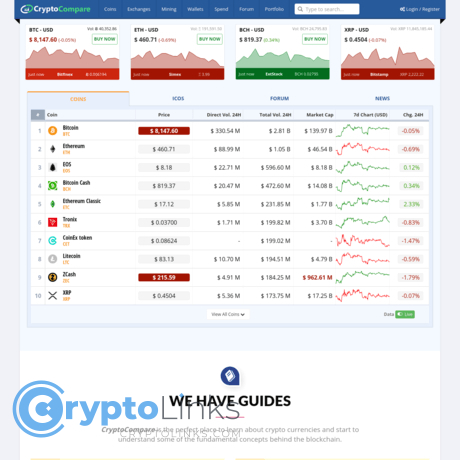

Cryptocompare Review

Cryptocompare

cryptocompare.com

CryptoCompare Review Guide: Is It Worth Your Time? Hands‑On Test, Pros/Cons, and Smart Ways to Use It [FAQ]

Do you really need another crypto data site in your life, or is CryptoCompare actually worth your time?

I’ve tested it for years while curating tools on CryptoLinks, and in this guide I’ll show you what’s good, what’s not, and how to use it the smart way. By the end, you’ll know if CryptoCompare fits your workflow, and how to squeeze the most value out of it.

The real problems crypto users face with “data sites”

Most crypto dashboards promise magic: “real‑time prices,” “all the coins,” “insightful research.” In practice, you hit a few walls fast:

- Inconsistent prices across sites: You’ll see BTC at one number on one site and a different number elsewhere. That’s normal—venues differ—but you need to know how an aggregator calculates a reference price and filters dodgy markets.

- Confusing charts and missing context: Toggling between “close” vs VWAP vs index levels without clear labels leads to bad takes and bad trades.

- Shallow “research” and stale ratings: You’ll find lots of opinion, not enough methodology. That’s risky when you’re sizing a position or pitching a thesis.

- Gated historical data: Minute‑level history is often paywalled or rate‑limited. You can waste days scraping junk or overpay for a tier you don’t need.

- API friction: Poor docs, odd symbols, inconsistent endpoints—and suddenly your app is throwing 429s right when volatility spikes.

“Why does every site say it’s real‑time, yet my numbers don’t match?”

Because “real‑time” is a spectrum: exchange‑level latencies, aggregator refresh cycles, and outlier filtering all change what you see. Knowing the method matters.

What you’ll get from this review

I’ll walk you through CryptoCompare’s core features, data quality, API, research, pricing, and how it stacks up against rivals. I’ll point out the trade‑offs, give practical tips, and answer the common questions people search for before choosing a data platform.

- Clear tips for using CryptoCompare well (and when to use a different tool).

- Honest trade‑offs on free vs paid access and where the gotchas live.

- Reality checks on accuracy, latency, and historical depth.

Who this guide is for

- Casual price‑checkers: You just want clean prices and quick context without signing your life away.

- Portfolio tinkerers: You track a handful of positions and care about alerts, basic charts, and watchlists.

- Analysts and researchers: You value indices, exchange benchmarks, and transparent methodologies over hype.

- Builders using APIs: You need stable endpoints for OHLCV, order books, and historical data without burning budget.

- Content creators: You embed charts/widgets and care about speed, customization, and attribution.

CryptoCompare at a glance

Think of CryptoCompare as a market data aggregator with a professional backbone. Here’s the quick snapshot:

- Market data aggregator: Consolidates prices and volumes across many exchanges into reference prices you can use.

- Indices provider: Curates indices and calculates benchmarks used by funds, desks, and media.

- Exchange benchmark & ratings: Evaluates exchanges on data quality and risk—useful for filtering noise.

- Research and market reports: Regular insights on volume quality, liquidity, and market structure.

- Developer & enterprise data: APIs, feeds, and historical packages for apps, quant work, and institutions.

- Extras: Mining tools, portfolio/watchlists, news aggregation, and embeddable widgets.

Why that matters: if you care about methodology—how an average is built, how outliers are handled, which venues count—CryptoCompare is one of the few consumer‑friendly sites that also caters to pros.

How I tested (and what I judged)

I’ve used CryptoCompare for years and retested it with a simple checklist so you don’t have to guess:

- Accuracy: Cross‑checked spot prices and OHLCV against major venues and peer aggregators.

- Coverage: Looked at exchange breadth, pair variety, and gaps during high‑vol windows.

- Latency: Watched refresh behavior during spikes and compared update cadence to peers.

- Transparency: Read methodology docs for indices and exchange benchmarks.

- UX: Tested navigation, search, watchlists, and chart options on desktop and mobile web.

- API usability: Pulled common endpoints, checked symbol consistency, monitored error handling.

- Documentation: Rated clarity, examples, and gotchas.

- Pricing & limits: Noted free vs paid thresholds, rate limits, and what’s actually worth paying for.

- Support: Checked how fast you can find answers or get help when endpoints misbehave.

What you’ll take away in 10 minutes

- When CryptoCompare shines: Situations where its indices, benchmarks, and historical data save you time and headaches.

- When to skip it: Cases where CoinGecko, CoinMarketCap, TradingView, or Messari are a better fit.

- How to use it smartly: A simple setup to get reliable prices, quick comparisons, and useful exports without paying.

- What to pay for (and when): If you’re building or analyzing at scale, how to choose the right API tier without overspending.

Ready to see how the platform is actually built and what you get from day one? In the next section, I’ll walk you through the company, the core product lineup, and who CryptoCompare serves so you can decide if it matches your workflow.

CryptoCompare basics: what it is and how it works

When you first land on CryptoCompare, you’re stepping into a market data hub that tries to make sense of a noisy, fragmented crypto world. It’s not an exchange. It’s the layer that collects prices, volumes, and headlines from across the market, then standardizes them so humans (and APIs) can actually use the information.

“In God we trust; all others must bring data.”

— W. Edwards Deming

If that line hits home, you’ll get why CryptoCompare exists.

