Pool Party Review

Pool Party

poolpartyyy.com

If your website is on the scam list and you think that you are not a scammer, contact us. After you provide us with all the proof that you are in Crypto World with good intentions, we will delist you. Usually, you get in this category because you are hiding your team, you have a bad reputation(you are tricking, deceiving, scamming people), and you haven't got a written project whitepaper or is a shitty one....

Their Official site text:

What is Pool Party?

A CryptoCurrency Staking Game

Pool Party is a decentralized finance (DeFi) platform that utilizes the Ethereum blockchain to enable users to stake and earn rewards in various liquidity Pools. The platform operates as a game that encourages users to make strategic decisions about which Pool to join, based on factors such as the annual percentage rate (APR), lock-up period, and the risk associated with each Pool.

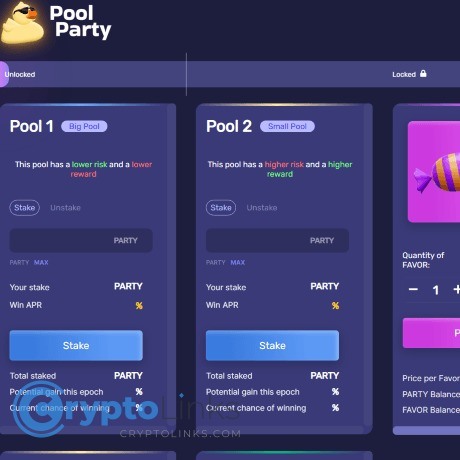

Pools

Pools 1 and 2 operate as a Cournot-style competition where players stake $PARTY in a single-sided Pool. The losing pool pays out 10% of their tokens to the winning Pool every day. On the other hand, Pool 3 offers a variable APY for players to stake $PARTY-ETH LP tokens. Rewards are earned every 24 hours, and this Pool carries no risk of losing tokens to other pools. However, Pool 3 will only be available for 14 days.

Design

Pool Party is designed to incentivize players to stake their tokens and burn them through various mechanisms, ultimately creating a deflationary token with high liquidity.

Epoch System

The game runs on an epoch system where each epoch lasts for one day. During the first 8 hours of each epoch, players must choose which Pool to stake their tokens in. After the 8-hour period ends, staked tokens become locked for 16 hours. After the lockup period ends, staked tokens can be unstaked and transferred. By default, tokens remain staked in the Pools after the epoch ends. Players also have the option to pay a 1% fee on their staked tokens to jump from one Pool to the other. Balances are dynamically adjusted each epoch, so there is no need to claim rewards.

Party Token

The $PARTY token is the native token of the Pool Party game, and it will have a total supply of 1 billion tokens. The token allocation is divided into different categories.

First, 40% of the $PARTY tokens are allocated to Pool 3 emissions. These tokens will be distributed over a period of 14 days as rewards for users who stake their $PARTY-ETH LP tokens in Pool 3. The emission schedule is designed to gradually increase the amount of $PARTY tokens added to the pool each day, starting from an initial seed amount on day 1 and linearly increasing over the 14-day period.

Second, 20% of the $PARTY tokens are allocated to contributors at the time of the game launch. These tokens may be distributed to individuals or entities that have contributed to the development, launch, or promotion of the Pool Party game.

Next, 20% of the $PARTY tokens are reserved for the team behind Pool Party. These tokens may be allocated to the developers, founders, or other team members.

Finally, 20% of the $PARTY tokens are allocated to an Ecosystem Fund. This fund can be used for various purposes related to the growth and development of the Pool Party ecosystem, such as liquidity mining incentives, partnerships, marketing, or community initiatives.

Overall, the token allocation of $PARTY in Pool Party is designed to incentivize participation, reward contributors, support the development team, and promote the growth of the Pool Party ecosystem.

Pool 1 and Pool 2

What are Pool 1 and Pool 2?

Pool 1 and Pool 2 are single-sided staking Pools within the Pool Party cryptocurrency game, which facilitate a Cournot-style competition among staked tokens. This is achieved by allowing participants to stake their $PARTY tokens in either Pool 1 or Pool 2, with the losing Pool paying out 10% of its tokens to the winning Pool each day. Winnings are distributed proportionally to the size of each participant's stake and remain staked until the user decides to withdraw.

Fees

There is a 1% fee to stake in Pool 1 or Pool 2. Additionally, another 1% is assessed when unstaking from Pool 1 or Pool 2. During the locked phase of each epoch, players cannot unstake from Pool 1 or Pool 2.

However, users can hop their entire staked balance from one pool to another with variable fees.

During the locked phase, players can hop their staked tokens from one Pool to another for a 1% fee. During the unlocked phase, pool hopping carries no fees.

Win Percentage

The win percentage for each Pool is determined by a risk-neutral pricing methodology grounded in the theory of martingale systems. Specifically, the win percentage is a function of the ratio of tokens staked between the two Pools. Key takeaways from this design feature include the fact that the larger Pool always has a higher win percentage than the smaller Pool, and the smaller Pool can potentially earn more tokens if it wins than the larger Pool.

