Green Bitcoin And hash Rate Migration: A New Beginning For Bitcoin Mining

Without any doubt, mining activities will continue to play an integral part in the Bitcoin economy for a very long time. As such, it comes as no surprise that Bitcoin mining has always come under scrutiny whenever the sustainability of Bitcoin is being discussed. If we are not defending the energy consumption rate of this hardware-intensive operation, then we most certainly will be dissecting the regulatory implications of concentrating mining activities in a particular jurisdiction.

In some rare cases, as we have witnessed in the last couple of months, these two prevailing narratives share the spotlight to the dismay of Bitcon’s reputation On one hand, the Bitcoin mining economy is facing a barrage of criticism due to its carbon footprint. At the same time, it has had to reshuffle amid an ongoing crackdown in China. Understandably, these two issues have contributed to the growing uncertainties of not just the Bitcoin mining ecosystem but also the entire Bitcoin economy at large.

In this article, I will discuss the apparent impacts of a strained Bitcoin mining economy, the possible long-term effects, and why the situation is not as bad as they seem. But first, it is important to understand how Bitcoin mining works and why it has been targeted in recent years.

How Does Bitcoin Mining Work?

How Does Bitcoin Mining Work

For the uninitiated, Bitcoin mining is a computer-powered process that determines the validation of Bitcoin transactions. It also doubles as Bitcoin’s primary distribution process as successful miners unlock newly minted coins as rewards. Therefore, we can say that Bitcoin miners play pivotal roles in the Bitcoin economy.

Interestingly, anyone can become a miner since the Bitcoin ecosystem is open and decentralized. In other words, there are no governing or licensing bodies that dictate requirements for starting a Bitcoin mining business.

However, while there are no stipulated global regulatory frameworks for mining Bitcoin, mining comes with caveats that indirectly set unwritten requirements for every aspiring Bitcoin miner. Most of these limitations revolve around the energy-intensive nature of Bitcoin’s consensus mechanism, which mandates miners to solve complex puzzles before they can add new transactions to the blockchain.

These puzzles are so difficult that mining computers do not even attempt to solve them mathematically. Instead, they try to guess the answer. The first miner to solve each puzzle gets the honor of adding a block of transactions to Bitcoin’s blockchain. In turn, the network allows the miner to claim the commission on each transaction on the block and an additional reward of 6.25 BTC. As rewarding as this venture is, the energy intensiveness of the entire process often diminishes the possibility of generating profits consistently.

For one, miners are forced to use advanced and energy-intensive hardware to power their mining operations. Since Bitcoin mining itself is a zero-sum game, miners have to constantly scale their mining output to run a profitable business. The moment a miner is unable to match or surpass the average mining output (or hash rate) of other miners, the less probable that the mining business would thrive. Unfortunately, the steady rise in the hardware specification for mining Bitcoin has also caused an upward trajectory of the electricity requirements. Every new mining machine plugged into the network increases the electricity consumption metrics of Bitcoin.

Additionally, these machines run round the clock. In essence, miners have to invest in cooling systems to prevent overheating. This inadvertently adds to the electricity requirement of their Bitcoin mining operations. When we take this into account, it is clear that electricity accounts for almost 90% of the recurring expenditure of a Bitcoin miner.

Although this has become the present reality of the Bitcoin mining market, it has not always been this way. Bitcoin mining has evolved over the years such that it has become unsustainable for hobbyists to profitably participate in the ecosystem. Earlier in Bitcoin’s history, a Bitcoin miner did not need to invest in sophisticated mining equipment to run a profitable mining business. Instead, all they needed were everyday CPU-powered computers since the competition was relatively low. However, as soon as mining became a fashionable crypto venture, there was a systematic shift to institutionalized mining operations.

Also not helping is the algorithmic design of the Bitcoin protocol that increases the mining difficulty, whenever there is a surge in active Bitcoin miners. Immediately the network realizes that more mining rigs are connected, it automatically sets a higher difficulty level for the puzzles. In summary, electricity, the cost of buying and maintaining mining hardware, and mining difficulty are some of the factors that determine the profitability, or lack thereof, of a Bitcoin miner.

