Gold Just Ripped to $5,080 in 48 Hours While Bitcoin Slipped — What I’m Watching (Jan 29, 2026)

Gold ripping to $5,080 in 48 hours while Bitcoin slips around $86K is the kind of move that exposes a painful truth: a lot of “safe haven” portfolios only look diversified on paper, and when stress hits, BTC can start acting less like digital gold and more like a risk trade that moves with the crowd. If you’re crypto-heavy, that gap doesn’t just bruise the ego—it can wreck your P&L because your hedge isn’t hedging when you actually need it, correlations tighten up at the worst time, and your sizing quietly turns “balanced” into “mostly BTC by risk.” I’m watching this rotation like a hawk because fast gold moves can force real money to rebalance, shift liquidity, and change what gets treated as protection in 2026, and that’s where the opportunity is: not in panic-selling Bitcoin, but in setting smarter rules—how to size positions by risk, how to rebalance without guessing headlines, and how to read what this kind of gold strength might be signaling so your portfolio doesn’t snap the next time the narrative flips overnight.

Listen to this article:

What if your “safe haven” setup is only working in your head… but not in your portfolio?

If you hold BTC and you’ve been treating it like digital gold, this week’s price action is the kind of wake-up call that stings for a day… and saves you for a year—if you actually listen to it.

Gold just jumped to $5,080 in roughly 48 hours (now up about 17% in January), while Bitcoin is hanging around $86K and didn’t play the “crisis hedge” role a lot of people expect. That gap changes the conversation fast.

When the asset you call your hedge starts acting like a risk trade, you don’t need a new religion… you need better rules.

Here’s the real opportunity: rotations like this can help you rebalance smarter before the next macro headline forces everyone to do it at once.

The pain right now: your “hedge” isn’t hedging when you need it

I’ve talked to a lot of crypto holders who feel the same frustration this week:

- Gold moves like fear is real. Bitcoin… kind of shrugs.

- You bought BTC for “uncorrelated protection,” but it sometimes trades like a high-beta tech proxy.

- You thought you were diversified, yet your P&L still swings like you’re basically in one trade.

To be clear, I’m not here to trash Bitcoin. I still respect what BTC is trying to be. But I’m also not going to pretend the market treats it the same way it treats gold during certain stress windows.

And that’s not just vibes—there’s research behind the “BTC behaves like risk” problem.

In multiple market stress periods over the last few years, Bitcoin’s correlation with equities has shown a habit of rising when investors de-risk. That’s exactly the moment people want their hedge to separate, not hold hands with everything else. You can see this theme discussed across major research outlets like the IMF and BIS, especially around “crypto’s role in the financial system” and how correlations can spike under stress:

- IMF Global Financial Stability Report (GFSR) (tracks shifting correlations and risk transmission channels)

- BIS working papers (often covers crypto market structure, leverage, and risk behavior in stress regimes)

Why this matters in 2026: the macro backdrop is still the kind that punishes lazy portfolio design.

- Higher-for-longer uncertainty keeps risk assets jumpy. Even when cuts are “expected,” timing matters, and timing whipsaws portfolios.

- Crowded trades unwind fast. When everyone is positioned the same way, one push becomes a stampede.

- Sentiment flips happen in hours, not weeks. Crypto is famous for that, but now macro is playing the same game.

The real problem I see isn’t that Bitcoin “failed.” It’s that a lot of investors are accidentally running a portfolio that’s concentrated in correlated risk… while telling themselves a story about diversification.

If your mix is basically:

- BTC

- ETH

- alts that move like leveraged BTC

- maybe a little cash that you never want to “waste”

…then you’re not diversified. You’re just wearing different hats in the same storm.

Promise solution

Here’s what I’m going to do in this post (and how I’d handle it if I were crypto-heavy):

- Explain what could be driving gold’s sudden dominance—without the lazy “because fear” one-liner.

