Bankera Loans Review

Bankera Loans

loans.bankera.com

Crypto loan facilities are becoming quite popular, as they offer a means to access funds without going through the expensive and complex process of selling your crypto holdings. One of the platforms that have contributed to this narrative is Bankera. In this review, we will explore the workings of the crypto lending websites, its features, as well as its strengths and weaknesses.

What is Bankera?

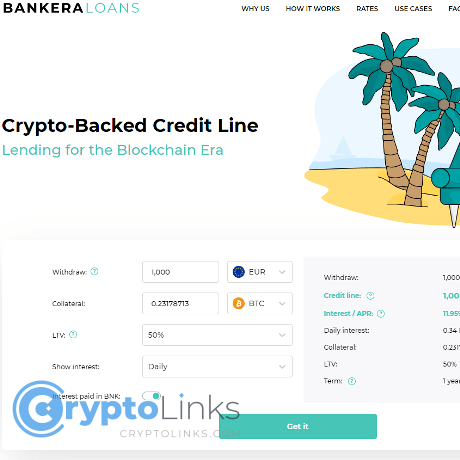

Bankera prides itself as the ultimate “crypto-backed credit line for the blockchain era.” Simply put, the platform is a lending facility specially designed for crypto holders who are willing to borrow funds while depositing their crypto holdings as collateral. Not only has Bankera capitalized on the efficacy of blockchain to provide lending services to cash-strapped crypto participants, but it has also adopted a business plan that has seen it thrive in an increasingly competitive crypto sector.

To establish an edge over other crypto lending initiatives like the Celsius network, Bankera has incorporated competitive interest rates, attractive credit line rates, impressive cryptocurrency support systems, a non-selective lending facility, and multiple layers of security. It is worth noting that the platform has its native coin, Banker token. Apparently, token holders are eligible to lower interest rates, among other perks.

What Are Bankera's Interest Rates?

As stated earlier, instead of going through the stress of selling your crypto holding when you need funds, you can simply deposit your digital assets with Bankera and access loans at predefined interest rates. Likewise, Bankera lend coins to eligible users. Unlike some of the crypto lending facilities popping up in the market, Bankera was somewhat explicit when explaining its loan rates.

Bankera classifies its interest rates under three main tags. Each tag is further broken down into subclasses, based on the impact of the ratio of the loan requested to the value of the collateral deposited (the loan-to-value ratio). The first class of fee framework is named Micro, which applies to loans under €1,000. As stated on the website, the rate for this class is 10.96%, 13.95%, and 16.95% for loans with LTV of 25%, 50%, and 75% respectively.

Likewise, the Standard loans ranging between €1,000 to €5,000 have interest rates of 8.95% for 25% LTV, 11.95% for 50% LTV, and 14.95% for 75% LTV. The third class applies to loans over €5,000 with interest rates of 6.95% for 25% LTV, 9.95% for 50% LTV, and 12.95% for 75% LTV. Note that borrowers can only deposit specific cryptocurrencies as collateral. For a borrower, who is willing to deposit collateral that is equivalent to at least 75% of the value of the loan requested, he or she can deposit with BTC, ETH, XEM, and DASH as collateral. On the contrary, borrowers with an LTV higher than 25% can only pay their collateral with BTC and ETH.

Although the three classes have unique rates, however, they are all term loans, as the repayment schedule is set at 1 year. Similarly, the minimum and maximum loan accessible on Bankera is €25 and €1,000,000 respectively. While this is a given, borrowers can either choose to pay up their loans at any time within the set duration or extend the loan agreement. Besides, Bankera advises its users to keep an eye on their LTV%, even as the price of cryptocurrencies fluctuates. By doing so, they can deposit more collateral whenever their LTV% falls below their preferred threshold as a result of price fluctuations.

What Are the Pros of Bankera?

It Has One of The Lowest Rates in The Crypto Lending Market

Bankera has implemented a loan service framework based on interest rates that are more reasonable than what a majority of crypto lending platforms offer, let alone traditional lending institutions. The interest rate starts at 6.95% and rises as high as 16.95% as the loan-to-value increases. That said, we suggest that you explore Bankera’s interest rate chart to identify the loan rates you will most likely pay on the amount you intend on borrowing.

The Platform Is Serious About the Security of Its Users

It is important to mention that Bankera is an affiliate of a digital exchange platform, Spectrocoin, which has over 1 million customers. Hence, it is certain that the development team backing this project is familiar with the common security threats plaguing the crypto space, especially platforms that offer custodial-based services. In line with this assertion, the Bankera lending facility has implemented multiple layers of defense systems to protect users’ details and secure digital assets held as collateral.

It Provides Lending Services to A Global Market

Bankera does not operate a geo-selective lending business model. In other words, as long as cryptocurrency is legal in your location, you are eligible to access loans on the crypto lending platform.

Bankera supports a broad array of cryptocurrencies

The global attractiveness of crypto platforms depends on its compatibility with cryptocurrencies popular in different regions of the world. Not only has Bankera enabled support systems for bitcoin lending, but it also offers lending services to a broad array of cryptocurrencies, including ETH, DASH, XEM, BNK, and stablecoins. While borrowers can service their loans or make repayment with any of the listed coins, however, they can only deposit collateral in selected cryptocurrencies applicable to the category that their loans fall under.

It Offers Perhaps the Lowest Minimum Amount Accessible as Loan

The minimum amount users can access as loans on the Bankera platform is €25, which you will agree is quite remarkable. As such, chances are Bankera would not turn you down because the amount you intend to borrow is too low.

Bankera Provides A Non-Restrictive Repayment Scheme

The crypto lending infrastructure offers a flexible repayment framework where users can choose how they want to repay their loans, so long they do so before the maturity stage.

What Are the Cons of Using Bankera?

It Supports Only One Fiat Currency

The most eye-catching downside of the Bankera lending ecosystem is its current restrictive payments system, which only supports Euros. Needless to say, this model is bound to unnecessarily inconvenient individuals who prefer to repay loans with other fiat currencies.

The Website Has Little to No Information on The Core Workings of The Platform

Truth be told, the Bankera’s website embodies a simple and easy to navigate design. Nevertheless, the over-simplistic nature of the website might have spurred the platform to snub sections explicitly discussing the functionalities of the lending facility and how to go about requesting for a crypto loan. We believe that details explaining the technical aspect of the operations of Bankera will boost its efficacy.