Bitcoin UTXO Stats Review

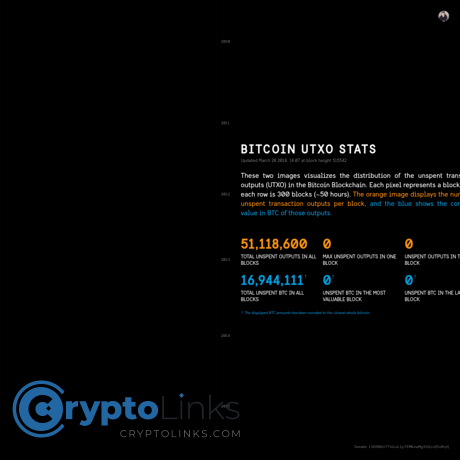

Bitcoin UTXO Stats

utxo-stats.com

Bitcoin UTXO Stats Review & Guide: Everything You Need to Know + FAQ

Ever wish you could “hear” Bitcoin’s on-chain heartbeat without getting lost in a sea of indicators? I use Bitcoin UTXO Stats as a fast, honest pulse check—so I can spot accumulation, distribution, and trend shifts before the noise takes over.

UTXO-based views are some of the cleanest signals Bitcoin gives us. If you want to see HODL behavior, coin age bands, and when old coins start moving (often when it matters most), this is where I start.

Quick truth: When older coins wake up, markets usually move. The trick is knowing when that’s healthy rotation and when it’s distribution into strength.

Describe problems or pain

Open an on-chain chart and it can feel like decoding the Matrix. UTXOs, age bands, dormancy, CDD—it’s a lot. And many dashboards bury you in toggles and heatmaps with no guidance on what actually matters.

That leads to three common headaches:

- Analysis paralysis: 20 tabs open, zero conviction.

- Bad reads: treating every spike as a signal, missing the bigger trend.

- Giving up on on-chain: which is a shame, because it does offer real edge when used right.

Real example: in late 2017 and again in Q1 2021, long-term holder spending ticked up into strength while younger supply swelled—classic distribution behavior. Many traders stared at price and missed that rotation. Research like Unchained Capital’s original HODL Waves and recurring on-chain insights from Glassnode have documented these patterns across cycles.

Promise solution

I’ll show you utxo-stats.com the way I actually use it—step by step, in plain English. No advanced math, no toolbox overload, just a practical lens you can apply every week.

- See supply aging in a way that instantly flags accumulation vs. distribution.

- Spot when “old coins waking up” is healthy rotation or a warning sign.

- Build a repeatable workflow that sets a simple market bias you can trust.

By the end, you’ll know which charts matter, how to read them fast, and how to avoid the classic traps that make on-chain look “mysterious.”

Who this guide is for

- Long-term holders who want a calm read on cycle health and conviction.

- Swing traders who want cleaner entries and exits without guesswork.

- Analysts/researchers who want reliable on-chain context without noisy dashboards.

If you’ve ever asked, “Are holders accumulating or distributing right now?”—you’re in the right place.

What you’ll learn

- What UTXOs are and why they form the backbone of on-chain behavior.

- How to read age distributions (HODL waves) to understand market structure beyond price.

- Why “old coins waking up” matters, with real-world examples from 2013, 2017, 2020–2022.

- How to turn charts into checkpoints in your strategy—accumulation vs. distribution, caution vs. confidence.

To make this practical, I’ll use simple signals and real patterns seen across cycles—like spikes in Coin Days Destroyed into euphoric moves (often distribution) and the steady growth of older age bands during bear markets (typical accumulation), as highlighted in public cycle studies and on-chain newsletters over the years.

Curious what makes this particular site worth your time and how it keeps things simple without dumbing it down? Let’s look at exactly what it is and why it matters next—ready?

What is Bitcoin UTXO Stats and why it matters

Bitcoin UTXO Stats is a focused, fast site that turns the Bitcoin UTXO set into clear visuals—so you can read holding behavior, coin age, and spending patterns without a PhD in chain analysis. It matters because it shows market structure beyond price. When age bands expand or shrink, you can often tell whether the market is quietly accumulating or distributing—long before headlines catch up.

“Markets whisper before they shout. On-chain is the whisper.”

