CryptoLinks CryptoCap Review

CryptoLinks CryptoCap

cryptolinks.com

Why do I need CryptoLinks All CryptoCurrencies site?

Cryptocurrencies have exploded in popularity in recent years, with more and more people looking to invest in the digital assets as a way to diversify their portfolios and potentially earn huge returns. One of the key tools that any cryptocurrency investor needs is a way to track their holdings, as well as keep an eye on the price movements and market capitalization of the various coins they own. In this article, we'll explore some of the best tools and resources for tracking your cryptocurrency portfolio, as well as keeping an eye on the price charts and market cap of your favourite coins.

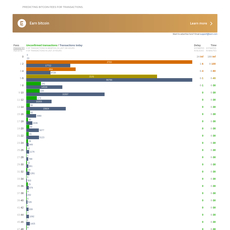

First and foremost, it's important to have a reliable way to track your cryptocurrency portfolio that is why we did Cryptolinks market cap. This can help you stay on top of your investments, see how they are performing, and make informed decisions about when to buy or sell. Cryptolinks allows you to input your cryptocurrency holdings and see how they are performing in real-time, as well as see the overall market trends for various coins.

Cryptolinks Market Capitalization

Another key factor to consider when investing in cryptocurrencies is market capitalization, which refers to the total value of all coins in circulation. Cryptolinks Market cap can be a useful indicator of a coin's overall popularity and demand, as well as its potential for growth. Market capitalization, refers to the total value of all coins in circulation. Market cap is a useful indicator of a coin's overall popularity and demand, as well as its potential for growth. In general, coins with high market caps tend to be more established and stable, while those with low market caps may be more risky but also offer more potential for growth. Cryptolinks offer real-time data on the market cap of various coins, as well as other key metrics such as trading volume and circulating supply.

Market capitalization is an important metric to consider when evaluating the performance of a cryptocurrency. It refers to the total value of all coins in circulation, and can be a useful indicator of a coin's overall popularity, demand, and potential for growth. In this article, we'll explore the importance of market capitalization in the cryptocurrency market and how it can be used to make informed investment decisions.

One of the main benefits of tracking market capitalization is that it can provide insight into the overall size and scale of a particular coin. In general, coins with high market caps tend to be more established and stable, while those with low market caps may be more risky but also offer more potential for growth. By tracking market capitalization, investors can get a sense of a coin's relative size and stability and how this may impact its price.

Another reason why market capitalization is important is that it can help identify potential market trends and patterns. For example, a sudden increase in the market capitalization of a coin may indicate a potential uptrend or increased demand, while a decrease may indicate a potential trend reversal or downward pressure on the price. By tracking market capitalization and looking for these types of patterns, investors can potentially identify buying or selling opportunities.

It's also worth noting that market capitalization can be affected by a variety of factors, such as the overall level of demand for a coin, its trading volume, and the size of its circulating supply. By keeping an eye on these factors and how they may be impacting market capitalization, investors can make more informed decisions about when to buy or sell their coins.

In conclusion, market capitalization is an important metric to consider when evaluating the performance of a cryptocurrency. It can provide insight into the overall size and scale of a coin, as well as help identify potential market trends and patterns. By tracking market capitalization and staying informed about market conditions, investors can make more informed investment decisions and potentially earn big returns on their holdings.

Cryptolinks circulating supply

Keep an eye on the circulating supply of a coin. This refers to the total number of coins that are currently in circulation and available for trade. Coins with low circulating supplies may be more scarce and therefore potentially more valuable, while those with high circulating supplies may be more easily accessible and less scarce.

Circulating supply is a key metric to consider when evaluating the potential value of a cryptocurrency. It refers to the total number of coins that are currently in circulation and available for trade, and can be a useful indicator of a coin's overall supply and demand dynamics. In this article, we'll explore the importance of circulating supply in the cryptocurrency market and how it can be used to make informed investment decisions.

One of the main benefits of tracking circulating supply is that it can provide insight into the overall level of scarcity of a particular coin. In general, coins with low circulating supplies may be more scarce and therefore potentially more valuable, while those with high circulating supplies may be more easily accessible and less scarce. By tracking circulating supply, investors can get a sense of a coin's relative scarcity and how this may impact its price.

Another reason why circulating supply is important is that it can help identify potential market trends and patterns. For example, a sudden increase in the circulating supply of a coin may indicate a potential trend reversal or downward pressure on the price, while a decrease in supply may indicate a potential uptrend. By tracking circulating supply and looking for these types of patterns, investors can potentially identify buying or selling opportunities.

