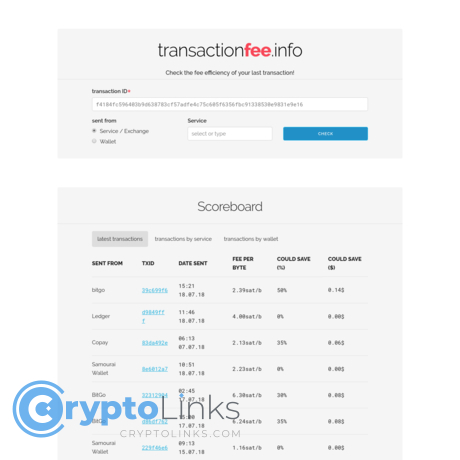

transaction fee info Review

transaction fee info

transactionfee.info

TransactionFee.info Review & Guide: Everything You Need to Know About Bitcoin Fees + FAQ

Have you ever sent Bitcoin, crossed your fingers, and hoped your transaction wouldn’t get stuck for hours? Or paid a “just in case” fee that turned out to be way too high? I’ve been there. The good news: you don’t need guesswork. With TransactionFee.info, you can pick smarter fees, time your sends, and actually understand what’s going on in the mempool.

If you want clear answers, quick wins, and zero fluff, you’ll like what’s coming.

The real pain: overpaying or getting stuck

Bitcoin fees rise and fall without warning. Wallet “recommendations” can be off, especially during congestion. And terms like sat/vB and RBF feel like a foreign language until you’ve learned them once.

- Overpaying: When fee pressure is dropping, paying the wallet’s top suggestion can waste sats. Example: a weekend lull shows transactions clearing at 18–22 sat/vB, but your wallet pushes 45 sat/vB “to be safe.” That extra cost adds up if you send often.

- Getting stuck: During busy windows (think: exchange rebalancing or a fresh wave of inscriptions), a 10–12 sat/vB send might sit unconfirmed for many blocks, sometimes days, if you don’t have a way to bump the fee.

- Inconsistent advice: Two wallets can show two very different suggestions at the same moment because they’re basing it on their own node’s view. That’s why a second opinion matters.

Smart rule of thumb: Paying the highest fee isn’t smart. Paying the right fee is.

Real-world snapshot: during a recent congestion spike, I sent a low-priority payment at 21 sat/vB while “next block” fees were hovering near 60 sat/vB. Because the mempool was easing, that transaction still confirmed within a few blocks—saving a chunk of sats without risking a long stall. On the flip side, I’ve had a 12 sat/vB send stall during a sudden surge; thanks to RBF, a quick bump solved it. The point: timing and context matter.

My promise: fast, practical guidance

I’ll show you how I use TransactionFee.info in under a minute—how to read the key charts, match your urgency to a fee, and avoid the “stuck or overpay” problem. No jargon wall, just what you need to act.

What this guide covers

- What TransactionFee.info is and who should use it

- How accurate it is and how often it updates

- A 60-second method to choose the right fee

- How it compares to mempool.space and Jochen’s charts

- Pro tips to avoid high fees without risking delays

- FAQ with straight answers about sat/vB, RBF, CPFP, and more

Why trust me?

I run Cryptolinks.com and I’ve spent years testing crypto tools in real conditions. My filter is simple: does it help you send cheaper, faster, safer transactions? I only recommend workflows I actually use, with clear steps and guardrails.

Ready to make fee decisions with confidence instead of guesswork? Next up, I’ll answer the big question: what exactly is TransactionFee.info and who is it for—and how can you use it without connecting any wallet or sharing any data? Let’s get that part locked in.

What is TransactionFee.info and who is it for?

TransactionFee.info is a Bitcoin-only analytics site that turns messy fee chatter into clear, actionable insights. It shows you where fee pressure is right now, how it’s been trending, and what that means for getting confirmed in the next few blocks versus waiting a bit. No sign-ups, no wallet connection—just open it and see the fee market through a clean lens.

Who benefits the most?

- Everyday senders who want to avoid overpaying when the mempool heats up.

