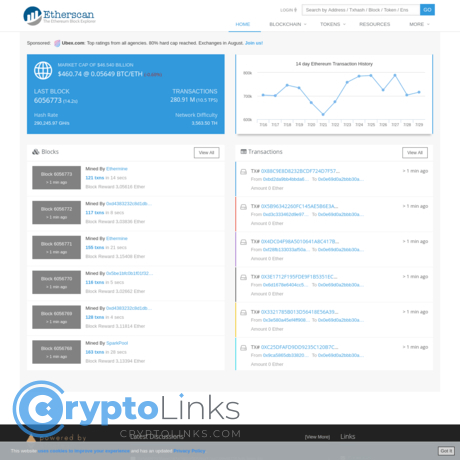

Etherscan.io Review

Etherscan.io

cryptolinks.com

Etherscan.io Review Guide: Everything You Need to Know + FAQ

Ever stared at a stuck Ethereum transaction and thought, “Why is this pending forever?” Or looked at a random token in your wallet and wondered, “Is this legit?” You’re not alone.

This guide shows you exactly how to use Etherscan.io the way power users do—so you can read transactions clearly, check wallet balances and NFTs, verify token contracts, monitor fees, set alerts, spot scams faster, and actually understand what’s happening on-chain.

I’ll keep it simple, practical, and real—no fluff. We’ll look at the screens you’ll use most, what the numbers mean, and how to avoid the mistakes that cost people money.

The problem: Ethereum is transparent… but not always easy to read

Ethereum is a public ledger. Everything’s visible, but not everything is obvious. If you’ve ever asked questions like these, you’re in the right place:

- “Why is my transaction pending?” Maybe your max fee was too low or you got stuck behind a surge in base fees.

- “Is this token real?” Copycat contracts and fake tokens are everywhere. Etherscan helps you confirm the official contract address.

- “What’s a nonce?” It’s your transaction counter. Get it wrong, and you’ll wonder why nothing is sending.

- “Where are my NFTs?” They might be under ERC‑721 or ERC‑1155, and transfers show up in a different tab than ETH transactions.

- “Why did my swap succeed, but my balance looks off?” Logs and decoded input data reveal what actually happened—bridges, approvals, fees, and multi-step swaps included.

Real talk: scammers love chaos. In 2023 alone, wallet drainers stole an estimated $295M via approval phishing. A quick check on Etherscan’s Token Approvals can save you from unlimited permissions you never meant to give.

What you’ll get from this guide (the promise)

- How to look up any address, ENS, token, or transaction hash—and know exactly what you’re seeing

- How to read fees, gas used, nonce, status, logs, and decoded input data without second-guessing

- How to verify token contracts so you avoid fake lookalikes

- How to use Read/Write Contract safely (when to trust it, when to avoid it)

- How to track wallets, set alerts, export history, and use labels/notes to speed up research

- How to catch risky approvals and revoke them before they bite

Quick example: A user sends a swap with a low priority fee during a spike. On Etherscan, the tx shows Pending, base fee jumps, and another replacement tx (same nonce, higher fee) gets mined first. The original shows Replaced. Without Etherscan, that looks like “my funds disappeared.” With Etherscan, it’s obvious—and fixable.

Who this guide is for

- ETH holders who want to check balances, fees, and incoming/outgoing transactions

- NFT collectors who want to verify collection contracts and view transfer history

- DeFi users who approve/spend tokens and need to audit permissions regularly

- Traders and researchers who track wallets, labels, and token movements

- Builders who want a clean read of contract state, events, and verification status

Quick snapshot of Etherscan’s value

Think of Etherscan as your Ethereum truth engine. It doesn’t hold your funds or send transactions for you—it gives you the clearest possible window into what’s on-chain:

- Address pages: balances, tokens, NFTs, approvals, and internal transactions

- Transactions: status, gas, nonce, decoded input data, and event logs

- Tokens: official contracts, holders, transfers, and verification badges

- Contracts: verified source code, Read/Write functions, and analytics

- Gas Tracker: live base/priority fees and timing tips to save money

- Quality-of-life: watchlists, alerts, labels, notes, and CSV exports

If you’ve ever hesitated before clicking “Confirm” in your wallet, Etherscan is how you get certainty. Ready to see what Etherscan actually is—and what it isn’t—so you can use it with confidence?

Etherscan basics: what it is, what it isn’t, and why it matters

What Etherscan actually does

Etherscan.io is Ethereum’s public microscope. It indexes blocks, transactions, addresses, tokens, and smart contracts so I can search, verify, and understand what truly happened on-chain—without depending on a wallet UI or a dapp’s spinner.

Here’s the simple way I think about it: the blockchain is the ledger; Etherscan is the reader. It pulls from Ethereum nodes, organizes that raw data, and makes it human-friendly.

- Look up anything: address, transaction hash, block number, token contract, or ENS name. Example: the Ethereum genesis block is public forever: block 0.

- Validate tokens and contracts: USDC’s official contract is here: 0xA0b8…eB48. If the address doesn’t match what the project publishes, I don’t touch it.

- See what a call actually did: a swap, mint, or transfer becomes readable through decoded input and event logs.

“On-chain doesn’t lie — sometimes the UI does.” When I’m unsure, I let Etherscan be the final source of truth.

Is Etherscan a wallet or exchange?