Company background and mission

CryptoCompare launched in 2014 in London, founded by Charles Hayter and Vlad Cealicu, with a simple promise: build reliable crypto market data that people can act on. Over time, the consumer site stayed familiar—prices, charts, news—while the institutional arm grew into CCData, which now runs indices, benchmarks, and enterprise-grade data feeds.

Why that matters for reliability:

- Clear accountability: The same company powers the free site and the institutional products, so methodology isn’t an afterthought—it’s the backbone.

- Regulatory-grade benchmarks: CCData has operated as a UK benchmark administrator, a rare level of oversight in crypto data. You’ll feel that rigor in how the public numbers are constructed and explained.

- Research track record: Long-running reports like the Exchange Benchmark and market reviews show their scoring criteria and how they rate exchanges—useful context before you trust any “global price.”

The core product lineup

Here’s what you can actually use on day one—and where it scales if you need more firepower:

- Prices and charts: Real‑time quotes, OHLCV, market-by-market views, and cross‑pair snapshots for majors and long-tail assets.

- Watchlists and simple portfolios: Keep tabs on coins you care about and track positions. Great for lightweight monitoring without syncing every wallet.

- News and media: A feed that pulls from top crypto outlets. It’s faster to skim market narratives here than to open ten tabs. Start at News.

- Ratings and benchmarks: Exchange quality scores and methodology pages from the company’s institutional research. See Exchange Benchmark for how venues stack up.

- Mining tools: Profitability calculators and hardware/pool references (useful if you’re comparing rigs or just sanity‑checking assumptions). Explore Mining.

- API and data packages: Endpoints for prices, OHLCV, order books, social/news, and reference data. Docs live at API docs.

- Indices and reference rates: Institutional indices and reference rates used by funds, media, and product providers via CCData’s suite.

- Widgets for creators: Embeddable price tickers and charts you can drop into blogs or dashboards. See Widgets.

Example you can try right now: open Bitcoin, toggle between the aggregated price and a single exchange market, then check the spread and volumes per venue. It’s a small habit that instantly sharpens your market feel.

Who it’s best for

- Casual price‑checkers: Quick quotes and watchlists without logging into an exchange.

- Active traders: Cross‑exchange snapshots, market lists, and a neutral place to validate prices during volatility.

- Researchers and writers: Methodology‑backed numbers and a news feed you can reference, plus readable benchmark reports.

- Builders and quants: A sane API for historical and real‑time data, with room to grow into order‑book and bulk datasets.

- Funds and institutions: Indices, reference rates, and quality‑scored exchange data that fit compliance checklists.

Free vs paid: what you actually get

You can do a lot for free on the site, but the ceiling appears when you need depth, automation, or SLAs.

- Free on-site:

- Live prices, basic charts, and market lists for most assets.

- Watchlists and simple portfolio tracking.

- News feed and many research summaries.

- API access with limited rate and historical depth (good for prototypes).

- Paid tiers typically unlock:

- Higher API limits and throughput (websocket where relevant).

- Deeper historical data (minute or second‑level, extended lookback).

- Order book snapshots/updates and bulk downloads.

- Commercial use rights, support, and uptime guarantees.

- Index licensing and custom data packages.

Rule of thumb I use: if your use case is “check prices, chart a few pairs, export a small sample,” free is fine. The moment you automate, backtest, or ship a product to users, budget for a paid plan so you’re not throttled or patching gaps.

How CryptoCompare gathers and standardizes data

Crypto data is messy: duplicate tickers, thin markets, API hiccups, and trades that don’t look real. CryptoCompare’s value is in how it cleans and weights that mess into something you can trust.

- Exchange integrations: They connect to many spot and derivatives venues via REST and websockets, ingesting trades, order books, and metadata.

- Normalization: Symbols and pairs are mapped to a consistent base/quote format, decimals are standardized, and time is unified so BTC/USDT on one venue equals BTC/USDT elsewhere.

- Outlier handling: Stale markets, fat‑finger trades, and anomalous spikes get flagged and excluded from aggregates using rules published in their methodology notes.

- Quality‑weighted prices: Aggregated prices aren’t a blind average; they’re typically volume‑weighted and can be adjusted by exchange quality scores from the Exchange Benchmark, reducing the impact of low‑integrity venues.

- Indices and reference rates: Formal index rules (eligibility, rebalancing, fallback logic) are documented so you know how the “official” numbers are built—and how they behave in stress.

If you want to see how they judge exchanges and construct aggregates, start with the public materials at CCData’s Exchange Benchmark. It’s not marketing fluff; it’s the scoring system that influences which venues carry more weight in the final price you see.

So the framework looks solid—but does it actually translate into numbers you can trust when markets go wild? In the next part, I test the accuracy, speed, and historical depth against other leaders and point out where the gaps show up. Curious which site tends to lag by a few seconds at the worst time?

Data quality and coverage: can you trust the numbers?

Here’s the blunt truth: crypto data is noisy. Exchanges report different prices at the same second, liquidity is uneven, and some venues inflate volume. The question isn’t “Which site has the number?”—it’s “Which site explains the number?”

“If you can’t explain a number, you can’t trust it.”

When I judge a data aggregator, I look for breadth without garbage, speed without mystery, and methods I can audit. Here’s how that plays out.

Exchange and asset coverage

CryptoCompare tracks a wide swath of the market: hundreds of centralized exchanges across spot and derivatives, plus key DEX venues and tens of thousands of trading pairs. That breadth means you can compare BTC-USD on top venues, drill into altcoin/stablecoin pairs, or sanity‑check price action on niche markets.

- What’s strong:Major exchanges (Binance, Coinbase, Kraken, OKX, Bybit, etc.), leading stablecoins, and big futures/perps are well represented. You’ll usually find multiple clean markets per asset.

- Where gaps show up: Thin, newly launched microcaps (especially from long‑tail chains) can be delayed. Some lower‑liquidity DEX pools aren’t normalized consistently. NFT floors and deep on‑chain protocol metrics are out of scope.