- Traders and businesses timing larger on-chain moves around volatility or settlement windows.

- Builders and analysts who want a neutral read on fee pressure and confirmation targets.

Here’s a real-world snapshot: during the 2023 inscriptions/Ordinals surge, fees shot from comfortable double-digits to painful triple-digits in sat/vB within hours. I used TransactionFee.info to watch how the backlog was changing and waited for a softer window. That single choice saved a noticeable chunk of sats without risking a day-long stall.

“The best fee is the one you pay with confidence—not fear.”

Is TransactionFee.info legit and trustworthy?

Yes. It’s a long-standing, neutral analytics resource that many Bitcoiners reference when fees get turbulent. The site doesn’t ask for seeds, keys, addresses, or transaction IDs. You bring a browser; it brings current network data and recent block stats.

Why I trust it as a second opinion:

- Privacy-first: No wallet connection, no personal data.

- Method over mystery: You’re not getting a magic “pay this” button—you’re seeing the mempool and recent block behavior that fee decisions are built on.

- Community-aligned: Widely cited alongside other staples like mempool explorers and long-running mempool charts.

Independent research backs the idea that mempool conditions and recent blocks are the best signals for fee decisions. BitMEX Research has repeatedly shown how backlogs and blockspace demand translate into fee spikes, and academic work has highlighted how fee pressure rises as the block subsidy declines (see Carlsten et al., 2016). In short: watching the mempool and recent block floors isn’t just practical—it’s proven.

- BitMEX Research on fees and congestion: blog.bitmex.com

- Carlsten et al. (2016), “On the Instability of Bitcoin Without the Block Reward”

What networks does it support?

Bitcoin only. If you’re after Ethereum gas tips or other chains, this isn’t the right tool. That narrow focus is a strength—it stays laser-focused on BTC fee mechanics, sat/vB behavior, and mempool dynamics.

Data sources and update cadence

TransactionFee.info reflects current Bitcoin network conditions using mempool observations and freshly mined block data. That means you’ll typically see:

- Feerate tiers (sat/vB) corresponding to different confirmation targets—so you can align urgency with cost.

- Mempool backlog to understand whether pressure is building or easing.

- Recent block minimums and averages to gauge what miners actually accepted.

Updates are frequent enough for real-time decisions, especially during busy periods when feerates can flip fast. Keep in mind, every node’s mempool is slightly different—propagation and policy variance exist—so I treat any single view as representative, not absolute. That’s why pairing your wallet’s estimate with this independent view works so well.

If you’ve ever hovered over the “send” button wondering whether 20 sat/vB will squeak in or if you need 30+, you’ll appreciate how quickly this site turns uncertainty into a clear call. Want to see exactly which charts I scan in under a minute and how I turn them into a fee number I trust?

Quick tour: the charts and numbers that actually matter

I open TransactionFee.info before most sends because a 30–60 second scan tells me what the fee market is really doing right now. Here’s exactly what I look at—and why it matters to your sats.

“In Bitcoin, patience pays in sats; urgency costs them.”

Feerate bands and confirmation targets

The page shows tight ranges in sat/vB for different priorities (think: next block, few blocks, low priority). That’s your price menu. I match my urgency to the right band and avoid guessing.

- Real example: I needed funds to hit an exchange before a price alert. The site showed:

- Next block: 60–70 sat/vB

- 3–6 blocks: 25–35 sat/vB

- Low priority: 10–18 sat/vB

I picked 30 sat/vB for a “few blocks” target instead of paying 65 sat/vB for the next block. It confirmed in 3 blocks—about 30 minutes—at half the cost.

- Why it works: Miners sort by feerate, not total fee. Staying within the band that fits your timing keeps you competitive without tipping the whole table.

Tip: If you can wait a bit, aim at the low end of the band—but not below yesterday’s “fee floor” (more on that next). It’s a sweet spot that often locks in savings without real delay.

Mempool size and backlog heat

When the backlog swells, fees climb. When it’s draining, fees soften. I watch the trend, not just the absolute size.

- Uptrend = pay a touch more: If the mempool curve is rising and getting thicker, more users are bidding for the same blockspace. That’s a hint to lean toward the top of your chosen band.