If you’ve ever stared at a chart and thought “Is this grind-up healthy or fragile?”, UTXO-based views offer one of the most honest tells. Studies like Unchained Capital’s foundational work on HODL Waves have shown that older coins typically grow during bear phases and get spent into strength during bull runs—patterns that have repeated across cycles (Unchained, 2018). Glassnode’s research has echoed this in multiple cycle reviews, where long-term holders reduced their share of supply into late-stage rallies (Glassnode Insights).

The big-picture view

The site centers on UTXO-driven charts that map how coins age and move over time. You’ll see the supply sliced into age bands (think 1m–3m, 6m–12m, 2y+), plus spent-coin activity that tells you when “old coins” wake up.

- Why it cuts through noise: Price can be manipulated intraday; the UTXO set is harder to fake. Seeing older bands steadily expand during choppy markets is a classic accumulation footprint.

- What that looked like historically: After the 2018 bear, older age bands swelled through 2019—signaling patient hands were stacking. In the 2020–2021 run-up, those same cohorts began spending into strength, a behavior Glassnode highlighted as long-term holders distributing to new buyers.

- What to look for on the site: Smooth HODL-wave style visuals to spot aging trends, and spent-output views that flag when seasoned coins start moving—often a precursor to higher volatility or late-stage exuberance.

Put simply: it’s a way to read the market’s heartbeat, not just its pulse rate.

Navigation and chart layout

The interface is clean and quick—no maze of tabs. Expect simple controls and sensible defaults so you can get a read in seconds, not minutes.

- Timeframes: Toggle common windows (1Y, 2Y, 5Y, All) to see whether trends are structural or short-lived.

- Overlays: Add or remove price to see if age-band shifts line up with moves on the chart.

- Legends and bands: Clear color bands for each age cohort. I like to keep 1w–1m and 1y+ visible together—it reveals churn at the edges versus conviction in the core.

- Smoothing/scale: Light smoothing helps spot trend without hiding regime shifts; log scale makes multi-year context easier on the eyes.

My quick setup: toggle to a multi-year view, enable price overlay, highlight 6m–12m and 2y+ bands, then glance at spent activity. If older bands are expanding while price grinds up, that’s healthy. If young bands balloon and older bands shrink fast, I raise my guard.

Data freshness and methodology transparency

Trust the data, or don’t use it. I always check for update cadence and methodology notes on any on-chain site. UTXO-Stats keeps things straightforward—look for an update timestamp and a brief description of how each metric is computed.

- Update cadence: Most UTXO charts update daily or near real-time depending on indexing. A fresh timestamp matters if you’re watching inflection points.

- Age bands: Defined by time since last spent. This draws directly from the UTXO set—a mature, well-established approach used in research by Unchained and others.

- Realized-value lenses: When available, these use the last on-chain move price as a coin’s cost basis—a method widely documented by Glassnode’s Academy and research posts. It’s powerful for reading where conviction is tested.

- Smoothing and bins: Light smoothing is fine; just remember it can delay signals. Tight bins show detail; wider bins show regime shifts.

Tip: if the site links its methodology or GitHub/docs, give it a quick skim. Knowing whether a chart is based on transaction outputs versus addresses, or whether it excludes certain noise (like dust), helps you avoid misreads.

Who should use it

- Long-term investors: Quick, honest context for cycle health. If older cohorts keep growing while price chops, that’s patience, not panic.

- Swing traders: Confirmation beyond candles. When young supply swells fast and spent activity spikes, I tighten risk—especially into strength.

- Analysts and researchers: Clear UTXO-first views to anchor macro theses and compare across cycles without dashboard overload.

- Builders and educators: Clean visuals to explain holding behavior to clients, teams, or students—no guesswork or paywall friction.

UTXO-Stats gives you the “are we aging well or churning hard?” answer at a glance. The next question is the fun one: which specific charts matter most, and what do their moves usually mean in practice?

Up next: I’ll break down the core visuals (yes, including those HODL waves and spent-coin activity) into plain “what it shows / why it matters / how I use it” so you can turn screenshots into real signals. Ready to read the hints others miss?