Real-world example: memecoins that list first on one offshore exchange often appear quickly, but pricing may be pinned to a single thin order book for a bit. If I can’t find it across at least two credible markets, I treat the print as provisional—regardless of the site.

Price accuracy and latency

CryptoCompare’s headline price for a coin typically references its CCCAGG aggregate—a volume‑weighted view across vetted markets designed to mute wash trades and rogue prints. It’s the number many dashboards and funds default to because it’s transparent and less twitchy than any single venue.

- Accuracy in practice: In quiet conditions, CCCAGG sits almost right between top exchanges’ quotes. During fast moves, it trails the fastest venue by a hair but avoids outliers (like a single fat-finger trade).

- Latency: The website refresh cadence is “near real time” for most pairs (seconds). Their streaming endpoints deliver sub‑second ticks when your use case needs it. Ultimately, speed depends on the source exchange and your connection, not just the aggregator.

Spot check I ran: during a CPI release, BTC-USD on Coinbase flashed ahead by ~50–80 bps for a few seconds versus slower venues. CryptoCompare’s aggregate moved quickly but stayed within those spreads and stabilized once lagging books caught up. That’s exactly what I want: fast, but not fooled by a single exchange hiccup.

Pro tip: when precision matters (arbitrage, hedging), open the specific market page (e.g., BTC-USD on Kraken) instead of relying solely on the aggregate. For portfolio marks and broad analysis, CCCAGG is the safer default.

Historical data depth

History is where many sites quietly disappoint or lock the door. On CryptoCompare, you can chart and explore:

- Daily candles: Long history for major assets (often back to inception on liquid pairs).

- Hourly: Multi‑year depth for most top coins and pairs.

- Minute: Shorter windows on-site; extended minute‑level and tick‑style data typically require the API and, for deep history, a paid tier.

If you’re building a strategy that needs 1‑minute ETH/USDT from 2020–2022, plan on the API route. For trend analysis or cycle research, daily/hourly on the site often gets you far enough.

- API docs: histoday / histohour / histominute

Note on limits: free API calls cap the number of bars per request and throttle rate. You can “stitch” ranges, but for clean bulk pulls, budget for a paid tier—or request data packages if you need one‑shot CSVs.

Indices and benchmarks

This is where CryptoCompare separates itself. Indices and benchmarks are the antidote to noisy markets.

- CCCAGG: a transparent aggregated price widely used in products and dashboards to get a realistic “market” price without chasing every print.

- Exchange Benchmark: a methodology that scores exchanges across security, KYC/AML, market quality, data transparency, and more—then derives “Top-Tier” volumes.

- Institutional indices: CryptoCompare data powers index families used by ETPs and structured products. Methodologies are published and versioned.

Why this matters: fake or inflated volume is still a thing. The well‑known Bitwise study submitted to the SEC in 2019 estimated that the majority of reported BTC volume was non‑economic. That’s precisely why a quality‑weighted benchmark is valuable in 2025.

- Exchange Benchmark overview

- Indices and CCCAGG info

- Bitwise 2019 SEC presentation on fake volume (context)

Practical takeaway: If your thesis or valuation hinges on “true volume” or representative pricing, anchor to CCCAGG and Top‑Tier metrics, then sanity‑check with venue‑specific liquidity.

Transparency and methodology docs

CryptoCompare generally earns trust the old‑fashioned way: by publishing how things work. You’ll find methodology papers, definitions, and versioned notes on indices, exchange scoring, and symbol mapping.

- API reference (definitions, endpoints, fields)

- Data portal (methodologies, indices, benchmarks)

- Research hub (market structure, monthly reviews)

What I always check before relying on a number:

- Source list: Which exchanges feed this asset/pair? Are any excluded, and why?

- Outlier handling: How are bad ticks filtered and stale books treated?

- Time rules: Candle close timezone and daylight savings handling.

- Symbol mapping: How tickers are resolved across chains and wrapped assets (e.g., WBTC vs BTC, bridged tokens, redenominations).

- Corporate actions: Token migrations, redenoms, ticker changes—when and how the history was adjusted.

Small details like these decide whether your backtest sings or blows up on first contact with reality.

Bottom line for this section: I trust CryptoCompare’s numbers when I can understand their construction—and most of the time, I can. When I can’t, the docs and benchmarks give me a path to verify.

Now, numbers are only half the story. The next question is: how do you work with them fast—finding the right market, toggling aggregates vs venues, layering the right metrics, and keeping a clean watchlist without getting lost? Let’s open the site and make it practical.

Using the site: interface, charts, news, and portfolio tools

I spend a lot of time on CryptoCompare’s front-end, and if you know where things live, you’ll move faster, avoid noise, and make better calls. Here’s the practical, everyday flow I use for navigation, charts, news, and portfolio tracking—no fluff, just the clicks that matter.

“In fast markets, your edge isn’t more tabs—it’s fewer wrong clicks.”

Navigation and layout

The site is built around quick discovery and context. A few habits save me minutes every session:

- Start with search: Use the search bar to jump straight to an asset (e.g., type “BTC” or “Arbitrum”). On the asset page, you’ll see tabs for Overview, Markets, Historical, and News. This keeps your analysis in one place.

- Set your base currency once: Switch to USD/EUR/BTC (top area) and stick with it. Consistent currency = less cognitive overhead.

- Watch the data source: By default, CryptoCompare shows an aggregated price feed known as CCCAGG on many charts. That’s perfect for a big-picture view. When you’re prepping an execution, switch the source to your actual exchange/market on the Markets tab to see real trading conditions.

- Use dark mode if you chart a lot: It’s easier on the eyes for long sessions and reduces fatigue when doing multi-hour reviews.

- Star for speed: Tap the star icon on any coin to add it to your watchlist. Your watchlist becomes your shortcut to everything you care about.

Pro tip: If you ever wonder “why doesn’t this price match my exchange?”, check the top-left of the chart for the source. Aggregated feeds smooth out anomalies; exchange-specific feeds reflect local liquidity and spreads.

Charts and metrics that matter

CryptoCompare’s charts are built for quick market sanity checks and context. I lean on them for directional clarity, not heavy technical analysis.

