CoinMarketCap Review

CoinMarketCap

coinmarketcap.com

CoinMarketCap Review Guide: Everything You Need to Know (+ FAQ)

Ever check three apps and see three different prices for the same coin? Wonder why market cap and FDV tell two different stories? Or why a token that “looks listed” ends up being an IOU and not the real asset?

You’re not alone. I’ve tested countless crypto data sites and talk to traders daily who make avoidable mistakes because of how crypto data is presented, aggregated, and—sometimes—marketed to them.

What most people struggle with (and why it costs them)

Let’s be real about the common headaches that show up when you use a market data site like CoinMarketCap:

- Market cap vs FDV confusion: A token with only 10% supply circulating can look “cheap” on market cap while showing a huge fully diluted valuation. I’ve seen beginners treat FDV as “today’s value,” which leads to wild expectations when big unlocks hit.

- Different prices across exchanges: Prices don’t match because liquidity, spreads, and index methodologies vary. Independent researchers like Kaiko have shown that thin order books on certain pairs can cause outsized moves and stale reference prices during volatility.

- IOU tokens vs the real thing: The classic example is Pi. What you often see on listings is Pi [IOU], not the mainnet coin people mine in the app. Treating that number as the “Pi price” is a shortcut to confusion.

- Listings feel opaque: Teams get mixed messages about how and when they’ll be listed. Meanwhile, paid “fast-track” services whisper in DMs as if they’re official. Spoiler: that’s almost always a red flag.

- Volume quality and wash trading risk: Exchange-reported volume can be messy. The famous Bitwise report (2019) highlighted how much “volume” was not what it seemed on long-tail venues. The industry has improved, but you still want to check pair-level details and liquidity depth.

“If you don’t verify the contract address and top trading pairs, you aren’t doing research—you’re rolling dice.”

These are the traps I see most. Good news: they’re fixable with the right approach to CMC’s pages and a few sanity checks.

What you’ll get out of this guide

I’m going to make CMC simpler to use, faster to verify, and harder to misuse. Here’s the plan:

- Show what CMC actually is, who’s behind it, and how it sources data

- Lay out the features that matter for decisions (and what’s just noise)

- Teach you to read a coin page like a pro—market cap vs FDV, supply schedules, volume quality, and contract verification

- Explain the Pi [IOU] situation so you don’t mistake an IOU price for the real asset

- Clear up listing expectations and the reality behind “fast-track” offers

You won’t need a PhD in tokenomics. You just need a clean checklist and a few examples. I’ll give you both.

Who this is for

- New to crypto? You want one reliable dashboard to check prices, find contracts, and avoid fake links.

- Active traders and researchers? You need quick liquidity reads, watchlists, and alerts without drowning in noise.

- Builders and token teams? You want to understand how listings work, what data matters, and how not to get burned by “guaranteed” services.

- Anyone who hates wasting time: You want a simple way to cross-check claims before you act.

By the way, if you want a single bookmark for fast access, I keep a live resource page here: cryptolinks.io/coinmarketcap.

Ready to make sense of it all? Next up, I’ll answer the question everyone asks first: What is CoinMarketCap—and is it legit? Let’s clear that up before we build your workflow.

What is CoinMarketCap and is it legit?

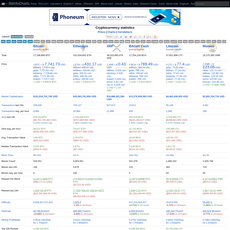

Here’s the simple answer: CoinMarketCap (CMC) is the internet’s go-to hub for crypto market data—prices, market caps, volumes, exchange rankings, watchlists, and more—in one fast, free dashboard. It launched in 2013 and grew into the most visited crypto data site because it covers thousands of assets, updates around the clock, and gives you a clean way to compare coins and exchanges.

If you’re wondering whether it’s worth using as your daily starting point: yes. It’s not perfect (no aggregator is), but it’s the fastest way to get oriented before you check explorers, on-chain tools, or research notes. For context, CMC consistently ranks among the top crypto websites by traffic on analytics trackers like Similarweb, and it’s embedded across wallets, widgets, and news sites you already use.

“Trust, but verify.” That’s my rule with any market data screen—especially in crypto.

Is CoinMarketCap a real company?

