Epstein’s Alleged $3M Coinbase Stake Hits the 2026 “Files” — Does It Change Bitcoin Security in the Next 30 Days?

What would you do right now if you woke up to a trending claim that Bitcoin had a “backdoor”… and it was tied to Epstein, a Coinbase stake, and a fresh 2026 file drop?

If you’re seeing the Epstein “$3M Coinbase stake” claim tied to a 2026 file drop and your stomach just did that thing where you start thinking “is Bitcoin about to get hacked?” you’re not alone—and that’s exactly why this kind of story spreads: it mixes a notorious name, a household exchange, and a scary word like “backdoor,” then leaves your brain to fill in the blanks while the market and social feeds sprint ahead of the facts. The pain here isn’t just price volatility; it’s the split-second custody panic, the urge to make a rushed move, and the wave of fake “proof,” phishing, and shady links that always rides along with it. What I’m going to do is slow the noise down and turn it into a simple decision framework: what’s confirmed vs repeated, what a real Bitcoin compromise would actually require, what could realistically matter in the next 30 days, and the calm steps I’d take if I had BTC on an exchange or in self-custody.

Listen to this article:

I’m watching the same pattern I’ve seen for years: a headline hits, the narrative mutates in real time, and suddenly good Bitcoiners are asking the most dangerous question in crypto:

“Do I need to move my coins today?”

This post is here to slow that moment down. Not to dismiss concerns, and not to hype them either. Just to separate what’s being claimed from what’s technically possible—so you can make decisions based on reality, not adrenaline.

These Epstein/Coinbase/“Bitcoin backdoor” claims stick for one reason: they’re built like the perfect viral sandwich.

- A real-world name with emotional gravity (Epstein)

- A big mainstream brand that lots of people already use (Coinbase)

- A scary technical idea most people can’t quickly verify (“backdoor”)

When you combine those three, the brain fills in the gaps automatically. Even smart people do it. The story feels plausible long before it becomes provable.

And there’s a real reason you should take the market impact seriously even if the core claim ends up being flimsy: misinformation and rumor travel fast enough to move behavior.

One of the most cited studies on this is from Vosoughi, Roy, and Aral (Science, 2018), which found false news spread “farther, faster, deeper, and more broadly” than true news on social networks. That’s not a crypto-specific study—but crypto is basically a live-fire exercise of that effect, because:

- Markets trade 24/7

- Leverage magnifies emotion into liquidation cascades

- Most people get “news” from screenshots and reposts

So yes—something can be technically wrong and still cause short-term risk through panic selling, scam attempts, and custody stampedes.

Promise solution

Here’s the framework I’m going to use so you can stay grounded over the next month:

- 1) What we know vs. what’s speculation (and how to tell the difference fast)

- 2) What a Bitcoin “backdoor” would actually require (not vibes—mechanics)

- 3) What could realistically impact BTC security or price in the next 30 days (and what probably can’t)

- 4) Practical steps I’d take as a holder (calm, boring, effective)

If you only take one thing from this opening section, take this:

Most “Bitcoin is compromised” narratives collapse when you ask, “Okay—how, exactly?”

And if the person posting can’t answer that without switching to another scary-sounding claim, you’re looking at a story designed to spread, not a story designed to be checked.

Why “Coinbase stake” headlines instantly trigger custody anxiety

I get why this particular angle hits a nerve. A lot of people’s first Bitcoin experience was custodial—buying on an exchange, leaving coins there, and trusting the platform to keep everything safe and liquid.

So the mental leap happens fast:

“Epstein + Coinbase = control over Bitcoin.”

But that leap bundles together several different ideas that are not the same thing:

- Ownership (who holds shares or had a financial position?)

- Influence (could they pressure decisions, policy, PR, listings?)

- Governance (does any of that change Bitcoin’s rules?)

- Custody risk (could this affect withdrawals, freezes, or user funds?)

A “stake” headline pushes people into thinking protocol control and custody control are the same. They aren’t. And mixing them is where panic gets its fuel.

Also, we’re all carrying trauma from past blowups—some recent, some not. After events like major exchange failures and surprise withdrawal halts across the industry over the years, readers have learned (the hard way) that counterparty risk is real. So when a story hints at “hidden influence,” the emotional reaction is: get out now.

That instinct isn’t stupid. It just needs structure.

The biggest pain point for readers: “Do I need to move my coins today?”

