Buybitcoinworldwide Review

Buybitcoinworldwide

www.buybitcoinworldwide.com

BuyBitcoinWorldwide Review Guide: Fastest, Safest Way to Pick a Bitcoin Exchange Today

Staring at a dozen exchange options and wondering which one won’t overcharge you, block your payment, or waste your time?

If you’re trying to buy Bitcoin for the first time—or you just want a smarter way to pick where to buy—this guide is for you. I’ll show you how to use BuyBitcoinWorldwide to quickly match the right exchange to your country, payment method, and budget. You’ll leave with a simple plan to avoid hidden fees, make your first purchase, and know exactly how to cash out when you need to.

The real problems people hit when trying to buy Bitcoin

Buying Bitcoin shouldn’t feel like homework, yet most people hit the same walls:

- Analysis paralysis: Too many exchanges and “top 10” lists—most of them look the same, and many are just ads with a ranking slapped on.

- Hidden costs: You see a “0% fee” splash, then get clipped by a 0.5–1.5% spread, a card processing fee, and a network withdrawal fee you didn’t plan for. A card buy can easily run 2–5% in fees, while a bank transfer might land closer to 0–1.5% depending on your region.

- Regional roadblocks: What works in the U.S. (ACH) might not work in the EU (SEPA) or the UK (Faster Payments), and card acceptance varies by bank. Some countries rely more on P2P or vouchers; others support instant bank rails.

- KYC speed and limits: You upload your ID and wait. Some platforms verify in minutes; others take days. Limits can be tiny until you complete full verification.

- Payment method traps: Cards are fast but pricey, bank transfers are cheaper but slower, PayPal is hit-or-miss by region, and ATMs are convenient but often charge 7–20% all-in.

- “Start small” confusion: People ask, “Is $100 even worth it?” Then they overcomplicate it and do nothing.

- No exit plan: Buying is easy. Selling back to your bank is where many get stuck—especially if they never checked withdrawal options upfront.

Real example: I’ve seen readers in the U.S. pay 3.99% on a card buy when the same platform offered free ACH deposits with a short wait. In the EU, SEPA transfers often keep fees low, but you need to confirm whether your bank supports crypto exchanges—some don’t. In regions with limited banking support, P2P can be the right move, but you’ll want escrow, solid reputation systems, and clear fee visibility.

Pro tip: Watch the spread in addition to the “fee.” If Bitcoin’s market price is $60,000 and the quoted buy price is $60,600, that’s a 1% spread before the platform’s fee even kicks in.

My promise: a practical, no-nonsense walkthrough

I’ll keep this simple. I’ll show what BuyBitcoinWorldwide does well, what it misses, and how to use it step-by-step to:

- Pick an exchange that actually works in your country with your preferred payment method.

- Understand the true cost of buying (fees + spread + network fees) before you click “buy.”

- Buy a reasonable first amount without second-guessing timing.

- Withdraw to a wallet you control, then know how to cash out later.

No hype, no guesswork—just a clear path that helps you avoid the common traps I see every week.

What you’ll learn and who this is for

This guide is for beginners, casual investors, and anyone comparing payment options like cards, bank transfers, PayPal, cash, or ATMs. Here’s what you’ll get:

- Fast exchange matching: Use country and payment filters to surface legit options that actually accept your bank or card.

- Fee clarity: Understand typical ranges and how to check final costs before you buy.

- Simple starting plan: Why $100 is a perfectly fine first step, and how a small weekly or monthly buy can reduce timing stress.

- Live-price shortcuts: Quick tools to estimate how much BTC you’ll get for $100 or $1,000—so you’re never guessing.

- Cash-out confidence: The exact places to confirm sell/withdrawal options before you deposit a single dollar.

Ready to see how BuyBitcoinWorldwide actually helps you find the right on-ramp in your country, and why so many first-time buyers start there? In the next part, I’ll break down what the site is, how it works behind the scenes, and why people trust it—plus where you still need to be careful. Curious about who runs it and how they make money? You’ll want to read on.

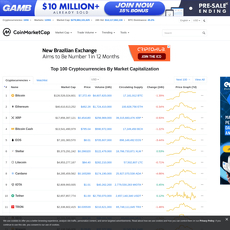

What is BuyBitcoinWorldwide and why people trust it

BuyBitcoinWorldwide is a plain-English guide that helps you answer one question fast: “Where can I safely buy Bitcoin in my country with the payment method I prefer?” It’s not an exchange. It’s a comparison and education site that cuts through the noise and routes you to legit on-ramps matched to your location, bank/card options, and risk tolerance.