Now that you have some level of understanding of how Bitcoin mining operates, the next section of this guide pinpoints the major talking points of Bitcoin mining.

Why Is Bitcoin Mining Gaining A Bad Rep?

Why Is Bitcoin Mining Gaining A Bad Rep

As discussed earlier, mining is one of the core components of the Bitcoin ecosystem. Therefore, an attack on the viability of this system is an attack on Bitcoin itself. Remember that I listed electricity as a major requirement. Well, judging by the recent barrage of criticism, it is clear that the high electricity consumption rate of Bitcoin mining has not gone unnoticed. The mainstream media and environmentalists alike have continued to rehash a damning narrative that paints Bitcoin mining as the main culprit in the unfolding global environmental tale of woe.

Ever since Bitcoin burst into the spotlight, Bitcoin mining operations have come under intense scrutiny with many claiming that the energy-intensive nature of the process underscores the fragility of Bitcoin. Some argue that it is counter-intuitive to accept an energy-intensive digital currency as the future of money. As a counterargument, Bitcoin proponents have claimed that Bitcoin miners are increasingly relying on clean energy for their mining operations. Also, they find it absurd that Bitcoin has been targeted, while the carbon footprints of the traditional financial market and other industries have gone unchecked.

Bobby Lee, a former CEO of BTCC exchange, recently explained:

“To be completely fair, many of the other industries use a lot of electricity: aluminum, steel, gold and silver mining — they all take up a lot of electricity and use a lot of energy, whether it’s electricity or fossil fuel energy. In the end, it’s a matter of judgment on which activity is good or bad. The answer here would be entirely subjective: For some, it’s good to mine gold or process steel, while mining Bitcoin is environmentally destructive. Conversely, I would argue that mining Bitcoin is good, and processing gold and steel is wasting money, energy and resources. After all, it’s subjective.”

While this back and forth has been a recurring theme since 2017, it eventually had a negative and lasting impact on the value of Bitcoin when Tesla and its CEO, Elon Musk, reversed the plan to start accepting Bitcoin payments. In a statement backing this decision, Musk explained that it became necessary to review its Bitcoin payment adoption plans after discovering the carbon footprint of the digital asset.

Following this announcement, the price of Bitcoin crashed by 50% in a matter of days. Notably, this event coincided with China’s move to shut down crypto mining operations in the country. Although it is hard to believe that China’s decision stemmed from environmental concerns, it did have an even more critical impact on the Bitcoin mining economy since 65% of the Bitcoin hash rate was generated within the Chinese jurisdiction.

Why Did China Ban Crypto Mining?

Why Did China Ban Crypto Mining

Chinese miners have always made up a large chunk of the Bitcoin mining community because they have access to cheap electricity and are somewhat geographically advantaged to be in the same jurisdiction with major Bitcoin hardware mining providers. The combination of these two factors has favored Bitcoin mining in China such that it became increasingly alarming that the Bitcoin network hash rate was concentrated in a particular country.

Some feared that China could easily capitalize on its dominance in the Bitcoin mining economy to attack or collectively vote for or against upgrades. As such, it was a surprise to many when the Chinese government decided to shut down the country’s crypto mining economy. Perhaps, as noted by Kelsie Nabben, a researcher at RMIT Blockchain Blockchain Innovation, this was part of the government’s plan to cripple operations of currencies competing with its newly introduced central bank-backed digital yuan:

“China’s policy position on Bitcoin seeks “financial stability and social order” and is possibly the result of geopolitical interests related to the desire to remove competitors to its own national digital currency, the digital yuan, in addition to its stated goals of lowering carbon emissions and redirecting energy toward other industries.”

How Does China’s Crackdown Impact Bitcoin?