Let’s speak plainly: most people aren’t reading this for entertainment. They’re reading because they’re trying to decide whether to:

- Move BTC off an exchange immediately

- Pause buys/sells until the “files” are clearer

- Ignore the noise and carry on

- Figure out if any of this touches actual Bitcoin security

And there’s a second danger layered on top of panic: scams love moments like this.

When the internet is flooded with “urgent” posts, it becomes the perfect time for:

- Fake “document links” that are really malware

- Phishing emails like “Coinbase compliance review—verify your wallet”

- Imposter support accounts offering “secure migration” help

- Seed phrase traps disguised as “verification tools”

So if you’re feeling that pressure to act instantly, I want you to hold one line in your head:

Speed helps scammers more than it helps you.

Now for the key question that decides whether this story is just loud… or actually important:

What exactly are the 2026 Epstein “files” claimed to show, and what can we verify versus what’s just being repeated?

That’s what I’m going to tackle next—starting with how this narrative spread so fast, and what would count as real evidence (not screenshots, not “someone said,” not vibes).

What the 2026 Epstein “files” are claimed to show — and what I can (and can’t) verify today

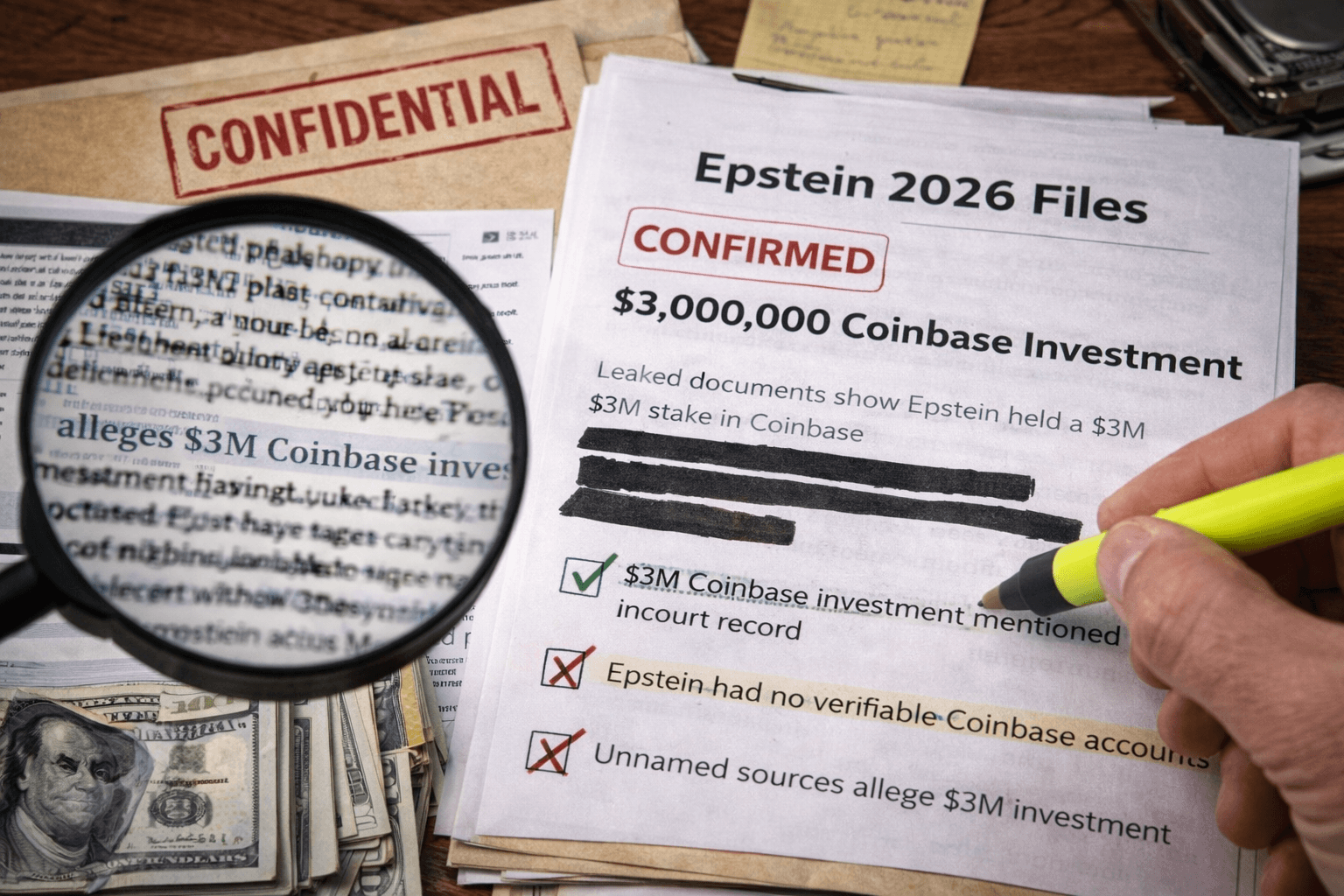

As of today (3 Feb 2026), the core viral claim I keep seeing boils down to this:

- An alleged ~$3M Coinbase position is being attributed to Jeffrey Epstein (or an entity tied to him) via the new “2026 files” chatter.

- That claim then gets stretched into a much bigger insinuation: “This connects Epstein to Bitcoin’s origins… therefore Bitcoin might be compromised.”

Let me be really clear about where I’m at right now: I cannot independently verify the authenticity of what’s circulating from screenshots alone. And “someone said it came from the files” is not the same thing as “we have a verifiable primary record.”

Here’s what would actually count as evidence (the stuff that holds up when the adrenaline fades):

- Primary documents (court exhibits, authenticated disclosures, subpoena returns) with clear provenance.

- Official filings (regulated reporting, audited statements, or documented ownership structures).

- Verifiable records that reputable journalists can confirm via multiple sources (not just “a source close to…”).

- Cryptographic proof (rare in this context, but if someone claims on-chain ties, they need to show work, not vibes).

And here’s what doesn’t count as strong evidence by itself:

- Single screenshots with no chain-of-custody

- Red-circled “ledger pages” with no docket reference

- Anonymous threads that interpret interpretations

- Claims that jump from “Coinbase stake” to “Bitcoin backdoor” without a mechanism

My rule: if a claim could move markets, it needs to survive daylight. If it only survives in cropped images and angry quote-tweets, it’s not ready to steer your portfolio.

There’s also a reason this spreads so fast: studies on misinformation show that false or emotionally charged stories propagate faster than corrections. A classic one is the MIT analysis published in Science (Vosoughi, Roy, Aral, 2018), which found false news spread “farther, faster, deeper, and more broadly” than the truth on social platforms. That doesn’t mean this claim is false. It means speed is not proof.

Quick timeline: how this story spread in 24–48 hours

What I watched happen (and I’m simplifying it so you can see the pattern):

- Phase 1: “Epstein had a Coinbase stake.” (a single claim, often with a screenshot)

- Phase 2: “So he was into early crypto.” (speculation expands the circle)

- Phase 3: “If he was early, he might be tied to Satoshi / Bitcoin’s origins.” (narrative leap)

- Phase 4: “If the origin is dirty, Bitcoin has a backdoor.” (technical fear gets injected)

- Phase 5: “BTC is compromised.” (the sell-now emotional endpoint)

This is how viral narratives mutate: each retelling adds certainty and strips caveats. By the end, you’re not even arguing about the same statement that started the whole thing.

People Also Ask (the questions I’m seeing everywhere)

I’m going to answer these the same way I’d answer a friend texting me in a panic—fast, direct, and grounded.

“Did Epstein create Bitcoin or fund Satoshi?”

There’s no verified proof that Epstein created Bitcoin or funded Satoshi. People are connecting dots because it’s emotionally satisfying: big villain + big money + big mystery. But satisfying isn’t the same as true.

“Can Bitcoin have a secret backdoor?”

Not in the way most people mean it. Bitcoin is open-source. The rules are enforced by many independent node operators. A “secret backdoor” would need to bypass public code review and consensus checks across a massive, adversarial network. Could there be bugs? Sure—any software can have bugs. But a hidden, controllable master key is a different category, and it’s not how Bitcoin works.

“If someone is tied to Bitcoin’s early days, can they break it now?”

Being early doesn’t grant magical control over the protocol. The main “early advantage” is usually coin holdings (market impact), not protocol authority. Even if you found a clear early-day connection, it still wouldn’t automatically translate to “can break Bitcoin.”

“Does a Coinbase stake mean control over Bitcoin or customer funds?”

No. Equity ownership in a company (especially a small stake) is not the same as controlling a decentralized network. Also, public companies have governance structures, boards, audits, regulators, and internal controls. Influence exists, but it’s not a remote control for Bitcoin.