Why do beginners keep landing there? Because it solves a stressful problem quickly. You get straight-to-the-point lists of exchanges by country and payment method, high-level fee snapshots, and practical explainers on wallets and verification—without asking you to become a pro trader.

“Trust is built in drops and lost in buckets.” In a market full of sponsored hype, simple transparency feels like a deep breath.

There’s another reason trust sticks: the site has been around for years, and it’s continually updated. Newcomers don’t want jargon, they want clarity—what works in my country, what it costs, and what to do next. That’s exactly the gap this site fills.

One last point on trust. Choice overload is real. In classic consumer research, too many options lead to more abandonment and regret. When you’re staring at dozens of exchanges, a well-structured shortlist reduces decision fatigue and avoids impulse mistakes. That’s the quiet power here—fewer, better choices, explained in normal language.

Who runs it and how it makes money

BuyBitcoinWorldwide was founded by Bitcoin educator Jordan Tuwiner. The site earns primarily through affiliate links, which means if you click through to an exchange and sign up, they may receive a commission. This is disclosed on the site, and it’s important for you to know because incentives exist in every “best of” list in this industry—transparency helps you calibrate trust.

- What that means for you: treat every recommendation as a starting point. Then confirm fees and limits directly on the exchange before you buy.

- What I look for on any affiliate site: clear disclosures, pros and cons listed (not just cheerleading), up-to-date country/payment coverage, and links to independent help articles (wallets, security, taxes) rather than only “sign up” buttons.

- Good sign here: the content doesn’t pretend to be an exchange, it’s a guide—education first, signup second.

Who it’s best for (and who it’s not)

- Great for: first-time buyers, casual investors, and anyone comparing payment options like credit/debit card, bank transfer, PayPal, P2P, or ATMs. If you want a no-BS shortlist that works in your country and you value straightforward wallet and security basics, you’ll feel at home.

- Not ideal for: pro traders who need advanced order types, derivatives, or API trading; altcoin hunters who want deep research into low-cap tokens; or anyone expecting in-depth exchange analytics like order book depth and maker/taker spread charts.

Real-world examples that fit perfectly:

- Canada: You want to use Interac e-Transfer and avoid high card fees. The site points you to Canadian-friendly exchanges supporting bank rails and shows typical verification times.

- Germany: You prefer SEPA transfers for lower fees. You’ll get EU-focused options and a heads-up on limits for new accounts.

- US (PayPal): You’d rather buy with PayPal for speed. The PayPal buying guide outlines the trade-offs—higher fees and potential withdrawal restrictions—so you know what you’re signing up for.

What you’ll actually find when you land there

You’ll see a clean set of hubs that map to how people really think when they’re buying Bitcoin for the first time. A quick scan:

- Exchange finder by country: A country-first approach to surface platforms you can actually use, with notes on identity verification and limits. Start from the homepage here: buybitcoinworldwide.com

- Payment method guides: Side-by-side pros/cons, typical fees, speed, and gotchas for each funding route. Try the focused pages like Credit/Debit Card and PayPal.

- Fee explainers: Plain-English breakdowns of spreads, deposit/withdrawal fees, and network fees—so you’re not surprised at checkout.

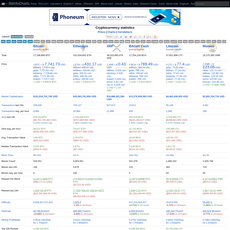

- Price and converter tools: Handy widgets to estimate how much BTC you’ll receive for a set budget, and unit converters to make sense of BTC, mBTC, and sats.

- Wallet basics: Simple, practical intros to hot vs cold wallets, seed phrases, and why withdrawing to your own wallet matters for security and control. A good starting point is the wallet hub from the homepage.

- Country pages with local nuance: Bank rails, ID rules, and common payment brands vary by region. These pages help you avoid methods that won’t work where you live.

In short, the site earns trust by being useful in the first five minutes: it trims choices to the ones that fit your reality, explains trade-offs, and nudges you toward safe storage. That’s exactly the kind of guidance that keeps beginners from burning money on avoidable fees or sketchy platforms.

Want to see how to turn that trust into an actual purchase—step by step, from picking an exchange to getting BTC in your own wallet? Keep reading, because next I’m going to map the exact clicks I’d make and the filters I’d use to go from “curious” to “owning Bitcoin” without guesswork. Ready to see the tools in action?