- Talk about what this kind of gold move can signal about liquidity, positioning, and what big money is trying to protect.

- Translate the “Fed next move” chatter into simple portfolio rules—no predictions, no chart astrology, just practical risk choices.

I’m not interested in convincing you to dump BTC. I’m interested in making sure your portfolio doesn’t break when the narrative changes for a few weeks.

What changed in 48 hours (and why it shocked everyone)

Let’s recap the punchline:

- Gold: ripped to $5,080 in about 48 hours, now roughly +17% in January

- Bitcoin: hovering around $86K, underperforming relative to the “fear trade”

The headline isn’t “gold up” or “BTC down.” The headline is the speed.

Fast moves matter because they don’t just change mood—they can force action:

- Systematic strategies rebalance when volatility spikes or trend signals flip.

- Risk-parity and vol-target funds often cut exposure when cross-asset volatility jumps.

- Margin and leverage get stressed when one asset moves so hard it changes collateral math.

That’s why a sharp 48-hour move can create second-order effects—selling in one place to cover risk in another, or buying the “clean hedge” because it’s the only thing working right now.

It also creates the one question that actually matters:

Was this a one-off headline spike… or the start of a longer rotation where “safety” gets re-priced?

If it’s a one-off, chasing it can be expensive. If it’s a rotation, ignoring it can be worse.

The biggest mistake I see crypto holders make during rotations

I’ve watched this movie too many times, and the script is always the same. When a rotation hits, people do one of these three things:

1) They go all-in / all-out based on one week of price action

They see gold ripping and think: “That’s it, BTC is dead.” Or they see BTC lagging and think: “This is manipulation, I’m doubling down.”

Both reactions are the same mistake: making a permanent decision off temporary data.

2) They ignore volatility sizing (position size matters more than being “right”)

This one is brutal because it’s silent. If gold is moving like a freight train and BTC is swinging like BTC, your position sizing becomes your real strategy—whether you admit it or not.

A practical example:

- If BTC can realistically swing 2–4x more than gold in a stressed week, then a “50/50” allocation by dollars is not 50/50 by risk.

- That means your portfolio can still be “mostly BTC” even when you swear it’s balanced.

This is one reason professional portfolios often think in risk contribution, not just percentage allocation. If you’ve never looked at your holdings that way, this week is a great reason to start.

3) They confuse the “store of value” narrative with short-term market behavior

Bitcoin can be a long-term store-of-value thesis and still trade like a risk asset in certain windows. Those two things can both be true.

In the short run, price is driven by flows, leverage, and positioning. In the long run, it’s driven by adoption, supply constraints, and trust. When those timeframes get mixed, people end up buying the top, selling the bottom, and calling it “macro.”

So here’s the question I want you thinking about before we go any further:

If gold is ripping like this while BTC pauses… is capital trying to reduce counterparty risk (a “trust” trade), or is it simply chasing momentum because systematic money got triggered?

Because the answer to that question changes what I watch next—and it changes what I’d do with a crypto-heavy portfolio without panic-selling my bags.

Next up: I’m going to break down what gold’s breakout might actually be telling us about 2026—without the hype—and why BTC can lag in the same window for reasons that have nothing to do with “Bitcoin failing.”

What gold’s breakout could be telling us about 2026 (without the hype)

When gold explodes higher in a two-day window, I don’t treat it like a “cool headline.” I treat it like a message. Not a perfect one… but a message about how big money is thinking about risk, trust, and liquidity right now.

Here’s the lens I keep coming back to:

Is capital trying to reduce counterparty risk… or is it just chasing momentum?

If the answer is “counterparty risk,” gold’s move matters a lot more than if it’s “momentum.” And in 2026, those two can look identical on a price chart—until they don’t.

So let’s separate the possible drivers, and what each one usually implies for Bitcoin.