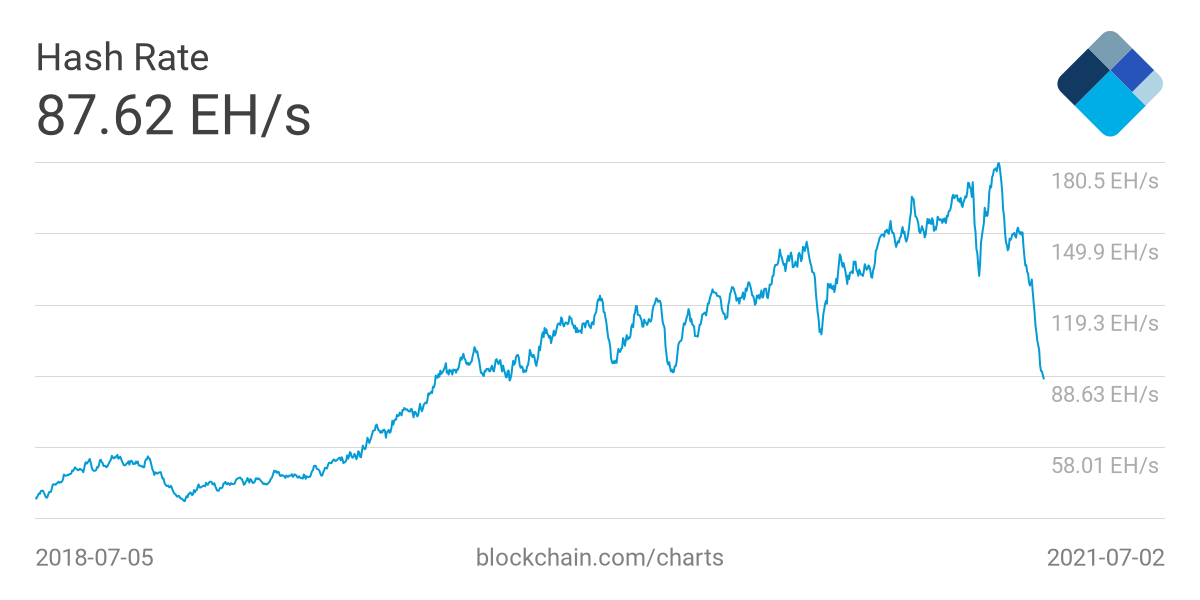

As mentioned earlier, the Bitcoin mining crackdown in China has had an impact on the price of digital assets negatively. However, apart from its apparent effect on pricing, it has caused a bit of reshuffling in the Bitcoin mining economy. Since nothing less than 65% of Bitcoin’s hash rate was contributed by China, the shutdown of Chinese miners has left a gaping hole in the Bitcoin mining ecosystem. In essence, the number of miners has reduced significantly in the last two months.

For the most part, large Chinese miners are looking to relocate their businesses to other Bitcoin mining-friendly countries. However, this is easier said than done. For instance, Chinese miners have begun to discover that most of their electric infrastructure is not compatible with the systems of other countries. Therefore, they are not only going to be relocating, they must remodel their setup in a way that fits into the electric model of their destination country.

Also, they need to negotiate with private or government-backed power plants to ensure that they reach reasonable electricity purchase supply agreements. It is critical to keep the electricity cost close to what they previously enjoyed in China. Lastly, they must consider going for regions with clean energy sources.

It is worth mentioning that it may take several months for these miners to eventually establish a base and commence mining operations. In that time, they may be forced to spend some of their Bitcoin holdings to finance this capital-intensive migration. Historically, when more Bitcoin floods the market, the price of the digital asset always plunges. Therefore, in the long run, a massive migration of hash rates could put selling pressure on Chinese miners. Annabelle Huang, head of GlobalX at Amber Group highlighted the selling pressure on Chinese miners as a contributing factor to the slump of the prices of cryptocurrencies:

“Following Inner Mongolia and Xinjiang, Sichuan province officially shut down BTC mining earlier this week despite hydro being a greener option than coal-based mining. Coupled with Fed’s hawkish sentiments, we saw a significant sell-off in the crypto markets. The shutdown in Sichuan came as a bit of a surprise and likely will cause medium-term selling pressure from miners who levered up to scale their operation during the bull run earlier this year.”