Core features: what you can actually do on BuyBitcoinWorldwide

You don’t need 20 tabs and a headache to buy your first sats. The whole point of BuyBitcoinWorldwide is to cut the noise and put the right on-ramp in front of you, based on where you live and how you want to pay. Think of it as a decision tool: choose your country, choose your payment method, and in seconds you’ll see legit exchanges with the fees, limits, and time-to-buy you should expect.

“Not your keys, not your coins.”

That line guides every feature you’ll see—find a place to buy, understand the true cost, and get your Bitcoin to a wallet you control.

Exchange finder: by country and payment method

This is the heart of the site. The exchange finder lets you filter by:

- Country: See platforms that legally serve your region (US, UK, EU, Brazil, India, etc.).

- Payment method: Bank transfer (ACH/SEPA/Faster Payments), card, PayPal, P2P, cash/ATMs, and more.

- KYC rules and verification: Know what ID you’ll need and how fast you’ll get approved.

- Limits: Daily buy limits, instant purchase caps, and withdrawal thresholds.

- Local rails: Support for things like PIX (Brazil), UPI (India), or Interac e-Transfer (Canada).

Here’s how that plays out in real life:

- United States + ACH bank transfer: The finder highlights major on-ramps that support Plaid-linked accounts with low fees and predictable limits. You’ll typically see instant buy limits for small amounts, with higher limits once KYC is complete.

- Brazil + PIX: You’ll surface exchanges and P2P desks that accept instant PIX transfers—fast funding, clear BRL pricing, and transparent withdrawal rules to your bank or wallet.

- EU + SEPA Instant: You’ll spot platforms with low EUR fees and quick SEPA settlements, often same-day. Great if you’re fee-sensitive and willing to wait a few hours over using a card.

- Emerging markets + P2P: If card rails are unreliable or banks block crypto, the finder shows P2P marketplaces that match you with verified sellers using your local bank or wallet app—plus the safety tools to use.

It’s not about a single “best” exchange. It’s about the best fit for your rails, verification comfort, and timeline.

Fee, speed, and limit snapshots

Good decisions come from knowing your true cost. BuyBitcoinWorldwide shows:

- Deposit method fees: Bank transfers are often free or close to it; cards are usually the most expensive. In traditional payments, card processing alone runs around 2.9% + a fixed fee, which is why exchanges often charge 3–5% on card buys.

- Trading fees: Typical retail buy/sell fees range from about 0.1% to 1.49%, depending on the platform and your volume.

- Withdrawal fees: Some exchanges charge a flat crypto withdrawal fee; others pass through network fees at cost. You’ll see which is which before you choose.

- Verification times: Automated KYC can be minutes; manual reviews can stretch to 24–48 hours during busy periods. The snapshots set expectations so you’re not stuck when you need speed.

- Minimums and daily limits: Some platforms let you start with $10–$20. Others enforce higher first-time minimums, or limit instant buys until KYC tiers increase.

Reality check on “fast”: card buys are near-instant but pricey; bank transfers are cheaper but can take a few hours or a business day. Bitcoin ATMs are instant cash-to-BTC, but fees can be high—often in the 6–12% range. The snapshots help you choose with eyes open.

Price and converter tools for quick USD-to-BTC estimates

Need to know how much BTC you’ll get for $100 before you press buy? The live converter on BuyBitcoinWorldwide gives you an instant estimate based on the current market price.

- Type your amount and currency: USD, EUR, GBP, BRL—done.

- See live BTC equivalent: Great for quick planning, DCA, or sanity checks.

- Pro tip: Add a small buffer for fees and spreads. If you’re paying with a card, assume a few percent less BTC than the pure price implies.

Example for planning: if BTC were at $58,000, then $250 would be about 0.00431 BTC before fees. Simple, fast, and realistic enough to avoid guessing.

Beginner guides: KYC, security, wallets, withdrawing to self-custody

The educational side keeps you from making the classic mistakes:

- KYC basics: What documents you’ll need, how to avoid verification delays (clear photos, matching addresses), and what to expect on higher tiers.

- Security must-dos: Turn on 2FA (authenticator app, not SMS), set strong unique passwords, and store backup codes offline.

- Wallets explained: Software vs hardware, hot vs cold. You’ll see when it makes sense to upgrade from a mobile wallet to a hardware wallet.

- Withdraw to self-custody: Step-by-step: generate a receive address, send a small test, then move the rest. Confirm on-chain and record your txid.

