Binance CEO Changpeng Zhao Unveiling the Crystal Ball: When Will the Next Crypto Bull Run Happen?

The ever-evolving world of cryptocurrencies, there’s a constant buzz surrounding the next crypto bull run. Investors and enthusiasts eagerly anticipate these periods of explosive growth and profit potential. But when will the next bull run occur? Predicting its timing is no easy feat, yet understanding the factors that influence its arrival can provide invaluable insights.

This article aims to delve into the intricacies of the crypto market, exploring the elusive nature of bull runs and their significance for investors. By examining the underlying catalysts and market conditions, we’ll uncover the secrets that may reveal when the next crypto bull run is likely to happen.

But why is it so important to predict the next bull run? The answer lies in the potential opportunities it presents. A bull run can lead to substantial gains for investors, with cryptocurrencies reaching new heights and creating life-changing wealth. By staying ahead of the curve, investors can position themselves strategically to capitalize on this financial phenomenon.

Through this article, we’ll embark on an exciting journey, dissecting the various factors that influence the timing of a crypto bull run. From technological advancements and regulatory environments to market adoption and investor sentiment, we’ll leave no stone unturned. By comprehending these dynamics, you’ll gain a deeper understanding of the intricate forces that shape the crypto market.

It’s important to note that predicting the precise timing of a bull run is an elusive task. The crypto market is notorious for its volatility and unpredictability. However, armed with knowledge and insights, you’ll be better equipped to navigate this ever-changing landscape and make informed investment decisions.

So, fasten your seat belts and join us as we embark on this captivating exploration. Discover the underlying factors, gain expert insights, and analyze market indicators that could potentially unveil the answer to the burning question: When is the next crypto bull run happening? Together, let’s unlock the secrets and harness the power of this exhilarating financial phenomenon.

Factors Influencing the Next Bull Run: Unveiling the Market Dynamics

Technological Advancements and Innovation

Blockchain technology, in particular, stands at the forefront, revolutionizing various industries beyond finance. Its decentralized nature and immutable record-keeping capabilities have the potential to disrupt traditional systems fundamentally.

Impact of Blockchain Technology

Blockchain technology serves as the backbone of cryptocurrencies, providing transparency, security, and efficiency to transactions. Its decentralized ledger eliminates the need for intermediaries, reducing costs and enhancing trust in financial interactions. As blockchain technology evolves and becomes more scalable, we can anticipate a positive impact on the crypto market, potentially fueling the next bull run.

Development of Decentralized Finance (DeFi) Applications

Another significant innovation within the crypto space is the rise of decentralized finance (DeFi) applications. These platforms enable users to engage in various financial activities, such as lending, borrowing, and trading, without the need for traditional intermediaries. The growing popularity of DeFi reflects a shift towards more inclusive and accessible financial services. The expansion of DeFi applications may play a crucial role in triggering the next crypto bull run.

Regulatory Environment

The regulatory landscape surrounding cryptocurrencies is a topic of intense discussion and speculation. Governments worldwide are grappling with the need to strike a balance between fostering innovation and protecting investors. As a result, regulatory actions can significantly influence the crypto market.

Government Regulations and their Effect on the Market

Government regulations, such as licensing requirements and compliance frameworks, can impact the ease of entry for new participants and shape the overall market sentiment. Stricter regulations may introduce stability and security, attracting institutional investors and paving the way for broader market acceptance. Conversely, overly restrictive regulations can dampen market enthusiasm and impede the next bull run.

Global Acceptance and Recognition of Cryptocurrencies

The global acceptance and recognition of cryptocurrencies are vital factors that influence their market trajectory. As more countries and institutions adopt digital assets, the legitimacy and mainstream integration of cryptocurrencies improve. Increased acceptance can propel the crypto market forward, creating an environment ripe for the next bull run.

Market Adoption and Mainstream Integration

Market adoption and the integration of cryptocurrencies into traditional financial systems are crucial for the sustained growth of the crypto market. The involvement of institutional investors and traditional financial institutions can have a profound impact on market dynamics.

Institutional Investment in Cryptocurrencies

The entry of institutional investors, such as hedge funds and asset management firms, brings additional capital and credibility to the crypto market. Their participation signals confidence in the long-term potential of cryptocurrencies and can serve as a catalyst for the next bull run.