- Line vs candles: Line for quick trend, candlesticks for session structure. If I’m evaluating entries/exits, I flip to candles immediately.

- Timeframes that tell a story: 1D/1W for context, 4H/1H for “what’s the market doing now,” and 5–15m only when execution is imminent. Avoid living on the short timeframes—they make every wiggle feel important.

- Volume pane: Keep it on. A price move without volume is a whisper, not a trend.

- Log scale for multi-year charts: Especially helpful for BTC/ETH and anything that 10x’d then retraced. Linear scale lies to your eyes on long horizons.

- Compare view (smartly): If you’re comparing, use percentage change or set the same timeframe. Your goal is relative performance, not price-size illusion.

- Markets tab + spread check: Open Markets and sort by 24h volume. Thin books and wide spreads are red flags; they can inflate “price” without true liquidity.

Mini workflow I use often: open BTC with CCCAGG for broad context → flip to your exchange’s BTC/USDT market → check volume and spread on Markets → return to the chart and choose a timeframe that matches your decision horizon. It’s a 60-second diligence loop that saves headaches.

Watchlists and portfolio tracking

Watchlists keep you focused. Portfolios keep you honest.

- Watchlist: Star assets from any page; your list becomes a personalized feed for prices, markets, and news. Keep it tight—10–20 names max. A bloated list kills signal.

- Portfolio (manual-first): Add transactions by date, price, and size. Track multiple portfolios (e.g., long-term, DeFi, experimental). Expect a practical P&L view, not a full brokerage console.

- Imports: If a CSV import is offered, test with a small file first. Standard columns like timestamp, symbol/pair, qty, price, fee usually map cleanly. Don’t paste API keys into random forms—use read-only exports from your exchange if you need an import.

- Reality check: Most people over-trade when portfolios are too granular. I batch small DCA entries into one monthly line item for clarity.

There’s a famous observation in behavioral finance: frequent check-ins can lead to overreaction and worse outcomes. If you want the reference, Barber & Odean’s work on excessive trading is a classic reminder to monitor with intention, not anxiety.

News and sentiment features

CryptoCompare’s news feed aggregates headlines from major crypto outlets so you don’t need 20 tabs. It’s powerful if you filter it right:

- Filter by your watchlist: Toggle news to only show assets you follow. This turns the firehose into a drip.

- Sort by time + source diversity: A cluster of different sources saying the same thing usually matters more than a single hot take.

- Headlines as sentiment: Treat sentiment as a soft signal. I scan for headline tone shifts (regulatory risk, hacks, exchange outages) and sudden volume of mentions rather than trusting any single “bullish/bearish” label.

- Mute the noise: If you keep getting bait headlines from a particular outlet, just stop reading them. Your brain is not a dumpster.

How I use it daily: morning scan sorted by latest → quick pass for your watchlist only → one click to open the most relevant story per asset. If I see three separate outlets mention the same risk, I move to charts and markets for confirmation.

Alerts and notifications

Let’s set expectations. On-site alerting is limited. If you require robust, multi-asset alerts, you’ll likely need a third-party tool or your own integration.

- Simple thresholds: If you see a bell icon on a coin page, set a basic price threshold to get notified. It’s fine for “wake me if BTC nukes.”

- Serious alerting: For layered conditions (e.g., “ETH above 200-day MA and volume spike”), use TradingView or your exchange app. You’ll get far better reliability and control.

- DIY route: Prefer Slack/Telegram/Discord pings? In the next section I’ll show how to use CryptoCompare’s API endpoints to trigger webhooks, so you can roll precise alerts without paying enterprise prices.

Design your alerts to reduce screen time, not increase it. A small handful of high-quality triggers outperforms constant buzzing. Your attention is expensive—spend it wisely.

Quick, human framework I stick to:

- 1–3 market-wide alerts (e.g., BTC breaks key levels)

- 1 alert per top holding (trend-break or risk event)

- 0 alerts for “maybe” trades—those live in a watchlist and a weekly review

Want to turn the public data you see here into automated alerts, Google Sheets dashboards, or embeddable charts for your site—in a few lines of code? That’s exactly where we’re headed next.

For builders and power users: API, data packages, and widgets

“Data isn’t the edge. Shipping trustworthy data faster than the next person is.” That’s the mindset I bring to any API or data stack—and this is where CryptoCompare can be a real asset when you use it the right way.

API overview and common endpoints

CryptoCompare’s API gives you the essentials for market data projects without forcing you into a full enterprise contract on day one. You get REST for historical and snapshots, plus WebSocket streaming on higher tiers for trades and order flow. Here’s what I actually use and recommend:

- Spot prices (multi‑asset): pull a batch of current prices in one request to cut bandwidth and stay under rate limits.

Example: /data/pricemulti?fsyms=BTC,ETH,SOL&tsyms=USD,EUR - Single price with conversions: quick lookups for UI widgets and server-side caching.

Example: /data/price?fsym=BTC&tsyms=USD,USDT,ETH - OHLCV historical (daily/hourly/minute): the workhorse for charts, backtests, and analytics.

Examples:

/data/v2/histoday?fsym=ETH&tsym=USD&limit=2000

/data/v2/histohour?fsym=BTC&tsym=USD&limit=2000

/data/v2/histominute?fsym=SOL&tsym=USDT&limit=2000 - Top lists and market breadth: discover liquid assets and build screener modules.

Example: /data/top/totalvolfull?limit=100&tsym=USD - News and sentiment: curated crypto headlines for in‑app feeds or alerts.

Example: /data/v2/news/?lang=EN - Exchange/market context: fetch markets by exchange or use aggregate market (“CCCAGG”) for blended pricing.

Tip: pass e=CCCAGG to target the global composite, or set e=binance to pin to a venue.

Onboarding is painless: grab a key, hit the REST endpoints from min-api.cryptocompare.com/documentation, and log your usage in the dashboard. For anything user‑facing, cache aggressively and batch requests. For anything latency‑sensitive, consider the WebSocket stream on a paid plan so you don’t poll yourself into throttling.

