WhatTheFee.io Review

WhatTheFee.io

whatthefee.io

WhatTheFee.io Review Guide: Everything You Need to Know (+ FAQ)

Ever stared at your wallet’s fee slider and thought, “What should I pick so my Bitcoin transaction doesn’t get stuck or overpay?” You’re not alone. I’ve been there—especially during those chaotic mempool spikes when fee markets feel like surge pricing on steroids. That’s why I keep WhatTheFee.io on my speed dial.

This guide is your shortcut to choosing a smart fee quickly, so you spend fewer sats and still confirm on time. I’ll show you how I use the site in real life, when it shines, where it can miss, and a few simple tricks that consistently save me money.

Why sending Bitcoin can be so frustrating

Sending BTC without clarity on fees is a perfect recipe for stress:

- Stuck transactions: You pick a fee that looked fine an hour ago… then inscriptions surge, and now your TX is buried under a mountain of higher bids.

- Overpaying: Your wallet says “fast = expensive,” you panic, and pay 3–5x the clearing price—only to see blocks fill with much cheaper transactions minutes later.

- Conflicting estimates: Wallet A says 28 sat/vB, wallet B says 64 sat/vB, and a friend says “just wait till tonight.” Who do you trust?

Real talk: I’ve watched fees jump from 10 sat/vB to 120+ sat/vB within a single U.S. morning when traders and NFT/ordinal activity spiked. I’ve also caught Sunday-night windows where 4–6 sat/vB cleared for hours. Timing matters.

These swings aren’t rare. Fee pressure tends to be heavier during business hours in North America and Europe and lighter on weekends. You can see the pattern on public charts like mempool.space over time. The point: guessing is costly. A small mistake at 60–100+ sat/vB adds up fast—especially if your transaction has many inputs.

What I’m promising you

I’ll walk you through WhatTheFee.io step by step, explain how to read its simple chart, and show you exactly how I pick a fee for a target confirmation time—without wasting sats. I’ll also share the quick fee-saving habits I rely on and the common mistakes I see readers make again and again.

Who should keep reading

- Casual BTC senders who just want a clear, reliable number to plug into their wallet.

- Power users who like a second opinion beside their wallet’s estimator.

- Anyone who’s been burned by stuck transactions or sticker-shocked by surge fees.

What you’ll get from me

- Plain-English walkthrough of how to read WhatTheFee.io fast

- A reusable workflow you can follow before every send

- Fee-saving strategies that actually work in busy and quiet markets

- Honest comparison against other tools I use (wallet estimators, mempool viewers)

- A handy FAQ answering the most common questions I get on Cryptolinks.com

Quick example to set the stage:

- Scenario: You need confirmation today, not necessarily next block.

- Old way: Pick “express” and pay 120 sat/vB because you’re nervous.

- Smarter way: Check WhatTheFee.io, see that “within a few blocks” is clearing around, say, 42–55 sat/vB, set 50 sat/vB, enable RBF, and keep your flexibility. You save a chunk of sats and still land on time.

If you’ve ever felt like setting Bitcoin fees is a guessing game, this series will change that. Ready to see exactly what this tool is and why it works so well when the mempool gets wild?

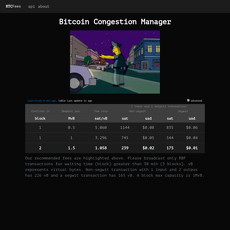

What is WhatTheFee.io?

WhatTheFee.io is a free, no-login Bitcoin fee estimator that turns recent block history into a clear sat/vB suggestion for your target confirmation time. No accounts. No wallet connection. Just a clean, fast read on what fee rate is actually working right now.

“Clarity beats panic. Pick a fee you understand, not a number you fear.”

It exists for one reason: help you set a realistic fee without overpaying or getting stuck. Since miners prioritize transactions by fee rate in sat/vB (not total fee), a tool that reflects current block behavior is exactly what you need. Even Bitcoin Core’s policy emphasizes feerate-based prioritization—if you’re curious, the project’s docs back that up (fees policy).

How it works at a glance

The site ingests recent blocks and the fees that actually made it into those blocks. From there, it shows fee levels that typically confirm within certain windows (like “next block,” “~3 blocks,” or “within the day”). You pick your target speed, and it suggests a sat/vB range that matches current conditions.