No. Etherscan is read-only for everything you view. It doesn’t hold funds, it doesn’t trade for you, and it won’t move your assets.

You can connect your wallet when you purposely choose to interact with a verified contract via the Write Contract tab, but that’s just a convenience interface. Your wallet (MetaMask, Ledger, etc.) still handles the signing and the gas. Etherscan never has custody of your keys or coins.

- Think “block explorer,” not “exchange.”

- You control what’s signed. Etherscan won’t auto-trigger anything. If a wallet pop-up appears, it’s because you clicked a function that requires it.

Is Etherscan safe and free?

Yes, browsing is free, and Etherscan is widely trusted by builders, analysts, and everyday users. I keep it in my bookmarks and use it daily. That said, there are two safety habits I never skip:

- Only use the official domain: etherscan.io. Phishing clones are a real thing across crypto. Industry research (see Chainalysis’ annual crime reports) consistently shows brand impersonation and scam pages as major attack vectors: Chainalysis 2024 Crypto Crime Report.

- Never, ever share a seed phrase or private key: Etherscan will not ask for it. If you see a prompt like that, it’s a scam.

You can make a free Etherscan account for alerts, notes, and API keys. I enable 2FA on mine and keep API keys private.

Key features at a glance

Etherscan packs a lot, but it’s organized in a way that makes sense once you know what to look for. Here are the highlights I rely on most:

- Address pages: ETH balance, token holdings, NFT tabs, transaction history, internal transactions, approvals, analytics, and labels. A well-known public wallet like 0xd8da…6045 shows how rich these pages can be.

- Transaction details: status (success/failed/pending), from/to, method, gas used, fee paid, nonce, decoded input, and event logs. This is where I confirm what actually executed.

- Token and NFT trackers: holder counts, transfers, and contract pages for ERC‑20s (like USDC) and ERC‑721 collections (like BAYC).

- Gas Tracker: live base fee and priority fee ranges so I don’t overpay: Gas Tracker.

- Contract verification: the “Contract Source Code Verified” badge means the source matches what’s on-chain—safer to read and analyze.

- Read/Write Contract: read state safely; write functions only when I’m 100% sure I’m on the right contract.

- Labels and notes: Etherscan’s public labels plus my private tags make research faster the next time.

- Alerts: get notified when a watched wallet sends or receives funds—great for whales, treasuries, or your own cold storage.

- API and exports: pull balances, transactions, and logs for tracking or automation; export CSVs for tax season or audits.

At its core, Etherscan turns Ethereum’s transparency into something I can actually use. It’s not a place to store coins or chase trades. It’s the place to confirm reality.

Ready to put this to work? In the next section, I’ll show you the exact screen I start with, the search tricks that save me time, and how I spot the right result in seconds—want the playbook?

Getting started: finding your way around Etherscan.io

Home page and search bar tips

Think of the Etherscan home page as your command center. The big search bar at the top is smarter than it looks—paste almost anything Ethereum-related and it will figure out where to send you.

- What you can search: wallet addresses (0x…), transaction hashes (0x… long strings), ENS names (like vitalik.eth), block numbers, token contract addresses, and even labels Etherscan already knows.

- Quick example: type vitalik.eth or paste 0xd8dA6B…6045. Etherscan resolves the ENS name to the address and shows you the full profile.

- Gas at a glance: check live network conditions from the header or jump to the Gas Tracker before you send anything pricey.

- Mainnet vs testnets: Etherscan has separate subdomains for networks like Sepolia (sepolia.etherscan.io). Make sure you’re on the right site for the network you’re using.

- Checksum tip: Etherscan will display addresses in checksum case (mixed-case). If the address you pasted looks different, that’s normal—checksum is just a safety format.

“In crypto, ‘I thought’ has cost more than ‘I checked’ ever will.”

Address page tour

Land on any address page and you’ll see a clean snapshot of everything that wallet or contract has been up to. Here’s how to read it without getting lost.

- Overview panel: balance in ETH, fiat equivalent, and a short profile if Etherscan has a public label (e.g., known exchange wallets or public figures).

- Transactions tab: the main list of outgoing/incoming transfers. Use the filters and “Method” column to spot swaps, approvals, mints, and bridges at a glance.

- Internal Txns: transfers triggered by smart contracts (not sent directly by the wallet). According to Etherscan’s docs, these are execution traces created during contract calls—super helpful for understanding complex interactions. See: Etherscan: What are internal transactions?

- Token holdings: ERC‑20 balances with USD values, plus ERC‑721/1155 (NFT) tabs. Click into a token to see holders, transfers, and the contract profile.

- Token Approvals: a full list of allowances you’ve granted to dapps (who can spend what). If you’re thinking “uh, did I leave an unlimited approval somewhere?”—hold that thought for the next section.

- Analytics: charts for balance over time, transaction counts, and gas spent. Great for spotting patterns and activity bursts.

- Comments and Labels: public tags from Etherscan and community comments. Treat comments as noise; treat official labels as signal.

Pro move: on token holdings, click the contract address to jump straight to the token’s page. That’s where you confirm you’re looking at the real contract, not a copycat.

Transaction page tour

Open a transaction and you’ll see the entire story, including the parts most wallets hide. Here’s the checklist I use:

- Status: Success, Failed, or Pending. If it failed, the gas is gone; the transfer didn’t happen. Pending? Compare the fee with the Gas Tracker.