I always nudge people to try a small test withdrawal first. It builds confidence and protects you if you mistype an address or pick the wrong network. You’ll thank yourself later.

Payment method pages with real-world pros and cons

Each payment option gets its own page with clear trade-offs, common pitfalls, and best practices.

- Bank transfer (ACH, SEPA, Faster Payments, PIX, UPI)

- Pros: Usually the lowest fees, higher limits, strong paper trail for taxes.

- Cons: Slower than cards; banks sometimes flag first crypto transfers.

- Best for: Anyone optimizing for cost over speed.

- Credit/Debit card

- Pros: Fast, familiar, often instant access to BTC.

- Cons: Highest fees; some banks block crypto card charges; interest risk on credit.

- Best for: Small, urgent buys or first-time tests.

- PayPal/Apple Pay/Google Pay

- Pros: Convenient, fast, widely adopted.

- Cons: Available only on certain exchanges and in specific countries; fees vary.

- Best for: Convenience-focused buyers where supported.

- P2P marketplaces

- Pros: Broad local payment options, can work around strict banking rails.

- Cons: Requires escrow and seller-rating discipline; watch for chargeback-prone methods.

- Best for: Regions with limited on-ramps or for buyers wanting local rails.

- Cash and Bitcoin ATMs

- Pros: Cash-based, quick, minimal setup.

- Cons: Higher fees (often 6–12%); limits can be tight; ID may still be required.

- Best for: Cash users, travelers, or privacy-minded buyers accepting the premium.

Industry surveys often show that first-time buyers default to convenience (cards, PayPal), then shift to cheaper rails (bank transfer, SEPA, PIX) once they understand fees. These pages help you skip the “burn money first, optimize later” learning curve.

Now that you know the tools and where to click, want me to turn this into a simple plan you can follow—start to finish—so your first buy is fast, safe, and in your own wallet? I’ll show you exactly how I’d do it next.

Step-by-step: how I’d use BuyBitcoinWorldwide to buy your first BTC safely

Set your goal and budget

I always start simple and specific. Pick an amount you’re cool with emotionally and financially. For most beginners, that’s around $100. Decide how you’ll approach it:

- Starting amount: $100 to test the process without stress.

- Timeline: Think in years, not days. Bitcoin is volatile.

- Habit: Set up dollar-cost averaging (DCA) like $25 every week or month so you don’t overthink timing.

- Custody plan: Exchange for buying, your own wallet for holding.

If you’re nervous about timing, DCA is your friend. It helps smooth out the ups and downs by spreading buys over time. You can read the basics of DCA on Investopedia if you want a quick primer.

“The best time to plant a tree was 20 years ago. The second best time is now.”

Compare and choose an exchange

Now pull up BuyBitcoinWorldwide. This is where you cut through noise fast:

- Filter by country: Choose your location so you only see platforms that actually serve you.

- Choose payment type: Bank transfer, card, PayPal, or P2P. Each has different fees/speeds.

- Scan fees and limits: Look at deposit fee, trading fee, and BTC withdrawal fee. Don’t forget the Bitcoin network fee.

- Check verification (KYC): What ID is needed and how long does it usually take? Some are minutes; some take a day or two during peak times.

- Withdrawal options: Can you withdraw BTC right away? Any holding periods? Daily limits?

Example mental math for a $100 buy:

- Bank transfer: Often 0–1% deposit + ~0.1–0.5% trade + BTC withdrawal + network fee.

- Card: Often 2.5–4% deposit + ~0.5–1.5% trade. Faster, but you pay for speed.

Always click through to the exchange and confirm fees on their own fee page before you move money. Also peek for recent user feedback and whether they publish any proof-of-reserves or transparency statements—extra peace of mind.

Create account, pass KYC, enable 2FA

Once you’ve chosen an exchange from BBW’s list:

- Use a strong, unique email and password: A password manager is worth it.

- Enable 2FA with an authenticator app (not SMS): Save backup codes offline.

- Complete KYC: Clear, well-lit photos of your ID. Use the same address as your bank to avoid delays.

Tip: Many exchanges let you set an anti-phishing code. Turn it on so official emails include your code and are harder to spoof.

Deposit funds (bank vs card: fees and speed)

Time vs cost is the trade-off:

- Bank transfer: Cheaper, usually arrives in 1–3 business days. Good for DCA and larger amounts.

- Card (debit/credit): Instant, but higher fees. Some banks treat crypto card buys as cash advances—check your bank first. Debit is safer than credit here.

