Scaling Bitcoin and Blockchain – The Biggest Solutions to Scalability

How to make Bitcoin and blockchain scalable has long been an important point of discussion. Many see Bitcoin and the blockchain technology that it runs upon as having little value if they fail to reach the speed offered by other technologies.

As it stands, it takes ten minutes for a block to be added to the Bitcoin blockchain. With many envisioning blockchains being applied to enterprise use cases, developers are constantly striving to come up with the best solution to scaling blockchain technology.

In this latest Cryptolinks post, we analyse the biggest solutions being proposed to make blockchain scalable and the validity of each.

Altcoins

Altcoins was one of the first proposals to tackling the limitations of the Bitcoin blockchain. With the Bitcoin code being open-source, it was available for any developers and software engineers to take and tinker to their own ideas.

Back in 2011, former Google software engineer and MIT graduate Charlie Lee took the Bitcoin source code and changed it to create Litecoin. Blocks on Litecoin were added every 2.5 minutes as opposed to Bitcoin’s ten minutes.

Since then, many other altcoins have been created with some building their blockchain from scratch. Some claim throughput capabilities up to 10,000 transactions per second but the security trade-offs to achieve this type of throughput have been unacceptable to most.

To this day, no altcoin has been able to significantly challenge the size and market capitalization of the Bitcoin blockchain. The market of the Bitcoin blockchain at the time of writing represents over 50% of the entire cryptocurrency market.

Block Size

Block size has been another proposal to tackle scalability which has had a long history. Debates to increase the number of bytes possible to be included in blocks in the Bitcoin blockchains span back as far as 2010.

Increasing the number of bytes which can be included in blocks allows more transactions to be included in each block and lower the fees required to process transactions. Discussion to increase the block size of Bitcoin intensified in 2015.

Between 2015 and August of 2017, two failed upgrades to increase the block size took place. These upgrades, known as the Hong Kong agreement and the New York agreement, scheduled block size increases as well as Segregated Witness (SegWit) implementation which will be discussed under software upgrades.

However, both upgrades failed when it came time for the node operators to upgrade and in August of 2017, a key part of the Bitcoin community split and hard forked to create a separate network Bitcoin Cash with an increased block size limit.

Bitcoin Cash does enable lower fees and more transactions due to its higher block size limit but many see the increased block size resulted in a more centralized network. There is also significantly less hash power securing the network and a ledger only spanning back to its genesis in August of 2017.

Software Upgrades

Other software upgrade proposals have also addressed scalability. Segregated Witness (SegWit) upgraded nodes partition the digital signature part of blocks from the transaction part to allow more space for transactions. SegWit was activated in August of 2017 via a soft fork and nodes are still upgrading to implement the software that supports SegWit.