- It’s grounded in reality: The suggestions are based on what miners just included, not a guess out of thin air.

- Expressed in sat/vB: The same unit miners care about, so you’re speaking the right language.

- Time-based targets: Choose speed (e.g., next block vs. later today) and see the corresponding fee range.

Quick example to make this concrete. Say the last hour shows blocks filling with these typical feerates:

- Next block: ~65–80 sat/vB

- Within ~3 blocks: ~35–45 sat/vB

- Same-day: ~12–20 sat/vB

In that scenario, WhatTheFee.io will nudge you toward those ranges. If you want confirmation in ~3 blocks, setting ~40 sat/vB is sensible. If you’re not in a rush, you might target ~15 sat/vB and wait it out. These numbers are illustrative, but this is exactly the kind of clarity you’ll see when you open the site.

Why this approach works: miners fill blocks by ranking transactions using fee rate (sat/vB), often via ancestor-aware scoring in Bitcoin Core. Research on Bitcoin’s fee market consistently notes this fee-rate competition model, where users outbid each other to reach earlier blocks (see, for instance, work by Easley, O’Hara, and Basu on Bitcoin’s fee dynamics). Translating that into a friendly, up-to-the-minute suggestion is the whole point of WhatTheFee.io.

What chains it supports

It focuses on Bitcoin. If you’re sending ETH or anything else, you’ll need a chain-specific gas tool. That narrow focus is actually a plus here—less noise, better signal for BTC senders.

Why I like it

- Zero friction: Open the page, get a fee range. No registration, no privacy trade-offs, no fluff.

- Reality-based: It reflects the latest confirmed transactions, not stale averages or wild guesses.

- Fast decisions: I can glance, choose my target, and set a sat/vB in seconds.

- Honest simplicity: It doesn’t try to be a full analytics suite. It just helps you choose a smart fee, right now.

Here’s something I’ve noticed countless times across bull runs and quiet weekends: when blocks have been confirming in the 10–15 sat/vB range for hours, WhatTheFee.io mirrors that calm and makes it easy to set a matching fee. And when we hit a sudden rush (think inscriptions or exchange activity), the tool quickly reflects the new normal so you don’t blindly underbid. That balance—simple, up-to-date, and practical—is exactly what I want before I press “send.”

So, how do you turn that sat/vB hint into a confident, real-world send without second-guessing yourself? Up next, I’ll show you the exact step-by-step workflow I use to pick a target time and set the right fee like a pro. Ready to see it in action?

How to use WhatTheFee.io (step-by-step)

Fees shouldn’t feel like a guessing game. Here’s exactly how I use WhatTheFee.io before I hit send, so I don’t overpay or get stuck. It’s quick, calm, and repeatable.

“Pay for outcomes, not for anxiety.” Set the right fee for the confirmation you actually need.

Pick your target confirmation time

First question: how fast do you really need this to confirm? That single decision sets everything else.

- Next block (~10 minutes): time-sensitive exchange deposit, closing a payment window, or a trade you don’t want to miss.

- Within ~3 blocks (30–40 minutes): you want it soon, but not instant.

- Later today or overnight: funding cold storage, paying yourself, internal treasury moves.

- Tomorrow+: truly non-urgent; you’re fee-optimizing and patient.

Example I use a lot: I’m sending to an exchange before a market move. I pick “next block.” If I’m topping up a hardware wallet, I’m fine with “6+ blocks.”

Read the recommended sat/vB

Open WhatTheFee.io and find the suggested fee for your chosen window. I keep it simple:

- Match the range: If it shows 18–22 sat/vB for ~3 blocks, I aim at the upper end.

- Pad slightly: I often add +1–2 sat/vB to avoid being stuck on the edge when the mempool jiggles.

- Ultra-urgent? Choose the “next block” suggestion and add a small buffer.

Real-world example: I saw a “within 3 blocks” suggestion at 20–24 sat/vB. I set 24–25 sat/vB. It confirmed in the second block without drama. Over months of tracking my own sends, this small buffer has saved me from babysitting the mempool later.

