Liquid Staking: Earn Yield With No Crypto Lockups

Have you been thinking about ways to boost your crypto earnings but hate the idea of locking it up forever? Liquid staking might just be your new best friend. Imagine earning juicy rewards while keeping your crypto free and flexible—too good to be true, right? Well, think again. With liquid staking, you can enjoy the best of both worlds: continuous rewards without surrendering control of your assets. Your crypto stays nimble, so you’re never stuck on the sidelines when market opportunities come knocking. Curious about how this game-changer can revolutionize your crypto strategy? Stick around; it’s time to see how you can keep everything in flow without compromising on those sweet gains.

What’s Keeping You Away? Problems & Concerns

So, what’s been holding you back from diving into the world of liquid staking? Let’s take a look at some of the main hang-ups people have when they think about staking.

The Fear of Locking Up Assets

Ever been jittery about handing over your hard-earned crypto to a staking pool, unsure of when you’d get it back? You’re not alone. Giving up control of your crypto for who knows how long can be nerve-wracking. Trust me, I get it.

Missing Out on Market Opportunities

Picture this: a hot new coin pops up that could be the next big thing, but guess what? Your assets are tied up in staking, and you’re left in the dust. No one wants to miss a good trade because their assets are stuck in staking.

Promise of Liquid Staking

But wait, don’t pack it all in just yet. Liquid staking is here to save the day. Imagine having your cake and eating it too! Liquid staking solves these hiccups by allowing flexibility and continuous rewards. Stick with me to see how.

And there’s a lot more brewing! Ever wondered how you can stay nimble while still reeling in those sweet, sweet yields? Hang tight, because next we’re cracking open what exactly liquid staking is all about and why it could totally flip your crypto game upside down!

What Exactly is Liquid Staking?

Have you ever wished you could have your cake and eat it too when it comes to your crypto investments? Well, with liquid staking, you just might be able to.

Basics of Liquid Staking

So, here’s the scoop. In traditional staking, your assets get locked up. But with liquid staking, it’s different. You stake your crypto and, in return, receive a liquid staking token (LST). These tokens not only keep earning rewards, but they also remain as flexible as a gymnast. It’s like getting a stand-in for your crypto that keeps making money for you!

Think of it this way: you put your money in a magic wallet that keeps rewarding you just for trusting it. A study even showed LST users could gain up to 10% more annually in some cases—numbers that are hard to ignore!

“The best investment you can make is in yourself. The more you learn, the more you earn.” – Warren Buffett

Why Flexibility Matters

In the world of crypto, things move fast. Missing a trading opportunity because your assets are tied up? That’s not something you want to experience. Liquid staking gives you the reins back. With your LSTs in hand, you have the freedom to explore more trades, manage risks, and simply enjoy the thrill of being active in the market. Want to make a quick move or respond to sudden shifts? Your LSTs make it possible.

A Closer Look at LSTs

You might be wondering what else you can do with these LSTs. Well, they aren’t just tokens on paper. They can be integrated into various platforms for additional liquidity or even used to earn yields through other decentralized finance (DeFi) opportunities. From lending them out to using them as collateral, the flexibility is quite impressive. Imagine the possibilities!

Are you ready to explore whether liquid staking could be your breakout crypto move? Or maybe you’re curious about how those potential returns stack up against some risks? Let’s jump right into that next!

Is Liquid Staking Worth Your Time and Crypto?

Alright, so you’ve heard a lot about this new wave of liquid staking, but is it just hype or a genuine game-changer for your investment strategy? Let’s break it down and see if it truly holds the potential it claims.

The Potential Returns

Imagine this: your crypto assets, instead of collecting dust, are continuously earning rewards without you locking them away. Many enthusiasts are excited about liquid staking because of the potential gains. For instance, platforms like Lido have shown that it’s possible to earn notable returns, not just in terms of percentage APY but also by freeing up your assets for additional opportunities.

