r/SafeMoon Review

r/SafeMoon

www.reddit.com

r/SafeMoon subreddit review guide: what it is now, how to use it, and the FAQs people keep asking

Thinking about checking r/SafeMoon but not sure what’s real, what’s old, and what’s just noise? Wondering why some posts say the token’s dead while others claim a comeback is around the corner?

You’re not alone. If you’ve ever scrolled that sub and left more confused than when you started, this guide is for you. I’ll show you how the subreddit works today, point out the useful threads worth watching, and share a quick system to fact-check anything before you click or sign.

Why r/SafeMoon feels chaotic right now

A lot of posts mix hype with frustration. Since the 2023 bankruptcy headlines hit, the subreddit has been a magnet for worried holders, old guides, and opportunistic scammers. That combo means it’s hard to find current, practical info without sifting through a pile of outdated threads and hot takes.

- Outdated instructions resurface: V1 vs V2 token steps from 2021–2022 get reposted as if they still apply.

- Conflicting answers: One comment says “just swap on PancakeSwap,” another says “liquidity is gone,” and a third links a random site that wants your seed phrase.

- Scam bait everywhere: Unsolicited DMs, fake “support” accounts, and QR codes that look official but aren’t.

- Emotions run the show: Holders vent, ex-holders dunk, and nuanced troubleshooting gets buried.

“My SafeMoon vanished from Trust Wallet. Is it gone?”

“How do I cash out?”

“Is the project shut down for good?”

These are common threads you’ll see every week. They’re not trivial questions, and the honest answer often depends on specifics like your token version, the contract address, and the current state of liquidity.

What you’ll get from this guide

I’ll keep things focused on what actually helps you navigate the subreddit today. No fluff, no fanboying, no doom-porn. Just a practical way to use r/SafeMoon without getting tripped up by old posts or shady links.

The promise

I’ll break down how the sub runs now, where the signal lives, what to ignore, and a simple routine to verify claims fast. I’ll also hit the big questions people keep asking—like whether SafeMoon is shutting down, what SFM V2 is worth, why balances vanish in Trust Wallet, and how people attempt an exit—so you can save time and protect yourself.

Who this is for

- Current holders who want clear next steps and safer ways to check info.

- Ex-holders who are curious about what happened and what the sub looks like now.

- Redditors researching crypto communities, moderation, and scam patterns.

- Anyone tracking SafeMoon’s history after the 2023 headlines and the ripple effects.

A quick note before we get rolling

This is not financial advice. Think of this as a field guide to a community space. I’ll show you how to use r/SafeMoon safely, where to find useful context, and how to confirm the details with trusted tools. Your wallet, your decisions.

Why this approach works (and keeps you safer)

Online, bad info travels fast. One well-known study published in Science found false news spreads farther and faster than true news on social platforms. Crypto adds another layer: low-liquidity tokens, complex migrations, and seed-phrase scams that look “official.” In that kind of environment, the best edge you can have is a repeatable verification routine and a short list of places you trust.

- Real example: You’ll often see “use this migration helper” or “scan this QR to unlock tokens.” If you build a habit of checking contract addresses on BscScan, comparing info across at least two credible sources, and avoiding DMs, you’ll sidestep most traps.

- Real outcome: People who slow down and verify usually keep their assets. People who rush to fix a balance display issue by connecting to a random site often lose them.

How I’ll keep it simple

- Show you how the subreddit is structured today so you can spot the useful posts fast.

- Highlight what to ignore, especially during heated comment storms.

- Give you a quick fact-check workflow you can run in under two minutes.

- Answer the high-traffic FAQs people search for daily, with context and clear cautions.

