Bitcoinity Review

Bitcoinity

data.bitcoinity.org

(2 reviews)

(2 reviews)

Site Rank: 388

Bitcoinity Review

When it comes to crypto market metrics, it is advisable to opt for an intuitive, up-to-date, and accurate charting website capable of coping with the volatile terrain. Herein lies our decision to explore the workings of Bitcoinity. In this Bitcoinity review, we will breakdown the operations of the website and determine its strengths and weaknesses.

However, before we get started, we should drop this disclaimer: At the time of this review, Bitcoinity claims this is the Beta version of their services. Therefore, they may update and change things drastically, rendering this review obsolete. With that said, let us dive in!

What is Bitcoinity?

Bitcoinity houses an array of charts and stats designed to provide real-time insight on vital Bitcoin metrics. In order words, the site focuses on utilizing on-chain and off-chain data to capture both the historical and current performance of the Bitcoin market. Here, you can access all the data you need to gauge the disparities in the operations of top Bitcoin exchanges. The exciting part about this platform is that it ensures that it stays grounded by incorporating easy to understand chart styles.

The website owner is looking to create an accurate way of measuring and ranking the performances of Bitcoin exchanges. And so, the website majorly incorporates metrics that compare the activities of traders on Bitcoin trading platforms. Thanks to Bitcoinity’s penchant for calculating a wide variety of market variables, you can select from a list of different market and blockchain variables. For example, users can change the chart to reflect prices, volumes, or arbitrage rates. You could also look into the blockchain section to display hashrate data or mining difficulty.

How Does Bitcoinity Work?

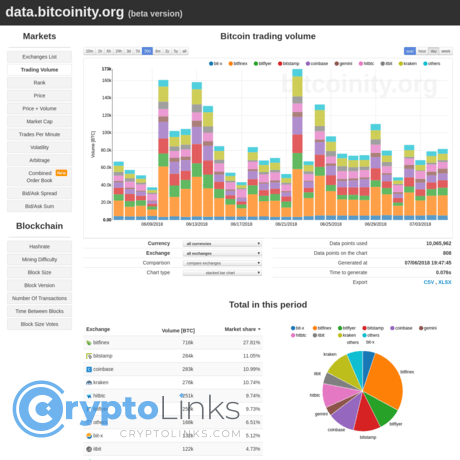

Trading Volume

Upon entering the site, users will first see this crazy colorful graph taking up more than half of their screen. This graph is based on Bitcoin Trading value and is highly customizable.You can change the time frames at the top of the graph. Under the chart, you will find several customizers to change. These include the type of currency, what exchange you are basing the data off, and varying data points. This chart feature is remarkable because it provides a lot of insight into trading volume. Even better, you can export the data and the chart as CSV or XLSX.

To compare the volumes of two or more exchanges, all you need to do is double click on one of the exchanges of interest. By doing so, the chart automatically singles out the volume data of that exchange. You can start comparing by clicking on another exchange, and the chart would feature the volumes of both platforms only. Note that you can follow the same procedure to analyze more than two exchanges.

The website explained that the data used to evaluate and rank the trading volume were sourced directly from the featured exchanges. Hence, the platform connects to these trading sites via API. Below is a list of the exchanges featured in the volume section.

● Bitpay

● Bitfinex

● Coinbase

● Kraken

● Gemini

● Korbit

However, Kacper Cieśla, the owner of Bitcoinity, argues that it is not advisable to base the rank of these exchanges merely on their trading volumes. There is a strong possibility that this data does not accurately depict the liquidity or the activities executed on each trading platform. This is because volumes are reported data, and there is no viable way of ascertaining their reliability. Thus, Bitcoinity has adopted a comprehensive ranking system that takes into account the order books of exchanges.

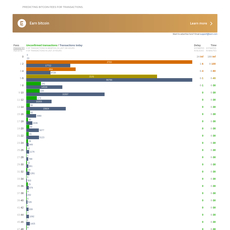

Exchange Rank

To the left of the trading volume chart, you will find a list of market options. These are an array of charts based on various metrics. You could click on “Exchange List” to get a bird view of the rankings. Here, exchanges are ranked based on 4 key metrics:● Volume

● Spread

● Volatility

● Trade per minute

At the bottom of this table, the website documents a brief description of the ranking methodology. It also provides a link to a page detailing the equations used to rate the quality of exchanges via their order books. Bitcoinity explains that exchanges, which can execute large orders without experiencing a significant shift in the price of Bitcoin, should rank higher.

It is worth mentioning that you can change the time variable of the rankings and even set your preferred currency. Also, you can sort the trading platforms based on their core operations. The options available are derivatives, OTCs, and conventional exchanges.