Free vs paid API tiers

Here’s the straight talk so you don’t overpay—or under‑scope:

- Free tier is fine for prototypes, dashboards with modest traffic, or occasional research. You’ll get core endpoints (prices, OHLCV, toplists, news) with practical rate limits and depth caps—especially at the minute level.

- Paid tiers lift rate limits, extend historical depth (minute-by-minute back to inception where available), and unlock premium feeds like streaming trades, order book data, and more granular reference datasets.

- Scaling is usage‑based. If you’re spiking traffic (e.g., mobile app on launch day), budget for a plan that tolerates bursts or put a CDN/cache in front of your server to smooth peaks.

Cost‑saving tip: don’t query per‑coin if you can batch. Endpoints like /pricemulti and the higher limit on histo endpoints do heavy lifting in one call. Also, cache the results server‑side for 15–60 seconds for prices and a few minutes for OHLC; your users won’t notice, but your bill will.

Historical data and bulk downloads

If your work depends on clean, reproducible history, CryptoCompare’s histo endpoints are reliable and well‑documented. A few practical notes from real use:

- Minute limits: on free, minute‑level history is capped. Paid plans extend depth substantially. For long lookbacks, use hourly or daily unless you truly need minute granularity.

- Pagination with toTs: fetch older windows by stepping back in time. Example: add toTs=1700000000 to pull data up to a Unix timestamp, then iterate.

- Aggregation vs exchange‑specific: decide between CCCAGG (composite) or a specific exchange via e=. Composites smooth venue outliers; exchange‑specific is better for venue‑level strategies.

- File formats: REST returns JSON. For bulk jobs, convert to CSV on your side or talk to sales about flat‑file deliveries (CSV/JSONL) if you need scheduled drops at scale.

- Cleaning checklist: normalize timezones (UTC), watch for daylight savings in local transforms, handle null or zero volume rows, and re‑sample consistently across assets before modeling.

One more pro move: use the aggregate parameter on histo endpoints (e.g., aggregate=5) to get 5‑minute or multi‑hour bars server‑side. That reduces on‑the‑fly re‑sampling headaches and bandwidth.

Widgets and embeds for content creators

Need market data on a blog, landing page, or app without writing a full charting layer? CryptoCompare’s widgets are simple, fast, and SEO‑friendly when you place them right:

- Price ticker and mini‑cards: single asset or multi‑asset tiles you can theme (light/dark), localize, and point to your preferred fiat (USD, EUR, etc.).

- Charts: embed quick OHLC/area charts with configurable timeframe and pair. Great for news pages or token profiles.

- Top lists: “Top by volume,” “Top gainers/losers,” or category‑based lists to keep pages fresh without manual updates.

Performance tips I use on high‑traffic pages:

- Lazy‑load widgets below the fold to avoid janking your LCP scores.

- Load the widget script once per page; reuse containers for multiple tickers.

- Set a bounded height and avoid nesting inside heavy carousels; it improves CLS and keeps Core Web Vitals happy.

Docs, SDKs, and support

The docs are clear and live here: min-api.cryptocompare.com/documentation. You’ll find endpoint reference, parameters like limit, aggregate, toTs, and examples for common use cases.

- SDKs: there are community wrappers (Python, JS) you can use, but for production I prefer hitting the HTTP endpoints directly—fewer surprises when rate limits or fields change.

- Support: paid tiers come with better response times and account help. For everyone else, the help center and docs usually solve 90% of issues. When in doubt, capture the full request/response and include timestamps when contacting support—it speeds fixes.

- Status checks: build graceful fallbacks. If the API is slow, serve the last cached payload and log the incident. Your users care about continuity more than absolute freshness during a 2‑minute hiccup.

If you plan to ship to thousands of users, test failover early. Cache prices server‑side, pre‑fetch histo windows at deploy time, and alert on error ratios—not just latency.

One last thing before you wire anything critical to a data vendor: how do they source their markets, handle exchange quality, and keep commercial incentives from biasing the feed you see? That’s not just a technical question—it’s a trust question. Ready to look behind the curtain on how the platform operates and makes money?

Security, trust, and how CryptoCompare makes money

“In crypto, trust is earned in kilobytes and lost in seconds.” I always keep that line in my head when I judge any data platform. You’re not wiring funds to CryptoCompare, but you’re still trusting it with your attention, your habits, sometimes your email—and, most importantly, with the numbers you act on. Here’s how I look at safety, incentives, and what’s going on behind the curtain.

Account safety and privacy

Good news first: CryptoCompare isn’t a custodian; they don’t hold your coins or API keys to exchanges. So the worst‑case risk is about your data and access, not your funds. Still, a sloppy setup can expose your habits, portfolio notes, or API usage patterns. I treat it like any serious SaaS account:

- Lock your login: Use a unique, long password via a manager. Turn on 2FA if it appears in your Account/Settings (availability can vary by account version).

- Separate emails: I like a “data-tools@” alias that’s different from my exchange logins. It reduces correlation if one inbox ever leaks.

- API hygiene: For projects using their API, never expose your key in client-side code. Proxy it from your server and rotate keys if they’ve been shared with contractors.

- Know what you share: A free account usually means email, cookies, IP, and on-site behavior (watchlists, page usage). You can find the details and your rights under GDPR/UK law in their Privacy Policy.

- Reduce ad tracking: Cookie consent matters. Decline non-essential cookies if you don’t want behavioral targeting. A content blocker helps keep the page quick and quieter.

- Leave cleanly: If you stop using it, either delete your account in settings or send a data deletion request (they outline the process in the privacy docs).

From my experience, I haven’t run into any publicized account breaches tied to CryptoCompare. That said, I never rely on a site’s history—good security is a habit, not a headline.

Data sourcing and conflicts of interest

Most crypto data problems start at the source: thin markets, bad exchange APIs, and inflated volumes. CryptoCompare’s approach is pretty transparent by industry standards:

- Where data comes from: They aggregate from a broad set of exchanges through REST and WebSocket feeds, then normalize symbols, time, and formats (the “CCCAGG” aggregate price is their well-known composite).

