Coinwarz Review

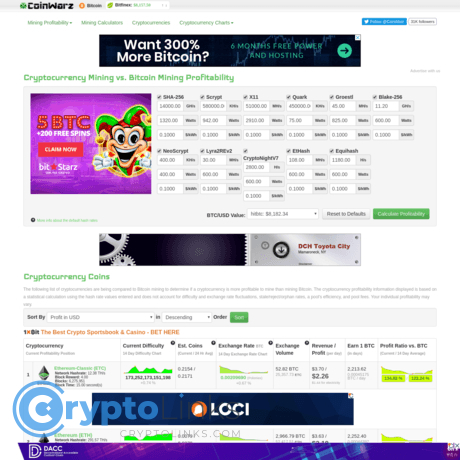

Coinwarz

cryptolinks.com

CoinWarz Review Guide: Everything You Need to Know + FAQ

Thinking about buying new hardware or switching coins, but not sure if CoinWarz will give you numbers you can actually trust?

Here’s the good news: you can use CoinWarz as a fast, no-login mining calculator to sanity-check profitability, compare coins, and spot difficulty trends before you make a move. I use it daily as a quick filter so I don’t waste time—or money—on bad assumptions. I test these tools so you don’t have to, and in this guide I’ll show you exactly how to get real-world results from CoinWarz without overcomplicating things.

Quick checks, realistic inputs, and smart cross-checks beat gut feelings—especially when difficulty and prices change faster than your electricity bill.

Why most miners get burned by “calculator math”

New and even experienced miners run into the same headaches over and over. Here are the big ones I see (and how they show up in the real world):

- Profitability guesses that don’t match real payouts. You plug in hashrate and watts, see green numbers, then your pool payouts are 5–15% lower. Common culprits: pool fees, payout thresholds, stale/rejected shares, downtime, and luck variance. For example, a small ASIC rig that “should” clear $2/day can be underwater if you didn’t include a 2% pool fee plus 2–3% stales. When margins are thin, that’s the whole profit gone.

- Confusing inputs or missing costs. Hashrate listed at “stock” settings might not match your tuned settings. Power draw on the box rarely equals your real at-the-wall watts. Cooling, internet, risers, and even time-of-use electricity pricing matter. According to the Cambridge Bitcoin Electricity Consumption Index, power costs dominate mining economics; getting your $/kWh wrong by just a few cents flips results from positive to negative.

- Data that’s stale during fast moves. A coin with thin liquidity or sudden difficulty swings can make 24h estimates misleading. You might switch to a “top” coin only to catch the backside of a spike. Mining variance is a thing too—see this clear explainer on pool luck from Braiins: Mining variance explained.

- Tool overload: CoinWarz vs WhatToMine vs NiceHash stats. Each tool optimizes for something slightly different—speed, filters, rental vs direct mining—and it’s easy to mix apples and oranges. That’s how rig moves get second-guessed after the fact.

What I’m going to help you do

I’ll show you how to use CoinWarz for quick, reliable profitability checks, when it’s the right tool, where it falls short, and how to set your inputs so your results line up with your actual payouts as closely as possible. No fluff—just the exact steps I use before I change coins or buy hardware.

Who this is for

- GPU and ASIC miners who want fast, realistic profitability checks

- Hobbyists trying to squeeze more out of their power costs

- Anyone comparing coins day-to-day without building a spreadsheet

What you’ll get

- Clear steps to set up CoinWarz so it reflects real-world results

- Pro tips to avoid the classic calculator mistakes (fees, stales, uptime)

- Practical comparisons with WhatToMine, Minerstat, and NiceHash stats

- A straight-talking FAQ with the questions miners actually ask

To keep things real, I’ll use practical examples—like why a 104 TH/s ASIC at ~3,000W and $0.12/kWh lives or dies on tiny changes in fees and uptime, or why a GPU rig that looks great on a 24h spike often disappoints a week later. I’ll also point you to outside references when it helps, like the U.S. EIA’s electricity price data for benchmarking your $/kWh and the CBECI for context on power’s role in mining economics.

If you’ve ever felt “the numbers looked good on paper” but payouts told a different story, you’re in the right place.

Ready to kick off with a fast overview—what CoinWarz actually is, what it covers, and why miners still use it in 2025? Let’s start there next.

What is CoinWarz? The quick overview (and why miners use it)

CoinWarz is a fast, low-friction mining profitability checker. It pulls live market and network stats for proof-of-work coins and lets you plug in your hashrate, power draw, and electricity cost to see if mining a specific coin makes sense right now. No account, no download, no fluff—just a quick reality check before you switch coins or power on new hardware.

“When power costs eat your margin by the hour, speed beats perfection.”

If you’ve ever watched price pump while difficulty lags—or seen a coin shoot to the top of a profitability list then vanish by lunchtime—you already know why a tool like CoinWarz exists. It gives you a rapid snapshot so you can make a decision, then confirm it with your pool or a deeper tool if needed.

Core purpose: fast profitability checks without an account

I use CoinWarz for quick hits: open the site, pick a coin, enter hashrate and watts, set my power price, and get a daily profit estimate in seconds. It’s ad-supported and free, so you can do this as often as markets move (which is…often).

- Zero sign-up, zero friction: it’s designed for quick comparisons, not dashboards.

- Instant sanity checks: “Is KAS better than ETC at my $0.12/kWh right now?” gets a fast answer.

- Great for day-to-day: when you just want to validate a hunch before you touch your rigs.

Example: if I’m holding an older 8 GB GPU rig and see chatter about Ravencoin (KawPow) spiking, I can plug in my known 130 W per card, current pool fee, and power price to see whether it actually beats mining Kaspa on my settings—before I retune and restart miners.

What it covers: coins, network stats, difficulty, price, and calculators

CoinWarz aggregates the core signals that move profitability. Each supported coin page typically includes:

- Algorithm: the hash function (e.g., SHA-256, Scrypt, KawPow, RandomX, kHeavyHash).

