Crypto Credit Card Benefits

Have you ever wondered if your daily spending could unlock a treasure of crypto rewards? Let’s explore the world of crypto credit cards, where the benefits aren’t only exciting but game-changing. Traditional credit cards offer rewards like points or cash back, but they often feel limited and subject to the gnawing effects of inflation, making your hard-earned rewards less valuable over time. Even worse, the trust issues with traditional banks can leave you feeling constrained. Here’s where crypto credit cards promise a remedy: They offer revolutionary rewards through cryptocurrencies like Bitcoin or Ethereum, turning your spending into potential investments that could grow in value. Unlike cash that loses value, your crypto rewards could hedge against inflation and provide enhanced financial freedom by eliminating the counterparty risks of traditional banking systems. Curious already? Stay tuned to see how crypto credit cards can transform your financial life!

The Common Financial Problems

Before jumping into the fun stuff, let’s talk about some common financial headaches we all face:

Limited Rewards Options

Traditional credit cards give you points, miles, or cash back, but nothing beyond that. Ever felt like you’re missing out on better rewards?

Inflation Impact

Cash rewards can lose value over time due to inflation. So, even if you’re earning, you might be losing out in the long run.

Banking System Limitations

Trust issues with traditional banks and fiat currencies are real. Have you ever thought about stepping out of the traditional banking system’s boundaries for more financial freedom?

What Crypto Credit Cards Promise

Crypto credit cards offer solutions to the above problems:

Revolutionary Rewards

With these cards, you can earn cryptocurrencies like Bitcoin or Ethereum. Imagine watching your rewards grow as these digital assets appreciate in value!

Hedge Against Inflation

The beauty of cryptocurrency rewards is their potential for growth. Unlike cash rewards that devalue, your crypto rewards might actually increase in worth over time.

Enhanced Financial Freedom

By using crypto credit cards, you eliminate counterparty risks and step outside the constraints of traditional banking systems. Sounds liberating, right?

Curious to know how crypto rewards can change your financial game? Stay tuned for the next part where we’ll explore how earning crypto can be a game-changer in the credit card space!

Cryptocurrency Rewards

Crypto rewards are game-changers in the credit card space. Imagine turning your everyday spending into a way to earn Bitcoin or Ethereum. Sounds exciting, right?

How They Work

Instead of the usual points or cash back, crypto credit cards let you earn various cryptocurrencies as rewards. Basically, every time you swipe your card, you’re stacking digital coins. This simple shift could have significant implications for your financial future.

Popular Choices

Most crypto credit cards offer a range of popular cryptocurrencies. Here are some of the common ones:

- Bitcoin (BTC) – The pioneer of cryptocurrencies, widely accepted and trusted.

- Ethereum (ETH) – Popular for its smart contract functionality.

- Altcoins – Other alternatives like Litecoin (LTC), Ripple (XRP), and more.

Real-life Application

Ever wondered how you can utilize these crypto rewards? Here are some practical examples:

- Investment: Use your earned Bitcoin to invest and watch your portfolio grow. Historical data shows significant growth; for example, Bitcoin’s value surged by over 160% from January 2020 to January 2021.

- Purchases: Make purchases at businesses that accept cryptocurrency. It’s becoming more common to see signs that say “Bitcoin Accepted Here.”

- Savings: Hold your crypto and see its value potentially increase over time, offering a hedge against inflation.

“The promise of crypto rewards is not just about accumulating wealth; it’s about redefining how we interact with money.” – Anonymous

Are you excited yet? Just imagine using your credit card and simultaneously stepping into the world of cryptocurrencies. But what about the different tiers of these crypto credit cards? What type of benefits can you expect as you move up the ladder?

Different Tiers and Benefits

The landscape of crypto credit cards is as diverse as it is exciting. One of the standout features you’ll come across is the different tiers these cards offer. Each tier comes with unique perks and rewards that can make your crypto journey even more rewarding.

Entry-Level Cards

For those just starting, entry-level cards are a fantastic option. These cards typically come with basic but still valuable benefits:

- Lower staking requirements: You don’t need to lock up a lot of your crypto to get started.

- Basic rewards: While the rewards might be modest, they’re still better than what you’d get from traditional credit cards. Think of earning 1-2% back in crypto.

- Access to essential features: Whether it’s fee-free purchases or simple cashback options, these cards make it easy to dip your toes into the crypto world.

*”Small steps in the right direction can lead to big rewards,”* said an early adopter of crypto credit cards. And it’s true, even small amounts of crypto earned through these cards can grow over time, especially with the market’s potential for appreciation.

Mid-Tier Options

As you get more comfortable, you might want to explore mid-tier options. These cards are designed for users who are ready to stake a bit more crypto for enhanced benefits.

