ETH Gas Station Review

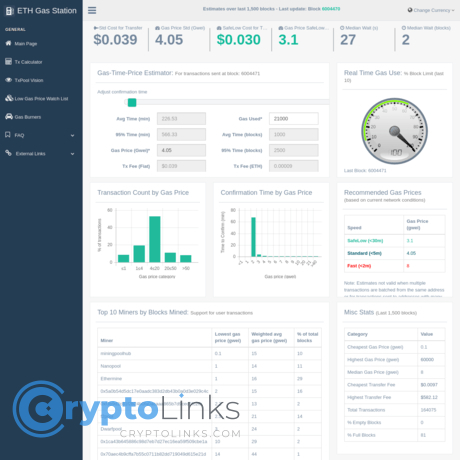

ETH Gas Station

ethgasstation.info

ETH Gas Station Review Guide: How to Pick the Right Gas Fee Every Time + FAQ

Quick question: how many times have you cranked up your gas “just to be safe,” or watched a transaction sit pending forever because you tried to save a few gwei?

If that stings a little, good—you’re exactly who I’m writing this for. I’m going to show you how I use ETH Gas Station to pick the right fee, avoid stuck transactions, and time swaps and mints without burning ETH unnecessarily.

I test crypto tools every day. ETH Gas Station is one of those simple, reliable helpers that quietly saves money and stress—especially after EIP-1559 made fees look more complicated (base fee, max fee, tip… what?). In this guide, I’ll spell out what it does well, where it can mislead you, and how to pair it with your wallet so you hit that sweet spot between speed and cost.

Bottom line: set fees with intention, not fear. ETH Gas Station gives you the numbers—this guide shows you how to use them.

Gas pain is real (and expensive)

Gas isn’t just “high” or “low.” It’s volatile. It can change minute to minute, and one wrong setting can cost you time and ETH. A few common headaches:

- Wallet guesses are vague: “Medium” and “High” don’t tell you if your tx will clear in 1 block or 10.

- EIP-1559 adds fields: base fee, max fee, and tip—get one wrong and you either overpay or stall.

- Spikes blindside you: NFT mints, liquidations, or news events can 5–10x gas within minutes.

- Confusing limits vs price: setting a huge gas limit doesn’t make it faster; setting the right price does.

- Pending limbo: a low tip during a surge can leave you stuck behind a wall of higher-paying txs.

Here’s a real-world pattern you’ve probably seen: you send a DEX swap at 14 gwei because it looked calm, then a hot mint triggers a spike to 60 gwei. Your transaction sits. You “speed up,” pay more, and end up spending more than if you’d just set a smart fee initially.

Or the opposite: you overpay 2–3x “to be safe” during off-peak hours because your wallet estimated too conservatively. That’s perfectly avoidable with the right read on the market.

What I’m bringing to the table

I’ll walk you through ETH Gas Station step-by-step, explain the numbers it shows (and what they mean for your confirmations), and show you how to translate those numbers straight into your wallet—especially with EIP-1559 settings like Max Fee and Max Priority Fee (tip).

You’ll see when to go “Fast” vs “Standard” vs “Safe,” how to avoid getting caught by sudden spikes, and how to time transactions for cheaper windows. I’ll also point out the edge cases where estimates can be off and what to do about it.

What you’ll get from this guide

- Clear basics without fluff: gas vs gas price vs base fee—what actually moves your final cost.

- ETH Gas Station decoded: how the Safe/Standard/Fast suggestions work and when to trust them.

- EIP-1559 made simple: base fee (burnt), tip (goes to validators), and how to set Max Fee smartly.

- Wallet mapping: plug ETH Gas Station gwei numbers into MetaMask or similar without guesswork.

- Pro timing tricks: spot cheaper windows, avoid gas wars, and react to sudden mempool spikes.

- Advanced angles: API uses for bots/dashboards, pending tx rescue (speed up/cancel), and batching.

- Comparisons and backups: when to cross-check another tracker or trust wallet-native quotes.

- Practical FAQ: fast answers to the most common fee questions I see every week.

If you’ve ever thought, “I wish someone would just tell me what to put in the fee box,” you’re in the right place. Ready to see what ETH Gas Station actually is and why traders still swear by it—even after EIP-1559 changed the game?

What is ETH Gas Station and why traders still rely on it

Quick overview: a long-running Ethereum gas tracker that shows current fee estimates, speeds, and suggested tips

ETH Gas Station is a real-time Ethereum gas tracker that turns network chaos into simple, actionable numbers. You’ll typically see three tiers — Safe, Standard, and Fast — each with a suggested gas price (in gwei) and an estimated confirmation time. It’s the “speed vs cost” slider, but with clear labels, so you can set fees with confidence in wallets like MetaMask.

When I’m in a hurry, I glance once and know if I should push a higher tip. When I’m moving funds between wallets, I switch to the cheaper tier and save a bit of ETH without guessing.

- Safe: cheapest suggestion with longer wait times

- Standard: balanced price for routine confirmations

- Fast: premium suggestion to land in the next few blocks

It’s simple, fast, and it loads on any device — which is exactly why traders keep it pinned.

How it fits post EIP-1559: base fee, priority fee (tip), and total max fee concepts you’ll see reflected in estimates

EIP-1559 changed how Ethereum fees work. Instead of bidding total gas price blindly, every block sets a base fee (burned), and you add a priority fee (your tip to the validator). Your wallet usually exposes this as Max Fee and Max Priority Fee. ETH Gas Station’s tiers map to realistic tips that are clearing in recent blocks, layered on top of the live base fee.

Example snapshot logic:

- Base fee is 12 gwei (automatic, burned)

- Safe tip around 1–1.5 gwei → total target ~13–13.5 gwei

- Standard tip around 2–3 gwei → total target ~14–15 gwei

- Fast tip around 4–6 gwei → total target ~16–18 gwei

These aren’t fixed rules — they’re reflections of what just worked in the last few blocks. During a hot NFT mint or liquidation wave, those tips can jump quickly. ETH Gas Station helps you spot that jump before you hit “Confirm.”