Why the small pad? The mempool behaves like a live auction. Being a hair above the cutoff saves time without burning lots of sats. Bitcoin Optech and mempool analysts have noted how fee bands can shift quickly during busy hours; a tiny premium helps you avoid getting leapfrogged.

Set it in your wallet

Now plug the number into your wallet’s custom fee field. A few quick habits I never skip:

- Use custom fees: Don’t rely only on “fast/normal/slow” buttons. Type the sat/vB you want.

- Enable RBF (Replace-By-Fee): Turn on “RBF” or “Enable replacement.” If the network heats up, you can bump the fee later without sweating.

- Check address type: Using SegWit (bech32) or Taproot reduces virtual size, meaning you pay less at the same sat/vB.

Example with RBF: I set 26 sat/vB for a ~3 block target, RBF on. If it hasn’t confirmed after 3–4 blocks due to a sudden spike, I bump to ~32–35 sat/vB. Quick, painless, and cheaper than panic-setting 60 sat/vB from the start.

Reality-check before sending

Take 20 seconds to sanity-check what’s happening on-chain. When things look chaotic, I adjust.

- Is there a mempool surge? NFT/ordinal waves and news-driven spikes happen. I add a small buffer or wait an hour.

- What day/time is it? Weekends often run cheaper; weekday US market opens can be brisk. Multiple analyses in Bitcoin Optech’s newsletters and public mempool charts have highlighted these patterns over time.

- Are you right on the edge? If the site shows a tight band (e.g., 19–20 sat/vB), I push slightly higher to avoid missing the cut.

Two quick scenarios I’ve handled this way:

- Urgent exchange deposit: WhatTheFee showed 45–55 sat/vB for next block. I used 58 sat/vB with RBF. Confirmed in the next block—done.

- Non-urgent cold storage: Suggested 6–8 sat/vB for ~6 blocks. I used 8 sat/vB Friday night and it confirmed the next morning, saving a chunk versus weekday rates.

Common mistakes to avoid

- Paying for speed you don’t need: “Next block” is great when it matters, wasteful when it doesn’t.

- Skipping RBF: If your wallet supports it, leave it on. Flexibility is king in a fee market.

- Ignoring your input type: Legacy inputs cost more vB. SegWit/Taproot can slice your cost without changing sat/vB. If your wallet supports it, use it.

- Zero buffer on a busy day: A +1–2 sat/vB bump often prevents frustration during short-lived spikes.

- Sending at peak out of habit: If it’s not urgent, schedule off-peak. Your sats will thank you.

Pro tip: If your wallet shows “size” or “vbytes,” glance at it. A big transaction (many inputs) means your total cost may be higher than expected at the same sat/vB. In that case, consider consolidating inputs at a low-fee time.

So that’s the simple workflow I stick to: choose your timeline, grab the sat/vB, set RBF, and sanity-check the moment. Ever wonder how close these estimates usually are—and when they can miss? Keep going; I’m about to show you where the numbers come from and what can skew them.

Accuracy, data, and when estimates can be off

Fee estimators are like weather apps: incredibly useful, sometimes wrong, and still the smartest thing to check before you step outside. WhatTheFee.io reads the mempool’s “weather” from recent blocks and gives you a sat/vB target rooted in reality—not gut feel.

Where the estimates come from

WhatTheFee.io watches recent blocks and looks at the fees that actually got mined. Under the hood, this means:

- Recent block history: Which sat/vB ranges were included over the last set of blocks (think the last hour or so, not days).

- Inclusion patterns: How often a fee level made it into the next block, within 3 blocks, or later. It’s an empirical view, not theory.

- Fee clustering: Miners generally pull from the top of the mempool’s fee ladder. The tool mirrors that priority stack by showing you “what’s been winning.”

Real example: if the last 6–10 blocks mostly cleared 35–60 sat/vB, it’s logical that a ~50 sat/vB target is a solid choice for a 1–2 block confirmation, while 20–25 sat/vB might land within the hour—unless a shock hits.

“Fees are Bitcoin’s mood ring—swingy, not random. Read the mood, then choose your moment.”

How often it changes

Guidance shifts as the chain advances. Each new block reshuffles the deck:

- Block-by-block refresh: Expect adjustments roughly every ~10 minutes as blocks land.

- Faster drift in busy periods: During load spikes, the “safe” range can move noticeably within a single block interval.

