BlockFi Review

BlockFi

blockfi.com

BlockFi Website Review

- BlockFi users gain access to a centralized hub for many different financial services that they would like to use.

- These services can range from simply taking out loans, holding crypto, or even managing credit card expenditures.

- Users can also earn a specific percentage in interest through the process of holding assets in a BlockFi interest account.

- BlockFi was originally founded in 2017 and currently has over 1 million verified users.

BlockFi is essentially a cryptocurrency exchange that offers interest-bearing accounts as well as low-interest-rate loans on a global scale. With the creation of a BlockFi account, users can earn a specific percentage of compound interest on the cryptocurrency holdings they have.

This interest rate varies by currency type and even fluctuates with market values.

Today, we are going to take an in-depth look and even explore everything that you need to know about the BlockFi website and will go over its features and overall functionalities. Let's jump in.

BlockFi Website

From the very moment that you visit the official BlockFi website, you are introduced to a minimalistic design that aims to keep things as simple as possible.

To truly put into words what you can view on the website, we will first be going over the top navigation bar so that you can visit almost every offering that BlockFi has to offer.

First, going from left to right, you have the BlockFi logo. Right next to it, there is the Products menu.

Within the products menu, you have access to many subpages, including:

- The BlockFi Wallet - this is a wallet that will let you safeguard and store your cryptocurrencies.

- Credit Earn - this is a service offered by BlockFi which essentially lets you earn 1.5% back on every purchase that you end up making.

- Trading Account - this is a page that lets you buy Bitcoin as well as be able to trade many other cryptocurrencies.

- Crypto-Backed Loans - this takes you to a service that will let you Borrow USD at an interest rate as low as 4.5%.

- Personalized Yield - this will offer you exclusive benefits. However, this is only the case for high net-worth clients.

Then there is the institutions menu, which will take you to multiple subpages, including BlockFi Prime, Miners, exchanges, and ATMs, as well as investment products. Right next to it, there is the services tab, which will take you to the pages known as Partners and Refer-A-Friend.

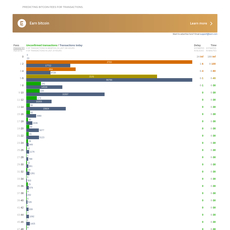

Alongside all of this, there is also the Resources tab that you can easily find. This resources tab will take you to multiple subpages, including the Resource Center, Blog, FAQ, BlockFi Live, the Rates, and the Help Center.

Right next to that tab, you have the Company tab. This tab also has a set of specific web pages that you can visit, including Mission, Contact Us, Leadership Team, Investors, and Jobs. The last navigation bar list is the Credit Card, which will take you to a separate page specific to the BlockFi credit card.

On the right side of the navigation bar, you also have the Log In button as well as the Get Started Button. Once you clock on the blue "Get Started" button, you will be redirected to a page where you can essentially start the account creation procedure.

In order for you to be able to actually make an account, you will need to enter your legal first name, legal last name, email, password, and optional referral code, and agree that you are 18 years or older and have read the Terms & Conditions, Wallet Terms, and Privacy Policy. You also need to confirm that you have read the SMS Policy and agree to receive text messages from BlockFi with security alerts regarding your account.

With the main navigation bar out of the way, we can move on to the rest of the page. RIght under that, there is the notable slogan of the BlockFi page and brand known as "Buy, sell and earn crypto," where you are showcased that with the BlockFi rewards credit card, you can earn up to 3.5%* back in crypto on every purchase you make. However, right underneath that, the website also tells you that the 3.5% is an introductory offer that spans the first 90 days of the card ownership, which begins on the date of the card's activation. The introductory offer is also capped at $100 in Bitcoin (BTC).

Underneath that, you also have some stats regarding the BlockFi service and products, such as the fact that it has over 1 million clients, 350 global institutions as well as over $10 billion in assets.

Furthermore, as you scroll further down the page, the website gives you additional information about the BlockFi Credit Card. Specifically, it claims that over $15 million in crypto were paid in rewards to date and no annual fees. Note that the website also claims that a soft credit pull happens before you have accepted the credit card offers, and a hard credit pull occurs when you have accepted your credit card offer, which can have an impact on your credit score.

Then you are introduced to the BlockFi trading section of the page. Here, the website promises low-cost trading for leading cryptos and allows you to buy, sell or trade a variety of different crypto assets at competitive prices, after which you can store them at a convenient location.

Then there are the exclusive benefits for high net-worth clients, where you can negotiate crypto trading rates, terms, and trading costs. This means that you can essentially earn custom crypto interest rates with BlockFi.

Near the bottom of the page, you will also be able to find the BlockFi Loan section. Here, you can borrow money at rates as low as 4.5% APR. Additionally, you are not required to sell your crypto in order to get cash, and you can borrow funds against your crypto assets so that you can get a loan while you continue to hold.

Note that collateral here is needed, and the collateral amount is based on a 50% Loan to Value (LTV).