- Block and timestamp: how many confirmations and when it landed. Useful for audits and support tickets.

- From → To: sender and recipient. For contract interactions, “To” is the contract; actual token movements show under “Tokens Transferred” and in the Logs.

- Value and fee: ETH sent and total fee paid (gas used × effective gas price). If the fee looks wild, check whether the transaction consumed all its gas due to a revert.

- Gas details: base fee, priority (tip), and gas used. If you see “Out of gas,” the gas limit was set too low.

- Nonce: the sender’s transaction number. This is crucial for speeding up or canceling a stuck transaction later.

- Method and Input Data: decoded when possible. A Uniswap trade might show something like swapExactETHForTokens. When it’s not decoded, Etherscan uses signature sources like 4byte.directory to match method IDs.

- Event Logs: the truth serum. This is where you’ll see tokens actually move, mints fire, or approvals set. If the method says “swap” but logs show no transfer to you, you didn’t receive tokens.

- Internal Txns: value transfers triggered mid-execution (bridges, multicalls, contract payouts). These fill in the gaps for complex dapps.

Real-world example: on a multi-hop swap, you may see no direct transfer from the contract to your address in the “To” field. Instead, check “Tokens Transferred” and Logs to verify the final token actually arrived in your wallet.

ENS names and labels

Human-readable names make Ethereum usable, but they also make scams easier. Etherscan helps you tell the difference.

- ENS resolution: search an ENS like alice.eth and Etherscan shows the resolved 0x address, the reverse record, and the current owner. Learn more about ENS at ens.domains.

- Official labels: look for badges like Contract Source Code Verified, “Token” info panels, and public tags (e.g., “Exchange,” “Bridge,” “Deployer”). These aren’t endorsements, but they’re strong signals you’re in the right place.

- Impostor defense: never trust a token by name alone. Match the contract address from the project’s official site, docs, or verified socials; then confirm you’re on that exact address page on Etherscan.

- Warning tags: Etherscan sometimes flags addresses with “Phish/Hack” notices. If you see a red banner, back away.

Emotional checkpoint: it’s okay to pause and verify. Fast is expensive; wrong is permanent.

Ready to make this practical? In the next part, I’ll show you how to track balances, tokens, and NFTs the right way—and the one tab that quietly lists every spending permission you’ve ever granted to a dapp. Which approval would you revoke first if you could see them all in one place?

Wallet tracking 101: balances, tokens, NFTs, and approvals

“Trust, but verify—on-chain.”

See ETH and token balances correctly

When I look at any address on Etherscan, I start with the balances box: it shows raw ETH and then ERC‑20 tokens with live USD values. That’s your quick snapshot. But the real gold is one click deeper.

- Open a token’s page from the wallet view to check the contract, verified status, holders, and transfers. Example blue‑chips:

- USDC: 0xA0b8…6e48

- WETH: 0xC02a…6Cc2

- LINK: 0x5149…86CA

You’ll see Profile Summary, supply, holder count, and recent transfers—perfect for sanity checks.

- Sort by value on the address page to spot what actually matters. It’s easy to get distracted by dust tokens.

- Identify spam: random tokens with sketchy names are often airdropped to bait clicks. Don’t visit unknown URLs from token pages, and never “swap to unlock” somewhere shady.

- Know the standards (if you’re curious): ERC‑20 is the token interface (EIP‑20). The “Allowance” mechanism is why approvals exist (we’ll fix those risks below).

Pro tip: If a wallet balance looks off, check the Token Transfers tab under the address and confirm timestamps vs. your wallet’s activity feed. Wallet UIs sometimes lag; Etherscan shows final truth.

Track NFTs the right way

NFTs live under two tabs on an address page: ERC‑721 and ERC‑1155. I always verify the collection before I click anything else.

- Confirm the collection contract matches the official one:

- BAYC (ERC‑721): 0xbc4c…f13d

- Common ERC‑1155 frameworks include shared storefronts; approvals here can be broad, so review them more often.

- Use NFT Transfers to see movement history, then click into a specific token ID to view its mint, holders, and transfers.

- Watch for fakes: a new contract using a famous name with almost no holders or a very recent “Contract Creation” is a red flag.

- Standards refresher: ERC‑721 is one token per ID (EIP‑721), ERC‑1155 supports multiple copies per ID (EIP‑1155). That difference matters for approvals.

Emotional gut-check: if the collection page doesn’t look right—no verification, tiny holder count, weird mint history—pause. Scammers count on curiosity. Your future self will thank you for not clicking.

Watchlists and alerts

I use alerts as my early-warning radar. It takes 60 seconds to set up and saves me from constantly refreshing pages.

- Create a free account on Etherscan, open an address page, then hit the star icon to Add To Watch List.

- Configure alerts for:

- Incoming/outgoing transactions

- Movements above a USD threshold (great for whale tracking)

- Token-specific activity (e.g., notify me when this wallet moves USDC)

- What I monitor:

- My cold wallet (in/out alerts = instant peace of mind)

- Project treasuries and vesting wallets

- Bridges I use, to see congestion patterns

Small habit, huge payoff: I’ve caught unusual approvals and unexpected airdrops within minutes because of email alerts. You sleep better when your wallets ping you before trouble does.