Ready to see what you’ll actually find when you land on the sub right now—member count, posting pace, where the mod updates live, and which threads are worth your time?

r/SafeMoon in 2025: what you’ll actually find when you land there

Community snapshot: member count, posting pace, and the overall mood

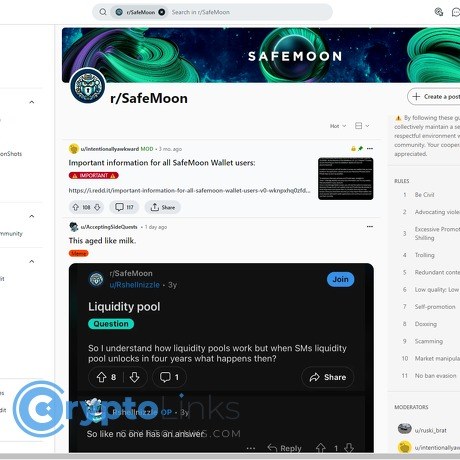

When you open r/SafeMoon, you’ll see a large community bannered by a recognizable logo, a big subscriber count, and a steady stream of new posts each day. A lot of people lurk; fewer people post. Comments come in waves—U.S. evenings and weekend hours usually bring the loudest conversations.

The mood is mixed. You’ll notice three currents:

- Survivor energy: holders swapping tips, trying one more fix before calling it quits.

- Skeptical pragmatists: they fact-check, share links, and push everyone to verify on-chain.

- Nostalgia and gallows humor: memes and “remember when” screenshots from 2021.

Expect quick reactions to headlines and wallet issues, but slower, more thoughtful replies on technical threads. Upvotes can skew what you see. A well-known finding in social systems research showed that a single early upvote can meaningfully boost a comment’s final score—so try sorting by “new” and scanning a few angles before locking in on the top comment.

“Trust the chain, not the chat.”

How the sub is organized: rules, flair, stickies, and where mod notes show up

The SafeMoon subreddit runs on familiar Reddit rails, but the layout matters if you want signal fast:

- Rules: Find them in the right sidebar (desktop) or “About” tab (mobile). Look for lines about no financial advice, no solicitation/DM support, contract address accuracy, and zero tolerance for recovery-phrase requests. If someone asks you to message them on Telegram, that’s already breaking the vibe.

- Flair: Common tags include “Megathread,” “PSA,” “Guide,” “Support,” “News,” “Scam Alert,” and “Discussion.” Treat “Megathread” and “PSA” as your first stop—they’re where the mods try to funnel repeat questions.

- Sticky posts: Pinned at the top. Typical pins are a Daily/Weekly Discussion, a running support Q&A, or a mod bulletin on contracts, migrations, or scam patterns. If anything material changed, it’s almost always reflected in a sticky or an Automoderator comment.

- Mod notes: You’ll see them as distinguished comments in popular threads, in the stickies, or linked in an Automoderator resource block. For nuanced stuff (like clarifying the correct SFM V2 contract), check these first, then verify independently on BscScan.

Tip: on desktop, the community header shows live “online” numbers. If the place feels quiet, switch your sort to “new” and you’ll often catch useful replies before they’re buried.

Typical post types you’ll see

You can predict 80% of the feed before you scroll. Here’s the greatest hits—plus real-world examples of the titles you’ll recognize:

- Price chat: “Is this last pump real?”, “SFM chart looks flat—am I missing something?” Often high-comment, low-action threads. Screenshots age in minutes.

- Support questions (Trust Wallet/PancakeSwap): “Can’t swap SFM V2 for BNB,” “PancakeSwap keeps failing—what slippage works?”, “Gas fee error on BSC.” These can be gold when someone posts exact transaction settings and a successful TX hash.

- Migration confusion (V1 vs V2): “I still see V1—did I lose everything?”, “Which contract is the real V2?” Expect side-by-side contract addresses and step-by-step checks with BscScan, PancakeSwap, and wallet token lists.

- Scam alerts: “Got a DM from ‘SafeMoon Support’ asking for seed phrase,” “Fake migration helper site,” “QR code drain warning.” These often include screenshots and instructions on reporting.

- Nostalgia posts: “My 2021 wallet screenshot—oof,” “Remember the first AMA?” They’re cathartic, sometimes informative (old contract references), and frequently upvoted.

- News spillover: “What does this legal filing mean?”, “Rumor of acquisition—does it change the token?” These spark heated takes; useful when someone links primary sources.