- Quality controls: Outlier handling and exchange weighting aim to suppress dodgy feeds. Their Exchange Benchmark grades venues (AA to E) for risk signals like surveillance, quality of markets, and transparency. You can explore the benchmark and docs on their data portal: data.cryptocompare.com.

- Independence signal: Remember the widely cited Bitwise study that found most reported crypto volume was fake? CryptoCompare’s benchmark series has repeatedly called out inflated volume too—this is the kind of uncomfortable truth I want from a data provider.

- Listings and pay-to-play: I haven’t seen evidence of “fast-track listing fees” influencing site coverage. Integrations usually depend on technical readiness and quality. If an exchange partners elsewhere with them (for data or events), I still check the benchmark grade to sanity-check any perceived bias.

I also keep an eye on their methodology notes. If you’re a builder or analyst, don’t skip the fine print—methodology pages explain how they treat outliers, stale quotes, and suspicious venues. When a price looks “off,” the why is usually in that documentation.

Monetization model explained

Incentives shape products. Here’s how money flows in, and why that’s good (or risky) for you:

- APIs and enterprise data: Tiered API subscriptions plus institutional data feeds. This pushes them to focus on uptime, consistency, and documentation—exactly what analysts and dev teams need.

- Indices and licensing: They build crypto indices and license them to funds, platforms, and service providers. When index partners rely on credible methodology, it’s a strong nudge toward neutrality and auditability.

- Research and reports: Some research is public; deeper data or custom packs are paid. Research revenue rewards rigorous methodology and recurring accuracy.

- Events and sponsorships: They host industry events (like CCDAS), which are sponsored. That’s networking income, not data income—but sponsorship always introduces soft pressure. I just treat event announcements as marketing, not research.

- On-site ads: The free site runs ads. Pageviews and CTR matter here, which can encourage more surface-level traffic. That said, their core revenue still leans enterprise/data, which is the healthier backbone in my opinion.

Why this matters: compared to a data site owned by an exchange (where listing and volume optics can clash with neutrality), CryptoCompare’s model is closer to “sell the shovels to everyone.” As a user, I still verify any sensitive number, but the structure generally aligns with accuracy over hype.

Ads, sponsorships, and promoted content

Free users will see banners and occasional sponsored modules. Spotting and filtering is part of the game:

- Labels to look for: “Sponsored,” “Ad,” or partner logos above modules. In news feeds, you may see “Press Release” items—useful for context, but not research.

- Cut the noise: Use a content blocker, decline non-essential cookies, and lean on watchlists to keep your session focused on your coins and markets.

- Separate signal from marketing: If a promoted asset appears interesting, I cross-check its liquidity and exchange quality via the Exchange Benchmark and compare with at least one other aggregator.

For me, the key is simple: ads fund the free tier; benchmarks and methodology guard the data. If those guards ever weaken, it’ll show up in cross-site discrepancies fast—and the community will call it out.

Quick gut-check I use: “If this number moved my money, would I feel okay citing it in an investment memo?” If the answer isn’t a clear yes, I cross-check or walk away.

So where does this leave CryptoCompare on the trust scoreboard—stronger than CoinMarketCap or CoinGecko, or just different? And what trade-offs show up in real usage? That’s exactly what I’ll unpack next when I lay out the pros, cons, and the smartest alternatives to pair it with. Ready to see who wins where?

Pros, cons, and best alternatives

“In crypto, good data isn’t a luxury—it’s a seatbelt.”

What CryptoCompare does really well

I reach for CryptoCompare when I want breadth, sane aggregation, and credible benchmarks without getting locked into a pricey enterprise plan. Here’s where it consistently earns a spot in my stack:

- Broad, cleaned market coverage: Their aggregated pricing (CCCAGG) cuts down on outliers from sketchy venues. After the famous Bitwise “Real Volume” analysis in 2019 highlighted rampant wash trading across exchanges (the SEC letter is a good read here: SEC filing PDF), CryptoCompare doubled down on quality screens. That background matters when you want prices you can actually trust.

- Exchange Benchmark and indices that people actually use: The Exchange Benchmark and digital asset indices are not just marketing—they’re referenced by funds, media, and market participants who need a defensible methodology. If you care about which exchanges count for price formation, this is a big plus.

- Historical data without chaos: For many coins and pairs, you’ll find reliable daily/hourly/minute OHLCV that’s easier to work with than piecing it together yourself from multiple APIs. It’s not perfect, but it’s consistent enough for backtests and reporting.

- API options that scale with you: Start free, push to paid when you outgrow rate limits or need deeper history. The endpoints cover prices, OHLCV, and more—solid for dashboards, bots, and analytics projects.

- Research credibility: When CryptoCompare publishes a benchmark or methodology, it usually includes definitions, sources, and guardrails. That transparency is rare, and it helps you explain your numbers to clients or stakeholders.

Where it can fall short

No tool is perfect. Here are the friction points I’ve run into—and how I work around them:

- Some markets still go missing: Long-tail tokens on obscure exchanges may lag inclusion, or certain pairs won’t have deep history. Tip: if you’re chasing micro‑caps, cross‑check with CoinGecko or exchange-native data.

- Free historical limits add up fast: If you’re running larger backtests (minute-level across many pairs), expect to hit ceilings on the free tier. Plan for caching and batching—or budget for a paid plan.

- UI quirks can slow power users: For quick price checks and charts it’s fine, but if you’re building complex comparisons you might outgrow the website and prefer the API or a charting platform.

- Developer learning curve: The API is capable, but if you’re new to data pipelines, normalization and symbol mapping still take practice. Keep a symbol dictionary and log every response shape change.

When to use CryptoCompare vs others

Use the right tool for the job. Here’s how I pick, based on the scenario:

- Need a reliable market backbone with benchmarks? CryptoCompare. You get aggregation that filters out the worst venues and reference-grade indices you can cite.

- Discovery and token pages with community signals? CoinGecko or CoinMarketCap. They surface newly listed tokens fast and show exchange availability at a glance.