There’s solid evidence EIP-1559 made fee setting more predictable by separating the base fee from the tip. Analyses like the Ethereum Foundation’s “EIP-1559 one year later” and community dashboards on Dune show reduced fee spikes relative to pre-1559, while tips now carry most of the “speed” signal. In plain English: your tip matters most when seconds count.

Who it’s for: NFT minters, DeFi users, market makers, and anyone who wants to avoid overpaying or getting stuck

- NFT minters: Need to avoid getting sandwiched or stuck while everyone rushes the same contract. A slightly higher tip can be the difference between minting and missing out.

- DeFi users: Swaps, staking, claims — you want fair fees without getting re-quoted or stuck mid-volatility.

- Market makers/arbitrage: Milliseconds matter. You’ll often pad the “Fast” suggestion, but ETH Gas Station anchors the baseline.

- Everyday transfers: Sending to a friend? Paying a safer, cheaper tier and waiting a few minutes is usually fine.

Real story: I once watched a popular mint spike priority fees from ~2 gwei to 20+ in under a minute. ETH Gas Station’s “Fast” tier jumped first — that early signal helped me bump my tip before the rush and get in the next block.

“Paying the highest gas isn’t a strategy. Paying the right gas is.”

What ETH Gas Station is not: it doesn’t replace your wallet — it informs it

Think of it as your pre-flight checklist, not the plane. You still set the numbers in your wallet. ETH Gas Station gives you a live, realistic range; your wallet executes with Max Fee and Max Priority Fee. Use both together and you’ll stop throwing ETH at the problem.

- It won’t send transactions for you

- It won’t guarantee inclusion at a specific block (nobody can)

- It won’t override wallet safety checks (like gas limit for complex contracts)

Where its data comes from (high level)

Under the hood, gas trackers watch:

- Recent blocks: what tips actually cleared

- Mempool pressure: how many pending transactions and their bid distribution

- Protocol rules: the EIP-1559 base fee algorithm and block gas limits

Most trackers compute tip percentiles (e.g., median to high-percentile priority fees) and translate them into the “Safe/Standard/Fast” tiers you see. That’s why their suggestions tend to feel “right” — they’re rooted in what just worked, not guesswork.

How often it updates (and why you should still refresh)

ETH Gas Station updates frequently, typically every few seconds, but your browser tab can go stale if it’s been open for a while or your connection sleeps. I always refresh right before I confirm a big transaction. A 10-second refresh habit can save you minutes of waiting — or worse, a stuck transaction during a sudden spike.

Why traders still rely on it

- Speed to signal: One glance tells you if you can go cheap or need to push.

- Consistency: It’s been around for years, through forks and market cycles.

- No fluff: Clean tiers, practical timings, and numbers that map cleanly to wallet fields.

- Cross-checking: Perfect for sanity-checking wallet quotes before sending size.

When the market feels loud, a calm, trusted gauge is gold. That’s why I keep it open whenever I’m on Ethereum L1.

What it looks like in practice

- Routine DEX swap: ETH Gas Station shows Standard at 15 gwei total? I’ll set a modest tip and a sensible Max Fee buffer in my wallet, then send.

- Hot mint: Fast shows 40 gwei but I see prices rising block by block. I’ll add a small tip buffer above Fast and confirm quickly.

- Casual transfer: Safe shows 9 gwei with a few minutes wait. Perfect — I’ll save the ETH and let it confirm while I grab coffee.

If that helped clarify the “what” and “why,” the next natural question is simple: what exactly are gas, gas price, base fee, and tip — and how do they multiply into the ETH you pay? I’ll break that down next so you can read any estimator like a pro.

Gas basics you must know before using any estimator

Before we start picking “Safe/Standard/Fast” numbers, we need to talk the same language. Gas on Ethereum isn’t scary once you split it into a few simple pieces. Understand these, and you’ll stop overpaying and avoid getting stuck when the network heats up.

“In Ethereum, you’re not paying for speed—you’re paying for certainty.”

Gas vs gas price vs total fee

Three terms create most of the confusion. Here’s the clean version:

- Gas = the amount of “work units” your transaction needs. Think of this as how many units of computation your action consumes.

- Gas price = how much you’re willing to pay per unit, quoted in gwei (1 gwei = 0.000000001 ETH).

- Total fee you pay = gas used × gas price.

Quick mental math you can use anytime:

- ETH paid (in ETH) ≈ gas used × gas price (gwei) × 1e-9

- Example: a 150,000-gas swap at 23 gwei costs 150,000 × 23 × 1e-9 = 0.00345 ETH.

If ETH is $3,000, that’s about $10.35—handy when you’re deciding whether to click “Confirm.”

EIP-1559 in plain language

EIP-1559 changed how fees work. You’ll see these fields in your wallet and on any gas tracker:

- Base fee: the protocol-set price per gas that everyone must pay. It adjusts each block based on demand, and it’s burned (sent to a dead address). Millions of ETH have been burned since this went live in 2021—see live data on ultrasound.money.

- Priority fee (tip): your incentive to validators to include your transaction sooner.

- Max priority fee: the most tip you’re willing to pay.

- Max fee per gas: the absolute ceiling you’re willing to pay for base fee + tip combined.

What you actually pay per gas is base fee + priority fee, but it will never exceed your max fee. If base fee drops between when you submit and when you’re included, you pay less automatically. If base fee spikes, the max fee protects you from paying more than you intended.

Example:

- Base fee: 20 gwei

- Max priority fee: 3 gwei

- Max fee: 35 gwei

Effective price per gas = 20 + 3 = 23 gwei. If the next block pushes base fee to 30 gwei, your effective tip can compress (the protocol uses the lower of your max tip and max fee minus base fee). If that still doesn’t fit under your 35 gwei max fee, your tx waits until there’s room.

Want the technical spec? Ethereum’s docs explain the adjustment rules and block “elasticity” clearly: ethereum.org/developers/docs/transactions/gas.

Gas limit is not gas price

This one trips people up—and it’s costly.

- Gas limit = the maximum units you allow your transaction to use. It’s a cap, not a speed lever.

- Setting it too low = your transaction reverts and you still pay for the gas used in the failed attempt.

- Setting it higher than needed = totally fine. You only pay for what’s actually used, not the limit.