1) Real yield expectations shifting

Gold tends to like falling real yields (or the market believing they’ll fall). When real yields feel capped—because growth is slowing, debt servicing is getting loud, or the Fed’s “higher for longer” story starts wobbling—gold often catches a bid.

Study note: Research like Baur & Lucey (2010) and related “safe haven” literature shows gold’s defensive behavior shows up most clearly during stress regimes, not in calm markets. Translation: gold doesn’t need inflation to run—it needs uncertainty about the system.

2) Central bank demand + “trust trades” moving into tangibles

Central banks have been meaningful buyers of gold in recent years (World Gold Council data has tracked multiple high-demand periods). Even if that’s not the only driver here, the narrative matters because it reinforces one idea: gold is nobody’s liability.

In a week where markets feel jumpy about policy surprises, geopolitics, or credit cracks, that “nobody’s liability” feature suddenly feels priceless.

3) Geopolitical risk getting repriced

Geopolitical risk doesn’t always hit markets instantly. Sometimes it sits quietly—then reprices violently when positioning is wrong. Gold is one of the few assets that can reprice fast without needing a “tech growth” story behind it.

4) “Momentum” and systematic flows (yes, this is real)

A move this sharp often triggers rule-based funds—trend followers, vol-target funds, risk parity adjustments. That can turn a normal rally into something that feels insane.

Now the Bitcoin side: why might BTC lag in the same window?

- Profit-taking after a strong run (especially if traders were leaning long into the week).

- Risk-off de-leveraging—perps get cut first because they’re easiest to reduce quickly.

- ETF flow shifts—even small changes in net flows can dominate short-term price action.

- Correlation spikes—in stress, assets don’t behave like their narratives; they behave like their liquidity profiles.

That’s why I don’t ask “Is Bitcoin still digital gold?” as a philosophical question. I ask a practical one:

In this specific 2026 regime, is the market treating BTC like a high-vol risk asset… or a balance-sheet hedge?

The Bitcoin angle: is this a dip, a trend change, or just a pause at $86K?

I’m not guessing. I map three scenarios and watch which one the data supports. Here’s how I’m framing BTC around ~$86K:

Scenario 1: BTC consolidates, then catches up (risk-on returns)

This is the “rotation snap-back” outcome. Gold spikes, fear peaks, then liquidity loosens and BTC rips as sidelined cash re-enters.

What I’d want to see:

- Funding rates normalize (not euphoric, not deeply negative)

- Spot buying shows up (not just perp games)

- ETF net flows stabilize or improve

- Stablecoin supply trends up again (fresh on-chain dry powder)

Scenario 2: BTC chops while gold leads (classic defensive rotation)

This is where portfolios quietly re-weight toward “ballast.” Bitcoin doesn’t have to crash—it can just go sideways while gold keeps soaking up risk-off demand.

What I’d look for:

- Perp volume dominance stays high (speculation > conviction)

- ETF flows are mixed or slightly negative

- Exchange reserves stop falling (less urgency to hold off-exchange)

- DXY firming + wider credit spreads (a combo BTC rarely loves short term)

Scenario 3: Both drop (liquidity squeeze / broad risk reduction)

This is the one most people ignore until it bites. If liquidity tightens fast, everything gets sold to raise cash—even “safe” stuff—at least initially.

What I’d look for:

- Credit spreads widening quickly

- Stablecoin supply shrinking (deleveraging, redemptions)

- Funding turns sharply negative and spot bids don’t step in

- Correlations go to 1 (the “sell what you can” phase)

My quick “sanity dashboard” for BTC here is:

- Funding rates (are traders paying up to stay long?)

- Spot vs perp dominance (real demand vs leverage demand)

- ETF net flows (does the marginal buyer show up?)

- Exchange reserves (are coins moving to sell or to hold?)

- Stablecoin supply trend (is liquidity entering the crypto system?)

Study note: A lot of academic work on Bitcoin’s hedge/safe-haven behavior (for example, papers by Bouri and co-authors across multiple years) points to something traders learn the hard way: BTC’s “hedge” behavior is regime-dependent. It can hedge in some windows and trade like risk in others—especially when liquidity is the real driver.

