Most Regulated Cryptocurrency Exchanges Available Today?

Regulation for the cryptocurrency industry is a hot topic right now. Prices declined throughout 2018 but activity and discussion around regulating the cryptocurrency industry certainly did not. Early in the year, the famous incident took place where the CFTC chairman Christopher Giancarlo explained HODL to the US Senate. As the year progressed, more meetings concerning regulation took place. Malta managed to establish a regulatory framework which attracted a number of businesses to register their operations on the island.

Choosing regulated exchanges has a number of advantages. More protection is provided to the user and this is especially relevant given the recent hacks which have taken place on the Cryptopia and QuadrigaCX exchanges. Even bigger hacks have taken place in the past with Mt.Gox and Bitfinex being the largest ones recorded. Using a regulated exchange also often means that the user can actively trade their fiat currencies for cryptocurrencies. Most unregulated exchanges only facilitate crypto to crypto trading. Given the advantages of using regulated exchanges and the increased transition towards regulation of the cryptocurrency industry, we present the top cryptocurrency exchanges that are complying with regulation presently.

Gemini

The exchange operated by the Winklevoss brothers kicked off 2019 with an advertising campaign which took place around Manhattan emphasizing the importance of cryptocurrency regulation. The advertising campaign contained slogans such as “crypto needs rules”, “crypto without chaos”, and “finally a regulated place to buy, sell, and store crypto”.

Gemini is a licenced exchange and custodian. The company is regulated by the New York State Department of Financial Services (NYSDFS). The exchange currently supports trading for bitcoin, bitcoin cash, ether, litecoin, and zcash. The company has also launched their own stablecoin pegged to the US dollar, the Gemini Dollar.

Gemini has high fees unless high amounts of volume are traded. This makes the exchange more suitable for institutional clients or those trading who have a high net worth. The rest of the exchanges included in this list are better options for the average cryptocurrency trader.

Coinbase

Coinbase is the most popular choice when getting started in cryptocurrencies. They are the most well-known exchange and often the first place beginners choose when making their initial purchase. The exchange has been operating since 2012 and has built up a significant reputation in the industry. The exchange has an intuitive interface and supports most of the top cryptocurrencies. Supported cryptocurrencies include bitcoin, ether, bitcoin cash, litecoin, and ether classic. The exchange allows users to purchase the supported cryptocurrencies through either funding their account with a bank transfer or making a purchase through a debit or credit card.

Coinbase also has a more professional exchange, Coinbase Pro, which allows users to speculate on more cryptocurrencies, use more advanced trading tools, and avail of lower fees. Coinbase complies with some of the strictest regulations within the US. It is considered one of the safest exchanges that users can choose and also operates in over 40 countries making their services accessible to a large number of people.