Check and revoke token approvals

Approvals are powerful—and dangerous. When you “Approve” a token or NFT, you grant a spender permission to move assets on your behalf. Marketplaces and DeFi apps need this. Attackers love it too.

- Open Token Approvals on your address page (or use Etherscan’s dedicated checker: tokenapprovalchecker). There are tabs for ERC‑20 and NFTs.

- What to look for:

- Unlimited allowances (often shown as “Max” or a huge number like 2256−1). Convenient, but risky.

- Unknown spenders you don’t recognize.

- Old approvals for apps you no longer use (especially legacy marketplace contracts).

- How to revoke:

- Click Revoke next to the spender, connect your wallet, and confirm. You’ll pay a small gas fee.

- Re-test the dapp later; it will ask for a new approval if needed. Set limited allowances when possible.

- NFT approvals matter too: marketplaces often request operator approvals for entire collections (721/1155). If you list occasionally, keep those disabled until you actually need them.

Security teams like SlowMist and education hubs like Revoke.cash Learn have documented how phishing kits trick users into granting dangerous approvals—no seed phrase required. Regular reviews cut that risk dramatically.

Quick safety checklist I actually use:

- Recheck approvals after every new dapp I test

- Limit approvals to exact amounts when the UI allows

- Set an Etherscan alert for any outgoing token I rarely use

- Keep marketplace/NFT operator approvals off by default

Here’s the emotional truth: the scariest drains don’t feel like hacks—they feel like “I just signed a normal approval.” Take two minutes to review. Future you will be grateful.

One more thing before we move on: ever seen a transfer that “succeeds,” yet your balance doesn’t look right, or fees eat more than expected? That’s where understanding transactions, status, and gas saves you real money. Ready to peek under the hood and fix those pain points?

Transactions and gas: understand, fix, and avoid mistakes

There’s nothing more gut-wrenching than watching a transaction sit “Pending” while the market moves without you. I’ve been there. The good news: once you understand what Etherscan shows you, you can read what happened, fix stuck transactions, and avoid wasting ETH on fees you didn’t need to pay.

“Slow is smooth, smooth is fast.” On Ethereum, patience plus the right fee beats panic-clicking every time.

Reading a transaction like a pro

Open your transaction on Etherscan and walk through it top to bottom. I use this checklist:

- Status & block: Success, Failed, or Pending. Confirmations tell you how final it is. A “Success” with many confirmations is settled reality.

- From / To / Method: If “To” is a contract, you’ll see a Method (e.g., swapExactETHForTokens, approve, transfer). That’s your headline of what you tried to do.

- Gas used & fee paid: Look for Gas Used, Gas Limit, and Effective Gas Price. Under EIP‑1559, your fee is:

Fee = Gas Used × (Base Fee + Priority Fee)

Base fee is burned; priority fee (tip) goes to the validator. - Input data (decoded): Click “Decode Input Data” to see the parameters you sent. Great for catching a wrong amountOutMin or a sketchy spender on approvals.

- Logs / Events: This is what actually happened. For swaps, you’ll see a chain of Transfer events and protocol-specific events (Uniswap’s Swap, OpenSea’s OrdersMatched, etc.). If you swapped but didn’t see a Transfer into your wallet in the logs, you didn’t receive the token you expected.

- Nonce: This is the sequence number of your txns from that address. If nonce N is stuck, nonce N+1 won’t get mined until N clears.

Example pattern to spot: You approve a token (Method: approve, gas used ~45k–65k), then you swap (Method: swapExactTokensForETH, gas used ~120k–220k). If the swap failed but you see the approve as Success, your approval still stands—review it in Token Approvals later so it doesn’t linger forever.

Pending, dropped, or replaced?

Here’s how I translate Etherscan’s language into next steps:

- Pending: Your tx is in the mempool waiting to be included. Reasons it lingers:

- Your max fee is too low for current base fee spikes.

- Your priority fee (tip) is too low compared to competing txns.

- You have an earlier pending nonce holding everything behind it.

- Dropped: Nodes gave up gossiping your tx (often because it was underpriced for too long). You may need to resend with a better fee.

- Replaced by fee: A higher-fee transaction with the same nonce took its place. This is what you want after hitting “Speed Up.”

Pro tip: Always check the lowest pending nonce for your address (the earliest stuck tx). Replace or cancel that one first. Anything with a higher nonce will wait until it’s cleared.

Speed up or cancel basics

Timing matters. Here’s my practical workflow:

- Find the nonce: Open the pending transaction on Etherscan and note the Nonce.

- Speed up (replace): Resend the same call with the same nonce and a higher fee. Most wallets have a “Speed Up” button; if you do it manually, keep gas limit equal or slightly higher.

- Rule of thumb for replacement: bump both max fee and priority fee by at least 10–15% over the previous attempt. If the chain is spiking, go more aggressive.

- Simple safe setting: Max fee = 2 × current base fee + priority. Start priority at 2–5 gwei for normal activity, 15–50 gwei for rush moments (mints, liquidations).

- Cancel: Send a 0 ETH transaction to yourself with the same nonce and a higher fee. If it lands first, it invalidates the original pending tx.

- Only works if the original tx hasn’t been included yet.

- Use a similar or slightly higher gas limit (e.g., 21,000–50,000) and a clear fee bump so validators prefer it.

Pitfalls I avoid:

- Don’t spam “Speed Up” five times. If two replacements land, you pay twice.