According to a study by XYZ Crypto Analysis, investors using liquid staking often see increased flexibility that leads to compounded gains over traditional methods. So, not only are you earning, but you’re also positioned to act on market changes.

Risks Involved

Of course, nothing in the crypto world is entirely risk-free. While liquid staking might sound like a win-win, there are risks you need to be aware of.

- Volatility: Cryptocurrencies are inherently volatile, which can impact the value of your liquid staking tokens (LSTs).

- Platform Reliance: The success of your liquid staking strategy depends heavily on the reliability of the platform you choose.

- Smart Contract Risk: Coding errors or vulnerabilities in smart contracts can present potential risks.

Understanding these risks is crucial if you want to balance optimism with caution.

Comparing Traditional Staking

Here’s where we see a clear distinction. With traditional staking, once your crypto is locked, it’s out of play—it’s like having your hands tied when you see market swings you want to react to. In contrast, liquid staking gives you room to maneuver.

Traditional staking might give you more predictable and sometimes higher returns in the long term, but it lacks the agility that many traders desire today. Can you afford to sit idly when the market races by or prefer the freedom of liquid staking?

“The greatest danger in times of turbulence is not the turbulence; it is to act with yesterday’s logic.” – Peter Drucker

This quote flows perfectly into our discussion as we consider how liquid staking really plays out in this ever-dynamic world of crypto investments. But is this just scratching the surface? Have we seen all of its potential?

Ready to explore how to make the most out of liquid staking and seize every opportunity? The next part is all about strategies that could turbocharge your crypto gains. Stay with me!

Making Money with Liquid Staking

When it comes to liquid staking, you might be wondering, “How can I maximize my gains?” This isn’t just about earning those usual staking rewards—it’s about creating opportunities to make your crypto work even harder for you.

Lending Your LSTs

Did you know that lending platforms are more than just buzzwords in the crypto space? If you have liquid staking tokens (LSTs), you’re in a unique position to lend them out and earn additional income. Platforms such as Aave often allow you to lend your LSTs, earning interest over time. It’s like letting your assets hustle while you focus on other things.

Utilizing Market Platforms

Market platforms are where the real action happens. Ever considered using your LSTs to explore liquidity pools? By doing so, you could get a slice of the trading fees and enhance your returns. Platforms like Curve Finance offer you a chance to widen your horizons. And remember, it’s not just about staking anymore—it’s about making every token count.

Examples of Successful Strategies

Think of successful strategies as roadmaps others have used to navigate the liquid staking landscape. Perhaps you’ve heard of Ethereum investors who integrated LSTs into their broader DeFi strategy, generating substantial returns. Here’s a tip—keep an eye on forums and communities; real-life success stories often begin with a shared experience or a case study. It’s not just theory; it’s proof that strategies work.

“Success is not just about making money. It’s about making a difference.” – A poignant reminder that while profits matter, the strategies you employ should resonate with your broader financial goals.

Hungry to know more about how liquid staking platforms can boost your crypto journey? Stick around as we explore the major platforms in the next section. Are you ready for the next level of insights?

Popular Liquid Staking Platforms and Their Features

Alright, let’s talk about some of the real heavy-hitters in the liquid staking game. There are a few platforms that truly stand out when it comes to offering features that you’ll want to know about. These platforms are more than just hype—they bring solid, tangible benefits for anyone considering liquid staking.