Acceptance by Traditional Financial Institutions

The embrace of cryptocurrencies by traditional financial institutions, such as banks and payment processors, opens doors for wider adoption and integration. When established players enter the market, it not only enhances accessibility for everyday users but also generates a renewed sense of trust and legitimacy.

Investor Sentiment and Market Psychology

Finally, as investors, our sentiment and psychology play a significant role in shaping market dynamics. Understanding the psychological factors at play can provide valuable insights into the timing of the next bull run.

Fear of Missing Out (FOMO) and Herd Mentality

The fear of missing out (FOMO) is a powerful force that can fuel market frenzies and drive prices to new heights. When investors witness others profiting from a bull run, they may be enticed to jump on the bandwagon, further accelerating market momentum.

Confidence in the Long-Term Potential of Cryptocurrencies

Long-term confidence in the transformative potential of cryptocurrencies can also influencemarket dynamics. When investors believe in the fundamental value and future growth of digital assets, they are more likely to hold onto their investments during market downturns, contributing to market stability. Additionally, sustained confidence in the long-term potential of cryptocurrencies can build a strong foundation for the next bull run.

The factors influencing the timing of the next crypto bull run are multifaceted and interconnected. Technological advancements, regulatory environments, market adoption, and investor sentiment all contribute to the market’s trajectory. By closely monitoring these factors and understanding their implications, we can gain valuable insights into the crypto market and position ourselves strategically for the next bull run.

Expert Insights and Predictions: Unveiling the Future of the Crypto Market

Analysis of Expert Opinions on the Timing of the Next Bull Run

I always seek valuable insights from industry experts to gain a deeper understanding of the market’s trajectory. Recently, Binance CEO Changpeng “CZ” Zhao shared his thoughts on the next Bitcoin bull market, shedding light on potential timelines and factors that may influence its occurrence.

