Bitwise Shines Light on the Crypto Market ?

As part of their efforts to launch the first bitcoin ETF, Bitwise delivered a presentation to the Securities and Exchange Commission (SEC). The presentation contained extensive research carried out by key personnel in Bitwise Asset Management and delved deep into the bitcoin market to reveal several findings that have shaken the crypto world to its core.

In light of their findings, leading cryptocurrency data provider CoinMarketCap has admitted that inaccuracies highlighted in their data are indeed correct. Apart from data concerns, Bitwise has shone a light on the inner workings of the cryptocurrency market and the reasons why they feel the market is ready for them to release an ETF.

Artificial volumes

A recent Cryptolinks post covered the research report by Coventure Capital which showed inconsistencies in the reported volume of exchanges and made a strong case that the majority of top exchanges are reporting artificial volume figures. The Bitwise report delved even further into this and analysed data in a variety of ways including analysing order books, trade histories, spreads, trade sizes, and volume.

The data was presented in a manner to make a strong case against multiple exchanges reporting volumes orders of magnitude higher than leading exchange Coinbase Pro. Some of the key exchanges the Bitwise believe are reporting artificial volumes include CoinBene, EXX, and BitForex.

Source: Bitwise Report

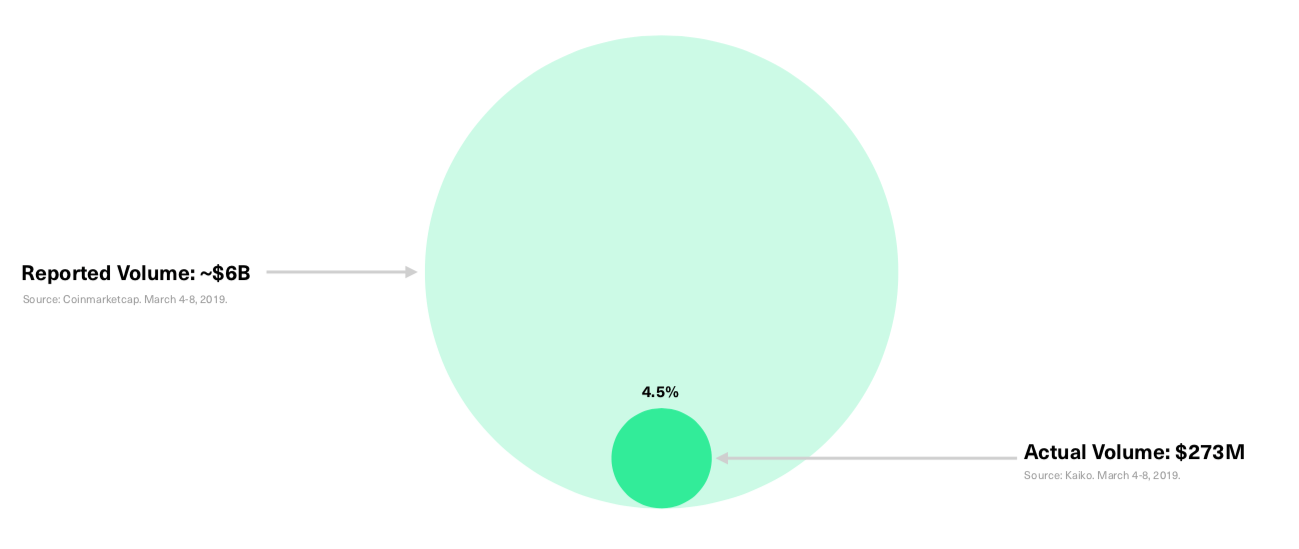

The reported daily volume for the bitcoin market is noted as $6 billion. The result of the report contended that around 95% of this is likely to be artificial and the actual traded volume of the bitcoin market is more likely to be $273 million.

Through the analysis, ten of the top 81 exchanges analysed were believed to be reporting real volume. These are the exchanges that Bitwise will base the pricing mechanism for its proposed ETF upon and are the following:

● Binance

● Bitfinex

● Kraken

● Bitstamp

● Coinbase

● bitFlyer

● Gemini

● itBit

● Bittrex

● Poloniex

Despite the actual volume being likely to be a small fraction of reported volume, the Bitwise report presents the bitcoin market as extremely liquid and highly resistant to market manipulation. We discuss some of the key developments noted by Bitwise for why this is below.