For your first $100, a card is fine if you want the instant buy experience and don’t mind paying a bit more. If you can wait and want to keep more satoshis, use bank transfer.

Buy BTC (market order for simplicity)

Keep the first buy simple. Find the “Buy” or “Convert” button:

- Choose Bitcoin (BTC).

- Enter $100 (or your local currency amount).

- Market order: Executes instantly at the current price. Clean and simple for small buys.

Some platforms have an “Instant Buy” with a slightly higher fee. If you can access the regular spot market, you’ll usually pay less. Either way, confirm the total cost before clicking “Buy.”

Withdraw to your wallet (self-custody is the goal)

“Not your keys, not your coins.”

Exchanges are on-ramps—not your long-term vault. Move your BTC to a wallet you control:

- Pick a wallet: Software wallets (e.g., Sparrow, BlueWallet) are free and solid for small amounts; hardware wallets (e.g., Trezor, Ledger) are best for larger holdings.

- Back up your seed phrase: Write it on paper or metal. Never screenshot. Never store it in cloud notes.

- Find your receive address: It should start with bc1, 3, or 1 for Bitcoin. Make sure you’re withdrawing on the Bitcoin network (not ERC-20, not BEP-20).

- Send a test first: Withdraw a small amount (like $5–$10). When it arrives, send the rest.

- Confirm: Check the first and last characters of the address before sending. Patience—on-chain confirmations can take minutes to an hour depending on network fees.

Pro tip: Many exchanges let you label addresses. Name your wallet address (“My Cold Wallet”) so future withdrawals are less nerve-racking.

Keep a simple record for taxes and future cash-out

Don’t overthink this. Keep a tiny log so tax time and off-ramps are easy:

- Date/time

- Fiat amount and currency (e.g., $100 USD)

- BTC received (e.g., 0.00xxxx BTC)

- Fees (deposit, trade, withdrawal, network)

- TXID for your on-chain withdrawal

- Wallet label you sent to

Even a basic spreadsheet or a note in your password manager works. It helps with taxes and proves the source of funds if a bank ever asks when you cash out later.

That’s your first clean BTC purchase from start to finish—no panic, no guesswork. But here’s what everyone asks right after: “So how much BTC do I actually get for $100 right now, and what do the fees knock off?” Want real numbers you can check any minute? I’ll show you next, with quick live-price examples and a simple way to track your gains without obsessing every hour.

Money questions everyone asks (with quick, practical answers)

“The market is a device for transferring money from the impatient to the patient.” — Warren Buffett

When you’re staring at the Bitcoin price, it’s easy to freeze. So let’s strip it down to the essentials you actually need today: how much BTC you get for $100 or $1,000, how to cash out to real money, what a sensible first buy looks like, and the simple records that keep tax season painless.

How much would $100 in Bitcoin be worth today?

The fastest way to check is the live converter on BuyBitcoinWorldwide. Open the site, tap Price/Converter, enter $100, and it shows BTC in real time. If the price is moving, that widget updates within seconds.

If you want a quick mental shortcut:

- BTC at $50,000 → $100 ≈ 0.002000 BTC

- BTC at $75,000 → $100 ≈ 0.001333 BTC

- BTC at $100,000 → $100 ≈ 0.001000 BTC

That’s the clean math. Now reality check it for fees:

- Bank transfer: often 0–1% deposit + 0.1–0.5% trading fee

- Card: common 2–4% total fees (card + spread + trading)

- Spread: the hidden cost between “mid-market” and the price you pay (0.1–1% typical)

Example at a hypothetical BTC price of $75,000 with a low-fee exchange (0% deposit, 0.5% trade): $100 × (1 − 0.005) = $99.50 → ≈ 0.001326 BTC. That tiny 0.5% fee shaves off a sliver of BTC. Card purchases can shave off more.

How much is $1,000 in Bitcoin right now?

Same move: use the BuyBitcoinWorldwide converter for the live number, then sanity-check fees. Here’s a realistic worked example to set expectations.

Let’s assume:

- BTC price: $64,000

- Bank deposit fee: 1%

- Trading fee: 0.5%

$1,000 − 1% = $990 available. Trade at 0.5% → $990 × (1 − 0.005) = $985.05 going into BTC.

$985.05 ÷ $64,000 ≈ 0.01539 BTC.

If you use a card with ~3% total costs instead, you might land closer to ~0.01505 BTC. It doesn’t sound huge, but those small differences add up when you DCA over months.