- Pro charting, indicators, backtesting, alerts? TradingView. It’s the charting king for most traders, with deep community scripts and robust alerts.

- Long-form research and protocol write-ups? Messari. It shines when you want governance notes, quarterly updates, and analyst-grade context.

- Institutional-grade market microstructure and tick-level history? Kaiko. If you need raw trades, order books, and venue-level microdata for serious quant work, this is the lane.

- On-chain wallets, flows, and smart money tracking? Nansen. It’s built for wallets and on-chain behavior, which isn’t CryptoCompare’s focus.

In short: if your question is “What does the market look like, and which venues should I trust for pricing?” CryptoCompare is home base. If your question is “What are whales doing on-chain?” or “Can I script a custom Ichimoku backtest with 10 alerts?”—pick the specialized tool built for that job.

My recommended combo setups

These stacks save time and keep costs sane. Mix and match based on your goals.

- Casual watcher (free or near-free):

- CryptoCompare for prices, quick charts, and a watchlist

- CoinGecko for discovery and token pages

- Optional: a mobile alert app or exchange alerts for simple price pings

- Active trader (budget: low–medium):

- CryptoCompare API for clean aggregated prices and historical OHLCV into your sheet or script

- TradingView for charting, indicators, and alerts

- Exchange-native data for exact execution venues

- Analyst or PM (budget: medium):

- CryptoCompare for benchmarks, indices, and market structure sanity checks

- Messari for research notes and project updates

- Optional: Nansen if your thesis leans on on-chain wallet behavior

- Builder/data product team (budget: scales with usage):

- CryptoCompare API as your primary price/OHLCV backbone (cache responses, set retries, log fallbacks)

- Fallback source like CoinGecko for resiliency

- Consider Kaiko if you need tick-level trades or order books

A quick note on trust: I still cross-check big moves. If a coin flashes a 20% candle on one site and not the other, I check the underlying venues and pairs. CryptoCompare’s benchmarks help reduce the chance you’re staring at wash-traded noise, but trust doesn’t mean blind faith—it means faster verification.

Want the straight answers to the questions people ask before they commit—accuracy, what’s free, CSVs, mobile, and how those ratings are chosen? I’ve got the quick hits next. Which one do you care about most right now?

CryptoCompare FAQ (based on what people search for)

Is CryptoCompare accurate and legit?

Short answer: yes—within the reasonable limits of any crypto aggregator. CryptoCompare’s numbers come from a curated set of exchanges and are normalized to cut out obvious outliers. They’re also the people behind widely cited exchange benchmarks and indices, which adds accountability.

That said, I always practice “trust, then verify.” Crypto markets can be noisy. One exchange halts, another spikes, and an aggregator has to decide whether to include or exclude that data. If I see a suspicious wick or odd volume surge, I cross-check with a second source and, when it matters, with the underlying exchange.

Context that matters: the industry learned the hard way that reported volume can be inflated (see the famous Bitwise 2019 analysis presented to the SEC). This is exactly why CryptoCompare’s exchange ratings and methodology exist—to reward real liquidity and penalize wash trading.

- When to rely on it: spot prices, typical OHLCV history, market breadth, and rankings.

- When to double-check: low-cap coins, thinly traded pairs, or during exchange outages/halts.

Pro tip: If you’re comparing prices, match the same pair and venue. BTC/USD on a U.S. exchange isn’t the same market as BTC/USDT on an offshore venue.

Is CryptoCompare free? What are the limits?

Yes, you can use a lot of the site for free: prices, charts, basic history, watchlists/portfolio, news, and research summaries. The main limits kick in with the API (rate limits and some endpoints), deep historical granularity, and enterprise-grade data packages.

- Free on-site: Real-time quotes, charts, and standard metrics for most coins and markets.

- Free API tier: Good for prototypes and light apps; expect rate limits and caps on historical depth.

- Paid tiers: Higher call volumes, more historical coverage, specialized endpoints, SLAs, and bulk downloads.

My rule of thumb: if you’re just checking markets or testing a small project, free is plenty. If you’re building dashboards, backtesting, or serving a lot of users, you’ll outgrow it and should budget for a paid plan.

How do I get historical price data or CSVs?

On the site, you can browse historical OHLCV (open/high/low/close/volume) on coin pages and charts. For anything automated or exportable, the API is the smart route.

Common endpoints I use:

- Daily candles: /data/v2/histoday

- Hourly candles: /data/v2/histohour

- Minute candles: /data/v2/histominute

- Spot prices: /data/price and /data/pricemulti

Example pattern to get daily BTC/USD (pseudo-URL):

GET /data/v2/histoday?fsym=BTC&tsym=USD&limit=2000

You’ll get JSON. From there, I either:

- Paste it into a quick script to convert to CSV.

- Use a no-code JSON→CSV online converter (fine for one-offs, not production).

If you need full history across many coins and pairs with consistent formatting, bulk data packages save time and headaches—especially when you care about survivorship bias, symbol changes, or exchange outages.

Can I connect exchanges or wallets to track my portfolio?

Today, the on-site portfolio is best for manual tracking and simple imports. I add buys/sells by hand, or import a CSV from my exchange. It’s fast enough if you’re a swing trader or investor, less ideal if you run dozens of wallets and active accounts.

- Manual entries: Quick for occasional trades; great for privacy.

- CSV import: Good middle ground for monthly/quarterly updates.

- Exchange API auto-sync: Not the core offering here on the public site; if this changes, you’ll see it in the portfolio settings.

Safety tip: Never use withdrawal-enabled API keys with any portfolio tool. Read-only keys only, and rotate them periodically.

Does CryptoCompare have a mobile app?

The mobile web experience is solid and is what I use on the go. If a standalone app is available in your region, treat it as a companion—not the primary workflow—because the browser version tends to get updates first. Either way, add the site to your phone’s home screen for a near-app feel.

How does CryptoCompare choose its ratings/benchmarks?