Key UTXO metrics on the site and how to read them

Open utxo-stats.com and think of it as a live map of holder conviction. These charts don’t shout; they whisper. My job is to show you what to listen for so you can spot accumulation, distribution, and those quiet moments right before the move.

“Markets turn when strong hands change their mind — not when headlines do.”

HODL Waves / UTXO Age Distribution

What it shows: The share of Bitcoin’s supply grouped by how long it’s been sitting without moving (age bands like 1m–3m, 6m–12m, 2y+). It’s the purest way to see whether coins are maturing (being held) or getting young again (being spent).

- Why it matters: When older bands (1y+, 2y+, 3y+) grow, it signals conviction. Shrinking older bands or swelling young bands (1d–1m, 1m–3m) often marks distribution and increased churn. Research from Unchained Capital popularized this view of “HODL waves,” showing how age bands expand in bear phases and compress into bull peaks. See their foundational work: HODL Waves.

- How I use it:

- Trend health check: If 1y+ and 2y+ bands are steadily expanding while price grinds higher, the uptrend has a real foundation. That’s constructive.

- Heat check near tops: Late-stage rallies often show older bands flattening or shrinking as veteran coins move to market strength (classic in Q4 2017 and Q1–Q2 2021).

- Bottom formation clue: After capitulations, you’ll see a lull in young supply and a slow, stubborn growth of mid-to-old bands (6m–12m turning into 1y+). This pattern was visible through 2019 and again post mid-2022.

Real-world sample: During the 2020–2021 run, the 1y+ cohort compressed as profits were realized into strength, while young supply swelled. Into 2022’s drawdown, those older bands rebuilt as coins aged in place — classic accumulation.

Realized-value lenses (e.g., realized-cap-based waves)

What it shows: Similar to HODL waves but weighted by realized value (the price each coin last moved on-chain). Instead of just “how old,” it answers “how much cost basis sits with each cohort.” Glassnode formalized this via Realized HODL concepts and related lenses: Realized HODL/RCHW.

- Why it matters: It highlights pressure points:

- If a big chunk of realized value sits in young bands, new holders have a high cost basis — vulnerable to volatility and shakeouts.

- If realized value concentrates in older bands, the market’s “ownership” leans to low-cost, patient hands — stronger structural support.

- How I use it:

- Conviction vs. fragility: When price approaches the aggregate cost basis of large, older cohorts, I watch for either durable support (if they hold) or sharp sell pressure (if they distribute).

- Cycle heat: Young realized value swelling fast often aligns with euphoric phases — think new buyers paying up. That’s where trend risk increases.

Real-world sample: After March 2020, realized value migrated toward older cohorts as long-term hands accumulated cheap coins. Into early 2021, realized value pivoted toward younger bands as high-price buyers took over — a classic sign of froth building.

Spent-output activity (Coin Days Destroyed, ASOL, Dormancy)

What it shows: These metrics quantify the “age of coins” being spent:

- Coin Days Destroyed (CDD): Sum of days each coin sat idle before it moved. Big spikes mean old coins are waking up. Primer: Glassnode Academy — CDD.

- ASOL: Average Spent Output Lifespan — the average age (in days) of coins spent on a given day. Primer: ASOL explained.

- Dormancy: Average coin age destroyed per coin spent — a “how old were today’s sellers?” lens. Primer: Dormancy basics.

- Why it matters: When old coins move, volatility often follows. High CDD/dormancy spikes can align with late-stage euphoria (distribution) or fear (capitulation). Quiet baselines usually match accumulation and consolidation.

- How I use it:

- Late-cycle risk: Repeated CDD or ASOL spikes into strength are caution flags. Old coins are taking liquidity — historically seen near Q4 2017 peak and April–May 2021.

- Bottom context: During bottoms, spent age metrics compress (younger coins doing most of the selling) while old coins largely sit tight. After a final flush, the silence in these charts can be golden.

- Noise filter: One-off spikes happen. I watch for clusters or regime shifts, not single candles, and cross-check with price structure and exchange flows.

Real-world sample: May 2021’s selloff showed elevated CDD as older cohorts distributed into cascading liquidations. Contrast that with late 2022, where dormancy trended lower as battered price action failed to shake many old hands — a constructive tell that preceded recovery.