How do exchanges artificially inflate their volumes?

There are a number of methods which exchanges can use to go about artificially pumping up their volumes. We discussed these in more detail in the analysis of the CoVenture research but the main methods are wash trading and a transaction fee mining.

Highlighted developments in the crypto markets

Source: Bitwise Report

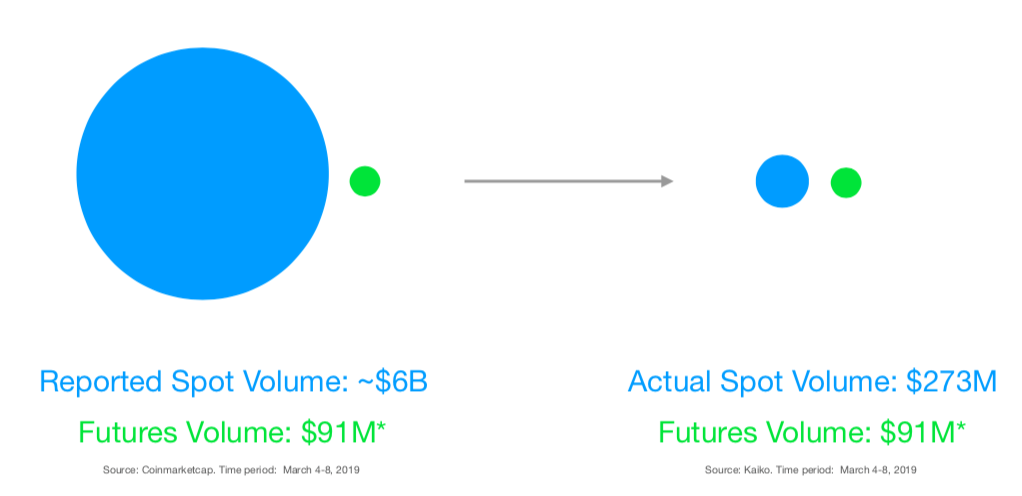

If the actual trading is in fact around 95% lower than reported volumes, this means the futures market holds far more significance on the price of bitcoin. Bitwise corroborate this point by noting that the launch of the futures corresponded closely with the all-time high of bitcoin facilitating the first two-sided market and means of hedging for bitcoin.

With CBOE recently after announcing that they will be discontinuing their bitcoin futures, the CME will serve a more important role than ever. Another important development that followed after the launch of bitcoin futures was several institutional market makers entering the bitcoin market.

These market makers include Jane Street, Flow Traders, and Susquehanna. The report also noted the launch of lending products by entities such as Genesis Global Capital as playing an important role in the development of a liquid bitcoin market.

Are there attractive arbitrage opportunities?

It is commonly believed by beginners in the cryptocurrency market that easy money can be made from arbitraging between the price discrepancies among major exchanges. The report has highlighted that these price discrepancies are likely due to the artificial volume reported by exchanges such as CoinBene and that very little arbitrage opportunities exist in reality among the ten exchange noted to be reporting real volume above.

The ten exchanges are noted to trade effectively as a unified price and there are only a handful of occasions where exchanges deviated greater than 1% and the lasted longer than 100 seconds. It also noted that any arbitrage opportunities that seem to arise from bitcoin trading at a premium when paired against stablecoin USD tether (USDT) are in fact due to USDT fluctuating in value against USD and erase when adjusted appropriately.

Breaking down the Bitwise ETF

Bitwise have carefully analysed previous ETF rejections and have noted responses by the SEC to carefully craft their ETF to meet the key criteria outlined. Bitwise constructed the proposed ETF so to make it extremely difficult to manipulate the price. They also noted their plans to use a third-party regulated and insured custodian to secure the bitcoin which is stored for the issuance of ETF shares.

If Bitwise successfully gains approval for the ETF, the listing exchange will be NYSE Arca. NYSE Arca is a member of the Intermarket Surveillance Group which will provide a surveilled market that was noted as lacking in the application by the Winklevoss twins to launch a bitcoin ETF.

Overall, the report demonstrates that Bitwise have meticulously thought out the details of launching a bitcoin ETF. Apart from providing promising prospects that we may see a bitcoin ETF in the near future, the report also provides an insightful look at the state of the bitcoin market as it stands.