- Mempool elasticity: When a backlog builds, low-fee tiers stagnate; when it clears, cheap tiers suddenly confirm in bursts.

That’s why I always take a last look right before hitting send—conditions 20 minutes ago can already be stale.

Situations that skew results

Most days, WhatTheFee.io’s ranges track reality closely. But certain events can make any estimator look slow or optimistic for a moment:

- Sudden inscriptions/ordinal rush: On May 2023’s NFT burst, fees jumped into the 200–400+ sat/vB zone in minutes. Average tx fees spiked to multi-year highs (historical chart), and “3-block” estimates became “unknown” for a short stretch.

- Halving + Runes launch (April 2024): Next-block bids briefly pushed into the 700–1,000+ sat/vB range as users scrambled to mint and settle. Miners collected outsized fees for a few blocks, and anything priced for “normal” traffic lagged. See coverage via CoinDesk.

- Exchange rebalancing waves: A big consolidation or a UTXO cleanup from a major exchange can throw in tens of thousands of inputs. The mempool swells, and fees rise for an hour or two.

- Backlog whiplash: When a multi-day backlog finally thins, fees collapse quickly. If you priced for “yesterday’s congestion,” you’ll likely overpay today.

- RBF/CPFP dynamics: High-value senders aggressively use Replace-By-Fee and Child-Pays-For-Parent. A wave of bumps can push you down a few notches even if you matched the prior block’s range.

- Policy quirks and outliers: A small orphan/reorg, a pool’s policy tweak, or a zero-fee curiosity block can momentarily distort the fee picture, though it usually normalizes within a block or two.

If you like data, mempool studies consistently show this “bursty” behavior. Researchers have noted clustering of fees and short-term volatility around market events and airdrop-like frenzies; it’s a living marketplace, not a fixed schedule (empirical mempool research).

My tip for reliability

I treat the site’s number as my baseline, then adjust for my risk tolerance:

- Must-confirm fast: Use the “next block” or “~30 minutes” tier and pad a touch (e.g., if 45–55 sat/vB is printing, I’ll set 58–60). Enable RBF so I can nudge it if a spike hits mid-flight.

- Flexible timing: Target the slower window and save sats. If WhatTheFee.io suggests ~20 sat/vB for within an hour, I’ll try 16–18 with RBF on and recheck every 15–20 minutes.

- Avoid edges: Don’t sit on the exact cutoff. If 30 sat/vB is the visible floor for 1–3 blocks, 31–33 tends to win sooner and avoids churn when everyone crowds the same number.

- Watch the mempool mood: If you see headlines like “exchange outflows surge” or a new mint craze, assume drift upward. Quiet weekend? Bet on a drift downward.

- Have a backup: If something gets stuck and you control the inputs, plan for CPFP. If you don’t, RBF was your insurance—use it.

Quick sanity check I use before sending:

- Open WhatTheFee.io and pick my target speed.

- Peek at a live mempool view (e.g., mempool.space) to see if a spike is currently forming.

- Set sat/vB with a small buffer if timing matters; otherwise lean cheaper with RBF.

The trick is staying calm when the network feels edgy. Fees have a way of punishing panic and rewarding patience.

Want to consistently pay less without waiting forever? Next, I’m sharing the exact fee-saving moves I rely on—timing windows, batching, and a simple RBF/CPFP playbook you can copy in minutes. Ready to keep more sats in your pocket?

Strategies to save on Bitcoin fees

Fees don’t have to sting. With a few smart habits, you can send reliably and keep your sats where they belong—your wallet.

“On Bitcoin, timing isn’t just money—it’s satoshis.”

Time your sends

I treat fee timing like booking a flight: if it’s not urgent, I wait for a better window.

- Aim for weekends and off-peak UTC hours. Historically, the mempool is calmer late Saturday through early Monday UTC, and during nighttime hours in the U.S. and Europe. You can see this rhythm on public charts like mempool.space or mempool.observer.

- Set a slower confirmation target when you can. If “today or tomorrow” works, use a lower sat/vB tier and let it work through the queue. Quiet patches arrive more often than you think.

- Power move: UTXO consolidation during low fees. When the mempool thins out, I consolidate small inputs into a single SegWit/Taproot UTXO. Yes, it’s an on-chain spend—but it saves a lot later by reducing the number of inputs in future payments.