Top Platforms

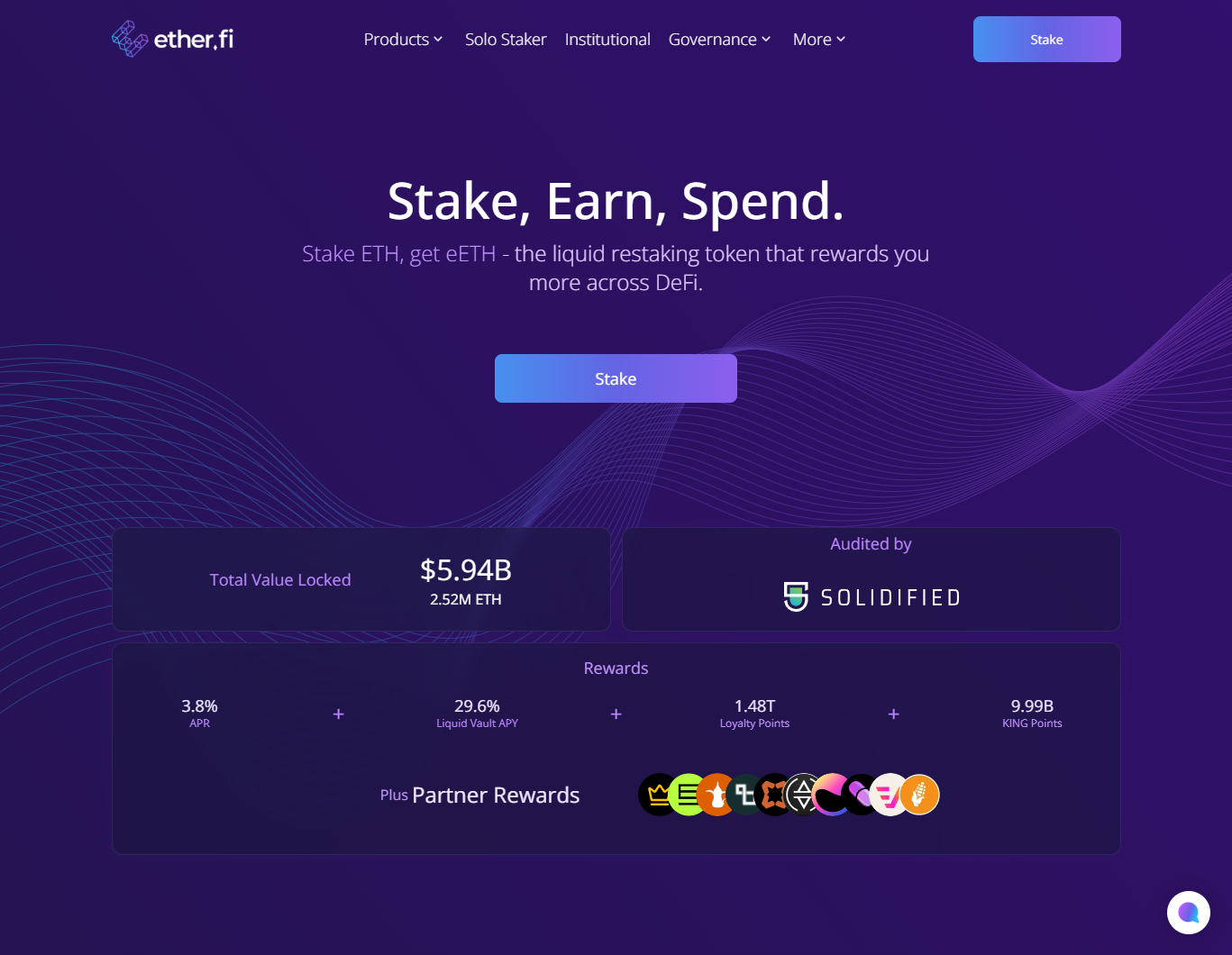

If you’ve been browsing around, names like Etherfi might have popped up on your radar. These platforms are spearheading the liquid staking revolution by providing user-friendly experiences and robust features. What do they bring to the table? Let’s break it down:

- Etherfi: Known for its seamless interface and high yields. It offers a unique opportunity to stake Ether without the typical lock-up periods.

- StakeWise: Offers features like staking pools, which make it super accessible for everyone, whether you’re a small or large investor.

- Rai Finance: Known for their focus on security and transparency. They use blockchain solutions to ensure that your assets are not only flexible but safe.

