LocalBitcoins Review

LocalBitcoins

localbitcoins.com

LocalBitcoins Review

Centralized crypto exchanges thrive because they are the de facto gateways to the crypto market. And while some of these exchanges boast a global network of users, there are still barriers forcing traders to look for alternative and more robust crypto gateways. This is where platforms like LocalBitcoins enters the fray.

For LocalBitcoins, the best approach is to offer users the freedom to set their preferred payment methods and interact directly with potential buyers and sellers. This framework has become popular in certain regions, and it is the only viable option for bitcoin proponents residing in countries with stifling crypto regulations. Continue reading for more details about LocalBitcoins and things to look out for before buying or selling bitcoin on its p2p market.

LocalBitcoins Overview

LocalBitcoins.com facilitates a peer-to-peer market where users can buy or sell bitcoin. Launched in 2012, the Finland-based platform has emerged as a viable alternative to centralized exchanges which provide automated order matching services. Here, users get to enjoy more control over their trades.

The platform permits users to choose their preferred exchange rate, the payment method, and the buyer or seller to transact with. LocalBitcoins believes that this framework eliminates all corporate overhead involved in selling and buying bitcoins. With this, the processes are customizable, lean, and fast.

Since LocalBitcoins offers a degree of control to users, the platform supports a wide array of payment methods. If you are unable to access a crypto exchange with your preferred payment option, then your best bet is LocalBitcoins. The capability of LocalBitcoins to support a robust list of fiat-to-crypto gateways is indicative of its inclusive business principle. The p2p exchange is looking to enable bitcoin’s financial paradigm in regions underserved by traditional banking systems.

Up until 2019, LocalBitcoins remained one of the few platforms where you can buy and sell bitcoin anonymously. Due to the influx of crypto regulations, the platform had to roll out KYC and AML requirements and it disabled the option to buy bitcoin with cash.

What are the supported countries?

LocalBitcoins is available globally, except in Germany and the state of New York. However, liquidity depends on the number of active traders from your country and the volume of trades facilitated. When you load the LocalBitcoins website, the platform automatically compiles advertisements created by traders in your current location. The competitiveness of the local bitcoin market in your country would determine the range of payment methods that are accessible and the exchange rate.

Limit and liquidity

As mentioned earlier, the size of the local bitcoin market in your country determines liquidity. However, this does not stop you from opting for international bitcoin offers, as long as you have access to a globally accepted payment network. In other words, liquidity also indirectly depends on the payment method you have access to.

Also, there are no caps on the number of bitcoins you can sell or buy. Remember that users have the right to choose the terms and conditions of their trades. Hence, they can set the maximum and minimum transaction limits independently. Nonetheless, you may have to scale multiple KYC processes to enjoy unlimited trade limits. Below are the verification levels and their associated trading limits.

- T0: Submission of name, country, email address, and phone number. The limit for trade is €1,000/year.

- T1: Submission of physical address, ID verification, and KYC info. The limit is €20,000/year.

- T2: Submission of Proof of residence. The yearly cap on trade is €200,000.

- T3: Extra ID verification process. There is no limit for trades.

Payment methods

As mentioned earlier, LocalBitcoins supports a wide range of payment methods. Some of the popular options you will find on LocalBitcoins are:

- Paypal

- Wire transfer

- SEPA

- Payza

- Neteller

- Skrill

- Cash deposits

- MoneyGram

- Payoneer

Note that it is not advisable to opt for payment options that offer chargebacks when selling bitcoins. Always remember that you are dealing with total strangers and there is always the possibility of falling victim to chargeback frauds. For those who intend to buy bitcoin with payment systems that offer reversals, you might have no other option than to purchase above the market rate. The higher the risks involved, the more expensive it is to buy bitcoin on p2p networks.

Fees

The trading fee charged by LocalBitcoins only applies to users who create advertisements. The exchange charges a 1% flat fee on all completed trades facilitated via advertised bids and offers. In other words, it is free to register, buy and sell on LocalBitcoins as long as you do not utilize the option to advertise offers. Likewise, transactions made within the LocalBitcoins network are free. In essence, you are not required to pay fees when you send bitcoin to other LocalBitcoins users. In contrast, the exchange passes on the bitcoin network fees required to transfer coins to external wallets to users.

Customer support

LocalBitcoins has had its fair share of backlash. Before the implementation of KYC requirements, scammers found it a tad easy to capitalize on the naivety of new users. However, as exemplified by the recent surge of positive reviews on Trustpilot, LocalBitcoins seems to have found a way to reduce the occurrence of scams.

For its customer support, LocalBitcoins offers an email ticketing system. There used to be a LocalBitcoins forum where users could network. We noticed that the forum was temporarily disabled at the time of writing this review. In addition to the email support, users have access to a library of guides on important LocalBitcoins concepts, policies, and processes.