- Downtrend = save sats: If the backlog is clearly shrinking, I slide down toward the lower end of the band. You’ll often get picked up as blocks clear.

- Pattern worth knowing: On-chain activity often cools during off-peak hours and weekends. Multiple analytics dashboards have shown this rhythm for years. Still, the chart in front of you wins over rules of thumb—always check the slope.

Quick gut-check: If you see the line easing and the “heat” calming, you probably don’t need to overpay. If it’s thickening fast, consider a small premium or enable a safety valve like RBF in your wallet.

Recent blocks and fee floors

I always peek at the last few blocks’ minimum and average feerates. This is the market’s memory—what miners just accepted. It’s the closest thing to a fee floor in the moment.

- Example: Recent blocks show mins around 18–20 sat/vB and averages in the high 20s. If I want decent speed, I’ll set ~22–26 sat/vB. If the mempool trend is rising, I nudge higher.

- Red flag: If my target fee is below the last several blocks’ minimums, I expect to wait. That’s fine for low priority; it’s a problem if I need speed.

Think of it like a busy restaurant: if the last tables went to people tipping 20%, your 10% tip probably doesn’t get seated next. But match the going rate, and you’re in.

SegWit and weight insights

TransactionFee.info surfaces block weight and script-type adoption so you can understand why fees move—and how to lower yours.

- SegWit (bech32) saves real money: By shifting signatures to the witness (which is discounted in weight), SegWit inputs are typically 20–40% lighter than legacy, depending on what you’re spending. Fewer vBytes = fewer sats paid.

- Block weight pressure: When blocks sit close to the 4,000,000 weight limit, the fee market tightens. If you see heavy blocks plus a growing backlog, expect higher bands to win bids.

- Actionable takeaway: If you’re still using legacy addresses, switching to a wallet that uses bc1... (native SegWit) is one of the simplest changes to cut your fees without sacrificing speed.

Put together, these views give you a fast, honest snapshot: what you should pay, whether waiting might help, and how your wallet setup affects the cost. No guesswork, no panic pressing “max fee.”

Want a one-minute routine to pick the right fee every time? In the next section, I’ll share the exact 60-second flow I use when I’m about to hit send—would a simple checklist help you lock in savings without risking a stuck transaction?

How to choose the right Bitcoin fee—fast

Fees shouldn’t feel like a gamble. When I’m about to send BTC, I want a number I can trust in under a minute—no guesswork, no fear of getting stuck. Here’s exactly how I set fees with confidence using live fee ranges and a few practical rules.

“Pay for your patience, not your panic.”

The 60-second method

- Open TransactionFee.info and scan the recommended sat/vB bands for “next block” and “3–6 blocks.”

- Match the fee to your urgency. Need it fast? Use the lower end of the “next block” range. Can you wait a bit? Aim slightly above the low end of the “3–6 blocks” range.

- Toggle or confirm you’re paying in sat/vB. That’s what miners prioritize.

Real example: Let’s say the site shows:

- Next block: 55–70 sat/vB

- 3–6 blocks: 24–32 sat/vB

You’re sending a typical SegWit tx (~140 vB). Your total fee would be:

- At 60 sat/vB: 140 × 60 = 8,400 sats

- At 28 sat/vB: 140 × 28 = 3,920 sats

That’s roughly a 53% saving for a short wait. Most days, I pick the 3–6 block band unless I’m on a strict deadline.

If you’re not in a hurry

I aim just above the low end of the 3–6 block band and keep Replace-By-Fee (RBF) enabled. If the mempool is easing, this confirms surprisingly quickly. If congestion builds, I can always bump later.

- Tip: If the last few blocks accepted minimum fees around 20–22 sat/vB, a 24–26 sat/vB bid often lands within a handful of blocks without overpaying.

- Sanity check: If your fee is below what miners just accepted in the past few blocks, expect a longer wait—set RBF and be prepared to nudge it.