Each platform has its unique selling points, but they all aim for one core goal: offering flexibility and better returns on your staking assets.

User Experiences and Feedback

There’s nothing like hearing directly from the users themselves to assess how these platforms actually perform in real scenarios. The general feedback you might hear includes:

“Liquid staking with Etherfi lets me be agile with my funds, and I’ve seen decent returns,” says one user from a recent online review.

The sense of financial freedom and security is a common theme among those who are actively using these platforms. Of course, like anything else, not everyone’s experience is a home run. Some users mention issues like complex interfaces, but overall, the community response has been largely positive.

What’s the Right Platform for You?

So, how do you choose the ideal platform? Here are a few tips that might help:

- Start with Research: Check out user reviews, community forums, and expert opinions.

- Look at Fees and Yields: Different platforms have different fee structures and yield offerings. Compare these before making a decision.

- Evaluate User Interface and Experience: A clunky interface can be a deal-breaker. Go for venues that offer ease of use.

Ultimately, the right platform for you will align with your personal financial goals and offer the convenience you need.

Have you thought about the practical uses of liquid staking tokens beyond just staking? How might they revolutionize the use of stablecoins? Stay tuned, as there are some fascinating insights coming up next.

Liquid Staking Tokens as Stablecoin Collateral

The world of liquid staking tokens (LSTs) isn’t just a one-trick pony. Imagine you’re not only earning rewards, but now you’re also using those earnings to back stablecoins. Intriguing, right?

Benefits of Using LSTs as Collateral

When it comes to backing stablecoins, LSTs make a compelling case. Here’s why they’re worth considering:

- Stability with Growth: LSTs provide a unique mix of earning potential and stability. Unlike other collateral forms, they don’t just sit there collecting dust. They grow.

- Liquidity Flexibility: You can tap into your LSTs’ value without shedding them. This keeps your portfolio dynamic and ready for any opportunity.

- Low Opportunity Cost: You’re not losing income potential when using LSTs as collateral since they continue generating rewards. It’s like having your cake and eating it too!

“The surest way to multiply your success is by placing your assets in a position to generate even more,” someone once said. It resonates deeply with using LSTs as collateral. No need to let your crypto just sit there.

Diversify and Optimize

Now that you’re stacking the odds in your favor, how about using these tokens for more than one purpose? Here’s how LSTs open doors:

- Enhanced Portfolio Diversification: Mix and match your crypto holdings for a robust approach. LSTs allow you to balance rewards with risks without sacrificing opportunities.

- Optimize Financial Strategies: Use LSTs alongside different financial strategies, whether it’s hedging against market volatility or optimizing your liquidity.

Did you know? A recent study found that multi-use assets can significantly enhance your overall portfolio resilience, giving you peace of mind.

Consider this: Could LSTs redefine how we think about collateral in the crypto ecosystem? With such benefits, they might just become a staple. But what’s next for liquid staking? There’s an exciting world ahead, full of innovations and trends that will redefine what’s possible. What will they mean for your crypto journey? Let’s explore what’s on the horizon.

Future of Liquid Staking: Trends to Watch

Liquid staking is more than just a buzzword. It’s gaining traction because it gives us what traditional staking couldn’t—a chance to earn while staying flexible. As we venture further into the future, I’m keeping an eye on a few key trends that promise to reshape how we think about this innovative approach.

The Growing Demand for Flexibility

“Flexibility is the new currency,” a phrase that’s never been more relevant, especially in the world of liquid staking. Investors crave choices. They want the freedom to allocate resources without being hindered by long lock-up periods. The increasing shift toward flexible staking options reflects our desire to maintain control while optimizing our earnings.

New Innovations on the Horizon

Imagine using your staked assets to vote on governance proposals or integrating them seamlessly into DeFi protocols. The future holds exciting innovations that are set to expand the utility of liquid staking tokens beyond just earning rewards. Emerging platforms are already working on solutions that will enable these new possibilities, blending liquid staking with other groundbreaking blockchain solutions. Can you feel the anticipation?