CZ’s Prediction on the Next Bull Run

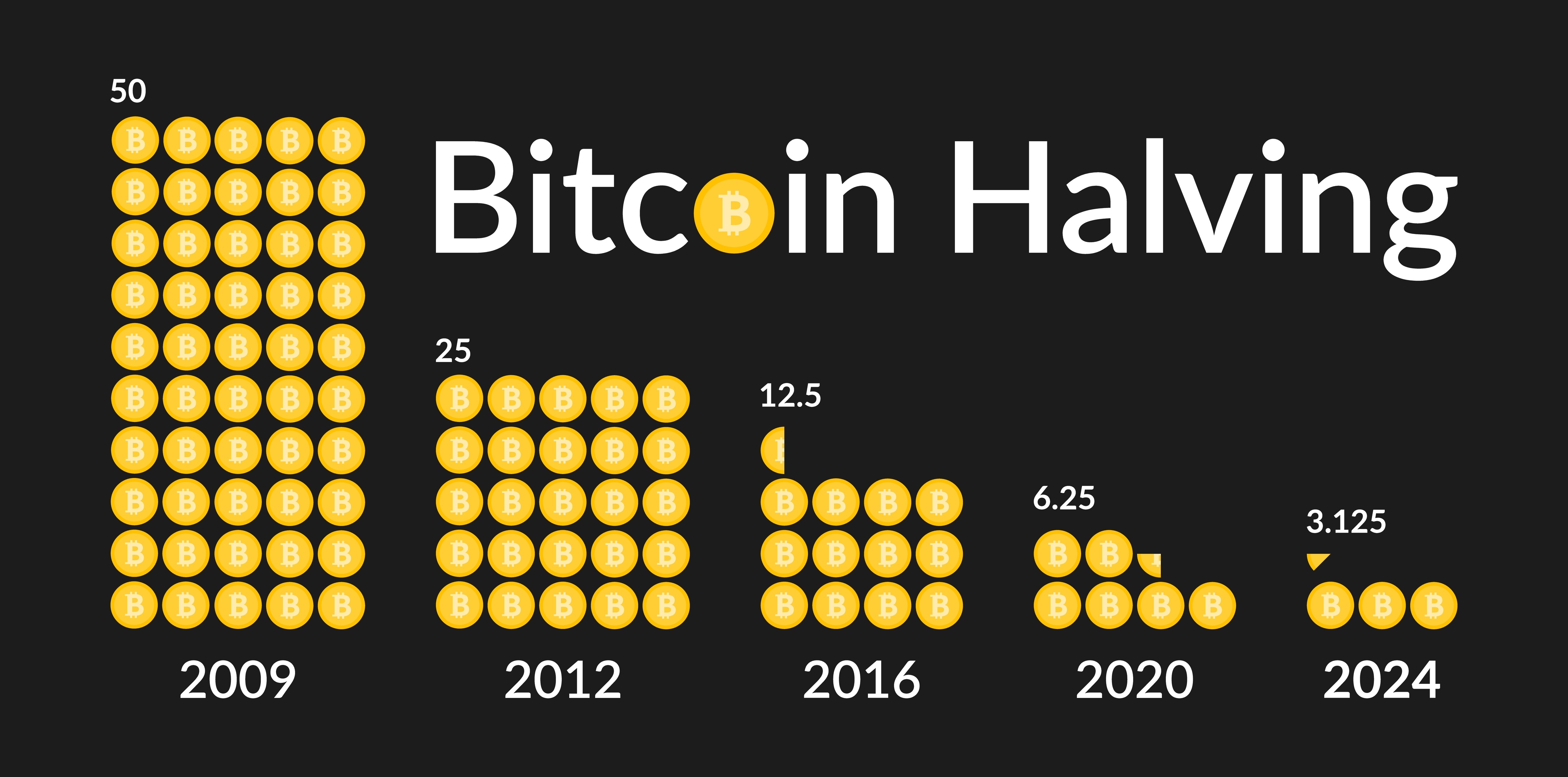

During a “ask me anything” session on Twitter, CZ acknowledged the historical four-year bull cycles of Bitcoin. While he couldn’t predict the future with certainty, he pointed out the upcoming Bitcoin halving event in 2024 and declared 2025 as the most likely year for the next bull market. This observation aligns with the historical pattern of post-halving bull runs in the past.

The Influence of Institutional Interest and Bitcoin Halving

CZ emphasized that increased institutional interest, coupled with the upcoming Bitcoin halving, are primary reasons why Binance aims to be prepared for higher trading volumes over the next eighteen months. Institutional involvement brings additional capital, credibility, and potentially paves the way for the next significant market surge.

Evaluation of Historical Patterns and Market Cycles

Understanding historical patterns and market cycles is essential to gaining insights into future price movements and potential bull runs. By evaluating past trends, we can identify recurring patterns and make informed predictions.

The Significance of Bitcoin Halving

Bitcoin halving events, which occur approximately every four years, have historically been followed by bull runs. The reduction in block rewards during halvings decreases the rate of new Bitcoin issuance, leading to a potential supply-demand imbalance and upward price pressure. Analyzing the historical impact of halvings helps us anticipate potential bull runs in the future.

Market Indicators and Technical Analysis

In addition to historical patterns, market indicators and technical analysis provide valuable insights into the timing of bull runs. Traders and analysts employ various tools, such as moving averages, trend lines, and volume indicators, to identify potential market trends and predict future price movements. These indicators and analysis techniques can offer valuable clues regarding the timing of the next bull run.

Expert insights and predictions serve as valuable guides in navigating the ever-evolving crypto market. CZ’s analysis, along with evaluations of historical patterns and market indicators, provide us with a glimpse into potential timelines and factors that may influence the next bull run. While no prediction is foolproof, staying informed and considering a variety of perspectives can help us make more informed investment decisions in this dynamic landscape.

Potential Catalysts for the Next Bull Run: Unleashing the Forces of Growth

Introduction of New Cryptocurrencies and Projects

As a keen observer of the crypto market, I am always on the lookout for innovative projects and emerging cryptocurrencies that have the potential to fuel the next bull run. The introduction of new digital assets and blockchain-based projects can inject fresh excitement and attract new investors, contributing to market growth.

The Power of Innovation

Innovation drives progress in the crypto space. When new cryptocurrencies with unique features and use cases enter the market, they bring fresh perspectives and possibilities. These innovative projects capture the attention of investors seeking promising opportunities, igniting market enthusiasm and potentially propelling the next bull run.