Can you cash out Bitcoin for real money? Yes—here’s what to expect

You’ve got multiple off-ramps. Pick the one that balances speed, fees, and convenience for your situation:

- Centralized exchanges (Coinbase, Kraken, Bitstamp)

- How: Sell BTC → withdraw to bank (ACH/SEPA/wire)

- Fees: Trading 0.1–0.5% + withdrawal fee (usually low)

- Speed: Same day to a few days depending on your region - P2P marketplaces (Binance P2P, Paxful alternatives)

- How: Match with a buyer, receive bank transfer or local method

- Fees: Often low, but price can include a premium; beware scams

- Speed: Minutes to hours, depending on counterparties - Bitcoin ATMs

- How: Send BTC, get cash from the machine

- Fees: High (commonly 7–15%+), but fast and convenient

- Speed: Usually within minutes after network confirmations - Crypto debit cards

- How: Spend or withdraw cash at ATMs as your BTC is converted on the fly

- Fees: FX + card fees + spread; read the card’s fee page carefully

- Speed: Instant spend, ATM cash depends on withdrawal limits

Quick tip: if you plan to cash out larger sums, test the full flow with a small amount first. Limits and bank approval quirks have a way of showing up at the worst time.

How much should a beginner buy?

I like a simple plan: start with $100 to learn the motions (KYC, buy, self-custody, withdraw), then set a small recurring buy like $25/week or $100/month if it fits your budget.

Why this works:

- Builds the habit: you learn without risking too much

- Smooths volatility: dollar-cost averaging (DCA) reduces timing anxiety

- Behavior beats brilliance: consistent action > perfect entry

For the math geeks: a well-known Vanguard study found that lump-sum investing historically outperformed DCA about two-thirds of the time in traditional markets—but DCA reduces downside regret and keeps beginners from overthinking. In a volatile asset like BTC, that reduction in regret is pure gold.

Taxes and records: keep it simple, stay sane

I’m not your tax advisor, but the basics are consistent across most regions: selling BTC, swapping BTC for another coin, or spending BTC is usually a taxable event. Long-term holding often gets better rates than short-term.

Keep a lightweight log from day one:

- Date/time of each buy/sell/transfer

- Amount in BTC and your local currency

- Fees paid (deposit, trading, withdrawal)

- Where (exchange/wallet name) and TX IDs

- Purpose (buy, sell, move to self-custody)

Two easy wins:

- Export CSVs from your exchange after each month or quarter (don’t wait until April)

- Pick a cost-basis method and stick with it (FIFO is common; some regions allow specific-ID)

Tools like Koinly, CoinTracker, or Accointing can automate a lot of this, but a simple spreadsheet plus exchange CSVs works fine for small portfolios.

One last emotional note: panic-buying and panic-selling are tax-inefficient. A calm DCA plan with clean records keeps both your nerves and your tax bill tidier.

Want to know the fee traps most beginners miss—and how to sanity-check them before you hit “buy”? That’s exactly what I’ll break down next.

Trust, safety, and gotchas: what BBW does well (and where to be careful)

What I like

Here’s what works: quick, clean comparisons that actually answer “where can I buy today, from my country, with my payment method?” The filters save time, the pages are written in plain language, and the links take you to real on-ramps and wallets that beginners recognize. When I sanity-check a couple of choices for a country + payment combo, I usually land on a shortlist I’d feel comfortable recommending to a new buyer.

I also appreciate the snapshots for fees, limits, and verification time. They help set expectations. If you’re planning to buy $100 using a card on a Sunday evening, you can quickly see whether that’ll clear fast (card) or cheaper (bank transfer) and how long KYC typically takes. It’s the kind of “so… what happens next?” context most lists skip.

Reality check: Good comparison sites reduce options overwhelm. They don’t remove your responsibility to verify the final numbers on the platform you pick.

What to double-check yourself

Some things you must still confirm on the exchange before you fund anything:

- Instant buy vs. “pro” trade costs: Many platforms show lower fees on their advanced order book and higher “instant buy” spreads for the beginner flow. Example: it’s common to see a 0.4%–0.6% maker/taker schedule on the advanced interface, but 1.5%–3.99% effective cost when using card-based instant buys (spread + fee). Always peek at both paths.

- Spread + fees, not just fees: The number on the fee page isn’t the full story. If BTC is $60,000 on the ticker but your instant quote is $60,600, that 1% spread is your real cost, before you even see a line-item fee.