“Can Coinbase freeze my Bitcoin?”

If your BTC is held custodially on Coinbase (or any exchange), yes—platforms can restrict withdrawals or freeze accounts under certain conditions (compliance flags, court orders, risk controls, regional rules, etc.). That’s not a Bitcoin protocol issue; it’s a custody and counterparty issue.

“What happens if Satoshi is identified?”

Market chaos is the short-term risk. From a protocol standpoint, the code doesn’t suddenly change because a person gets named. The bigger question is: does a credible identification come with cryptographic proof (like signing a message from early known addresses)? If not, it’s mostly noise.

“Is Bitcoin’s code still safe if the ‘origin story’ is messy?”

Yes—because Bitcoin’s security isn’t “trust the founder.” It’s verify the rules. Bitcoin is designed so you don’t need a clean hero narrative to validate blocks and enforce consensus.

What a “backdoor in Bitcoin” would technically mean (in plain English)

When someone says “backdoor,” I always ask: which type? Because people mix four totally different things into one scary word.

- 1) Backdoor in the code

This would mean malicious logic hidden in Bitcoin client software that changes consensus behavior or leaks keys. The problem for attackers: Bitcoin code is publicly reviewed, widely mirrored, and changes are scrutinized. Also, many users run different implementations and versions. Sneaking in something catastrophic without anyone noticing is extremely hard—and keeping it hidden is harder.

- 2) Backdoor in the math

This is the “SHA-256 is secretly broken” or “ECDSA has a trapdoor” fear. That’s not a Bitcoin-only issue; that would be a global cryptography earthquake. It would hit banks, messaging apps, TLS, and more. There’s no credible evidence of an imminent break here, and if a practical break existed, you’d expect it to show up as widespread, measurable exploitation—not just a narrative attached to a headline.

- 3) Backdoor in the network

Here we’re talking eclipse attacks, routing manipulation, mining censorship, mempool games—real things researchers study and engineers mitigate. These can cause disruption and localized risk, but they aren’t “someone flips a switch and steals everyone’s coins.” They’re operational threats, not mythical skeleton keys.

- 4) Backdoor in people and companies

This is the most realistic “backdoor,” and it has nothing to do with Bitcoin’s cryptography: exchanges, custodians, influencers, regulators, and media cycles can pressure behavior. Panic is a lever. Scams are a lever. Compliance choke points are a lever.

If you want the brutal truth: the easiest way to “hack” Bitcoin users is to hack humans, not SHA-256.

Reality check: who can change Bitcoin’s rules?

This is where the conspiracy narrative usually collapses. Even if a powerful person existed, even if they had money, even if they had connections—Bitcoin’s rules aren’t changed by vibe or status.

Rule changes require broad alignment across:

- Node operators who enforce consensus rules

- Miners who produce blocks, but can’t force you to accept invalid ones

- Developers who propose code, but can’t make you run it

- Exchanges/wallets/users who choose what software to trust

So the question I keep asking when someone yells “backdoor” is simple:

Where is the mechanism? Which code? Which change? Which deployment path? Which consensus threshold? If those answers aren’t there, it’s not a technical claim—it’s a fear story.

The Coinbase angle: what a stake can influence (and what it can’t)

Let’s assume, purely for argument, that the alleged stake was real. What could that actually influence?

- Corporate influence and PR narratives (who gets funded, what gets promoted, what gets framed as “safe”)

- Policy and lobbying posture (what rules the company pushes for, how it cooperates with regulators)

- Product decisions that impact custodial users (withdrawal UX, compliance friction, supported assets, surveillance tooling)

What it can’t do:

- It can’t rewrite Bitcoin’s consensus rules.

- It can’t “backdoor” the Bitcoin protocol.

- It doesn’t equal ownership of customer funds. Customer funds are a custody and balance-sheet matter, not “shareholder gets keys.”

Where people get hurt is mixing these categories. A Coinbase-related headline can absolutely trigger custody anxiety (and sometimes for good reason). But custody anxiety is not evidence of a protocol compromise.

The next 30 days: what could actually change Bitcoin security (not just vibes)

Here are the realistic near-term risks I’m watching that could affect you quickly:

- Forged or unauthenticated “documents” causing panic sellingIf you’ve been around crypto long enough, you’ve seen how a fake screenshot can move price for a few hours—sometimes longer. The risk isn’t “Bitcoin breaks.” The risk is people stampede.

