The Crypto Narrative Is Gaining Traction in Africa

The prevailing belief that the ongoing economic and health crises provide a promising outlook for the blockchain and crypto industry has spurred key stakeholders to begin to identify new frontiers to propagate crypto’s compelling narrative. Recently, I have seen this conversation take a new twist as reports, detailing the high propensity of a crypto renaissance in Africa, begin to emerge.

In light of this revelation, I have decided to shed light on Africa’s growing crypto market and what it means for the economies of the countries in this region.

How Crypto Has Thrived in Africa

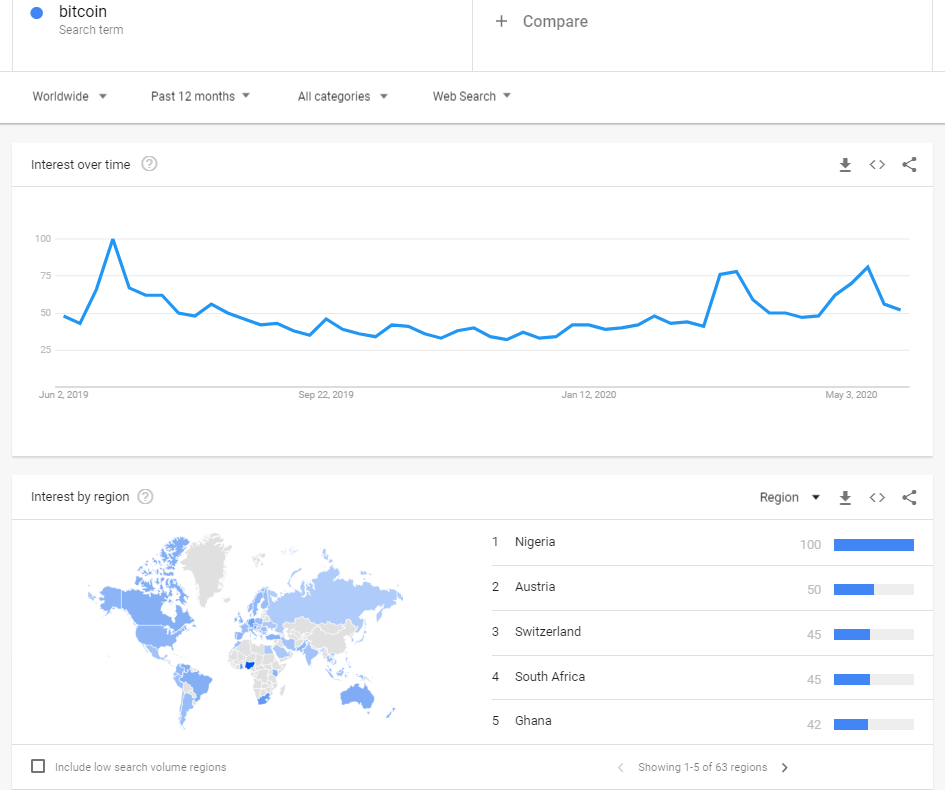

To capture the growth of the crypto narrative in Africa, Luno and Arcane Research jointly published a report that highlights the influence of crypto in the economies and lifestyles of individuals living in Africa. The report found that 6 African countries, including South Africa, Nigeria, Kenya, Uganda, and Ghana, consistently ranked on Google’s top ten countries generating the highest searches for the word “Bitcoin.” Apart from this feat, the researchers discovered a growing affinity for crypto in selected countries in the region in recent times.

According to the research, the budding crypto economy in Africa owes its growth to the continent’s young population, the precarious state of the region’s financial system, and the cost ineffectiveness of traditional remittance infrastructures. In response to these pain-points, individuals have begun to lean towards crypto as a means to protect their wealth from the aftereffects of poor financial policies and a way to engage with the global remittance market cheaply.

Global Remittance Is Serious Business in Africa

As per data from the World Bank, families in Sub Saharan Africa receive remittance worth $48 billion annually. As such, you would expect this region to have access to well-greased payment systems with relatively low transaction charges. However, this is not the case, as global payment infrastructures still charge up to 9% as fees for $200 remittances transferred to this region. Therefore, it comes as no surprise that individuals have taken to the decentralized and cost-effective cryptocurrency. In support of this notion, we witnessed an increase in demand for crypto p2p trading marketplaces that open up the continent to the vast crypto market and, in turn, provide quick and unhindered access to the global financial market.