Supply dynamics: accumulation vs. distribution

What it shows: Stitch the above together and you get a living picture of who is holding, who is spending, and whether the market is building or burning fuel.

- Accumulation tells:

- Steady growth in 1y+ and 2y+ age bands.

- Muted CDD/ASOL/dormancy — older supply mostly asleep.

- Price can range or grind higher slowly while the foundation thickens.

- Distribution tells:

- Older bands flatten or shrink; young bands swell quickly.

- Spent-age metrics fire in clusters into price strength.

- Breakouts feel “hot” and crowded — then range expands both ways.

- How I use it: I map the state (accumulation vs. distribution) and then let price action handle timing. UTXO reads set my bias; structure sets my entries.

Real-world sample: 2019’s recovery had growing 1y+ bands and chilled spent-age activity — a gentle base. By early 2021, the picture flipped: swelling young supply and repeated spent-age spikes — a sign the engine was running hot.

Quick-reading cheat sheet

- Old bands rising + price grinding up: Healthy, patient trend. I stay constructive.

- Old bands shrinking + young supply surging: Distribution risk. I get cautious on chasing.

- CDD/ASOL/Dormancy spiking into strength: Late-cycle vibes. I tighten risk and take wins.

- Spent-age metrics compressing after a flush: Post-liquidation quiet. I watch for basing.

- Realized-value tilting to young cohorts fast: Froth. Vulnerable to pullbacks.

- Realized-value anchored in older cohorts: Strong hands own the cost basis. Good foundation.

Want to turn these reads into a repeatable weekly routine? I’m about to share the exact 5-step checklist I use — simple, fast, and honest. Ready to see how it all comes together?

From charts to decisions: my simple workflow

Charts are only useful if they change what you do next. Here’s the weekly routine I run on UTXO-Stats to turn “interesting” into “actionable.”

“The goal isn’t to predict; it’s to prepare.”

A 5-step process that keeps me honest

- Scan the age distribution trend (HODL-style waves).

What moved week-over-week? Are 6m–12m and 1y+ bands growing or shrinking?

Example: After the March 2020 crash, older bands kept expanding into late 2020 while price recovered—textbook accumulation fueling the next uptrend. - Check spent-coin activity for “old coins waking up.”

Glance at Coin Days Destroyed (CDD), Average Spent Output Lifespan (ASOL), and Dormancy. I note percentiles versus the last 6–12 months rather than raw values.

Example: In Q4 2021, multiple spikes in spent age metrics lined up with distribution into strength—great context for de-risking. - Overlay price and risk context.

I pair these reads with simple TA, futures funding, and open interest. If price is vertical and old coins are moving, I get cautious. If price is grinding up and older bands are still growing, I stay constructive.

Example: May–July 2021 had choppy price with subdued dormancy—neutral bias made more sense than guessing bottoms. - Hunt for divergences.

Accumulation divergences: older bands up while price drifts down or sideways. Distribution divergences: young supply swelling while price still pushes higher.

Example: Late 2022 into early 2023, spent activity dried up as 6m–12m graduated into 1y+—a quiet bottoming context after the FTX flush. - Set a simple bias: risk-on, neutral, or cautious.

I write one sentence: “Older bands ↑, spent age muted, price consolidating → risk-on.” If anything breaks that case (e.g., dormancy surge into resistance), I shift to cautious.

Why this works: UTXO age changes slowly and resists intraday noise. Spent-age spikes are rare, so when they hit, I pay attention. Percentiles beat hard thresholds because cycles differ.

Signals I watch for tops and bottoms

- Late-cycle top context

- Repeated spikes in CDD/ASOL while price is strong.

- Older bands (1y+) stall or contract; younger supply grows.

- Exchange liquidity is hot; derivatives are crowded long.

Case notes: Jan 2018 and Nov 2021 both showed elevated dormancy into strength—classic distribution characteristics documented across on-chain research, including the original HODL Waves study by Unchained Capital.

- Early bottom context

- Dormancy and ASOL compress for weeks; fewer “old coins” are spending.

- Older bands keep building as coins age in place.

- Price bases while open interest resets.

Case notes: December 2018 and December 2022 showed muted spent-age with steady aging—conditions that preceded trend repair rather than immediate moonshots.