- Higher rewards: Expect to see up to 3-4% back in crypto. For example, if you frequently use your card for everyday purchases, these rewards can add up quickly.

- Additional perks: You might get access to features like limited airport lounge access or exclusive discounts on partner services.

- Better cashback rates: Increased cashback percentages on specific categories such as dining, travel, and entertainment make these cards even more appealing.

With mid-tier cards, you’re not just spending; you’re making a smart investment. Imagine earning crypto back on a fancy dinner and watching its value increase as the market grows.

Premium Tiers

For the heavy hitters, premium tier cards are where things get really exciting. These come with the best rewards and require higher staking amounts, but they offer unmatched benefits.

- Top-tier rewards: Earn up to 5% or more back in crypto. For high spenders, this can translate to significant earnings over time.

- Exclusive perks: Think complete airport lounge access, higher-tier customer support, and even travel insurance.

- Enhanced security features: Premium cards often come with additional security measures to protect your investments.

As they say, *”To the brave and bold go the rewards.”* Are you ready to elevate your spending power to new heights?

Now that you have a clearer picture of the different tiers and their benefits, which one aligns best with your lifestyle and financial goals? Stay tuned as we take a closer look at one of the leading crypto credit card options, the Crypto.com Visa Card, in the next part!

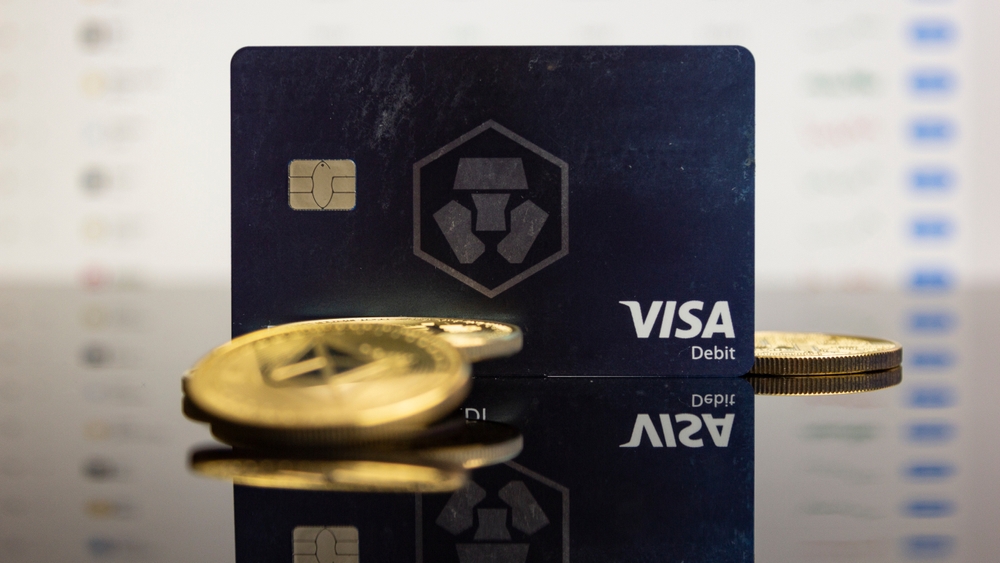

Crypto.com Visa Card – A Closer Look

Let’s explore one of the top options out there in the crypto credit card world – the Crypto.com Visa Card. This card has been making waves, and it’s time to see what all the fuss is about. Imagine a card that not only makes your everyday purchases easier but also offers you crypto rewards and many more benefits. Sounds pretty awesome, right?

How It Works

The Crypto.com Visa Card is a prepaid card that requires you to stake some of your cryptocurrency. “Staking” essentially means locking up a certain amount of your crypto for a period, which allows you to access various levels of rewards. The higher the amount you stake, the better the benefits you receive.

Rewards and Benefits

So, what are these rewards and benefits? Here’s a quick rundown:

- Cashback in Crypto: Depending on the amount staked, you can earn up to 8% cashback in cryptocurrency.

- Subscription Rebates: The card offers rebates on popular subscriptions like Spotify, Netflix, and Amazon Prime.

- Airport Lounge Access: Premium tier cardholders can enjoy airport lounge access, making your travels a bit more luxurious.

- Exclusive Discounts: Gain access to exclusive discounts on various services and products.

Here’s a quote from a user that really sums it up:

“The cash back in crypto is a game-changer. It feels like my daily purchases are actually building my financial future.”

Convenience and Usability

One of the most convenient features of the Crypto.com Visa Card is its usability. It’s accepted anywhere that Visa is. You can use it for everything from buying groceries to booking your next vacation. Plus, with the integration in the Crypto.com app, managing your account and staking more crypto has never been easier.