Payment Channels

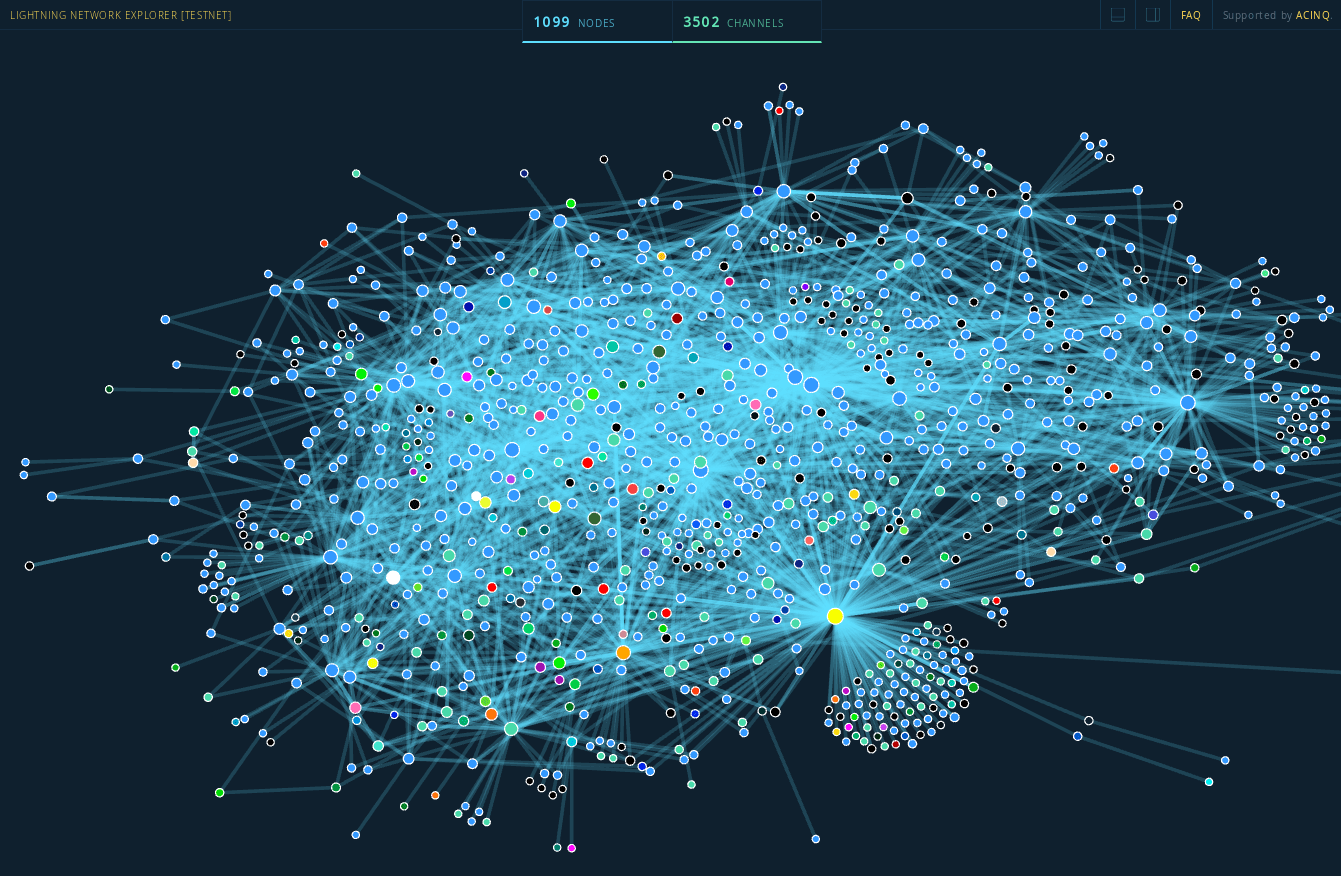

Payment channels are likely to be the most successful solution so far to Bitcoin scalability limitations. The Lightning Network is a payment channel built on top of the Bitcoin blockchain that enables payments to be completed off-chain between channel participants and return to the main blockchain for settlement.

The Lightning Network has been increasing in popularity recently and businesses have started providing services where payments are facilitated to take place through the Lightning Network. Payments can take place extremely fast through this network and at minimal fees but there are still some security concerns with the network and improvements still need to take place before the network can be widely used.

The Lightning Network is the most widely implemented solution to scaling the Bitcoin network that has been proposed so far.

Sidechains

Sidechains are similar to the payment channels. They are separate settlement layers that are built on top of blockchains.

The Liquid sidechain launched by Bitcoin development company Blockstream is a sidechain operating on top of the Bitcoin protocol. Sidechains are currently useful solutions for corporation consortiums to run together but they are unlikely to achieve wide adoption among average users.

Sharding

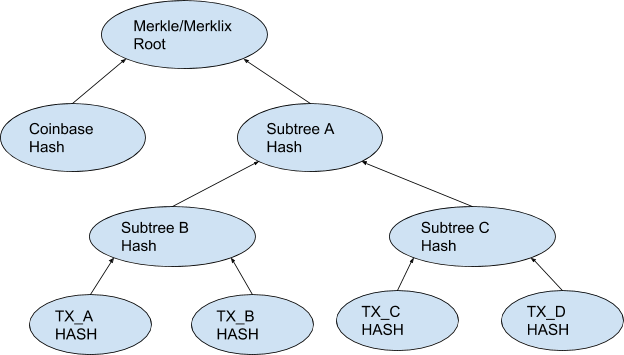

Sharding involves the splitting of data so that different nodes do not have to validate the entire dataset. Sharding is a great scalability solution in a network where trust is not an issue.

For example, in a traditional database, the data is simply split into shards and each shard is processed by a different computer enabling the system to leverage the computational power of the distributed network. When it comes to a blockchain, the proposal of sharding gets vastly complex.