The portfolio shift question: should you rotate from BTC to gold in 2026?

I don’t like the word “rotate” because it makes people do something dramatic. What actually works is decision rules. Here’s the decision tree I use when a move like this hits:

- If you need drawdown control (you’ll panic-sell a 20–30% dip) → you don’t need a hot take, you need ballast (gold exposure, cash-like exposure, shorter-duration collateral).

- If you’re high-conviction long-term BTC → don’t “switch religions” mid-week. Use rebalancing rules so you buy weakness and trim strength without emotions running the show.

- If you’re over-levered → reduce leverage first, and call it what it is: survival. Rotation comes after you’ve removed the fragility.

Three practical approaches that keep you from doing something you’ll regret:

1) Barbell allocation

One side is your high-upside core (BTC). The other side is boring ballast (gold/cash-like). The point isn’t to be “safe.” The point is to stay in the game long enough for your thesis to work.

2) Rebalancing bands

Instead of guessing tops and bottoms, you set bands. Example logic (not a recommendation): if BTC runs and becomes too large a % of your net worth, you trim a little into gold/cash. If BTC dumps and falls below your band, you add according to plan.

3) Volatility-based sizing

This is the one most crypto holders skip. BTC’s volatility is usually multiples of gold’s. So a “50/50” split by dollars is not 50/50 by risk. If you’ve never sized positions by volatility, you may be taking way more risk than you think.

People also ask (I’ll answer these directly)

Why is gold pumping while Bitcoin is down?

Simple version: gold is catching defensive flows while BTC is digesting leverage and positioning.

The nuance: gold can react to “trust/counterparty” fear immediately, while BTC often gets treated like a risk asset during de-leveraging windows.

What I’m watching next: BTC spot vs perp dominance, ETF net flows, and whether stablecoin supply starts expanding again.

Is Bitcoin still a hedge against inflation in 2026?

Simple version: sometimes, not always.

The nuance: BTC has hedged monetary debasement narratives over long arcs, but over shorter windows it can trade like a liquidity-sensitive tech proxy.

What I’m watching next: real yield expectations, DXY direction, and whether BTC demand is spot-led or leverage-led.

Should I buy gold or Bitcoin right now?

Simple version: buy what matches your time horizon and your stomach for volatility.

The nuance: gold can protect you in stress regimes; BTC can outperform when liquidity improves. The mistake is buying either one with no plan for the ugly weeks.

What I’m watching next: credit spreads + stablecoin supply trend (liquidity), and whether the gold move fades or holds.

What happens to BTC if the Fed cuts/pauses/hikes?

Simple version: cuts often help risk assets unless the cut screams “something broke.”

The nuance: markets care about why the Fed moves. A dovish pivot because inflation is cooling can be bullish. A pivot because growth is cracking can be messy at first.

What I’m watching next: unemployment surprises, CPI trend, and liquidity conditions (not the headline).

How much gold should a crypto investor hold?

Simple version: enough that you don’t blow up or panic-sell your BTC at the wrong time.

The nuance: the right amount depends on your leverage, income stability, time horizon, and whether BTC is already a huge chunk of your net worth.

What I’m watching next: correlation shifts during stress—if BTC starts behaving like risk, gold earns its keep fast.

I’ve been watching what people are reacting to in real time. These posts capture the mood, but I always sanity-check the emotion with the boring indicators (flows, funding, liquidity, spreads):

- TrendingBitcoin market snapshot

- GlobalMktObserv on macro context

- ZynxBTC commentary

- Web3Niels thread

- Dipdas2001 on price action

- yawaradoteth perspective

- Cryptoemperor06 take

- BSCNews headline context

- Dipdas2001 extra thread

- LiberaInvest macro angle

Sometimes the crowd is early. Sometimes it’s just loud. Either way, these links are useful as a “what narrative is spreading” map—just don’t confuse that with confirmation.