- Watch for “Replaced by fee” on Etherscan before sending another attempt.

- Fix the earliest stuck nonce first, or nothing after it will confirm.

Gas Tracker tips

The Gas Tracker is your friend: Etherscan Gas Tracker. It shows live base fee, recommended priority fees, and recent blocks. A few money-saving habits have paid my bills (literally):

- Send at quieter times: Multiple analyses of historical gas (including public dashboards on Dune and community research) show weekends and late-night UTC hours tend to be cheaper, while US/EU business hours are busier. It’s not guaranteed, but it’s a reliable pattern.

- Use sane tips: For routine transfers and approvals, 1–3 gwei priority often clears quickly in normal conditions. For fast inclusion during spikes, 10–30 gwei is common. For hot mints or liquidation races, go higher or you’ll wait.

- Know typical gas usage:

- ETH transfer: ~21,000 gas

- ERC‑20 approve/transfer: ~45,000–70,000 gas

- DEX swaps: ~120,000–250,000+ gas (depends on route)

- NFT mints: highly variable; contracts can exceed 200,000+

- Quick cost math you can trust: If a swap uses 150,000 gas and base fee is 15 gwei with a 2 gwei tip, total cost ≈ 150,000 × 17 gwei = 2,550,000 gwei = 0.00255 ETH. At $3,500/ETH, that’s ~$8.93.

- Avoid accidental overpay: Setting a huge max fee is fine as a safety ceiling, but your effective paid rate equals base fee + priority. Focus on a realistic tip; the base fee adjusts per block.

- Resend with confidence, not fear: If you’re replacing, increase both the max fee and tip clearly above your prior attempt. A tiny bump may not clear.

One more sanity check: if a tx “succeeds” but your swap outcome looks off, read the logs. The chain doesn’t lie. Whether you were sandwiched, slipped too much, or received a different token, the logs show the balances that moved, where they went, and which contract did it.

Speaking of contracts… how do you know the token address you’re approving is the real one, and that the contract code matches what the project claims? Ready to spot fakes before they touch your wallet and use Read/Write safely?

Tokens and smart contracts: verify before you click anything

There’s a moment right before you hit “Mint,” “Approve,” or “Swap” where your stomach tightens. That’s your instincts asking for proof. Etherscan gives you that proof—if you know where to look and what to trust.

“Trust, but verify.” In crypto, that means verify the contract—every time.

Find the real token contract

Scammers count on typos, lookalike names, and fake listings. I never rely on a token name alone. Here’s how I confirm the official contract address before I take action:

- Start with the project’s official sources: website Docs page, announcement post, GitHub, or verified social profiles. Cross-check that address on Etherscan.

- Use “Token Tracker” pages to sanity-check the data: supply, decimals, creation date, and holder distribution. Example for illustration only: USDC (Ethereum).

- Beware search-engine results and sponsored links. Always backstop with an official source.

- Match the full address, not just the first/last 4 characters. Copy-paste mistakes are how funds get lost.

Green flags I like to see:

- “Contract Source Code Verified” on Etherscan (more on this below)

- Consistent address across the project’s site, docs, and socials

- Reasonable holder distribution (no single wallet holding most of the supply unless clearly explained)

- Stable “Info” and “Holders” data over time, not erratic spikes

Red flags that make me pause:

- Token name matches a popular coin but the address is new and unverified

- Top 10 holders control nearly everything and liquidity is tiny or externally controlled

- Website is a template or recently registered with no reputable references

- “Airdropped” spam tokens appearing in your wallet urging you to click a site—ignore those

Independent incident trackers like SlowMist and research from Chainalysis repeatedly show that centralized mint/upgrade powers and opaque ownership are common in rug pulls. If the token can be minted arbitrarily or fees can be changed at will, that’s not a meme—that’s a risk.

Verified contracts and what that means

When you see the badge “Contract Source Code Verified” on Etherscan, it means the human-readable source code matches the bytecode on-chain. That unlocks ABI decoding (so you can actually read what’s going on) and gives you a better shot at spotting dangerous functions.

What I check on the Contract tab:

- Verification type: Exact match on Etherscan or Sourcify. “Similar match” is better than nothing but not perfect.

- Proxy status: If you see “Read as Proxy/Write as Proxy,” it’s an upgradeable proxy. Click through to the Proxy Admin and Implementation contracts and check who controls upgrades.

- Ownable patterns: Look for

owner()and whether ownership is renounced (owner = 0x000...000). If not, what can the owner do? - Risky capabilities: Functions like

_mint(),setTax,setFees,blacklist,enableTrading,setMarketingWallet, or anything that sweeps tokens can be fine if publicly explained—but they demand caution. - Compiler and optimization: Normal to see, but sudden re-verifications with different settings on a live system can be a signal to read changelogs.

Verification doesn’t guarantee safety. It just means you can see what you’re dealing with. Combine that with control checks (owner, admin, timelocks, multisig) and you’ll avoid a lot of traps.

Read/Write Contract, safely

Etherscan’s Read Contract and Write Contract tabs are power tools. I use them to confirm state before I approve anything.

Useful “Read” calls I check:

symbol(),decimals(),totalSupply()— do these match the project’s claims?owner()orgetOwner()— is ownership renounced, a multisig, or a single EOA?balanceOf(myAddress)andallowance(myAddress, spender)— what will I actually spend or expose?- For NFTs:

ownerOf(tokenId),tokenURI(), andisApprovedForAll()

Before I ever use “Write” (changes state), I do this:

- Double-check I’m on the correct contract and chain. Cross-reference with official links again.