Good replies usually share:

- A contract address with a direct BscScan link

- Clear wallet/app settings (e.g., slippage number, exact router, confirmation steps)

- Fresh links to official posts or verified announcements

What’s useful vs. time-wasting (and when to jump to verified sources)

Not all threads are worth your energy. Here’s how I sort them in under two minutes:

- Prioritize:

- Any sticky “Megathread,” “PSA,” or “Guide” curated by mods

- Support posts where the top comments include TX hashes, contract links, or screenshot settings

- Scam alerts with reproducible evidence and clear steps to stay safe

- Skim or skip:

- Endless price arguments (“wen moon?”) without data

- Hype posts with no links

- Repeat nostalgia or meme reshares when you’re trying to solve a wallet problem

- Switch to verified sources immediately if:

- Money might move (swaps, bridges, migrations)

- You see a contract address (always confirm on BscScan)

- A claim sounds urgent (liquidity “unlock,” new “official” site, app “fix”)

Two-step sanity check that saves time and stress:

- Cross-verify the claim on at least two trusted sources (blockchain explorer, official app/website, reputable tracker).

- Replicate safely in a tiny test if it involves a transaction—small swap, minimal gas—before you scale up.

“In bear markets, time is your most valuable asset—don’t waste it defending a position online.”

Use Reddit’s tools to protect your focus: sort by “new” to catch real fixes, filter by flair, hide threads that won’t help you, and step away from threads where the top comments are insults or one-liners. You’ll get to solutions faster—and avoid getting farmed by attention traps.

So, what about the questions that never stop showing up—“Is SafeMoon shutting down?” “Is it worth anything now?” “How do I get money out?” and “Why did my tokens vanish in Trust Wallet?” I’ll tackle those next with quick, practical steps you can use right away.

FAQ everyone Googles about SafeMoon (answered fast, with context)

“Is SafeMoon shutting down?”

Short answer: the corporate entity behind SafeMoon went into Chapter 7 liquidation in December 2023. That’s a court-supervised wind-down of the company’s assets, not a restructuring. You can find background context summarized on sources like Wikipedia’s SafeMoon entry which cites news and legal references.

There were also community-circulated reports in 2024 about a potential acquisition or asset purchase involving the VGX Foundation. Treat that as “claims until proven” and look for primary statements on X from the named parties and, ideally, supporting legal filings or press releases. If anything did occur, it would relate to corporate assets/rights—not magically fixing on-chain liquidity or guaranteeing token value.

Here’s the part most people miss:

- Company vs. token: A company can go bankrupt while a token contract still exists on-chain. The SFM V2 smart contract on BNB Chain doesn’t vanish because a legal entity does. What can vanish (or shrink) is liquidity, market-maker support, or off-chain services that made trading easier.

- Subreddit vs. company: A community subreddit can keep existing regardless of a corporate bankruptcy. People will still post, trade anecdotes, and ask for help even if there’s no functioning company.

“Trust, but verify. Screenshots lie; the chain doesn’t.”

“Is SafeMoon worth anything now?”

“Worth” depends on two things: the last trade price and whether there’s enough liquidity for your size. A token can show a price on a tracker but be practically unsellable in size without extreme slippage.

How I check in under 2 minutes:

- Find the current SFM V2 contract on BscScan (search “SFM” and confirm the verified token with the most holders and historical comments). Copy the exact contract address.

- Paste that contract into a live DEX chart like Dexscreener (BSC) or GeckoTerminal (BSC) to see:

- Price and 24h volume

- Liquidity in the main SFM/BNB pool

- Recent trade sizes and price impact

- Cross-check with a big tracker like CoinGecko or CoinMarketCap. If the listing is marked “untracked” or missing, rely on the DEX pair data above.

Reality check with a simple example: if the pool only holds ~$120,000 of liquidity and you try to sell a chunk worth $10,000, you might eat double-digit slippage and move the price against yourself. That’s why price screenshots age fast and don’t tell the whole story. Always look at both price and pool depth.

“How do I get my money out of SafeMoon?”

This is the broad workflow many holders attempt. It’s not advice—just the typical path you’ll see described by people who successfully exited:

- Step 1 — Confirm the token and network: You should be on BNB Chain (BEP-20) holding SFM V2. Use BscScan to verify your wallet’s holdings. If it shows SFM V1, migration paths may be closed or unreliable—be extra careful with any “helper” site.

- Step 2 — Gas ready: Keep a small amount of BNB in the same wallet for network fees. No BNB = you can’t swap.