Bitcoin network hash rate 7-day average.

Bitcoin network hash rate 7-day average. Source: Blockchain.com

Conversely, the China crackdown has reduced the competitiveness of the Bitcoin mining economy. Only a fraction of miners are still operational. As such, mining difficulty has experienced a downward correction. In other words, it is a lot more profitable to mine Bitcoin presently. Daniel Frumkin, mining researcher at Braiins and Slushpool made this known in an interview with Cointelegraph:

“Difficulty has gone down in three of the past four adjustments, and the next adjustment may be the largest downward adjustment in Bitcoin’s history. For miners outside of China who focus on maximizing their BTC accumulation, this is an incredible opportunity as the hash value (BTC/TH/day) is increasing rapidly during a time when everybody would have been expecting the opposite.”

According to Frumklin, the void left by Chinese miners has increased the profitability of miners in other regions considerably. Unlike Chinese miners, miners in other countries can use this opportunity to accumulate Bitcoin.

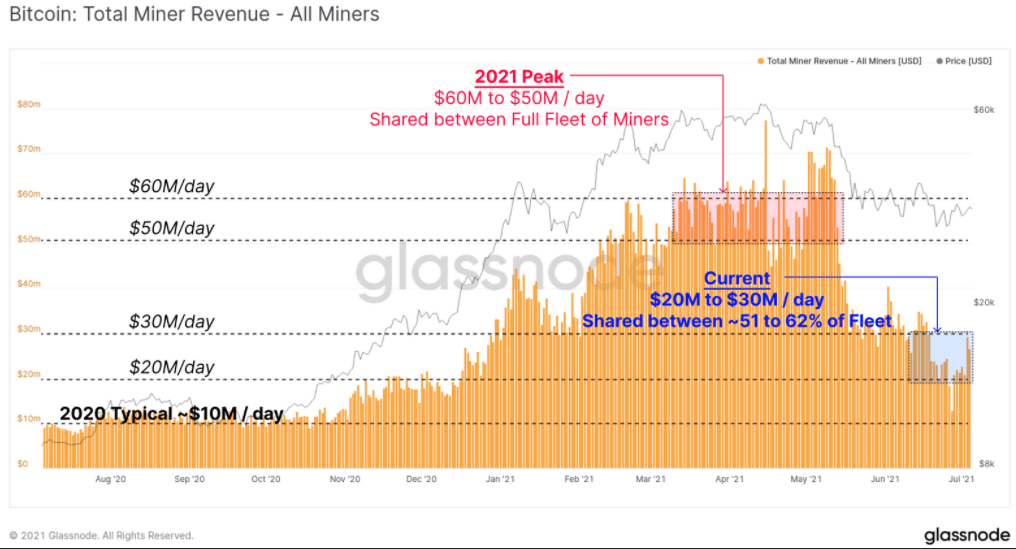

Bitcoin mining revenue distribution annotated chart.

Bitcoin mining revenue distribution annotated chart. Source: Glassnode

In a recent report, Glassnode compared the economic impacts on Chinese miners and their counterparts in other countries. It concluded that the current Bitcoin market distribution set up interesting dynamics:

“We have a very interesting dynamic where approximately 50% of the hash power is currently offline and incurring a great number of costs due to logistics and just simply not hashing, having hardware that’s not currently working, and the other 50% has essentially seen half their competition drop off the network. Whilst the protocol’s now issuing the same number of coins as it regularly does, having difficulty wound down, we’re now in a situation where half the network has doubled their income and the other half of the network is essentially producing nothing.”

Another notable effect was the influx of second-hand mining hardware in the market. An excess of mining hardware in the global market has forced the price to fall in the meantime. As noted by Frumklin, small scale miners, especially hosting companies can use this opportunity to scale up their mining operations:

“Many smaller-scale miners use third-party hosting services that offer better electricity rates than typically found on regular energy grids. Since this hosting capacity is in high demand, it’s likely not very easy for those miners to scale right now. However, any miners with off-grid facilities (e.g. next to gas wells) or who otherwise have direct access to some source of surplus energy are in a better position to start mining or to scale up than at any time in the past year or so because hardware is cheaper and more accessible, and the hash value (BTC/TH/day) is unexpectedly high.”