- Read the function signature and parameters carefully. Who is the spender? What is the amount?

- Avoid unlimited approvals by default. If I must approve, I set only what I need and revoke later.

- If it’s a proxy, I use “Write as Proxy” so I’m interacting with the implementation ABI, not just the proxy shell.

Quick example that has saved me headaches: when a site asks for an ERC-20 approval, I check the spender address on Etherscan first. If it’s not the router or contract I expect (e.g., a known DEX router), I stop. Unlimited approvals to mystery spenders are how wallets get drained later.

Decode input data and events

When something goes wrong—or when I just want to learn exactly what happened—I open the transaction on Etherscan and hit “Decode Input Data.” If the contract is verified, Etherscan translates hex gibberish into human-readable function names and parameters.

Here’s what I look for on a transaction page:

- Method: Was it swapExactTokensForETH, approve, transferFrom, safeTransferFrom (NFT), or a generic multicall?

- Parameters: For swaps, check the path array—are those the correct token addresses? For approvals, confirm the spender and amount.

- Event Logs: This is golden. Transfer events tell you what moved where and in what amounts. For NFTs, look for Transfer and ApprovalForAll.

- Internal Txns: Useful for contracts that forward ETH or call other contracts under the hood.

Example scenarios:

- Swap confusion: You approved a token but received less than expected. The logs show a path through a fee-on-transfer token—now you know where the slippage hit.

- “Claim” turned approval: The input decodes to an approve with

uint256 max, not a claim. That “airdrop” was a trap. Close the tab. - NFT mint drama: Logs show only an approval and no Transfer (mint). The contract never minted—your gas went to a function that didn’t deliver.

The more you read decoded inputs and logs, the faster your pattern-recognition gets. It’s the easiest way to turn stress into certainty.

Want a simple habit that pays for itself? Every time you meet a new contract, read three things before interacting: the owner, the risky functions, and the last 10 event logs. It takes a minute and saves you nights.

You’ve now got the playbook for separating real from risky. Next, I’ll show you how I keep research organized with labels, private notes, exports, and APIs—so you never have to “re-figure” the same contract twice. Ever wish your future self could remember everything you’ve checked already?

Pro features: labels, notes, exports, and APIs

“Trust, but verify.” That one line is the difference between guessing and actually knowing what happened on-chain.

Labels, private tags, and notes

I treat Etherscan like a personal research notebook. When I tag wallets and leave quick notes, I stop re-doing the same research every time a new transaction pops up.

What I actually use:

- Private Name Tags: Sign in, open any address, and add a private label—something like “Coinbase deposit 1”, “Main cold wallet”, or “Airdrop test wallet”. Only you can see it.

- Private Txn Notes: On a transaction page, add a short note like “cancel replace for nonce 57” or “gas spike, paid 0.01 ETH”. Next time you’re auditing your history, those two lines save 20 minutes.

Real examples I keep:

- Bridges: “Arbitrum bridge out”, “Optimism bridge in” so I can link movements across chains.

- DEX routers: “Uniswap V3 Router”, “1inch Aggregation Router” to spot swaps instantly in my feed.

- Recurring payouts: “Staking rewards – protocol X”, “Royalty split – collection Y” for quick income tracking.

Smart habit: use a simple naming system like [Type] – [App] – [Purpose] (e.g., Wallet – Ledger – ETH Long-term). It keeps your on-chain map clean as your activity grows.

CSV exports for taxes and tracking

When it’s time to prove what happened, a clean CSV beats guesswork every time. Etherscan lets you export normal transactions, internal transactions, ERC‑20 transfers, and NFT transfers right from any address page. I regularly pull four files and keep them together with a readme note so future-me doesn’t suffer.

Why it matters:

- Tax reporting: Agencies like the IRS and the UK’s HMRC expect detailed records—dates, amounts, fees, and counterparties. Your Etherscan CSVs are the ground truth.

- Portfolio analysis: You can stitch exports into a simple spreadsheet to track cost basis, realized PnL, and fee burn over time.

- Audits & grants: If you manage a multisig or community treasury, a monthly CSV packet keeps everyone aligned and reduces drama.

Pro tips I’ve learned:

- Export everything: Normal, internal, ERC‑20, ERC‑721, and ERC‑1155. Internal txns often include ETH moved by contracts that won’t show in the “normal” list.

- Lock the timezone: Set a single timezone across exports so totals match your accounting system.

- Keep raw files: Archive untouched CSVs first, then work from copies. If you ever need to re-check numbers, you’ll be glad you did.

- Large histories: Big wallets may need multiple exports. You can segment by date ranges to keep files manageable.

Etherscan API basics

When I need real-time signals or custom dashboards, the API is my go-to. It’s simple, fast, and battle-tested.

Popular endpoints I use:

- Account balance: module=account&action=balance (get ETH balance for any address)

- Transactions: module=account&action=txlist (normal txns) and action=tokentx (ERC‑20 token movements)

- Logs (events): module=logs&action=getLogs (filter by contract and topics—great for monitoring mints, swaps, or approvals)

- Gas: module=gastracker&action=gasoracle (grab base/priority fee suggestions for bots or schedulers)

- JSON‑RPC proxy: module=proxy (fetch on-chain data like eth_getTransactionByHash without running your own node)

How I keep it smooth (and safe):

- Respect rate limits: Free keys handle light workloads; batch and cache results. For high-frequency bots, upgrade or queue requests.