Examples:

- Simple ETH transfer uses exactly 21,000 gas. If you put 18,000, it fails. If you put 50,000, it succeeds and you pay only for 21,000.

- A complex contract call might use 220,000 gas on a good day and 260,000 when the path changes (e.g., DEX routing). Give it headroom.

Common pitfalls that cost real ETH

- Confusing units: Typing “30” when your wallet expects gwei vs wei. Sanity-check: normal prices are usually in the tens of gwei on L1, not single-digit wei or full ETH.

- Using low tips during spikes: When NFT mints or liquidations hit, thousands compete with higher priority fees. A low tip gets you leapfrogged for many blocks.

- Ignoring the mempool: If there’s a large backlog, even a solid tip can lag. The base fee can climb up to ~12.5% per block when blocks are over target (EIP-1559’s elasticity), so your max fee matters.

- Underestimating gas limit on complex calls: Aggregators, multi-swaps, or batch calls can branch differently at execution time. If you give a tight limit, you risk a revert.

- Leaving stale tabs open: Gas changes minute to minute. Always refresh before confirming.

Typical gas usage by action (ballpark)

These are helpful anchors. Actual usage varies by contract and path, but the ranges are reliable enough for planning:

- ETH transfer: 21,000 gas

- ERC‑20 token transfer: ~50,000–65,000 gas

- Token approval (approve/permit fallback): ~45,000–70,000 gas

- DEX swap (e.g., Uniswap v2): ~110,000–160,000 gas

- DEX swap (router/aggregator, v3 paths): ~140,000–220,000+ gas

- NFT mint (typical 721/1155): ~150,000–300,000+ gas; “hot” mints can be higher

- Claim airdrop: ~60,000–180,000 gas (wide range: merkle proofs, extra checks)

- Bridge L1→L2 deposit: ~60,000–120,000 gas (contract-specific)

- Multicall/batch operations: Add up the parts; expect 10–25% overhead for orchestration

Why the spread? Each EVM opcode has a cost, and complex paths (like splitting liquidity or verifying proofs) add up. If you love the guts-and-bolts, the Yellow Paper and opcode references show per-op costs—nerdy, but useful for builders.

How spikes and “the queue” change what you pay

Every L1 block targets a certain gas usage (Ethereum aims for half-full blocks on average—roughly 15M gas target with up to 30M max due to elasticity). When demand rises:

- Mempool backlog grows (the public “waiting room”).

- Base fee rises to push out lower-priced transactions.

- Higher tips move you closer to the front of the line.

That’s why a swap that cost $6 at 2 a.m. might cost $15 at 6 p.m.—same gas used, different market price per gas. If you’re price-sensitive, time of day matters. If you’re time-sensitive, your tip matters.

Gwei sanity checks you can do in your head

- 21,000 gas at 20 gwei ≈ 0.00042 ETH

- 100,000 gas at 10 gwei ≈ 0.001 ETH

- 200,000 gas at 30 gwei ≈ 0.006 ETH

Multiply by the ETH price to get a quick USD sense. This mental check saves you from signing something that looks off by 10x.

Pro tips that make the math work for you

- Give limits room: Slightly higher gas limits prevent accidental reverts; you only pay for what’s used.

- Use a realistic tip: During quiet times, 1–2 gwei tip often clears. During spikes, 3–5+ gwei is common—and “gas war” mints can see much higher.

- Refresh and compare: Gas moves. If you opened your wallet 10 minutes ago, refresh your gas data before you confirm.

- Know your action: A DEX swap and an NFT mint are not equal. Expect different gas used and plan your max fee accordingly.

All good so far, but the real magic is turning these basics into the exact numbers you put in your wallet at the right moment. Want to see how I translate “base fee + tip” into a one-click choice you can trust?

How to use ETH Gas Station: step-by-step

“Paying for speed is a feature; overpaying is a bug.”

Here’s exactly how I work with ETH Gas Station to set the right fee every time, without sweating over hidden fields or getting stuck in pending purgatory.

Reading the homepage: what those numbers actually mean

Open the site and you’ll typically see three tiers with suggested fees in gwei and a rough wait time:

- Safe: cheapest, longer wait. Good for non-urgent sends.

- Standard: balanced cost/speed for most DeFi actions.

- Fast: pay a bit more to land quickly (mint windows, volatile trades).

Under the hood, you’ll also see the current Base Fee (burned) and a suggested Priority Fee (tip)—those are the EIP-1559 parts your wallet needs.

Quick way I read the page:

- Glance at Base Fee: if it’s jumping every refresh, we’re in a spike—use Fast or pause a few minutes.

- Pick a tier based on urgency. Each tier shows a tip suggestion and sometimes a max fee suggestion.

- Refresh once before you approve anything. Stale tabs cause stuck txs.

Example snapshot you might see (purely illustrative):

- Base fee: 24 gwei

- Safe: tip 1 gwei, ETA ~2–5 min

- Standard: tip 2 gwei, ETA ~30–60 sec

- Fast: tip 3–4 gwei, ETA ~< 15 sec

What matters is the relationship: bigger tip = higher priority, and your max fee needs headroom above the current base fee so the tx doesn’t fail if base moves up a bit.

Translating numbers into wallet settings (MetaMask included)

Most wallets today use EIP-1559 fields. You’ll see two numbers you can edit:

- Max Priority Fee (gwei): this is your tip to validators. Copy the tip from your chosen tier.

- Max Fee (gwei): this is the ceiling you’re willing to pay per gas. The network will only charge what’s needed (Base + Tip), but this ceiling protects you from sudden jumps.

How I set them:

- Step 1: Enable “Advanced gas controls” in your wallet settings if you haven’t already.

- Step 2: Choose your tier on ETH Gas Station.

- Step 3: Set Max Priority Fee = the tier’s suggested tip.

- Step 4: Set Max Fee = Base Fee + Tip + a small buffer. If ETH Gas Station shows a Max Fee suggestion, use it. If not, here’s a reliable rule:

- Standard buffer: Max Fee ≈ (Base Fee × 1.3) + Tip

- Fast buffer: Max Fee ≈ (Base Fee × 1.7 to 2.0) + Tip

Sample walk-through:

- Base fee = 24 gwei

- Standard tip = 2 gwei → set Max Priority Fee = 2

- Standard Max Fee ≈ (24 × 1.3) + 2 ≈ 33 + 2 = 35 gwei

Important guardrail: never set Max Fee below (Base Fee + Tip). If you do, your tx won’t have room to execute if base moves up even slightly.