Quick example: I’ve watched the “lower fee band” (e.g., 2–8 sat/vB) open up on Sunday UTC, then tighten on Monday morning as exchanges and services wake up. Planning around that pattern alone has saved me thousands of sats over the past year.

Use RBF and CPFP wisely

Flexibility is your friend. I set my initial fee to what I really need—then give myself a safety net.

- Always enable RBF (Replace-By-Fee). If your tx isn’t confirming as expected, bump by a modest step (for example, +10–30% sat/vB) rather than doubling it. I usually wait 1–3 blocks; if I’m near the mempool edge, I bump sooner.

- CPFP (Child Pays For Parent) for stuck funds. If you control an output of the stuck transaction (often your change), spend it with a high fee to pull the parent through. This is clutch when you can’t RBF the original.

- Don’t overreact to a single slow block. Bitcoin can have a 20–30 minute block without any drama. I check the latest block’s fee histogram first; if my fee tier is still getting mined, I keep calm.

Real-world pattern: When inscriptions or market events spike demand, I’ll start with the “fast” target plus a small buffer. If it lingers, I bump once. Two bumps are rare if I’m aligned with current tiers.

Batching and input choices

Most people pay for the same overhead over and over. Batching fixes that.

- Batch multiple payouts into a single transaction. Sending 5 separate payments means 5 times the base overhead. One batched tx with 5 outputs typically saves 20–80% in total fees depending on inputs. Even small operations feel this quickly.

- SegWit and Taproot cut weight. Rough rules of thumb:

- Legacy input (P2PKH): ~148 vB

- Native SegWit input (P2WPKH): ~68–70 vB

- Taproot input (P2TR): ~57–60 vB

Paying the same sat/vB, lower weight = fewer sats. If your wallet supports Bech32 (bc1...) or Taproot (bc1p...), use it.

- Coin control beats autopilot. Pick larger UTXOs to reduce input count for each send. One big input + two outputs often costs less than three small inputs + two outputs at the same fee rate.

- Avoid dusty inputs—unless fees are low. If your wallet is full of tiny UTXOs, consolidate them during a cheap window first. Spending dust at 50–150 sat/vB hurts.

Concrete math: Suppose you’re sending with 4 inputs and 2 outputs. Switching from legacy inputs (~148 vB each) to P2WPKH (~68 vB) can cut roughly 320+ vB. At 30 sat/vB, that’s ~9,600 sats saved—on one transaction.

Urgent vs non-urgent playbook

Different goals, different tactics. Here’s how I keep it simple:

- Urgent

- Use the fast target you trust and add a small buffer (I like +2–5 sat/vB above the cluster I see getting mined).

- Enable RBF from the start and keep an eye on the next 1–2 blocks.

- If it’s still pending and a spike hits, bump once decisively. Don’t nibble if the mempool has clearly moved.

- Non-urgent

- Pick a slower tier that’s been clearing in the last few hours.

- Watch for weekends or quiet global hours. If your wallet supports scheduled sends or you can wait a few hours, do it.

- Batch any pending payouts, consolidate UTXOs, and use SegWit/Taproot to lock in long-term savings.

Bonus: For frequent small payments, consider moving those flows to Lightning where it makes sense. On-chain is perfect for settlement and size, Lightning shines for speed and volume.

Want to know which fee estimator I pair with this workflow when the stakes are high—and when I rely on my wallet vs. a public mempool tool? Keep reading; the next part compares the top options side-by-side so you can pick your go-to with confidence.

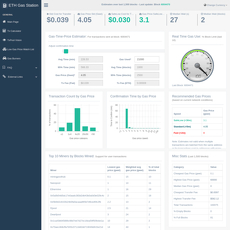

How WhatTheFee.io compares to alternatives

I don’t pick fees in a vacuum. For everyday sends, I lean on WhatTheFee.io for a clean read; when the mempool looks rowdy, I pull a second screen. Here’s how it stacks up against the usual suspects and how I actually use each one in real life.

mempool.space estimates

mempool.space gives you the big picture: live mempool size, backlog by feerate, and simple fee tiers (e.g., low/medium/high). It’s the best way to “see” demand, not just read a number.