- Block reward and time: how much you earn per block and how often blocks hit.

- Network difficulty/hashrate: how competitive the network is right now.

- Price and volume: current market price and basic liquidity context.

- Profit calculator: inputs for hashrate, watts, power cost, and pool fee with revenue vs profit outputs.

For a quick mental model: difficulty and block reward set your “slice of the pie,” price turns that slice into dollars, and your watts/electricity cost decide whether that dollar is profit or a rounding error. Independent research consistently shows electricity is the dominant cost driver for miners; if your rate is high, your margin gets crushed fast. The Cambridge Bitcoin Electricity Consumption Index is a great reference for understanding how power economics shape mining competitiveness.

Supported mining types: GPU, ASIC, CPU (how to tell what’s relevant to you)

CoinWarz lists coins across major mining categories. The key is matching your hardware to the right algorithms:

- ASIC miners: Purpose-built machines for specific algorithms. Examples: Bitcoin (SHA-256) with Antminer S19 series; Litecoin/Dogecoin (Scrypt, often merged-mined) with L7; Kadena (Blake2S) with KD units. If you own an ASIC, you’re locked to its algorithm—filter coins accordingly.

- GPU miners: More flexible, algorithm-dependent performance. Examples: Ravencoin (KawPow), Ergo (Autolykos), Flux (ZelHash), Nexa, and Alephium. Note that some coins (like Kaspa) now have strong ASIC competition; GPU profitability can be suppressed when this happens.

- CPU miners: Fewer options, but still viable for certain algorithms. Examples: Monero (RandomX), Raptoreum (GhostRider), Verus (VerusHash). These are sensitive to memory and cache; don’t expect ASIC-level returns.

Quick way to avoid picking the wrong coin on CoinWarz:

- Check the algorithm label first. If it doesn’t match your hardware’s sweet spot, move on.

- Scan for ASIC dominance on historically GPU coins; it often shows in rising network hashrate and falling GPU returns.

- Confirm your miner software supports that algorithm and that your VRAM/driver setup meets typical requirements.

Once you’ve matched category and algorithm, CoinWarz’s inputs will make sense for your setup, and the profit numbers won’t be fantasyland.

Is CoinWarz legit and free to use?

Yes—CoinWarz has been around for years, it’s widely referenced by miners, and it’s free. You don’t connect a wallet, you don’t run anything on your machine, and you don’t need to create an account to use the calculators. It’s a classic ad-supported utility site.

- Safety basics: always make sure you’re on the correct domain (coinwarz.com). Don’t trust popups or random “download” buttons—stick to the calculator and coin pages.

- Privacy: you’re entering generic hardware numbers (hashrate, watts, $/kWh), not sensitive data.

- Realistic expectations: it’s an estimator. Prices, fees, and difficulty move. Treat it as your first pass, then cross-check with your pool or an operations tool if you’re about to make a costly change.

Here’s the good part: you don’t need to guess which page to open or where your numbers go. Want to see exactly what to click and how to set the inputs so the profit matches your real rig? That’s next—ready to walk through it step by step?

How to use CoinWarz’s mining calculators step by step

I use CoinWarz when I want fast, no-login profitability checks that actually reflect what my rigs do in the real world. Here’s the exact workflow I follow to get numbers I can act on without fooling myself.

Pick your coin or hardware category first (so inputs actually make sense)

Before typing anything, make sure you’re on a calculator that matches your hardware and algorithm. Wrong page, wrong math.

- ASIC examples: An Antminer S19j Pro mines SHA-256 coins (BTC, BCH). A L7 mines Scrypt (LTC/DOGE). Don’t put a SHA-256 hashrate into a Scrypt page.

- GPU examples: RTX 3070 on KawPow (RVN), kHeavyHash (KAS), or Etchash (ETC). Each algorithm has a different hashrate and wattage.

- CPU examples: Monero (RandomX) uses CPU; your GPU numbers don’t belong here.

On CoinWarz, I either open the coin-specific page (e.g., Kaspa, Ravencoin, Bitcoin) or the algorithm category if I’m comparing sibling coins. This keeps my inputs in the right units and avoids nonsense results.

Enter the right inputs: hashrate, power draw (watts), electricity cost ($/kWh), and pool fee

Small input mistakes cause big output lies. I always pull numbers from actual rigs and pool dashboards, not spec sheets.

- Hashrate: Use your steady hashrate after tuning, not a peak. For ASICs, use the pool-side average. For GPUs, let it run 10–15 minutes and note the stable value.

- Power (watts): Measure at the wall with a meter (Kill A Watt or smart PDU). Firmware power ≠ wall power. Example: an S19j Pro might show ~3,050 W at 104 TH/s; a 3070 on KAS might be ~120 W at ~600 MH/s with safe tuning.

- Electricity cost ($/kWh): Use your real blended rate, taxes/fees included. In the U.S., the EIA reports residential averages near $0.16/kWh lately, while industrial contracts can be much lower. I keep separate values for home vs colo.

- Pool fee: If you don’t know, 1% is a reasonable default. Many pools are 0.5–2% depending on payout scheme (PPLNS, PPS, FPPS).

Quick real-world examples (inputs you can copy):

- ASIC (BTC): 104 TH/s, 3,050 W, $0.08/kWh, 1.5% fee. Your power cost alone is ~3.05 kW × 24 h × $0.08 = $5.86/day. I keep this in mind while reading output.

- GPU (KAS): 600 MH/s, 120 W, $0.14/kWh, 1% fee. Power cost is ~0.12 kW × 24 h × $0.14 = $0.40/day.

Paste these into the CoinWarz calculator for the matching coin page, then hit calculate. Don’t adjust anything else yet—we’ll correct for reality in a second.

Read the outputs: revenue vs profit, 24h vs longer-term expectations

CoinWarz usually shows your projected revenue (coins × price) and profit (revenue minus electricity). Here’s how I read it without getting fooled:

- Revenue is the shiny number. It goes up when price pumps and can look amazing on a volatile day.