Volatility

Further down the market option is the Volatility chart. This graph depicts the price fluctuations registered on 9 exchanges, including Bit-x, Bitfinex, Bitsamp, Cex.io, Exmo, Gemini, Itbit, and Kraken. Like the trade volume charts, you can compare the volatility of the price of Bitcoin on two or more exchanges. Also, you can set a suitable time frame.Below the chart is a summary of the methodology used to deduce price volatility. The text reads:

“Price volatility is calculated as standard deviation from all market trades. For longer periods it is average of hourly standard deviations (stddev calculated for each hour then averaged).”

Arbitrage

Since Bitcoinity compares the Bitcoin markets of several exchanges, the website already has access to all the data required to set up an arbitrage table. And so, it comes as no surprise that the platform has capitalized on the resources available to provide a useful tool for arbitrage traders. Bitcoinity highlights the disparities between the prices of Bitcoin on 9 exchanges. With this, interested traders can explore these anomalies and determine the exchanges with the lowest and highest Bitcoin rates for profitable arbitraging. This feature is also useful for traders interested in identifying the best price to buy Bitcoin.On-Chain Metrics

Recall that we mentioned at the beginning of this guide that Bitcoinity provides both off-chain and on-chain metrics. Now that we have exhausted the off-chain aspect, the next section documents the on-chain charts and stats. However, it seems that these metrics are no more operational, as the last time each chart logged data was way back in March 2020. Regardless, some users may find this useful for historical research.Mining Difficult

For those who are familiar with the workings of the Bitcoin blockchain, you will know that mining difficulty plays a pivotal role in determining the profitability of miners. There is a certain threshold of complexity that the blockchain must maintain to ensure that the network is secure. You can track the Bitcoin mining difficulty on Bitcoinity and have a historical view of how difficult it has been to mine Bitcoin over time.Block Data

In addition to tracking the changes in the complexity of Bitcoin mining, Bitcoinity also delivers a chart for monitoring the size of blocks found by miners. Below this chart is a table where you can find the size and number of blocks each mining pool has found. Furthermore, there is a section that computes the time it takes to create a new block. With this, you can track the time between blocks.Number of Transactions

One more crucial metric that Bitcoinity tackles are the number of transactions processed each day. This chart tracks the daily transaction volume processed by the Bitcoin blockchain.What Are the Pros and Cons of Bitcoinity?

After taking the time to understand the website, we went ahead to highlight the strengths and weaknesses of its features.The Pros of Bitcoinity

Its Charts Are Easy to Use and Understand

It is always advantageous when a charting website takes the time to explain the intricacies of its data and the methods used to derive them. Hence, it helps that the creator of Bitcoinity divulged vital information about the equations used to calculate some of its data. The decision to use basic chart designs also improves user experience.

The Charts Are Customizable and Downloadable

While exploring this website, we could not help but admire the flexibility of some of the charts available on Bitcoinity. This is especially true for the exchange-based metrics, which allows users to compare and contrast the Bitcoin markets of selected crypto exchanges. Also, users can download these charts in CSV and XLSX formats for further analysis.It Introduces A New Ranking System for Exchanges

Having identified the frailties of the commonly used volume-based exchange ranking system, the creator has introduced a unique model where the order books come into play. The platform considers the effect of large transactions on the stability of the price of Bitcoin on exchanges. Hence, trading websites that can maintain a level of stability, regardless of the size of exchanges executed, rank higher on Bitcoinity.

It Is A Useful Arbitraging Tool

Arbitrage traders may find this platform resourceful as it provides a price disparity chart for 9 exchanges. As such, it is possible to determine the most profitable strategy for capitalizing on Bitcoin price differentials.

There Are No Ads

Users do not have to worry about distractions when using Bitcoinity because the creator has opted to establish a no-ad policy. Without any doubt, this system boosts user experience.

The Cons of Bitcoinity

It Is Still in The Beta Phase of Development

For a platform that has existed for more than 5 years, it is surprising that Bitcoinity is still in the beta stage of the development cycle. Hence, there is no certainty as regards the future of the platform. Also, there is no way to track the development of the platform or ascertain that the creator is committed to finishing the project.

The On-Chain Metrics Are No More Logging Data

As pointed out in this guide, Bitcoinity’s charting of on-chain activities on the Bitcoin blockchain seems to have halted since March of last year. Hence, it is not ideal for users requiring real-time data. However, it may come in handy when analyzing the historical data of on-chain Bitcoin metrics like mining difficulty, block size, and transaction volume.

It Is Solely A Bitcoin Metrics Site

The platform restricts users to Bitcoin metrics only. This factor may not suit individuals with diversified portfolios.

Bitcoinity WAS SHUT DOWN IN 2020!

Pros & Cons