Underneath this specific section of the page, there is the Company News part of page. Here, you will be able to review the BlockFi announcements.

Additionally, there is also the “Why Choose BlockFi” section of the page, where you are given numerous reasons as to why you might be interested in using this product and overall service.

You also have the investors section, where you can view some of the biggest investors who have put their trust and capital within BlockFi. This indicates that BlockFi is backed by industry-leading investors, including Valar Ventures, Morgan Creek Capital Management, Coinbase Ventures, Galaxy Digital, Susquehanna Government Products, and Winklevoss Capital, as well as others.

Underneath all of that, there is the footer of the page, where you are given access to the App Store iOS application and Google Play Android application download links and a "Get Started" button alongside information on where you can find all of the various social media channels.

History of BlockFi

BlockFi is a service that was originally founded in 2017 by two people, Zac Prince as well as Flori Marquez. It was created as a means of offering cryptocurrency lending and savings products and is a fully regulated U.S.-based exchange that has its headquarters in New Jersey.

BlockFi Functionality

When it comes to functionality, BlockFi is essentially a product that enables users to earn interest on their cryptocurrency holdings and even take out USD loans against them. They are also given the opportunity to trade cryptocurrencies. However, the number of cryptocurrencies available might be limited when compared to alternative cryptocurrency exchanges.

There is the BlockFi Wallet, which allows users to buy, sell, trade, and even hold cryptocurrencies, which also include stablecoins. They can use the wallet as a means of storing crypto rewards, which each user can earn from the BlockFi Rewards credit card. However, note that users cannot really earn any interest from assets that are held inside of the BlockFi wallet. Instead, in order for them to earn interest, the tokens have to be held inside of a BlockFi interest account.

Then there are the crypto loans offering, where users can borrow USD against the coins which they have deposited. The minimum loan amount is $10,000, and the Loan-to-Value (TVL) ratio is 50%. What this essentially means is that 50% of a user's coins need to be put up as collateral. Coins that can be utilized as a means of getting a loan include BTC, ETH, or LTC, and the loan duration is 12 months, where the interest rate works out to 4.5%. Note that cryptocurrencies are volatile currencies, and as such, users might fall outside of the 50% LTV requirement. When the LTV reaches 70%, BlockFi will send a notification to each user that they have to put up more collateral as a means of bringing the LTV back down to 50%.

Alongside all of this, users can gain access to the BlockFi Rewards Visa Credit Card. This means that users can earn a reward on all of the purchases they make with the card, with no annual fee. For the first 90 days, while using the card, users can earn up to 3.5% back, and afterward, the card is set to earn 1.5%.

Another quite interesting and popular product that BlockFI offers is the BlockFi Interest Account (BIA). However, these are no longer offered to new clients who are located within the United States.

However, the interest-bearing account is called the BlockFi Interest Account, and users that can get this as an offering can earn interest in BTC, ETH, USDC, GUSD, LTC, and even PAX and best of all, a minimum balance is not actually required. However, this account is currently available to persons outside of the United States and is only offered through BlockFi's subsidiary, known as BlockFi International.

Pros and Cons of BlockFi

BlockFi Pros

- BlockFi is headquartered in the United States and is also fully regulated.

- There is no commission fee.

- There is no monthly fee or any minimum deposits.

- BlockFi is available on a global scale, except for sanctioned or watch-listed countries.

BlockFi Cons

- There are limited free withdrawals from interest accounts.

- The APY and loan rates have volatility associated with them.

- The savings aren’t really protected against the failure of a bank.

- The number of available cryptocurrencies is limited when compared to competing exchanges.

The Bottom Line

BlockFi is a fully licensed as well as secured, albeit centralized cryptocurrency exchange that offers an easy way through which many users can buy cryptocurrencies. While the cryptocurrency selection is quite limited, users are also given the additional functionality of being able to borrow against their crypto assets for access to cash.

The exchange does not charge a transaction fee or a deposit fee; however, it does charge a spread of a specific percentage of the purchase price. All of this still makes BlockFi a solid option for newcomers to the crypto industry who want easy access to cryptocurrencies, and this is showcased throughout the simple design and minimalistic user interface showcased throughout the website, which explains things in great detail and makes any option easily accessible even to the most inexperienced users. All of this contributes to a solid user experience.

Frequently Asked Questions (FAQs)

How Can I Open a BlockFi Account?

You can visit the official BlockFi website in order to open an account. However, you will need to upload a clear photo of an identification document, and the approval process will typically only take a few minutes.

Is the Money Stored on BlockFi Safe?

BlockFi takes measures towards protecting the funds of its users, such as keeping the majority of user funds in cold storage, and BlockFi also claims that its client funds are placed ahead of any equity or employee funds in the event of a potential loss.

Does BlockFi Offer Its Users a Cryptocurrency Wallet?

Yes, you will be able to get a cryptocurrency wallet the moment you create an account with BlockFi; however, if you want to earn interest on your crypto holdings, you will need to transfer them into a Bitcoin Interest Account (BIA).