Yes. CMC was founded in 2013 by Brandon Chez in New York and acquired by Binance in 2020. It continues to operate as a standalone brand focused on market data and rankings. The acquisition raised fair questions about neutrality, but here’s what I look at in practice:

- Independent coverage: Thousands of assets appear on CMC that never list on Binance. CMC doesn’t function as a “Binance listings page.”

- Methodology-driven rankings: Exchanges are scored using a framework (liquidity, volume quality, web usage signals, and more), not just raw volume. This limits the chance any one venue dominates purely on self-reported numbers.

- Clear labels: Sponsored slots are marked, and “self-reported” fields are flagged. That transparency helps you spot what’s data and what’s marketing.

Bottom line: it’s a real, long-standing business that most of the industry checks every day—even people who prefer other tools still open CMC to sanity-check prices and pairs.

How CMC makes money (and why it matters)

Knowing the business model helps you read the screen with a sharper eye. CMC’s revenue comes from:

- Advertising: Display ads and homepage banners. They’re labeled and often targeted to traders.

- Sponsored placements: You’ll sometimes see “promoted” coins, learn campaigns, or featured airdrops. Treat these like billboards, not endorsements.

- API plans: Free and paid tiers that feed apps, wallets, funds, and analysts. The paid plans power a big chunk of the industry’s dashboards.

- Exchange and partner integrations: Data feeds, widgets, and co-marketing (for example, Learn & Earn campaigns).

- Affiliate referrals: “Buy” buttons or links to exchanges can include referral tracking.

Why this matters to you: sponsored modules can sit next to organic rankings, so train your eyes to spot the “promoted” or “ad” labels. That one habit saves you from mistaking a paid placement for a top market performer.

Trust and transparency

CMC is an aggregator, so it’s only as strong as its methodology and sources. Here’s what it provides—and how I sanity-check it:

- Methodology you can read: CMC publishes how it ranks exchanges and calculates metrics. Start here when you want to understand what you’re looking at: coinmarketcap.com/methodology.

- Exchange Score and liquidity signals: Exchange pages include score components and liquidity depth to reduce the impact of inflated volume. Independent work (like the well-known Bitwise 2019 analysis) showed how common wash trading is—so I treat CMC’s score as a filter, not a guarantee.

- Proof-of-Reserves links (when available): Centralized exchanges that publish PoR get a link or badge. You can check those here: coinmarketcap.com/exchanges/proof-of-reserves. PoR isn’t perfect, but it’s better than silence.

- Self-reported fields are flagged: You’ll see labels like “self-reported circulating supply” or “self-reported market cap.” That’s your cue to click through to the explorer or docs before relying on the number.

My quick, practical verification flow when something catches my eye on CMC:

- Match the contract: Click the contract address on the coin page, open it on the official explorer (Etherscan, BscScan, etc.), and compare it with the contract listed on the project’s official site or pinned tweet.

- Check top pairs: Are the leading markets on reputable exchanges with deep order books, or are they thin, obscure pairs? Poor depth = unreliable price.

- Scan the labels: Any “self-reported” tags or warnings? If yes, confirm supply and unlocks from docs or token trackers.

- Cross-check one source: I often glance at an alternate aggregator or the project’s explorer page to confirm the direction and magnitude, not just the exact number.

Data can lag at the edges (especially for brand-new listings or supply updates), and no ranking system is immune to gaming. The win for you is learning what each label means and verifying the specifics that matter to your decision.

So, if CMC is your launchpad, what should you actually click and use each day to make smarter calls—without getting lost in noise? I’ll show you the exact screens, alerts, and shortcuts I rely on next. Want the 10-second scan I use before I ever open a chart?

Core features you’ll actually use

“Data is only useful when it drives better decisions.”

Coin pages: prices, market cap, FDV, supply, and on-chain stats

When I pull up a coin on CoinMarketCap, I treat the top panel like the cockpit: price, market cap, fully diluted valuation (FDV), volume, and supply. These aren’t just numbers—they’re context.

- Price: Real-time aggregated price from listed markets. Always click into the Markets tab to see what pairs actually drive that price.

- Market Cap: Price x circulating supply. This is what’s actually tradable right now.

- FDV: Price x max supply or total supply if max isn’t set. It’s a what-if number assuming all tokens exist at today’s price. It’s not the project’s “true value.” If unlocks are steep, FDV can be a mirage.

- Supply:

- Circulating = in the wild today

- Total = minted so far (may include locked)

- Max = absolute cap, if defined

Watch for projects with a tiny circulating slice and a giant cliff ahead. Those are your dilution risks.