What I’m watching next week: the “Fed move” checklist (no crystal ball needed)

I don’t trade the Fed headline. I trade what the Fed headline changes in actual conditions. Here are the few signals that usually matter more than the press conference:

- CPI trend: not one print—trend + what’s happening in sticky components

- Unemployment surprises: a small surprise can shift the entire rate path narrative

- Liquidity conditions: are financial conditions loosening or tightening?

- Credit spreads: widening spreads often mean “risk-off is real,” not just vibes

- DXY direction: a strong dollar can be a short-term headwind for BTC; gold’s reaction can vary depending on fear vs yields

How this typically hits gold vs BTC in the short run (not a law, just a pattern I respect):

- If markets price policy easing because inflation is cooling → BTC often benefits as liquidity expectations improve.

- If markets price easing because something is breaking → gold often wins early while BTC can wobble with risk assets.

- If markets price higher-for-longer again → gold can still hold up if fear is rising, but BTC usually needs real liquidity to thrive.

My simple “if this, then that” plan around macro events:

- If credit spreads widen + DXY rises → I assume stress regime and prioritize drawdown control.

- If stablecoin supply expands + ETF flows improve → I assume liquidity tailwind and prefer staying with my BTC plan.

- If funding spikes while spot demand looks weak → I treat pumps as fragile and avoid chasing.

One question for you before you scroll: if gold keeps acting like the “trust trade” and BTC keeps acting like the “liquidity trade,” do you have a rules-based way to protect your downside without nuking your long-term crypto exposure?

Because next, I’m going to lay out exactly how I’d adjust a crypto-heavy portfolio step-by-step—starting with the one change that reduces fragility fast (and it’s not what most people think).