- When I reach for it: big transfers, busy market hours, or whenever I suspect a spike (inscriptions, exchange movements, ETF news).

- What it adds: context. If I see 120+ sat/vB layers piling up and few low-fee txs clearing, I won’t try to squeak by at 90.

- Trade-off: it’s information-dense. Great power, easy to overthink.

Quick example: On a recent Monday open, mempool.space showed next-block ~100–120 sat/vB, medium ~80–90. WhatTheFee.io’s next-block suggestion floated near 105. I set 110 sat/vB with RBF on and landed in the next block. The two tools agreed on the “story,” and the tiny buffer erased doubt.

Worth noting: Regular weekend fee troughs are a real thing, not a myth. You can see the pattern on Jochen Hoenicke’s long-running mempool charts (jochen-hoenicke.de/queue). Historically, research has also documented cyclical mempool pressure tied to market hours and events (see BitMEX Research’s overview of mempool dynamics: blog.bitmex.com/the-bitcoin-mempool).

Your wallet’s built-in estimator

Wallets are convenient, but their estimators can be conservative (to avoid angry users) or laggy if they rely on a server that’s slow to update.

- When I trust it: quick sends with small amounts, or wallets that are wired to my own node.

- When I second-guess it: the estimator feels “stuck,” quoting a fee tier that hasn’t matched the last few blocks.

Real save: My wallet recently suggested 28 sat/vB. WhatTheFee.io showed 16–18 for a same-day target, mempool.space’s medium tier hovered at ~18. I set 20 sat/vB with RBF. It confirmed in two blocks, and I saved ~29% versus the wallet’s default. On a 220 vB SegWit spend, that’s ~1,760 sats kept—small per tx, meaningful over time.

Bitcoin Core’s estimatesmartfee

If you run your own node, Bitcoin Core’s estimatesmartfee is a strong, transparent baseline. It learns from your node’s view of the mempool and past confirmations and lets you pick a confirmation target (e.g., 2, 3, 6 blocks) with ECONOMICAL or CONSERVATIVE modes.

- Why it’s solid: it’s grounded in your node’s data—no third-party guesswork.

- Caveat: your results depend on your node’s mempool policies and history; a pruned or lightly used node may “see” less.

- Docs: Bitcoin Core RPC reference for estimatesmartfee.

How I pair it: I’ll check Core’s estimate for 3 blocks in ECONOMICAL mode, peek at WhatTheFee.io for a sanity range, and glance at mempool.space to see if higher-fee layers are growing or shrinking. Three quick looks, one confident number.

When to use WhatTheFee.io

When I want a fast, clean sat/vB target without getting sucked into charts, WhatTheFee.io wins. It gives me a number I can act on, and I can still cross-check in 15 seconds if the stakes are high.

- Calm network (e.g., Saturday): I’ll often set WhatTheFee.io’s same-day target, round up a hair, and move on.

- Volatile hour: I’ll use WhatTheFee.io for a number, confirm the mempool “shape” on mempool.space, and enable RBF to keep control.

- Large or time-sensitive tx: WhatTheFee.io + mempool.space + (if available) my node’s estimatesmartfee. Belt and suspenders.

“Pay for urgency, not anxiety.”

That’s my rule of thumb. Tools are opinions; miners are the truth. What matters is matching your fee to your timeline with just enough buffer to sleep well.

One more thing people ask me all the time: which of these options respects your privacy the most, and what do you actually share by visiting? I’ll show you exactly what hits the wire, what I block, and how I think about trust next—curious which one keeps your footprint smallest?

Privacy, security, and trust factors

I care about saving sats, but I care even more about not leaking info or getting tricked by a lookalike site. The good news: WhatTheFee.io doesn’t ask for addresses or wallet access. You’re not pasting xpubs, seeds, or anything sensitive. Still, I keep a simple privacy and safety routine whenever I check fees.

“Trust is good. Verify is better.”

What you share by visiting

Like most public websites, you expose basic metadata when you load the page. That usually includes:

- IP address (can reveal your rough location)

- Browser details (user agent, screen size, OS)

- Timestamp and referrer (when you visited, where you came from)

- Cookies (if the site sets any)

Crucially, you’re not sharing transaction data here. You don’t paste addresses or broadcast anything. If you want to reduce the metadata footprint further, I’ll sometimes open it through Tor Browser or a reputable VPN, then cross-check from my regular browser.