Considering the long and often complicated process of earning and converting traditional credit card rewards, the simplicity and directness of getting crypto for your spending makes a strong case for making the switch. Don’t you think?

Curious about how this compares to traditional credit cards? Stay tuned as we explore the real differences between crypto and traditional rewards in the upcoming section.

Comparing Traditional Credit Cards with Crypto Cards

Ever wondered how your usual credit card stacks up against a crypto credit card? Let’s break it down and see the differences that matter to you, the everyday spender.

Rewards Comparison

Traditional credit cards typically offer rewards like points, miles, or cash back. These are great, but they don’t have the same potential as cryptocurrency rewards. Imagine earning Bitcoin or Ethereum instead of points. Over time, these crypto rewards could grow in value, unlike points which often stay static.

For instance, if you spent $1,000 and got 1% back in traditional rewards, you’d earn $10. But if you got the equivalent in Bitcoin and Bitcoin’s value went up, that $10 could be worth $20, $30, or even more in the future. It’s almost like having an investment portfolio with your spending!

Transaction and Processing Fees

Let’s talk about fees. Traditional credit cards often hit you with various fees – annual fees, foreign transaction fees, and sometimes even fees for just having the card. Crypto credit cards aim to minimize these. Some don’t have an annual fee at all, while others might waive certain fees if you stake some cryptocurrency.

One comparison I love is from Crypto.com. Their Visa card, based on staking different amounts of their CRO token, has varying benefits but can essentially become fee-free. Meanwhile, a lot of traditional cards charge around 3% for foreign transactions. Ouch! With crypto cards, your fees are generally much more predictable.

Risk and Security

Here’s a big one – security. Traditional credit cards offer fraud protection, and banks are pretty good at monitoring suspicious activities. But they also hold significant counterparty risk. Remember the 2008 financial crisis?

Crypto credit cards offer decentralized security. This means you’re not entirely relying on a central authority to ensure your funds are safe. Advanced cryptographic technology makes hacking extremely difficult. Plus, losing your cards doesn’t mean losing your funds if you’ve taken the proper security measures.

Consider this: According to a study by CipherTrace, cryptocurrency fraud dropped by 57% from 2020 to 2021, showcasing just how resilient and evolving crypto security is.

“The real risk is in staying where you are – revolution doesn’t happen without a leap.” – Unknown

So, we’ve looked at rewards, fees, and security. But how can you further educate yourself on the best crypto credit cards out there and stay updated? Up next, I’ll share some additional resources that could be your next step toward financial freedom and making the most of your spending.

Additional Resources to Explore

Alright, if you’re intrigued by the world of crypto credit cards and want to dig deeper, you’re in luck. I’ve got some excellent resources lined up for you. Whether you’re looking for detailed breakdowns, comparisons, or expert opinions, these links will have you covered.

Crypto.com

Curious about the Crypto.com Visa Card we discussed earlier? This site provides all the ins and outs of how it works, the rewards structure, and what you need to get started. You’ll find everything from staking requirements to real-world usability explained here.

The Future of Spending: Crypto Credit Cards

Alright, folks, let’s wrap this up. We’ve been talking about the exciting realm of crypto credit cards and all the cool benefits they offer. Now, let’s bring it all together by taking a glimpse into the future of spending with these innovative cards.

Enhanced Financial Independence

One of the most compelling aspects of crypto credit cards is the financial freedom they provide. With traditional banks, you’re always playing by their rules. But with crypto cards, you’re stepping into a decentralized world where you are more in control.

Think about it—no more worrying about bank holidays, transaction delays, or hidden fees. Whether you’re traveling internationally or making everyday purchases, crypto cards empower you to manage your finances independently.

Growing Your Wealth

Here’s where things get really interesting. Unlike the static rewards you get with traditional credit cards, cryptocurrencies have the potential to grow in value. Imagine earning Bitcoin or Ethereum with your regular spending, only to see its value increase over time. That’s like getting double rewards!

A study conducted by Deloitte found that over 75% of customers are interested in using cryptocurrencies primarily as a store of value and a potential investment. This growing interest makes crypto rewards an enticing option for anyone looking to make their money work harder for them.

Conclusion: Are You Ready to Make the Switch?

So, are you ready to rethink how you use your credit card? Crypto credit cards offer a fresh, exciting way to earn rewards and manage your money. With the benefits of enhanced financial independence and the potential to grow your wealth, they could be the game-changer you’ve been looking for.

It’s time to start exploring your options. Look into the different cards available and see which one fits your lifestyle best. Let your everyday spending lead to extraordinary gains and open up a whole new world of financial freedom.

Thanks for sticking around, and I hope this guide has given you some valuable insights into the amazing world of crypto credit cards.