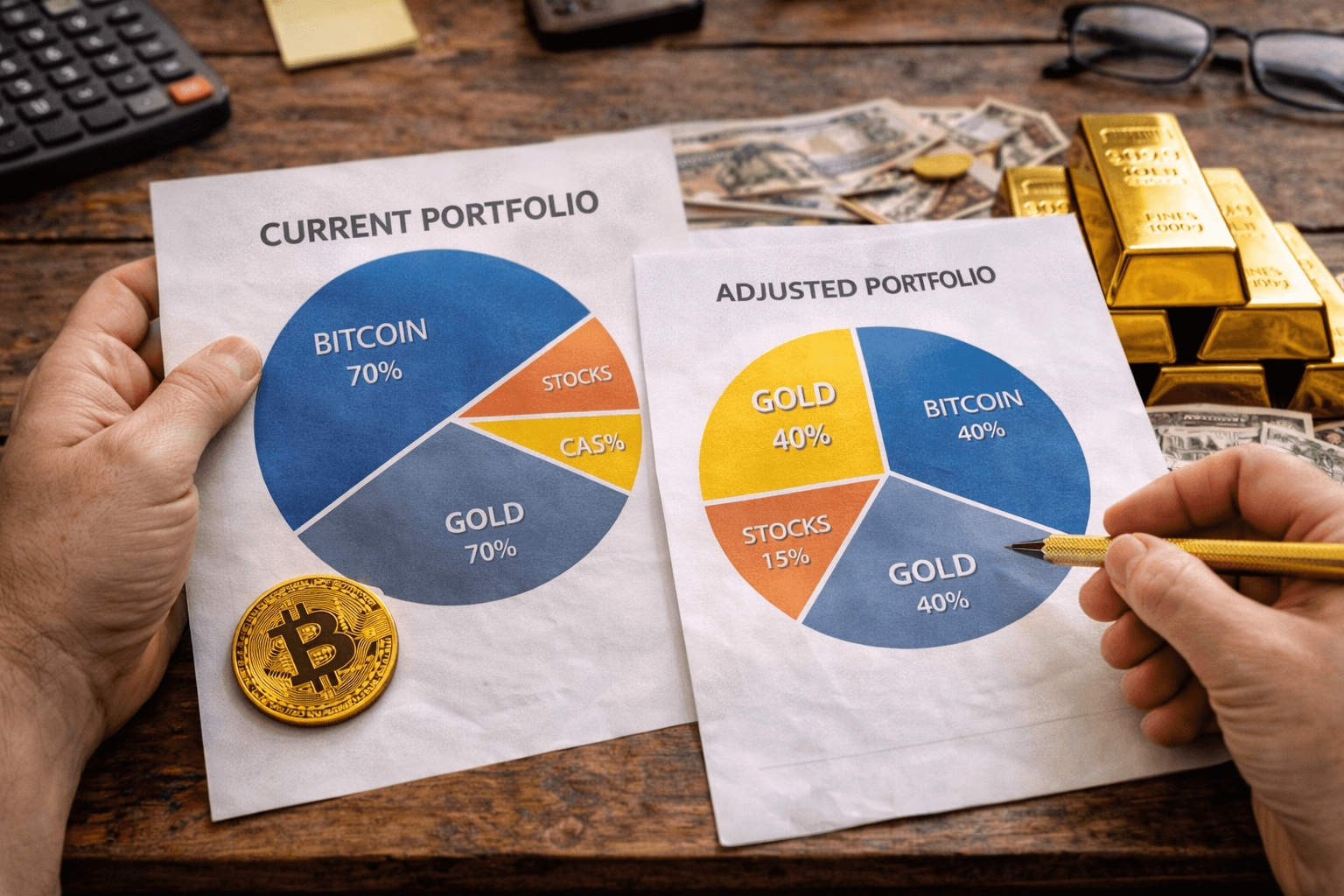

How I’d adjust a crypto-heavy portfolio if gold keeps leading

If gold keeps acting like the “adult in the room” while crypto chops, I’m not trying to guess the next candle. I’m trying to make my portfolio harder to break.

When markets rotate fast, the mistake isn’t “owning the wrong thing.” It’s being fragile — too much leverage, too many weak positions, and not enough ballast to survive a nasty month.

Here’s the framework I use. It’s simple on purpose, because simple is what I can follow when headlines get loud.

Step 1: Reduce fragility (before you rotate anything)

- Kill leverage first. If I’m using margin/perps, I cut it down before I touch spot holdings. In real stress, liquidation risk beats “being right.”

- Trim the “story coins.” If an alt only works in perfect liquidity, I treat it like a luxury item. In rotations, liquidity is the first thing that disappears.

- Concentrate quality. I’d rather hold fewer, stronger positions than a basket of maybes. For most people, that means the core stays BTC-heavy, with ETH as the only major “maybe” depending on your conviction.

Step 2: Add ballast (so you’re not forced to sell BTC at the worst time)

- Cash / T-bills equivalents for optionality. Not exciting, but this is what turns a crash into an opportunity instead of a crisis. Short-duration tends to behave better when things get weird.

- Gold exposure as a portfolio shock absorber. That can be physical, an ETF, or even tokenized gold if you understand the custody and redemption risks. The point is: something that historically can hold up when confidence cracks.

- Quality collateral mindset. I want assets I can reliably rebalance from, not just assets that look good in a bull market.

Step 3: Keep optionality (don’t abandon the upside)

- Keep a core BTC position that I don’t micromanage. If I’m long-term bullish, I don’t want to “accidentally” trade my way out of the best days of the cycle.

- Stage buys and re-entries. Instead of one heroic buy, I’ll place staggered limits or DCA over a few weeks. Rotations love to fake people out.

- Hold dry powder with a plan. Cash isn’t a viewpoint — it’s ammunition. But only if I know what would make me deploy it.