Poor Political and Financial Policies

Apart from offering improved remittance solutions, the economic realities of a majority of countries in this region have also propelled the budding interest in crypto. Africans are coming to terms with the ill-preparedness of the existing financial system for the ongoing global financial shift. Unlike developed countries, Africa, which is home to several emerging markets, depends on unevenly distributed banking infrastructures that have left a significant number of people at a disadvantaged position. The gross unevenness of the banked to the unbanked, coupled with questionable economic policies at play in some of these countries, has contributed to the surge in crypto awareness.

The prevailing political ideology in Africa has, over the years, created wider disparities between the have and the have nots. As much as the world expects a great deal of development in this continent, the fact remains that the monetary policies in a majority of Africa nations expose their local currencies to inflation. To protect themselves against dwindling asset valuation and, in some cases, the inaccessibility of foreign exchange, a growing number of individuals have shifted their attention to stablecoins and the store of value capabilities of bitcoin.

Proactive Population

Even more impressive is the fact that crypto is proving to be a compelling topic for Africa’s young and vibrant populace. Trends show that Africa is a mobile technology-inclined continent. And the establishment of a superior mobile culture has further pushed the attractiveness of crypto technology in this continent. Already, there is a buoyant mobile money and eCommerce sector, which makes it easier to market crypto’s improved capacity as a payment solution.

Bitcoin Keyword on Google Trends

As a result of all these factors, the crypto narration in Africa is alive now more than ever. For one, Africa countries rank high in the list of countries showing unprecedented interest in digital assets. According to a report, South Africa, with 13% of its internet users owning crypto, is fifth among countries leading the crypto adoption trend of connected citizens, closely followed by Nigeria with 11%. Nigeria, on the other hand, leads the way as the country with the highest interest in the “Bitcoin” keyword on Google by generating double the traffic recorded by second-placed Austria.

Another report suggests that the recent renaissance of crypto in Africa has had a massive impact on the continent’s crypto trading volume. Thus, the p2p trading volume in recent weeks has surpassed the all-time high posted during 2017’s bull market. If this data is anything to go by, then there is every reason to expect more from Africa.

What Do Crypto Experts Think of Africa’s Growing Presence In The Crypto Economy?

Several prominent figures have expressed optimistic prospects regarding the budding crypto community in Africa. One of such individuals is Jack Dorsey, CEO of Twitter. Back in November, Dorsey expressed his belief that Africa is a fertile landscape for the growth of bitcoin. This statement came after his brief visit to the continent, which opened his eyes to the potentials of the digital asset in the emerging economy of Africa. Furthermore, he made known his intention to return to the continent and spend as long as 6 months to explore opportunities and establish infrastructures that will capitalize on bitcoin’s popularity in this region.

Like Jack Dorsey, Changpeng Zhao, founder and CEO of Binance, has acknowledged the increasing influence of crypto in Africa and begun to position the exchange to take advantage of this growth. While discussing this topic with key members of Africa’s crypto community, CZ stated:

Changpeng Zhao, founder and CEO of Binance

“Even from the first day when Binance launched, we had users from Africa, and they were actually relatively active. So, we’ve always known that Africa is an important market. And so, I think it was early 2018 that I visited Uganda, Togo, Nigeria at the same time — and also Ethiopia. So, I had a little tour around Africa just to learn a little bit more about the market, and soon after that we opened Binance Uganda.”

He further revealed Binance increased presence in the region and what his expectations are for the future. He added:

“We view the entire African market as a really key market, and this year we were very lucky to be able to find a good banking partner in South Africa, and we are able to now accept banking deposits directly through bank accounts. […] We will soon be able to launch credit card buying as well. South Africa, and Africa as a whole, is a really important market for us.”

Similarly, a stakeholder in the burgeoning blockchain industry in Africa, Victor Alagbe, believes that crypto’s strongest selling point in Africa is the ease it offers people interested in remittance. Alagbe told Cointelegraph:

Stakeholder in the burgeoning blockchain industry in Africa, Victor Alagbe

“I see crypto taking up a strong position in the remittances space. It’s often cheaper, less stressful (in terms of documentation) and faster to send and receive crypto. Many younger folks in the diaspora are now leveraging crypto to send money back home. Some techies working remotely are also getting paid in crypto.”