- Profit is what matters. It subtracts your electricity, but not hardware amortization, spare parts, or labor. I mentally add a small buffer for those.

- Timeframes: The 24h estimate can swing hard. I always glance at week/month projections for a sanity check. If day is green and week is barely break-even, I don’t change anything yet.

“Price pumps come and go. Your power bill never forgets.”

If profit is negative but revenue is high, that’s your sign the coin is hyped but your electricity rate is the bottleneck. I’ve saved myself from chasing noise more times than I can count by focusing on profit and the longer windows.

Adjust for reality: stale shares, rejected shares, and uptime

Real rigs don’t hash 24/7 at 0% stale. You’ll get closer to real payouts if you bake in a haircut. Two easy ways:

- Lower the hashrate by a small percentage to reflect stales/rejects/uptime.

- Inflate the “pool fee” a touch to simulate overhead if you prefer to keep hashrate clean.

I usually use the hashrate method. Here’s the quick math I keep on a sticky note:

- Effective Hashrate = Reported Hashrate × (1 − stale − reject) × uptime

Example: 600 MH/s GPU with 0.8% stale, 0.3% reject, and 98% uptime → 600 × (1 − 0.008 − 0.003) × 0.98 ≈ 586.1 MH/s. That’s what I plug into CoinWarz.

What numbers should you use?

- Stale shares: With decent latency and stable clocks, 0.5–2% is common. Many pools suggest keeping it around 1% or less; see guidance like F2Pool’s help.

- Rejects: Aim for well under 1% on healthy setups.

- Uptime: If you reboot once a day or power-cycle often, you might be closer to 95–98%. In hot rooms or on flaky power, be conservative.

Pro tip: If your numbers are consistently off vs pool payouts, this is the section that fixes it. As I like to say: “Measure twice, hash once.”

Save time: presets, copy/paste settings, and quick coin switching

The goal is fast checks without sloppy inputs. Here’s how I make it painless:

- Make simple presets: I keep a tiny note with my common profiles:

- S19j Pro (SHA-256): 104 TH/s, 3,050 W, $0.08, 1.5%

- RTX 3070 (KAS): 600 MH/s, 120 W, $0.14, 1%

- RTX 3070 (RVN): ~22–24 MH/s, 135–150 W, $0.14, 1%

Copy/paste into coin pages in seconds.

- Reuse algorithm profiles: ASICs keep the same hashrate across coins on the same algorithm (e.g., BTC vs BCH on SHA-256). For GPUs, each algorithm needs its own preset.

- Open multiple coins in tabs: Same inputs, different coins. I flip between tabs to compare profit after costs. It’s faster than retyping.

- Time-of-use electricity: If your utility has peak/off-peak pricing, save two electricity presets (e.g., $0.10/$0.18). A lot of miners are surprised how much that changes the math.

- Grab stats from the source: I snap a pic of my miner dashboard or pool page and use those values. Never the marketing sheet.

With this setup, I can switch coins, adjust for reality, and understand whether I’m looking at a lucky hour or a sustainable week—all in under two minutes.

One nagging question remains: how fresh are the prices, rewards, and difficulty that power these outputs, and what happens during crazy volatility? In the next section, I’ll show where the data comes from, what’s truly live, and when you should double-check before making a move.

Accuracy: where CoinWarz data comes from and how often it updates

Profitability calculators live and die by their data. If the inputs are even a little off, the “top coin” you see this minute can be the wrong pick an hour later. Here’s how CoinWarz typically sources numbers, what updates fast, what can lag, and how I keep my estimates honest before I switch rigs or buy gear.

“Numbers don’t lie—unless they’re late.”

Data sources: price feeds, network difficulty, hashrates, block rewards

CoinWarz pulls from a mix of public blockchain and market endpoints. While the exact vendor list can change, the mechanics are similar across miners’ favorite tools:

- Prices: Aggregated exchange quotes via public APIs (think major spot venues and market aggregators). These are mid-market prices, not your actual exit price after fees and slippage.

- Network difficulty: Read directly from the latest blocks or reliable explorers. For coins like Bitcoin, difficulty is fixed for an epoch and only changes at retarget; for many GPU coins, it floats nearly every block.

- Estimated hashrate: Derived from difficulty and recent block times using rolling windows. It’s an inference, not a direct count, so it’s noisy by design. See the basics of difficulty/HR math here: Bitcoin Wiki: Difficulty.

- Block rewards & fees: Base subsidy is deterministic; fees are variable. Some calculators fold in an average fees-per-block number. On chains where fees are a big share (or near zero), this can swing your revenue.

Reality check: when macro events hit mining, these feeds can look weird. In 2021, after China’s crackdown, Bitcoin’s hashrate fell ~50% in weeks—profitability flipped for many miners overnight. That wasn’t a calculator bug; it was the network moving. Source: Cambridge Bitcoin Mining Map.

Update cadence: what’s “live” vs what can lag during volatility

Here’s the practical timing I see when I’m eyeballing CoinWarz during busy markets:

- Price quotes: Usually refresh every 30–120 seconds. In a fast candle, a 2–5% move can slip through before the next poll.

- Difficulty:

- Bitcoin/SHA-256: Updates every 2016 blocks (~2 weeks). Between adjustments, profitability moves with price and fees, not difficulty.

- GPU coins (KawPow, kHeavyHash, etc.): Effective difficulty shifts almost every block. Calculators estimate this rapidly, but you’ll still see minute-to-minute wobble.

- Fees per block: Near-real-time but highly spiky. If a mempool bursts or quiets down, the average fee assumption can be wrong for an hour or two.

- Exchangeability/liquidity flags: Not “live.” A coin might be listed but practically illiquid for the size you want to sell.

Quick mental model: revenue per day is roughly proportional to (block reward × coin price ÷ difficulty). If any one of those moves 10% between refreshes, your “profit” box will too.