APR

Finally, each Pool offers a variable APR, which is continuously recalculated based on the total number of tokens staked in the other Pool. Specifically, the APR for Pool A is determined by 0.1 times the total number of tokens staked in Pool B, multiplied by 365, while the APR for Pool B is determined in a similar fashion using the total number of tokens staked in Pool A.

Summary

In summary, Pool 1 and Pool 2 are designed to incentivize participants to stake their tokens and engage in a competitive staking environment, with the ultimate goal of creating a deflationary token with high liquidity. The use of a Cournot-style competition and dynamic APRs serve to promote efficient resource allocation and provide participants with a fair chance at earning rewards.

Favor

What is Favor?

In the Pool Party game, players can use "Favor" to influence the win rate of a particular Pool. Favor is a mechanism that provides a bonus to the win rate of a Pool based on the ratio of one Pool's Favor to the other. The maximum bonus that Favor provides is 25%, which is only achieved when the ratio of one Pool's Favor to the other is infinitely high. In practice, this means that the maximum bonus is achieved when one Pool has Favor and the other Pool has none.

Examples

If Pool 1 has 10 Favor and Pool 2 has 5 Favor, the Favor ratio is 100%, resulting in a bonus of 12.5%.

If Pool 1 has 13 Favor and Pool 2 has 10 Favor, the Favor ratio is 30%, resulting in a bonus of 3.75%.

How Favor is Calculated

Restrictions

It is important to note that there are restrictions on the use of Favor. The maximum win rate that a Pool can have after applying Favor is 75%. This means that even if a Pool has a win rate of 60% and a Favor bonus of 20%, the resulting win rate will only be 75%. Moreover, in order for the opposing pool to restore the original win percentage of 60%, they will have to increase their Favor by 2x.

If one Pool has Favor and the other does not, the Pool with Favor receives the maximum bonus of 25%. However, as the Favorless Pool begins buying Favor, the Favor bonus is calculated according to the above formula.

Price of Favor

The pricing of Favor follows a VRGDA (variable rate gradual Dutch auction). This means that Favor starts at a price of 5,000 $PARTY, and the protocol adjusts the price of Favor to target 200 sales per day. If there are no sales in 24 hours, the price of Favor will decay roughly 50%.

Summary

In summary, Favor is a powerful tool that players can use to increase the win rate of a Pool. However, it is subject to restrictions, and there is a theoretical maximum bonus of 25%. The pricing of Favor follows a VRGDA, which ensures that its price is dynamically adjusted based on demand.

Pool 3

What is Pool 3?

Pool 3 is a unique opportunity for users to stake $PARTY-ETH LP tokens and earn increasing rewards over the first two weeks of the Pool Party launch. The rewards are distributed every 24 hours.

Restrictions

There are no fees to stake in Pool 3, in contrast to Pools 1 and 2. However, players must keep their tokens staked for 24 hours before they are eligible to receive rewards. If a player unstakes their tokens before the 24 hour period is over, the player will forfeit their unclaimed earnings, and their reward claim will be reset back to zero.

What are Emissions Like?

The initial seed amount for Pool 3 is 5 million $PARTY on day 1. Each day thereafter, the amount of $PARTY added to the Pool will linearly increase at a rate of approximately 3.6 million $PARTY per day. This means that on day 2, approximately 8.6 million $PARTY will be added to the Pool, and on day 3, approximately 12.2 million $PARTY will be added, until day 14 when approximately 52.1 million $PARTY will be added.

Total Emissions

Overall, Pool 3 will emit a total of 400 million $PARTY over the 14-day period that it is available. This emission schedule is designed to encourage users to stake their LP tokens early on, as the rewards will increase over time.

Lockups

Why are there Lockups?

In the Pool Party game, lockup periods are implemented in order to incentivize long-term commitment and discourage short-term speculation. The lockup period is the duration of time that a player cannot withdraw their tokens from a Pool. This is designed to help stabilize the Pool and ensure that there is sufficient liquidity available for all players throughout the game.

Start of the Game

In the game, players have 8 hours to stake their tokens in Pool 1 or Pool 2. Once the 8 hour period has elapsed, the tokens are locked for a period of 16 hours. This means that players cannot withdraw their tokens from the Pool for the next 16 hours after the staking period. After this lockup period, the tokens become available for withdrawal.

Pool Hopping

It's important to note that players are allowed to hop from one Pool to another at any point during the lockup period, but there is a 1% fee for doing so during the locked phase. Outside the lockup phase, Pool hopping incurs a 0% fee. This fee is designed to discourage players from constantly switching pools and to encourage long-term commitment to a single Pool. This fee also helps to stabilize the pools by reducing the frequency of players switching between them.

Pool 3

There is no lockup period for Pool 3. This is because Pool 3 is designed to incentivize players to provide liquidity to the Pool by staking their $PARTY-ETH LP tokens. The rewards earned in Pool 3 are distributed via rebasing at a random time each day, so there is no need for a lockup period to ensure liquidity. However, players must keep their tokens staked for 24 hours before they are eligible to receive rewards. If a player unstakes their tokens before the 24 hour period is over, the player's reward claim will be reset back to zero.

Token Burns