- Contract addresses and official links: On a coin page, you’ll see the Contract box (often with a chain selector) and official links like Website, Docs, Twitter/X, Telegram, and Audit. Always copy the address straight from here, then confirm it on the project’s site and block explorer. Multi-chain tokens will list multiple contracts—use the right one for the chain you trade.

- On-chain stats (when available): Holder distribution, top wallets, and basic activity. If the top 10 wallets own 85% and they’re not clearly locked or treasury, that’s a liquidation landmine.

Quick example: If a token trades at $2 with a 100M circulating supply and a 1B max supply, market cap is $200M but FDV is $2B. If emissions unlock 10% monthly, you don’t own the same slice of the pie in a few months unless demand ramps up.

Exchange rankings and liquidity signals

This is where price becomes tradable reality. CMC splits things into Spot and Derivatives tabs, then ranks exchanges with a composite Exchange Score. I focus on two layers:

- Exchange-level health:

- Reputation and uptime history

- Depth across majors, not just one coin

- Derivatives open interest stability (for perps)

- Pair-level quality (from a coin’s Markets tab):

- 2% depth: How much buy/sell size sits within ±2% of the last price. $25M depth beats $250k every time.

- Spread: Tight is good. A 0.01% spread on BTC/USDT is normal on top venues; 0.8% on a small venue screams slippage.

- Volume vs depth: Reported volume without depth often means wash trading or incentive games.

- Confidence and Liquidity indicators: Use them to sort markets and avoid the junk pairs.

Why be picky? A landmark analysis submitted to the SEC by Bitwise in 2019 showed most reported crypto volume then was likely non-economic. That lesson still stands: volume is easy to fake; depth and spread are harder to fake. Sort by depth and reputable venues first, then decide where to trade.

Quick check I use: Compare BTC/USDT on a top exchange vs the same pair on a fringe venue. If the top-of-book depth is $40M vs $120k, I know where my order belongs.

Watchlists, portfolio tracking, and price alerts

CMC’s utility jumps once you personalize it. A few tweaks save me hours every week:

- Watchlists:

- Star coins to add. Create multiple lists like “Core,” “Narratives,” “Speculative.”

- Switch base currency (USD, EUR, BTC, ETH) to keep context consistent.

- Use tags and filters to group by chain or theme.

- Portfolio:

- Manual entries for buys/sells with timestamps and fees to keep PnL honest.

- Track realized and unrealized PnL across lists. Keep it simple; this is for tracking, not tax filing.

- Alerts:

- Price crosses ($1.00), percent moves (+8%/-8%), or specific pair alerts.

- Push notifications on mobile help you react without doomscrolling.

Pro tip: Set alerts at decision levels, not round numbers. “Breakout above last weekly high” keeps you objective; “$1 round number” invites noise.

Airdrops, Learn & Earn, and Community

These tabs can be signal or pure engagement. I treat them as discovery tools, not buy signals.

- Airdrops:

- Sort by ongoing vs upcoming; read the eligibility and KYC notes.

- Favor projects with clear on-chain criteria (snapshots, usage thresholds) over pure social tasks.

- Don’t overcommit wallets—sybil resistance is getting smarter, and time is your scarcest asset.

- Learn & Earn:

- Good for getting paid to learn basics and collecting minor allocations.

- Use it to build a watchlist of fresh listings—you’ll often see marketing pushes around these.

- Community:

- Check social links from the coin page only. Mismatched handles are a red flag.

- Scan engagement quality: comments from real users beat inflated follower counts.

Remember: airdrops and quizzes can be fun, but hype ≠ liquidity. Tie any action back to market depth, supply, and real usage.

Mobile apps and the CMC API

If you track on the go, the mobile app is worth installing. Watchlists and alerts sync to your account, and the widgets make it easy to glance at prices without opening the app. I keep a “Levels” watchlist just for alerts I care about this week.

For builders and power users, the CoinMarketCap API is a simple way to pipe market data into dashboards, spreadsheets, or bots.

- When it helps:

- Telegram/Discord bots that post price/volume/liquidity updates

- Custom screeners for market cap, FDV, or 24h depth thresholds

- Portfolio sheets with live quotes and conversion to your base currency

- What to know:

- There’s a free tier for light usage and paid tiers for heavier workloads.

- Cache responses and set sane refresh intervals—over-querying won’t make the market move faster.