- Withdrawal costs and network congestion: Exchange withdrawal fees can be fixed (e.g., 0.0003 BTC) or dynamic. When the Bitcoin mempool is jammed (think inscription/halving hype), network fees have spiked above $20–$50 in the past. If you’re only buying $100, you may want to bundle a few buys before withdrawing, or use an exchange that supports cheaper options like Lightning for small amounts.

- Verification tiers and limits: “Buy up to X” often assumes you’ve completed the enhanced KYC tier. If you need to move more than a few thousand in or out, make sure your ID, source-of-funds, and bank details are accepted in your country before you wire money.

- Payment method risk: Cards and PayPal are fast but reversible; exchanges price in that fraud risk. Bank transfers are cheaper but slower and sometimes get flagged by banks with conservative crypto policies.

- Regional rules change fast: Marketing rules in the UK, exchange licensing across the EU, or banking policies in places like India and Nigeria can shift availability week to week. If you suddenly see a “not available in your region” banner, that’s usually why.

One more safety nuance: proof-of-reserves. It’s a good signal when an exchange posts on-chain addresses and a Merkle-tree audit, but that alone doesn’t guarantee solvency. The gold standard is proof of assets + proof of liabilities with an independent attestation. If an exchange only boasts “we hold X BTC on-chain” without showing liabilities, take it as a partial transparency step, not a full bill of health.

Why I’m strict about this: Chainalysis’ 2024 Crypto Crime report notes illicit volumes fell from 2022 highs, but scams and exchange risk still do real damage each year. Good hygiene—verifying fees, limits, and withdrawal functionality—matters more than ever.

Affiliate disclosures and why that doesn’t replace your due diligence

Yes, some of the options you’ll see pay referral fees. That’s normal across finance comparison sites. What matters is twofold:

- Transparency: When the site clearly marks its business model, you can adjust for bias.

- Your verification: Click through and read the fee schedule, minimums, withdrawal rules, and the latest support notes. If anything’s fuzzy, ask support before sending funds.

A referral link never justifies ignoring a red flag. If you can’t find a straightforward fee page or the platform won’t show you a clear BTC network withdrawal option, pick another exchange. There are plenty.

Smart safety habits I recommend (beyond the pages you’ll read)

- Create a “crypto-only” email and strong unique password: Data leaks happen. A separate inbox and a password manager cut your risk.

- Turn on app-based 2FA (not SMS): Use an authenticator app or a hardware key. SIM swaps are still a thing.

- Whitelist withdrawal addresses and use a small test send: Send $5–$20 first, confirm it lands, then move the rest. It takes minutes and can save you a headache.

- Self-custody when you can: Exchanges are for buying/selling. Wallets are for holding. If you’re keeping a stack, move it to your own wallet with a backed-up seed phrase.

Common gotchas I see beginners hit (with quick fixes)

- Sticker shock at the ATM: Bitcoin ATMs are convenient, but total costs of 7%–15% (spread + fees) are typical. They make sense for cash-heavy situations or no-bank users; otherwise, bank transfers on reputable exchanges are far cheaper.

- “Deposit fee is free”… but withdrawal isn’t: Zero-fee deposits from bank transfer can be offset by withdrawal/network fees. Always calculate your round trip if you plan to cash out later.

- Locked funds due to compliance checks: If your first buy triggers a review, support might hold withdrawals until they verify your documents. Keep your first purchase small and time-sensitive funds off exchanges.

- Card chargebacks and account bans: Buying with someone else’s card or running multiple accounts can get you shut down. Stay squeaky clean; crypto compliance is strict.

Alternatives worth knowing (so you’re never stuck)

- Go direct to a reputable exchange: If you already know who you want, go straight to their fee page and support center to confirm regional access.

- Non-custodial P2P: Platforms like order-book P2P can suit bank-to-bank trades with escrow. They require more care: check trader ratings, use platform escrow, and never move off-platform chats.

- Lightning-first options for small buys: If your goal is to move tiny amounts or pay instantly, look for exchanges and wallets that support Lightning withdrawals. It can cut costs dramatically for sub-$100 moves.

- ATM networks with upfront pricing: If you must use an ATM, pick operators that show the fee and exchange rate before you confirm. Walk away if that info isn’t crystal clear.

One last thought before we wrap this up: Do you know the fastest way to sanity-check an exchange in 60 seconds and avoid most hidden costs? I’ll show you the exact checklist I use next—short, punchy, and designed for your very first test buy.