Frumklin added that North American miners, in particular, are favorably positioned to capitalize on the ongoing hash rate migration because they are no more competitively disadvantaged. He explained:

“Meanwhile, many larger miners in North America have found sub-four and even sub-three cents per kWh electricity, which is on par or better than the prices Chinese miners have been paying in recent years… Now that they’re no longer facing a competitive disadvantage in hardware procurement, the stage is set for these North American mining companies to become dominant players in the next few years.”

Ultimately, the drop in mining difficulty would attract new miners in their numbers. Nick Spanos, the co-founder of Zap Protocol, explained that this is a good time for miners, who previously wouldn’t have had a competitive edge, to join the Bitcoin mining economy:

“Bitcoin’s algorithm adjusts roughly every two weeks to allow one block of transactions to be mined every 10 minutes. So, it’s become both easier and more profitable to mine Bitcoin. That’s a recipe for enticing more miners back in.”

Who Are The Winners And Losers?

Winners

The Bitcoin Ecosystem

While China’s crackdown contributed to the price slump of Bitcoin, it also reinforced the sustainability of Bitcoin since it had largely defiled intensified efforts by China to clamp down the crypto market. As highlighted by Mike Novogratz Bitcoin has largely navigated the threats posed by the decisions of the Chinese government.

It is also good that the mining economy is undergoing a major reshuffling. Thanks to the ban on crypto mining in China, the country has lost its dominance in the Bitcoin mining market. In the coming months, especially when offline mining rigs come back online, expect a new Bitcoin mining order evenly distributed among Bitcoin mining-friendly regions.

Likewise, the migrations of Chinese miners to regions known for their cheap and renewable power sources would ultimately help promote a green Bitcoin mining economy.