When to pick Safe vs Standard vs Fast

Match the tier to the moment. If you’re paying for speed, make it intentional—if you’re saving, accept the wait.

- Fast:

- NFT mints: competing with others. Use Fast, tip at the top of the suggestion, and a 2x base headroom for Max Fee.

- Arb/volatile markets: seconds matter. Set Max Priority Fee to Fast, and add 20–40% more buffer than usual.

- Timeboxed actions (auctions, expiring options): don’t gamble—pay to confirm.

- Standard:

- DEX swaps where 1–2 minutes is fine (stablecoin swaps, routine rebalances).

- Approvals before a mint/swap you’ll do later.

- Safe:

- Simple ETH transfers to your own wallet or exchange.

- Non-urgent contract interactions (e.g., ENS renewals, claim contracts with no rush).

Emotional sanity check I always do: “If this confirms in 3 minutes instead of 20 seconds, do I actually care?” If yes, go Fast. If no, enjoy the savings.

Timing your transaction: cheaper windows, weekends vs weekdays, and reacting to spikes

You don’t have to fight the tide. A bit of timing saves a lot of ETH over the year.

- Cheaper windows: Multiple analytics dashboards (including BitInfoCharts) consistently show lower average gas on weekends and during late-night UTC hours. If your action is flexible, aim for Sat/Sun or off-peak UTC night.

- Weekday rhythm: US market overlap (approx. 13:00–01:00 UTC) often brings more on-chain activity; expect higher base fees.

- React to spikes:

- If Base Fee jumps 30–50% in a few minutes (you’ll see it when you refresh), either use Fast with a bigger buffer or wait 5–15 minutes—many spikes cool off.

- Refresh the page once right before you hit “Confirm” in your wallet. Prices can change between quote and sign.

Quick “is it worth it?” check I use to keep perspective:

- Cost estimate: ETH Price × Gas Used × (Effective Gas Price in gwei ÷ 1e9)

Example: 120,000 gas × 31.5 gwei = 0.00378 ETH. If ETH is $3,000, that’s about $11.34. - If waiting 30 minutes saves you $8 and you don’t care about speed, wait. If it risks a missed price or mint, pay up.

Real-world walkthrough you can replicate

Let’s say I’m swapping ~$2,000 on a DEX with no rush:

- I open ETH Gas Station. It shows Base Fee 28 gwei, Standard tip 2 gwei (ETA ~45 sec), Fast tip 3–4 gwei (ETA ~15 sec).

- I choose Standard and set Max Priority Fee = 2.

- Max Fee = (28 × 1.3) + 2 ≈ 38.4 + 2 → I round to 40 gwei.

- My wallet shows an estimated cost around 120k gas × ~30 gwei effective ≈ $10–12 at $3k/ETH.

- I confirm. If I see the base fee climbing twice in a row on refresh, I bump to Fast and add extra buffer to Max Fee (e.g., 55–60 gwei) to avoid getting caught mid-spike.

There’s nothing worse than watching a pending swap while the price drifts. Pick a tier that matches your nerves and your goal.

Two small habits that save me the most

- Pin ETH Gas Station in the browser and refresh right before confirming. Stale estimates are the #1 culprit behind “why is this still pending?”.

- Pad the Max Fee, not the tip, unless you need to outbid others quickly. A higher ceiling keeps you safe in spikes without overpaying when the base fee settles back down.

If you’ve ever asked yourself, “How much can I actually trust these estimates when things heat up?”—good. In the next section, I’ll show you the two moments it can mislead you and the 10‑second cross-check I use to avoid unpleasant surprises. Want to see it?

Accuracy and reliability: how much can you trust it?

Think of gas estimators like weather radar: great at showing the storm front, imperfect at predicting the next lightning strike. ETH Gas Station is solid for real-time context and “good enough” targets, but Ethereum is a market where demand can lurch in seconds. I’ve watched a “Standard” quote work flawlessly for hours… and then evaporate during a sudden mint or liquidation wave. That’s not the tool being bad—it’s the chain being alive.

“In crypto, minutes feel like hours. Pay for certainty when time matters, and pay for patience when it doesn’t.”

What affects accuracy right now

- Mempool swings: A burst of pending transactions can push inclusion tips higher within a block or two. Ethereum’s base fee adjusts by up to ~12.5% per block, but tips can jump instantly.

- MEV activity: Arbitrage and sandwich bots outbidding each other can yank priority fees up fast. When MEV spikes, “Fast” moves to “Barely Fast.” Check MEV-Boost stats or Flashbots dashboards for hints.

- Sudden demand (mints, liquidations): Hot NFT drops, oracle updates, or cascading liquidations (Aave/Maker) can turn a quiet block into a gas war.

- Private orderflow: If your wallet sends via private relays (e.g., MEV-boost routes) or your RPC sees a different mempool, public trackers might under/overstate the pressure you’ll face.

- Replace-by-fee waves: When many users speed up at once, the effective floor tip ratchets up quickly.

Real-world snapshot I’ve logged more than once: ETH Gas Station shows Standard ≈ 25 gwei and Fast ≈ 30 gwei. A big liquidation hits, bots flood in, and the next two blocks only include tx with tips ≥ 40 gwei. Five minutes later, things cool off and Fast slides back to 28–30 gwei. That swing isn’t a bug—it’s a surge.

How I cross-check before committing

I run a quick “triangle check.” If two corners line up, I go. If they don’t, I pad or wait.

- ETH Gas Station vs wallet: Compare the suggested tip (priority fee) to your wallet’s EIP-1559 quote. If they’re within a few gwei or ~10–15%, that’s a green light.

- One more tracker: Open a second source like Etherscan Gas Tracker or Blocknative. If all three broadly agree, send it. If one is an outlier, don’t trust it blindly.

- Trend check: Glance at the last few blocks’ base fee trend and inclusion speeds. Rising fast? Add buffer. Flat or falling? You can be stingier.