Final verdict, quick checklist, and FAQ wrap-up

My verdict in one paragraph

BuyBitcoinWorldwide is a smart, beginner-friendly way to find a legit exchange fast without wading through hype or sketchy “best of” lists. Use it to compare by country and payment method, then confirm fees and limits on the exchange’s own page. Start with a small test buy, withdraw to your own wallet, and only scale once you’ve proven you can deposit, buy, and withdraw smoothly. Simple beats fancy here.

Rule of thumb: buy small, test withdraw, then scale. That one habit avoids 80% of beginner headaches.

Quick-start checklist

- Open BuyBitcoinWorldwide and select your country + payment method (bank, card, PayPal, P2P, ATM).

- Shortlist 2 exchanges. Open each exchange’s official fee page in a new tab and compare total cost (deposit + trading + withdrawal + network fee).

- Create your account on the cheaper one. Complete KYC. Enable 2FA with an authenticator app (app-based MFA is safer than SMS; see CISA’s MFA guidance).

- Deposit a small amount (for example: $20–$100) and place a simple market buy for BTC.

- Withdraw a tiny amount to your self-custody wallet. Wait for confirmations, save the TXID, and label the transaction. This is your “proof I can exit” test.

- If everything checks out, set a modest DCA plan (e.g., $25/week). DCA reduces timing stress and regret, which is why many beginners stick with it. For context, Vanguard’s research found lump sum often wins on returns, but DCA can be easier on emotions—consistency beats FOMO.

- Keep a simple record of buys, withdrawals, and addresses for taxes and future cash-outs.

When it’s not the right tool

Skip it if you already know the exact pro exchange you want for advanced order types, futures, or niche altcoins. In that case, go straight to a reputable, regulated platform with the features you need and compare its published fees directly. If you’re hunting obscure tokens, use a respected market data site and the project’s official links to avoid fake contract addresses.

FAQ wrap-up

Is BuyBitcoinWorldwide free?

Yes. It’s a guide and comparison site. You pay fees to the exchange you choose, not to BBW.

Is it an exchange?

No. It sends you to exchanges and wallets that fit your country and payment method.

Will I need KYC?

Usually yes for bank/card buys. P2P or ATMs can vary by country and limit. If you want smooth cash-ins and cash-outs to a bank, expect KYC.

How long until I actually get my BTC?

After KYC: card can be minutes, bank transfers often same day to 3 business days, ATMs are instant on-chain. Network congestion can add time.

What fees should I expect?

Rough ranges (these move): bank deposit 0–1.5%, trading 0.1–1%, card 2–5%, P2P varies with spread, plus a blockchain network fee on withdrawal. Always check the exchange’s live fee page before buying.

What wallet should I start with?

A simple, reputable mobile wallet for self-custody works to start. Back up your seed phrase on paper (or steel), offline, and test a small restore. If you plan to hold larger amounts, consider a hardware wallet later.

What if I lose my seed phrase?

Nobody can recover it. Treat that phrase like the keys to your home safe. Store it offline, in two secure locations, never in cloud notes or email.

Is DCA better than buying all at once?

On average, lump sum historically outperforms because markets rise more than they fall—but DCA reduces regret and timing stress, which keeps beginners consistent. See Vanguard’s analysis for perspective; your behavior matters more than perfect timing.

Can I cash out to “real money” later?

Yes. Use the same exchange (sell BTC to your fiat balance, withdraw to bank), a P2P platform with escrow, or a BTC ATM that supports cash-outs. Compare fees and limits first.

What if my bank blocks crypto deposits?

Try a different payment method (e.g., local transfer vs. card), a different regulated exchange, or a bank that supports crypto transactions in your region.

How do I avoid overpaying?

Compare the all-in cost: deposit fee + trading fee + spread + withdrawal/network fee. Do a tiny test buy and withdrawal first, then scale.

Your next 10 minutes

- Open BuyBitcoinWorldwide and shortlist two exchanges that support your country and preferred payment.

- Check each exchange’s official fee and withdrawal pages. Confirm limits and payout methods.

- Create an account on the winner, secure it with an authenticator app, buy $20–$100, and run a test withdrawal to your own wallet.

Bottom line: if you want a clear path from “I’m ready to buy Bitcoin” to “I control my BTC,” BuyBitcoinWorldwide gives you the map. Use it thoughtfully, keep receipts, stick to a steady plan like DCA if it helps you stay consistent, and always self-custody what you plan to hold.