- Paginate properly: Use page and offset and sort by block/tx to avoid gaps.

- Don’t expose keys: Store API keys server-side or in secure env variables. Public front-ends leak keys.

- Backoff and retry: Network hiccups happen. Exponential backoff prevents throttling and keeps your scripts reliable.

Simple idea starters:

- Telegram alert bot: Ping yourself when a watched wallet gets an approval or sends > X ETH.

- Google Sheets tracker: Nightly job pulls balances and latest txns into a tidy sheet for quick morning checks.

- NFT mint monitor: getLogs with the Transfer event topic to spot fresh mints on a contract you care about.

Etherscan Pro vs free

Most people won’t outgrow the free tier—searching addresses, decoding transactions, pulling occasional CSVs, and setting a few alerts. When I’ve needed more, it’s been for automation and scale.

When an upgrade makes sense:

- Heavier API use: Bots, dashboards, or monitoring multiple wallets without hitting rate limits.

- Larger or faster exports: Historical pulls for busy wallets or treasury reporting.

- More alerts/watchlists: Teams who track many addresses and need reliable notifications.

- Quality of life: Ad‑free browsing and priority support when time actually is money.

I always start free, then upgrade only when I hit a bottleneck. If you’re building anything that needs steady, reliable data flow, the bump in limits pays for itself by not breaking at the worst possible moment.

Quick gut-check: If you copy/paste from Etherscan a few times a week, free is perfect. If your scripts run while you sleep, Pro is probably cheaper than a missed trade or a broken report.

Curious how this setup plays with wallets, portfolio apps, and multichain explorers—and where Etherscan stops being the right tool? In the next section, I’ll show you exactly how I stack these tools without overlap. Which piece of your workflow takes the most time today?

When to use Etherscan vs other tools, and how it fits your stack

Multichain explorers to know

I keep an “explorer tab” open for every chain I touch. If you work across networks, the good news is most of them use the same Etherscan-style layout. That means once you’re comfortable on Etherscan, you’re basically fluent everywhere.

- Ethereum: Etherscan

- BNB Chain: BscScan

- Polygon: Polygonscan

- Arbitrum: Arbiscan

- Optimism: Optimistic Etherscan

- Base: BaseScan

- Fantom: FTMScan

- Avalanche C-Chain: SnowTrace

- Linea: LineaScan

- Scroll: ScrollScan

- Celo: CeloScan

Same muscle memory, different chain IDs. If you bridge or swap on another network and something looks off in your wallet, jump to the right explorer and check the transaction page or your address page immediately.

Tip: Add “explorer bookmarks” by chain. I use a folder called Explorers with quick links so I never paste a tx hash into the wrong chain.

Wallets and dapps work best with a block explorer

Your wallet is the interface. Etherscan is the truth. I pair them for almost every on-chain action:

- Before I send: I paste the recipient into Etherscan to confirm it’s a real address/contract and look for labels or warnings. If it’s a token transfer, I double-check the official token contract address.

- After I swap: I open the transaction on Etherscan and read the Logs to confirm the amounts actually moved. If a UI bug shows “0 received,” the logs tell me what really happened.

- When I approve: I check the Token Approvals tab for my wallet right after. Unlimited approvals are convenient but risky—phishing kits target these. Chainalysis has shown approval-based scams are a common vector in recent crime reports.

- Bridging or L2 deposits: I track both sides. For example, an Ethereum L1 deposit to Arbitrum will show up on Etherscan first, then I follow the message/tx link on Arbiscan to see the L2 execution.

- NFT mints: I verify the collection’s contract on the explorer and watch the Token Minted/Transfer events live. If the mint site is fake, the explorer won’t show the expected events or verified contract.

This two-step habit (wallet + explorer) has saved me from sending to the wrong address more than once, and it helps me catch UI quirks fast.

When Etherscan isn’t enough

Etherscan is the source of truth for raw on-chain data, but sometimes I need different lenses:

- Portfolio tracking across chains: Use tools like DeBank, Zerion, or Zapper for a dashboard view. They aggregate balances and positions, but I still click through to Etherscan-style explorers to verify anything critical.

- Security and approvals at scale: For a multi-chain sweep of allowances, revoke tools (e.g., revoke.cash) are convenient. I confirm the final state on Etherscan/BscScan/etc.

- Simulation and debugging: When I need to test a contract call before sending, I simulate on Tenderly or a similar tool, then compare the result with the real tx on Etherscan after execution.

- MEV and mempool insights: If I’m timing a high-value trade, I check MEV dashboards like Flashbots’ explorers to see how noisy the block space is. Etherscan shows confirmed truth; MEV tools show the game that happens around it.

- Deep analytics and labels: For entity-level labels or historical behavior, I’ll use platforms like Nansen or Dune. Once I spot a pattern, I go back to the explorer to review the exact transactions and contract interactions.

- Taxes and audits: Spreadsheets and accounting tools (Koinly, CoinTracker, Rotki) are great for categorizing. The CSVs from Etherscan are my receipts when I need to show what actually happened.