- Step 3 — Import the correct token on PancakeSwap: Go to PancakeSwap, connect your wallet, and import SFM V2 by pasting the exact contract you verified on BscScan. Avoid anything that auto-fills with the wrong logo or name—match the contract, not the icon.

- Step 4 — Check liquidity first: Open the pair on Dexscreener/GeckoTerminal. If liquidity is thin, consider smaller batches. If you see warnings about taxed tokens, note you might need higher slippage.

- Step 5 — Test swap: Try a tiny swap SFM V2 → BNB. If it fails, gradually raise slippage (some taxed tokens need double digits). Start low and only increase if you must. Never max slippage unless you fully accept the risk.

- Step 6 — Scale carefully: If the test works, split the rest into smaller transactions to avoid shocking the pool. Watch “Minimum received” and price impact before confirming.

- Step 7 — Off-ramp: After you get BNB (BEP-20), send it to a centralized exchange that supports BNB Chain deposits, sell to fiat, and withdraw to your bank or stablecoin of choice.

Warnings I repeat every time:

- Fake contracts are everywhere. Always paste the contract from BscScan’s verified token page, not from a random comment or DM.

- “Unlock”/“Recovery” sites are almost always scams. Nobody needs your seed phrase to help you trade.

- Approvals matter: If you’ve granted token approvals to shady sites in the past, review and revoke at revoke.cash before swapping.

“Why did my SafeMoon disappear from Trust Wallet?”

In most cases, it didn’t “vanish”—the wallet just isn’t showing it correctly or you added the wrong token. Here’s my quick triage:

- V1 vs V2 mix-up: Open your address on BscScan. Under “BEP-20 Tokens,” see if SFM appears—and which contract it points to. If BscScan shows SFM V2 but your wallet doesn’t, it’s a display problem.

- Wrong contract added: In Trust Wallet, remove the token, then add a custom token using the exact SFM V2 contract from BscScan. Ensure network = BNB Smart Chain, and decimals match the token tracker.

- Cache/price feed glitch: Force close the app, toggle airplane mode off/on, and reopen. Sometimes the balance exists but the fiat value shows $0 due to disabled price feeds.

- Network mismatch: Make sure you’re on BNB Smart Chain (BEP-20), not Ethereum or another network. The same token name on the wrong chain = zero balance.

- Explorer desync vs. real loss: If BscScan also shows no SFM, check your token transfers tab. If tokens moved out, investigate approvals and device security. If they never moved and it’s a UI issue, proceed slowly until your wallet displays correctly.

Extra tools for peace of mind:

- tokenallowance.io or revoke.cash to review and revoke risky allowances

- Trust Wallet Support for display and custom token guides

“What about taxes, slippage, and ‘failed’ swaps?”

SafeMoon’s tokenomics and community tooling changed multiple times. Some periods used transfer taxes; some didn’t. Because these settings (and liquidity conditions) can change, I treat every session as fresh:

- Start with a tiny test trade to discover the slippage you need today.

- Read Contract on the token page in BscScan to see if fees/taxes are still present.

- If you repeatedly get “transfer failed” or “insufficient output amount,” reduce size, raise slippage modestly, and confirm you’re using the main SFM/BNB pool on PancakeSwap V2.

Fast links to keep handy

- BscScan (verify contract, holders, transfers)

- Dexscreener (BSC) or GeckoTerminal (BSC) (price, liquidity, trades)

- PancakeSwap (swapping SFM V2 ↔ BNB)

- revoke.cash (review and revoke token approvals)

- Trust Wallet Help Center (custom token/how-to)

One more thing—uncertainty attracts scammers. Chain analysis firms repeatedly note that bad actors flock to communities during chaotic news cycles. So before you click anything you see discussed on the subreddit, what’s the 30-second verification routine I use to avoid getting farmed? Keep reading—I’ll show you the exact checklist next.

How to use r/SafeMoon safely (without getting farmed by scammers)

Let’s be real: when you scroll r/SafeMoon, you’ll see helpful people and you’ll see opportunists. Stress, confusion, and old guides make anyone an easy target. I use a simple routine to keep my guard up and my tokens safe—steal it if you like.

“Not your keys, not your crypto. If someone wants your seed phrase, they want your coins.”