Miners In Other Countries

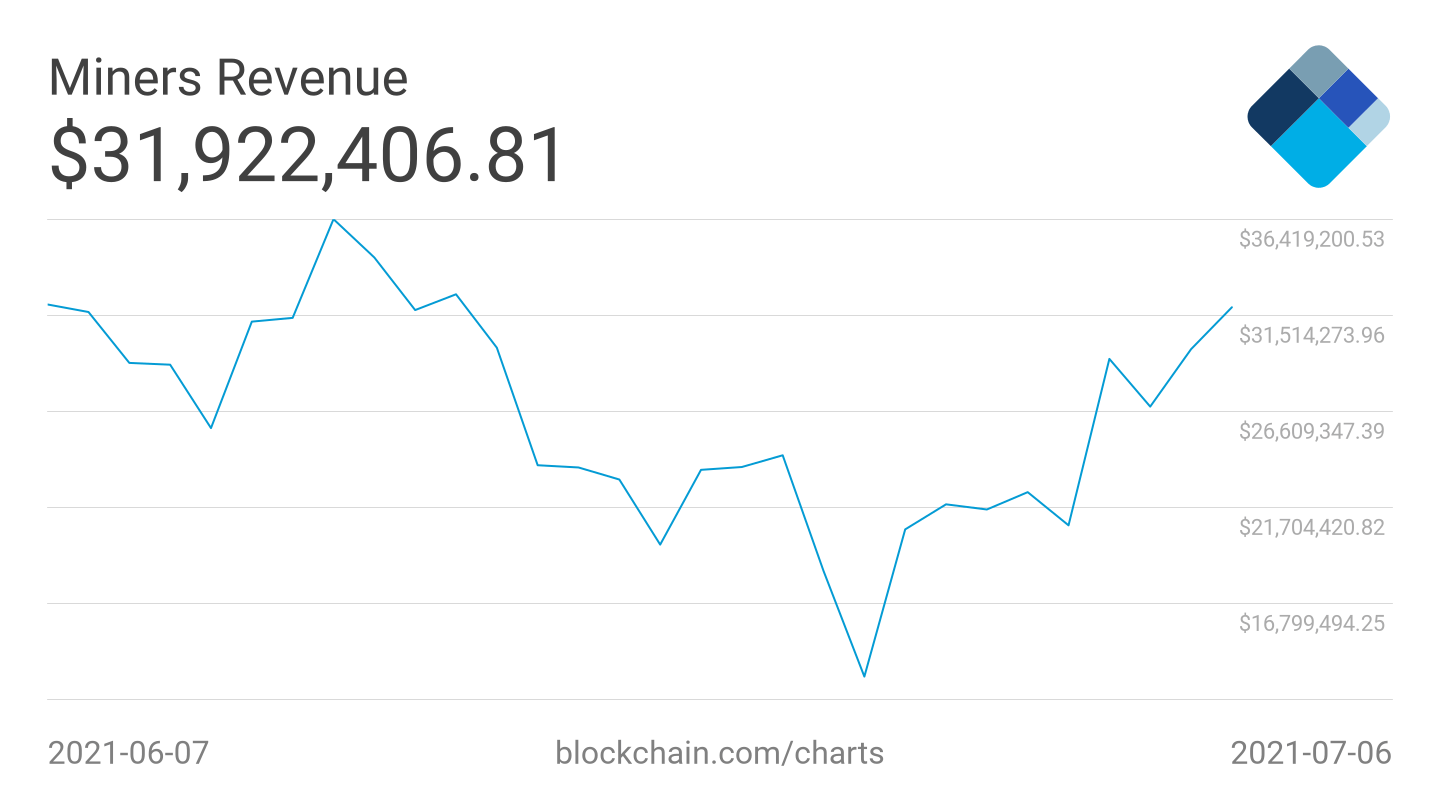

Bitcoin miner revenue chart. Source: Blockchain

As discussed earlier, the crash in mining difficulty has increased the profitability of Bitcoin mining and reduced the prices of mining equipment. In essence, miners that are still operational can take advantage of this opportunity to expand their mining operations such that they can remain competitive even when Chinese miners come back online.

Regions With Existing Crypto Mining Economies

The U.S. has been identified as the obvious destination for migrating Chinese miners. For instance, States like Texas and Wyoming have begun to exploit the high demand for cheap and clean electricity. Canada is also a suitable location, thanks to the abundance of clean energy sources and its cold climate. Khurram Shroff, CEO of iMining and chairman of IBC Group, commented that the reshuffling of the Bitcoin mining market would offer untold opportunities to Canada:

“A shift of crypto mining operations out of China will be a huge opportunity for Canada. The Toronto Stock Exchange recently listed the world’s first Bitcoin ETF, so the nation is already ahead of the curve, in terms of mainstreaming cryptocurrencies.”

In Asia, Kazakhstan seems to be another potential destination for miners. The government recently passed a crypto mining bill that will impose extra fees on the energy utilized by crypto miners. Russia, Malaysia, and Iran are other locations that crypto miners could consider.

Losers

Chinese Miners

It is never an enjoyable process to relocate your business due to unforeseen circumstances. These miners would have to spend a large chunk of their accumulated revenue to move and set up their hardware in another country. This is in addition to the technical and regulatory challenges that they will likely face along the way.

China

Before the recent crackdown, China was home to a multi-billion dollar crypto mining economy. Some hoped that the economic value of Bitcoin mining operations would be enough reason to spur the government to regulate the industry rather than scrap it. But in tandem with its crypto stance, China has opted for a total ban on crypto mining altogether. While it may not be all that obvious at first, the migration of Bitcoin miners out of China would certainly leave a void in the country’s economy.

Proof of Work (PoW) Mechanism

Proof of Work Mechanism

Recall that Bitcoin mining requires miners to solve complex problems. Well, the consensus mechanism that governs this process is called Proof-of-Work. This system utilizes a compute-intensive model of validating transactions and reward validators. Although the high computational requirements of this mechanism provide added security, it does expose the Bitcoin ecosystem to regulatory attacks.