Little workflow idea: Pull a daily snapshot of your watchlist via API and compare week-over-week changes in market cap vs 2% depth. Momentum without depth is usually a trap.

Measure twice, trade once. Now that you know which tools matter—and how to avoid the traps—want to see how to turn a single coin page into a clear yes/no decision? Ready to spot when market cap lies, FDV screams dilution, and prices disagree across exchanges for a reason?

How to read a CMC coin page like a pro

If you can read a CoinMarketCap coin page the right way, you’ll spot traps, confirm real opportunities, and stop chasing screenshots. My rule: never act until I’ve answered five questions—what’s the supply reality, where’s the liquidity, what’s the real price, is the contract legit, and how does it compare to peers?

“Numbers don’t lie—until you read them without context.”

Open any coin page and run this quick sequence:

- Glance: Market Cap, FDV, Circulating Supply, and 24h Volume.

- Reality check: Is circulating supply a small fraction of total? That’s float risk.

- Markets tab: Sort by volume and Confidence; favor reputable pairs with tight spreads.

- Contract: Click the contract address; verify on the chain explorer and cross-check the project’s official links.

- Tags/Categories: Click into sector and chain peers; compare like-for-like.

- News/Socials: Scan the official links, not random channels. Look for audits, docs, and recent updates.

- Only then decide if the price you see is actionable on the pair you can actually trade.

Market cap vs fully diluted valuation (FDV)

Market cap = price × circulating supply. It reflects what’s tradable now.

FDV = price × total supply (circulating + locked). It’s a “what if everything unlocked today” number—useful for context, dangerous for decisions.

Here’s the trap: a token can show a $500M market cap but a $5B FDV because only 10% is circulating. If emissions, team/VC unlocks, or ecosystem incentives bring big supply to market, price pressure is common. You’re not just betting on demand—you’re fighting new supply.

What I check on the coin page and beyond:

- Circulating vs total supply: If float is under ~20%, I assume unlock overhang.

- Schedule: Find vesting and emissions in the project’s whitepaper/docs. If CMC links an Economics or Token page, read it. If not, I search the docs and cross-check with TokenUnlocks or the project’s GitHub/blog.

- Cliffs vs linear unlocks: Cliffs can be brutal if they coincide with low liquidity.

- Float growth rate: A slow, predictable schedule is easier for the market to absorb than sudden unlocks.

Multiple industry studies (from research desks like Messari and Binance Research) have highlighted negative performance clustering around large unlock events—especially in tokens with small initial float and aggressive emissions. You don’t need a PhD to use that: just weigh market cap against FDV and timeline the supply.

Volume, liquidity, and price discrepancies

“Why is the price different on Exchange A vs Exchange B?” Because each market is its own mini world with unique liquidity, market makers, and spreads. CMC aggregates prices across eligible markets, but you trade on a specific pair, not the global average.

On the coin page, tap Markets and do this:

- Sort by 24h volume and Confidence: Prioritize High confidence pairs on reputable exchanges.

- Check the spread: A tight spread (basis points, not percent) is a sign of healthy markets.

- Centralized vs DEX: On DEX pairs, click through to the pool (e.g., via the pair link) and look at liquidity; if a $2,000 buy would move the price 3–5%, that “price” is fragile.

- Perp noise: If derivatives volume dwarfs spot, funding flips and liquidations can whip the price—spot pairs with depth tell the truer story.

Two quick examples I watch for:

- Small-cap illusion: A token shows $5M 24h volume, but 80% is on little-known venues with low Confidence and wide spreads. That’s not real liquidity for a larger position.

- Region/time skew: A token trades richer on a single regional exchange during off-hours. I avoid chasing those prints and anchor to deep USD/USDT pairs instead.

When a big buy or sell matters, I’ll open the top pair’s order book on the exchange or check a DEX analyzer like Dexscreener to estimate slippage. CMC helps me shortlist the right markets fast.

Contract addresses and “official links”

Always verify the contract from the coin page—this is non-negotiable. I click the address, then:

- Open the explorer: Etherscan, BscScan, Solscan, etc.

- Check the token page: Verified contract, holders distribution, recent transfers, and whether the deployer and ownership status make sense (renounced, multisig, timelock).

- Cross-check links: The project’s website from CMC should match the URL pinned on the official X/Twitter or in docs. If there’s a mismatch, I stop.