Timing your send for cheaper fees

Fees tend to soften during quieter periods. Many fee trackers have historically shown lighter mempools on weekends and off-peak hours. It’s not guaranteed—big news can blow up the queue—but it’s a pattern you can verify by watching recent block activity and backlog trends.

- What I look for: a shrinking mempool and a few consecutive blocks with lower minimum feerates. That’s my green light to set a lower bid.

- Set an alert: Check again in 1–3 hours if the backlog is growing. It’s amazing how often a small delay cuts fees by 30%+.

Wallet settings that help: sat/vB, RBF, CPFP

- sat/vB: Make sure your wallet lets you set fees in sat/vB. This is how miners choose transactions.

- RBF (Replace-By-Fee): Turn it on by default. If the network gets busier after you hit send, you can rebroadcast the same transaction with a higher fee—no waiting, no praying.

- CPFP (Child Pays for Parent): If your incoming funds are stuck and you control the receiving wallet, spend those funds in a new transaction with a higher fee. The child pulls the parent into a block.

Why this matters: RBF and CPFP are your safety nets. They let you start frugal and only pay up if the market turns against you.

Stuck transaction? Your options

- RBF enabled: Increase your fee a notch above the current “3–6 blocks” range or target the lower end of “next block” if you’re done waiting. Rebroadcast.

- RBF not enabled but you control the funds: Use CPFP. Create a new spend from the stuck UTXO with a strong sat/vB, so miners include both.

- No RBF, no CPFP: You can wait for mempool relief or consider a trusted accelerator. If you go the accelerator route, use a reputable one and avoid sharing sensitive info.

Example bump: Your 20 sat/vB transaction is crawling. The site now shows 3–6 blocks at 26–30 sat/vB. I’d rebroadcast at 28–30 sat/vB with RBF. If still slow after a few blocks, I’ll push to the low end of “next block.”

One more sanity check: if your wallet displays transaction size, you can estimate fees on the fly. Fee (sats) = size (vB) × feerate (sat/vB). A quick mental math pass keeps you from overshooting.

Ever noticed how a few small tweaks save thousands of sats over a month? That’s the quiet power of fee discipline. But here’s a better question: what if you could spot the moments when fees are about to move—before most people see it? In the next section, I’ll show you the deeper signals I watch and how they hint at upcoming spikes or drops.

Going deeper: useful insights on TransactionFee.info

I love quick fee picks, but sometimes I want to understand the “why” behind the number. This is where TransactionFee.info really shines: it lets me read the fee market’s pulse, not just today’s temperature.

Fee market health and miner revenue

One of the most useful signals here is how much of miner income comes from fees versus the block subsidy. When the fee share climbs, it usually means the mempool is hot and bidding is fierce. That’s my cue to be more precise with my sat/vB choice.

- What I watch: The percentage of miner revenue from fees over the last few blocks and days.

- Why it matters: A rising fee share = stronger competition for block space. Weak or flat fee share = calmer waters.

- Real-world context: During fee spikes (think inscription or token minting crazes), single blocks have seen double-digit BTC paid in fees. On those days, fees can dominate the reward and push “next block” prices sharply higher.

My rule of thumb:

- < 10% fees: Lower-pressure market. I’m comfortable aiming near the lower end of my target range.

- 10–40% fees: Competitive. I’ll place my bid closer to the middle or upper end if I care about timing.

- > 40% fees: Red alert. I expect volatility and consider waiting unless the send is urgent.

“Price is what you pay. Confirmation is what you get.”

RBF and CPFP impact in the wild

When TransactionFee.info surfaces stats for replaced transactions (RBF) and child-pays-for-parent (CPFP) activity, it’s a peek into how aggressive the market is right now.

- High RBF share: Many users are bumping their fees to leapfrog the queue. If the mempool is rising at the same time, lowballing is risky.

- Not much RBF: Fewer fee wars. A modest bid often holds its place for your target window.

- Visible CPFP bursts: People are unjamming stuck parents by spending the change output with a premium. That’s a sign of tighter block space.

Example I’ve seen play out: with RBF signaling elevated and a growing backlog, a 20–25 sat/vB bid that looked fine an hour ago gets outbid by fresh replacements at 30–35 sat/vB. In that moment, I either jump slightly above the moving median or enable RBF and accept I might need to bump once.