- Real documents triggering regulatory pressure on exchangesThis is where operational risk lives: withdrawal delays, enhanced KYC friction, sudden policy changes, region-based restrictions. That’s not theoretical; it’s the kind of thing that happens when regulators feel forced to “do something” in public.

- Phishing and social engineering riding the headlinesScammers love big news because it creates urgency. Expect “Epstein files — check if your Coinbase is exposed” style lures. Agencies like the FTC have repeatedly warned that fraud spikes around major news events because urgency kills skepticism. If you see “verify your wallet” links, assume it’s hostile until proven otherwise.

- Volatility from uncertaintyNot because Bitcoin is failing, but because humans are emotional and over-leveraged. Volatility is the tax we pay for a global market that trades 24/7 with uneven information.

What I think is unlikely in a 30-day window:

- A sudden, proven cryptographic break in SHA-256/ECDSA that only affects Bitcoin

- A stealth “protocol takeover” that changes rules without the network noticing

- A magical “Epstein link” that directly translates into remote control of BTC

My verification checklist (so readers can follow along with me)

If you want to track this story without getting emotionally hijacked, here’s the exact checklist I’m using:

- 1) Source authenticityIs there a primary document? Can I trace provenance? Is it cited by reputable reporting with named verification steps?

- 2) Technical plausibilityDoes the claim match how Bitcoin actually works? If the claim implies protocol control, where is the mechanism?

- 3) IncentivesWho benefits if this spreads today? A political actor? A scammer? A rival project? A trader needing liquidity?

- 4) Risk exposureAm I exposed through custody (exchange), leverage, lending, or a single point of failure? If the worst-case headline hits, what breaks first in my setup?

If you only do one thing: separate “protocol risk” from “platform risk.” Most people mix them—and that’s where bad decisions happen.

Resources I’m tracking for context (threads, commentary, and rebuttals)

I’m actively monitoring these threads because they show how the narrative is evolving in real time (and in some cases, pushing back on the weakest claims). I’m linking them so you can compare interpretations side-by-side:

- https://x.com/duonine/status/2017881670750527891

- https://x.com/SwanDesk/status/2018455421443572167

- https://x.com/s_lutz95/status/2018366053957460311

- https://x.com/BTC_for_Freedom/status/2018376886812819943

- https://x.com/cowboycrypto313/status/2018537296325197910

- https://x.com/kyletorpey/status/2018073706799489491

- https://x.com/kyletorpey/status/2018080449692578028

- https://x.com/xrpaldia/status/2018311961339928584

- https://x.com/echodatruth/status/2018541151356416410

- https://x.com/1teslasmuse/status/2017572952670371921

- https://x.com/kyletorpey/status/2017964107161329703

Now the real question: if the next week brings either (A) a credible primary document, or (B) a coordinated wave of fakes and “verify your wallet” scams… would your current setup keep you safe either way?

Because that’s where I’m going next—and it’s the part most people skip until it’s too late.