Example from my notes: Gas Station Fast tip ~3 gwei; Etherscan Fast ~2.8; wallet suggests 2.5. Close enough—I’ll set tip at 3–3.5 gwei and bump Max Fee to cover a couple blocks of base fee increases. If the wallet says 1 gwei while others say 4–6, I assume the wallet’s behind and pad generously.

When estimates can be off

- Gas wars: During the 2022 Otherside mint, base fees shot into the thousands of gwei. Any “normal” estimate was instantly stale. This can happen on smaller scales during trending mints too.

- Volatility bursts: Sharp market drops trigger liquidations and MEV—tips spike, inclusion targets slip. What was “Fast” 30 seconds ago might be “Too Slow.”

- Stale tabs: Sounds basic, but it’s the silent killer. If the page’s been open for 10 minutes, refresh. Always refresh again right before you hit Confirm.

- RPC eccentricities: If you’re on a congested or throttled RPC, your perceived mempool may lag. Consider switching to a reliable endpoint for critical sends.

My rule-of-thumb settings that rarely disappoint

- Time-sensitive (launches, volatile trades):

- Pick Fast and add a small buffer to the tip:

- Low congestion: +0.5 to +1 gwei on the suggested tip

- High congestion: +20–30% on the suggested tip

- Set a Max Fee that comfortably covers a few blocks of base fee increases. I often use 1.5–2× the current base fee plus my tip. You only pay base+tip at inclusion.

- Pick Fast and add a small buffer to the tip:

- Casual (token transfers, non-urgent approvals):

- Use Standard or Safe.

- Keep a modest tip (e.g., 1–2 gwei in calm periods) and a wide Max Fee so you don’t get knocked out if base fee wobbles. Again, you won’t overpay—EIP-1559 refunds the headroom.

Quick numeric example that’s worked well for me in choppy markets:

- Current base fee: 18 gwei

- ETH Gas Station Fast tip: 3 gwei

- I set: Max Priority Fee (tip) = 3.5–4 gwei; Max Fee = 45–60 gwei

Result: If included immediately, I pay ~21–22 gwei. If blocks heat up and base fee climbs to 30–35 gwei, I’m still eligible without re-sending. If nothing heats up, I don’t overpay.

My pre-send “heartbeat” checks

- Refresh ETH Gas Station and your backup tracker.

- Peek at the next-block probability (Blocknative shows this) for your chosen tip.

- Scan crypto Twitter/Discord for sudden mints or liquidations if you suspect a spike.

- Watch one more block if you’re unsure—patience for 12 seconds can save a lot of ETH.

If you want to go from “pretty accurate” to “surgical,” the next step is using a few power tools I keep open during busy times. Want to see how I pull live estimates into bots, spot cheap time-of-day windows with past data, and rescue stuck transactions without panicking?

Advanced features and pro tips

“Paying for speed is smart. Paying for panic is expensive.”

API and data: plug fee estimates into bots, dashboards, and scripts

If you automate anything—market-making, arbitrage, sniping mints, or simply alerting your team when gas is cheap—programmatic access is gold. ETH Gas Station offers an API with the same “Safe / Standard / Fast” style data you see on the site. I use it to feed a small dashboard and to pre-fill EIP-1559 values in scripts so I’m not guessing under pressure.

- Use cases: pre-trade checks for DEX bots, auto-pausing high-gas strategies, scheduling batch payouts when fees drop, building internal gas alerts in Slack/Discord.

- Basic flow: poll estimates, smooth with a short moving average, and set maxPriorityFeePerGas and maxFeePerGas with a buffer. Cache for 15–30 seconds to avoid rate limits.

- Sanity check: always compare with your node or a second source before deploying real capital at scale.

Example (pseudo) pattern I use in Node.js to keep it simple:

// fetch current suggestions

const res = await fetch('https://ethgasstation.info/api/your-endpoint'); // check their docs for the latest path

const g = await res.json();

// choose a tier based on urgency

const tip = g.fast.tip; // gwei

const base = g.baseFee; // gwei

// EIP-1559 wallet params

const maxPriorityFeePerGas = tip;

const maxFeePerGas = Math.ceil(base * 1.3 + tip); // 30% headroom for base fee swings

Two practical tips I’ve learned the hard way:

- Headroom matters: base fee can swing up to ~12.5% per block. Give yourself room so you don’t get stuck mid-surge.

- Fallback plan: if the API times out, pause non-essential txs or switch to a backup estimator. Blindly sending with stale data is how you donate ETH to miners/validators.

Historical and time-of-day patterns: pick your spots like a pro

Gas follows human behavior. It’s noisy, but trends exist. My logs (plus public datasets from trackers like Etherscan) show a consistent pattern:

- Cheapest windows: roughly 00:00–08:00 UTC. Weekends beat weekdays more often than not.

- Expensive windows: US business hours, major token launches, hot NFT mints, liquidation cascades, or airdrop claims.

- Seasonality: big market moves spike gas. Flat markets = calmer mempools.

Real example from my playbook:

- I needed to batch 40 token payouts. At 19:00 UTC, the base fee hovered around 45 gwei. I waited until 02:30 UTC on a Sunday; the base fee fell to 14–18 gwei. Same on-chain work, ~60% cheaper. Multiply that by weekly operations and it’s not pocket change.

If you’re managing a team or treasury, set “green light” windows and enforce them unless the transaction is truly urgent. Your PnL will thank you.

Pending tx management: speed up or cancel without breaking a sweat

Everyone gets stuck eventually. The trick is responding fast and correctly. EIP-1559 makes it simple once you internalize the rules.

- Speed up (same nonce, higher fee): submit a replacement tx with:

- maxPriorityFeePerGas higher than the previous tip, and

- maxFeePerGas high enough to cover current base fee + your new tip.

- Cancel: send a 0 ETH transfer to yourself with the same nonce and a higher fee than the stuck tx.

How much higher?

- Light congestion: bump tip by 10–20% or +2–3 gwei, and maxFee with 20–40% base fee headroom.

- Heavy congestion / gas wars: bump tip by 25–100% or +10–50 gwei (depends on the frenzy), and set maxFee so base fee surges won’t outpace you for a few blocks.