Limits to keep in mind: sudden difficulty swings, thin-liquidity coins, fee changes

There are three places where good calculators still look wrong for a bit:

- Inrush hashrate on trendy coins: Say KAS pumps 12% in an hour and miners jump on it. If difficulty rises 15% across a few dozen blocks, your expected coins/day drops ~15% even if price holds. That can make a bright-green result fade quickly.

- Thin books mean slippage: If a coin shows $8/day on paper but only trades $50k/day across two small exchanges, your real exit might be 2–8% worse after slippage and fees—sometimes much worse. Profitability rankings don’t factor your order size.

- Reward schedule flips: Halvings and emission tweaks are instant. Litecoin and Ravencoin halvings, for example, cut subsidy at a specific block. If a site caches reward data or you’re looking at outdated tabs, you’ll overestimate until the next refresh.

- Pool-side variables: A pool bumping fees from 1% to 2% or a temporary luck dry spell will undercut estimates. Luck normalizes over time, but day-to-day can be off by 5–10% on small pools.

One more subtlety: some sites smooth hashrate with longer windows to avoid noise. That’s great for trend reading, but it can hide short, sharp changes that matter if you switch coins aggressively.

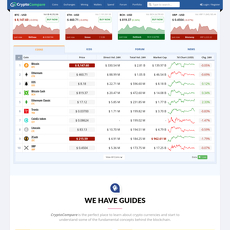

Cross-checking: when to compare with WhatToMine, Minerstat, or your pool stats

I treat CoinWarz as my fast first look, then I do a 2-minute sanity pass when any of this happens:

- Price moves >2% in 10 minutes: Open a second tab on WhatToMine or Minerstat. If both agree within ~3%, I’m good. If they disagree by 7–10%, I assume the lagging one hasn’t refreshed a component yet.

- Difficulty whipsaws: On coins like RVN or KAS, check your pool’s recent blocks page. If pool-side “network difficulty” and “avg block time” look off from CoinWarz, trust the source that just saw the last few blocks land.

- Low-liquidity coins topping the list: Open an exchange or market aggregator’s markets tab. Look at 24h volume and top-of-book depth. If you can’t exit your daily yield without moving price, haircut your estimate.

- Weird fee days: If a chain’s fee market spikes (meme mania, inscriptions, etc.), peek at a live explorer or mempool stats to confirm. Yesterday’s average fee won’t help today.

Two real-world snapshots I’ve seen this year:

- Bitcoin fees surge for a few hours: CoinWarz briefly overstates revenue because it’s using a rolling average that lags the drop-off. My fix: compare with pool’s last 24 blocks—if recent fees collapsed, I take the lower number.

- GPU crowd piles onto a trending coin: CoinWarz shows it on top at 11:00, WhatToMine puts it third at 11:03. By 11:10, both agree it’s no longer number one. That was difficulty catching up, not a bug.

The short version? I love “fast,” but I act on “fast + verified.” And yes, that two-minute check has saved me from chasing ghosts more times than I can count.

Want the good news? Once you know what’s fresh and what’s lagging, you can use the site’s best tools to make smarter picks in seconds. Curious which features actually move the needle—and how to avoid the classic “top coin” trap that eats profits? Let’s open that up next.

Features you’ll actually use (and how to get the most from them)

I use CoinWarz for fast, no-nonsense checks. These are the features that actually move the needle—and the little tweaks that keep you from getting misled by shiny numbers.

“Profit is what you keep after reality subtracts your optimism.”

Profitability rankings: quick picks and when “top coin” is a trap

The rankings are the front door: you plug in hashrate, power, and cost, then sort by daily profit. It’s perfect for quick scans—but that “top coin” can be a mirage if you don’t sanity check it.

- Thin spreads flip winners: If the top three coins are within a few cents of each other, small changes in difficulty, price, or pool luck will reshuffle the list. Don’t chase a $0.05/day edge on a 1 kW rig.

- Liquidity matters: Click through to the coin page and check the listed exchanges/markets. If 24h volume is low, you might eat slippage or get stuck with withdrawals. A good rule: daily volume should be at least 10–20x your intended daily sell.

- Fees can erase the edge: Add your pool fee (0.5–2%) and expect 1–2% stale/rejects. A coin that “wins” by 2% on paper is basically a tie in real life.

Real example: Your rig uses 1,000 W and power is $0.12/kWh. That’s $2.88/day in electricity. If CoinWarz shows the top coin at $3.10/day revenue, you’re netting $0.22/day before pool/stales. Add 2% total friction and you’re at ~$0.16/day. One unlucky day or a small price slip, and you’re negative. The “winner” wasn’t really winning.

Pro move: sort by profitability, then immediately compare the top 3–5 over the 7–30 day view on their charts. If a coin is only on top because of a single price candle, it’s bait.

Electricity cost tweaks: region-based rates, tiered pricing, and time-of-use notes

CoinWarz gives you a single $/kWh input. That’s fine for flat-rate power, but many of us pay variable pricing. I handle it with quick blends:

- Time-of-use (TOU) blend: Use a daily weighted average.

Example: 14 hours off-peak at $0.08 + 10 hours peak at $0.20

Blended $/kWh = [(14×0.08) + (10×0.20)] / 24 = $0.132 - Tiered pricing: Estimate your monthly kWh from your rig(s), then blend tier costs.

Example: First 1,000 kWh at $0.12, next at $0.18. If you consume 1,600 kWh:

Blended = [(1000×0.12) + (600×0.18)] / 1600 = $0.1425 - Dynamic markets (ERCOT, UK Agile): Run two quick scenarios—“cheap day” and “expensive day”—and keep a rough midpoint. If your grid swings hard, this range is more honest than any single number.

Industry research (Hashrate Index and Cambridge CCAF) consistently shows electricity is the dominant operating cost for PoW miners. Even small errors in $/kWh swamp tiny coin-to-coin profitability gaps. If you only perfect one input, make it this one.

Helpful links: Hashrate Index • Cambridge Bitcoin Electricity Consumption Index

Difficulty and hashrate charts: spotting trends vs noisy blips

CoinWarz charts are great for reading the room. The trick is to separate trend from noise:

- Use 7–30 day views for signal: Single-day spikes are often block luck or short-term speculative pops. A steady 7–30 day climb in difficulty tells you miners are piling in—expect profitability compression.