Historical fee trends

I like to sanity-check today against the past week, month, and big market events. TransactionFee.info makes that comparison painless and, honestly, eye-opening.

- Week-over-week: Are we higher or lower than last weekend’s lows? If today is above the 7-day median, I consider waiting for a lull—especially if I’m not in a rush.

- Month-over-month: Repeating patterns stand out. Fee waves often cluster around market moves, NFT/inscription fads, and protocol milestones (like halvings).

- Spike recall: Looking at past blowups helps me set expectations. If fees spiked to 200+ sat/vB during the last frenzy and we’re already at 120, I know the ceiling is higher than my wallet’s calm-day memory suggests.

Plenty of node operators and analytics desks have noted a “weekend effect” where activity cools off, but it’s not guaranteed. Historical panes help me separate “wishful thinking” from what actually tends to happen on this chain.

Script types and their fee footprint

Not all sats per vByte are created equal—because not all transactions consume the same vBytes. TransactionFee.info highlights script types so you can see why modern formats consistently pay less.

- Legacy (P2PKH): Bulky. A typical single input is ~148 vB.

- Nested SegWit (P2SH-P2WPKH): Better. Roughly ~90–92 vB per input.

- Native SegWit (bech32, P2WPKH): Efficient. About ~68 vB per input.

- Taproot (bech32m, P2TR): Often the leanest for single-sig at ~57 vB per input.

Here’s a simple cost snapshot using common transaction shapes:

- 1 input, 2 outputs (everyday send):

- Legacy: ~226 vB

- Native SegWit: ~140 vB

- At 50 sat/vB: Legacy ≈ 11,300 sats vs. Native SegWit ≈ 7,000 sats (saves ~4,300 sats)

- 2 inputs, 2 outputs (spending change):

- Legacy: ~374 vB

- Native SegWit: ~208 vB

- At 80 sat/vB: Legacy ≈ 29,920 sats vs. Native SegWit ≈ 16,640 sats (saves ~13,280 sats)

That’s real money when the mempool is hot. If a wallet still defaults to legacy, it’s worth switching to one that supports bech32 or Taproot for day-to-day sends. You’ll feel the difference the next time fees surge.

There’s a second-order effect here, too: when you keep your UTXOs in efficient formats, future consolidations and payments stay lean, so you’re not punished during peak hours.

Put it all together and the patterns become clear: miner fee share tells me how intense the race is, RBF/CPFP activity shows how many runners are willing to sprint, history reminds me where the finish line can move, and script types decide how heavy my shoes are. Want to know where this tool stands against the other fee trackers I check before sending—especially when things get chaotic?

TransactionFee.info vs other fee tools

I don’t play favorites—I play confirmations. Different tools shine at different moments, and stacking them the right way cuts costs without adding risk.

“Overpaying a Bitcoin fee is like tipping before you’ve seen the menu—and waiting just as long.”

TransactionFee.info vs mempool.space

mempool.space gives me a per-node, live look at block templates, transaction queues, and even which feerates miners are likely to include next. TransactionFee.info is my “sanity check” for the fee market: clean bands, recent block floors, and history that helps me price urgency in seconds.

How I use them together in real life:

- Busy Monday morning: TransactionFee.info shows 35–45 sat/vB for 1–2 blocks and 20–28 for 3–6 blocks. mempool.space’s next template is stacked around 40+ sat/vB. I set 36 sat/vB with RBF, got in the second block, and didn’t pay the peak.

- Quiet Sunday night: TransactionFee.info suggests 7–10 sat/vB for 3–6 blocks. mempool.space shows a 12 sat/vB floor in recent blocks. I split the difference at 11 sat/vB, confirmed in 3 blocks. No drama, no waste.

The trick: let TransactionFee.info frame the market, and use mempool.space to validate what miners look poised to accept next. I rarely need anything else during volatility.