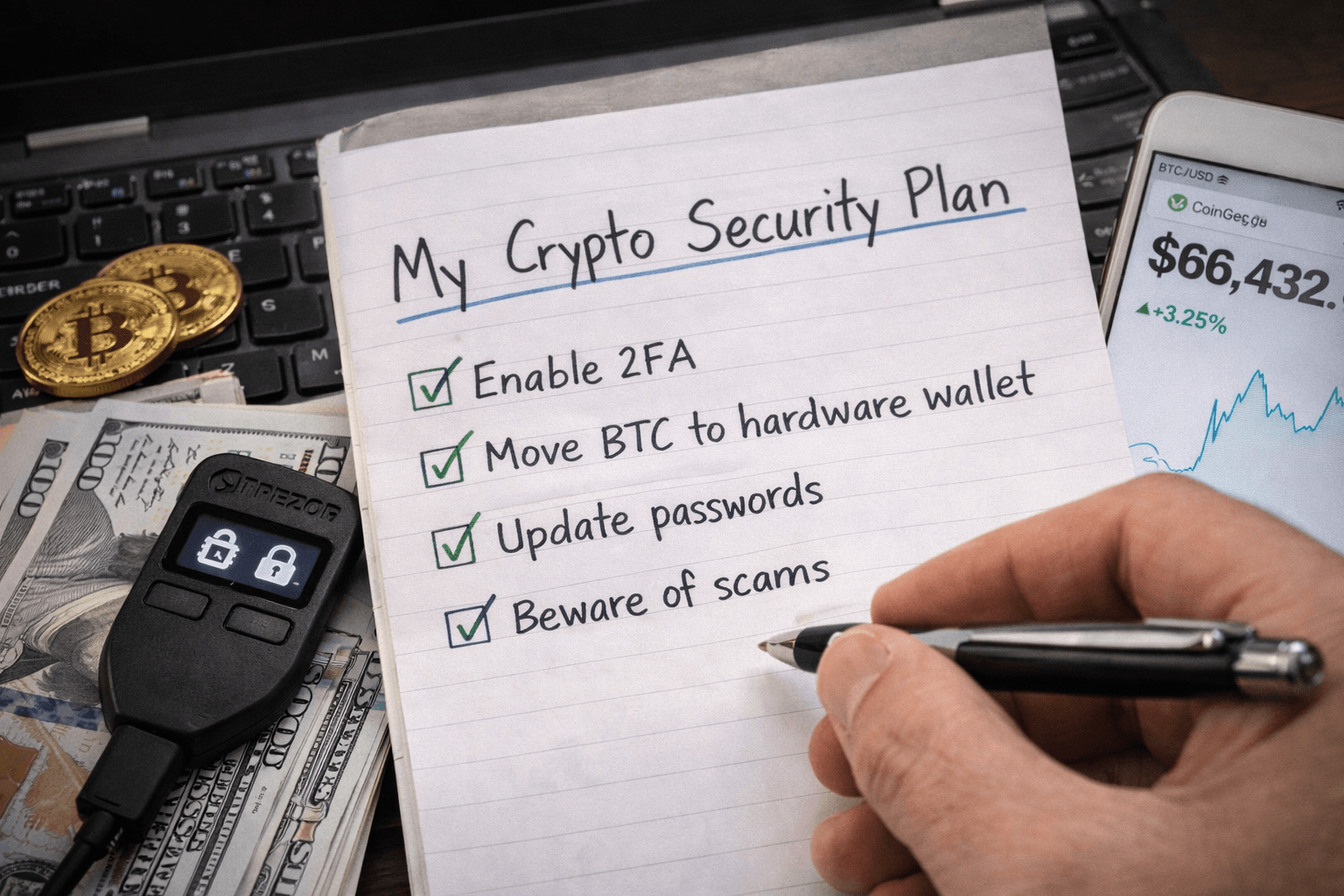

What I’d do as a BTC holder this month (simple, practical, no panic)

If a headline is making you feel rushed, that’s usually the first red flag.

My plan for the next 30 days is boring on purpose: reduce the ways I can get hurt by people (panic, scams, custodians, sloppy security), not by some mythical “instant protocol failure.” If the Epstein/Coinbase story ends up true, half-true, or total noise, the same moves still protect me.

- Trim counterparty risk: I decide what amount actually needs to sit on an exchange this week.

- Harden access: I treat my exchange and email like they’re already being targeted.

- Don’t trade the headlines: especially not with leverage or tight liquidation levels.

- Expect scam waves: trending news events are scam season.

Why I’m so focused on scams right now: big “breaking news” cycles reliably increase phishing. That’s not a crypto-only opinion. It’s a pattern the broader security world tracks every year. If you want receipts, skim the Verizon Data Breach Investigations Report (DBIR) and look at how often stolen credentials and phishing show up as root causes.

And crypto-specific? The FBI IC3 has been documenting crypto losses tied to social engineering, fake “support,” and account takeovers for years, while Chainalysis’ annual crypto crime research keeps highlighting how fast scammers adapt narratives to whatever is trending.

Rule I follow: if a story makes people emotional, scammers will package it into “verification,” “urgent security updates,” “claim forms,” and “wallet migrations” within hours.

If you custody on an exchange: 5 checks to run today

I’m not anti-exchange. I’m anti-pretending an exchange balance is the same as holding keys. If you keep coins on a platform, here are the five checks I run when a “trust shock” story starts trending.

- 1) Prove withdrawals work (small test, not a panic bank-run).

I send a small withdrawal to my own wallet first—something like $20–$100 worth—then a second one a bit larger if the first lands cleanly. I’m checking the whole path: login → 2FA → email approvals → address format → actual on-chain arrival.Real example: If you’ve never withdrawn from an exchange before, don’t wait until the day everyone is trying to withdraw at once. - 2) Lock down the account recovery path (this is where people get wrecked).

I review:- Is my email protected with strong 2FA (ideally a security key)?