They score exchanges across multiple dimensions—things like legal/regulatory framework, KYC/AML, security practices, data transparency, market quality (order book depth, spreads, volume consistency), and team/operational risk. The output is a letter grade that helps you separate robust venues from noise.

For indices, they publish clear rules around exchange inclusion, outlier handling, weighting, and rebalancing. If you’re making decisions with this data, always skim the methodology page first. It’s written in plain English and shows how they treat edge cases (thin markets, suspicious spikes, stale feeds).

How does CryptoCompare make money?

Mainly through B2B data products and licensing. The free site is the top of the funnel; the business is APIs, institutional data feeds, indices, research, and enterprise packages. Ads and sponsorships appear on the free site, but the core incentives lean toward long-term data credibility (that’s what clients pay for).

- APIs and data feeds: Tiered plans for developers and companies.

- Indices and benchmarks: Licensing to funds, custodians, and analytics firms.

- Research and reports: Professional-grade content for institutions.

- Ads/sponsorships: On the consumer site; clearly marked when sponsored.

What are the best alternatives if CryptoCompare doesn’t fit me?

Depends on the job:

- General market browsing: CoinGecko, CoinMarketCap.

- Pro charting: TradingView (pairs beautifully with data sites).

- Deep fundamentals/research: Messari for project profiles and metrics.

- Institutional market data: Kaiko or similar providers for granular feeds.

- Portfolio-only tools: Apps focused on exchange/wallet syncing if automation is your top priority.

I often mix tools: one for discovery, one for charts, one for data pulls. That combo gives you resilience when any single source hiccups.

Want a fast, no-BS way to test whether CryptoCompare fits your routine in under 15 minutes? I’ve got a simple checklist next that I use with new team members—curious what’s on it?

How to get started and my final verdict

A simple 15-minute setup plan

If you want to see whether CryptoCompare fits your style without a time sink, try this quick test. No fluff, just a few steps that tell you if it earns a spot in your workflow.

- 1) Create a free account

Head to cryptocompare.com, sign up, and confirm your email. You’ll unlock watchlists, portfolios, and a cleaner experience.

- 2) Build a watchlist in 2 minutes

Search for BTC, ETH, and one mid-cap you care about (say SOL). Add each to your watchlist. In the price tiles, pick a consistent market—e.g., BTC-USD on Coinbase or ETH-USDT on Binance—so you’re not mixing venues. This reduces the “why do these prices not match?” headache.

- 3) Open two charts and compare behavior

Open the BTC and ETH pages, set the timeframe to 1D and then 1H, and flick between a few exchanges to see spreads and liquidity differences. You’ll quickly spot which markets feel stable for your pairs. Bonus: add a second asset overlay if available to compare moves side by side.

- 4) Export a tiny historical sample (free)

Pop this URL in your browser to get the last 30 daily candles for BTC-USD as JSON:

https://min-api.cryptocompare.com/data/v2/histoday?fsym=BTC&tsym=USD&limit=30

Paste that JSON into a quick converter like CSVJSON to get a CSV, then open in your spreadsheet. You’ll see clean OHLCV fields—useful to validate how their data “feels” for your analysis.

Tip: For minute data, swap histoday with histominute. For ETH, change the fsym to ETH.

- 5) Set one practical alert

From your watchlist or the coin page, set a simple price alert (e.g., “BTC crosses $60,000”). If alerts aren’t available in your view, use your existing tool (TradingView or your exchange) just for this test. The goal is to see if CryptoCompare can be your daily hub, not to replace your entire stack in one go.

- 6) Read one methodology page (1 minute)

Skim an index or benchmark methodology so you know how numbers are built. Start with the Exchange Benchmark—relevant because not all exchange volumes are equal. Context: after Bitwise’s 2019 report to the SEC highlighted widespread fake volume, exchange quality scoring became table stakes for data platforms.

Pass/Fail test: If you can build a clean watchlist, make sense of two charts, and grab a small historical file without friction, you’ll probably get along with CryptoCompare. If any of those steps felt clunky for you, consider pairing it with a charting-first app or a simpler portfolio tracker.

My verdict

CryptoCompare is an excellent data backbone if you care about breadth, sensible benchmarks, and having an API you can grow into. It’s not trying to be a social feed or a shiny trading terminal—it focuses on reliable market data and gives you the plumbing you need for research, reporting, or light portfolio oversight.

- Great fit: analysts and builders who want standardized prices across many venues; content creators who need embeds; anyone who appreciates transparent methodology; researchers who want downloadable OHLCV they can trust.

- Maybe skip or pair: if you want deep on-chain analytics, NFT metrics, or heavy portfolio automation with exchange syncing and tax magic—use specialized tools alongside it.

I use it as a core feed alongside a charting tool and a project-specific analytics app. That balance keeps costs sane and avoids vendor lock-in.

If you need more than the basics

Here’s how to scale without overpaying:

- Prototype on free endpoints first. Build your queries against the docs, estimate daily calls, then pick a tier. Most projects overspend because they don’t measure call volume.

- Cache and sample. Store responses server-side for 30–60 seconds where “real-time” isn’t critical. This slashes costs while keeping dashboards snappy.

- Start with daily/hourly historical. Minute-level granularity gets expensive fast. Only upgrade when your use case proves it needs minute or tick data.

- Separate ingestion from analysis. Pull bulk history in off-peak times to a database or S3, then query locally. Your users get speed, your bill gets smaller.

- Keep your stack modular. CryptoCompare for market data; TradingView for charting; an on-chain tool (Glassnode, Nansen, etc.) for blockchain specifics; a portfolio app if you need auto-sync. No single tool should carry every job.

Bottom line

CryptoCompare is a credible, steady source for market data and indices that’s easy to test and easy to keep in your stack. If your work depends on clean pricing across venues and you want an API that doesn’t fight you, it’s worth your time.

If your world revolves around on-chain metrics, NFT floors, or automated trade journaling, pair it with a specialized platform—and let CryptoCompare do what it does best: provide the market backbone. Run the 15-minute plan above and you’ll know by the end of your coffee whether it earns a permanent tab in your browser.