- Compare price vs difficulty: If price is flat but difficulty is rising, margins will shrink. If price rises faster than difficulty, you may have a window to earn above-average returns.

- Watch for structural changes: Protocol updates, halvings, or new ASICs showing up in the wild can bend these lines. When the curve shape changes, re-check your assumptions.

Quick sanity test: If a coin’s difficulty climbed 25% in a week while the price didn’t, and CoinWarz still ranks it at the top for you, assume that lead won’t last.

Exchange and payout paths: can you actually sell what you mine?

CoinWarz usually lists exchanges and markets for each coin. Don’t skip this. A coin with top-ranked “profit” that you can’t liquidate at scale is not profitable to you.

- Look for real market depth: Check 24h volume and the pairs you can access (BTC, USDT, fiat). Thin pairs equal slippage and random freezes during volatility.

- Mind withdrawal fees and minimums: A $1 withdrawal fee on a coin that earns you $0.70/day is a problem unless you batch payouts.

- Confirm KYC/region rules: Some exchanges gate withdrawals or pairs by country. If you can’t cash out, it’s theoretical profit.

Practical workflow: Pick the coin on CoinWarz → open the listed markets → confirm volume on your target pair → check withdrawal fees on the exchange’s fee page → then mine. It takes 90 seconds and saves you from awkward “stuck coin” moments.

Break-even thinking: daily profit, ROI horizon, and hardware lifespan

CoinWarz gives you the daily net estimate. Turn that into a clear ROI picture with a few reality checks:

- ROI baseline: Days to break even ≈ Hardware cost / Average daily net profit.

Use a 30-day average net profit, not yesterday’s spike. - Uptime and rejects: Assume 95–98% uptime for a home rig (power, reboots, updates). Subtract 1–2% for stale/rejects. Bake this in before you divide.

- Hardware lifespan:

- GPUs: 2–4 years when undervolted and kept cool; resale value cushions ROI.

- ASICs: 18–36 months of competitive life is common; efficiency jumps with new gen gear can compress that window. Hashrate Index’s reports have shown how payback windows stretch or shrink with difficulty and BTC price cycles.

- Maintenance overruns: Fans, PSUs, risers. Assume a small monthly reserve (1–3% of hardware value) if you run 24/7.

Example: $1,200 in GPUs, $1.80/day average net profit after realistic costs. ROI ≈ 667 days. If you can resell later for $400, your economic payback shortens—don’t ignore salvage value when planning.

Last thing: always re-check ROI after big moves (price, fee changes, halvings, firmware). An ROI you computed six months ago is a different planet today.

One more thing that saves headaches: run a tiny test. Mine the “winner” for 48–72 hours, track actual payouts, and compare with CoinWarz’s estimate. If the gap is bigger than 5–7%, find out why before scaling.

So, when should you rely on CoinWarz’s speed and when do you switch to a more granular tool with filters and portfolio monitoring? I’ve battle-tested them side by side—want the exact situations where each one wins?

CoinWarz vs alternatives: where it wins and where others are better

If mining tools were a toolbox, CoinWarz is the trusty flathead screwdriver: always there, quick to grab, no instructions needed. Sometimes that’s exactly what you want. Other times, you want the ratchet set. Here’s how I actually switch between CoinWarz and the other big names when real money is on the line.

“Profit isn’t the number on the screen—it’s the number that hits your wallet after fees, power, and bad luck.”

CoinWarz vs WhatToMine: speed and simplicity vs advanced filtering

CoinWarz loads fast, asks for the basics (hashrate, watts, $/kWh, pool fee), and gives you a clean profitability snapshot. That’s perfect when you already know your rig’s true hashrate and power and you just want a “should I switch?” check.

WhatToMine shines when you need more control. It lets you:

- Pick exact GPUs/ASICs and quantities (great for mixed rigs).

- Filter coins by algo, exchange availability, or minimum volume.

- Toggle extra parameters (MEV/reorg-sensitive chains, switching penalties, etc.).

How I decide:

- Quick flip check: CoinWarz. I can go from idea to answer in 15 seconds.

- New rig planning or mixed hardware: WhatToMine. It models per-GPU differences and saves me guesswork.

Real example: if I’m considering switching a mid-size GPU rig between Kaspa, Ravencoin, and Flux, I’ll run CoinWarz to see the current top pick, then confirm on WhatToMine with my exact GPUs selected. When the rankings agree within a few percent, I act. If they don’t, I assume something quirky is happening (thin liquidity, a sudden difficulty jump) and wait for confirmation.

CoinWarz vs NiceHash profitability: renting hashrate vs mining a coin directly

This comparison trips up a lot of people. NiceHash isn’t a coin calculator; it’s a hashrate marketplace. You’re selling your hashrate to buyers who decide which coin to mine. That creates a few practical differences:

- Payout asset: NiceHash pays in BTC (stable unit, easy to store). Direct mining pays in the coin you mined (higher upside if the coin pumps, more friction if it doesn’t).

- Pricing source: NiceHash payrate equals what buyers are willing to pay on that algo, minus NH fees and your withdrawal friction. It can be slightly lower than the best direct-mining opportunity in a spike, but often more stable across quiet periods.

- Fees and timing: NiceHash includes marketplace/service fees and withdrawal costs. Direct mining includes pool fees, exchange spreads, and your own timing risk.

What I see in practice:

- When a coin is surging: Direct mining that coin often beats NiceHash for a few hours because buyers haven’t bid up the hashrate price yet.

- When markets are flat: NiceHash’s BTC payout can match or beat “average” direct-mining picks because it aggregates demand and auto-switches internally.

My habit: I keep CoinWarz open for direct coin estimates and the NiceHash profitability page open for the same algo. If the NH payrate is within a few percent of the top coin on CoinWarz and I want BTC anyway, I’ll often choose the easier path (NH). If I’m aiming to stack a specific coin or I see a fresh spike, I’ll mine it directly and accept a bit more volatility.