It's also worth noting that circulating supply can be affected by a variety of factors, such as mining, staking, and the overall level of demand for a coin. By keeping an eye on these factors and how they may be impacting circulating supply, investors can make more informed decisions about when to buy or sell their coins.

In conclusion, circulating supply is an important metric to consider when evaluating the potential value of a cryptocurrency. It can provide insight into the overall level of scarcity of a coin, as well as help identify potential market trends and patterns. By tracking circulating supply and staying informed about market conditions, investors can make more informed investment decisions and potentially earn big returns on their holdings.

Cryptolinks trading volume

Cryptolinks tracks trading volume, which refers to the number of coins that are being bought and sold on exchanges over a given period of time. High trading volume can indicate strong interest in a coin and may be a sign of future price movement. However, it's important to be cautious of artificially inflated trading volumes, which can sometimes be caused by wash trading or other forms of manipulation.

Trading volume is an important metric to consider when evaluating the performance of a cryptocurrency. It refers to the number of coins that are being bought and sold on exchanges over a given period of time, and can be a useful indicator of the overall demand for a coin. In this article, we'll explore the importance of trading volume in the cryptocurrency market and how it can be used to make informed investment decisions.

One of the main benefits of tracking trading volume is that it can provide insight into the overall level of interest in a particular coin. Generally speaking, coins with high trading volumes tend to be more popular and widely traded, while those with low volumes may be less well-known or less actively traded. High trading volumes can be a sign of strong demand for a coin and may indicate potential price movement in the future.

Another reason why trading volume is important is that it can help identify potential market trends and patterns. For example, a sudden spike in trading volume may be a sign of a trend reversal or breakout, while a sustained period of high volume may indicate a strong uptrend. By tracking trading volume and looking for these types of patterns, investors can potentially identify buying or selling opportunities.

It's also worth noting that trading volume can be affected by a variety of factors, such as market news, regulatory changes, and the overall sentiment of the market. By keeping an eye on these factors and how they may be impacting trading volume, investors can make more informed decisions about when to buy or sell their coins.

In conclusion, trading volume is an important metric to consider when evaluating the performance of a cryptocurrency. It can provide insight into the overall level of demand for a coin, as well as help identify potential market trends and patterns. By tracking trading volume and staying informed about market conditions, investors can make more informed investment decisions and potentially earn big returns on their holdings.

Cryptolinks Charts

In addition to tracking your portfolio, it's also important to have access to real-time price charts for the various cryptocurrencies you own. This can help you stay on top of price movements and identify potential buying or selling opportunities. Cryptolinks offer a variety of charting tools and features, such as technical analysis indicators and real-time alerts.

Cryptocurrency charts are an essential tool for any investor looking to track the performance of their favorite coins and make informed investment decisions. In this article, we'll explore the various types of cryptocurrency charts available and how they can be used to analyze the market and make informed trading decisions.

One of the most commonly used types of cryptocurrency charts is the line chart, which plots the price of a coin over a specific time period. Line charts are simple and easy to read, making them a popular choice for beginners. They can be used to identify trends and patterns in the price of a coin, as well as potential support and resistance levels.

Another popular type of cryptocurrency chart is the bar chart, which consists of vertical bars that represent the price of a coin at a specific point in time. Bar charts provide more information than line charts, including the high, low, and close prices for a given time period. They can be used to identify key support and resistance levels, as well as trend reversals and breakouts.

Candlestick charts are another popular type of cryptocurrency chart, which consist of "candlesticks" that represent the price of a coin over a specific time period. Candlestick charts provide a visual representation of the price action of a coin, with the body of the candlestick representing the price range for the time period and the wicks indicating the highest and lowest prices. Candlestick charts are particularly useful for identifying potential trend reversals and breakouts.

In addition to these basic chart types, there are also a variety of advanced charting tools and indicators available for more experienced investors. These include technical analysis indicators such as moving averages, Bollinger bands, and the Relative Strength Index (RSI), which can help identify trends, support and resistance levels, and potential buying and selling opportunities.

Other metrics to consider when evaluating a cryptocurrency include the coin's price-to-earnings ratio (P/E ratio), which compares the coin's current price to its earnings per share, and the coin's return on investment (ROI), which measures the profitability of an investment. Both of these metrics can help you gauge the potential profitability of a coin and make more informed investment decisions.

Cryptolinks helps tracking your cryptocurrency portfolio, keeping an eye on price charts, and staying up-to-date on market capitalization are all important tasks for any cryptocurrency investor. By using Cryptolinks and staying informed about the market trends, you can make more informed investment decisions and potentially earn big returns on your cryptocurrency holdings.