Wallets like MetaMask make this easy with “Speed Up” and “Cancel.” Under the hood, it’s the same-nonce replacement logic. Ethereum clients typically require a meaningful bump (commonly around 10%+) to accept a replacement; tiny bumps get ignored. If you’re technical, tools like Blocknative, Flashbots Protect RPC, or a direct node connection give you better feedback on replacement acceptance.

Two more quality-of-life moves:

- Watch the mempool: if you see sudden base fee ramps, increase headroom rather than tapping “Speed Up” three times in 30 seconds.

- Avoid reverts: simulate when possible. A revert still burns gas. I run quick sims in Etherscan, Tenderly, or wallet-native previews to catch obvious failures.

Minimizing fees: smart habits that add up

Gas savings aren’t always about gwei. They’re about fewer mistakes and fewer transactions.

- Batch where it makes sense: one transaction often has a fixed overhead (~21,000 gas for basic execution + calldata). If a dapp lets you bundle actions or transfer to multiple recipients in a single call, you cut duplicate overhead. For example, two separate ERC-20 transfers might cost ~2 × 50k gas, while a contract’s batchTransfer can come in closer to ~100k plus a small overhead—saving the second transaction’s overhead.

- Skip separate approvals: if the token supports EIP-2612 Permit or Permit2, use it to approve and swap in one go. Fewer txs, fewer chances to pay base fee twice.

- Right-size allowances: blanket infinite approvals can be risky. If you must, keep them for high-trust protocols only. Otherwise, set smaller allowances to reduce the chance of future emergency revokes (another tx).

- Use MEV-protected routes when possible: a sandwich or failed backrun doesn’t just sting your execution—it wastes gas. Routes like Flashbots Protect RPC or aggregators with backrun protection (e.g., CowSwap) can lower your “wasted gas” bill by avoiding toxic order flow.

- Avoid peak events unless you’re competing: if you aren’t trying to win a hot mint or liquidation, wait it out. Paying surge prices for a casual transfer is a quiet way to leak ETH.

- Myth-busting: old “gas tokens” like GST2/CHI no longer help after EIP-3529 reduced refunds. Focus on timing and batching instead.

I keep a simple checklist taped to my monitor:

- Is this urgent? If not, wait for the next cheap window.

- Can I combine steps or use Permit to avoid an extra tx?

- Do I have enough base fee headroom for 2–3 blocks of volatility?

- Did I simulate to avoid an expensive revert?

One last thing—some of the biggest wins come from choosing the right venue for the job. That can mean a different L1/L2, or simply a smarter estimator. Want to see which alternatives I trust and when I override wallet quotes? Let’s look at your best options next.

Alternatives, complements, and L2 context

Other estimators and trackers: the second source I actually check

I love saving ETH with smart fee settings, but I don’t gamble on a single data point when time matters. If the stakes are high, I sanity‑check ETH Gas Station against one more live source before I press Confirm. Here are the ones that earn their keep:

- Etherscan Gas Tracker — Shows current base fee, suggested priority fees, and block-by-block history. Quick, familiar, and often aligned with what your wallet shows. Link: etherscan.io/gastracker

- Blocknative Gas Estimator — My go-to during volatile moments. It estimates inclusion probabilities by block and gives granular EIP‑1559 tips. There’s also a robust API for bots. Link: blocknative.com/gas-estimator

- OKLink Gas — A clean snapshot with historical charts and min/max ranges when you want a quick reality check. Link: oklink.com/eth/gas-price

- TX Street — Not a fee number per se, but a fantastic mempool visual to spot surges (think: NFT mints/liquidations). If the “bus” is overloaded, go Fast or wait. Link: txstreet.com

My quick rule: if ETH Gas Station and a second source differ by more than ~20–30% on suggested priority fee during an urgent moment, I pick the higher tip or wait a few minutes and refresh both. Stale tabs are quiet fee-killers.

“Paying for speed is cheaper than paying for regret.”

Real example: Right before a high‑volume token listing, ETH Gas Station showed 32 gwei tip for Fast, while Blocknative suggested 36 gwei for next-block inclusion. I set max priority fee to 36 with a comfortable max fee ceiling and got in within 1 block. Friends who stuck with 28 gwei waited ~10 minutes or had to speed up after the fact.

Wallet-native estimates: when I trust them, and when I override

Wallets are better than they used to be, especially with EIP‑1559 integrated, but I treat them differently based on the situation:

- MetaMask — “Low/Market/Aggressive” (plus Advanced). I let MetaMask lead for routine transfers and small DEX swaps during calm periods. If I see sudden volatility or a hot mint starting, I click Advanced and set Max Priority Fee using ETH Gas Station or Blocknative’s Fast suggestion (plus a small buffer), and keep the Max Fee high enough to cover a few base‑fee jumps.

- Rabby — Shows expected confirmation time and makes it easy to speed up with the same nonce. I trust its default during off‑peak. During busy windows, I still cross‑check tips and often add +1–3 gwei to the priority fee if I care about the next 1–2 blocks.

- Frame / Coinbase Wallet — Similar approach: default is fine when the mempool is calm; custom numbers when I see spikes or care about exact timing.

Override signal: if the wallet’s “Aggressive” is below both ETH Gas Station’s Fast and Blocknative’s next‑block tip, I override with the higher number. If I’m not in a rush, I go with the wallet’s Market/Standard and accept the wait.

Layer 2 fees and bridges: the L1 shadow you still pay for

Rollups are cheaper, but not magically independent. L2 fees generally include two parts:

- L2 execution cost — What you pay to run the transaction on the L2.

- L1 data cost — The cost of posting compressed call data back to Ethereum. This scales with the L1 base fee, so when L1 gets busy, your L2 fees can increase too.

That’s why a swap on Arbitrum, Optimism, Base, or zkSync might feel “sticky” when L1 gas spikes. You’ll still usually pay far less than on L1, but the price can jump from, say, $0.10 to $0.40 during peak L1 congestion. Your exact cost depends on the chain and the specific action.

Bridges add another wrinkle:

- Deposits to L2 originate on L1, so the deposit itself is sensitive to L1 gas. Cheap L2 ≠ cheap deposit when base fee on L1 is hot.