One more reason not to skip the explorer: approval phishing and fake contracts are still common. In 2023–2024, multiple industry reports flagged social-engineering and approval exploits as steady drivers of losses. A 10-second Etherscan check is cheap insurance (Chainalysis research).

Quick best practices

- Bookmark official contracts: Token pages and top protocol addresses get a star in my browser. I never rely on search after that.

- Use alerts for big moves: Set an address alert on Etherscan for whales, team wallets, or your own cold storage. Immediate pings beat waiting for CT rumors.

- Check the chain first: If a tx “vanishes,” make sure you’re on the right explorer (Ethereum vs Arbitrum vs Polygon). Wrong chain is the most common “it’s gone” moment I see.

- Respect gas and timing: If fees spike, I either wait or set a reasonable priority tip. Speeding up is fine, but don’t panic fee into a sandwich-prone block.

- Read the logs: For swaps, mints, or complex contract calls, the event logs are your receipts. If the UI and the logs disagree, trust the logs.

- Verify before write: Only interact with verified contracts and only from official links. If a site asks for a fresh approval, I check my existing allowances first.

Remember: Your wallet signs. The explorer verifies. Together, you get both speed and certainty.

Still unsure about which page shows what, or how to read a specific field without second-guessing? Up next is a fast, no-fluff FAQ that answers the exact questions people ask every day—want a 30-second refresher on pending vs dropped, or where to find decoded input data?

FAQ: real questions people ask about Etherscan

What is Etherscan and is it safe?

Etherscan is a blockchain explorer for Ethereum. It indexes and displays on-chain data so you can see what really happened: transactions, addresses, tokens, contracts, and events. It’s free and widely used by devs, traders, and auditors.

Safety tips I personally follow:

- Always check the URL is https://etherscan.io (watch for lookalike domains).

- Avoid clicking ads that spoof Etherscan—type the address directly or use a bookmark.

- Never enter seed phrases or private keys anywhere. Etherscan will never ask.

- Turn on 2FA for your Etherscan account if you use alerts, tags, or API keys.

Phishing and malicious approvals remain a top risk across crypto. Scam Sniffer estimated over $300M stolen via “drainers” in 2023 alone.

Is Etherscan a wallet or exchange?

No. It’s read-only. You can view data on Etherscan, but you still use your wallet (MetaMask, Ledger, etc.) to sign and send transactions. Even the “Write Contract” actions route through your wallet.

How do I track a transaction on Etherscan?

Easy:

- Paste the transaction hash into the search bar.

- Check Status (Success/Failed/Pending), From/To, Value, Gas Used, Fee, Method, and Logs.

- If it’s pending, compare your fee to the live market on Gas Tracker.

Tip: If maxFeePerGas is below current base fee, it won’t get picked up. Use your wallet’s “Speed Up” with a higher max fee and a reasonable priority tip.

How do I find the official token contract?

Here’s my short checklist:

- Get the contract from the project’s official site/Docs or verified socials.

- Confirm the address on Etherscan and look for Contract Source Code Verified.

- Sanity check the token page: holder count, transfers, and any official labels.

Examples of legit, well-known contracts:

- USDC: 0xA0b8…6eB48

- WETH: 0xC02a…6Cc2

Beware of similarly named tokens with tiny holder counts and no verification.

How do I check and revoke approvals?

Approvals let a contract spend your tokens—handy for DeFi, risky if unlimited. To review:

- Go to your address page on Etherscan and open the Token Approvals tab, or use the tool directly: Token Approval Checker.

- Revoke anything you don’t recognize or no longer need.

Pro tip: Reduce risk by granting exact amounts instead of unlimited approvals whenever possible.

Can I see NFTs on Etherscan?

Yes. On your address page, open the ERC-721/ERC-1155 tabs to see holdings and transfers. For a collection’s contract page, you can view holders and recent mints/transfers.

Example: BAYC contract page — 0xbc4c…f13d

How do I cancel or speed up a pending transaction?

If your wallet supports it:

- Speed up: Resend the same nonce with a higher fee. Use Gas Tracker to pick competitive values. For example, if base is 20 gwei, try maxFee ~35–40, priority 2–3.

- Cancel: Send a 0 ETH transaction to yourself with the same nonce and a higher fee than your stuck one. If it confirms first, the original gets replaced.

Timing matters. If your replacement fee isn’t high enough, miners will still ignore it.

Are there fees to use Etherscan?

Browsing is free. You pay network fees only when you broadcast transactions from your wallet. Etherscan’s API has a generous free tier with rate limits; details here: Etherscan API Docs.

How do I read contract calls and decode input data?

On the transaction page:

- Open Input Data and click Decode Input (works when the contract is verified).

- Check Event Logs to see what actually fired—transfers, swaps, mints, etc.

For complex swaps (think DEX routers), the Logs show each hop: tokens in/out, amounts, and final receiver. If it’s not decoding, visit the contract page and see if the source/ABI is verified.

Wrap-up: your next best step

Here’s what I’d do in the next 10 minutes:

- Bookmark Etherscan.io and the Gas Tracker.

- Send a tiny test transaction and watch it confirm in real time.

- Set one alert on a wallet you care about.

- Tag your main addresses so future research is faster.

If you want me to add anything to this guide on Cryptolinks.com, ping me and I’ll update it. The more you use Etherscan, the clearer Ethereum becomes.