on the CME for bitcoin futures contracts has steadily risen over time, indicating greater interest in the financial instrument and would be considered bullish for bitcoin.

On May 13, 2019 the CME bitcoin futures contract saw its highest ever one-day volume. As the saying goes amongst traders, price follows volume. If there is a breakout in the volume of an asset, its price will follow shortly after, and this holds true for bitcoin as well.

In June, the bitcoin futures contracts on the CME set a record for new open interest, with 6,609 contracts at the end of June and has been steadily rising over the last seven months. This is a key indicator of demand for bitcoin and signals that traditional finance types are paying closer attention to the leading cryptocurrency. The number of large open interest holders – which are investors which have contracts worth at least 25 BTC – has also recently hit a new high of 49, up from 46 in the last week of June.

What is the Outlook for Bitcoin’s Price for the Rest of 2019?

Where next for bitcoin? Well, we look at what commentators and the charts have to say.

Well-known technical analyst Peter Brandt recently stated that bitcoin has entered its “fourth parabolic phase” and is “taking aim at $100,000”. While not strictly a price prediction for Q3, it does go to show how high traders think bitcoin could go in the future, where Brandt added, “No other market in my 45 years of trading has gone parabolic on a log chart in this manner. Bitcoin is a market like no other.”

It’s not just Brandt who believes bitcoin has a lot of room to the upside. Binance’s company strategy office (BSO), Gin Chao, has forecast bitcoin to reach anywhere between $50,000 and $100,000 by the end of 2019.

Mike Novogratz, chief executive of crypto investment group fund Galaxy Digital, reckons that bitcoin will fluctuate between $10,000 to $14,000 in the near future before trying to retake the all-time high near $20,000 by the end of Q3 2019.

The chart below for the CME bitcoin futures contracts shows that if a break of $11,760 occurs, then we should see a rapid move towards the next fractal resistance at $16,845. However, if the $11,760 level holds as strong resistance, then we can expect bitcoin to bounce between $9,840 and $11,760.

If the volume continues to keep flowing into the CME bitcoin futures contracts, then this should be bullish for bitcoin over the long term. In particular, we want to see a fresh high in the volume traded to expect fresh highs in the price of bitcoin. Alternatively, if volume dwindles from current levels and dries up, we should prepare for moves to the downside.

The weekly chart below shows that if bitcoin can close above $11,760, then the all-time high is in sight, as suggested by Mike Novogratz. However, the recent spike to $14,000 could be a barrier, as if bitcoin does not move above the recent high before July 15, then a fractal resistance will form at $14,170.

On the other hand, if bitcoin manages to move higher than $14,170 by July 15, then this should give confirmation that bitcoin will test it’s all-time high near $20,000 and possibly extend beyond this level.

One concern about the weekly chart is that, at present, the current candlestick looks like the pattern known as the dragonfly doji, which could be considered bearish, as it is occurring during an upward trend. A dragonfly doji usually indicates that a top is in, but we will have to wait for the weekly candlestick to close before making any definitive judgments.

Another important factor to consider over the next five months or so is the policy of the Federal Reserve. If the geopolitical situation worsens and the Fed maintains its dovish stance, then this should bode well for bitcoin going forward.

You can find a calendar of the Federal Reserve meetings here and if they make announcements signaling a move to quantitative easing or other unconventional policies, then bitcoin’s price should benefit over the medium term. Interest rate decisions are generally announced at the end every couple of months, with the next due on July 30-31, where an interest rate cut should boost the bullish mood for bitcoin.