- Withdrawals from optimistic rollups (e.g., Arbitrum/Optimism) include a challenge period (often ~7 days). You can use third‑party bridges to exit faster, but expect a fee premium.

Useful links for L2 fee reality:

- l2fees.info — A quick look at approximate costs by action across top L2s.

- L2BEAT Fees — Context on how fees are constructed and how they vary.

- Chain explorers (e.g., Arbiscan Gas, Optimistic Etherscan) — For chain‑specific estimates.

Sample scenario: I needed to move USDC from Ethereum to Optimism during a rush hour. L1 base fee jumped from ~20 gwei to ~70 gwei in 10 minutes, and the deposit cost tripled. I waited 15 minutes, rechecked ETH Gas Station and Etherscan (base fee eased to ~30–35 gwei), and the deposit cost fell back into a sane range. The swap on Optimism itself was still cents.

Which tool for which job: fast mints, routine transfers, and bots

- Routine transfers (payroll, NFT sends to a friend, claim and chill):

- Use your wallet’s Market/Standard.

- Quickly confirm with ETH Gas Station. If they align, send. If you can wait, pick Safe and enjoy the savings.

- DEX swaps during moderate volatility (you care about minutes, not seconds):

- Compare ETH Gas Station Standard vs Etherscan. If within ~10–15%, use Standard + small tip buffer (e.g., +1–2 gwei).

- Set a higher Max Fee ceiling in case base fee pops for a few blocks.

- Hot mints and liquidations (seconds matter):

- Check Blocknative’s next‑block estimate alongside ETH Gas Station’s Fast.

- Use the higher priority fee + a buffer. Keep Max Fee generous.

- Optional: route through a private RPC like Flashbots Protect to reduce exposure to MEV and failed‑tx spam. Note: in rare cases, private routing can affect inclusion speed; watch pending status.

- Bot‑driven trading and automation:

- Pull programmatic tips from ETH Gas Station or Blocknative APIs.

- Apply guardrails: min/max priority fee, abort if spread doesn’t cover gas + slippage.

- Use multi‑source confirmation before firing time‑sensitive bundles.

- L2 activity:

- Use chain‑specific gas sources (Arbiscan/Optimistic Etherscan) or l2fees.info.

- Plan deposits when L1 gas is calmer; withdrawals via fast bridges if time > fee.

I’ve learned this the hard way: one minute of prep beats ten minutes of anxiety watching a pending spinner. And if you’re wondering why a transaction can still get stuck even after using a suggested fee—and exactly how to fix it without wasting more ETH—that’s where we’re headed next.

ETH Gas Station FAQ: straight answers to common questions

Is ETH Gas Station accurate and up to date?

Yes, for real-time estimates it’s solid. It tracks what’s happening in the mempool and recent blocks to suggest tip (priority fee) levels for different speeds. No estimator is perfect during sudden spikes (NFT mints, liquidations, MEV bursts), but if you refresh the page before confirming and your wallet’s quote is in the same ballpark, you’re good most of the time.

I like to cross-check in fast-moving markets: ETH Gas Station + your wallet + one other tracker. If two out of three agree, I proceed. If there’s a mismatch, I pad the tip slightly.

What’s the difference between Safe, Standard, and Fast suggestions?

They’re tiers that map to how quickly your transaction is likely to land:

- Safe: Lower tip, slower inclusion. Good for non-urgent transfers and when the network is calm.

- Standard: Balanced tip for predictable confirmation under typical load.

- Fast: Higher tip for priority inclusion, useful during volatility or when you can’t miss the next few blocks.

These are priority fee (tip) targets. Your total cost also depends on the base fee, which you don’t control.

How do I set Max Fee and Max Priority Fee (tip) in my wallet using these numbers?

Quick example using EIP-1559 fields (e.g., MetaMask Advanced):

- Note the current base fee on your wallet or any tracker.

- From ETH Gas Station, choose a tier (Safe/Standard/Fast) and take its tip suggestion.

- Set Max Priority Fee to that suggested tip (e.g., Fast tip of 4–8 gwei).

- Set Max Fee high enough to handle short-term spikes:

- Rule of thumb: Max Fee = (1.5× to 2.5× current base fee) + priority fee.

- Urgent? Lean closer to 2×–2.5×. Casual? 1.5× is usually fine.

This doesn’t mean you’ll pay that full Max Fee; you’ll pay the actual base fee at inclusion + your tip. The extra headroom just prevents your tx from getting stuck if base fee jumps a bit.

Why did my transaction get stuck even though I used the suggested fee?

A few common reasons:

- Base fee spiked above your Max Fee. Your maximum couldn’t keep up with short-term demand.

- Tip too low for the moment. If a gas war starts, miners/validators prioritize higher tips.

- Stale data. You opened ETH Gas Station 15 minutes ago and never refreshed.

- Wallet bug or nonce conflict. A pending tx with the same nonce can block the queue.

Fix: Use your wallet’s Speed Up option and increase both Max Priority Fee and Max Fee meaningfully (not 1–2 gwei—think +25–100% during spikes).

What is the base fee, and why can’t I control it?

The base fee is the network-set cost per gas unit under EIP-1559. It auto-adjusts up or down with demand and gets burned (destroyed), not paid to validators. You can’t change it; you only control the priority fee (tip) and your Max Fee ceiling.

How do I speed up or cancel a pending transaction?

The easy way is built into most wallets:

- Speed Up: Click Speed Up, then set a higher tip and higher Max Fee. I usually add 30–100% to the tip and raise the Max Fee buffer.

- Cancel: Click Cancel, which sends a 0 ETH tx to yourself with the same nonce but a higher fee to overwrite the pending one.

Manual approach (advanced): Send a replacement transaction with the same nonce and a clearly higher tip/Max Fee. For cancel, send 0 ETH to your own address. For speed up, resend the original call. If the increase is too small, it won’t replace the pending one.

What’s a good tip during heavy congestion or a hot mint?

In a true gas war, tips escalate quickly. Practical ranges I’ve used:

- Busy but not crazy: 5–15 gwei tip.

- Hot mint/MEV-heavy period: 20–60 gwei tip (sometimes even more).

Pair that with a strong Max Fee so a sudden base fee surge doesn’t cap you out. The point is to stand out in the mempool so validators pick you first. If you can’t justify the cost, wait—being first isn’t always worth it.