All these views resonate with the verdict of Arcane Research’s report earlier highlighted. As per the document, the increased adoption of crypto in Africa is indeed a strong indication that the industry is on the right path. The document reads:

“Africa is one of, if not the most promising region for the adoption of cryptocurrencies. This is due to its unique combination of economic and demographic trends. While the overall adoption is relatively low, the potential is enormous, the growth is rapid, and the development is likely to become defining for the cryptocurrency industry going forward.”

What About the Hurdles Negating Crypto Penetration in This Economy?

Even though crypto is generating promising results in Africa, there are, however, challenges peculiar to this market, which makes it a tad difficult for the continent to surpass some of the milestones achieved in other regions. One such hurdle is the almost non-existential nature of infrastructures like mining operations, blockchain nodes, a robust ecosystem of crypto-friendly merchants, reliable internet connectivity, and so on. Without all these facilities in place, it is hard to establish the fundamental components of crypto technology.

For now, the increased demand for cryptocurrency is largely tied to the effectiveness of crypto as a financial instrument for remittance and the gains that could be made in the speculative market. Apart from that, it is difficult to utilize digital assets as a payment medium in the continent. This challenge is due to several factors. First is the lack of a basic understanding of cryptocurrency and its underlying technology. In support of this assertion, Victor Alagbe, while using Nigeria as a case study, explained that it is hard for Nigerians to see past the speculative nature of crypto because of the unavailability of an effective crypto education system in the country. Alagbe opined:

“There’s still a whole lot of education that needs to go into helping people understand the relationships between Bitcoin (crypto) and its underlying Blockchain technology. However, the Nigerian market is likely to focus on crypto to the exclusion of other applications of Blockchain in as much as there’s profit to be made in the speculative side of cryptocurrency… In my opinion, Bitcoin (and cryptocurrency in general) is still seen as a speculative play to make quick gains. You can see people trading huge sums of Bitcoin on platforms such as Remitano but you’ll be hard-pressed to find a business that accepts crypto as payment for products or services.”

Another factor derailing the growth in this region is the lack of regulatory frameworks tailor-fitted to this continent. Aside from South Africa, which has openly revealed its support for digital assets, other African countries have either banned crypto outrightly or decided to sit on the fence. And so, crypto firms targeting African countries are taking a huge gamble, knowing fully well that most of these governments are yet to fully back the emerging crypto market. Moreover, the absence of reliable internet connectivity and the poor banking culture of Africa have further reduced the potency of crypto in this region.

Therefore, it came as no surprise when Changpeng Zhao reiterated Africa’s peculiar hurdles. According to CZ, crypto exchanges operating in Africa face a lot of banking issues, which puts a cap on their growth. He explained:

“I think that in South Africa there’s a few crypto exchanges — they’re doing quite well. But I believe they are still relatively small. I’m not sure how profitable they are or how sustainable they are. In other parts of Africa, I think the coverage is very weak and very poor. I don’t think it’s very easy to buy cryptocurrencies in Africa right now overall, so we want to help improve that situation… It is a very much untapped market. There’s a different set of challenges there. I think basically, that’s the reason for it being untapped. Working with banks there is a little bit more difficult. The banking API interfaces are slightly older or nonexistent, and the number of people having bank accounts are quite low. So, even if you have a bank account support, the overall population you can tap into [is] still in the low double digits.”

The Way Forward

Due to the unique issues challenging crypto’s growth in Africa, developers and entrepreneurs must design solutions that fit into the continent’s crypto narrative. We must find a way to introduce a different approach to crypto adoption that will capture the economic and cultural realities of this emerging market. Therefore, this is why Cardano is working on creating a microchip that will provide offline crypto payments. Cardano’s creator, Charles Hoskinson, stated that it was only right to introduce infrastructures that will evade the impediments of crypto adoption in some regions, particularly in Africa. Hoskinson explained:

Cardano’s creator, Charles Hoskinson

“So, when you look at that, you say, well, OK, 98 percent are mostly offline and not banked or digital. So, if I was building a money system for them, it would probably be a bad idea to say, ‘oh, you have to use an always online, purely digital currency. You need some other thing. And so how do I replicate the cash money experience but still have a blockchain backend? Well, what you do is you create a hierarchy where those two percent basically become like micro banks, and then they can manage the issuance of these tokens to people, and then their local phones or infrastructure can verify.”