Security

There are recurring attempts by scrupulous traders to scam unsuspecting users. However, if you follow instructions and take your time to evaluate the integrity of sellers and buyers, the chances of falling for such fraud are slim. Notably, LocalBitcoins have never suffered a major security crisis. There is two-factor authentication implemented as an extra security layer for sensitive processes. Also, the exchange offers a Login Guard that remembers web browsers and verifies that all logins are processed via authorized browsers.

How to use LocalBitcoins?

Now that you have a fundamental understanding of the core features of LocalBitcoins, the next step is to explore ways to safely buy and sell bitcoin on the network. First and foremost, you need to register and submit vital documents to scale the KYC requirements.

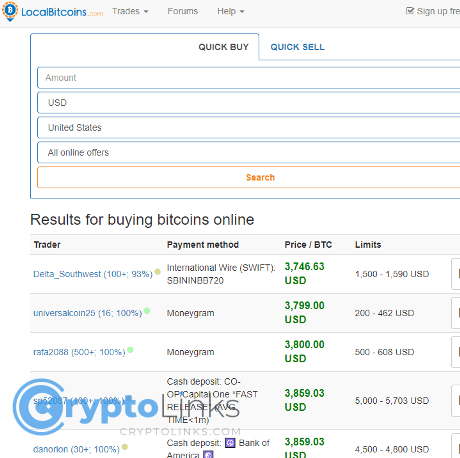

Once you are verified, you can begin to search for offers. It is advisable to search for established sellers and buyers rather than advertising your offer. When you advertise an offer, you tend to attract scammers in their numbers. Therefore, the best line of action is to click the “Buy Bitcoins” or “Sell Bitcoins” tabs to explore the offers available.

You can go ahead to filter offers by choosing a preferred payment option. And although the exchange rate could be a determining factor, you should never choose sellers based on their price rates alone. You will agree that it is better to buy bitcoin at a slightly higher rate from a trusted vendor than to opt for an unverified seller with a low exchange rate. Below are some of the factors to look out for before choosing a seller or buyer on LocalBitcoins.

- Ensure that they have verified accounts

- Ascertain that they have processed a significant volume of trades

- Confirm that the account has been active for more than a year

- Ensure that the seller or buyer is trusted by more than 10 users

- Check the history of the users’ activities. This would help gauge the last time the seller or buyer completed a trade.

You are less at risk of falling victim to scams once you follow this guideline. As soon as you agree to the term and conditions set by the seller or buyer, LocalBitcoins will immediately lock the bitcoins in escrow. The seller would release the locked bitcoin once he or she confirms the payment. The reverse is the case if you are the seller.

Note that all communication and trades must be done within the platform. This will help LocalBitcoins determine the guilty party in the event of a dispute. Do not allow a trader to cajole you into negotiating on external platforms for a more competitive exchange rate. Lastly, always confirm payments before releasing coins.

What are the pros and cons of LocalBitcoins?

Pros of LocalBitcoins

It is a peer-to-peer exchange

As a p2p network, users can set preferred prices and limits. Likewise, this approach is suitable for traders located in bitcoin unfriendly regions.

LocalBitcoins offers a broad range of payment methods

Unlike centralized exchanges, LocalBitcoins supports a wide variety of payment options. Therefore, it is an ideal option for traders that would prefer to use payment systems that are popular locally. It also exposes users with globally accepted fiat settlement networks to a global bitcoin market.

Fees are relatively low

Other than the 1% flat fees imposed on traders with advertised offers, it is free to register, buy and sell bitcoin on LocalBitcoins.

There are no trading limits

When you scale all the KYC processes required by LocalBitcoins, you are free to buy or sell as much bitcoin as you want.

It is available worldwide

LocalBitcoins only restricts users from Germany and the state of New York. This means that you can use its services if you are not in any of these two jurisdictions.

It is a reputable and established exchange

LocalBitcoins is one of the oldest bitcoin exchanges that is still operating to date. As such, it is a reputable brand in the crypto industry.

Cons of LocalBitcoins

You can only buy and sell bitcoin

Although LocalBitcoins features a wide variety of payment options, the same level of flexibility cannot be said of its supported cryptocurrencies. As its name implies, LocalBitcoins only focuses on providing the infrastructure to sell and buy Bitcoin.

Scammers tend to target LocalBitcoins’ users

The p2p nature of this exchange is bound to expose users to fraudulent entities. Scammers are constantly looking for ways to lure sellers to forfeit their coins or funds. Therefore, it is advisable to always be on the lookout for red flags.

High exchange rates

Depending on your preferred payment option, you may have to buy bitcoin above the market rate.