My 90‑second verification routine

I never click first. I verify first. Here’s the exact flow I follow when I see a link, a “fix,” or a contract shared in a post or comment:

- Open BscScan yourself in a new tab: bscscan.com. Paste the contract you saw (don’t click it). Confirm:

- Token name and symbol are what you expect (scam clones often tweak a letter like “SAFE MOON,” “SFM2,” or “SAFEMØON”).

- Verification badge on the contract and a sane holder count (fake forks often have tiny holder numbers and very recent creation dates).

- Token Decimals match what reputable trackers show.

- Cross‑check the contract on two independent trackers:

- CoinGecko or CoinMarketCap should list the same contract on the BSC chain. If they disagree, stop.

- Optional: check basic market flags on DexScreener. If there’s no liquidity or obvious warnings, don’t proceed.

- Sanity‑check the source:

- Is the info posted in a sticky or megathread by a mod? Random fresh accounts posting “fixes” are a no from me.

- Search the username’s post history. If they only post “support” replies across crypto subs, that’s a pattern you don’t want.

- Test safely:

- If you must use a dApp, open it from a bookmark you created, not a link in a comment. Connect a fresh burner wallet first.

- Try a tiny test transaction before you move anything meaningful.

This routine sounds slow but it’s faster than recovering from a drain. The FTC has warned for years that social platforms are a prime hunting ground for crypto scams, with “support” impersonation and investment lures topping reports. See their guidance here: FTC Data Spotlight.

Red flags I see every week (and how they talk)

Scammers reuse scripts. Once you’ve seen them, you can’t unsee them:

- Unsolicited DMs right after you post: “Hello sir, I’m Reddit support/mod/Trust Wallet engineer. I can help resolve your stuck SFM. Fill this form.” No legit mod will DM you for keys or ask you to leave Reddit for “verification.”

- Telegram or WhatsApp “support” invites: The goal is to move you off Reddit where they can apply pressure. Real support doesn’t start in your DMs.

- QR codes or “validation portals”: “Scan this to unlock V2” or “authorize migration.” These often request unlimited approvals or your seed phrase. Don’t scan random codes.

- Seed phrase or private key requests: No exception. No one needs your 12/24 words to “assist.”

- “Unlock” or “migration helper” dApps with almost‑right domains: things like safemoon‑unlock[.]app or safemoon‑migrate‑v2[.]io. They look official, they’re not.

- Hurry pressure: “Only 30 minutes left, or your SFM will be burned.” Scarcity and timers are classic manipulation tactics.

- Weird approvals: Any dApp asking for unlimited spend on tokens you’re not swapping is a red flag. Open your wallet’s approvals page (e.g., BscScan Token Approvals) and review regularly.

Reddit’s own safety docs back this up—no one legitimate will ask for your credentials or recovery phrase. Worth a read: Reddit: Avoiding Scams. And if you like numbers, Chainalysis has repeatedly shown scammers shift tactics to wherever anxious investors congregate; social channels remain a key vector.

Find the signal fast

There’s good info in r/SafeMoon—you just need to grab it without getting stuck in arguments. Here’s what works for me:

- Scan stickies first: On the subreddit homepage, look for posts pinned by mods—often megathreads, PSAs, or rule updates.

- Search with intent:

- Use keywords like “Megathread”, “PSA”, “Guide”, or “V2” in the subreddit search bar.

- If search is messy, use Google with site:reddit.com/r/SafeMoon plus your keyword.

- Sort smart:

- New for urgent issues (scams, outages).

- Top (week) to see what the community validated recently.

- Prioritize mod comments: Mod usernames have a label. If they link out, still verify, but give those posts priority over random replies.

- Check timestamps: Anything pre‑late 2023 can be outdated for obvious reasons. Age matters a lot with token migrations and broken dashboards.

- Keep your own notes: Save helpful posts and keep a small checklist in your Notes app. Next time, you won’t start from zero.

Report and move on (don’t wrestle with pigs)

Arguing with scammers just gives them visibility. Here’s the clean play:

- Report the content: Click the three dots on the post/comment → Report → pick Scam, Spam, or Impersonation.

- Ping the mods if it’s urgent: Use Modmail here: contact mods. Include links and screenshots.

- Block and move on: Open the user’s profile → Block user. Your attention is their fuel.