- Never copy addresses from chats: Phishing campaigns commonly post lookalike tickers. I’ve seen “ARB2.0” and “OP Classic” lures that existed only as scam contracts.

Pro tip: If the coin is multichain, CMC shows multiple contracts. Make sure you pick the contract for the chain you’re using. A legit token on Ethereum doesn’t make a random BSC clone safe.

The Pi question: “How much is 1 Pi on CMC?”

On CMC, you’ll see Pi as an IOU market from certain exchanges—not the transferable mainnet coin people “mine” in the Pi app. That IOU price is a side market and often trades at levels that don’t reflect any official, freely transferable supply.

- What it means: The IOU is a promise to deliver future Pi; it is not the mainnet asset in free circulation.

- Why it’s volatile: Thin liquidity, uncertain timelines, and no direct redemption path create price dislocations.

- How I treat it: As a separate speculative instrument. I don’t use the IOU price to value in-app balances.

If you’re comparing Pi values with friends, make sure they understand this distinction. It’s one of the most common misunderstandings on CMC.

Using filters, comparisons, and categories

The quickest way to sanity-check a coin is to compare it to its peers—not to Bitcoin or the whole market.

- Tags and Categories on the coin page: Click them to see peers (e.g., Layer 2, AI, RWA). Then sort peers by Market Cap, FDV, and 24h Volume. You’ll instantly see if expectations are in the clouds.

- Compare tool: Use the Compare button to overlay price, market cap, and volume with 2–3 similar projects. If your pick has a tiny float but a massive FDV versus its peers, you’ve learned something important.

- Chain filter in Markets: If you only trade on a specific chain or quote asset (USDT, USD, WETH), filter the pairs so you’re seeing what you can actually execute.

Patterns I look for:

- Sector rotations: If the whole category is cooling while your coin rallies on low volume, I’m cautious.

- Outlier FDV: If two similar L2s have comparable users and TVL, but one’s FDV is 3–5× higher with the same unlock schedule, I question the upside/risk balance.

Read a coin page like this a few times and it becomes muscle memory. You’ll start catching the little tells—the spread that’s too wide, the unlock that’s too close, the “official” link that looks off.

Now, here’s the kicker: how do projects even get their data onto CMC in the first place, and do those “fast track listing” offers you see in Telegram actually work—or are they just expensive fairy tales? I’ll show you exactly how listings really happen next.

Listings, submissions, and the “fast track” myth

If you’re trying to get a token listed or you’re judging a fresh listing, here’s the truth: listings are about data quality and market reality, not who you know or what you pay. I’ve seen great projects wait, and I’ve seen hype coins get in fast—because the data lined up. Let’s keep this simple, practical, and scam-proof.

“We do not charge any fee for listings.” — CoinMarketCap Help Center

How listing works on CMC

CMC is a data aggregator first. A listing isn’t a stamp of approval; it’s a reflection of verifiable, trackable markets. If your token isn’t trading on exchanges CMC tracks or if the data can’t be verified, it won’t stick.

- Submit via the official form: Use the request page (or Help Center link above). Anything else—Telegram DMs, “special portals,” backdoors—is noise.

- Provide a real footprint: Website with SSL, whitepaper/docs, active socials, block explorer link, and a verified contract address. If you’re multichain, list every contract clearly.

- Show tradable markets: At least one or more active pairs on exchanges CMC tracks, with API-accessible order books and recent trades. The pairs should have real liquidity and consistent pricing.

- Support the numbers: Circulating supply, allocation chart, vesting schedule, lockups, and audit links if available. If supply is self-reported, expect a “self-reported” badge until independently verified.

- Expect a wait: Reviews can take weeks. Teams that ship complete, consistent data and have stable markets tend to get processed faster.

If you want to understand how CMC thinks about data, their Methodology is worth a read. It explains why some coins appear “untracked,” why certain metrics are excluded, and how rankings are assigned.

How much does it cost to list a coin on CoinMarketCap?

Nothing. Standard submissions are free. If someone tells you it costs $5k, $20k, or $50k to “guarantee” or “expedite” a listing, that person is not CMC. This is one of the oldest grifts in crypto marketing.

- Classic red flags:

- “Official” Telegram handles with misspellings or no history.

- Emails from non-coinmarketcap.com domains or with sketchy signatures.

- “We can make you top 300 in 3 days”—rank manipulation isn’t a service; it’s a lie.