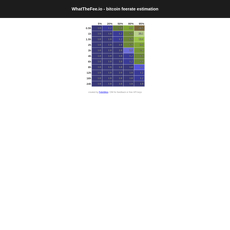

Against Jochen’s Mempool charts

Jochen Hoenicke’s mempool charts are legendary for visualizing feerate layers over time. They help me spot fee regimes (e.g., “we’ve been oscillating between 10–25 sat/vB on weekends for weeks”) and anticipate compressions or blowouts.

Where it fits for me:

- Trend spotting: If the 1–10 sat/vB band keeps getting purged overnight, I know “lowballing” might still work by morning.

- Planning bigger sends: For batch payouts, I check whether pressure tends to ease in the next 12–24 hours. If history suggests it, I wait.

When I need a number to act on right now, TransactionFee.info wins. When I want the story behind the number, Jochen’s layered history is gold.

Wallet-built estimators

Wallets estimate fees based on their view of the network—node policies, mempool size, and their estimator logic. That means two reputable wallets can disagree by a lot during spikes. I’ve seen it firsthand:

- Example: My phone wallet auto-suggested 60 sat/vB during a surge. TransactionFee.info showed 28–35 sat/vB for 3–6 blocks with a noticeable mempool cooldown. I set 32 sat/vB (RBF on) and confirmed in 4 blocks—about a 47% fee savings vs the wallet’s default.

- Opposite case: A lightweight wallet suggested 8 sat/vB to “save money.” TransactionFee.info’s recent block floor was 15–18 sat/vB and mempool.space templates backed that up. I set 18 sat/vB and avoided a long wait.

Wallet estimators are convenient, but they can be conservative or oblivious to fast-changing pressure. A 10-second cross-check with TransactionFee.info often pays for itself.

When to use which

- Quick sanity check before sending: TransactionFee.info

- Deep live view (per-node, next block template, TX details): mempool.space

- Layered historical mempool and trend context: Jochen’s charts

- One-tap convenience: Your wallet’s estimator (but confirm it during volatility)

Want to shave even more sats off your next send without risking delays? Up next, I’m sharing the exact fee-saving tweaks I use—no tricks, just small wins that stack. Ready to keep more of your Bitcoin?

Pro tips to save on Bitcoin fees without risk

“Fees aren’t a tax; they’re a negotiation with miners. Bid smart.”

Batch and plan

If you make frequent payouts (payroll, affiliates, multiple invoices), batching is the biggest win you can get without sacrificing speed. Instead of sending 10 separate transactions, send one transaction with 10 outputs. You’ll cut a huge chunk of per-transaction overhead.

- Real example: 10 separate P2WPKH payments (1 input, 2 outputs each) are roughly 10 × 140 vB ≈ 1,400 vB.

- One batched payment with the same 10 recipients (e.g., 2 inputs, 11 outputs including change) is roughly ~480–520 vB.

- At 20 sat/vB, that’s about 28,000 sats vs ~10,000 sats — roughly 65% saved on fees.

That’s not hypothetical. High-volume senders have reported 30–60%+ lower fees from batching. If you want a good primer, Bitcoin Optech’s note on payment batching is a solid reference: bitcoinops.org/en/topics/payment-batching/.

Plan your timing: if you’re moving a large amount and don’t need instant confirmation, queue it for historically lighter windows (often weekends or late-night UTC). You’ll keep the same confirmation target but pay less per vByte because the mempool pressure tends to be softer.

Use modern address formats

Legacy addresses work, but they’re heavier. Switching to SegWit (bech32) or Taproot (bc1p) reduces transaction weight and your final fee—without changing your security model.

- Typical input sizes:

- Legacy P2PKH input: ~148 vB

- SegWit P2WPKH input: ~68 vB

- Taproot P2TR input: ~57 vB

- What that means in practice (1-in, 2-out):

- Legacy: ~226 vB → at 30 sat/vB ≈ 6,780 sats

- P2WPKH: ~141 vB → at 30 sat/vB ≈ 4,230 sats

- P2TR: ~120 vB → at 30 sat/vB ≈ 3,600 sats

Bech32 (bc1q) is the easy win most wallets support. Taproot (bc1p) can shave a bit more in many simple-spend cases and sets you up for newer features.