- Know the rules have your back: Reddit bans phishing and impersonation sitewide. If you see a serial scammer, also report via the platform’s Content Policy.

I get why this all feels intense. When your balance looks off or a swap fails, every “helper” sounds like a lifeline. But the fastest way to a solution is still the boring way: verify on-chain, use trusted tools, and treat every message like it might be a trap until it proves otherwise.

Want the short list of what this subreddit can actually do for you—and what it can’t? That’s next.

What r/SafeMoon can and can’t do for you

What it’s good for

Think of the subreddit as your early-warning radar and quick peer-to-peer help desk. It shines when you want street-level details fast, not polished press releases.

- Real-time sentiment check: You’ll feel the mood shift in hours, sometimes minutes. That helps you gauge whether you’re the only one seeing an error on PancakeSwap or if it’s widespread.

- Quick peer fixes: Threads like “Trust Wallet not showing SFM V2?” or “Why is slippage failing?” often get practical replies (e.g., “toggle auto vs. fixed slippage,” “clear cache and re-add the V2 contract,” “try a smaller lot size”).

- Scam alerts that move faster than blog posts: When a fake “migration helper” or “unlock portal” pops up, the sub usually flags it before most outlets. I’ve seen mod stickies go up within minutes of a new phishing domain surfacing.

- Pointers to external tools: People share links to contract pages, liquidity views, and swap interfaces that actually work with SFM V2—useful breadcrumbs to start your own verification.

“Hope is not a strategy—verification is. Trust screenshots less than you trust transaction hashes.”

There’s also a valuable social dynamic here: dozens of eyes spotting the same pattern quickly. Research on crypto pump-and-dump behavior shows social channels accelerate both hype and detection; fast community callouts can cut losses for latecomers (Hamrick et al., SSRN).

What it’s not good for

The flip side: r/SafeMoon is a forum, not an oracle. It’s great at surfacing signals, weak at closing loops for you.

- Not an official source: A highly upvoted comment isn’t a statement from any company. Treat every claim as unverified until you match it against on-chain data or recognized platforms.

- Not real-time price accuracy: Price bots lag. Screenshots age in minutes. In thin liquidity, the number you see is rarely the number you’ll get at execution.

- Not guaranteed step-by-step withdrawals: Wallets, routes, slippage, and gas conditions change. A guide that worked yesterday can fail today if liquidity moved or if a pool was drained.

- Not wallet support: Nobody in a thread can safely “fix” your wallet. If a reply asks for your seed, a QR code scan, or a “support” DM, you’re looking at a scam.

Here’s a common trap: someone posts “I swapped SFM V2 with 12% slippage and it worked.” You copy it, but your transaction fails because the route changed or the pool’s shallow. The advice wasn’t malicious—it was just stale by the time you tried it.

Reality check you’ll thank yourself for later

Use the subreddit to discover leads, then confirm everything outside Reddit:

- Confirm the contract: Match the SFM V2 contract on BscScan and compare the address wherever you see it repeated on Reddit.

- Check liquidity and routes: Look at the actual pool and route you’ll use on the swap interface you trust. Thin pools mean big slippage.

- Validate with two sources: Don’t act on a single comment. Cross-check with a second tracker or explorer before clicking anything.

- Time-box your scrolling: Give yourself 10 minutes to gather signals, then switch to verification. Endless threads won’t move your tokens; confirmed data will.

When to stay in the sub vs. when to leave it

- Stay when you need a fast gut-check: “Is Trust Wallet showing zero for anyone else?” “Is this domain being reported as phishing?” Crowd intel helps.

- Leave the sub the moment action is required: execute swaps on known interfaces only, confirm contracts on-chain, and ignore any link that asks to connect your wallet without ironclad verification.

- Stay for scam pattern recognition: repeated DM offers, “unlock fees,” or “airdrop claim” threads teach you what to avoid next time.

- Leave for anything legal or final: bankruptcy details, exchange policies, or token listings—check official dockets, exchange notices, or recognized trackers.

Bottom line for this section: use r/SafeMoon as your smoke alarm, not your fire extinguisher. It tells you something’s burning; it won’t put the fire out for you.

If you still hold SFM—or think you might—do you know for sure whether it’s V1 or V2, and can you test a small exit without tripping every trap in the book? Keep reading; the next section gives you a straightforward checklist and links you’ll actually use.

