Paybis Review

Paybis

paybis.com

Paybis Review

The availability of a plethora of crypto gateway options has improved the seamlessness of crypto purchases. At the forefront of this dynamic improvement are crypto exchanges like Paybis. With a design that permits instant crypto-to-fiat trades, Paybis has established a safe and fast way to access the crypto market. In this review, we will explore the workings of Paybis and highlight its strengths and weaknesses.

Paybis Overview

Paybis is a UK-based exchange focused on delivering functioning and instant fiat gateways to the crypto market. In other words, it is a platform that allows users to buy bitcoin and other established coins with fiat. Note that this brokerage service looks to bridge the gap between the crypto sector and the traditional financial market such that users can utilize conventional payment methods to purchase cryptocurrencies.

Launched in 2014, Paybis set out to enable a transparent and efficient exchange, which does not necessarily rely on flamboyant functionalities for recognition but instead thrives as a trusted and responsive platform. As such, it comes as no surprise that the exchange’s features are simple to navigate and utilize.

Already, Paybis offers its services in over 180 countries, including 48 US states. The globalization of Paybis has allowed more users to buy bitcoin and other cryptocurrencies with their local fiat currencies. There are over 40 fiat currencies, including USD, EUR, and GBP, supported by Paybis. This is made possible by its decision to prioritize credit/debit card payments.

Although the exchange has focused on card payments, it also supports other popular fiat gateways. You can purchase bitcoin with Skrill, Neteller, or through bank transfers. And if you already own bitcoin, you can use your coin to buy other cryptocurrencies. Other supported coins include Litecoin, Tron, Ethereum, Bitcoin Cash, Tether, Stellar, Binance Coin, and Ripple.

Another important piece of information that you need to know about Paybis is that it is heavily regulated. Due to its current location, Paybis falls within the jurisdiction regulated by the Financial Conduct Authority. Therefore, it must abide by strict regulations designed to protect the interest of users. Additionally, it has gone a step further to receive a license from FinCEN Department of the Treasury, United States of America. This allows Paybis to operate in a majority of US states except for the state of New York and Hawaii. An additional License from Estonia gives Paybis the regulatory backing to operate in the EU.

Things to Know Before Using Paybis

KYC requirements

Recall that Paybis has chosen to facilitate fiat-to-crypto trades in jurisdictions that are particular about crypto regulations. Hence, it enforces KYC requirements on all its users. With this in mind, expect to scale identity verification processes before you can buy crypto via the Paybis platform. While this may seem restrictive and privacy-unfriendly to some crypto proponents, Paybis believes that compliance with KYC and AML requirements ultimately keeps the exchange on its toes. Likewise, it shows that the exchange is running a legitimate crypto business.

More so, Paybis claims that it takes an average of 5 minutes for users to scale its verification process. Therefore, the KYC requirement does not complicate the registration process unnecessarily.

A simple way to buy crypto with fiat

As mentioned earlier, Paybis specializes in facilitating fiat-to-crypto trades. As such, it is an ideal option for new crypto investors as it does not come with complex charts or tools. Here, users process their transactions instantly via an order box. You will be required to enter the type of digital asset you want to buy, the number of coins, and the preferred payment method.

Once all the correct information has been entered, you can confirm your transactions and immediately receive cryptocurrencies in your personal wallet. Note that the transaction speed depends on your chosen payment method. Paybis says that it takes 5 to 15 minutes to confirm card transactions, whereas it could take longer to complete and confirm bank transfers.

It is worth noting that the sell side of the crypto exchange only supports bitcoin. Hence, you can only sell bitcoin on Paybis.

Crypto price

According to the website, Paybis rely on price rates aggregated from other established exchanges. In essence, the exchange uses the average crypto price across multiple trading platforms, including Kraken, Bitfinex, and Bitstamp, to arrive at its fixed and dynamic prices for its supported cryptocurrencies. With this, Paybis offers reasonable exchange rates. In contrast, most crypto brokerage services opt to sell cryptocurrencies at a premium.

Speaking of dynamic prices, Paybis has incorporated a special pricing system that is suitable for volatile assets like crypto. The exchange activates a 30-minute fixed rate when a “Buy” transaction is executed. In other words, Paybis ensures that the crypto price rate at the time that a “Buy” transaction was initiated is maintained for 30 minutes. Once the 30 minutes elapse, the price will be updated every minute until Paybis receives a confirmation of payment.