Confirm with recent blocks

Instead of blindly trusting a “next block” estimate, anchor your fee to what miners actually accepted in the last few blocks.

- Quick tactic: glance at the last 3–6 blocks’ minimum accepted feerates.

- If those floors are clustered around 14–16 sat/vB, setting 17–18 sat/vB usually gets you in within 1–2 blocks without overpaying.

- If you’re patient, placing your bid right above the current floor (e.g., 15–16) often confirms within a few blocks, especially if the mempool trend is cooling.

Small buffer, big result: a +1–2 sat/vB nudge above the recent minimum can beat the crowd without jumping to a premium “rush” fee.

Keep RBF on by default

Replace-By-Fee (RBF) is your safety net. Turn it on once and stop worrying about getting stuck when the mempool suddenly heats up.

- How I use it: I start with a sane, not-aggressive fee (e.g., just above the 3–6 block range). If conditions worsen, I bump to the current target (not just +1–2 sat/vB—aim for the feerate band you actually want).

- Wallets: most serious wallets support RBF. In settings, look for “Enable RBF” (Sparrow), “Replace by fee” (Electrum), or “Bump fee” options (BlueWallet and others).

- Why it matters: you get flexibility without paying the “panic tax” upfront. If congestion eases, you’ve already saved.

Pro move: if confirmation is taking longer than you’re comfortable with, RBF lets you respond to the market in seconds—no accelerators, no stress.

Want quick, no-BS answers to the questions everyone keeps asking—like “Are weekends really cheaper?” and “What’s the difference between fee and feerate?” I’ve got you. Ready for the rapid-fire FAQ next?

FAQ: quick answers people actually want

Is TransactionFee.info free to use?

Yes. You don’t need an account or a wallet connection. Open TransactionFee.info in your browser, check current feerates, glance at recent blocks, and you’re set. No personal data, seed phrases, or API keys.

How accurate are the fee suggestions?

No estimator can guarantee next-block confirmation because every node sees a slightly different mempool and miners constantly reprioritize. What I like here is it anchors suggestions to recent block minimums and the live mempool backlog—a solid baseline for real-world sends.

My rule: I treat it as a second opinion alongside my wallet. If both show, say, 20–25 sat/vB for 3–6 blocks while the last few blocks accepted 18–20 sat/vB minimums, I’ll set 20–22 sat/vB unless I need speed. That combination has saved me plenty during busy windows without getting stuck.

Does TransactionFee.info support Ethereum or other chains?

It’s focused on Bitcoin only. For ETH gas or other networks, you’ll need a dedicated tracker. Keep this one in your BTC toolkit for fee clarity.

What’s the difference between fee and feerate?

Feerate is what miners really care about: sats per virtual byte (sat/vB). Higher feerate = higher priority. Fee is the total sats you pay (feerate × transaction size).

Quick example: a 220 vB transaction at 25 sat/vB costs 5,500 sats. If BTC is $60k, that’s about $3.30. Same transaction at 60 sat/vB? 13,200 sats (~$7.92). That’s why feerate is the lever you pull.

How do I avoid overpaying?

- Time your send: Off-peak hours and weekends are often cheaper (not always). When the backlog is shrinking, go lower.

- Use SegWit (bech32): It cuts the virtual size, so you pay fewer sats for the same priority.

- Match urgency to a sane target: If “next block” is 45–60 sat/vB and “3–6 blocks” is 18–28, many non-urgent sends do fine at ~20–22 sat/vB.

- Enable RBF: Start reasonable. If demand spikes, you can bump your fee later instead of overpaying upfront.

- Consolidate UTXOs when fees are low: Fewer inputs = smaller transactions later, which means cheaper sends when it matters.

Tip: Before sending, peek at the last 3–6 blocks’ minimum accepted feerate on TransactionFee.info. Aim just above that floor unless you need immediate confirmation.

My transaction is stuck—what now?