The Role of Blockchain Technology

Blockchain technology continues to be the backbone of liquid staking evolution. The upgrades in blockchain systems, like Ethereum’s move to proof-of-stake, power the continuous development in this space. This evolution doesn’t just enhance security and transaction speeds; it opens new avenues that were previously unthinkable.

Now, as you ponder on these developments, curious about what else lies on the horizon, you might wonder, what resources are out there to further satiate your curiosity? Well, you’ve come to the right place—stay with me, because up next, we’ll explore resources to deepen your understanding of this ever-expanding world.

Resources to Deepen Your Understanding

So, you’re curious about liquid staking, and I totally get it—this is a fascinating corner of the crypto universe with plenty to explore. With so many aspects to consider, why not equip yourself with some solid knowledge? Here, I’m sharing some top-notch resources to help you dig deeper and make sense of it all!

The Role of Research in Making Smart Choices

Listen, I’ve been in the game long enough to know that a big part of winning is being informed. Research isn’t just about gathering information—it’s about safeguarding your assets and making empowered decisions. Whether you prefer reading detailed guides or watching explainer videos, whatever keeps you well-informed is invaluable.

Think of research as your crypto shield, defending you from pitfalls while giving you the courage to take smart leaps. How much better would you feel making your next crypto move knowing you’ve got a toolkit brimming with knowledge?

Are you ready to take the leap with liquid staking? Don’t stop here—there are still more ways to maximize your crypto strategies, and we’ve only scratched the surface. Stay tuned as we line up the next steps in your crypto journey. What could possibly come next? The answers might just change your approach to earning with crypto!

Taking The Next Step in Your Crypto Journey

Alright, my fellow crypto enthusiast, you’ve journeyed through the landscape of liquid staking with us. So, what’s the next step? If you’re feeling both excited and a bit anxious about diving into liquid staking, you’re not alone. Let’s explore what it really takes to make your first move in this potentially game-changing approach.

Making Your First Move

The initial step might sound obvious, but it’s crucial: get familiar with the platforms out there. Start by checking what the big names in liquid staking, like Etherfi and others, have to offer. Look into user experiences and platform features. Remember, knowledge is your best friend here.

The next is to decide on how much you’re willing to invest and what returns you are expecting. It’s like standing before a buffet; you can’t indulge in everything, so choose wisely according to your taste and risk tolerance. Start small if you’re uncertain, testing the waters before going all in. One sample move could be staking Ethereum and receiving LSTs, letting you earn rewards while striking out to explore further options.

Preparing for Risks and Rewards

Every new path has its bumps and golden opportunities. The key is to stay prepared. Before committing, ask yourself if you’re ready to handle the risks that come with market volatility and opportunity costs. Being cautious doesn’t mean being timid; it means arming yourself with research and insights. Studies show that those who invest the time into understanding both sides tend to fare better in risk-laden environments.

Also, always be on the lookout for better strategies – whether it’s lending your LSTs, utilizing different market platforms, or engaging with the community to share tips and insights.

Conclusion: Embrace the Future of Crypto Earning

Now that you have the tools and insights, it’s time to embrace this exciting chapter in crypto. Liquid staking represents a new era of flexibility paired with earning potential. Imagine having the freedom to hold your crypto when opportunity knocks, while still earning rewards. That’s what liquid staking offers.

Your crypto journey doesn’t end here; it’s just beginning with a new twist. So, get ready to navigate and optimize how you earn from your digital assets. The future of cryptocurrency earning is bright, and you’ve got the chance to be a part of it. Whether you’re taking cautious steps or bold leaps, make sure you’re informed and adaptable.

Want more tips and latest updates? Keep an eye on Cryptolinks News for ongoing insights. Let’s embrace the potential and flexibility of liquid staking together – jump in and make the most of this dynamic world.