Significant Partnerships and Collaborations

Partnerships and collaborations within the crypto industry have the power to create a ripple effect that influences market dynamics. When prominent companies, institutions, or even blockchain networks join forces, it often signals wider acceptance and mainstream integration, sparking investor interest and potentially triggering the next bull run.

The Impact of Collaboration

Collaborations between established entities and blockchain projects can create synergies that drive adoption and market growth. When companies from traditional sectors embrace blockchain technology or form strategic partnerships with crypto projects, it not only enhances the credibility of the industry but also attracts new investors who see the potential for widespread adoption. These collaborative efforts can act as catalysts, pushing the market towards a bull run.

Market Demand and Adoption of Decentralized Applications (dApps)

The growing demand for decentralized applications (dApps) has the potential to be a powerful catalyst for the next bull run. As more individuals and businesses recognize the benefits of blockchain-based applications, the adoption of dApps can significantly impact the crypto market.

The Rise of dApps

Decentralized applications provide transparent, secure, and efficient solutions across various industries, from finance and gaming to supply chain management and beyond. The increasing usage and adoption of dApps showcase the potential of blockchain technology and attract more users and investors to the crypto market. The continued growth of the dApp ecosystem could contribute to the emergence of the next bull run.

Macroeconomic Factors and Global Financial Instability

The macroeconomic landscape plays a crucial role in shaping the crypto market. Economic uncertainties and global financial instability can act as catalysts for investors seeking alternative assets and stores of value, potentially driving increased interest and investment in cryptocurrencies.

Seeking Alternatives in Uncertain Times

During times of economic turbulence, individuals and institutions often look for ways to protect their assets and hedge against traditional market risks. Cryptocurrencies, with their decentralized nature and potential for substantial returns, become an attractive option for diversification. As global financial instability persists, the demand for cryptocurrencies as a hedge may contribute to the next bull run.

Several potential catalysts can influence the occurrence of the next bull run in the crypto market. The introduction of new cryptocurrencies and projects, significant partnerships and collaborations, the adoption of decentralized applications (dApps), and macroeconomic factors al l play pivotal roles. While the exact timing and combination of these catalysts remain uncertain, staying attuned to industry developments and market trends can help investors navigate this dynamic landscape and seize the opportunities presented by the next bull run.

Summary of Key Findings and Insights

As we conclude this exploration of the factors influencing the next crypto bull run, let’s recap the key findings and insights we’ve uncovered. By analyzing the market dynamics, expert opinions, historical patterns, and potential catalysts, we have gained valuable perspectives on the crypto market’s future.

Timing and Uncertainty

One crucial aspect to remember is the inherent uncertainty and unpredictability of the crypto market. While we have examined various factors that can influence the timing of the next bull run, it’s important to note that no prediction is foolproof. The crypto market’s volatility and complex interplay of factors make it challenging to pinpoint the exact timing of significant market movements.

The Need for Information and Caution

In this dynamic landscape, staying informed is essential. Continuously educating ourselves about market trends, technological advancements, regulatory developments, and expert insights can help us make more informed investment decisions. The crypto market evolves rapidly, and being aware of the latest information and industry developments can provide a competitive edge.

Acknowledgment of the Unpredictable Nature of the Crypto Market

It’s crucial to acknowledge that even with thorough analysis and insights, the crypto market remains inherently unpredictable. Rapid price fluctuations, regulatory changes, and unexpected events can influence market dynamics in unforeseen ways. It is essential to approach investments in the crypto market with caution and a long-term perspective.

The Importance of Risk Management

As we navigate the crypto market, it is vital to exercise caution and implement proper risk management strategies. Diversifying investment portfolios, setting realistic expectations, and only investing what one can afford to lose are fundamental principles to mitigate risk. Additionally, staying vigilant and avoiding speculative behavior can help safeguard against potential pitfalls.

Encouragement to Stay Informed and Exercise Caution while Investing

Crypto market holds tremendous potential and presents exciting opportunities. By understanding the factors that influence the market, staying informed, and exercising caution, we can navigate this dynamic landscape more effectively. It’s crucial to stay updated on industry developments, seek expert insights, and continuously evaluate our investment strategies.

Remember, investing in cryptocurrencies carries inherent risks, and the market can be highly volatile. By remaining diligent, informed, and mindful of market dynamics, we can position ourselves for potential success while managing risk effectively.