- What actually speeds things up:

- Complete, consistent documentation (tokenomics, vesting, explorer links).

- Trading on reputable exchanges CMC already tracks, with visible depth and volume.

- Clear, non-confusing branding—matching ticker, name, and social domains.

- Audits and multisig/admin-key disclosures that show you’re serious about security.

If you need a sanity check, read CMC’s own words again: “We do not charge any fee for listings.” You can also look at industry research on impersonation and social engineering scams—Chainalysis has covered this pattern across multiple reports.

Data integrity: updates, delays, and self-reported fields

CMC ingests data from exchanges and project teams. That mix is powerful, but it’s not instant and it’s not perfect. Understanding the labels helps you avoid bad assumptions.

- “Self-reported” tags: If circulating supply or market cap is labeled self-reported, it means the team supplied it and CMC hasn’t validated it yet. Treat rankings that rely on self-reported data as tentative.

- “Untracked listing” badge: This usually means the markets don’t meet liquidity/volume criteria or data is incomplete. It’s a public placeholder—not a green light.

- Update lag is normal: If an exchange API is flaky or pairs are paused, prices and volumes can lag. Cross-check recent trades on the exchange’s own UI when in doubt.

- Market confidence matters: Pair pages include confidence or quality indicators. Low confidence on the top pairs is a warning sign that price may be unreliable.

Quick verification stack I use when numbers look off:

- Compare supply figures to the primary block explorer and any lock/vesting contracts.

- Check the top two trading pairs’ order books for depth and slippage at 1–2%.

- Open the trade history—do the sizes and intervals look organic?

- Scan the project’s GitHub (if applicable) and governance/announcements for recent changes.

When not to trust a listing

CMC is a window into the market, not a bouncer at the door. Scammy projects can still show up, and legitimate projects can look messy during early days. Your job is to tell the difference—fast.

- Tiny DEX-only liquidity: If 95% of volume is one DEX pair with ~$30k in real liquidity, the price can be gamed. One whale can move your “market cap.”

- Mismatched identities: Ticker clashes, wrong website in socials, or Telegram/Discord links that don’t appear on the official site. This is how impostor tokens thrive.

- Unclear contracts: Multiple contracts with no canonical label, proxy admin keys with god-mode, or “renounced” contracts that still have upgrade hooks via a separate admin.

- Unrealistic FDV vs unlocks: A $1B FDV with 4% circulating and big unlocks in 30 days is a setup for pain if demand doesn’t grow.

- Wash-traded pairs: Dead order books but perfect-looking volumes, always-on tick activity, and prices that never slip even on “large” trades—these are typical wash-trade fingerprints.

Real-world reminder: the infamous Squid Game token went from hype to rug in days—major media covered the collapse (BBC). A listing page with a price chart is not validation. It’s just data. Your process is the guardrail.

Here’s a 5-minute sniff test I use before I trust any fresh listing:

- Contract: Verified on the explorer, matches what’s on the official site, and has clear ownership/admin details.

- Markets: Two or more reputable exchanges or one deep DEX pool; check slippage at 1–2% and 5–10% sizes.

- Supply: Circulating supply can be reproduced from the explorer; any locks/escrows are visible and time-bound.

- Consistency: Ticker/name/links match across CMC, website, GitHub, and socials.

- Narrative risk: If all momentum is from “airdrops” and influencer threads with no product or code commits, assume fragility.

If your heart rate spikes while checking a listing, trust that signal. As someone once told me in a bull market, “Urgency is the enemy of good due diligence.”

So when is CMC the perfect tool—and when should you switch to something else for deeper liquidity or on-chain analysis? I’ve got a short, brutally honest list of pros, cons, and the best complements up next. Want the checklist I use before acting on any CMC data?

Pros, cons, and best alternatives

What CoinMarketCap does best

I use CoinMarketCap as a daily dashboard because it’s fast, broad, and simple. A few things it nails:

- Coverage and speed: It tracks a massive set of coins, exchanges, and pairs. When a new market goes live, I can usually see it populate on pair pages within minutes.

- Clean UI for busy work: Watchlists, price alerts, currency toggles, and quick filters save a ton of time. If I’m checking 20+ names before Asia opens, CMC keeps it organized.

- Exchange rankings that aren’t fluff: The blend of liquidity, traffic, and pair-level data is useful for filtering out venues I don’t want to touch. I care less about headline “24h volume” and more about where deep, tradable books exist—CMC makes that visible fast.