One study I’ve found useful for mindset here (not crypto-specific, but very relevant) is the idea of managing exposure based on volatility. The classic paper by Moreira & Muir on volatility-managed portfolios shows that scaling risk down when volatility spikes has historically improved risk-adjusted returns in traditional markets. Crypto is its own beast, but the principle still matters: position size often matters more than your prediction. See: “Volatility-Managed Portfolios” (Moreira & Muir).

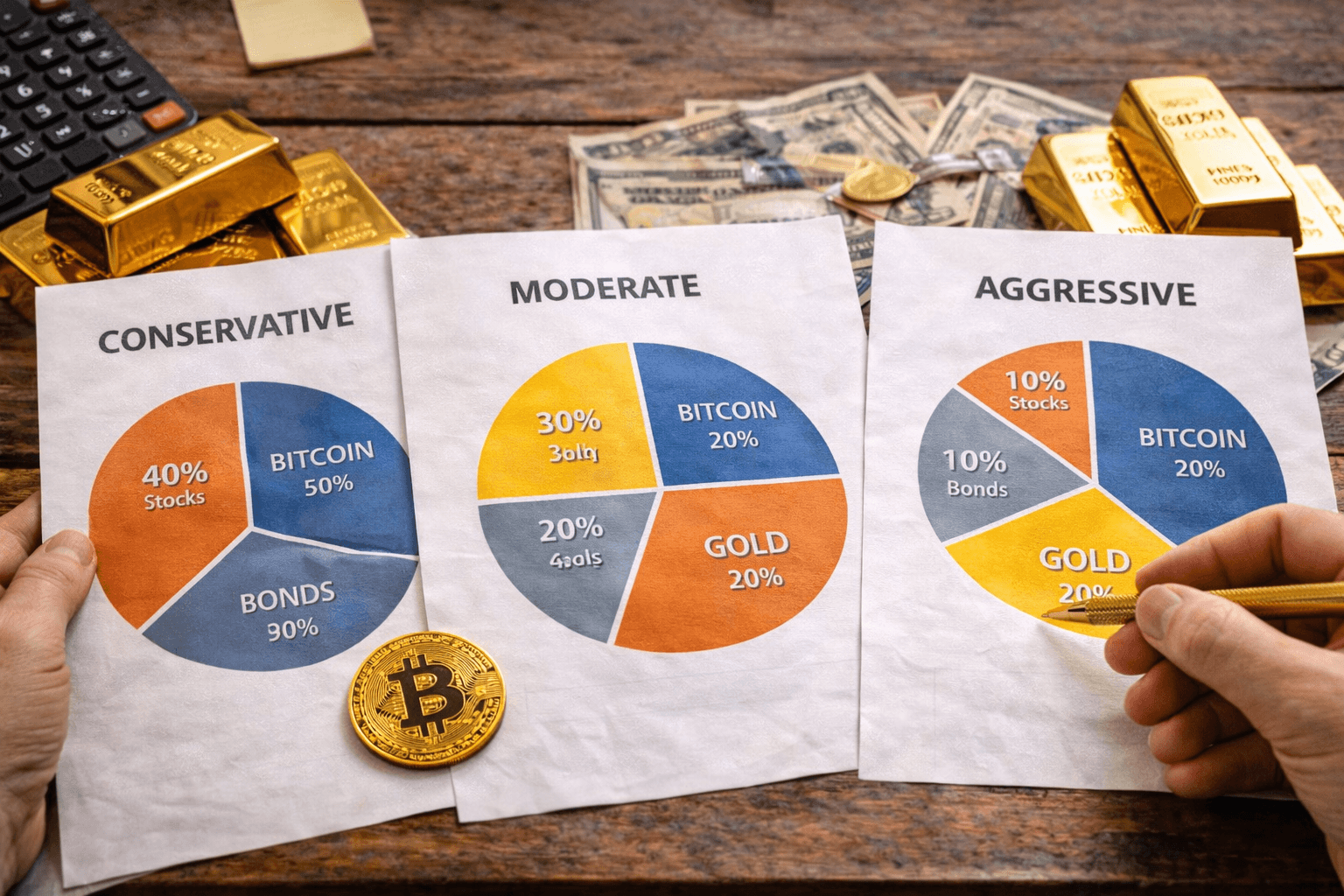

I’m going to give sample models with clean percentages because people always ask for something concrete. Treat these as templates, not a commandment. Your income stability, time horizon, and stomach for drawdowns should decide the final numbers.