CoinWarz vs Minerstat calculators: monitoring suites vs quick checks

Minerstat brings a full monitoring and management stack (OS, remote configs, profit switchers) with calculators built in. It’s fantastic for farms that want one cockpit for everything—especially if you automate coin switches or need per-rig telemetry.

CoinWarz is the opposite end of the spectrum: it starts fast, stays light, and doesn’t ask you to commit to an ecosystem. When I’m at my desk managing several rigs and need control, Minerstat earns its keep. When I’m on my phone in a line at the grocery store, CoinWarz wins every time.

A small but real edge: CoinWarz’s minimal interface makes it hard to “overfit” the model. With big suites, it’s tempting to tweak every knob and end up believing a perfect backtest that never happens in real life.

When to mix tools: my workflow for cross-verifying before making changes

I rarely trust a single screen—especially during volatility. Here’s the exact routine I use before I switch coins, change pools, or touch flight sheets:

- Step 1 – Snapshot: Punch my known hashrate/watts/$/kWh into CoinWarz for the top 3 coins on my algo.

- Step 2 – Cross-check: Recreate the same setup on WhatToMine using my actual GPUs/ASICs. I want the rankings to rhyme, not necessarily match to the cent.

- Step 3 – Market sanity: Check NiceHash’s payrate for the same algo and current exchange liquidity for the top coin (look at 24h volume and order-book depth on the exchange I actually use).

- Step 4 – Variance reality: Remember that short windows are noisy. Mining rewards follow a Poisson process—short-term luck swings are normal. If you want a reference, the Bitcoin Wiki has a helpful note on pool variance here: Mining pool variance.

- Step 5 – Test first: Move a fraction of hashrate for 6–12 hours and compare real payouts vs estimates (accounting for stale/rejects and uptime). If reality and calculators are within a few percent, scale.

The emotional side matters too. Nothing stings like switching at midnight because a calculator flashed green, only to wake up and see difficulty jumped and the win evaporated. That’s why I want two agreements (CoinWarz + one other) before I move anything meaningful.

One last thing before we keep going: the fastest way to mess up with any of these tools is to forget the unglamorous inputs—pool fee, stale rate, uptime. Want the exact defaults I use for those, and when I change them after a halving or firmware update?

Pro tips to avoid bad decisions with any mining calculator

Always include pool fees, stale rate, and realistic uptime

Calculators are optimistic by default. Reality isn’t. I always “tax” the output before I make a decision.

- Pool fee: Most pools take 0.5–2.5%. Examples: 2Miners ~1%, F2Pool 1–3%, ViaBTC varies.

- Stale/reject rate: With decent latency and tuning, expect 0.5–2% (ASICs on a good link can be lower; noisy Wi‑Fi or cross-continent routing can be higher). Tips: pick regional pool servers and keep your overclocks sane. Practical guide: How to reduce stale shares.

- Uptime: “24/7” is a myth. Reboots, power blips, pool issues, and your own tinkering add up. I model 95–98% uptime unless I’ve proven better for months.

Quick sanity formula: Effective revenue = Calculator revenue × (1 − pool_fee − stale_rate) × uptime.

Example: If a page says $10/day, with 1.5% pool fee, 1% stale, and 96% uptime: $10 × (1 − 0.015 − 0.01) × 0.96 = $9.36/day. On 10 rigs, that “tiny” gap is $19.20/day you don’t see until the bill hits.

“Profit isn’t what the calculator promises. Profit is what lands in your wallet after fees, faults, and Fridays.”

Don’t chase 24h spikes—watch 7–30 day trends

Fast movers tempt you with green numbers, then punish you with difficulty jumps and thin liquidity. Price and difficulty are coiled together—when price pumps, miners pile in, difficulty rises, and margins compress. Coin Metrics has shown this “hashrate follows price” effect repeatedly (Coin Metrics research).

- Use 7D–30D medians for price and difficulty when making choices. A 24h candle is noise; a week tells you if there’s signal.

- Check liquidity on your exit exchange. If order books are shallow, your “top coin” can slip 3–10% on sell.

- Model the migration: If a coin spikes 25%, assume difficulty climbs soon after. I haircut short-term “top coin” picks by 10–20% unless I’m already mining it.

Example: A coin jumps 20% and the calculator shows +$1/day. Twelve hours later, difficulty is up 15%. Net? You’re roughly flat after switching time and missed uptime.

Rule of thumb: If it looks insanely good in the last 24 hours, you’re probably late.

Factor power limits, ambient temps, and card tuning into watts

Most people enter software-reported watts. That’s not the bill. You pay “at the wall,” including PSU losses, fans, and network gear.

- Measure at the wall with a plug meter and budget 5–10% PSU overhead (depends on 80 PLUS rating and load). See efficiency curves from 80 PLUS.

- Seasonality matters: Hotter rooms = higher fan RPM = more watts, and sometimes lower hashrate due to throttling.

- Lock realistic power limits: Undervolt and set fan curves you can maintain year-round. Don’t enter your “best 5-minute screenshot” into a calculator.

Example (8× RTX 3070 rig): Winter: ~860W stable. Summer: ~980W (fans + VRAM temps). At $0.12/kWh, that extra 120W costs ~$0.35/day or ~$10.50/month—per rig—before throttling impacts revenue.

Revisit settings after halvings, fee changes, or firmware updates

Everything moves. If your inputs don’t, your results drift into fantasy.

- Halvings and emissions: Bitcoin’s April 2024 halving instantly changed revenue per TH/s. Kaspa reduces rewards continuously on a monthly schedule. Ravencoin has set halving cycles. Update block rewards in your mental model the day they shift.

- Pool/developer fees: Miner updates sometimes tweak dev fees. Pools adjust fees, PPS/PPLNS terms, or minimum payouts. Re-check fee pages monthly.