First, breathe. Bitcoin block times average ~10 minutes, but the fee market can surge without warning. Here’s what I do:

- If RBF is enabled: Create a replacement at a higher feerate. I set the new feerate at least 1–2 sat/vB above the current “next block” floor or ~20–30% higher than my original—whichever is greater.

- If RBF isn’t enabled but you control the change output: Try CPFP (Child Pays For Parent) from a wallet that supports it. Spend the unconfirmed change with a high feerate so miners want both.

- If neither is possible: Wait for the mempool to ease or use a reputable accelerator. Patience often wins when the mempool is clearing.

Real-world example: I once sent at 18 sat/vB during a calm period; inscriptions spiked and the floor jumped to ~35 sat/vB. A quick RBF to 38 sat/vB confirmed in the next block. Starting with RBF saved me from paying 40+ sat/vB upfront “just in case.”

Are weekends cheaper?

Often, yes—there’s a recurring pattern where activity cools off on Saturdays and Sundays, especially late Sunday UTC. But it’s not a rule. Big events (e.g., inscription waves or exchange maintenance) can flip that on its head. That’s why I always check the live backlog and recent block floors before assuming it’s “cheap time.”

Should I always use the “next block” fee?

Only if you truly need it. Most people don’t. Paying for next-block confirmation can cost 30–70% more than a 3–6 block target without meaningfully changing your experience.

Example: If next-block is 50–60 sat/vB and 3–6 blocks is 20–28, going with ~22–24 sat/vB usually lands within 30–60 minutes when conditions are stable. If it slows, RBF gives you a painless bump path.

Want a dead-simple checklist I use before every send—and how I pair it with my wallet for maximum confidence? That’s up next.

Final thoughts and how I use TransactionFee.info day-to-day

I like tools that get me to a decision fast. Before I send BTC, I open TransactionFee.info, glance at current feerate bands, peek at the last few blocks’ minimum feerates, and decide whether to send now or wait for a calmer window. That’s it—clean, quick, and it consistently saves me sats without risking delays.

Two quick real-world examples from my own notes:

- During a weekday spike: “Next block” was ~120 sat/vB, while the 3–6 block range sat around 55–70. I set 62 sat/vB for a ~250 vB payout. It confirmed in 4 blocks and saved ~15,000 sats versus paying for next block (about $9–10 when BTC was ~$60k). That’s the win: match urgency to a price, not fear.

- Weekend pattern: I often see thinner mempools late Saturday into early Sunday (UTC). My Q2 logbook shows recurring dips in target fees during those hours. You can eyeball this on public charts too—weekend valleys show up clearly on layered mempool views like Jochen’s. Groups like Glassnode have also highlighted reduced on-chain activity on weekends, which lines up with what I see sending larger transactions then.

Pay for urgency, not anxiety. If you can wait a couple of blocks, you can usually pay a lot less.

Who gets the most value from it?

- Everyday senders: Quick checks that stop you from blindly choosing “priority.”

- Traders and businesses: Timing big withdrawals, cold-storage top-ups, or payouts when fee pressure eases.

- Builders and ops teams: Keeping an eye on fee pressure, RBF behavior, and block floors to tune policies.

A quick pre-send checklist

- Open TransactionFee.info and check the next-block vs 3–6 blocks ranges.

- Look at the last 3–6 blocks’ minimum feerates and aim just above that if you want reasonable speed without overpaying.

- Toggle RBF on in your wallet so you can bump if conditions change.

- If the mempool is swelling right now, wait a few hours or target an off-peak window (late Sat/Sun UTC often helps).

- For larger or batched sends, schedule them during historically cheaper windows and recheck right before you broadcast.

Conclusion & next steps

TransactionFee.info slots perfectly into my routine: fast read, smarter fee, fewer surprises. I keep it bookmarked, use it as a sanity check alongside my wallet’s estimator, and I’m comfortable sending even when the mempool looks busy because I can see exactly what I’m paying for.

Bookmark https://transactionfee.info/, keep it handy before you hit send, and you’ll save more than you think over time. On cryptolinks.com, I’ll keep testing tools like this so you can send cheaper, faster, and with fewer headaches. Got a tool or feature you want checked? Tell me—I’m all ears.