If you’ve ever tested your browser at EFF’s Cover Your Tracks, you’ve seen how unique fingerprints can be. The point isn’t to hide from everything; it’s to avoid spraying more data than needed for a simple fee check.

Ads, trackers, and blockers

Many sites rely on third-party scripts (analytics, CDNs, fonts). Academic scans (Princeton’s web transparency work is a solid example) have shown how common this is across the web. Fee guidance doesn’t need your identity, so I keep my usual protections on:

- uBlock Origin or similar to cut unnecessary third-party calls

- Privacy Badger to auto-limit trackers

- Strict tracking protection in Firefox, Brave Shields, or Safari’s ITP

- Private window when I’m fee-checking from shared or travel devices

These don’t break the usefulness of the page. If something doesn’t load right (rare for a simple tool), I selectively allow only what’s needed. No reason to hand over more data than the task requires.

Reliability mindset

Even the cleanest estimator is still an estimator. I treat it like radar: super helpful, not a guarantee. Here’s my personal playbook:

- Bookmark the real domain (whatthefee.io). Look out for typosquats. Always use HTTPS.

- Keep one “clean” browser profile for money tasks with minimal extensions. Malicious or sloppy extensions can alter page content—and a wrong fee suggestion can cost you.

- Update your browser. Old versions are easier to exploit. We’ve all seen supply-chain scares (compromised JS packages, rogue extensions) in the news.

- Cross-check once before big sends. A quick glance at mempool.space’s fee tiers takes 5 seconds and kills second-guessing.

- Enable RBF in your wallet. If the mempool surges, you can bump. I’ve had a “safe” 12 sat/vB sit longer than expected during an inscription wave—RBF saved the day without overpaying upfront.

- Sanity-check timing. If you see chaos (NFT rush, market panic), add a small buffer or wait a bit. You’re paying for priority, not perfection.

If you’re more technical, peek at your browser’s network tab to see which third-party domains load. Not necessary, but it’s a nice way to confirm nothing unexpected is running.

Bottom line on trust: a site that never asks for wallet access or addresses already reduces risk, and a few simple habits make it safer and more private. Want straight answers to the questions people ask me most—like “How accurate is it?” or “Why didn’t my tx confirm at the suggested fee?” Keep going; the next part tackles those head-on.

FAQ: Quick answers people ask

What is WhatTheFee.io?

WhatTheFee.io is a free, no-login Bitcoin fee guide that looks at recent blocks and shows you what sat/vB ranges are currently getting confirmed. I open it whenever I’m about to send BTC and want a quick, realistic target—no charts to wrestle with, no guessing from my wallet’s slider.

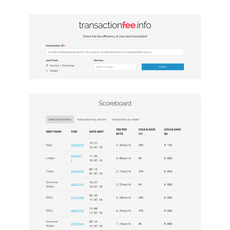

Does it support Ethereum or other chains?

No—it's Bitcoin only. If you’re sending on other networks, use chain-specific tools (for example, a gas tracker for Ethereum). Different chains have different fee markets and confirmation mechanics, so trying to use a Bitcoin estimator elsewhere won’t help.

How accurate is it?

For “right now” conditions, it’s usually spot-on. Where any estimator can wobble is during sudden demand spikes—think popular ordinal mints, exchange consolidation waves, or market panic. In those moments, the mempool can jump faster than a static suggestion. My real-world habit: if I must land within the next block or two, I pad a little; if I’m flexible, I go with a slower target and save sats.

Reality check: Bitcoin blocks average ~10 minutes, but arrivals are random. Two back-to-back fast blocks can help you, two slow ones can hurt you. That’s why a small buffer and RBF are your best friends.

What fee should I pay right now?

Open WhatTheFee.io, pick your target confirmation time (next block, a few blocks, later today/tomorrow), and use the suggested sat/vB. If your payment is time-sensitive—like a withdrawal cutoff or a DCA buy you want settled—add a small buffer to avoid landing on the edge during a mempool shuffle.

Example: if the site shows ~28–32 sat/vB for “within 3 blocks,” I’ll usually pick 33–35 sat/vB. That tiny bump tends to move you ahead of the big cluster at the lower bound.