- Is my phone number exposed to SIM-swap risk? (If I’m using SMS 2FA anywhere, I change that.)

- Do I have backup codes stored safely?

My preference is hardware-key 2FA (FIDO2/U2F) where the exchange supports it, because it’s designed to shut down a lot of phishing.

- 3) Turn on withdrawal address whitelisting (and give it time to “cool.”)

If the platform offers an address whitelist with a delay (24–48 hours), I enable it. That delay is annoying until it saves you. It gives me a window to react if someone compromises my login. - 4) Check concentration risk (one platform, one point of failure).

I ask myself: “If this exchange froze withdrawals for 72 hours, would my life be impacted?” If the answer is yes, I’m overexposed.I also look at my stablecoin/BTC split and what I’m actually doing. If I’m not actively trading this week, I don’t need 90% sitting there “just because.” - 5) Decide what truly must stay on-exchange.

My personal rule of thumb: only keep what I need for near-term trading, bills, or scheduled buys. Everything else goes to self-custody in a calm, tested way.

One more thing I do: I ignore random DMs offering “help with withdrawals” or “account verification.” Real support doesn’t start with a DM and it never asks for your seed phrase. Not today, not ever.

If you self-custody: how to sanity-check your setup without breaking it

Self-custody is powerful… and it’s also where people accidentally lock themselves out because they “cleaned up” in a stressful moment. When I’m sanity-checking my setup, I keep it slow and mechanical.

- 1) Verify backups without exposing the seed.

I confirm I can physically locate my backup(s) and that they’re readable and complete. I do not type the seed into a computer or “seed checker” site. If I want a full restore test, I do it on a spare hardware wallet offline. - 2) Confirm device/app authenticity.

I only use the official wallet software source, and I double-check URLs. If I’m updating firmware, I do it through the vendor’s official app and verify I’m not clicking sponsored ads pretending to be the wallet brand.Quick habit: I keep the official vendor URL bookmarked and I access it only from that bookmark. - 3) Run a small test transaction habit.

If I’m moving coins to a new address or new wallet, I send a tiny amount first, wait for confirmation, then send the rest. It’s not “paranoid,” it’s just good ops.If I want extra peace of mind, I watch the transaction on a public explorer like mempool.space so I’m not relying on a single wallet UI. - 4) Add a passphrase only if I truly understand it.

A BIP39 passphrase can be great security. It can also permanently lock you out if you forget it. I only use it if I’m confident in my process and I’ve done a full restore drill. - 5) Basic contingency planning (the thing people ignore until a scary headline).

I write down a simple “if something happens to me” plan. Not my seed phrase in a will, not something complicated—just clear instructions for where backups exist and who should access them. If I’m using multisig, I document the steps in plain language.

My personal line: I don’t make irreversible changes to my custody setup on the same day I’m emotionally charged by breaking news.