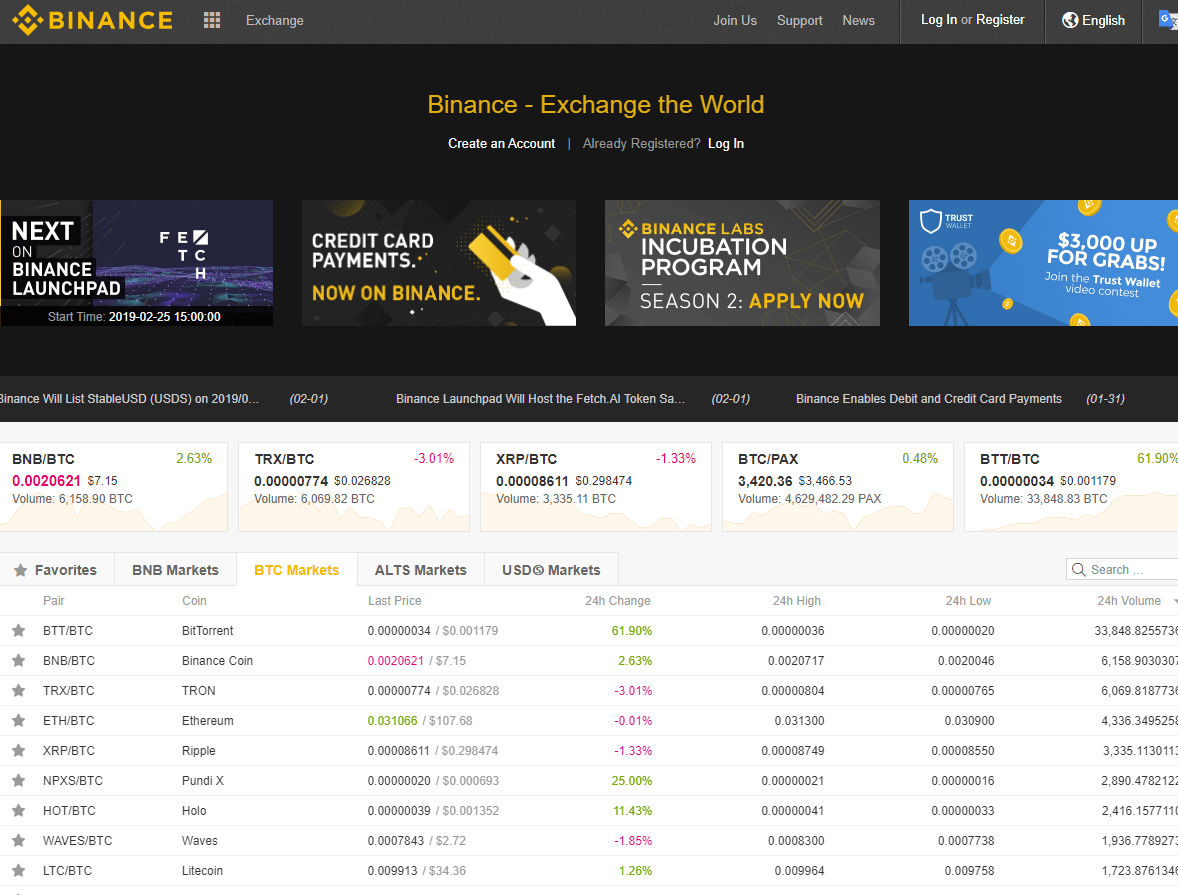

Binance

Binance moved its operations to Malta in 2018. The company was initially founded in Hong Kong. Binance moved to Malta after the country passed laws that put in place a regulatory framework for companies operating in the cryptocurrency and blockchain industry. Binance was originally a crypto-to-crypto exchange with support for a wide variety of altcoins. The crypto-to-crypto exchange regularly accounts for the highest amount of trading volume of cryptocurrency exchanges. More recently, they have started launching fiat to cryptocurrency exchanges including Binance Jersey which facilitates trading between EUR, GBP, bitcoin, and ether. They also launched an exchange that supports trading between the Ugandan dollar, bitcoin, and ether.

Bittrex

Another exchange which changed its business operations in response to Malta changing their regulations was Bittrex. For a long time, Bittrex was a popular option as a crypto-to-crypto exchange. The exchange was started by three cybersecurity experts in 2014 giving it a good foundation for being a secure option for traders. The exchange became popular due to its low fees, trading tools, and a wide range of options for traders. The exchange offers over 500 trading pairs with bitcoin. The exchange recently launched USD markets which are much more limited than the crypto to crypto options.

Bittrex is also in the process of launching a new platform for trading – Bittrex International – which will comply with the regulations set forth by the Maltese government. The key feature of the new exchange will be a streamlined process for listing tokens. Bittrex International will be restricted from the United States.

Huobi

Cryptocurrency users and traders in Japan have the option to use Huobi as their exchange of choice. The exchange recently acquired BitTrade which was another exchange operating in Japan. The acquisition of BitTrade marked the exchange becoming regulated by the Japanese Financial Services Agency (FSA). The FSA began cracking down on cryptocurrency exchanges in 2018 resulting in unregulated exchanges exiting the market. The exchange offers a number of cryptocurrencies which can be traded against the Japanese Yen. The supported cryptocurrencies are bitcoin, ether, XRP, bitcoin cash, litecoin, and monacoin. The exchange is also operating in Canada, Brazil, Australia, and UAE for their respective local currencies.

What’s in store for 2019?

2019 has already seen two major exchange hacks taking place. Investors became more cautious during the bearish declines of 2018 and we will likely see more prudence from investors as 2019 progresses. We will likely see an increased focus on regulation from top exchanges in 2019 with leading exchanges such as Binance already increasing their focus on compliance in 2018.