If you still hold SFM (or think you do): a simple checklist and helpful links

Still seeing “SFM” in your wallet or wondering why it went missing? Here’s a no-nonsense workflow I use to figure out what’s real, what’s just a display issue, and how to attempt an exit with minimal drama.

- Confirm the token: Am I holding SFM V2 or an old V1/remnant import?

- Validate on-chain: Does BscScan show the same balance I see in my wallet?

- Check liquidity: Is there enough real liquidity on PancakeSwap pairs to support any swap?

- Test small: If I want out, try a tiny swap first. Note slippage, taxes, gas, and actual output.

- Fix visibility: If balances look off in Trust Wallet, re-add the correct token and re-sync before taking action.

- Stay scam-proof: Avoid “unlock,” “helper,” or “migration” sites you can’t independently verify.

Identify your token (V1 vs V2) the clean way

The fastest way to cut through confusion is to ignore the app display at first and go directly to the chain.

- Open your wallet and copy your public address.

- Paste it into BscScan. On your address page, click “Token Holdings.”

- Find the entry that looks like SFM or SafeMoon. Click it to open the token’s page and copy the contract address from there.

- On that token page, check:

- Token symbol/name (SFM vs older names),

- Contract age and comments,

- Holders and transfers (active vs abandoned),

- Links (official site, socials). Use the Wayback Machine if links are dead: web.archive.org.

- Back in your wallet, make sure you added the exact contract as a custom token on the BNB Smart Chain (BEP‑20). Don’t guess—paste the contract you just copied from BscScan.

Tip: If you see multiple SafeMoon-ish tokens in Token Holdings, you might be looking at old V1 remnants or spoof tokens added long ago. Always start from your address page on BscScan and work forward. Don’t search random token names inside the wallet app.

If you want to attempt an exit, do this first

Exiting illiquid or taxed tokens is less “click sell” and more “test, measure, scale.” Here’s a practical flow that reduces nasty surprises:

- Check liquidity and pairs:

- Use DexScreener (BSC), GeckoTerminal, or DEXTools (BNB) to find active SFM pairs (often SFM/BNB).

- Look at Liquidity, 24h volume, and price impact simulations. If volume is near zero, a large swap will likely fail or move the price against you.

- Open the real PancakeSwap: pancakeswap.finance/swap — beware of lookalikes and ads.

- Import the token by contract: paste the exact contract from BscScan to avoid clones.

- Set slippage thoughtfully:

- Some tokens have a transfer tax. If so, you may need higher slippage to get a fill.

- Start low (e.g., 2–3%), then step up gradually. Keep gas reasonable via the BSC gas tracker.

- Learn what slippage is and why it matters: Binance Academy: Slippage.

- Run a tiny test swap:

- Swap a very small amount of SFM to BNB. Confirm the transaction on BscScan and compare expected vs. received output.

- If it works, scale up in chunks to reduce price impact and failed‑tx frustration.

- Mind approvals:

- If you previously approved SFM on shady sites, revoke them first using BscScan Token Approval Checker or Revoke.cash.

Why I’m strict about this: Chainalysis’ 2024 Crypto Crime Report shows phishing/drainer operations keep evolving, often impersonating legit “support” or “migrators.” Unsolicited DMs, QR codes, and “unlock” prompts are common lures. Stay in verified interfaces, paste contracts yourself, and keep approvals tidy. Sources: Chainalysis 2024, plus frequent alerts from researchers and wallet teams.

Troubleshooting Trust Wallet visibility (before you panic)

Most “my SFM is gone” messages I see come down to wallet display quirks or the wrong token contract.

- Refresh and re-add:

- In Trust Wallet, pull to refresh on the main screen.

- Tap the token list icon, search for SFM/SafeMoon, and toggle it on. If it’s not there, tap “Add Custom Token,” choose BNB Smart Chain, and paste the contract from BscScan.

- Compare with BscScan:

- Your address page on BscScan is the source of truth. If BscScan shows the balance but the app doesn’t, it’s a display issue.

- If BscScan also shows zero or a different token than you expected, you may be looking at the wrong contract or an old V1 artifact.

- Resync the wallet:

- Back up your recovery phrase first.