Why didn’t my transaction confirm at the suggested fee?

A few common reasons:

- Mempool spiked after you sent. A rapid burst of higher-fee transactions can push you down the queue.

- You aimed at the very bottom of a tier. Edges are fickle—if lots of folks target the same number, you might sit just below the cut.

- Slow block arrivals. If the network hits a streak of slow blocks, even “good” fees can take longer.

What I do next:

- Enabled RBF? Bump the fee slightly above the current cluster and re-broadcast.

- No RBF? If you control an incoming output, try CPFP. Otherwise, wait for conditions to relax (they often do).

What’s sat/vB?

Satoshis per virtual byte. It’s how miners prioritize Bitcoin transactions: higher sat/vB, higher priority. Your total fee in sats = sat/vB × transaction vbytes.

Quick example: A typical SegWit spend (1 input, 2 outputs) might be ~140 vB. At 50 sat/vB, the fee is ~7,000 sats. Switch that to Taproot or reduce inputs, and you can shave vbytes—and cost—without changing sat/vB.

Can I change the fee after sending?

Yes—if you enabled Replace-By-Fee (RBF) before broadcasting. Just bump the fee in your wallet and the higher-fee replacement should take priority. If RBF wasn’t enabled and you control a stuck incoming output, you can try Child-Pays-For-Parent (CPFP) by spending that output with a higher fee. If neither applies, you’ll likely have to wait it out.

Is there an API?

The site is built for quick visual guidance. If you need programmatic data, consider running your own node and using Bitcoin Core’s estimatesmartfee, or lean on a public mempool API for richer analytics. For most senders, the site itself is plenty.

Is it free?

Yes. No account, no emails, no paywall—just a public, fast-loading page to help you pick a sane fee.

Want to see how I turn these answers into a foolproof sending routine—complete with my “don’t-overpay” checklist? Stick with me; I’m about to share the exact steps I take right before I hit send.

Final thoughts and next steps

Bitcoin fees don’t have to be a guessing game. When I want a fast, no-nonsense read on what sat/vB will actually work right now, WhatTheFee.io is the tab I open first. It consistently helps me avoid overpaying while keeping confirmations on schedule.

Real talk: on a recent mempool surge, my wallet pushed an aggressive “priority” fee that would have cost nearly 40% more than necessary. WhatTheFee.io showed a tighter, realistic range for a 1–3 block target. I rounded slightly above the top of that range, enabled RBF, and confirmed in two blocks. That’s the kind of calm, data-driven decision-making I want before pressing send.

If you like patterns, you’ll appreciate this too: fee data watchers (check the public dashboards from Coin Metrics and Glassnode) often point out weekend and off-peak hours where feerates relax. You’ll see the same story on the 1D/1W charts at mempool.space. It’s not a guarantee, but it’s a useful bias when you’re flexible.

My verdict as a daily user

- Fast: I can pick a fee in seconds, not minutes.

- Clear: No fluff—just the ranges I need for a sensible target.

- Practical: Pairs perfectly with RBF so I stay in control if conditions change.

- Trustworthy enough: For big amounts, I still cross-check with mempool.space or my node’s estimator, but this is my first look.

Quick checklist before you hit send

- Decide your true urgency (next block vs. today vs. tomorrow).

- Open WhatTheFee.io and pick the matching confirmation window.

- Use the suggested sat/vB and round a touch upward if timing matters.

- Enable RBF so you can bump if the mempool heats up.

- Sending a large amount? Consider a small test output first.

- Glance at mempool.space to confirm no sudden spikes.

- If you’re flexible, schedule off-peak (weekends and overnight UTC often help).

- After it lands, jot down what worked; your future self will thank you.

Pro tip: If your fee was “edge case” low and blocks start filling above you, don’t wait hours—send a modest RBF bump early. Small nudges beat panicked overpays.

Wrap‑up: Send with confidence

If you’ve been second-guessing fees or lighting sats on fire, this changes the game. Open whatthefee.io, follow the quick routine above, and you’ll set smarter fees in under a minute. I’ll keep sharing practical, money-saving tools and tactics on Cryptolinks.com—so you always send with confidence, not hope.