- Firmware/driver gains: ASIC autotuning (e.g., Braiins OS+) and GPU drivers can swing efficiency by a few percent. If your J/TH or MH/W improves, update both hashrate and watts in the calculator—or you’ll under/overestimate profit.

Pro move: Keep a changelog. Any time you flash firmware, change pools, or patch miners, jot the new hash/watt and fee so your calculator matches reality.

Keep a small test rig to validate calculator results against real payouts

Paper profits are guesses. A test rig is truth.

- Run a dedicated 1–2 GPU rig or a spare ASIC as your “scout.” When a coin looks good, point the scout for 48–72 hours to span PPLNS windows and variance.

- Record: pool credited coins, time online, accepted/rejected shares, and kWh used from the wall. Don’t forget exchange slippage on sell.

- Build a calibration factor: If the calculator says $5.00/day but your scout realizes $4.70/day over 3 days, use a −6% fudge factor for that coin/pool combo next time.

- Repeat periodically: Networks, pools, and your environment change. Recalibrate monthly.

Why it works: Variance smooths out over time, and the scout’s ground truth saves you from moving an entire farm based on a momentary spike or a bad input.

Bottom line: calculators are tools, not oracles. The edge comes from cleaning the inputs, tempering the outputs, and pressure-testing with a small slice of your hashrate.

Still seeing your payouts come in lower than what the screen promised—even after doing all this? Or wondering which settings in CoinWarz you might be missing? I’ve answered those exact questions next. Ready for the straight talk in the FAQ?

CoinWarz FAQ: straight answers to common questions

What is CoinWarz and how does it work?

It’s a fast, no-login mining calculator that pulls live coin data (price, block reward, difficulty) and compares it with your rig’s hashrate, power draw, and costs. You enter numbers you control (hashrate, watts, $/kWh, pool fee), and CoinWarz estimates daily revenue and profit for the coin or algorithm you choose.

I use it when I want a quick “is this worth it today?” gut check without opening a dozen tabs or building a spreadsheet.

Is CoinWarz accurate and up to date?

For quick decisions, yes—within the normal noise of crypto mining. CoinWarz updates price feeds and network stats frequently, but a few realities still apply:

- Price volatility: If a coin pumps 10% in 10 minutes, any calculator can lag until the next refresh.

- Difficulty swings: Coins with fast retargets or surging hashrate (like KAS or newly hyped GPU coins) can change profitability hour-to-hour.

- Pool luck: Your 24h payout can be ±5–15% vs. the estimate because block finds are probabilistic.

My rule of thumb: treat 24h profit estimates as a range, not a point. If CoinWarz says $10/day, I mentally bracket that as $8–$12 unless you’re on PPS-style payouts.

How do I add electricity costs, pool fees, and other real-world factors?

Use the calculator inputs and nudge them to match your real rig behavior:

- Electricity ($/kWh): Put your all-in rate from your bill. If you have time-of-use (TOU), use your average or run day vs. night scenarios.

- Power (watts): Enter wall watts from a meter (Kill A Watt/smart plug). Software-reported watts can be 5–15% low.

- Pool fee (%): Most pools are 0.5–2%. Enter it directly.

- Stale/rejects (%): Add 0.5–2% as “extra fee” if the calculator doesn’t have a field. High latency or unstable OC? Go higher.

- Uptime: If you average 98% uptime, multiply the daily revenue by 0.98 when sanity-checking.

Example: A 3.5 GH/s KAS rig at 1,200 W, $0.12/kWh, 1% pool fee, and ~1% stale:

- Electricity/day ≈ 1.2 kW × 24 h × $0.12 ≈ $3.46

- Enter 2% total fee (1% pool + 1% stale) in the fee box. Compare revenue vs. $3.46 to get profit.

Does CoinWarz support ASIC and GPU miners?

Yes. It lists coins and algorithms relevant to both. The trick is choosing the right coin page or algorithm so the hashrate units match your gear:

- ASICs: BTC (SHA-256), LTC/DOGE (Scrypt), KAS (kHeavyHash ASICs are emerging), etc.

- GPUs: KAS (kHeavyHash), ERG (Autolykos), RVN (KawPow), ETC (Ethash), etc.

If the unit is wrong (e.g., you’re entering MH/s on a GH/s coin), your results will be nonsense. Always check the unit label next to the hashrate field.

Can I use CoinWarz for NiceHash or only direct mining?

You can use it for both, but adjust expectations:

- Direct mining: CoinWarz estimates coins you mine and sell yourself.

- NiceHash: You’re paid per algorithm, not per coin. Compare your rig’s hashrate and power with NiceHash’s PPS pay rate. If you want to approximate on CoinWarz, pick a coin with the same algorithm and then compare the resulting $/hash to NiceHash’s live payout page. Use whichever number is lower as your baseline.

In choppy markets, NiceHash can sometimes beat direct mining for short windows, but fees and withdrawal thresholds can offset the gain.

CoinWarz vs WhatToMine: which should I trust more?

I use both. CoinWarz is fast and simple; WhatToMine has more filters and niche coins. Here’s my approach:

- Quick check: CoinWarz to see if a switch looks tempting at a glance.

- Confirmation: WhatToMine for extra coins/settings and to stress test power costs and fee assumptions.

- Reality check: My pool stats and a small test rig to see if real payouts align within ~10% over 48–72 hours.

If two tools disagree by a lot, the difference is usually assumptions (fees, stale rate, price source) or difficulty lag on a thin coin.

Is CoinWarz free? Do I need an account?

Yes, it’s free and you can use it without an account. That’s why I keep it bookmarked for quick checks on desktop and phone. If you want saved presets or historical logging, you’ll need your own notes or a monitoring suite—even then, CoinWarz is great for a fast sanity pass.

How do I read difficulty and hashrate charts without getting misled?

Think trends, not blips:

- Zoom out: Use 7–30 day windows to spot real changes. Single-day spikes can be just luck or a temporary botnet/firmware wave.

- Pair with price: Rising price + flat difficulty is usually a green flag. Rising difficulty + flat price can crush margins.