- Remove and reimport the wallet to force a resync. Then re-add the correct custom token.

- Trust Wallet’s guide: How to add a custom token.

If balances don’t match between your app and BscScan, stop. Don’t try random swaps. Figure out the contract mismatch first. Wrong-contract trades are exactly how scammers get paid.

Quick links worth saving

- Explorers:

- BscScan — address, token, approval checker

- BSC Gas Tracker

- Swap interfaces:

- PancakeSwap — import tokens by contract only

- Liquidity and charts:

- DexScreener (BSC)

- GeckoTerminal (BSC)

- DEXTools (BNB)

- Security:

- BscScan Token Approval Checker

- Revoke.cash

- Chainalysis Crime Report 2024

- Wallet help:

- Trust Wallet: Add a custom token

- Archival and verification:

- Wayback Machine — check old “official” pages

One last thought before we move on: if you tested a tiny exit and got blocked by slippage, taxes, or thin liquidity, would you know when to stop trying and when to try a different path? I’ve got a simple way to make that call—next up.

My verdict on r/SafeMoon and how I’d use it today

What the sub does well

When I want fast, real-world feedback, this subreddit delivers. People are quick to test things, report outcomes, and warn others. That speed matters in crypto, where hours can be the difference between saving funds and clicking the wrong link.

- Scam callouts land quickly. “Migration helpers,” QR code drainers, and fake support bots usually get flagged within minutes. That community vigilance is valuable—especially when FTC data shows social platforms are a top contact point for crypto scams, and Chainalysis notes scams are still a leading source of illicit revenue.

- Practical troubleshooting beats guesswork. If you’re seeing a zero balance in Trust Wallet or a failed swap on PancakeSwap, someone has likely run into the same thing and posted the exact sequence that worked (or didn’t). That can save you from repeating costly mistakes.

- Collective memory. Old megathreads and mod comments help connect dots—V1 vs V2 confusion, slippage ranges that actually executed, or why certain explorers show different balances.

One solid example I’ve seen more than once: a holder panics because SFM “disappeared.” Top replies usually separate it into the right buckets: V1 token added by mistake, wallet cache, or explorer desync—then point to the fix and where to verify on-chain. You get answers in minutes, not hours.

Where it struggles (and how I handle it)

The weak spots are predictable: old guides keep resurfacing, emotions run hot during price moves, and confident comments can still be plain guesses. That’s not a dig—it’s just the reality of any open community.

- Timestamp drift: A “working method” from last year might be useless today. I always check post dates and scan the latest comments for corrections.

- Source quality: If a claim doesn’t link to an authoritative source (BscScan, official token pages, recognized trackers), I treat it as a rumor until proven.

- Price screenshots: Screenshots age instantly and can be cherry-picked. I open a live tracker and compare multiple sources before I even start a swap.

- Emotional bias: Bullish or bitter, both can distort risk. I filter for comments that include steps, receipts, or verifiable links.

My rule is simple: the subreddit is great at discovery—not final answers. I use it to surface leads, then I confirm everything off Reddit.

Bottom line

Used with a verification mindset, r/SafeMoon is still worth your time. It’s fast, human, and blunt—exactly what you need when you’re stuck on a swap error or trying to figure out why a balance looks wrong.

- Start smart: Skim the sticky and the most recent “Top (Week).” Look for mod comments, PSAs, and any fresh warnings.

- Search first: Type your exact issue—“V1 vs V2,” “Trust Wallet not showing,” “PancakeSwap slippage”—and open the newest threads.

- Verify off-platform: Match contract addresses on BscScan, compare price/liquidity on two trackers, and only use links you can confirm independently.

- Test small, then scale: If you’re swapping, start with a tiny amount. Adjust slippage in small increments, and watch gas and minimum received.

- Give back: If you solved something, post your steps and the exact settings that worked. That’s how the signal stays ahead of the noise.

Quick mantra: “Trust the chain, not the chat.” Use the subreddit to find the right questions—then let on-chain data and trusted tools give you the answers.

If you’ve found a cleaner method, share it. The best threads here are the ones that turn chaos into clear, repeatable steps—and help the next person avoid a bad click.

CryptoLinks.com does not endorse, promote, or associate with subreddits that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.