Important: I treat these as context, not blind triggers. Tops and bottoms are processes. The power is in stacking evidence, not betting the farm on one chart.

Common pitfalls and how to avoid them

- Overreacting to a single spike.

Fix: Use rolling percentiles (e.g., is dormancy above its 80th percentile over 180 days?) and wait for at least two confirming sessions. - Misreading wallet housekeeping as distribution.

Entity consolidation or exchange shuffles can mimic “old coins moving.”

Fix: Cross-check with exchange flow context and look for consistency across multiple spent-age metrics, not just one. - Forgetting UTXO data is slow-moving.

Fix: Let age bands be your macro compass, not a scalping signal. I use them to set bias for weeks, not over hours. - Confirmation bias.

Fix: Write down the invalidation: “If ASOL spikes and 1y+ shrinks while price is at resistance, my risk-on bias is wrong.” Then stick to it. - Ignoring the macro tape.

Fix: Pair UTXO reads with liquidity and funding context. If funding is frothy and dormancy is popping, that’s two red flags, not one.

Pro tips that save time

- Bookmark a 3-chart cockpit on UTXO-Stats:

1) Age distribution (weekly), 2) Dormancy/ASOL (7D and 30D), 3) CDD with a 180D percentile overlay if available. - Keep a simple weekly log with screenshots and one-liners:

“Week of 2024-11-04: 1y+ ↑, dormancy muted, price consolidating → risk-on but patient.” - Use relative bands, not absolutes.

Every cycle has different magnitudes. Percentiles normalize behavior across regimes. - Focus on transitions.

I care most when the 3–6m band graduates into 6–12m (accumulation) or when 1y+ stops growing and young supply swells (distribution). - Set alerts where it matters.

If your platform allows, alert when dormancy or ASOL pushes into the top 10–20% of the last year, or when 1y+ share turns down after a steady climb. - Zoom out after volatility.

Post-liquidation spikes can distort spent-age for a few sessions. I wait for the weekly picture before changing bias.

Want to see how I stack these reads against other tools and where I cross-verify before acting? I’ll show you exactly what I pair with UTXO-Stats next—curious which platforms consistently confirm or challenge these signals?

Beyond UTXO-Stats: context, comparisons, and useful links

If UTXO-Stats is my clean on-chain heartbeat, context is the stethoscope. On its own, a UTXO view tells me who’s holding and who’s spending. Paired with market data, it tells me why that might matter right now—and how aggressive I should be with risk.

How it compares to other on-chain tools

I treat UTXO-Stats as a fast, focused lens. It’s lightweight and gets me straight to age bands, HODL behavior, and spent-coin activity without digging through endless menus. When I need extra granularity or alternate methodologies, I cross-check with heavier platforms.

- Glassnode / Checkonchain: Fantastic for detailed long/short-term holder splits, spent price bands, and cohort-level spending. Great for confirmation when UTXO-Stats hints at distribution (e.g., LTH spending into strength). See Glassnode Academy for definitions.

- Coin Metrics: Solid for network quality context—supply, addresses, and “State of the Network” research that often frames UTXO signals in macro terms. Worth watching: State of the Network.

- LookIntoBitcoin: Great “cycle tools” like the RHODL Ratio and NUPL for historical ranges when UTXO-Stats shows old coins waking up. A classic cross-check is RHODL’s heat vs. rising old-coin spending: RHODL Ratio.

- Mempool/fees (mempool.space): Tells you if on-chain activity is organic or fee-driven noise. If fees spike while UTXO-Stats shows a surge in young supply, I’m extra cautious. Try mempool.space.

Real example: In October–November 2021, UTXO age bands for 6–12m and 1–2y shrank as younger bands grew—classic distribution into strength. Glassnode’s cohort data at the time showed long-term holder (LTH) spending picking up and LTH supply drawing down. That two-step confirmation was enough for me to step down risk even as price printed new highs.

Rule I live by: “On-chain shows you who is moving coins. Price shows you who is winning. Use both.”

When to pair it with market data

UTXO reads are best as a bias filter and trend context, not a trigger. I stack them with price, liquidity, and risk gauges to avoid overfitting.

- Price structure: If older bands keep expanding while price makes higher lows, that’s constructive. If old coins wake up into lower highs, I’m cautious. Simple, but powerful.