- Watch block times: If actual block time is below target, difficulty will likely adjust up soon (profit may compress).

- Events: Halvings, dev fee changes, and new miner releases often show up first as difficulty bumps.

Tip: If a coin’s difficulty is stair-stepping up every few days while price is flat, your 24h profit “surprise” tomorrow is already baked in.

Why do my real payouts differ from CoinWarz estimates?

Common culprits:

- Pool luck and variance: Even on PPS, short-term windows can wobble. On PPLNS, session length and luck matter more.

- Stale/invalid shares: 0.5–2% is normal; poor connectivity or too-aggressive overclocks push it higher.

- Dev fees: Miner software or firmware may skim 0.5–3%. Add that to your fee assumption.

- Power estimation: PSU efficiency and “at the wall” vs. software watts can differ by 5–15%.

- Price execution: Exchange fees, slippage, and withdrawal costs trim net profit.

- Payout thresholds: If a pool pays once per day or above a threshold, your rolling average can look off for a few days.

When I see a gap bigger than ~10% over 72 hours, I check: pool fee setting, stale rate, firmware dev fee, and whether difficulty quietly climbed while price stalled.

Still wondering how to turn these estimates into smart, low-risk moves? In the next section, I’ll show you the exact workflow I use to go from “looks profitable” to “I flipped and locked it in”—without getting whipsawed by noise. Ready to see the checklist I follow before switching coins or buying hardware?

Putting it all together: a smart way to use CoinWarz today

I treat calculators as signal, not gospel. The trick is turning that signal into consistent decisions you don’t regret a week later. Here’s how I use CoinWarz right now to pick coins, protect margins, and avoid chasing noise.

The workflow I recommend (quick checks, cross-checks, then act)

- 1) Two-minute scan

- Open your saved CoinWarz preset with your real hashrate, watts, pool fee, and $/kWh.

- Sort by profit. Note the top 3 coins for your hardware (ASICs: your algo family; GPUs: the algos you actually mine well).

- Glance at difficulty and price change on each coin page to make sure you’re not staring at a one-hour spike.

- 2) Quick cross-check

- Compare the leader with a second source like WhatToMine or Minerstat. If it’s only winning on one site, slow down.

- Verify 7–30 day difficulty/price trend on a chart. One-day green with a red week is a red flag.

- Check your pool’s last 3–7 days of payouts. Pool luck routinely swings; Braiins has a good explainer on variance here: mining luck and variance.

- 3) Liquidity and payout path

- Open CoinGecko for the top exchanges and 24h volume on the winner. If you need to offload $1k/day, but the coin only does $200k/day with thin books, expect slippage.

- Note deposit/withdrawal fees and any KYC frictions that could delay cashing out.

- 4) Reality discount

- Apply a haircut to profits before you act: 1–2% stale/rejects (more if your latency is weak), pool fee, and 1–2% for exchange friction. I keep a simple rule: subtract 5% from any calculator revenue to be safe.

- 5) Threshold rule and test run

- I only switch if the new coin beats my current setup by ≥15–20% after haircuts.

- Test with a single rig or a fraction of hash for 12–24 hours. Watch actual payouts vs CoinWarz expectations. If reality tracks within ~5–10%, then I scale.

Mini example: If Coin A shows $3.50/day profit per GPU and Coin B shows $3.00, I apply a 5% haircut. That’s $3.33 vs $2.85. That’s a 16.8% edge—just over my line. I’ll move one rig for 24 hours and verify pool payouts, stale rate, and exchange slippage before moving the rest.

Optional: risk controls before switching coins or buying hardware

- Switching coins

- Minimum advantage: Require a sustained edge for 24–72 hours. If it disappears overnight, revert automatically.

- Rolling checks: Use a simple rule like: “If the 6-hour rolling payout drops 10% below the last 3-day average, switch back.”

- Illiquid coin cap: Limit low-volume coins to a fixed % of your hash (e.g., 25%) until you validate cash-out speed and slippage.

- Stale guardrails: If stale shares exceed 2% on the test run, troubleshoot network/stratum settings before scaling.

- Buying hardware

- Scenario planning: Model ROI with three cases using your CoinWarz output:

- Base: today’s profit with a 10% revenue haircut

- Stress: revenue -30%, power +20% (seasonal rates), difficulty +20%

- Upside: revenue +20% (price lift) but difficulty +10%

- Payback bar: I only buy if base-case payback is reasonable and stress-case still pays back within my cutoff (e.g., 18 months). If stress-case is negative, I pass.

- Total cost of ownership: Add shipping, duties, PSUs, rack/PDUs, network gear, firmware licenses, and a summer cooling premium. Those missing items wreck many “paper ROIs.”

- Power contract reality: Confirm real $/kWh across tiers/time-of-use. A 2–3 cent surprise can erase margins.

- Health checks on used gear: Demand hashboard photos, uptime screenshots, and a live pool test. Assume fans and PSUs need replacement in year one.

- Scenario planning: Model ROI with three cases using your CoinWarz output:

Rule of thumb: calculators tell you what could happen; a 24-hour test tells you what will happen. Make decisions on the second one.

Why the caution? Even solid pools can experience luck variance of ±5–10% week to week, which can mask whether a coin is truly more profitable. That’s normal Poisson noise in block discovery—again, see this explainer.

Conclusion

The smartest way to use CoinWarz is simple: let it surface opportunities fast, then force those ideas through a short checklist and a small real-world test. No FOMO, no spreadsheet rabbit holes.

- Save a preset on CoinWarz with your true watts, fees, and power cost.

- Require a 15–20% edge after haircuts before switching.

- Test with a fraction of your hash for 12–24 hours and compare payouts to expectations.

- Verify liquidity and fees so profits don’t vanish on the way to your wallet or bank.

- For hardware, buy only if the stress-case still clears your payback cutoff.

Keep it boring, keep it repeatable, and your monthly profit will look a lot better than the folks chasing whatever tops the list in the last hour.