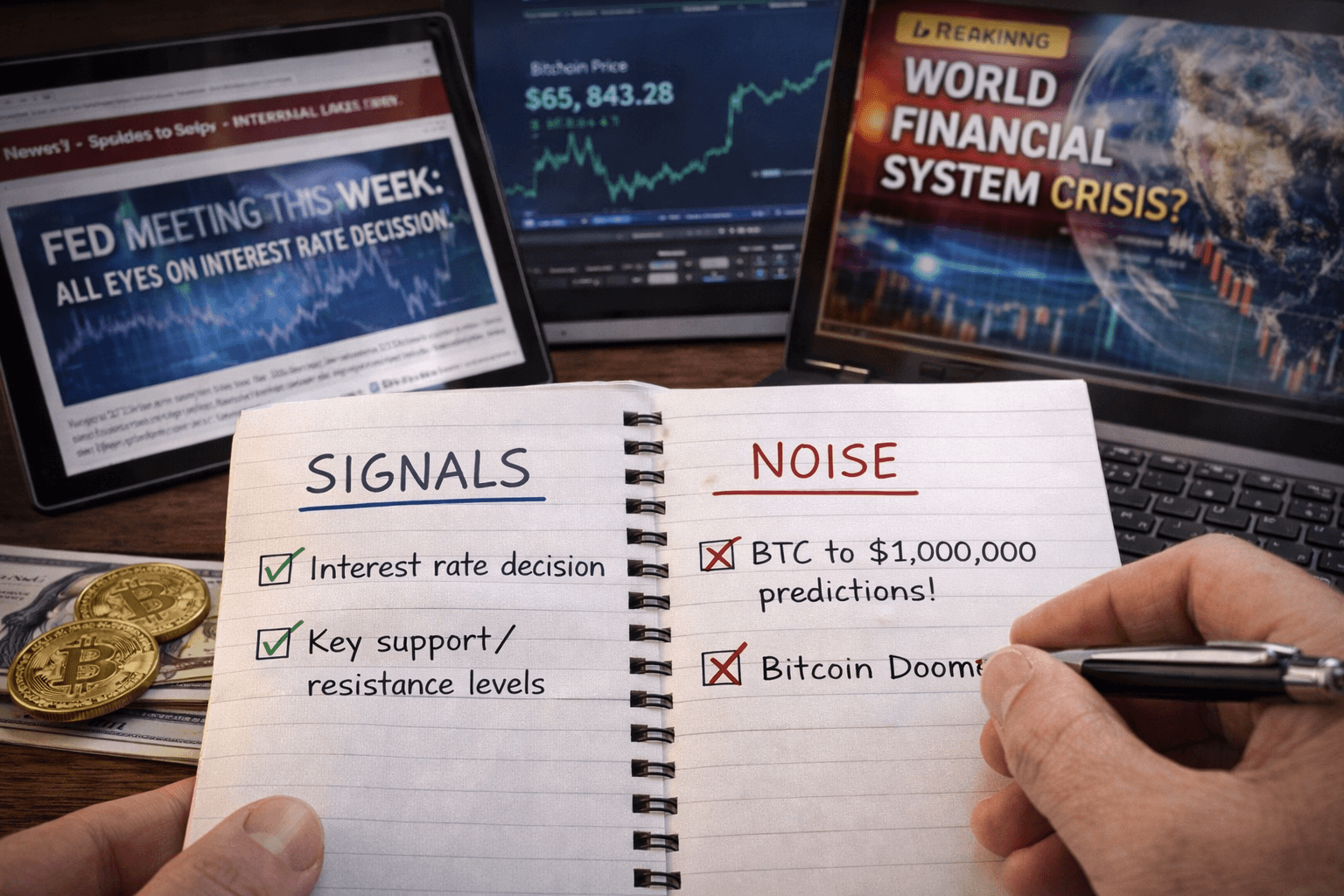

What to watch next: signals that matter vs. noise that wastes your time

If you only have 10 minutes a day for this story, use them on high-signal items. Everything else is entertainment (or bait).

High-signal (I pay attention):

- Verified primary documentation with clear provenance, plus credible investigative reporting that shows the chain of custody for the documents.

- Official exchange/legal updates that affect withdrawals, KYC/AML rules, or asset custody. If an exchange changes terms, limits, or withdrawal policies, that’s actionable.

- Measurable network indicators that you can independently check:

- Hashrate trends and major mining disruptions (I’ll cross-check multiple dashboards, not just one tweet).

- Fee spikes tied to real congestion vs. obvious spam patterns (again, mempool.space is useful).

- Major client releases and security notes (for Bitcoin Core, I look at the official release notes on GitHub: https://github.com/bitcoin/bitcoin/releases).

Low-signal (I ignore):

- Anonymous screenshots with no provenance.

- “A dev said…” posts with no link to the actual quote, context, or code discussion.

- Vague “backdoor” claims that never explain a mechanism, never show reproducible evidence, and never survive basic peer review.

- Anything trying to rush me into clicking, installing, “verifying,” or connecting my wallet.

If you want a simple mental filter: Can I verify it myself, or can a trusted third party verify it with clear sources? If not, I treat it as noise until proven otherwise.

My bottom line for the next 30 days

Even if the Epstein/Coinbase stake claim turns out to be real, it doesn’t automatically translate into Bitcoin being “compromised.” The bigger near-term danger is what these stories do to human behavior: panic-selling, sloppy security, and people leaving coins on platforms they don’t fully trust because moving feels scary.

This week, I’m focusing on what actually moves the needle:

- I control my keys where it makes sense.

- I tighten my account security (email, 2FA, recovery).

- I don’t let headlines push me into leveraged decisions.

- I assume scammers are watching the same news feed I am.

Bitcoin’s security doesn’t come from a clean origin story. It comes from open verification and decentralized consensus—things you can check, not just “trust.” And the best way to feel confident again is to do a few calm, practical actions this week that remove the easiest ways to lose coins.