Why does a simple ETH transfer need less gas than a contract interaction?

An ETH transfer triggers a straightforward balance update. Interacting with a smart contract runs more opcodes and storage writes. More work = more gas units. That’s why a token transfer or a DEX swap consumes more gas than sending plain ETH, and NFT mints or complex DeFi calls can use a lot more.

Is ETH Gas Station free to use, and is it safe?

It’s free to check estimates and doesn’t require wallet connection. That’s inherently safer than any tool that asks for permissions. Still, always verify the URL, beware of sponsored clones, and never paste private keys or sign messages you don’t understand. ETH Gas Station is informational—your wallet is where you confirm.

What’s the best time of day or week to send cheaper transactions?

Patterns shift, but there’s a consistent theme: off-peak hours are cheaper. Historically, late nights and early mornings UTC (approx. 00:00–05:00 UTC) and weekends tend to be calmer, while US business hours often cost more. Always check live data—if the estimate graph is trending down for 10–15 minutes, you can often snag a better price by waiting a bit.

Pro tip: If your tx isn’t urgent, set a Safe/Standard tip and walk away. Let the network come to you during a lull.

Does ETH Gas Station support EIP-1559?

Yes. Use it alongside your wallet’s EIP-1559 fields. Set the suggested Max Priority Fee (tip) from your chosen tier, and give your Max Fee enough ceiling to handle base fee bumps. Refresh the page right before you hit confirm.

Want the exact checklist I use before big swaps and how I avoid paying “panic premiums” without missing blocks? That’s up next—care to see the playbook I actually follow in live markets?

My take: when ETH Gas Station shines, and how to get the most from it

ETH Gas Station isn’t flashy, but it’s the tab I keep open whenever I’m pushing anything on Ethereum. It gives me a grounded, real-time reference that stops me from guessing. Here’s how I use it to pay fair fees without getting stuck.

Best use cases that consistently pay off

- Timing non-urgent transfers. For simple sends or token approvals, I watch the “Safe/Standard/Fast” spread and wait for a calmer window. If the gap between Safe and Fast is wide, I’ll often pick Standard and let it confirm. Weekend late nights UTC tend to be cheaper; you can see longer-term patterns on the Etherscan Gas Price chart and hourly volatility on live trackers like Blocknative.

- Getting a fair fee for DEX swaps. For swaps that aren’t racing a price move, I match ETH Gas Station’s Standard suggestion to my wallet’s EIP-1559 fields. In quiet periods, a small tip (often 1–2 gwei) clears quickly. During volatility, I bump the tip slightly and keep max fee realistic so I don’t overpay if base fee spikes momentarily.

- Sanity-checking wallet quotes before big moves. Some wallets inflate suggested fees to “be safe.” Cross-checking against ETH Gas Station helps me right-size the max fee and tip. If both align, great. If they’re far apart, I either add a small buffer or wait 5 minutes and refresh to see where the market settles.

Tip: EIP-1559’s base fee can jump rapidly when blocks are overfilled, but only rises 12.5% max per block. If you’re not in a rush, a brief spike is often not worth chasing.

Quick checklist I run through every time

- Refresh. Gas quotes get stale quickly. I refresh ETH Gas Station and my wallet before setting numbers.

- Compare one more source. I glance at one secondary feed (wallet-native, Blocknative, or Etherscan). If both sources agree, I proceed. If not, I add a small tip buffer.

- Pick the right tier for the job.

- Safe: routine transfers, approvals, batched tasks.

- Standard: most swaps and mints when there’s no gas war.

- Fast: time-sensitive actions or volatile markets.

- Set a tip buffer if urgent. I add +1–3 gwei to the suggested tip in calm periods, +5–15 gwei during busy times. Keep max fee high enough to cover a few blocks of rising base fee without going absurd.

- Monitor pending status. If it lingers, I either speed up with a higher tip or wait 2–3 blocks and reassess. Don’t mash “speed up” repeatedly—use a deliberate bump once.

When to go beyond it

- Gas wars and hot mints. If you’re competing against bots or lightning-fast minters, baseline estimates won’t cut it. Use a meaningful tip buffer, set a competitive max fee, and be ready to replace-by-fee once if it doesn’t land immediately.

- MEV-heavy moments. Liquidations, rebase events, and airdrop claim windows attract MEV searchers. Consider sending via a private relay to avoid being sandwiched or leaked to the public mempool. A popular option is Flashbots Protect RPC.

- Ultra time-sensitive trades. If slippage or opportunity cost dwarfs fees, I ignore Safe/Standard and push Fast with a healthy tip. I also keep a “gas escalator” mindset: if not included in 1–2 blocks, I replace with a higher tip once—no dithering.

- Congestion from big events. Major NFT mints or protocol launches can distort fee markets for short bursts. If your action isn’t urgent, waiting 10–20 minutes often saves a lot. You can confirm the surge visually with live mempool explorers or your secondary gas source.

Mini playbooks I actually use

- Routine transfer or approval: Standard → set tip +1 gwei → send → if not in 2–3 blocks, one moderate speed-up.

- DEX swap with price risk: Fast → tip +3–8 gwei depending on volatility → set a max fee that tolerates a few blocks of base fee jumps → monitor → one speed-up if needed.

- Potential gas war (mint/claim): Fast → tip +10–20 gwei to pre-empt a wave → consider private relay → be prepared to cancel/replace once if the mempool explodes.

On the “is this actually worth it?” question: small optimizations compound. Avoiding even 10–20% overpayment across a handful of weekly transactions adds up over a year. Public dashboards frequently show calmer weekend windows and overnight UTC lulls, and using those windows with a Standard tip often clears just as quickly as a bloated Fast does during peak hours. A simple habit—refresh, compare, right-size your tip—pays for itself.

Final word

ETH Gas Station is a simple edge that adds up over time. Keep it open, use it to sanity-check your wallet, and match your tier to the job. Pad the tip when seconds matter; take the discount when they don’t. You’ll avoid unnecessary waits and stop torching ETH on guesswork.

Want more practical, no-fluff walkthroughs? Bookmark cryptolinks.com. I’ll keep sharing the playbooks that actually save time and money.