- API and app access: The API is widely supported by bots, spreadsheets, and portfolio tools. The mobile app is good enough for quick checks and alerts when I’m away from the desk.

Real example: during the USDC de-peg scare in March 2023, prices swung wildly across venues. CMC’s pair tables made it easy to see which exchanges had the most stable books and where spreads were widest—useful for deciding whether to hedge or wait.

Where CoinMarketCap can feel limited

CMC isn’t built to be everything. When I’m making decisions that depend on deep on-chain or protocol-level data, I need other tools. Here’s where I hit the edges:

- On-chain analytics: No wallet flow tracking, holder concentration charts, or entity labeling. If I’m worried about a whale moving tokens to an exchange, I won’t catch it on CMC.

- Granular DEX liquidity: CMC lists pairs and volumes, but it won’t show Uniswap v3 liquidity distribution, live pool depth by price range, or MEV risk signals. For memecoins or fresh pools, that detail matters.

- Token unlock calendars: You’ll get supply stats, but not the unlock timelines I need to gauge sell pressure. When FDV is huge and circulating supply is tiny, the unlock path is everything.

- Research and fundamentals: Profiles are helpful, but they’re not deep-dive reports. If I need revenues, fee splits, treasury runways, or governance context, I’m going elsewhere.

One more reason to look beyond headline numbers: independent analyses over the years (from outfits like Bitwise, Forbes, and multiple market data firms) have shown that reported volumes on smaller venues can be inflated. That’s why I treat CMC’s exchange score and pair-level liquidity as starting points, not a final verdict.

Good complements to CoinMarketCap

I think of CMC as “macro map + fast checks.” Then I plug gaps with specialized tools:

- Cross-checking prices and listings: CoinGecko. Different data pipelines and methodologies help catch anomalies. If the price or market cap looks off on one site, I compare.

- Serious charting and alerts: TradingView. Yes, CMC charts are fine for quick glances, but when I’m working with multi-timeframe setups, alerts on custom indicators, or comparative overlays, I switch to TV.

- DeFi and chain flows: DeFiLlama. It shows TVL by chain and protocol, stablecoin flows, and funding trends—perfect to validate if a narrative actually has liquidity moving behind it.

- Tokenomics and unlocks: TokenUnlocks or similar trackers. I want exact cliffs, linear schedules, and who gets what. If 80% of supply is still locked, the unlock calendar is my risk map.

- Deep research: Messari (and similar research shops). For governance, revenue models, addressable markets, and smart summaries, nothing beats a structured report.

- DEX trading specifics: DEXTools, GeckoTerminal, or Birdeye (chain-specific). For brand-new or thinly traded tokens, I need pool depth, top holders, and recent swap activity—this is where I get it.

Example workflow: I spot a new mid-cap on CMC that’s pumping. I confirm contracts and top pairs on CMC, then I hop to DeFiLlama to see if TVL or stablecoin inflows back the move. If it’s a DEX-heavy token, I pull up Birdeye/DEXTools to check pool depth and whether a single wallet is driving buys. If unlocks are near, I check the calendar; if fundamentals matter, I scan Messari for a profile.

Rule of thumb: If the story is “price up,” I want to see “liquidity up” and “credible venues” behind it. If those aren’t moving, I assume it’s noise until proven otherwise.

My quick checklist before I act on CMC data

This is the short list I run through when something catches my eye:

- Verify the contract: Click through to the explorer. Match the contract with the project’s official site and socials. No verified contract, no trade.

- Check top pairs and depth: Are the leading pairs on reputable exchanges? Look at order book depth or pool liquidity near mid-price. If $10k moves the price 5%, that’s a red flag.

- Compare prices across 2–3 reputable venues: If spreads are wide or a single venue sets the price, I pause. Thin markets are traps.

- Look at supply schedule: Circulating supply vs FDV, upcoming unlocks, emissions. If FDV is massive with only 5–10% circulating, I assume gravity will kick in unless growth is exceptional.

- Scan official links and socials: Real site, active GitHub or dev updates, consistent branding. If the Telegram is hyped but the docs are empty, it’s a no.

- Sanity-check the narrative elsewhere: If DeFiLlama shows no TVL growth, TradingView shows a straight-line pump, and DEX analytics show a single wallet driving volume, I treat the move as short-lived.