- Volume and order books: UTXO distribution + thin order books = air pockets. Accumulation + rising spot volume = healthier advance.

- Derivatives (funding, OI, basis): Rising old-coin spending with overheated funding and soaring open interest often marks late-cycle froth. Neutral/negative funding with growing older bands can be a stealth accumulation phase.

- ETF flows (2024+): Spot ETF inflows can absorb distribution. In Q1 2024, we saw “old coins waking up” while ETFs net-bought billions, cushioning supply. I track ETF flow dashboards like Farside or SoSoValue alongside UTXO changes.

- Macro (rates/dollar/liquidity): Tightening liquidity can turn benign distribution into sharp pullbacks. I keep one eye on rate expectations (e.g., CME FedWatch) when UTXO signals get noisy.

Scenario checklist I actually use:

- Old coins waking up + positive funding + rising OI → I trim risk or tighten stops. Late-stage rallies tend to coincide with seasoned holders distributing into leveraged buyers.

- Old bands expanding + flat/negative funding + rising spot volume → I get constructive. Strong hands are sitting tight while price advances on real demand.

- Spent-coin activity dries up after a flush + price basing on higher lows → I watch for early accumulation. This behavior preceded the late-2022 base after the FTX shock.

Case study snapshots:

- Nov 2021 top: UTXO-Stats showed shrinking older bands and swelling young supply while derivatives overheated. Glassnode’s LTH spending confirmed distribution. That combo nailed the risk-off pivot for me.

- Nov–Dec 2022 base: Coin Days Destroyed stayed muted, older bands hit all-time highs, and funding was negative as price stabilized—classic post-capitulation accumulation. I used it to layer back into spot.

- Q1 2024 rally with ETFs: Old coins did move, but sustained ETF inflows offset supply. UTXO-Stats told me distribution was present; ETF dashboards explained why price held up. Context averted a premature exit.

Extra resources worth checking

If you like seeing where these ideas came from, a few evergreen reads add depth without overwhelming you:

- HODL Waves origin: The classic research that popularized age-band analysis is still worth your time: Unchained Capital’s HODL Waves.

- Concept primers: Definitions for dormancy, CDD, LTH/STH, and realized cap are neatly explained in Glassnode Academy.

- Weekly macro-on-chain context: Coin Metrics’ State of the Network blends data with narrative and helps sanity-check any UTXO signal.

One last thing before we keep going: a lot of people ask “Which UTXO metric should I trust when they disagree?” In the next part, I’ll tackle that head-on—plus quick answers to the questions I get most, from coin days destroyed to dormancy. Want the fast, no-jargon version?

FAQ: Your common questions answered

People also ask about Bitcoin UTXOs and this site

Q: What’s a UTXO in plain English?

A: Think of Bitcoin as a pile of spendable “coins” (UTXOs). Each time BTC moves, it consumes some coins and creates new ones. There are no account balances on-chain—just UTXOs you own or don’t.

Q: Why do HODL waves matter?

A: They show what share of supply hasn’t moved for different time ranges. When older bands grow, holders aren’t selling into volatility. When older bands shrink and young bands grow, spending is picking up. For background, see the original HODL Waves research by Unchained Capital: unchained.com/blog/hodl-waves.

Q: Can UTXO charts predict price?

A: Not by themselves. They’re best for context and market bias. For example, large spikes in old-coin spending have often lined up near late-stage rallies or fear-driven sell-offs, but timing trades off a single spike is risky. Glassnode’s public notes show these dynamics clearly: academy.glassnode.com.

Q: What does “old coins waking up” really mean?

A: Coins that sat for months or years moved. Historically, we’ve seen notable upticks in Coin Days Destroyed (CDD) around major inflection points (e.g., late 2017, Q1–Q2 2021). It doesn’t equal “top is in,” but it tells me long-time holders are taking action—something I treat as a yellow flag until confirmed by price structure and liquidity.

Q: I saw a sudden jump in young supply—did whales dump?

A: Maybe. But it can also be wallet housekeeping, exchange shuffling, or UTXO consolidation. Self-spends reset coin age and can make “young” bands swell without net distribution. I cross-check with realized-value lenses and spent-coin metrics to confirm intent.