1) Conservative “I want to sleep” model

- 25% BTC (core)

- 25% Gold exposure

- 50% Cash / T-bills equivalents

This is for someone who wants crypto upside but refuses to let volatility run their life. If gold continues to lead, this mix tends to feel a lot less stressful.

Rebalance: monthly check-in, rebalance if any sleeve drifts by ~5–7 percentage points.

2) Balanced “I still want upside, but I’m not naive” model

- 45% BTC

- 15% Gold exposure

- 25% Cash / T-bills equivalents

- 10% ETH (only if you actually want ETH exposure)

- 5% Alt sleeve (strictly capped, strictly curated)

This is the version I like when I want to stay meaningfully invested in crypto without being hostage to a single regime. The small alt sleeve is there for optionality, not ego.

Rebalance: every 4–6 weeks, or immediately after a big spike (up or down). Use 7–10 point drift bands.

3) Aggressive “BTC-heavy, but with rules so I don’t get wrecked” model

- 70% BTC

- 10% Gold exposure

- 15% Cash / T-bills equivalents

- 5% Opportunistic sleeve (ETH/major alts only, no illiquid bets)

This is for people who know they want to be heavy BTC… but also know that “heavy BTC” without guardrails turns into emotional decisions.

Rules I’d attach to this model:

- Hard cap leverage at zero (spot-only) during macro stress, or keep leverage tiny enough that a violent move can’t liquidate you.

- Volatility trigger: if BTC’s realized vol spikes (ex: 30D vol materially above its recent average), I reduce exposure by a fixed amount (like 5–10%) and park it in cash/T-bills until volatility cools.

- Re-entry plan: I only add that risk back in steps, not all at once.

That “gold as ballast” idea isn’t just vibes. Academic work often frames gold as a hedge/safe haven in certain stress windows (not all). A classic reference is Baur & Lucey’s research on gold’s role during market turmoil: “Is Gold a Hedge or a Safe Haven?” (Baur & Lucey). It’s not a promise gold always saves you — it’s a reminder that it can behave differently when fear rises.

Risk notes I won’t sugarcoat

- Gold can whipsaw after blow-off moves. A vertical move can retrace fast. If you buy gold purely because it “feels safe” after a spike, you can still get clipped.

- BTC can rip the moment everyone gets defensive. Some of Bitcoin’s biggest up days show up when positioning is lopsided and people are underexposed.

- Correlations are not loyal. In stress events, assets that “normally diversify” can suddenly move together. That’s why I want cash/T-bills ballast too, not just “BTC + gold and hope.”

- The goal isn’t to win the week. It’s to stay solvent, stay flexible, and avoid being forced into bad sells.

If I’m making portfolio decisions that require perfect timing to work, it’s not a strategy — it’s a gamble.

My takeaway for Jan 29, 2026

If gold’s $5,080 spike is the start of a real rotation, I don’t think crypto investors need to abandon BTC. I think we need to stop pretending one asset can do every job in every regime.

My move is simple: reduce fragility, add ballast, keep optionality — and run it with rules instead of emotion.

Your practical homework tonight:

- Write down your current split (BTC, ETH, alts, cash-like, gold-like).

- Set rebalance bands (ex: adjust when something drifts 7–10 points).

- Decide what would force a change (volatility spike, leverage, drawdown threshold).

Now I want to hear it straight: what’s your current split between BTC and gold (or gold-backed exposure), and what would actually make you change it?