Since miners now have to stack mining rigs and negotiate for favorable electricity deals, governments can easily identify and target them. Using China as a case study, Kelsie Nabben argued that hardware requirements of PoW consensus can inadvertently give room for governments and other entities to attack Bitcoin.

“Hardware has always been a major vulnerability in decentralized infrastructure. In blockchain-based cryptocurrency networks that run on a proof-of-work (PoW) consensus algorithm, such as Bitcoin, the commonly agreed record of transactions relies on a distributed network of computers. This is vulnerable to structural exploitations, including concentration of hardware mining in industrial-scale factories in certain geographies (such as China), “premining” cryptocurrency with upgraded hardware that is not yet available to the broader market (such as new model ASICs), or supply chain delays.”

Nabben added that the growing industrialization of Bitcoin mining goes against the original peer-to-peer design of the Bitcoin ecosystem:

“Having a majority of hashing power concentrated in one country, reliant on expensive hardware setups, and subject to regulatory crackdown is antithetical to the “decentralized” ethos of Bitcoin that was outlined by Satoshi Nakamoto. The initial vision of Bitcoin in its white paper was a peer-to-peer system, whereby infrastructure could be run by individuals on a general-purpose computer in a distributed way (via CPU mining), so that the entire network could not be shut down by targeting a single point of failure.”

Furthermore, Nabben argued that the Bitcoin mining crackdown in China shows why Ethereum’s switch to the Proof of Stake (PoS) consensus mechanism is a wise move:

“Attacking a PoS network is more costly in time and money than the cost of hiring or buying hardware to attack a PoW blockchain, as an attacker’s coins can be automatically “slashed.” Furthermore, it is much less conspicuous to run a PoS validator node on a laptop than it is to run a large-scale hardware mining operation. If anyone can run a node from anywhere with consumer-grade equipment, then more people can participate in validating the network, making it more decentralized, and regulators would find it almost impossible to stop people from running nodes. In contrast, the huge energy-consuming factories found in Bitcoin mining are much more easily targeted.”

Is The Rehashed Bitcoin Environmental Unfriendliness A Myth?

Is The Rehashed Bitcoin Environmental Unfriendliness A Myth

There is truth in the argument for and against Bitcoin’s environmentally unfriendly mining process. According to a report published by the University of Cambridge, Hydropower, which is a renewable energy source, accounts for 62% of the energy used by surveyed Bitcoin miners. The researchers wrote:

“Hydropower is listed as the number one source of energy, with 62% of surveyed hashers indicating that their mining operations are powered by hydroelectric energy. Other types of clean energies (e.g. wind and solar) rank further down, behind coal and natural gas, which respectively account for 38% and 36% of respondents’ power sources.”

It is worth mentioning that these findings contradict unfounded claims that Bitcoin mining had largely contributed to the increase in the use of fossil fuel energy. While a fraction of Bitcoin miners still use fossil fuel, it should not overshadow the fact that some miners are conscious of the impact of their operations on the environment.

The truth is that miners have begun to take the environmental impact of Bitcoin mining seriously. And as argued by Hass McCook, a retired chartered professional engineer, the migration of Bitcoin miners will likely push a cleaner Bitcoin mining economy:

“…it would appear that Bitcoin’s emissions peaked a few months ago, and thankfully, with the banning of Bitcoin mining in China, has commenced its aggressive march down to zero emissions. It is expected that in the worst case, emissions from Bitcoin in five years will be less than a third of its emissions today, and in 10 years, Bitcoin will emit nothing at all.”

McCook, while referencing another report by the University of Cambridge, noted that Bitcoin mining can help offset the excess electricity produced. This argument highlights part of the study that showed that the electricity consumed every year by idle devices in US homes can power the Bitcoin mining economy for over 3 years. McCook wrote:

“While this may seem counter-intuitive, when all of the data is aggregated and assessed with logic and textbook business and economic frameworks, it can be easily seen that Bitcoin poses almost no threat to the environment. Indeed, in the best case, Bitcoin will actively heal the environment through offsetting of flared methane and by holding the key to an abundant, clean energy future. I look forward to revisiting this prediction in 2026!”