The exchange explains that this policy will help protect both parties against loss resulting from price fluctuations. However, since it takes an average of 15 minutes to process a majority of “Buy” transactions executed on Paybis, this policy may not affect you. For a “Sell” transaction, the dynamic pricing system fixes the fiat payment for 15 minutes before updating the price rate every additional minute it takes for the transaction to complete.

Security

Paybis is a fairly secure platform since it does not run a custodial exchange. Once you facilitate a Buy transaction, you can enter a destination address. With this system, Paybis does not have to take up the security responsibilities associated with custodial exchanges and you have full control over your purchased cryptocurrencies.

Therefore, the major bone of contention as regards security is the safety of users’ personal data. Since Paybis complies with KYC requirements, it has access to users’ data. And so, it must ensure that submitted information does not fall into the wrong hands. So far, we have not found any major complaints regarding Paybis’s privacy policy and personal information security.

Transaction limits and fees

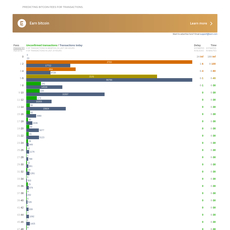

Depending on your preferred payment method, you are subjected to a minimum and maximum transaction limits. For debit/credit card payments, the minimum limit is $60 while the daily and monthly maximum limits are $20,000 and $50,000 respectively. You get to enjoy higher limits when you pay via your bank account. Bank transfers have a $200,000 maximum limit per transaction. Other supported fiat payment methods have their minimum and maximum limits set at $50 and $25,000 respectively for each transaction. When you sell bitcoin on Paybis, you can receive a maximum amount of $100,000 per transaction.

Also, note that there are fees applicable to each payment method. All USD, EUR, and GBP transactions processed via debit/credit cards attract a 6.9%. Card payments featuring other local currencies will incur an 8.99% fee. Generally, the transaction fees of Paybis ranges between 1.5% for SEPA EUR transfers to 10% when using eWallets like Skrill and Neteller. It is worth mentioning that new users do not pay fees on their first purchase.

Customer support

Judging by the 4.5-star score of Paybis on Trustpilot, it is safe to say that the exchange has done enough to provide functioning channels and services to its global network of users. The platform has a dedicated support section where users can read articles on processes and concepts relevant to the Paybis ecosystem. Likewise, there is an email ticketing system. The icing on the cake is the live chat which is available 24/7/. Users can take advantage of these channels to log their complaints and access help from the platform’s customer service representatives.

Paybis business product

Apart from the above-mentioned crypto exchange products, Paybis is also in the business of enabling liquidity services to businesses. This product is suitable for businesses that want to receive crypto as payments without having to hire or develop complicated technical solutions.

What Are the Pros and Cons of Paybis

Pros of Paybis

It has a simple user interface

Looking at the website design of Paybis, it is clear that the exchange has done enough to eliminate complexities associated with crypto gateways. The website is simple and void of convoluted charts or tools. As such, you can seamlessly initiate a Buy transaction, pick a payment method, and have your coins transferred to your personal wallet.

Paybis support fiat currencies

With over 40 local currencies supported, Paybis has a robust payment infrastructure that makes it easier to evade the overheard cost of exchanging local currencies to globally accepted fiat, like USD and EUR. The exchange eliminates the barriers of entry by allowing users to buy crypto directly with their local currencies.

It offers 24/7 customer support

Remarkably, Paybis provides 24/7 support to its customers. You can use the live chat to access swift response or submit a ticket detailing your complaints. The availability of instant customer support channels bodes well for users as they are certain that the platform has the resources and technology required to help them resolve issues swiftly.

It is available in over 180 countries

It is not common for fiat-enabled crypto exchanges to support a wide range of jurisdictions including the United States. Therefore, it is commendable that Paybis have put in the work to receive the licenses to operate in multiple regions. We advise that you confirm that your country is among the supported jurisdictions before opting for Paybis.

Paybis is a non-custodial exchange

Since Paybis does not provide hot wallet services, you have to enter a destination wallet address for all purchased coins. This system allows you to have more control over your crypto holdings.

Cons of Paybis

It supports a limited number of coins

Although the exchange promises to add more coins in the future, users are currently restricted to only 9 coins. In essence, Paybis may not suit investors interested in a wide variety of altcoins.

The transaction fees are high

The fees can be as high as 10%, depending on the preferred payment method. However, you can reduce the cost by opting for a bank transfer.

Users can only sell bitcoin

Currently, Paybis only allows users to sell Bitcoin for fiat. The lack of options may force users to exchange their altcoins for bitcoin before trading them for fiat currencies.