To design sharding in a way where transaction validation doesn’t pose any risks to the network is extremely difficult and most developers have disregarded sharding as an option in the short-term.

Consensus Algorithms

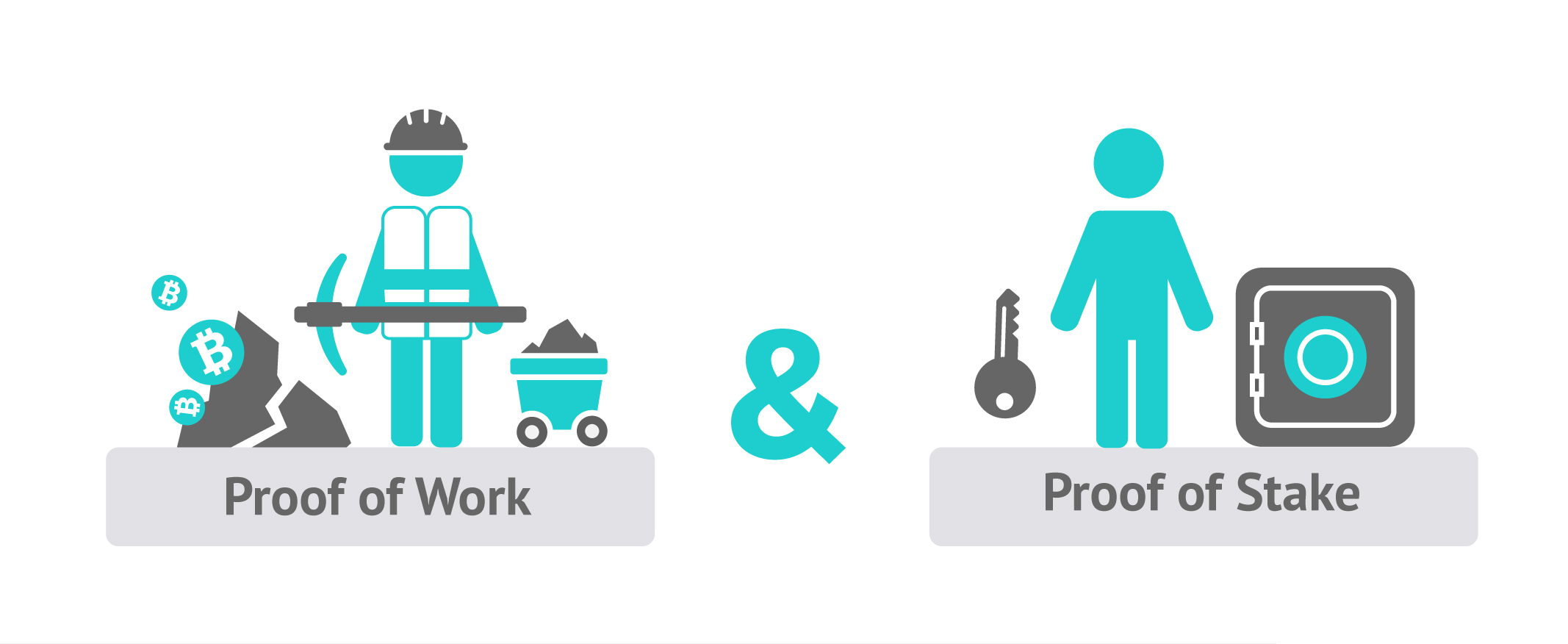

The proof-of-work (PoW) consensus mechanism that Bitcoin implemented was a huge innovation in being able to enable participants across a distributed network to trust each other. No other altcoin has been able to successfully match the level of security that the Bitcoin protocol procures.

Some have adapted the way that the protocol reaches consensus to optimise for speed but all consensus algorithms outside of PoW are considered highly risky. The most popular alternative which is planned to be implemented into the Ethereum protocol is proof-of-stake (PoS).

PoS involves miners (called block validators in PoS) staking coins to validate transactions. If they validate transactions which are incorrect, their stake will be slashed. They also receive a monetary incentive in the form of dividends for processing valid transactions.

Summing Up Scalability

Scalability remains one of the hottest topics in blockchain and bitcoin. As it stands, the protocols which have emphasized security have dominated the market.

This is why we see Bitcoin and Etherum representing the largest market share of all cryptocurrencies. However, as the technology progresses, we may see some of the scalability solutions noted in the post more widely implemented along with other solutions being proposed.