Recently, Jay Hao, CEO of OKex, also lent his voice to this argument. In a post published on Cointelegraph, Hao also referenced the same report and noted that the energy consumed by Bitcoin miners is nowhere near what other industries consume:

“Also, according to the CBECI, 25,082 TWh of energy is produced in the world yearly. Only 20,863 TWh is consumed, meaning 16.82% is wasted. Bitcoin represents an energy expenditure of 0.47% of the total energy produced and only 0.54% of total electricity consumption worldwide. Another survey recently released by Galaxy Digital compares Bitcoin’s use of energy to the use of banks and gold mining. According to the document, the gold industry uses 240.61 TWh per year, while the banking system uses 263.72 TWh.”

However, when it comes to the carbon footprint of Bitcoin, there are reasons to be concerned. A 2019 report revealed that the carbon footprint of Bitcoin ranges between 22 and 22.9 metric tons of CO2. To put this into perspective, this figure is comparable to the carbon emitted by Sri Lanka.

In light of this, Hao explained that there is a need for a measured approach to the reduction of the use of fossil fuels by Bitcoin miners. He went on to propose the following:

“Fortunately, there are simple ways to offset the carbon footprint left by Bitcoin. With the tokenization of assets, some companies have chosen to tokenize carbon credits, making it easier for miners and all those involved in some way with the cryptocurrency industry to lessen the impact caused by the generation of electrical energy used in mining machines. Looking ahead, our attention should be on the reduction of the use of fossil fuels, with the aim to diminish the remaining carbon footprint. It is worth noting that the environmental problem will not be solved only by reducing the use of fossil fuels. It is even more important to optimize the use of the generated energy while focusing on reducing any waste and unnecessary carbon emissions in the process.”

What Does The Future Hold For The Bitcoin Mining Market?

What Does The Future Hold For The Bitcoin Mining Market

Experts expect the mining difficulty of Bitcoin to recover as soon as Chinese miners come back online. In the meantime, the existing Bitcoin miners will continue to maintain high profitability unless new miners manage to fill the hole left by Chinese miners.

There is also a high probability that we will begin to see an influx of crypto mining regulations. Just as Kazakhstan has opted to tax mining operations, other countries will try to capitalize on the influx of mining operations within their jurisdictions. There is also a slim chance that some of this region will try to put a cap on the amount of energy distributed to crypto miners. In some cases, this could be a result of explosive demand for energy.

While this is playing out, we should see a significant increase in the use of clean energy to power mining farms. Notwithstanding, I do not expect this to put to bed the common belief that Bitcoin is environmentally unfriendly. It is time we start to understand that some of the attacks on Bitcoin stem from an intentional attempt to downplay and control the Bitcoin narrative. Note that most of Bitcoin’s energy inefficiencies narratives are overblown. In his writeup, McCook highlights the tendency of skeptics to reference erroneous data. He wrote:

“One of the most widely debunked, yet still widely referenced claims of ‘academia’ is that Bitcoin will single-handedly increase the planet’s temperature by 2 degrees Celsius.”

Also worth noting is the fragility of Bitcoin in the US, especially now that the country is looking to introduce a digital dollar. The question is: Will the US view Bitcoin as a competitor and subsequently opt to replicate China’s ban on Bitcoin mining?

Closing Thoughts

Undoubtedly, the recent showdown between China and the Bitcoin mining community has had a serious impact on the dynamics of the crypto market. Not only has the price of Bitcoin crashed, but also the mining difficulty has experienced a similar downtrend. Perhaps, for the first time, the Bitcoin community has witnessed the downside of the increasingly industrialized Bitcoin mining economy.

On the upside, there is hope that the reshuffling will ultimately lead to the decentralization of the crypto mining economy. Likewise, there are reasons to believe that the exodus of Chinese miners would promote the use of clean energy to mine Bitcoin since it has become critical to consider the carbon footprint of Bitcoin and identify ways to make Bitcoin mining clean.