Want quick answers about accuracy, update frequency, listing costs, and that Pi [IOU] confusion? I’ll tackle those head-on next—along with a couple of myths that refuse to die. What’s the one question you always wanted to ask about CoinMarketCap but didn’t see addressed yet?

FAQ and wrap-up

Is CoinMarketCap a real company?

Yes. CoinMarketCap was founded in 2013 by Brandon Chez and was acquired by Binance in 2020. It continues to operate as a widely used market data platform with its own team, brand, and methodology. Ownership matters when judging neutrality, so I always treat CMC as a strong source that still benefits from cross-checking.

If you want to see how they structure rankings and feed aggregation, read their official methodology. It’s useful for understanding why certain exchanges, pairs, or supplies look the way they do on site.

How much is 1 Pi on CoinMarketCap?

On CMC you’ll find Pi [IOU], which reflects prices of IOUs traded on a few venues, not the live, redeemable mainnet asset people earn inside the Pi app. IOU markets can detach wildly from what a future mainnet coin could trade at. If you see a number there, treat it as speculative and separate from the in-app balance most users refer to as “Pi.”

Bottom line: don’t use Pi [IOU] as the “official” price of Pi. It’s a side market with its own risks and no guaranteed convertibility to the mainnet coin.

How much does it cost to list a coin on CMC?

Standard submissions are free. If anyone pitches a “guaranteed fast-track listing” for a fee, that’s not an official CMC service. The only legit route is through CMC’s own submission portal and support docs. Typical requirements include a verifiable contract address, active markets, real liquidity, accurate supply data, and matching official links.

Quick sanity checks if you’re a project:

- Submit only via links on coinmarketcap.com or their support center.

- Never pay third-party brokers for “listings.” If they’re real, they won’t need your money.

- Keep explorers, docs, and socials consistent and verified—this speeds up reviews.

Is CMC accurate and how often is it updated?

Prices and volumes are updated frequently (near real-time) based on exchange APIs. But not all data moves at the same speed:

- Price/volume: fast, but depends on each exchange feed.

- Circulating supply: slower; often needs manual confirmations and project disclosures.

- Exchange/market quality metrics: blended and updated less frequently than prices.

It’s smart to validate with an explorer and a second aggregator. The industry learned hard lessons here: the 2019 Bitwise report showed how easy it was for some venues to inflate volumes. CMC has introduced more signals over time (exchange scoring, liquidity metrics), but you’ll still want to judge pair-by-pair quality yourself.

Market cap vs FDV — quick refresher

Market cap is price times circulating supply. FDV is price times total supply (or max supply). If only 10% of tokens are circulating and the token trades at $X, FDV is roughly 10× market cap. That number can be wildly misleading when big unlocks are coming. Always check vesting schedules and emissions before you assume FDV reflects a “fair” future value.

Why do prices differ across exchanges?

Crypto is fragmented. Different exchanges, base pairs, fees, funding rates, and latency create gaps—especially during fast moves or in thin markets. For large caps, arbitrage tightens spreads quickly. For smaller caps, spreads can stick around.

This isn’t just theory. Research has documented persistent cross-exchange differences, particularly in altcoins and during volatility. See Makarov & Schoar’s study, Trading and Arbitrage in Cryptocurrency Markets, and ongoing Kaiko research on liquidity and market structure.

What I do in practice:

- Anchor on the deepest, most reputable trading pairs.

- Compare the top 2–3 venues for the same pair (same base currency).

- Check slippage and order book depth before assuming you can get “the CMC price.”

Does Binance ownership affect listings or rankings?

CMC says it operates independently. You’ll see plenty of assets listed and ranked highly that aren’t on Binance. Still, ownership is a factor worth being aware of. The safest approach is straightforward: read CMC’s methodology, compare with a second source (CoinGecko, DeFiLlama, Messari), and let liquidity and contract verification lead your decisions.

Rule of thumb: Trust good data sources—but verify every contract address, top trading pair, and supply number before you risk capital.

Wrap-up

Used right, CoinMarketCap is a reliable daily dashboard: fast watchlists, alerts, clean market views, and broad exchange coverage. The edge comes from how you read it. Verify contracts from official links. Prioritize deep, reputable pairs. Understand unlocks and emissions before leaning on FDV. Cross-check anything that can be self-reported.

If you want the resource I keep pinned for quick checks, it’s here: cryptolinks.com. Bookmark it, set your alerts, and stay picky with your data. That alone filters out a lot of avoidable mistakes.