Q: How often does utxo-stats.com update?

A: Check their site’s update note or methodology section. UTXO data is typically refreshed daily or near-real-time depending on indexing. If timing matters (e.g., you trade on lower timeframes), verify the last update before making a call.

Q: Are these metrics lagging?

A: For intraday trading, yes—they’re best on weekly rhythm. For cycle reads, they’re excellent. I personally scan them once per week and only act when multiple signals align with market structure.

Q: Do exchanges distort age bands?

A: Exchange cold storage can sit for ages and then reshuffle, resetting age. That can create noise. This is why I compare multiple views: age distribution, spent activity (CDD/ASOL), and realized-value aggregates. Consistency across them matters more than any single print.

Q: What’s the difference between CDD, ASOL, and Dormancy?

A: Quick take:

- CDD: Total “coin days” destroyed when coins move. Older, bigger UTXOs boost it.

- ASOL: Average age (in days) of coins spent on a given day. High ASOL = older coins moving.

- Dormancy: CDD normalized by volume. It captures the average holding time per coin spent.

Good primers: Glassnode Academy.

Q: How do halvings or big narrative shifts show up here?

A: You often see slow growth of older bands into and after bear markets (accumulation), then a pickup in spending during euphoric phases post-halving when price breaks prior highs. It’s not the halving itself—it’s how holders respond across the cycle.

Q: Does Ordinals or high-fee activity mess with the read?

A: Ordinals increase UTXO churn and fee pressure, but HODL waves are supply-weighted, so small-value “spammy” UTXOs don’t dominate the picture. That said, consolidation and wallet maintenance can still create noisy short-term shifts—use weekly averages.

Q: What about Lightning channels?

A: Channel opens lock UTXOs, which continue to “age.” Closing a channel spends them, resetting age. It’s a minor effect at the scale of total BTC, but locally you’ll see age rollovers on closures.

Q: Can whales fake these signals?

A: They can move coins between their wallets and reset age, creating noise. That’s why I look for confirmation across metrics and price, not a single UTXO read. Broad, sustained changes across multiple charts are harder to fake.

Q: Can I apply this to ETH or other chains?

A: UTXO logic fits Bitcoin and other UTXO chains (LTC, BCH). Account-based chains (like ETH) require different metrics, so these charts won’t translate 1:1.

Q: What timeframe should I use?

A: Weekly is the sweet spot. I keep a Sunday snapshot of key charts and note: “old bands up/down,” “CDD calm/spiking,” “price structure supportive/weak.” It keeps me honest and avoids overreacting.

Q: Where should I start on the site?

A: Start with HODL waves to set the backdrop, then check CDD/ASOL/Dormancy for spent behavior, and finally glance at any realized-cap lenses for cost-basis context. Three minutes, once a week.

If I missed your question, drop it here and I’ll add it: cryptolinks.com.

Quick glossary: UTXO terms in plain English

- UTXO: A spendable chunk of BTC created by a prior transaction. Your wallet balance is just the sum of your UTXOs.

- Age bands: Buckets showing how long coins sat untouched (e.g., 1–3 months, 6–12 months, 2+ years).

- HODL waves: A stacked view of age bands over time—how supply “rolls” from young to old and back.

- Coin Days Destroyed (CDD): Every coin accumulates one “coin day” per day it sits. When spent, those days are “destroyed.” Big values = older/heavier coins moved.

- Dormancy: Average holding time of spent coins (CDD divided by volume). High dormancy = older holders are active.

- ASOL: Average Spent Output Lifespan. The mean age of coins spent in a day.

- Realized cap: Valuing each coin at last moved price (its cost basis on-chain) and summing it up. Useful for understanding where holders may feel pressure.

Pro tip: Aging happens even if price is flat. If waves look “bullish” simply because time passed (older bands tick up slowly), I still want to see spent activity remain quiet and price structure hold higher lows before I flip risk-on.

Conclusion

UTXO-Stats is my quick window into who’s sitting tight and who’s moving. Use it to set bias and manage expectations—not to chase entries. When I pair these reads with price action, liquidity, and funding, my decisions get calmer and cleaner. I’ll keep this resource updated on cryptolinks.com/news as the site evolves.